501C3 Donation Receipt Template

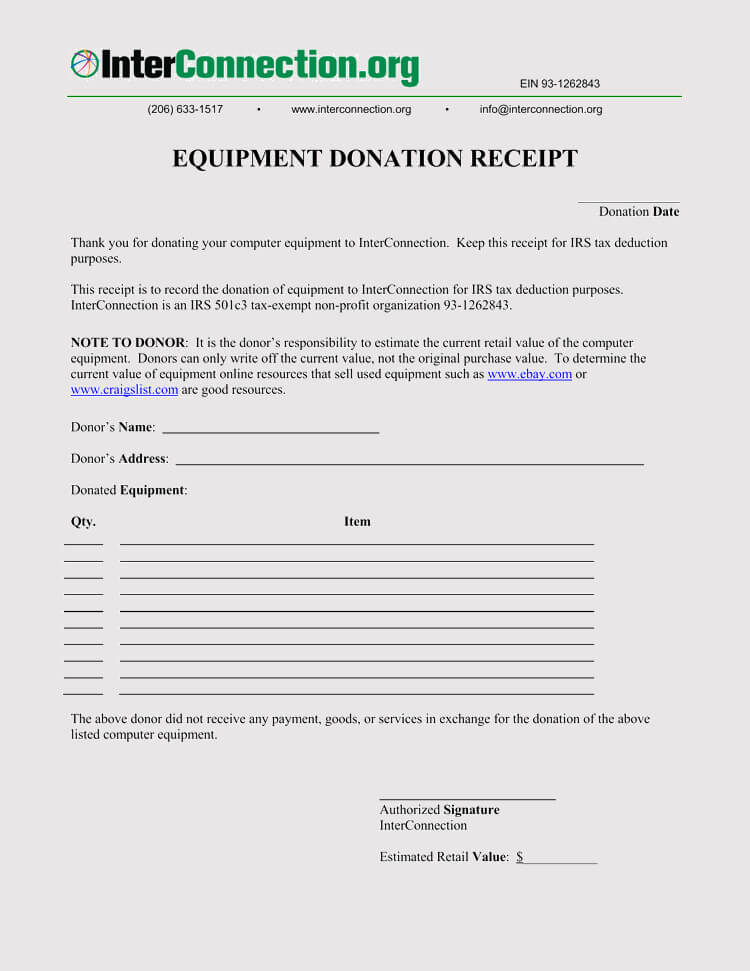

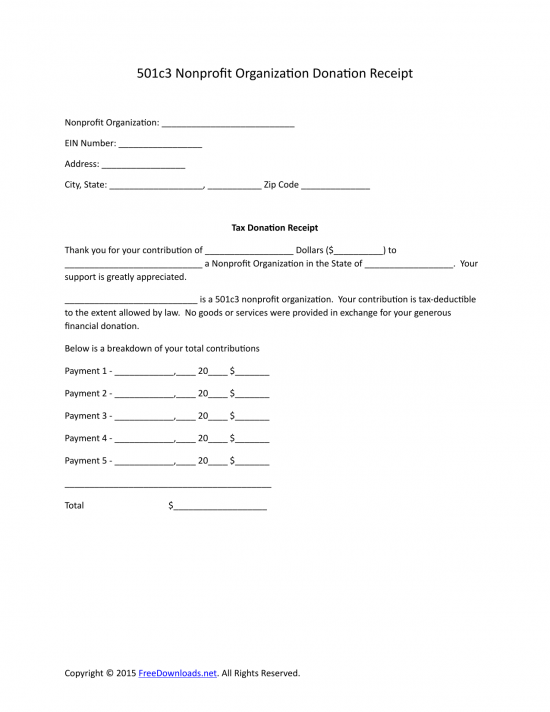

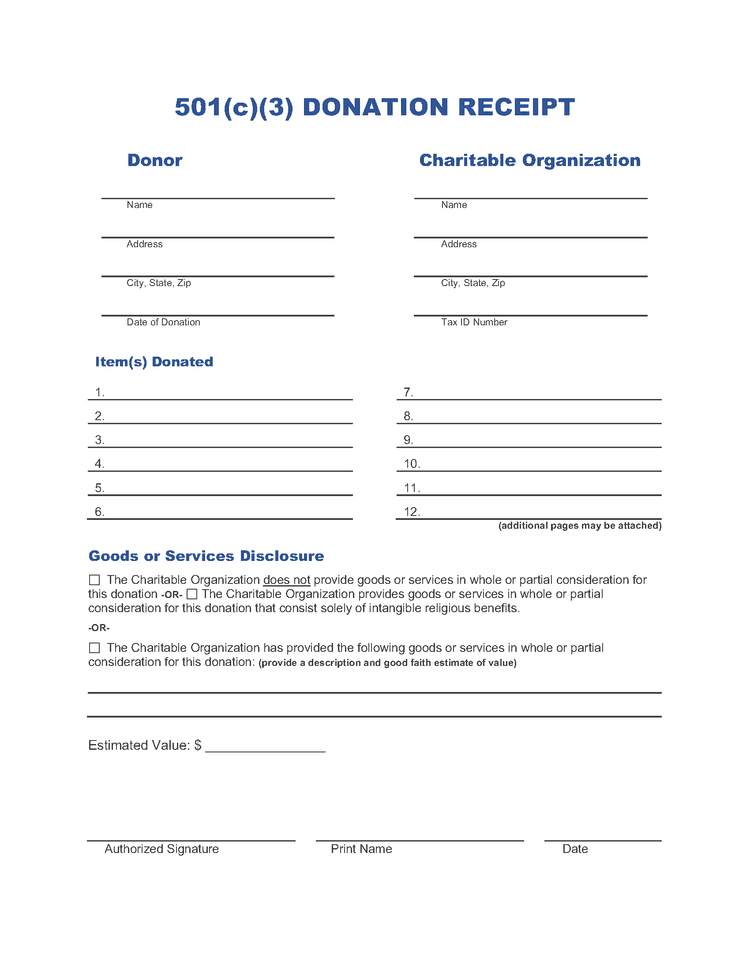

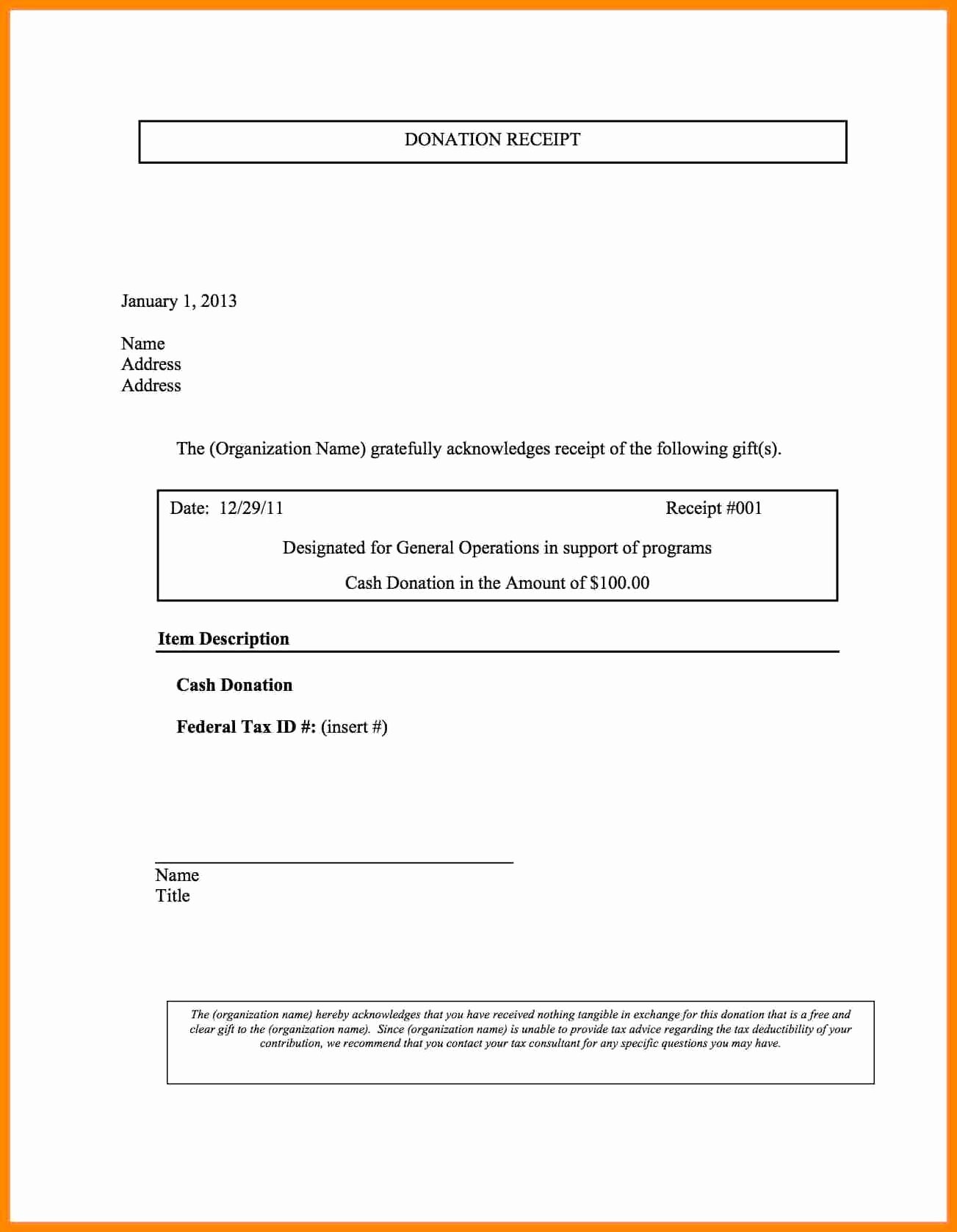

501C3 Donation Receipt Template - 501 (c) (3) organization donation receipts (6) a 501 (c) (3) organization donation receipt is given to a donor for tax purposes. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. These are given when a donor donates to a nonprofit organization. Statement that no goods or services were provided by the organization, if. Nonprofit donation receipts make donors happy and are useful for your nonprofit. When to issue donation receipts. Web updated november 14, 2023. Use our easy template editor. They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: According to the irs, any deductions claimed of $250 or more for donations must have a physical or electronic receipt from the organization it was made. Web a 501 (c) (3) donation receipt is required to be completed by. Made to meet canada and the usa requirements. Web jotform donation receipt template. Benefits of a 501c3 donation receipt. 501 (c) (3) organization donation receipts (6) a 501 (c) (3) organization donation receipt is given to a donor for tax purposes. Web these are examples of tax donation receipts that a 501c3 organization should provide to its donors. 501 (c) (3) organization donation receipts (6) a 501 (c) (3) organization donation receipt is given to a donor for tax purposes. Why do you need a donation receipt? Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: A donation receipt is used by companies and individuals in order to. What should donation receipt include. Web what makes a business nonprofit. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Benefits of a 501c3 donation receipt. Web free nonprofit donation receipt templates for every giving scenario. Made to meet canada and the usa requirements. Scroll down to “enhance your campaign” and click “receipt emails.”. Web published july 5, 2023 • reading time: What should donation receipt include. Why do you need a donation receipt? Benefits of a 501c3 donation receipt. A donation receipt is an official document that provides evidence of donations or. 501 (c) (3) organization donation receipts (6) a 501 (c) (3) organization donation receipt is given to a donor for tax purposes. Web published july 5, 2023 • reading time: Web donation receipt templates | samples. Web free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Web free nonprofit donation receipt templates for every giving scenario. Web jotform donation receipt template. A donation receipt is used by companies and individuals in order to provide proof that. Statement that no goods or services were provided by the organization, if. Web these are examples of tax donation receipts that a 501c3 organization should provide to its donors. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web donation receipt templates | samples. 501 (c) (3) organization donation receipts. __________________ (find on the irs website. Benefits of a 501c3 donation receipt. Web published july 5, 2023 • reading time: Use our easy template editor. Web 501 (c) (3) organizations are required to issue donation receipts for any contribution of $250 or more. Web using a donation receipt template—which we will share a few of below—is a convenient way to make sure your nonprofit nurtures these relationships and remains in compliance with the internal revenue service. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. The receipt should include the same information. Scroll down to “enhance your campaign” and click “receipt emails.”. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web using a donation receipt template—which we will share a few of below—is a convenient way to make sure your nonprofit nurtures these relationships and remains in compliance with the internal revenue service. Web what makes a business nonprofit. Web these are examples of tax donation receipts that a 501c3 organization should provide to its donors. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. 501 (c) (3) organization donation receipts (6) a 501 (c) (3) organization donation receipt is given to a donor for tax purposes. Web 501 (c) (3) organizations are required to issue donation receipts for any contribution of $250 or more. Web free nonprofit donation receipt templates for every giving scenario. Clear and consistent nonprofit donation receipts help build trust with your donors. Nonprofit donation receipts make donors happy and are useful for your nonprofit. What should diy donation receipts include? They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. Why do you need a donation receipt? The receipt should include the same information as a receipt for a larger contribution. Statement that no goods or services were provided by the organization, if.

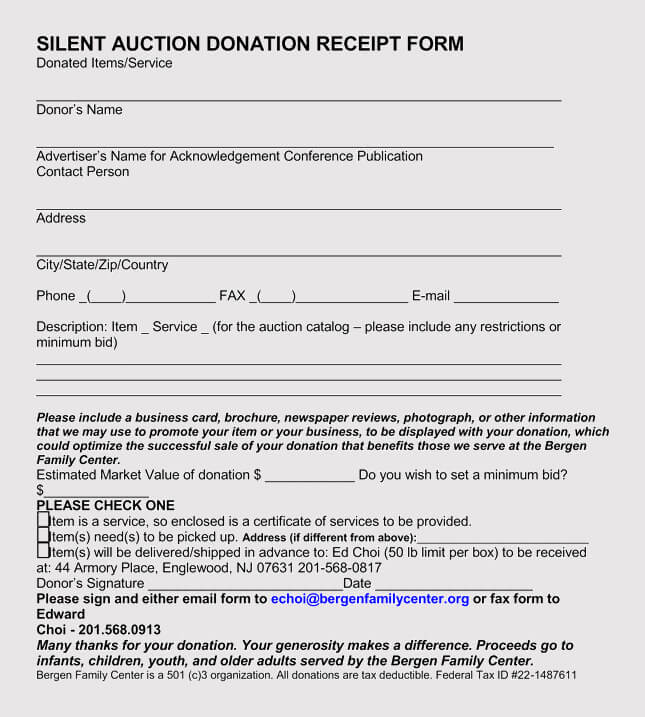

Printable 501C3 Donation Receipt Template

Download 501c3 Donation Receipt Letter for Tax Purposes PDF RTF

501(c)(3) Organization Donation Receipts (6) Invoice Maker

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-Template.jpg)

501c3 Donation Receipt Template Printable [Pdf & Word]

501c3 Donation Receipt Template Printable pdf & Word pack Etsy

501C3 Donation Receipt Template

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt.jpg)

501c3 Donation Receipt Template Printable [Pdf & Word]

501C3 Donation Receipt Template

editable free 501c3 donation receipt template sample pdf 501c3

Nonprofit Receipt Template

What Should Donation Receipt Include.

Web Jotform Donation Receipt Template.

These Are Given When A Donor Donates To A Nonprofit Organization.

The Receipt Shows That A Charitable Contribution Was Made To Your Organization By The Individual Or Business.

Related Post: