503020 Budgeting Template

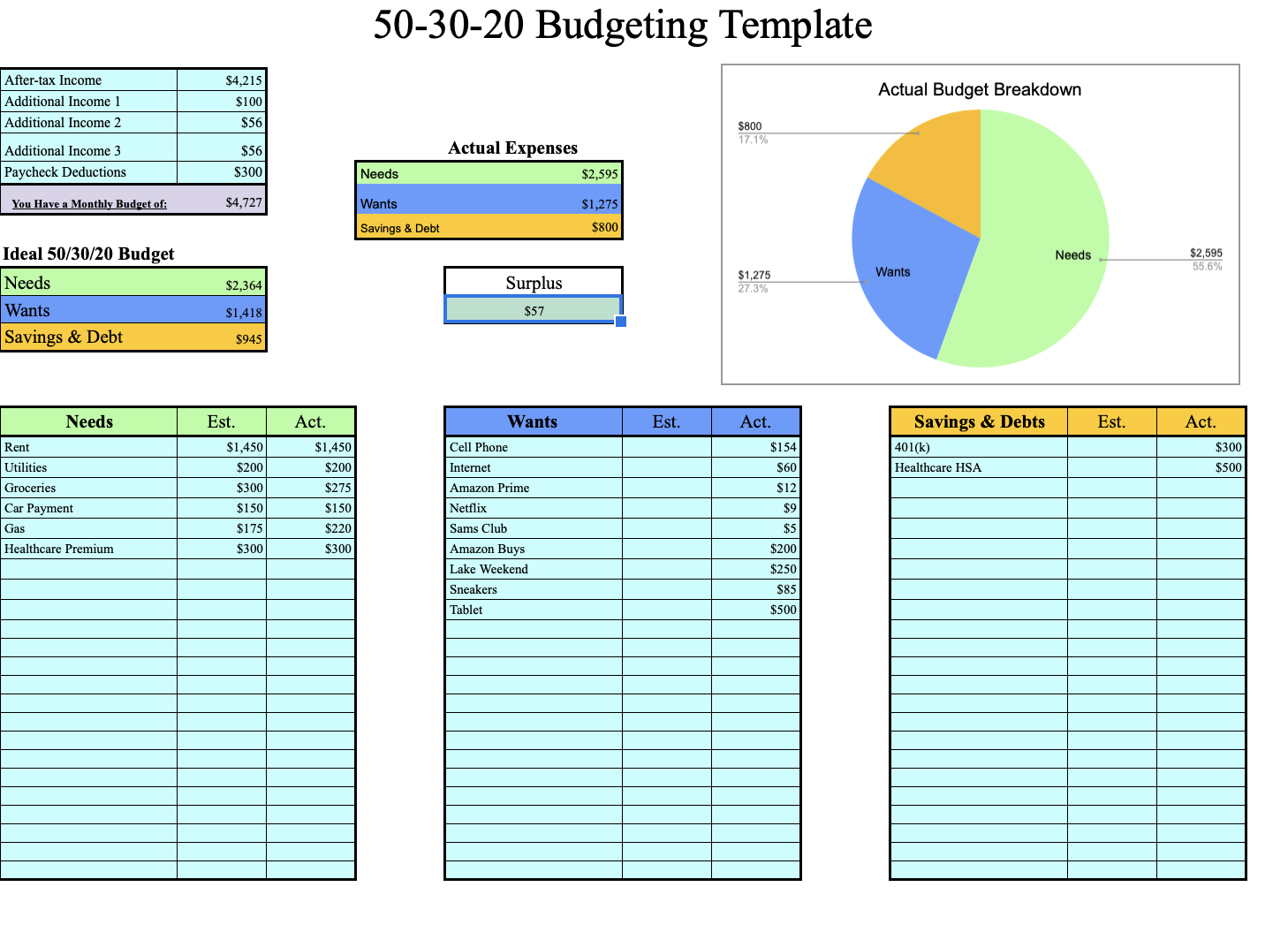

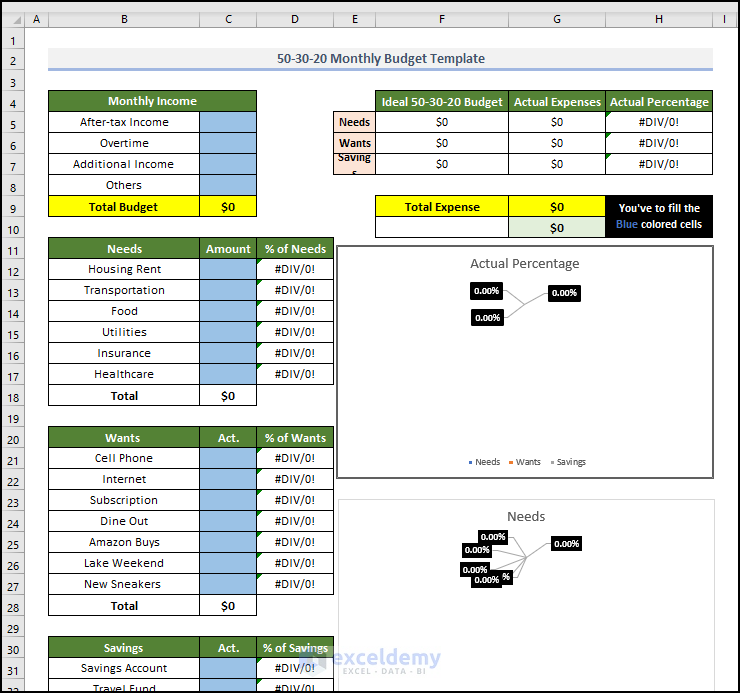

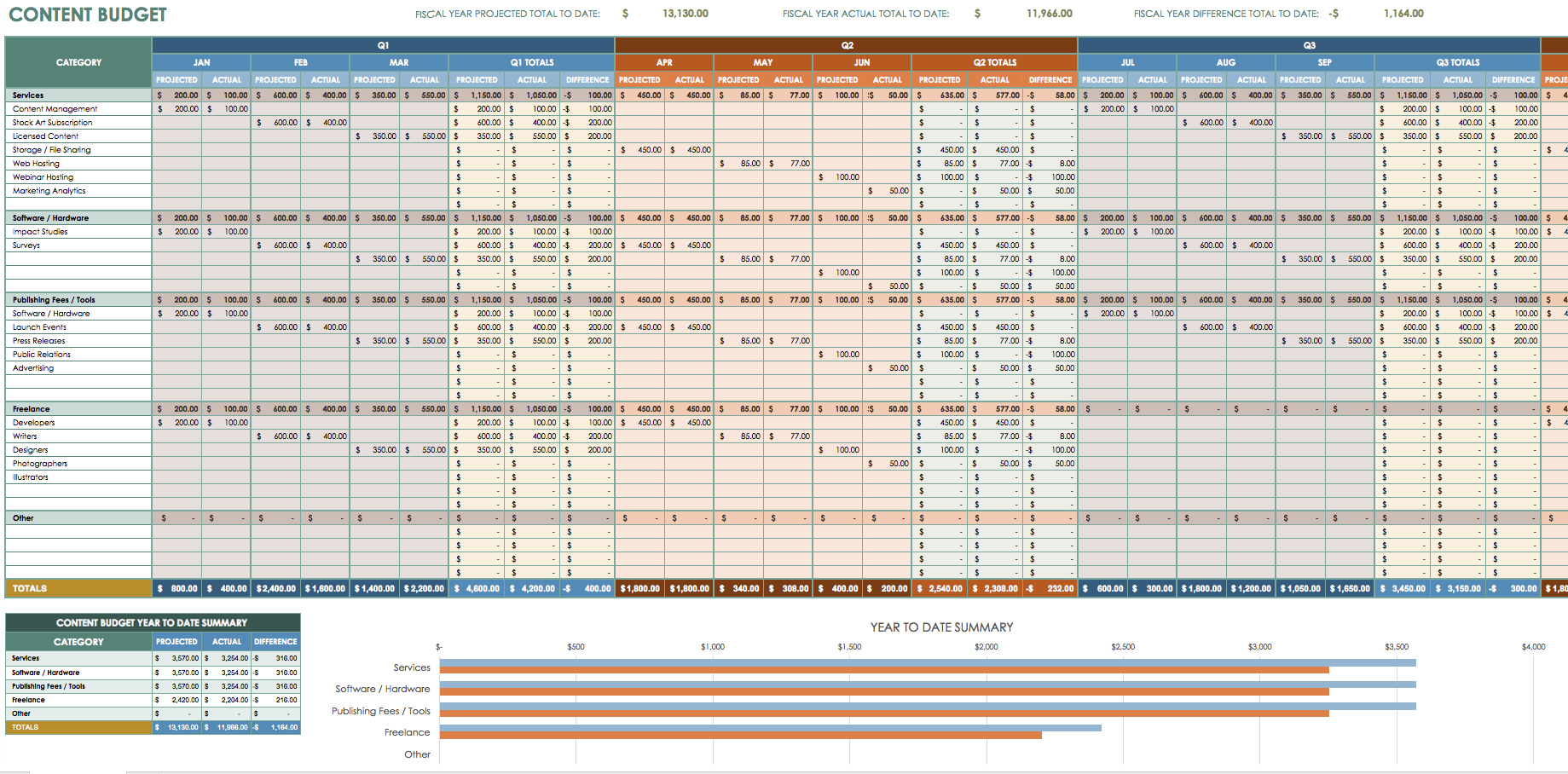

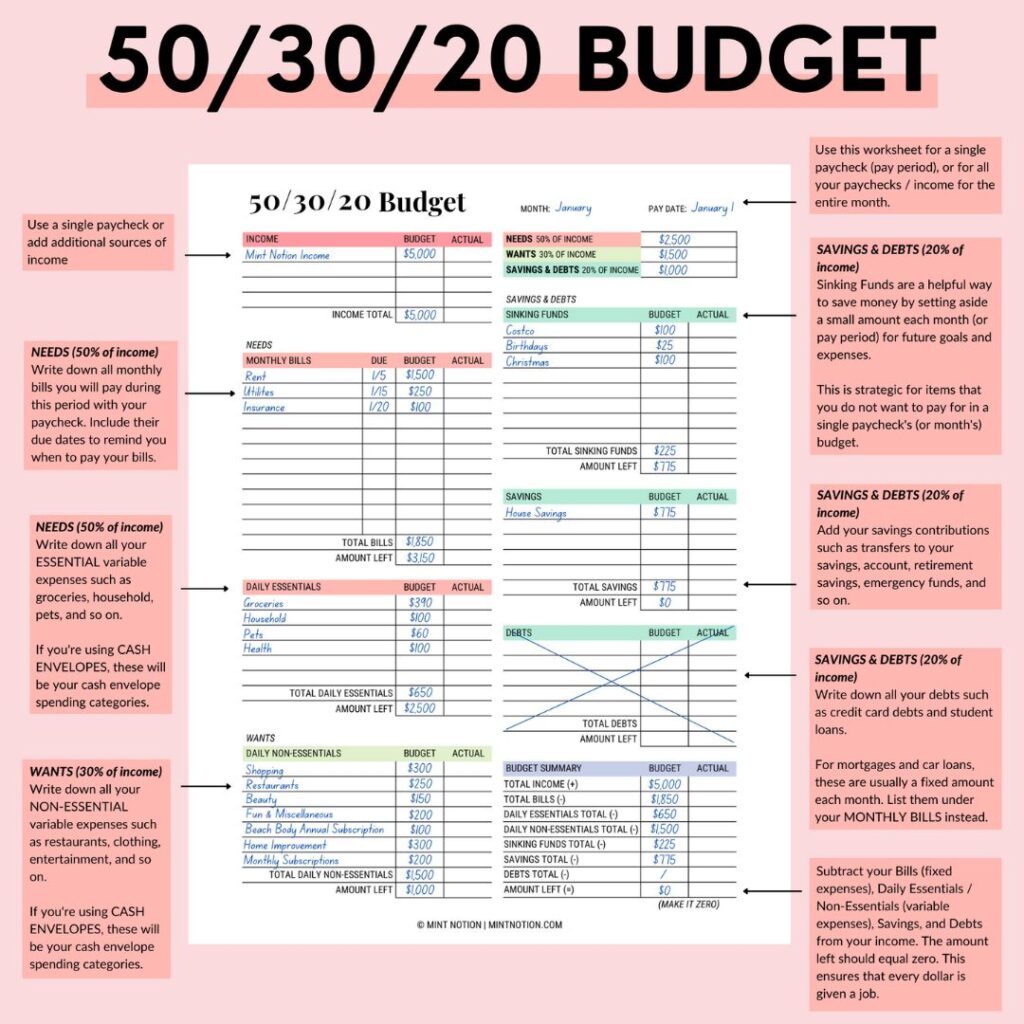

503020 Budgeting Template - Excel includes a huge selection of budgeting templates. Divide your money into needs (50%), wants (30%) and savings (20%) for financial success! Web interested in building your best budget yet? 50% for your needs, 30% for your wants and 20% for your savings. Web see how the 50/30/20 budget rule helps you spend smarter each month, plus free templates for google sheets and excel Limit your needs to 50% of your income. Allocate 50% of your income to essentials, 30% to wants, and 20% to savings and debt repayment. Web this budgeting method proposes that 50% of your income should be spent on needs, 30% on wants and 20% on savings. Basically 20% goes straight to savings, 30% goes to wants (shopping, eating out, hobbies), 50% to needs (housing, food, insurance, gas) excel tutorial here: Embrace the renowned 50/30/20 rule effortlessly with our monthly budget template. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. The 50/30/20 budget method helps individuals achieve their financial goals while ensuring they. This type of budget divides every expense into three categories: Track and visualize your income and spending for an average month to see how it compares to an ideal budget. This. This type of budget divides every expense into three categories: Web if the thought of having a budget tracker with a predetermined formula excites you, then take a look at our review of some of our best 50/30/20 google sheets budget templates for you to get started in no time. Includes real examples,a spreadsheet & free budget printables! 20% towards. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Web a 50/30/20 budget, sometimes referred to as the 50/30/20 rule, is a simplified way of budgeting that anyone can do. 50% for your needs, 30% for your wants and 20% for your savings. Includes real examples,a spreadsheet & free budget printables! Allocate 50% of your. And remember, you can always use a 50 30 20 calculator or even a 50 30 20 budget template to create yours. This formula can help manage lifestyle and easily track your expenses. Limit you wants to 30% of your income. Web see how the 50/30/20 budget rule helps you spend smarter each month, plus free templates for google sheets. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Limit your needs to 50% of your income. If you don’t normally keep track of your spending, using a budgeting tool like mint.com for a month might be helpful. This type of budget divides every expense into three categories: Web interested in building your best budget. Embrace the renowned 50/30/20 rule effortlessly with our monthly budget template. Her total monthly income that she will budget based on is $4,000. Get your free 50/30/20 budget spreadsheet here, along with a detailed overview and instructions. Download our free 50/30/20 budget template and customize it to your unique financial situation. Web if the thought of having a budget tracker. Excel includes a huge selection of budgeting templates. We’ll also show you how to create a 50/30/20 budget from scratch if you need more customization options. Includes real examples,a spreadsheet & free budget printables! This formula can help manage lifestyle and easily track your expenses. Spend 20% of your income on savings and debt payments. Web 50/30/20 budget calculator to plan your income and expenses. If you don’t normally keep track of your spending, using a budgeting tool like mint.com for a month might be helpful. Basically 20% goes straight to savings, 30% goes to wants (shopping, eating out, hobbies), 50% to needs (housing, food, insurance, gas) excel tutorial here: Web find out how to. This guide shows you how to use the budget, and comes with a free spreadsheet to set up your budget. Web interested in building your best budget yet? 50% for your needs, 30% for your wants and 20% for your savings. This formula can help manage lifestyle and easily track your expenses. Streamline budgeting, allocate funds wisely, and gain control. Includes real examples,a spreadsheet & free budget printables! The 50/30/20 budget method helps individuals achieve their financial goals while ensuring they. This type of budget divides every expense into three categories: Web a 50/30/20 budget, sometimes referred to as the 50/30/20 rule, is a simplified way of budgeting that anyone can do. Web stop financial stress with our 50/30/20 budget. We’ll also show you how to create a 50/30/20 budget from scratch if you need more customization options. Web interested in building your best budget yet? Web see how the 50/30/20 budget rule helps you spend smarter each month, plus free templates for google sheets and excel Brittney gets paid $2,000 every 2 weeks. Includes real examples,a spreadsheet & free budget printables! Web how much of your income should go to bills? And remember, you can always use a 50 30 20 calculator or even a 50 30 20 budget template to create yours. Download our free 50/30/20 budget template and customize it to your unique financial situation. Limit your needs to 50% of your income. Web a 50/30/20 budget, sometimes referred to as the 50/30/20 rule, is a simplified way of budgeting that anyone can do. Excel includes a huge selection of budgeting templates. Track and visualize your income and spending for an average month to see how it compares to an ideal budget. Make adjustment and stick to it! Her total monthly income that she will budget based on is $4,000. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Allocate 50% of your income to essentials, 30% to wants, and 20% to savings and debt repayment.

50 30 20 Rule (Free Excel Budgeting Template) I Try FI

50 30 20 Rule of Budgeting (Excel Template Included) YouTube

503020 Monthly Budget Spreadsheet Excel Budget Planner Google Sheets

The 503020 Budget Method Defined

50/30/20 Template Excel

50 30 20 Budget Excel Spreadsheet for The 503020 Budget

Printable 503020 Budget Planner Template Monthly Budget Etsy

Understanding the 50/30/20 Rule to Help You Save MagnifyMoney

Can You *Really* Afford It? Use the 50/30/20 Rule (Free Editable

50 30 20 Budget Worksheet Worksheets For Kindergarten

This Guide Shows You How To Use The Budget, And Comes With A Free Spreadsheet To Set Up Your Budget.

Web Stop Financial Stress With Our 50/30/20 Budget Template At Template.net.

Divide Your Money Into Needs (50%), Wants (30%) And Savings (20%) For Financial Success!

20% Towards Saving, Investing & Excess Debt Payoff.

Related Post: