1099 Blank Template

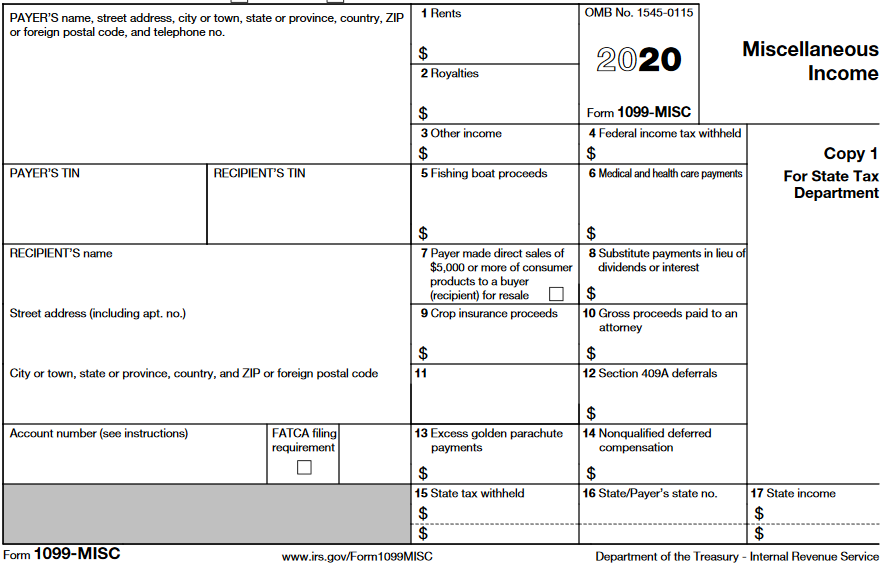

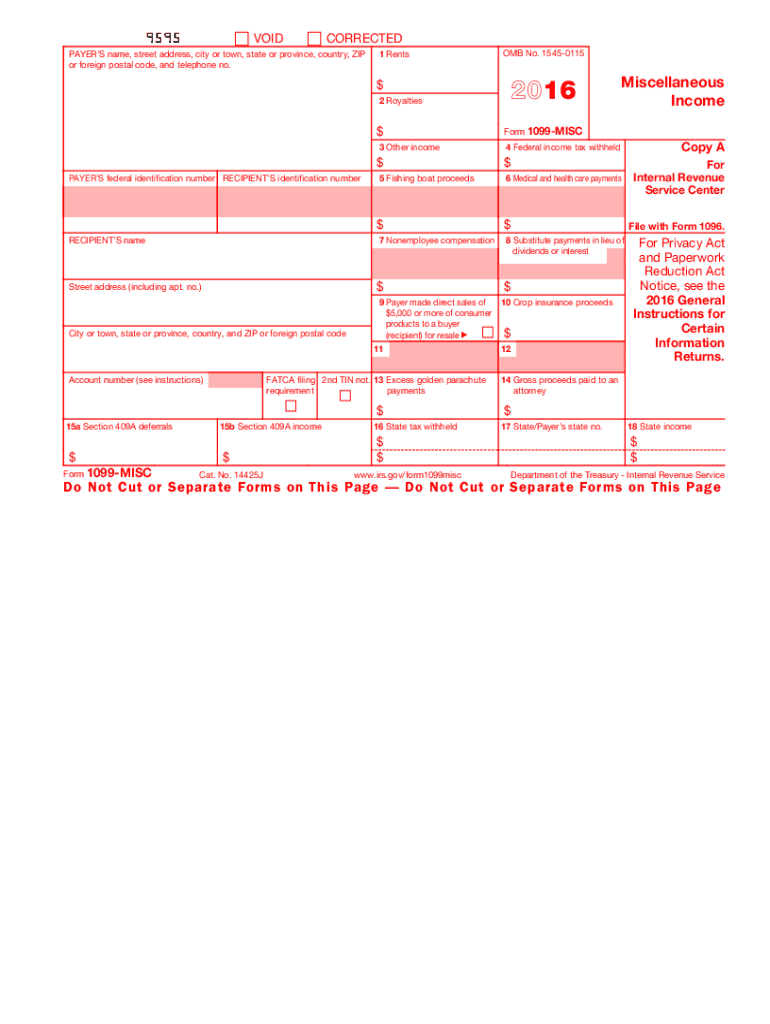

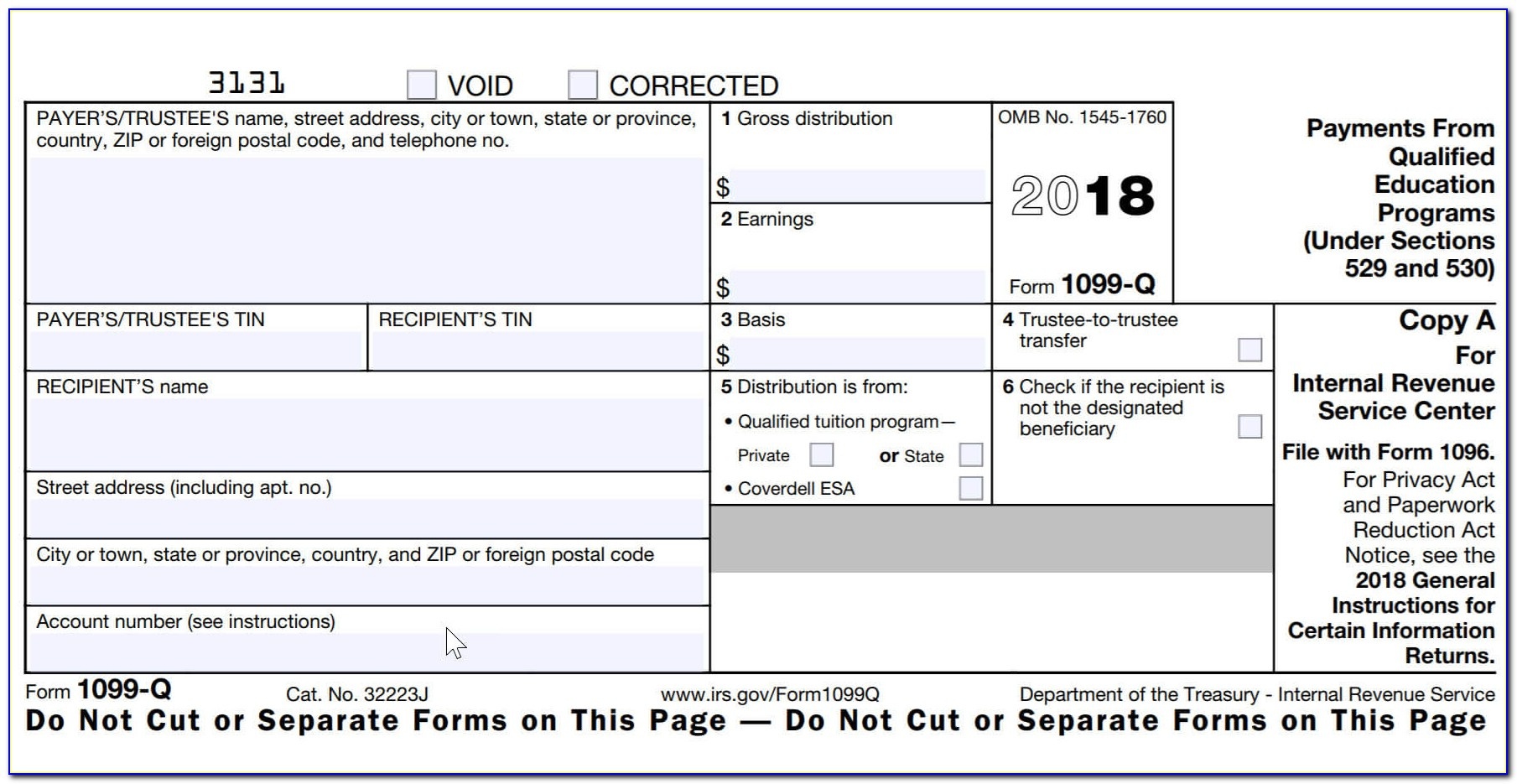

1099 Blank Template - File to download or integrate. Quickbooks will print the year on the forms for you. *the featured form (2022 version) is the current version for all succeeding years. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types”. You may also have a filing requirement. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous compensation,. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Web updated november 06, 2023. Persons with a hearing or speech disability with access to tty/tdd equipment can. The 1099 form is a common irs form covering several potentially taxable income situations. Currently, iris accepts forms 1099 only for tax year 2022 and later. Web it's just $50. Persons with a hearing or speech disability with access to tty/tdd equipment can. Web blank 1099 templates for immediate download. According to the pew research center, 56% of americans dislike or. Web blank 1099 templates for immediate download. *the featured form (2022 version) is the current version for all succeeding years. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous compensation,. These can include payments to. 1099 forms can report different types of incomes. (you don’t want the information getting printed in the wrong box!) To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. See the instructions for form 8938. Payments above a specified dollar threshold for rents, royalties, prizes, awards,. (you don’t want the information getting printed in the wrong box!) See the instructions for form 8938. Onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Web blank 1099 templates for immediate download. You may also have a filing requirement. According to the pew research center, 56% of americans dislike or. The 1099 form is a common irs form covering several potentially. File to download or integrate. Simple instructions and pdf download. These “continuous use” forms no longer include the tax year. You may also have a filing requirement. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Quickbooks will print the year on the forms for you. What it is, how it works. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. You may also have a filing requirement. See your tax return instructions for where to report. Persons with a hearing or speech disability with access to tty/tdd equipment can. These “continuous use” forms no longer include the tax year. Looking for a 1099 excel template? See the instructions for form 8938. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Web it's just $50. Correctedpayer’s name, street address, city or town, state or province, country, zip or foreign postal code, and telephone no. Looking for a 1099 excel template? Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends,. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types”. See the instructions for form 8938.. You're probably hoping to find something — anything — that can make your taxes less of a buzzkill. The 1099 form is a common irs form covering several potentially taxable income situations. If you paid an independent contractor more than $600 in. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Simple instructions and pdf download. Quickbooks will print the year on the forms for you. What it is, how it works. Web updated november 06, 2023. Onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. According to the pew research center, 56% of americans dislike or. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Looking for a 1099 excel template? Web it's just $50. See your tax return instructions for where to report. You may also have a filing requirement.

Microsoft Word 1099 Tax Form Printable Template Printable Templates

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

Print Blank 1099 Form Printable Form, Templates and Letter

Blank 1099 Form Fill Out and Sign Printable PDF Template signNow

Free Blank 1099 Form 2023 Printable Blank Printable vrogue.co

1099 Misc Printable Template Free Printable Templates

1099 nec form 2021 pdf Fill out & sign online DocHub

![]()

Printable 1099 Form Pdf Free Printable Download

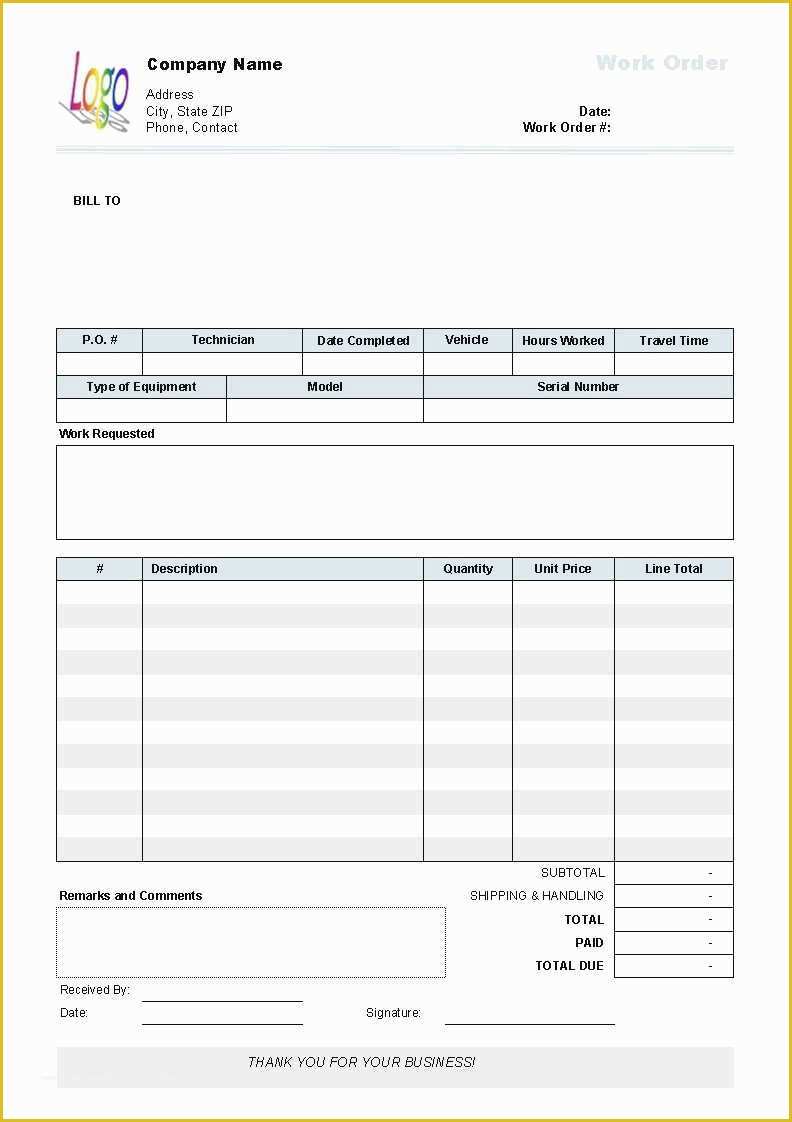

1099 Invoice Template

1099 Form Template. Create A Free 1099 Form Form.

Getting A 1099 Form Doesn't Mean You Necessarily Owe Taxes On That Income, But You Will.

Depending On What’s Happened In Your Financial Life During The Year, You Could Get One Or More 1099 Tax Form “Types”.

(You Don’t Want The Information Getting Printed In The Wrong Box!)

Web On This Form 1099 To Satisfy Its Account Reporting Requirement Under Chapter 4 Of The Internal Revenue Code.

Related Post: