Bill Collection Letter Template

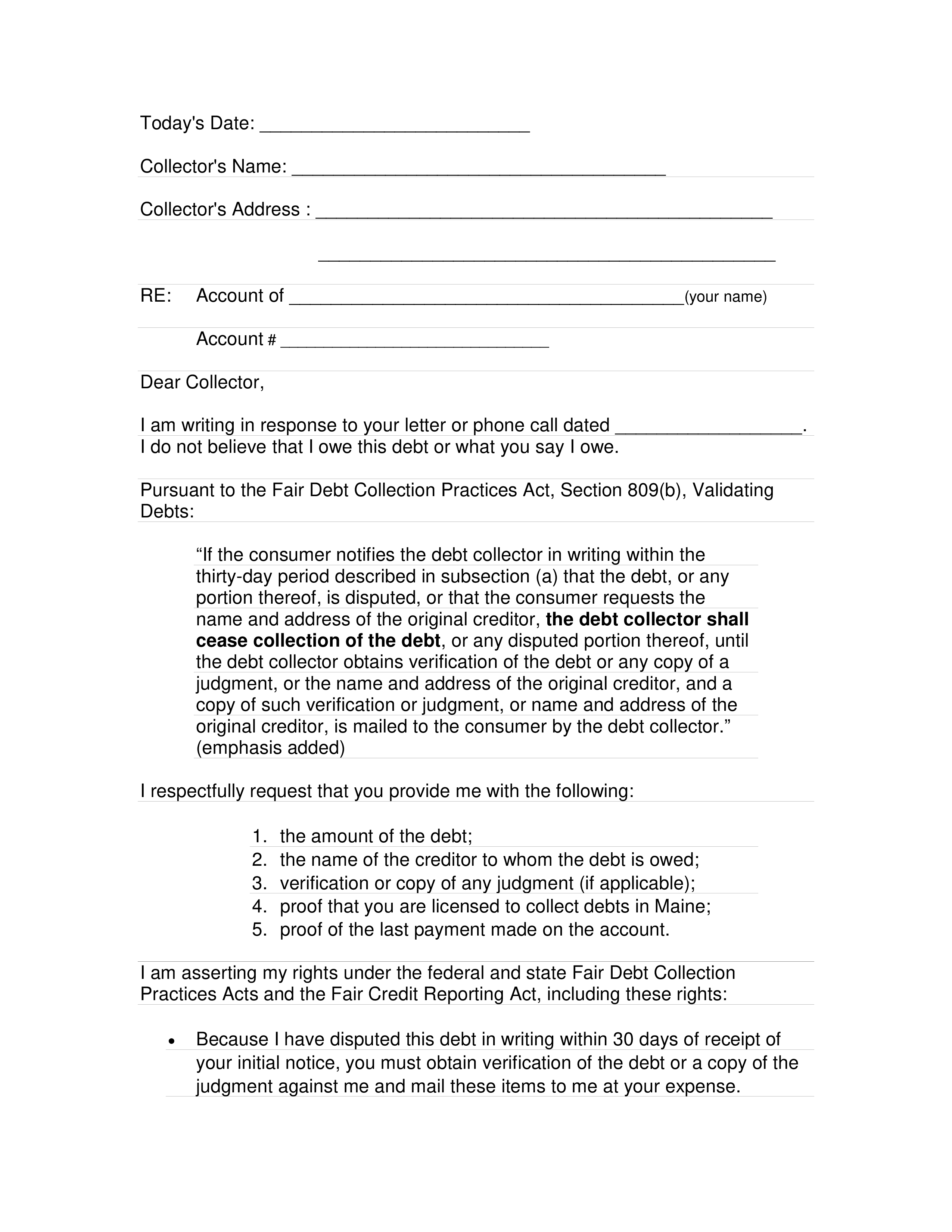

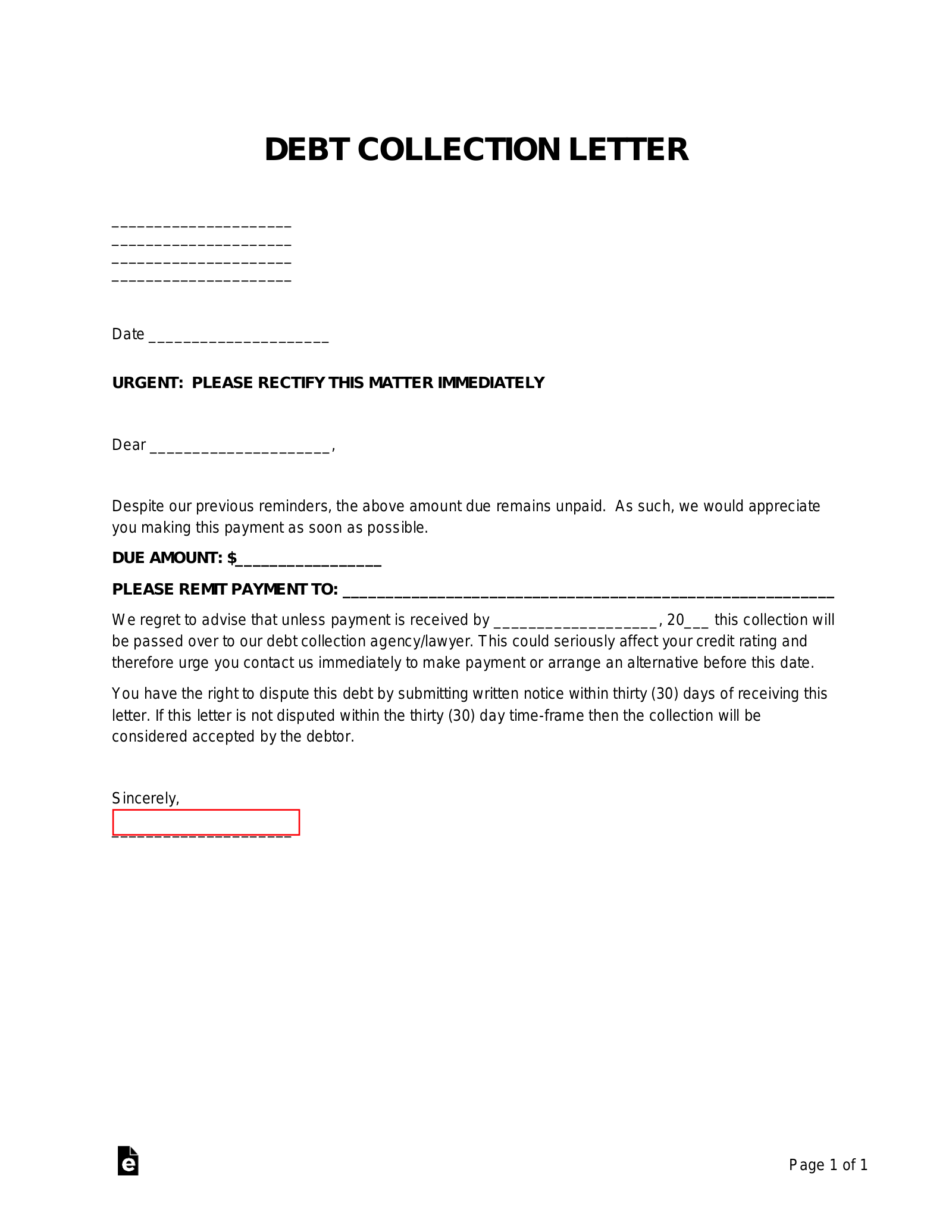

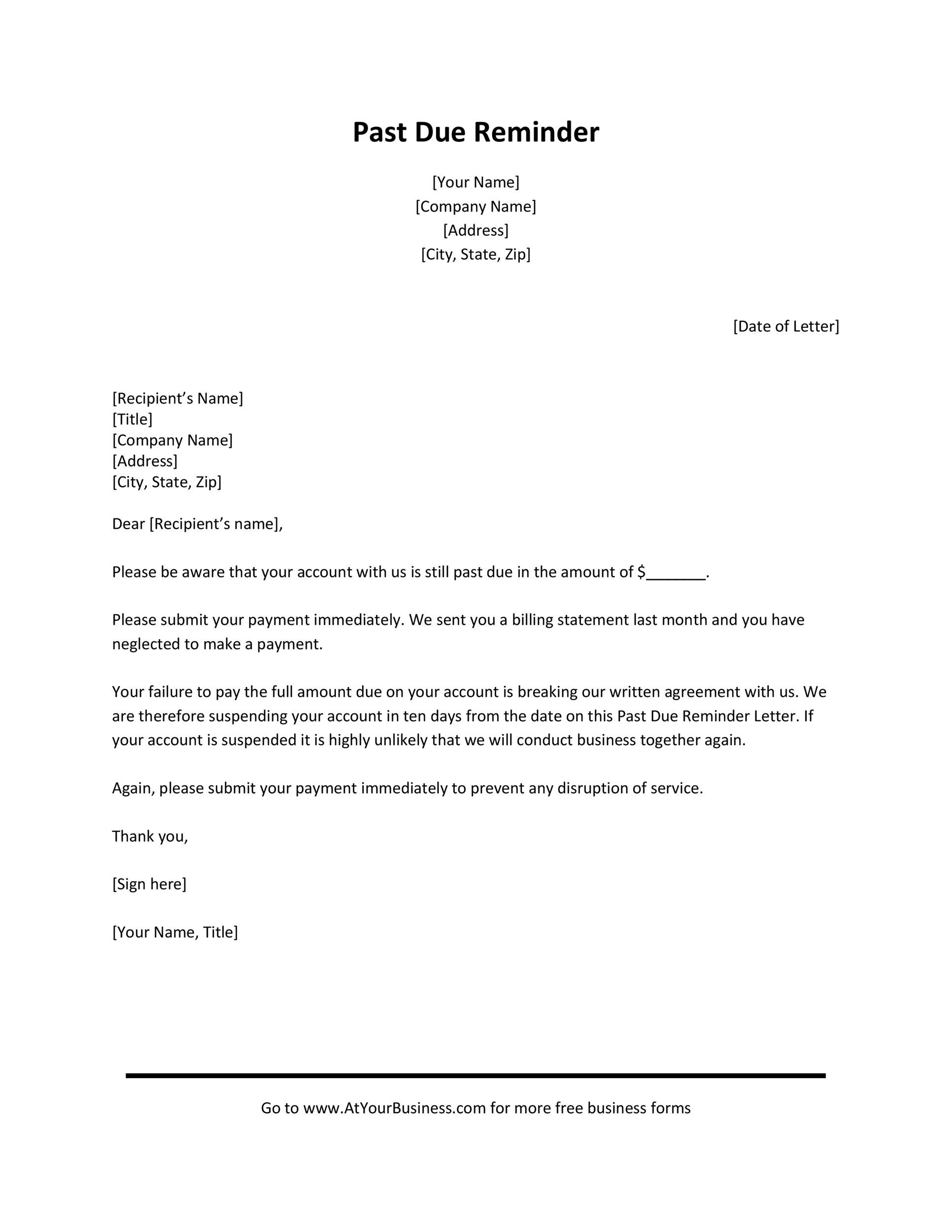

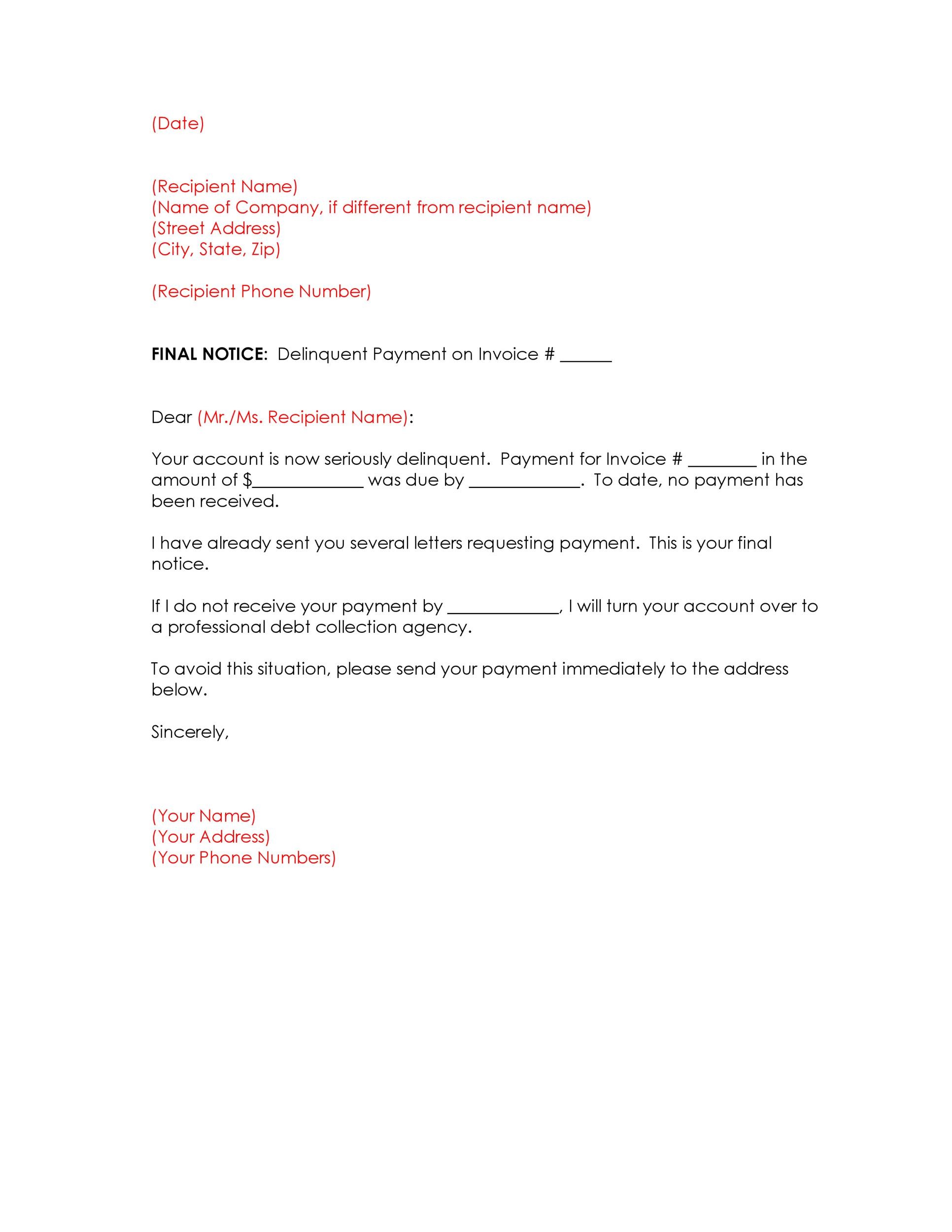

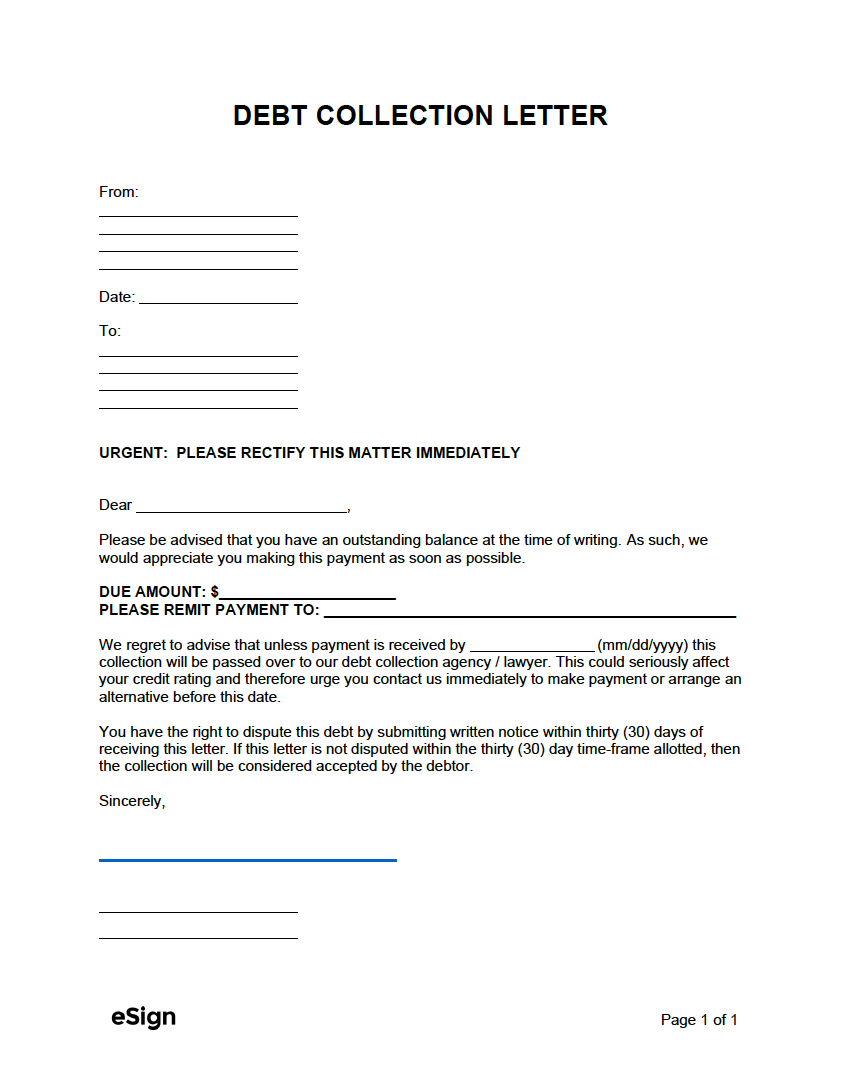

Bill Collection Letter Template - If the collection hasn’t been paid, continue paying on time. Check your credit report thoroughly. The letter should include the following information: In a debt collection letter, the subhead contains the details of both your law firm and your client. The first letter you send is nothing more than a notification. The collection letter process typically offers more than one warning to the debtor in written form, followed by a final. Your office address, zip code, and contact number. Web what to include. Web this sample collection letter can help you address possible issues, resolve debts, and move forward. Initial debt collection email or due date notice. A new due date or immediately upon receipt of the letter. Collection letter templates are created to provide written notice that there is money owed that will be sent to collections. It includes details of the missed payment and a payment request. Write in a polite but firm tone. Let this letter serve as a reminder that your payment must. The first letter you send is nothing more than a notification. Web collection letter sample 1: The letter can serve as a general reminder or can be used to inform the recipient that legal action will be taken against them soon. Some delayed payments may occur because the customers forgot these payments and as such, a. Collection letter templates are. If you’ve not received these email messages and documents, here is a summary of your account. There are other costs as well, but these are the most common. Mention of all previous attempts to collect, including the first collection letter. The first letter you send is nothing more than a notification. Web you need money to thrive and grow, and. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: The second collection letter should include: Mention of all previous attempts to collect, including the first collection letter. A demand letter should account for likely complications by being detailed and thorough. The letter can serve as a. The main function of this letter is to serve as a reminder to a debtor of their delinquent payment owed to a creditor. Reference invoice numbers, contract agreements, etc. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: The purpose of a debt collection letter is. To inquire about a missed payment, considering there might be a valid reason. Web final collection letter template. Like your email or call, this letter should be. Web a debt collection letter is a document mailed by a creditor (or collection agency) to a debtor demanding payment for an unpaid balance. If you don’t find any errors, ask the debt. Include all necessary details for you, your firm, and the client at the top. Web here are some tips to help you get your message across in an effective collection letter: Web consider including the following: Write in a polite but firm tone. If the collection hasn’t been paid, continue paying on time. Web here’s a detailed overview of the different types of debt collection letters: Web here are eight important details that every debt collection letter should include: Web this sample collection letter can help you address possible issues, resolve debts, and move forward. The second collection letter should include: Highlight the outstanding amount, the original due date, and any additional charges. Cite the principal amount, any interest or fees, and a description of what the original balance is for—including dates and locations. To gently remind the debtor of a missed payment. In a debt collection letter, the subhead contains the details of both your law firm and your client. The letter can serve as a general reminder or can be used. Mortgage loans make up the majority of debt, followed by student loans, then auto loans, and finally credit card debt. The second collection letter should include: Check your credit report thoroughly. Sent 14 days after your initial reminder call or email. Dear, this is a kind reminder that your account is overdue. Collection letter templates are created to provide written notice that there is money owed that will be sent to collections. Web here are eight important details that every debt collection letter should include: The amount of the debt ($); Web the total of any debt in the united states is $14.96 trillion. The letter may include information on the consequences of failing to. Web the debt collection letter template is used to inform a debtor that they owe money to someone. In order to be compliant with fair debt collection practices, the letter must contain the following: The purpose of a debt collection letter is to request payment of the outstanding debt or to negotiate a repayment plan. The letter should include the following information: Web here are some tips to help you get your message across in an effective collection letter: To inquire about a missed payment, considering there might be a valid reason. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: Check your credit report thoroughly. The second collection letter should include: Web final collection letter template. In a debt collection letter, the subhead contains the details of both your law firm and your client.

9 Debt Collection Letters Templates SampleTemplatess SampleTemplatess

Debt Collection Letter Templates at

10 Sample Collection Letters Examples, Format and How To Write Sample

Free Debt Collections Letter Template Sample PDF Word eForms

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

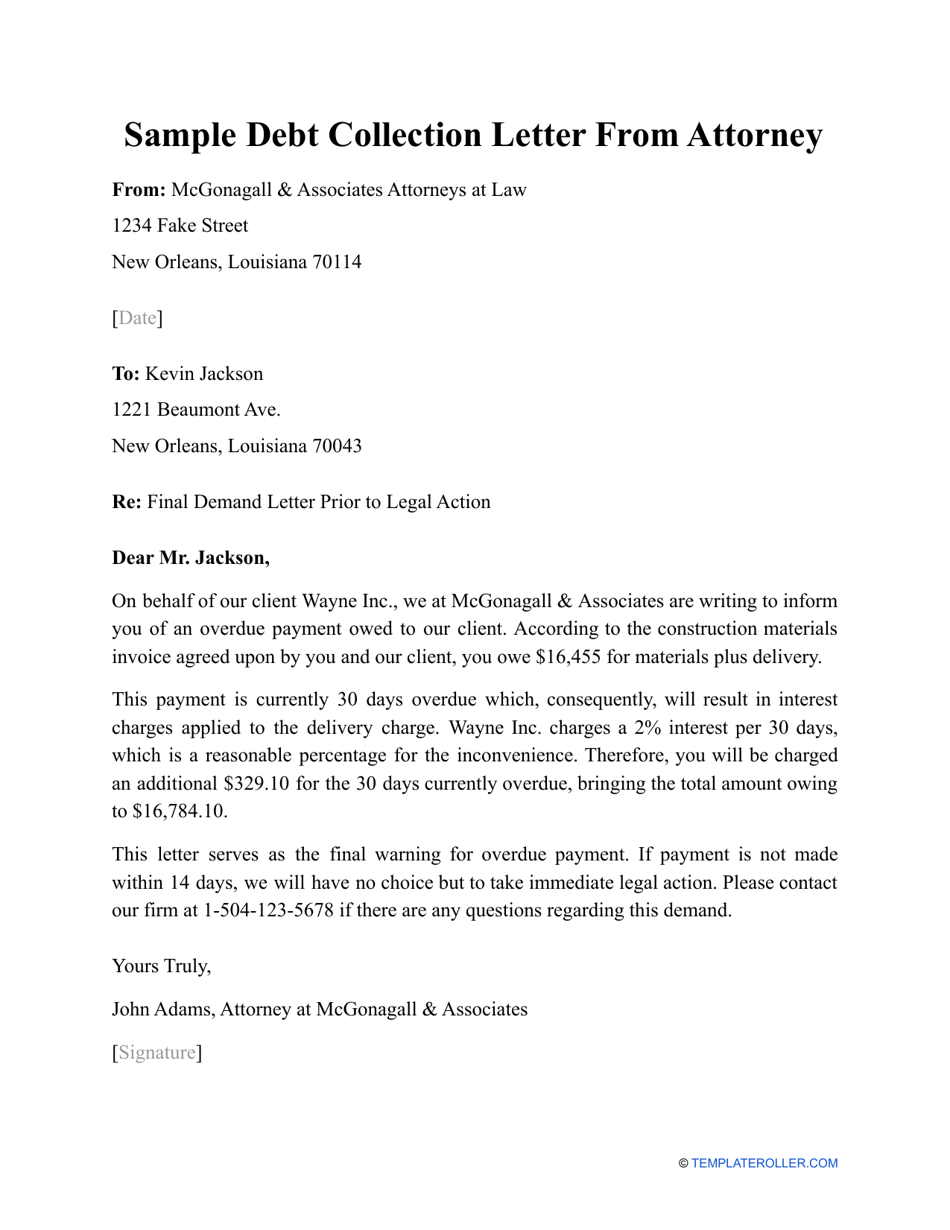

Sample Debt Collection Letter From Attorney Fill Out, Sign Online and

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

10 Sample Collection Letters Examples, Format and How To Write Sample

Legal Debt Collection Letter Template

Web A Payment Collection Letter Is A Document Sent In Writing That Informs A Client Of Their Payments That Are Already Past Due.

If You Don’t Find Any Errors, Ask The Debt Collector To Verify It.

Let This Letter Serve As A Reminder That Your Payment Must Be Paid By [Month/Day/Year].

To Gently Remind The Debtor Of A Missed Payment.

Related Post: