1099 Excel Template Free

1099 Excel Template Free - Web download the 1099 form and convert 1099 to excel. Web independent contractor expenses spreadsheet: To calculate and print to irs 1099 forms with their unconventional spacing. Where to put it in your schedule c when you’re doing your taxes Simply create a yearli account, import your data using our custom excel template, review your data and checkout. An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Download for excel download for word download in pdf. Therefore, payments should be made in full. Web 1099 excel templates for 2023. Download for excel download for word download in pdf. Have you ever struggled to manage your financials as an independent contractor? Keeper tax’s independent contractor expenses spreadsheet. You can find all of the above in our free excel spreadsheet for 1099 contractors! What is a pay stub? Based on 1,000+ reviews from. Make small adjustments if needed. Where to put it in your schedule c when you’re doing your taxes Web the best home office deduction worksheet for excel [free template] a free home office deduction worksheet to automate your tax savings. Getting to write off your housing costs. Web on this form 1099 to satisfy its account reporting requirement under chapter. Web independent contractor (1099) invoice template. What is a pay stub? Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web 1099 nec excel template. Preview the form (s) before payment and transmit them to the irs. Freshbooks’ free contractor invoice template. See your tax return instructions for where to report. Therefore, payments should be made in full. Clients are not responsible for paying the contractor’s taxes; Web the best home office deduction worksheet for excel [free template] a free home office deduction worksheet to automate your tax savings. Make corrections to information returns filed with iris. To calculate and print to irs 1099 forms with their unconventional spacing. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Download for excel download for word. Next, you are going to want to convert this pdf document into an excel document. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Web 1099 excel templates for 2023. To calculate and print to. Web track 1099 expenses & keep peace of mind. Web 1099 excel templates for 2023. We'll file your forms to the fed, applicable state agency and send copies to your recipients. Web independent contractor expenses spreadsheet: Shoeboxed to streamline your expense tracking. Simply create a yearli account, import your data using our custom excel template, review your data and checkout. Web 1099 nec excel template. Get the template here for free: Our system validates the file for any missing or incorrect data, letting you correct errors. See the instructions for form 8938. Clients are not responsible for paying the contractor’s taxes; See the instructions for form 8938. Web 1099 nec excel template. You can find all of the above in our free excel spreadsheet for 1099 contractors! An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Therefore, payments should be made in full. Spreadsheetpoint.com‘s independent contractor expenses spreadsheet. To calculate and print to irs 1099 forms with their unconventional spacing. Web in this article, we’ll provide a free 1099 expenses template so you can use it for your schedule c and tax filing. It even comes with a few extras, like columns for: Freshbooks’ free contractor invoice template. Based on 1,000+ reviews from. See your tax return instructions for where to report. Therefore, payments should be made in full. It even comes with a few extras, like columns for: Preview the form (s) before payment and transmit them to the irs. Next, you are going to want to convert this pdf document into an excel document. You can find all of the above in our free excel spreadsheet for 1099 contractors! To calculate and print to irs 1099 forms with their unconventional spacing. Web 1099 excel templates for 2023. Free template) march 9th, 2022 | accounting & bookkeeping, contractor resources, tax time. Make corrections to information returns filed with iris. Print to your paper 1099 or 1096 forms and mail. Have you ever struggled to manage your financials as an independent contractor? Download this 2023 excel template. An accountant will break down exactly how to fill out our 1099 template and give you tips as well as recommendations.

1099 Payroll Template

1099 Template Excel

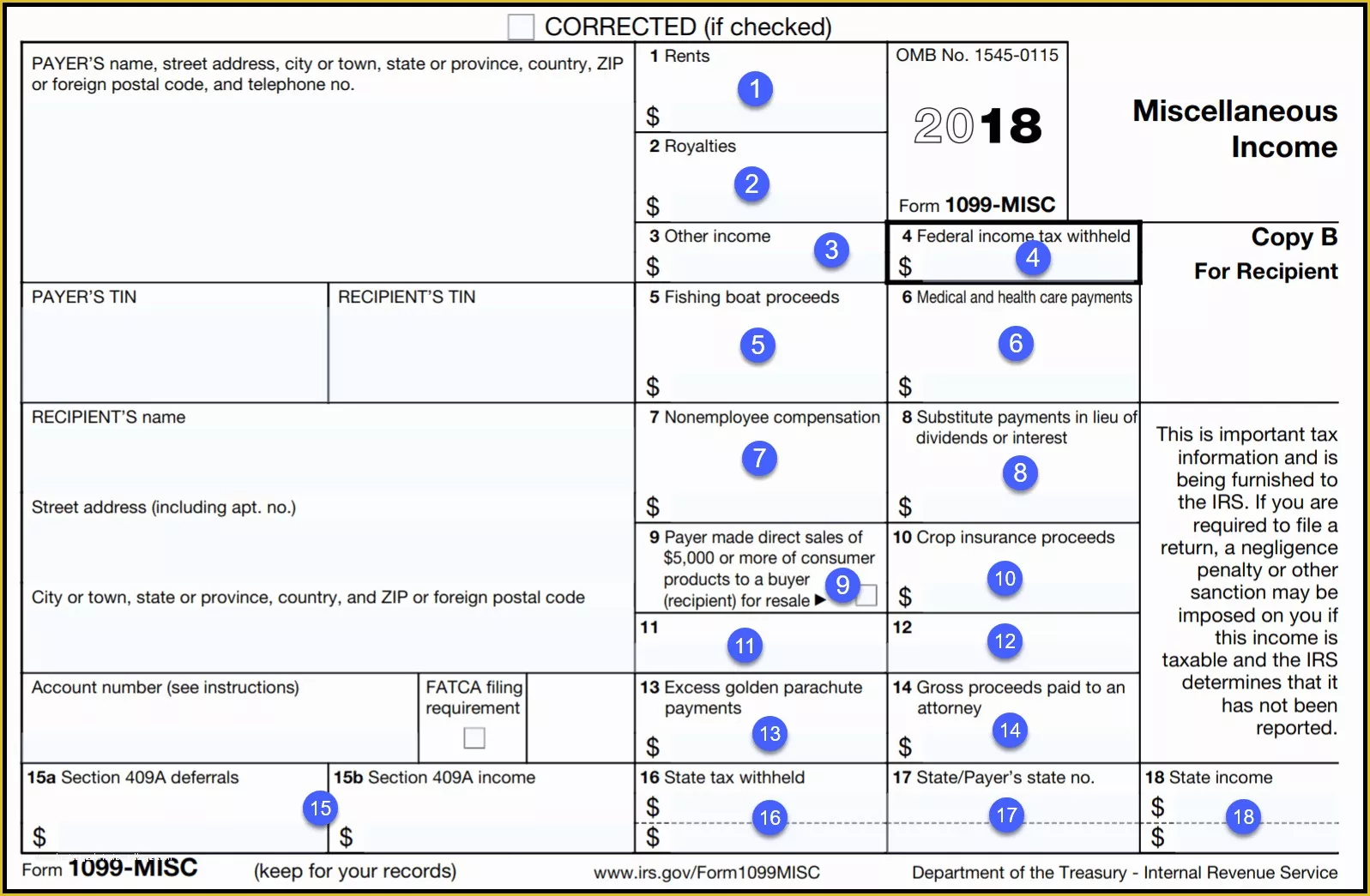

Free 1099 Template Excel (With StepByStep Instructions!) (2023)

1099 Form Template. Create A Free 1099 Form Form.

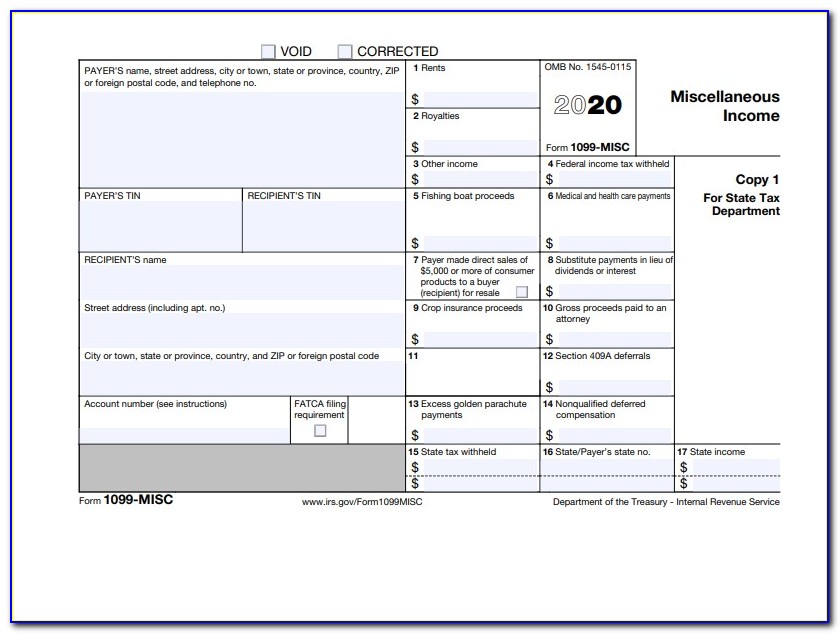

1099 Misc Template Excel

Free 1099 Template Excel (With StepByStep Instructions!)

Free 1099 Template Excel (With StepByStep Instructions!) (2023)

Free 1099 Template Excel (With StepByStep Instructions!)

Free 1099 Template Excel 2019

1099 Misc Excel Template Free

Shoeboxed To Streamline Your Expense Tracking.

You May Also Have A Filing Requirement.

Web On This Form 1099 To Satisfy Its Account Reporting Requirement Under Chapter 4 Of The Internal Revenue Code.

We Will Also Discuss Its Uses, Benefits, And Common Tax Deductions, Ensuring You Don’t Miss Any Important Details As An Independent Contractor.

Related Post: