1099 Print Template

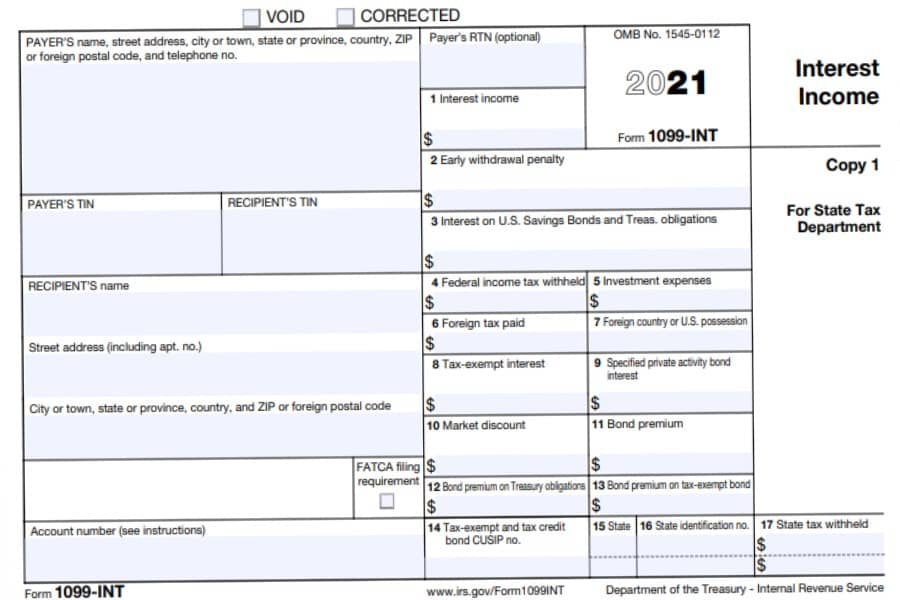

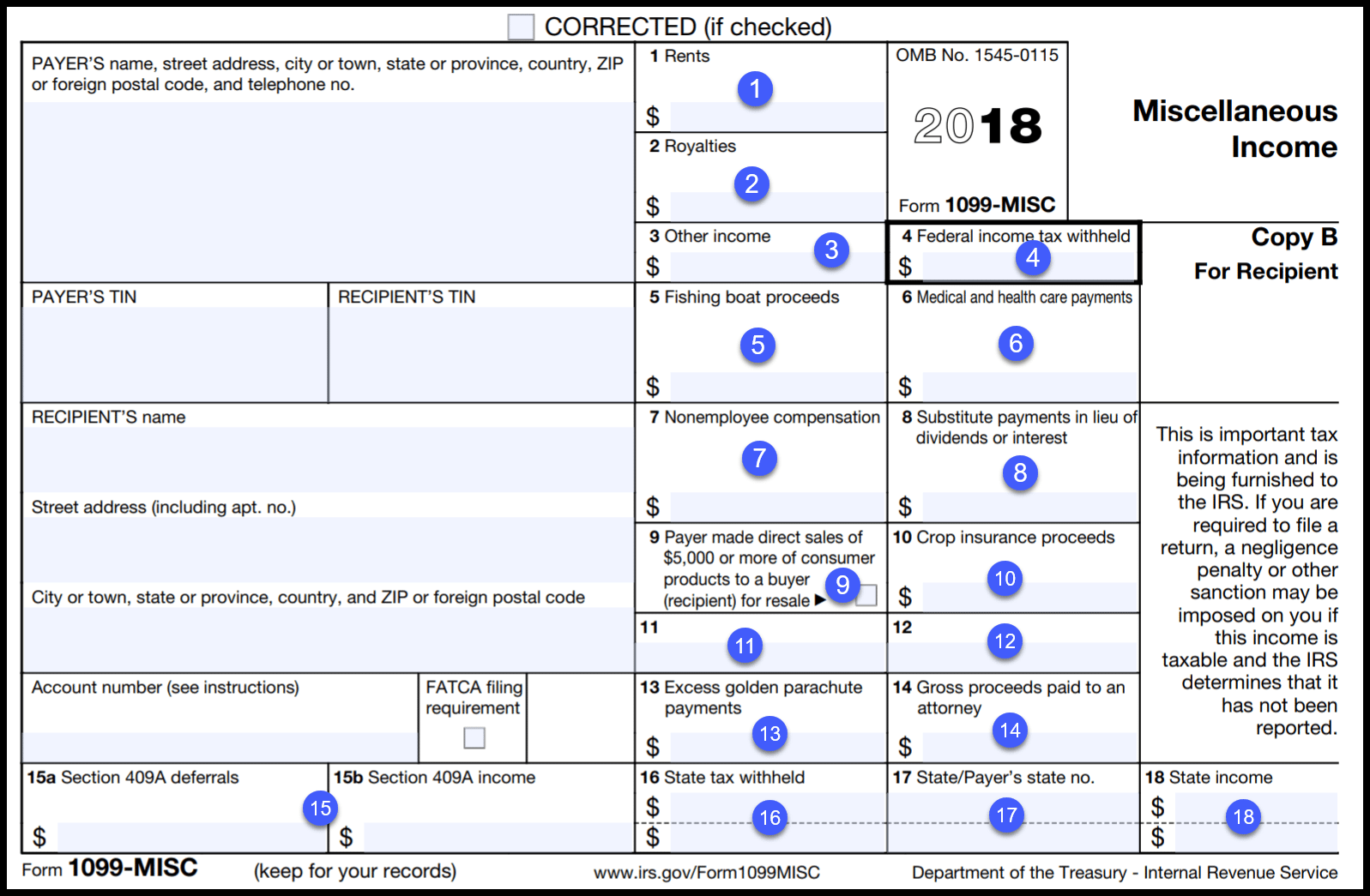

1099 Print Template - 1099 forms can report different types of incomes. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous compensation,. Web print and file copy a downloaded from this website; Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Web print and file copy a downloaded from this website; Web use this free spreadsheet for your independent contractor expenses. Download this 2023 excel template. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Select state you’re filing in. Web select which type of form you’re printing: What it is, how it works. Choose the scenario that fits your situation. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as. Who gets a 1099 form? Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Printable from laser and inkjet printers. Fill out a 1099 form. Go to taxes then select 1099 filings. Web you can print the following number of copies for these 1099 forms on 1 page: Web use this free spreadsheet for your independent contractor expenses. Select state you’re filing in. Web print and file copy a downloaded from this website; Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Web print and file copy a downloaded from this website; Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Their full legal name and address. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Print to your paper 1099 or 1096. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. File to download or integrate. Who gets a 1099 form? Receipts, invoices and any other payment information. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. Web select which type of form you’re printing: Who gets a 1099 form? Washington — the internal revenue service announced today that businesses can now file form 1099. Web it's just $50. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. Printable from laser and inkjet printers. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf. Web it's just $50. If you paid an independent contractor more than $600 in. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. What it is, how it works. Miscellaneous income (or miscellaneous information, as it’s now. Web use this free spreadsheet for your independent contractor expenses. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. If you paid an independent contractor more than $600 in. Looking for a 1099 excel template? Print to your paper 1099 or 1096 forms and mail. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Printable from laser and inkjet printers. Receipts, invoices and any other payment information. Web print and file copy a downloaded from this website; Select view 1099 to view a pdf copy. See part o in the current general instructions for certain information returns, available at irs.gov/form1099, for more information about penalties. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Print to your paper 1099 or 1096 forms and mail. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Select state you’re filing in. Choose the scenario that fits your situation. Print your 1099s or 1096. Who gets a 1099 form? Looking for a 1099 excel template? If you paid an independent contractor more than $600 in. Select view 1099 to view a pdf copy. How it works, who gets one. How to file a 1099 form online. You're probably hoping to find something — anything — that can make your taxes less of a buzzkill. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec.

Printable Form 1099 Misc For 2021 Printable Form 2024

1099 Contract Template HQ Printable Documents

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

1099 Misc Form Printable Instructions

1099 NEC Editable PDF Fillable Template 2022 With Print and Clear

1099 Form Template. Create A Free 1099 Form Form.

2020 1099NEC Form Print Template for Word or PDF 1096 Transmittal

How to Fill Out and Print 1099 MISC Forms

Print Blank 1099 Form Printable Form, Templates and Letter

1099 Irs Form Printable Printable Forms Free Online

Web Select Which Type Of Form You’re Printing:

Gather Information For All Of Your Payees.

(You Don’t Want The Information Getting Printed In The Wrong Box!)

Irs 1099 Forms Are A Series Of Tax Reporting Documents Used By Businesses And Individuals To Report Income Received Outside Of Normal Salary Or Wages, Such As Freelance Earnings, Interest, Dividends, And.

Related Post: