Blank 1099 Template

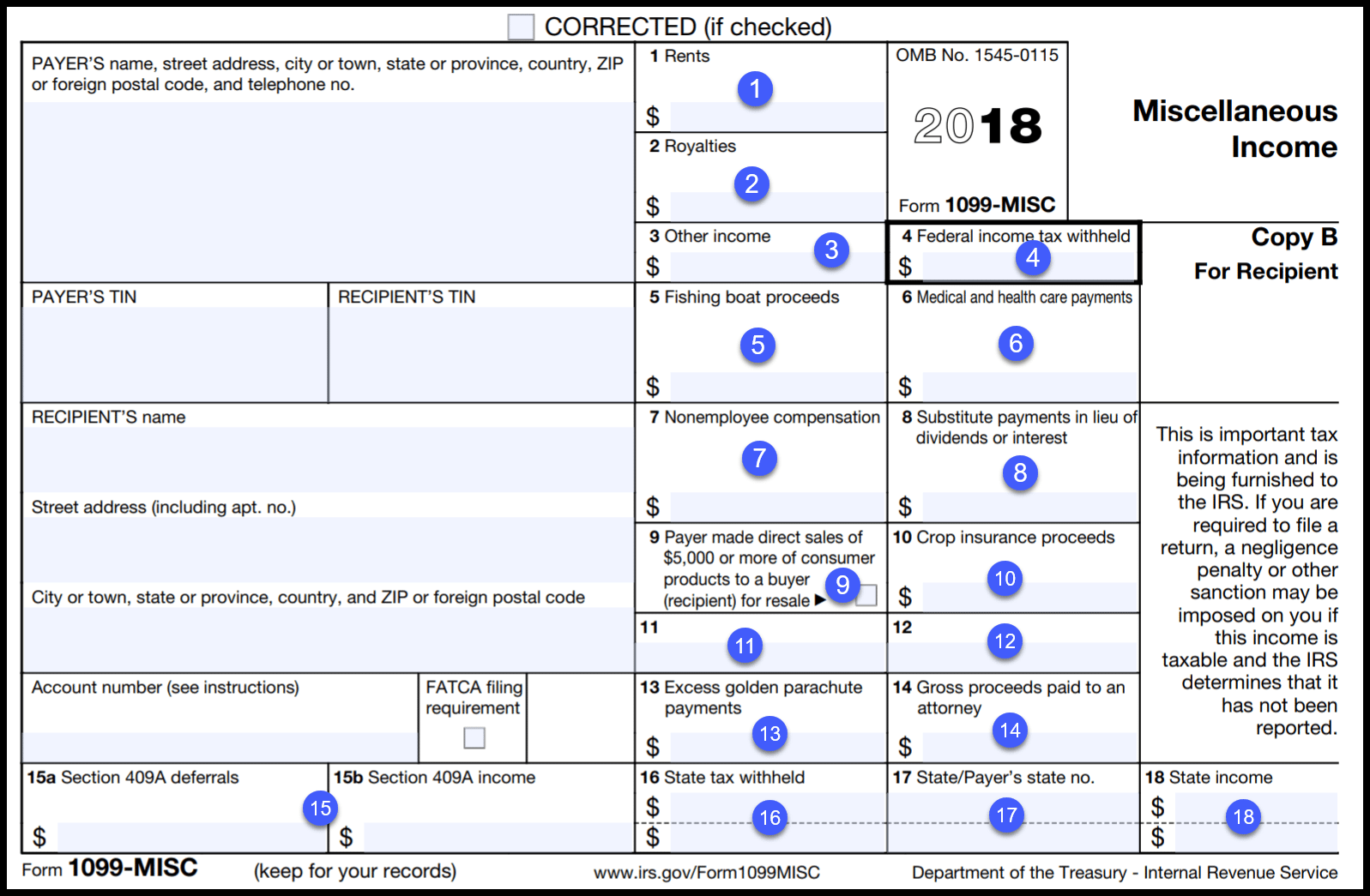

Blank 1099 Template - Onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. If you paid an independent contractor more than $600 in a. Download this 2023 excel template. Prepare form 1099 (all variations) printable 1099 forms. Web updated november 06, 2023. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. This form is used by businesses to report payments made to nonemployees, like independent contractors or freelancers. Web select which type of form you’re printing: Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Correctedpayer’s name, street address, city or town, state or province, country, zip or foreign postal code, and telephone no. Onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Make small adjustments if needed. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to. This form is used by businesses to report payments made to nonemployees, like independent contractors or freelancers. Persons with a hearing or speech disability with access to tty/tdd equipment can. Looking for a 1099 excel template? Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. See your tax return instructions. Download this 2023 excel template. Make small adjustments if needed. Web updated november 06, 2023. Web updated november 27, 2023. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. See the instructions for form 8938. Persons with a hearing or speech disability with access to tty/tdd equipment can. Print to your paper 1099 or 1096 forms and mail. Web it's just $50. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. (you don’t want the information getting printed in the wrong box!) This form is used by businesses to report payments made to nonemployees, like independent contractors or freelancers. Web updated on january 12, 2022. If you paid an independent contractor more than $600 in a. Simple instructions and pdf download. You're probably hoping to find something — anything — that can make your taxes less of a buzzkill. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See the instructions for form 8938. Web updated november 06, 2023. To calculate and print to irs 1099 forms with their unconventional spacing. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of. Web updated on january 12, 2022. Web updated november 27, 2023. Looking for a 1099 excel template? Persons with a hearing or speech disability with access to tty/tdd equipment can. See the instructions for form 8938. See your tax return instructions for where to report. Web updated on january 12, 2022. Make small adjustments if needed. See the instructions for form 8938. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Web updated on january 12, 2022. You're probably hoping to find something — anything — that can make your taxes less of a buzzkill. Simple instructions and pdf download. Persons with a hearing or speech disability with access to tty/tdd equipment can. Make small adjustments if needed. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Download this 2023 excel template. Web select which type of form you’re printing: File to download or integrate. You're probably hoping to find something — anything — that can make your taxes less of a buzzkill. You may also have a filing requirement. If you paid an independent contractor more than $600 in a. Make small adjustments if needed. Print to your paper 1099 or 1096 forms and mail. Web updated on january 12, 2022. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Web blank 1099 templates for immediate download. (you don’t want the information getting printed in the wrong box!) Correctedpayer’s name, street address, city or town, state or province, country, zip or foreign postal code, and telephone no. Persons with a hearing or speech disability with access to tty/tdd equipment can. Persons with a hearing or speech disability with access to tty/tdd equipment can.

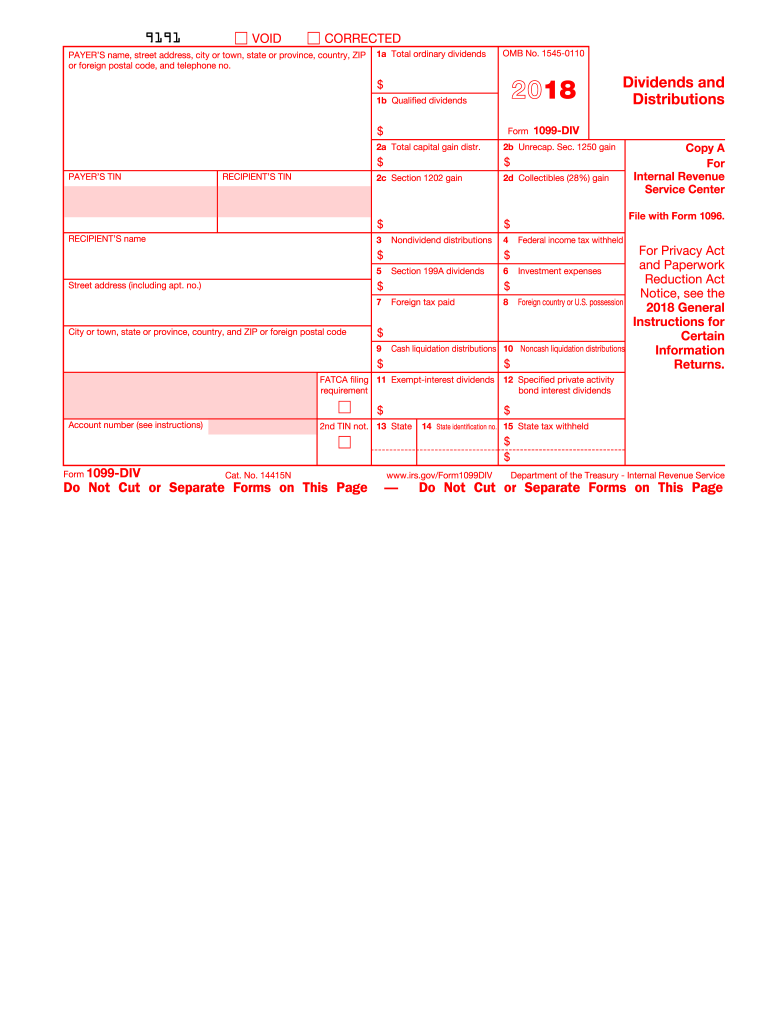

2018 Form IRS 1099DIV Fill Online, Printable, Fillable, Blank pdfFiller

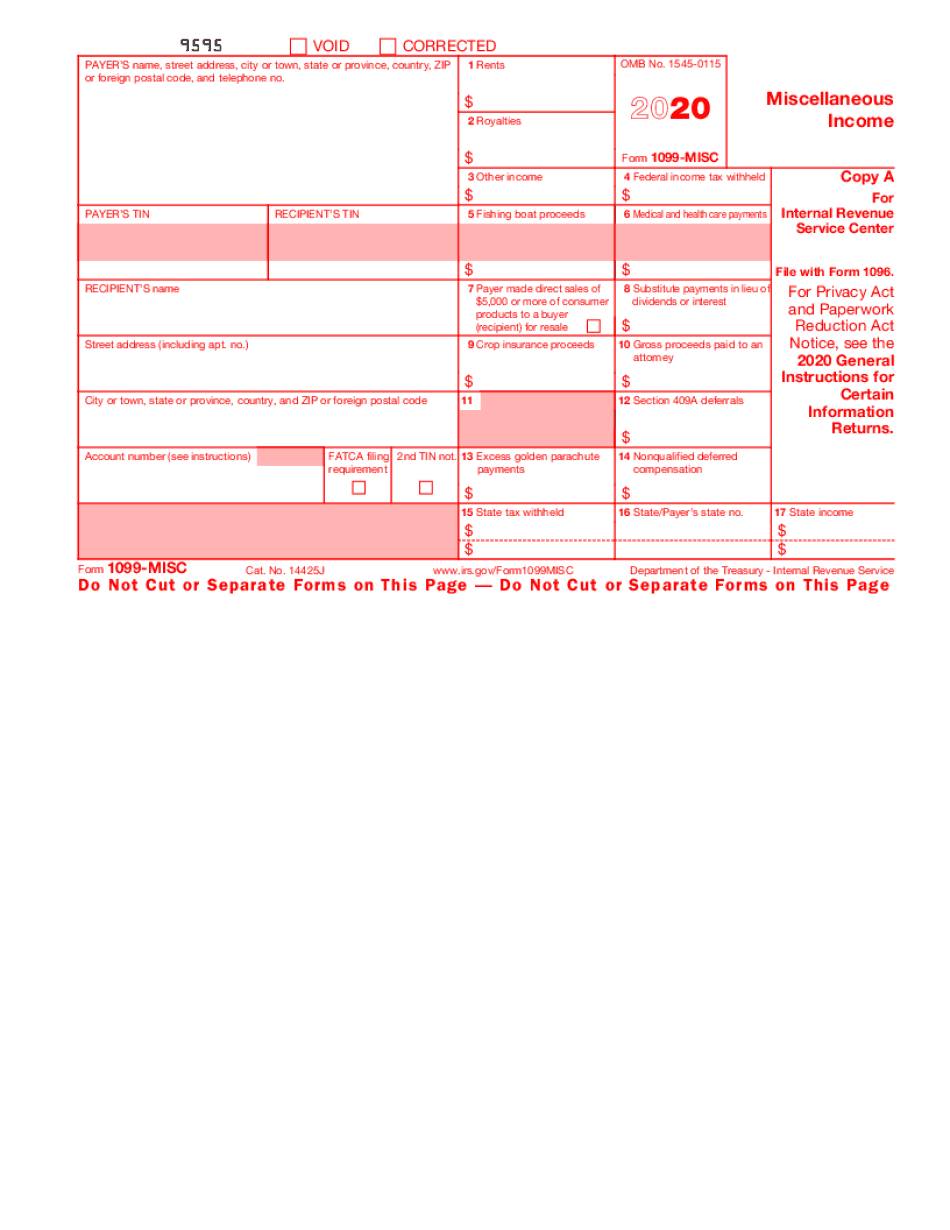

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

1099 Template Free

Free Printable Irs 1099 Misc Form Printable Forms Free Online

Print Blank 1099 Form Printable Form, Templates and Letter

Form 1099 Misc Fillable Universal Network

Printable Blank 1099 Form

Free 1099 Form Printable Printable Forms Free Online

1099 Irs Form Printable Printable Forms Free Online

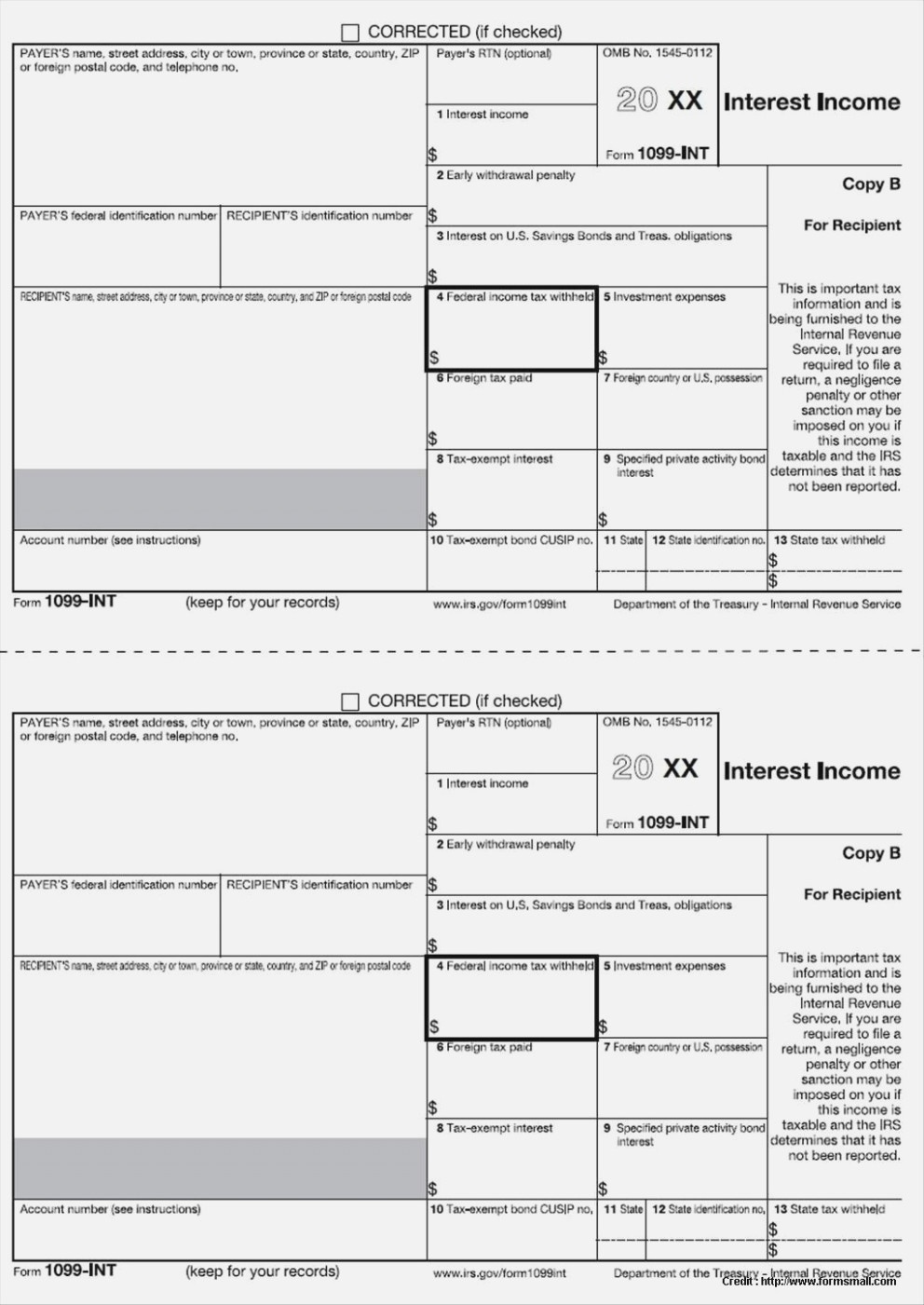

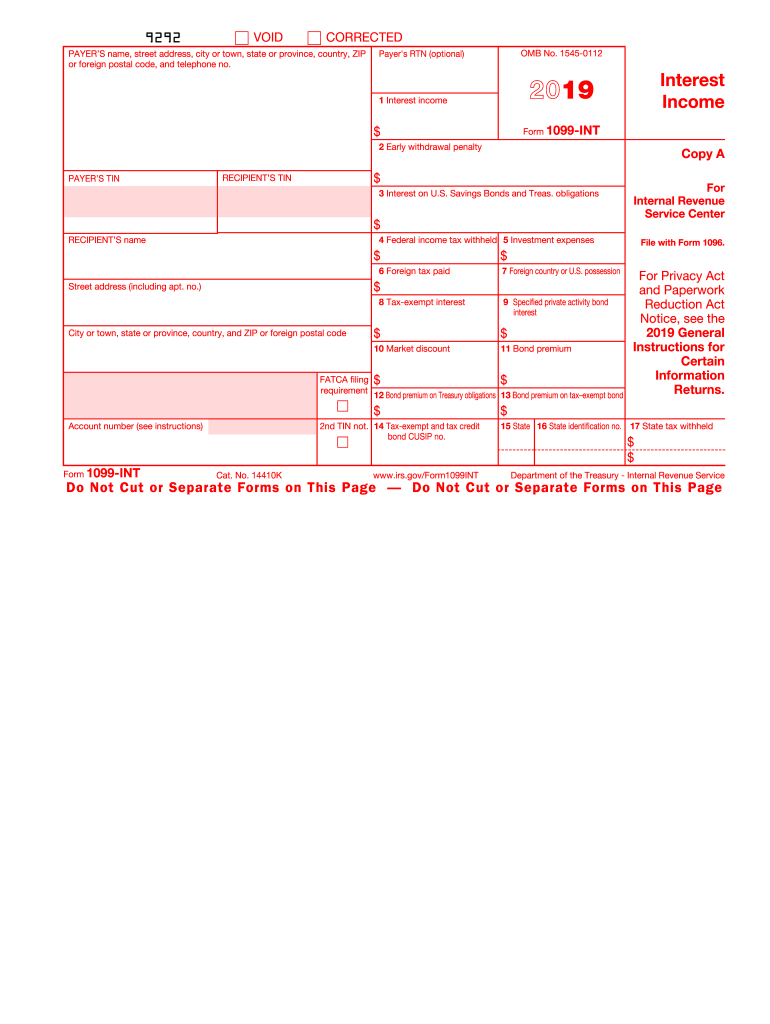

IRS 1099INT 2019 Fill and Sign Printable Template Online US Legal

This Form Is Used By Businesses To Report Payments Made To Nonemployees, Like Independent Contractors Or Freelancers.

Web Updated November 06, 2023.

Web Updated November 27, 2023.

You Can Print The Following Number Of Copies For These 1099 Forms On 1 Page:

Related Post: