1099 Form Printable Template

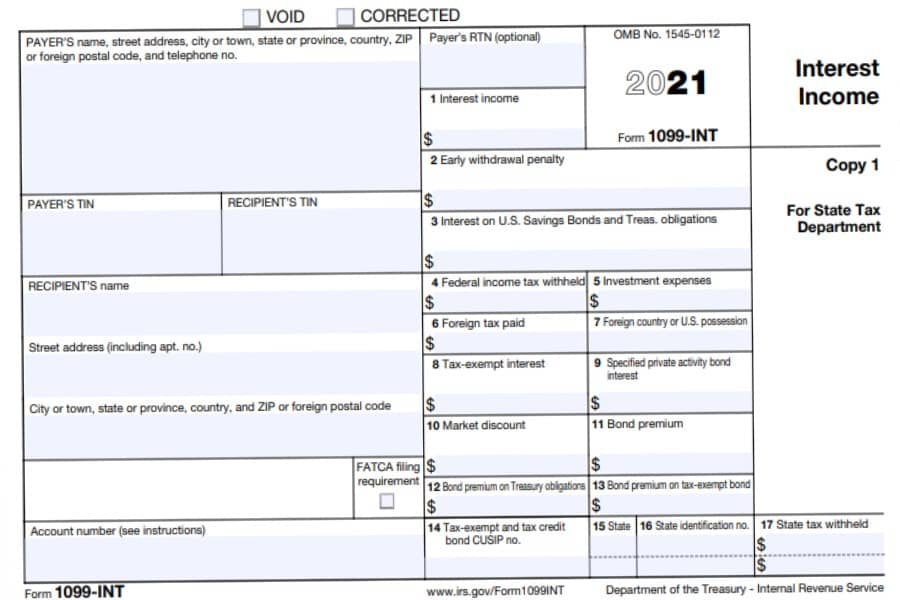

1099 Form Printable Template - How to print 1099s from a spreadsheet. File to download or integrate. Written by sara hostelley | reviewed by brooke davis. Tips and instructions for use. How to print 1099s from a pdf. Web what to do after filling out your 1099 template. Simple instructions and pdf download. Filling out a 1099 form: For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Web updated march 20, 2024. Web updated january 18, 2024. Where to order printable 1099 forms. Web recipient’s taxpayer identification number (tin). Once you’ve determined who your independent contractors are and you feel confident your books are in order, you can begin completing a 1099. What to do before you print your 1099s. This spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax category. When should you print and send your 1099s? Simple instructions and pdf download. File to download or integrate. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin),. Web recipient’s taxpayer identification number (tin). Written by sara hostelley | reviewed by brooke davis. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Written by sara hostelley | reviewed by brooke davis. Web you can. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Introducing keeper's independent contractor expenses spreadsheet. Tips and instructions for use. Web what to do after filling out your 1099 template. Web updated november 06, 2023. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Web what to do after filling out your 1099 template. Web updated january 18, 2024. How to print 1099s from a spreadsheet. Introducing keeper's independent contractor expenses. When should you print and send your 1099s? Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web updated january 11, 2024. This spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax. Written by sara hostelley | reviewed by brooke davis. A 1099 is a type of form that shows income you received that wasn't from your employer. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. When should you print and send your 1099s? Web what to do after filling out your. File to download or integrate. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. How to print 1099s from a pdf. An independent contractor agreement is a legal document between a contractor that performs a service. Web updated january 18, 2024. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Printing 1099s from sage 50. Filling out a 1099 form: Web updated november 06, 2023. Web updated january 11, 2024. Web recipient’s taxpayer identification number (tin). We’ll walk you through this step by step so you can ensure proper taxation. Where to order printable 1099 forms. How to print 1099s from a pdf. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web recipient’s taxpayer identification number (tin). *the featured form (2022 version) is the current version for all succeeding years. Filling out a 1099 form: Tips and instructions for use. Web you can print the following number of copies for these 1099 forms on 1 page: Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Web recipient’s taxpayer identification number (tin). However, the issuer has reported your. How to print 1099s from a spreadsheet. How to print 1099s from quickbooks. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Getting a 1099 form doesn't mean you necessarily owe taxes on that income, but you. Simple instructions and pdf download. An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment. File to download or integrate.

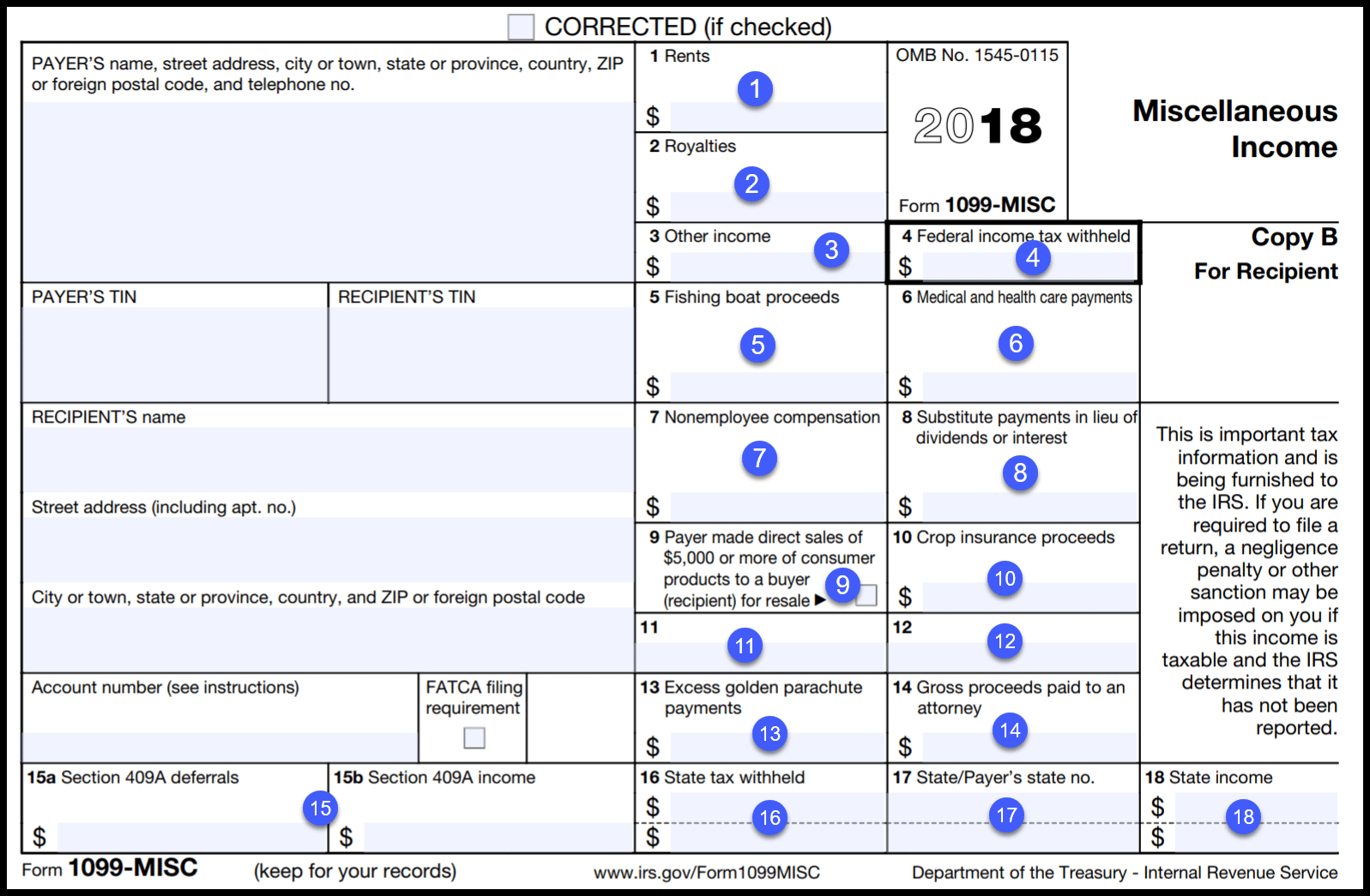

Form 1099MISC for independent consultants (6 step guide)

Free Printable 1099 Form 2018 Free Printable

Print Blank 1099 Form Printable Form, Templates and Letter

1099 Form Template. Create A Free 1099 Form Form.

Free Irs Form 1099 Printable Printable Templates

1099 nec form 2021 pdf Fill out & sign online DocHub

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

Irs Form 1099 Fillable And Online Filing Printable Forms Free Online

Printable Form 1099 Misc For 2021 Printable Form 2024

1099 Employee Form Printable

Where To Order Printable 1099 Forms.

Web Updated March 20, 2024.

Persons With A Hearing Or Speech Disability With Access To Tty/Tdd Equipment Can.

Onpay’s Goal Is To Make It Easier For Small Business Owners To Take Care Of Payroll, Hr, And Employee Benefits.

Related Post: