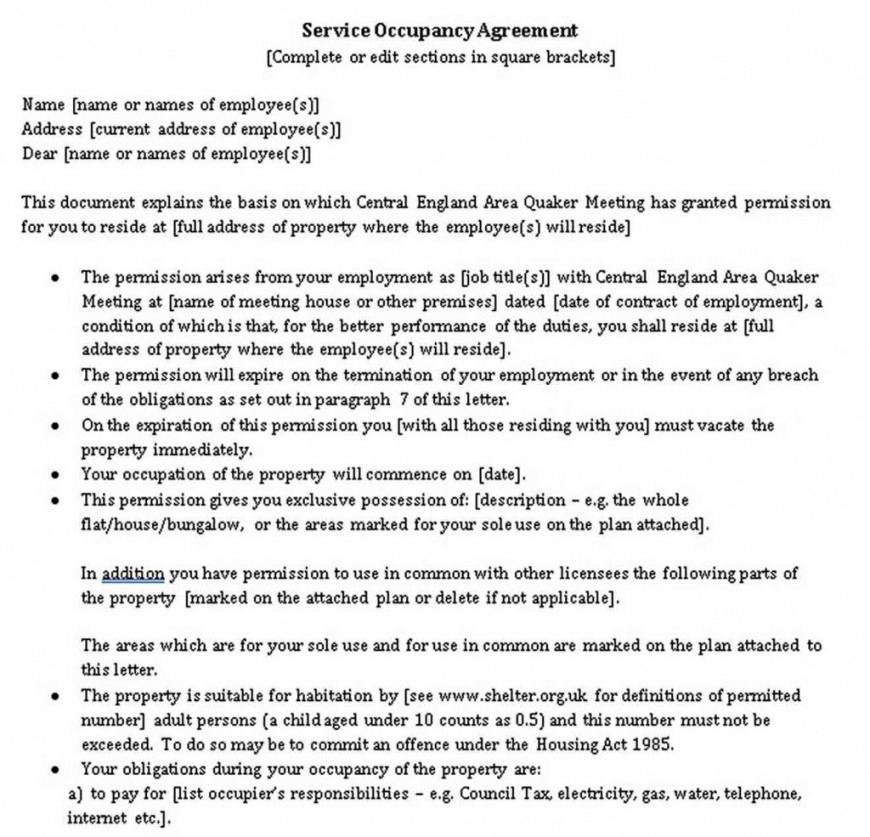

B Notice Template

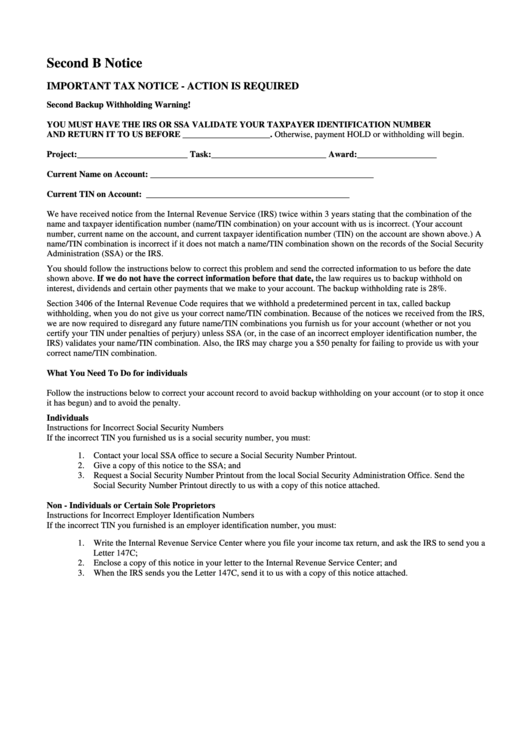

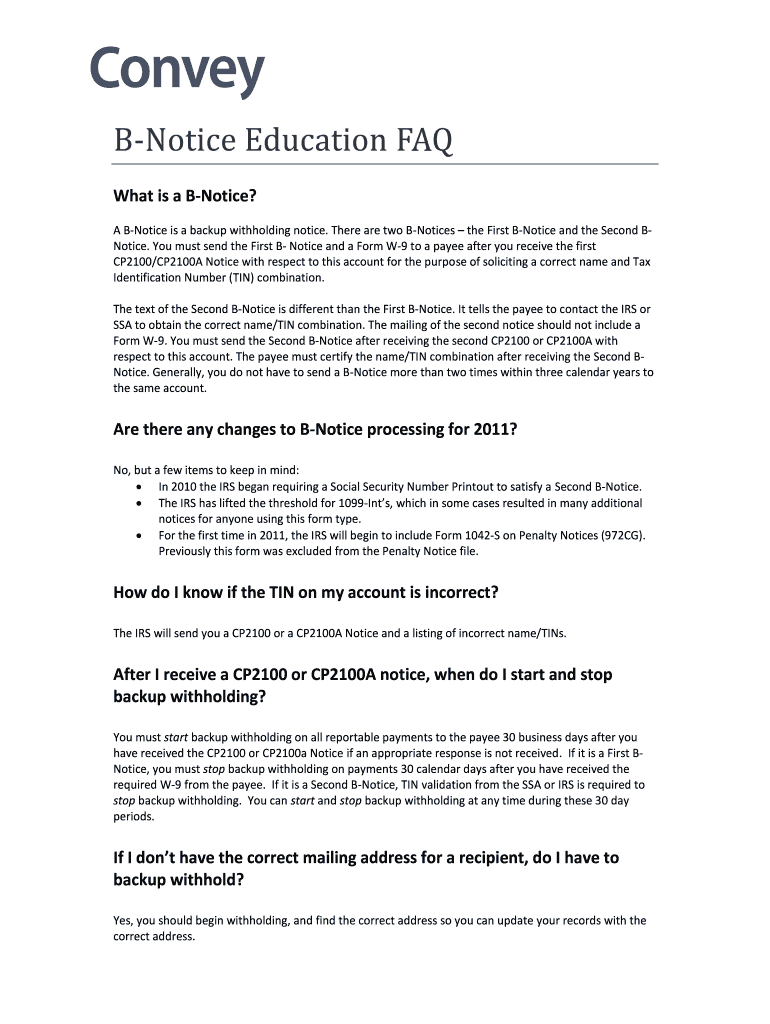

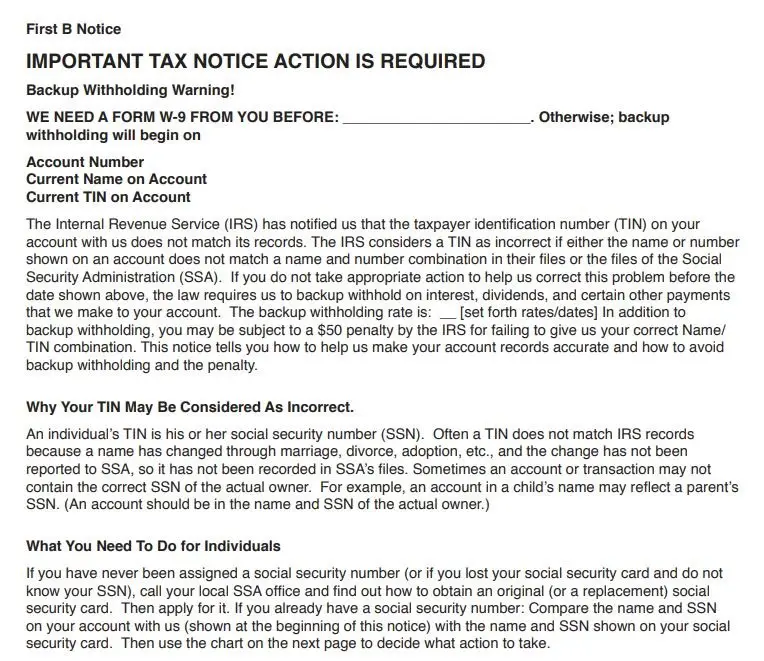

B Notice Template - If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. A “b notice” is part of the irs’s backup withholding program, which provides notices to payers (such as businesses) who file certain. Any payors and withholding agents that filed information returns with a missing, incorrect, and/or not currently issued taxpayer. Check those out in irs publication 1281. You do not need to. Web irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the. Web ðï ࡱ á> þÿ q s. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t match the irs database and need correction. Web what is a “b notice”? Edit your irs b notice word template online. Identify which irs notice you received. Web who is impacted by a b notice? You do not need to. Any payors and withholding agents that filed information returns with a missing, incorrect, and/or not currently issued taxpayer. Web also known as an irs b notice, the irs notifies the 1099 filer that a name and taxpayer identification number (tin) don’t. Video instructions and help with filling out and completing first b notice template. Then use the chart on the next page to decide what. Web who is impacted by a b notice? What is a b notice (i.e., what is required if a b notice is received? Additional complexities of b notice resolution. Edit your b notice form pdf online. Additional complexities of b notice resolution. Web table of contents. Video instructions and help with filling out and completing first b notice template. Web share your form with others. You do not need to. You must have the irs or ssa validate your taxpayer identification. Identify which irs notice you received. Edit your irs b notice word template online. What is a b notice (i.e., what is required if a b notice is received? Additional complexities of b notice resolution. Edit your first b notice form template word. Video instructions and help with filling out and completing first b notice template. Then use the chart on the next page to decide what. Check those out in irs publication 1281. Web what is a “b notice”? You can also download it, export it or print it out. Edit your first b notice form template word. “b” notices are sent out by the irs twice per year to businesses that. Web irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. You must have the irs or ssa validate your taxpayer identification. Important ta x notice action is required backup withholding warning! What is a b notice (i.e., what is required if a b notice is received?. Edit your irs first b notice form template. Video instructions and help with filling out and completing first b notice template. Additional complexities of b notice resolution. Web what is a “b notice”? A “b notice” is part of the irs’s backup withholding program, which provides notices to payers (such as businesses) who file certain. Sign it in a few clicks. Web share your form with others. Video instructions and help with filling out and completing first b notice template. Any payors and withholding agents that filed information returns with a missing, incorrect, and/or not currently issued taxpayer. You must have the irs or ssa validate your taxpayer identification. A “b notice” is part of the irs’s backup withholding program, which provides notices to payers (such as businesses) who file certain. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. Web share your form with others. You do not need to. Edit your b. Type text, add images, blackout confidential details, add comments, highlights and more. Web table of contents. Send first b notice template via email, link, or fax. You must have the irs or ssa validate your taxpayer identification. Web published october 13, 2012 · updated may 11, 2021. Web on your account with us (shown at the beginning of this notice) with the name and ssn shown on your social security card. Any payors and withholding agents that filed information returns with a missing, incorrect, and/or not currently issued taxpayer. Web what is a “b notice”? Web share your form with others. What is a b notice (i.e., what is required if a b notice is received? Web ðï ࡱ á> þÿ q s. Edit your irs b notice word template online. Additional complexities of b notice resolution. Sign it in a few clicks. You can also download it, export it or print it out. Web the initial b notice informs the payer that the combination of tin and a name has not been identified in any b notice received by the filer within the past three years.

First B Notice Fill and Sign Printable Template Online US Legal Forms

Printable First B Notice Template Printable Templates

Irs B Notice Template

Printable First B Notice Template Printable Templates

Printable First B Notice Form Template Sample Tacitproject

Irs First B Notice Fillable Form Printable Forms Free Online

Second B Notice Important Tax Notice Action Is Required printable

Printable First B Notice Template Free Printable

Professional First B Notice Template Word PDF Sample Tacitproject

First B Notice Template

If You Have Any Questions About Backup Withholding, Information Reporting, Forms 1099, Or The Cp2100 Or Cp2100A Notices And Listing(S), You May Call The.

You Do Not Need To.

A “B Notice” Is Part Of The Irs’s Backup Withholding Program, Which Provides Notices To Payers (Such As Businesses) Who File Certain.

Important Ta X Notice Action Is Required Backup Withholding Warning!

Related Post: