Business Mileage Log Template

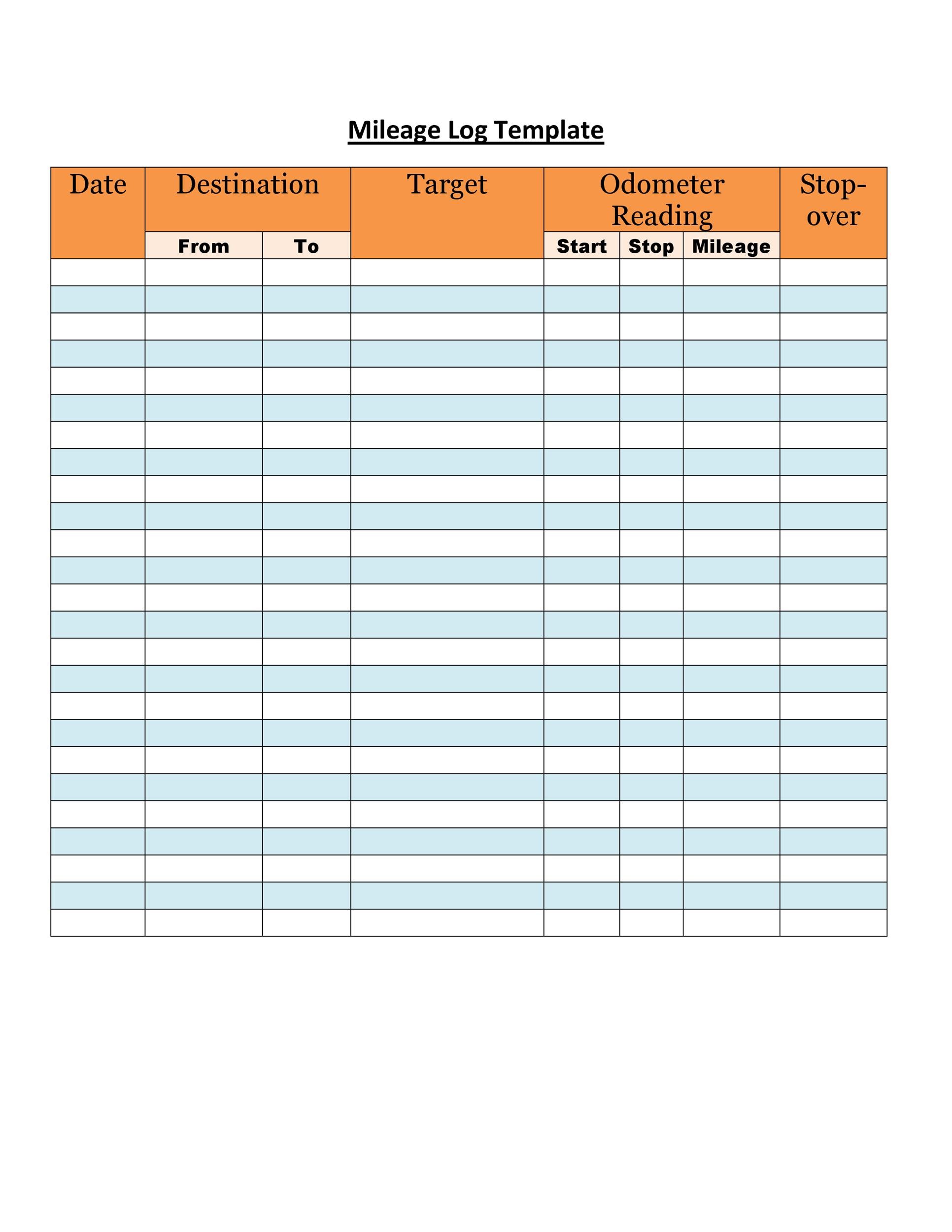

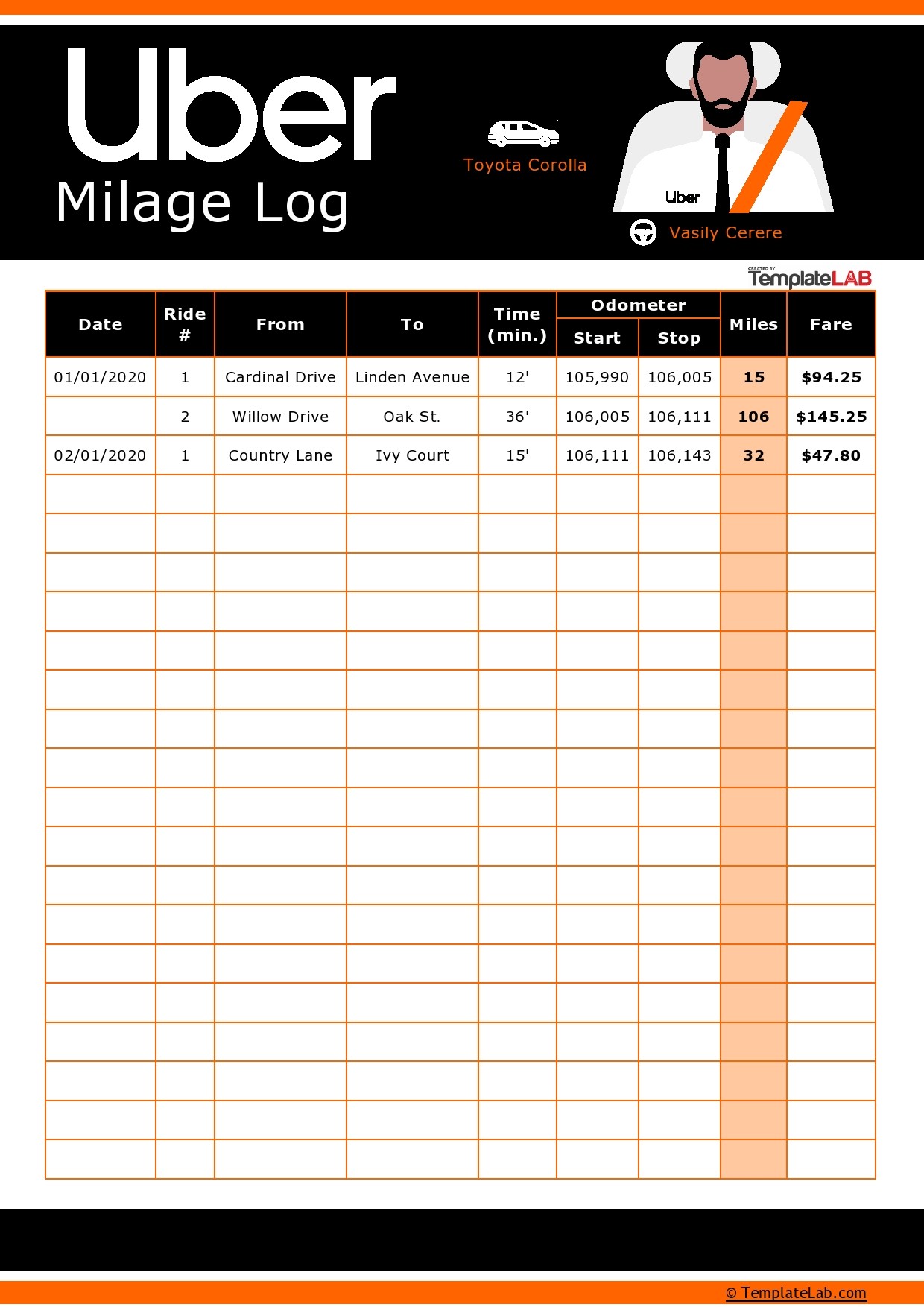

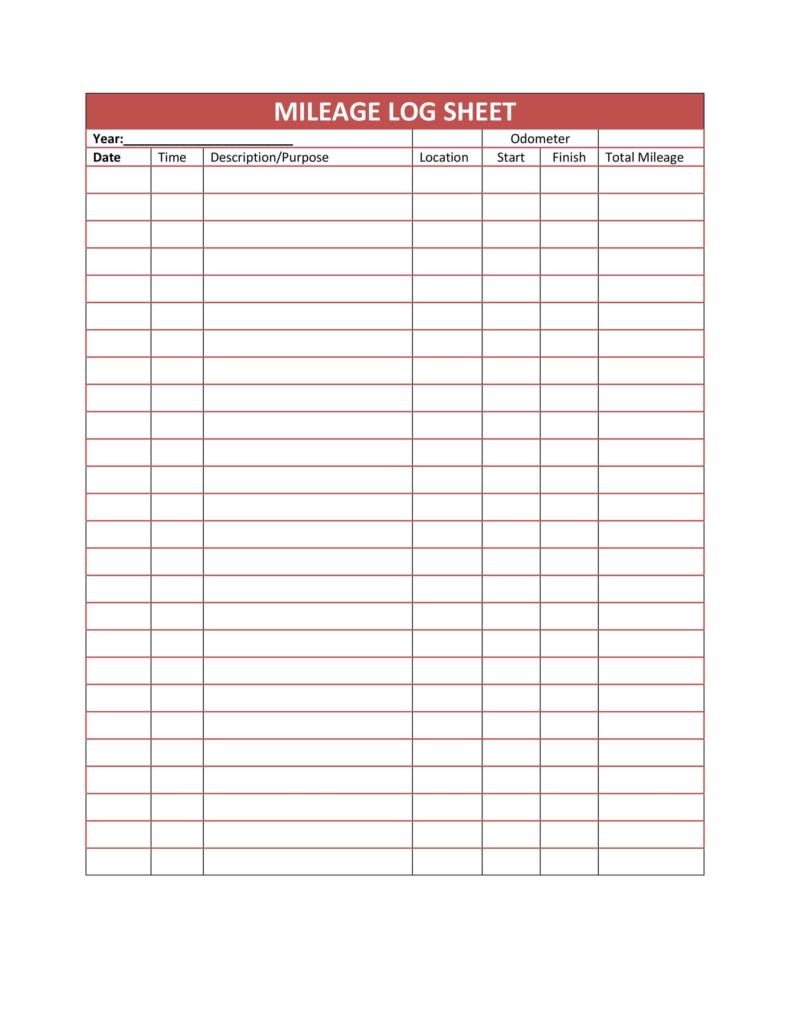

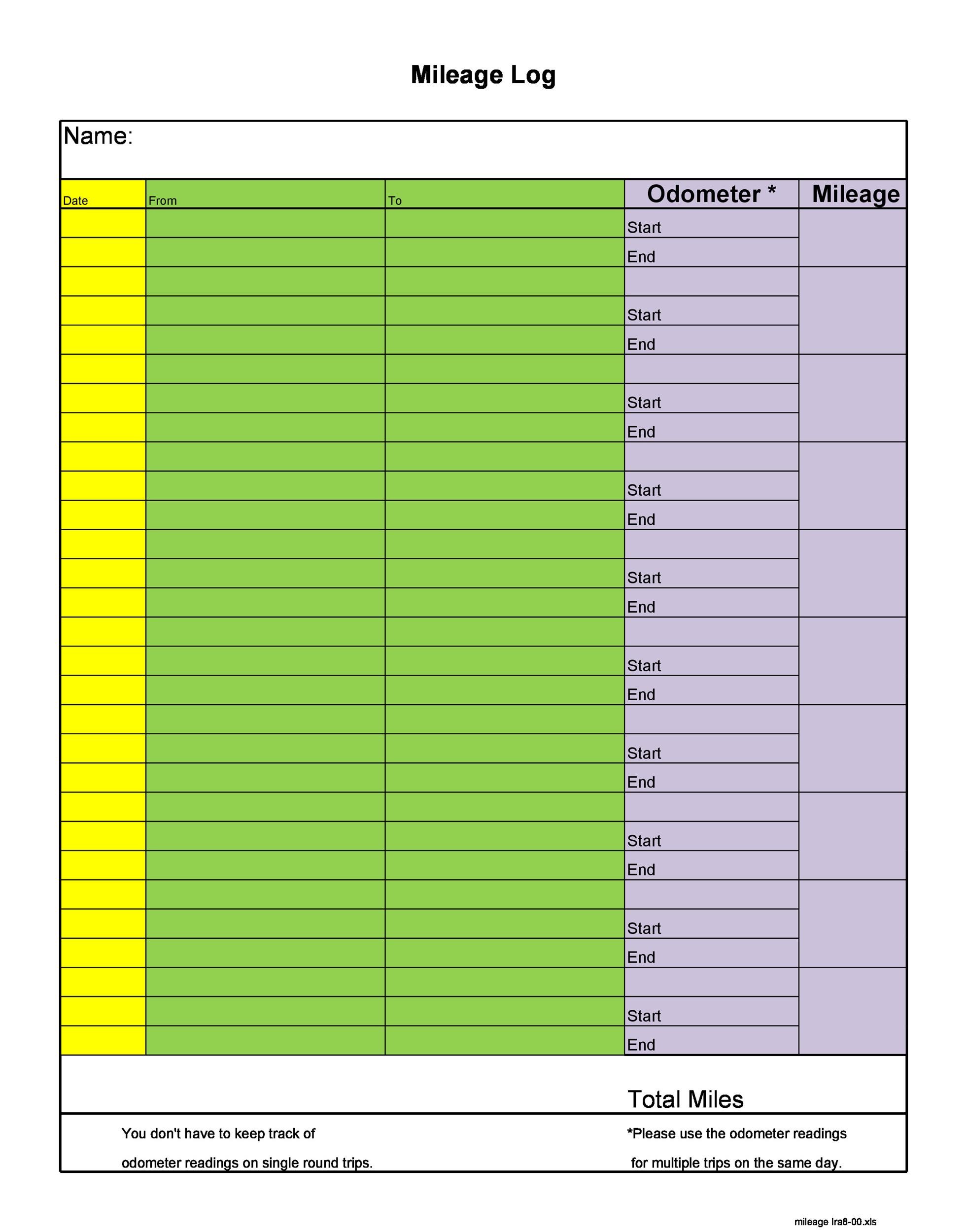

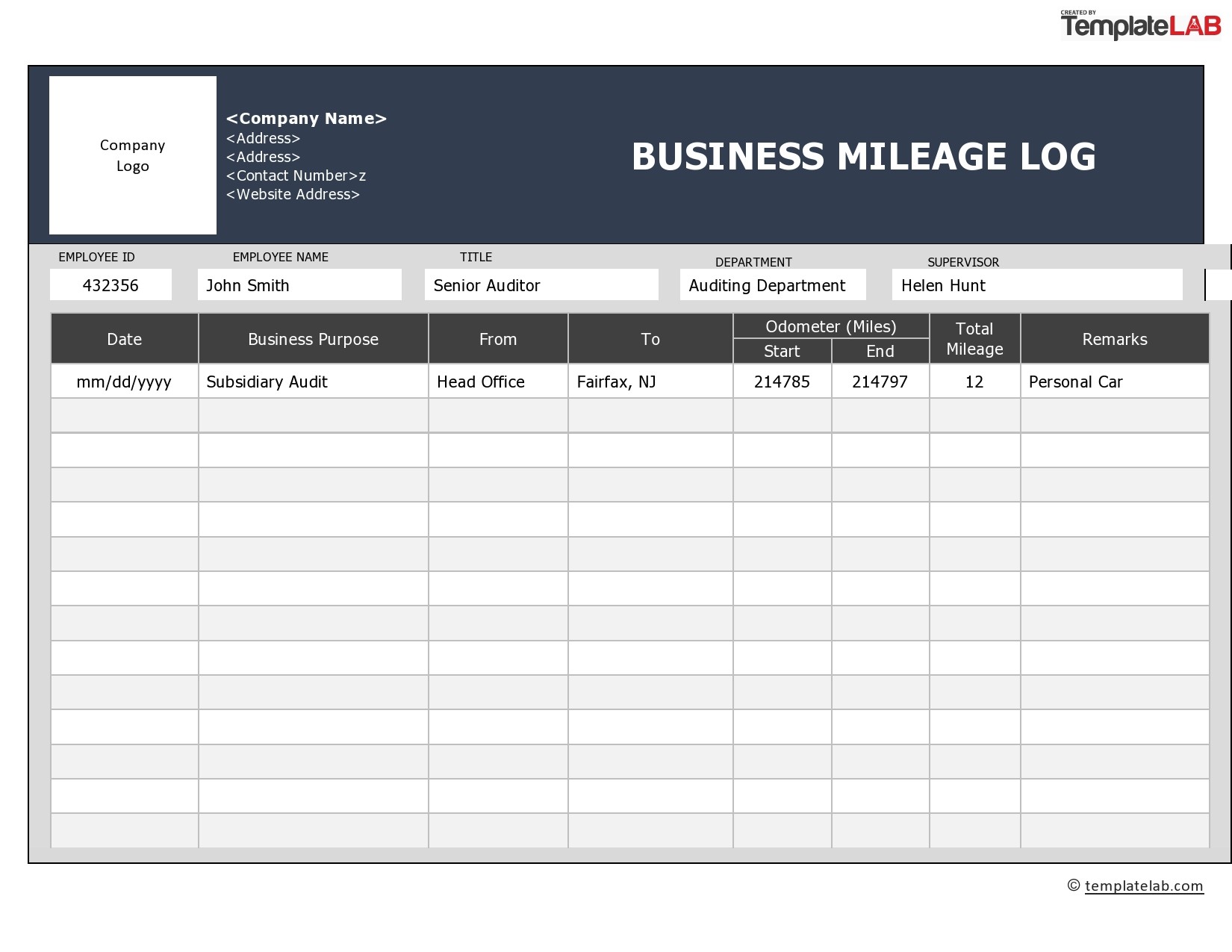

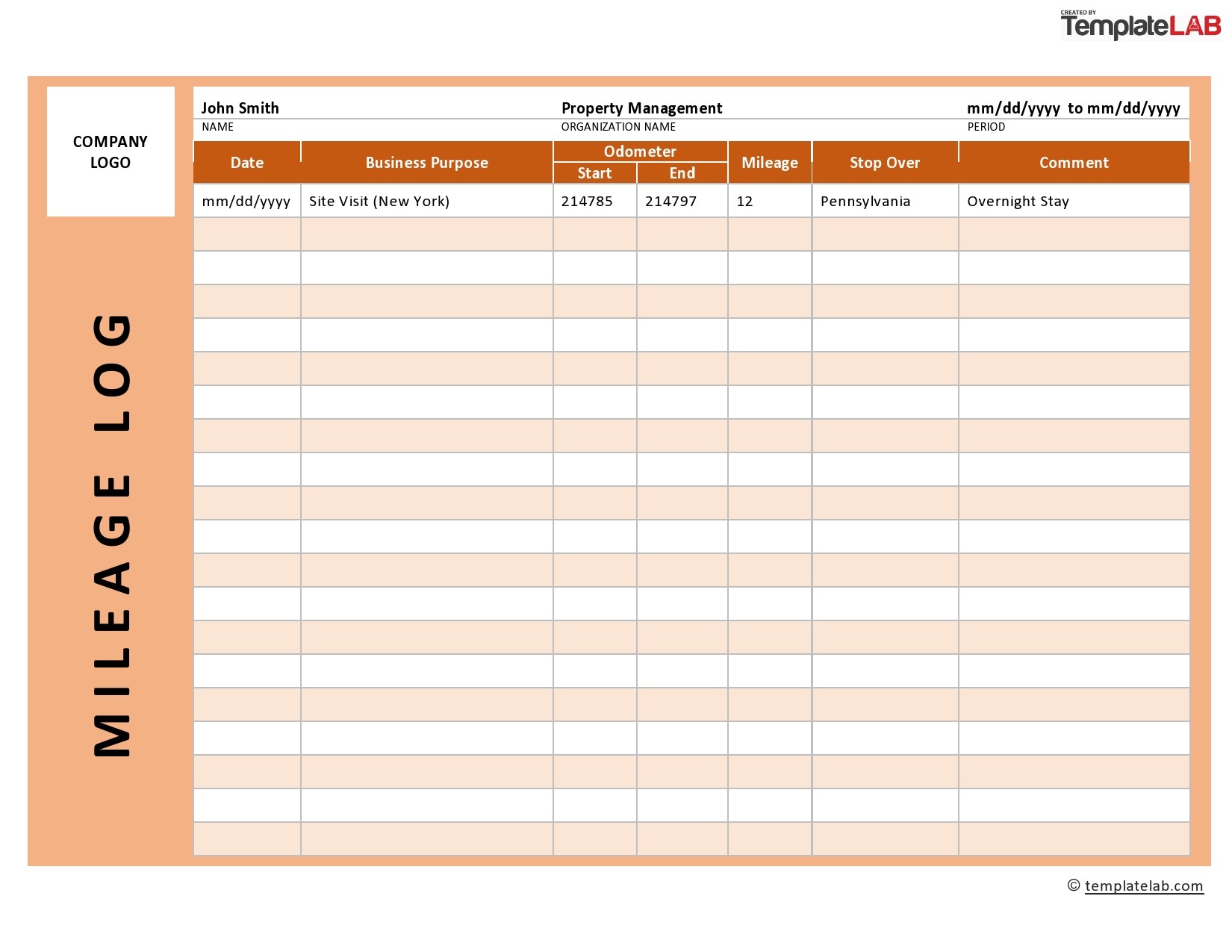

Business Mileage Log Template - Web this includes keeping a daily log of the purpose, the destination, and the miles traveled, supported by the odometer readings at the start and end of the trip. These templates already have the key columns, formulas, and features. Business mileage tracking log spreadsheet sample. Web a mileage log is a method of record keeping for drivers who plan to either deduct mileage (1099 workers) or collect reimbursements from an employer for miles traveled for business (w2). In 2022, the mileage rate was 58.5 cents per mile for january through june, and increased to 62.5 cents per mile after july 1. Simply put, a good mileage log tracks relevant information for any. Web if you prefer to record all your business expenses in one place, look at our expenses templates. This rate is adjusted for inflation each year. =sum(g8:g100) this formula adds together every figure from the total miles column. For 2021, 2022, or 2023. Web free mileage log template for taxes. Track mileage effortlessly with our free mileage log template & mileage tracker template. This requires a business to record a log of qualifying mileage driven. How to use the excel mileage log template. Web business mileage tracking log. These free printable mileage logs are sufficient to meet the irs’s. Track mileage effortlessly with our free mileage log template & mileage tracker template. In this article, we will discuss the benefits of using a printable mileage log. This rate is adjusted for inflation each year. Another free printable mileage log template was created for drivers who need to organize. Free irs printable mileage log form to download. This rate is adjusted for inflation each year. The current (starting in 2018) irs standard mileage rate is 54.5 cents per business mile. Web there are two methods of calculating mileage deductions: In 2022, the mileage rate was 58.5 cents per mile for january through june, and increased to 62.5 cents per. Calculate your mileage log deduction by using either: Keep track of your overall mileage as well as business miles that can be deducted. There are two methods of calculation that you can choose i.e. Web this mileage log template offers you to offer a full detail of the mileage and includes all the relevant pointers such as purpose or project,. There are two methods of calculation that you can choose i.e. Web use these mileage log templates to help you track your mileage expenses and related expenses. Feel free to download our excel mileage log template. When tax time rolls around, you can use this mileage template to determine your. =sum(g8:g100) this formula adds together every figure from the total. Dates and reasons for the trips. Web business mileage log this business mileage log is designed to help individuals and businesses accurately track and record mileage for tax deduction purposes. Web when using our template spreadsheet for mileage tracking, enter the reimbursement rate to get the proper results for total reimbursement. Standard mileage deduction and actual expense method. Business car. Sahil dua taught himself the basics of software engineering while at university. How to use the excel mileage log template. Web business mileage log this business mileage log is designed to help individuals and businesses accurately track and record mileage for tax deduction purposes. The standard mileage rate for business will be 67 cents per mile, effective jan. To simplify. Here are the formulas we used in this spreadsheet: Standard mileage deduction and actual expense method. Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement form or for determining the mileage. The current (starting in 2018) irs standard. For 2024, it'll be $0.67. How to use the excel mileage log template. Choose from 15 different styles and print for free. To simplify this task, we have created a free 2024 mileage log template that you can download and use. Web there are two methods of calculating mileage deductions: Download pdf [541 kb] download. Here are the formulas we used in this spreadsheet: A mileage log template can make tracking your business mileage much easier. Get started by downloading, customizing, and. Web business mileage tracking log. There are two methods of calculation that you can choose i.e. Workyard provides leading workforce management solutions to construction, service, and property maintenance companies of all sizes. Web it not only helps in accurately tracking miles driven for business purposes but also ensures compliance with the internal revenue service (irs) regulations. You may also see free log templates in pdf. Free irs printable mileage log form to download. Web when using our template spreadsheet for mileage tracking, enter the reimbursement rate to get the proper results for total reimbursement. Web download the free 2024 mileage log template as a pdf, sheets or excel version and keep track of your trips. Web this mileage log template offers you to offer a full detail of the mileage and includes all the relevant pointers such as purpose or project, miles, start and end odom as well as any additional notes. Download pdf [541 kb] download. Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement form or for determining the mileage. Available in pdf, word, excel a google formats. Web free mileage log template for taxes. You can use the following log as documentation for your mileage deduction. This template will calculate the value of your business trips based on this figure. Sahil dua taught himself the basics of software engineering while at university. Calculate your mileage log deduction by using either:

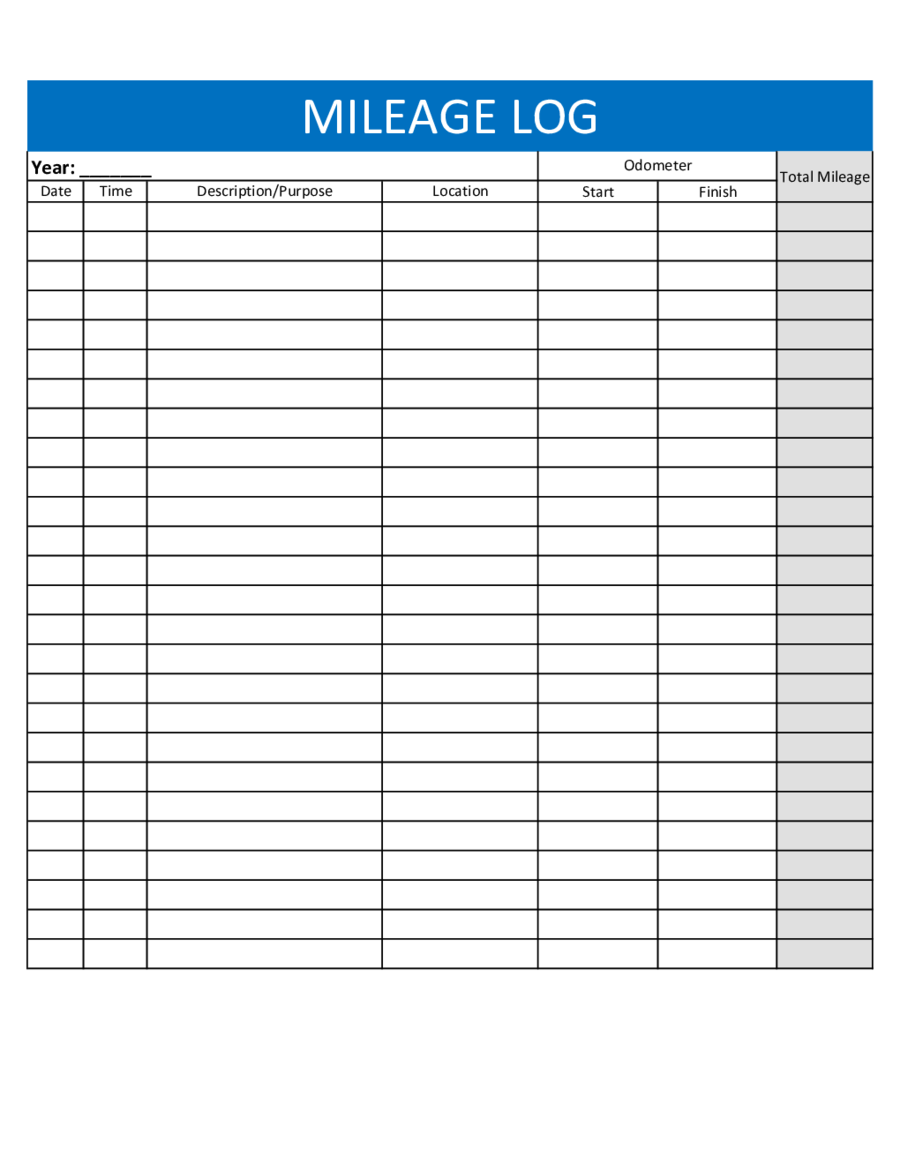

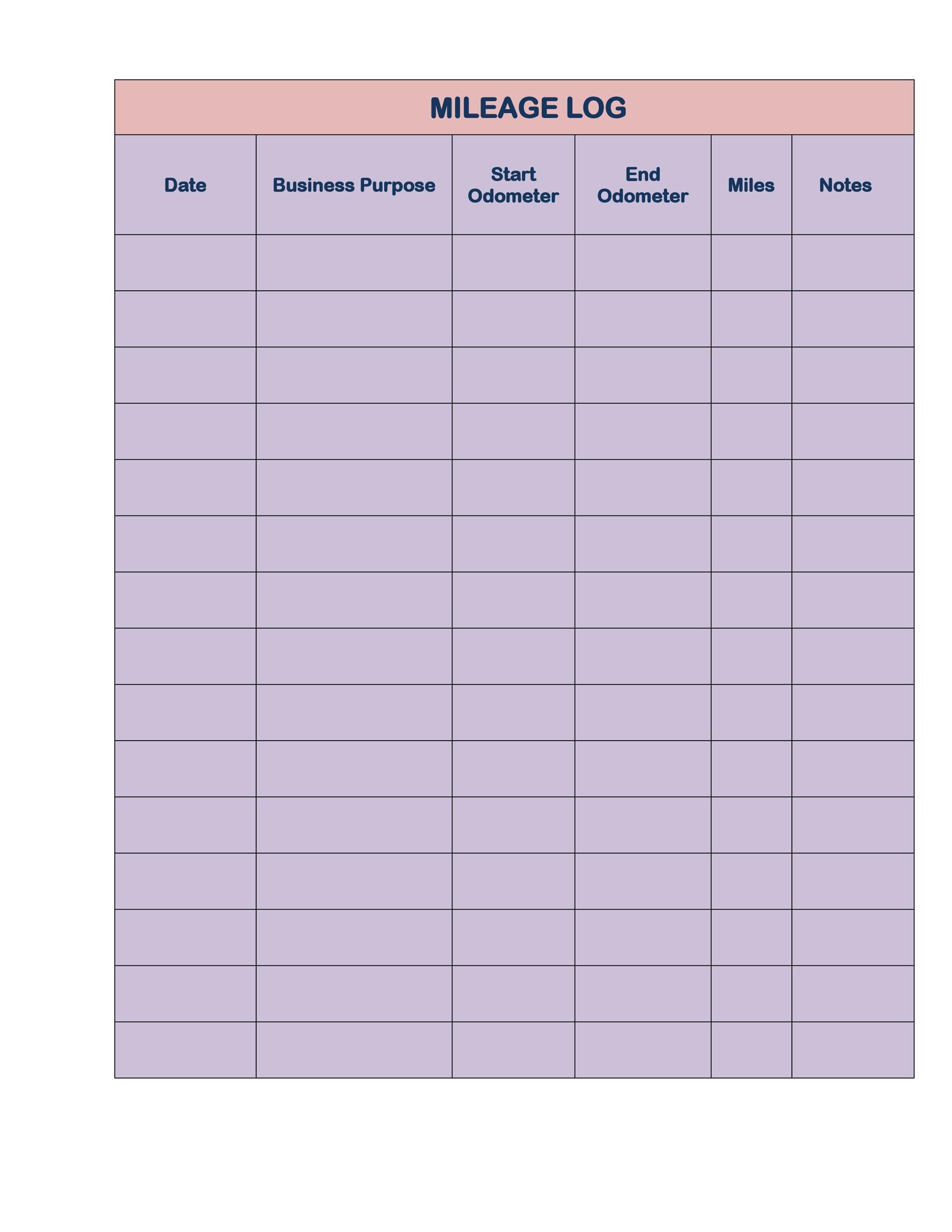

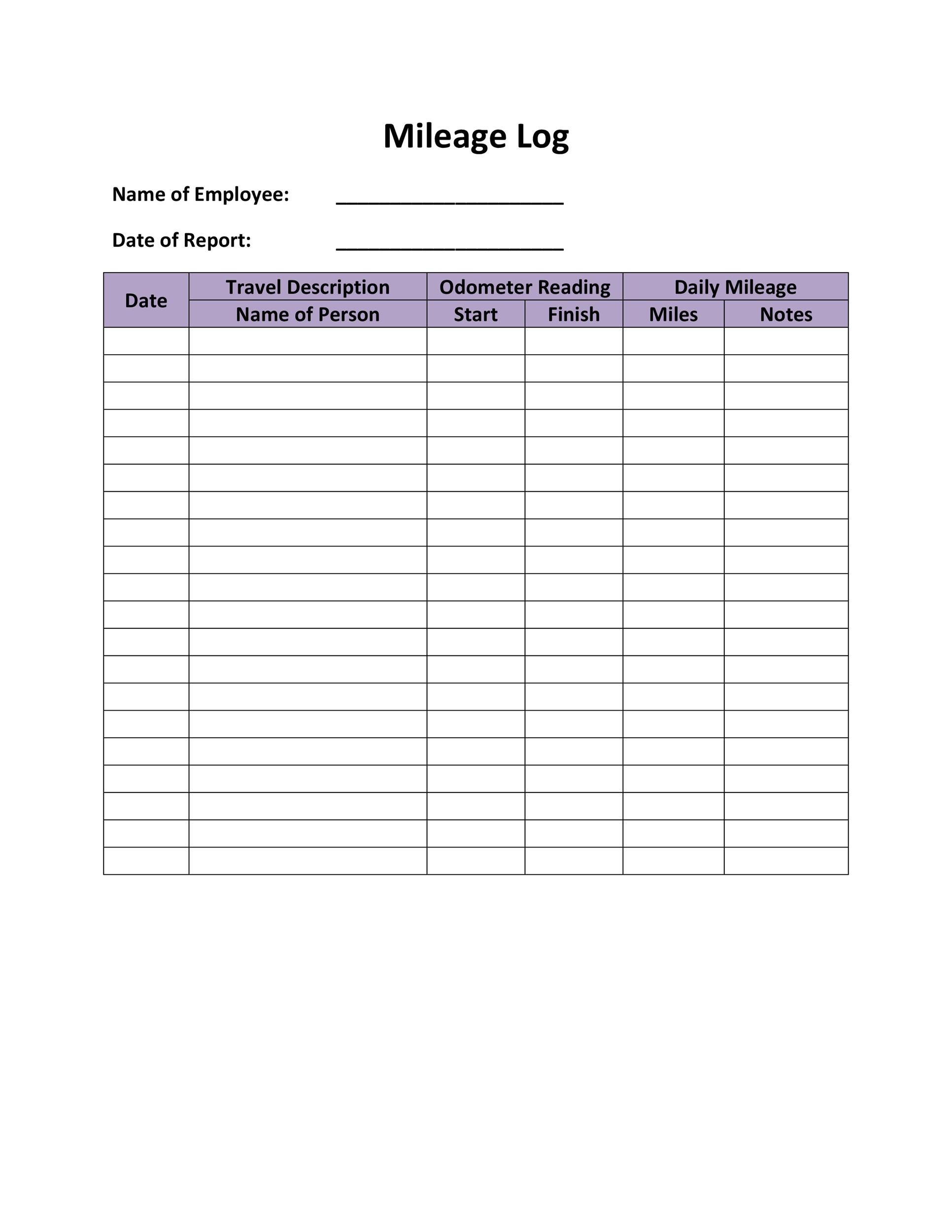

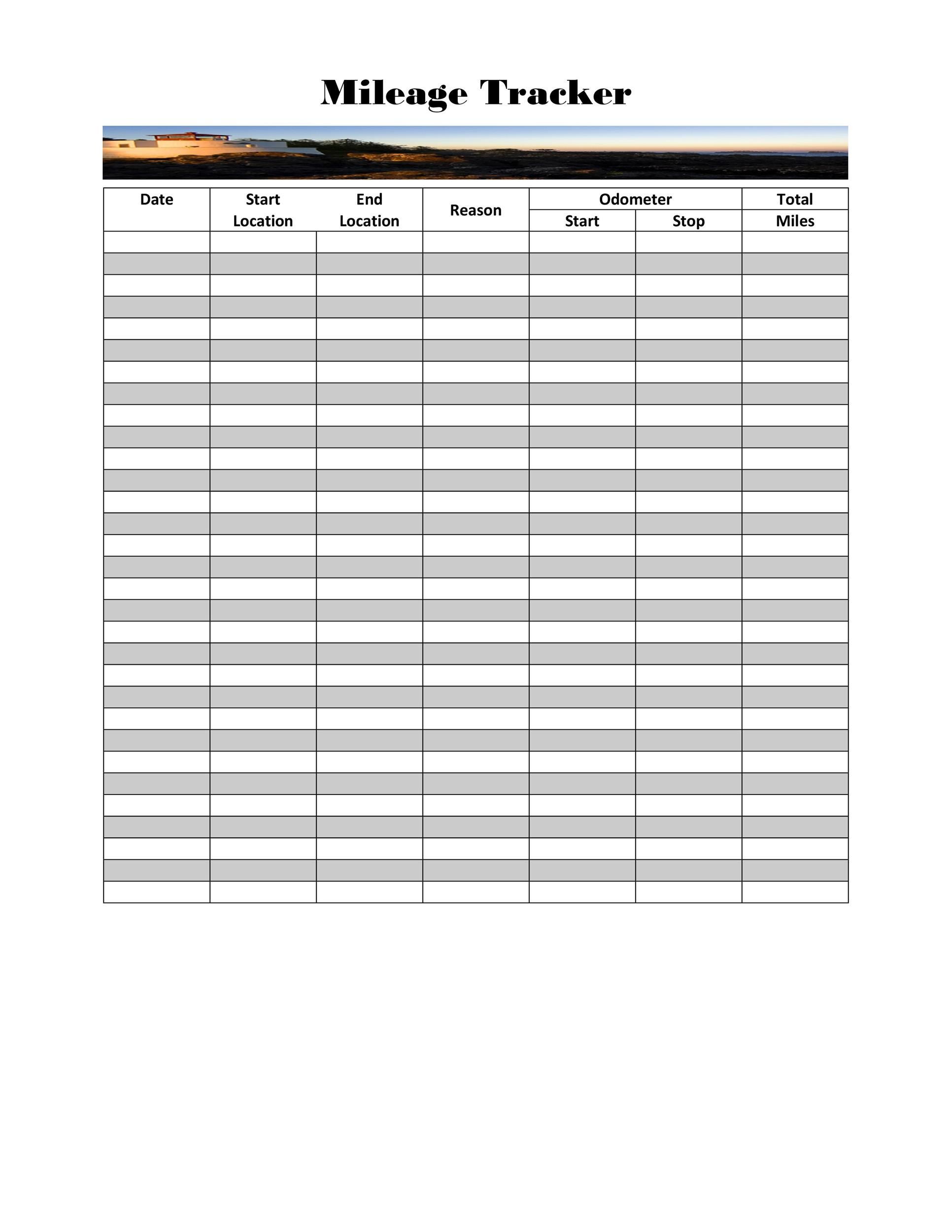

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

30 Printable Mileage Log Templates (Free) Template Lab

30 Free Mileage Log Templates Excel Log Sheet Format Project

30 Printable Mileage Log Templates (Free) Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

30 Printable Mileage Log Templates (Free) Template Lab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Web The Mileage Deduction Is Calculated By Multiplying Your Yearly Business Miles By The Irs’s Standard Mileage Rate.

Web A Mileage Log Is A Method Of Record Keeping For Drivers Who Plan To Either Deduct Mileage (1099 Workers) Or Collect Reimbursements From An Employer For Miles Traveled For Business (W2).

These Handy Mileage Log Templates Allow You To Accurately Track The Miles You Drive For Business, Medical, Charitable, And Other Deductible Purposes.

Miles Notes Date Trip Purpose Starting Mileage Ending Mileage Miles Notes Company.

Related Post: