Business Valuation Template

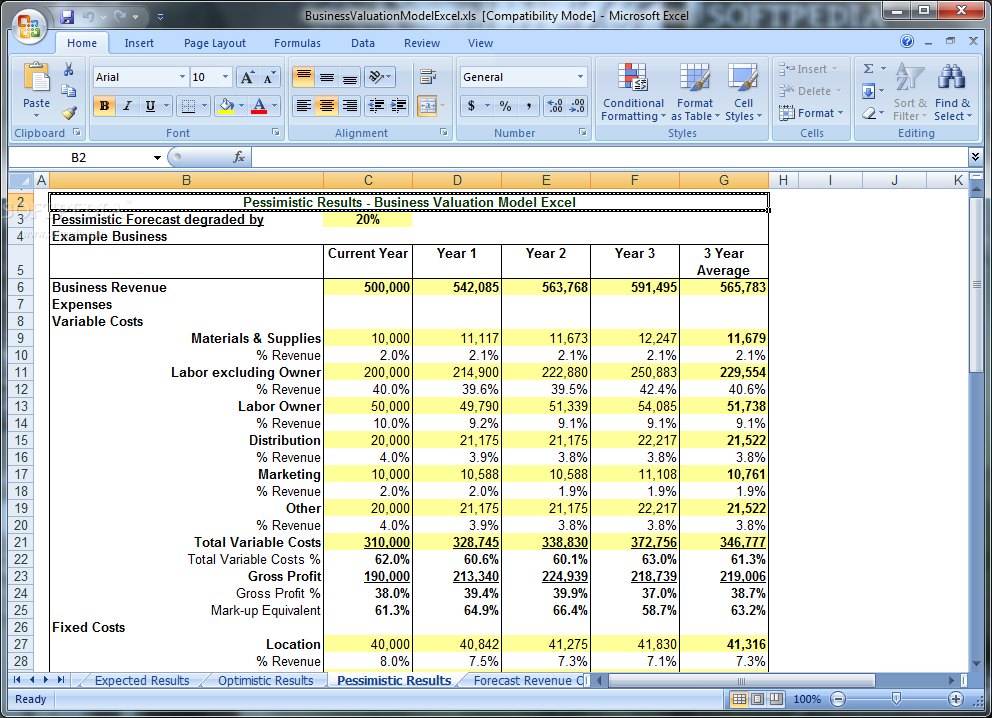

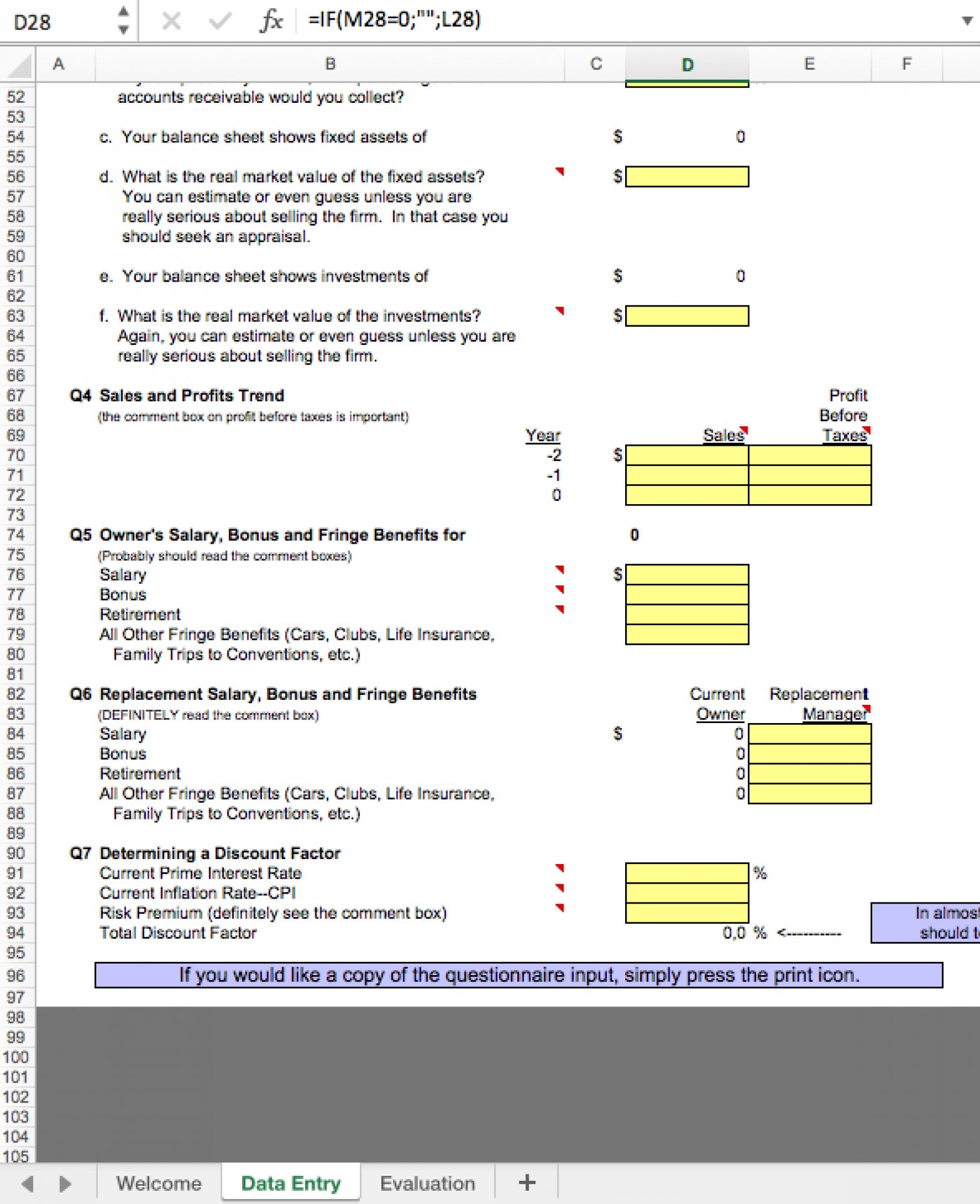

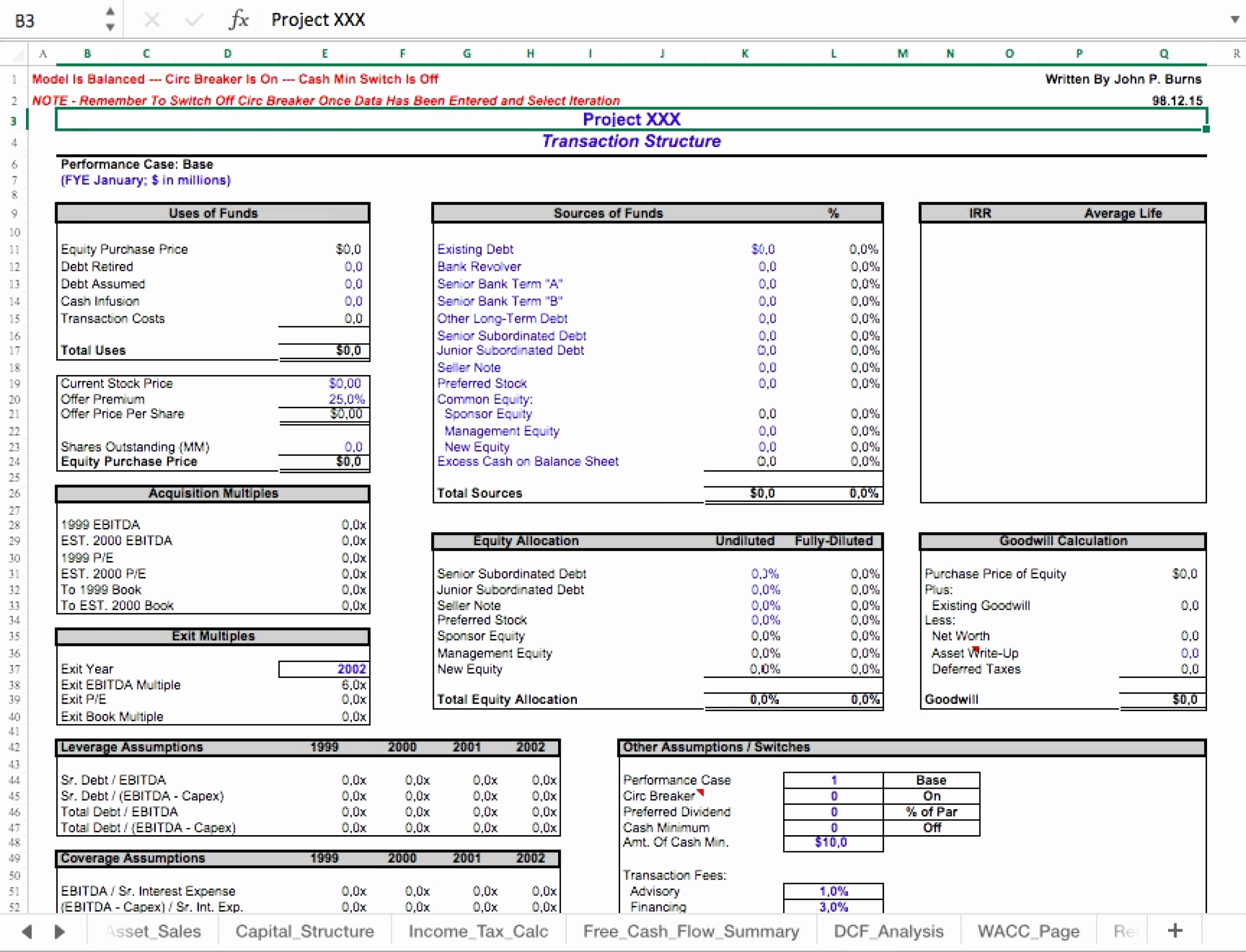

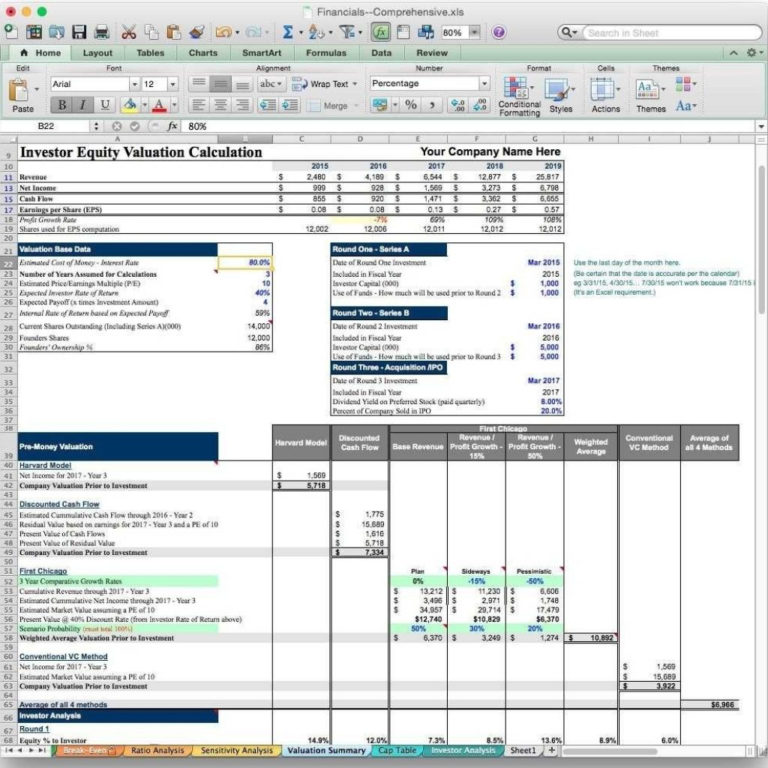

Business Valuation Template - Note that there will always be a discrepancy between the business value based on sales and the business value based on profits. The following sheets are included in this template: Web total value = earning metric * multiple. Determine the basis of value. Review the historic performance of the business. Identify the purpose of the business valuation. Web understand the purpose of the valuation. It explains the purposes and value of a plan and uses a content template to help determine what goes into each section of this plan. You don't need to be a finance whiz to get the hang of it. Web the excel investment and business valuation template provides an easy and accurate solution for calculating the valuation of proposed business investments and entire companies. Determine the valuation approach to use. The multiple is similar to using a. Web this template is a unique business valuation solution which adds immeasurable value in determining and analysing the estimated value of a business on a discounted cash flow basis. Web designed for anyone who has done their business research, most of their marketing plan, and understands some. Just enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. We've ditched the complex stuff and kept it simple. Note that there will always be a discrepancy between the business value based on sales and the business value based on profits. Web no need to spend time or money on. Business value = $30k * 12. New investment proposals can be valued. Outstanding number of shares for each public company; Gather financial reports and business history details. Gather previous years' financial statements. Full collection of document templates for selling or buying a business ( 30+ files) $59. Improve your business valuation process with our comprehensive template, offering financial analysis, value assessment, reporting, and client delivery. New investment proposals can be valued. Sample detailed and summary valuation reports. Outstanding number of shares for each public company; Gather previous years' financial statements. Determine the valuation approach to use. Typically, a business valuation happens when an owner is looking to sell all or a part of their business, or merge with another company. Web business valuation template(single file, view below) order now! Arrive at a determination of value. Web the industry profit multiplier is 1.99, so the approximate value is $40,000 (x) 1.99 = $79,600. Say your business has a net income of $30k, after subtracting all costs. Here’s an example of how to value a small business using the multiple of earnings method. Web if you used ebitda to value your business, you would use an ebitda. It explains the purposes and value of a plan and uses a content template to help determine what goes into each section of this plan. Web why you'll love our business valuation template. The multiple is similar to using a. Gather financial reports and business history details. Just enter in the information on our valuation spreadsheet and our software will. These factors can be evaluated either individually or in combination. Extract key figures including revenue, cost of goods sold, operating expenses, assets, and liabilities. Cash in the companies as reported in the mostly recently. The various types of analyses may be built from scratch in excel or may use an existing template/model. Improve your business valuation process with our comprehensive. Web the excel investment and business valuation template provides an easy and accurate solution for calculating the valuation of proposed business investments and entire companies. Outstanding number of shares for each public company; Our presenters doug ware and richard. Gather previous years' financial statements. The current value of anticipated future earnings from the business. Typically, a business valuation happens when an owner is looking to sell all or a part of their business, or merge with another company. On average, this forecast typically goes out about 5 years. Determine the valuation approach to use. The forecast has to build up to unlevered free cash flow (free cash flow to the. Most valuations consist of. Despite the importance of value statements that can direct companies to achieve sustainable goals, which kind of values can be perceived as. If you have a multiple of 12 based on your industry and other factors, then: Web no need to spend time or money on a business valuation firm. Most valuations consist of the following information: Web this template is a unique business valuation solution which adds immeasurable value in determining and analysing the estimated value of a business on a discounted cash flow basis. Other reasons include if you need debt or. Here’s an example of how to value a small business using the multiple of earnings method. The following sheets are included in this template: The two numbers give you an approximate range of potential values for your business. Web total value = earning metric * multiple. Web valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. Web in our excel valuation template, this analysis is performed in cells a15:k27 of our market valuation worksheet. Cash in the companies as reported in the mostly recently. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future cash flow projections over three and five year. Web the excel investment and business valuation template provides an easy and accurate solution for calculating the valuation of proposed business investments and entire companies. Sample detailed and summary valuation reports.

Business Valuation Model Excel Free Download Printable Templates

Free Business Valuation Template Google Sheets, Excel

Valuation Model Excel Template

Business Valuation Excel Template for Private Equity Eloquens

FREE 5+ Sample Business Valuation Reports in PDF

Business Valuation Report Template

Business Valuation Excel and Google Sheets Template Simple Sheets

Business Valuation Excel and Google Sheets Template Simple Sheets

Business Valuation Template Excel Free Printable Templates

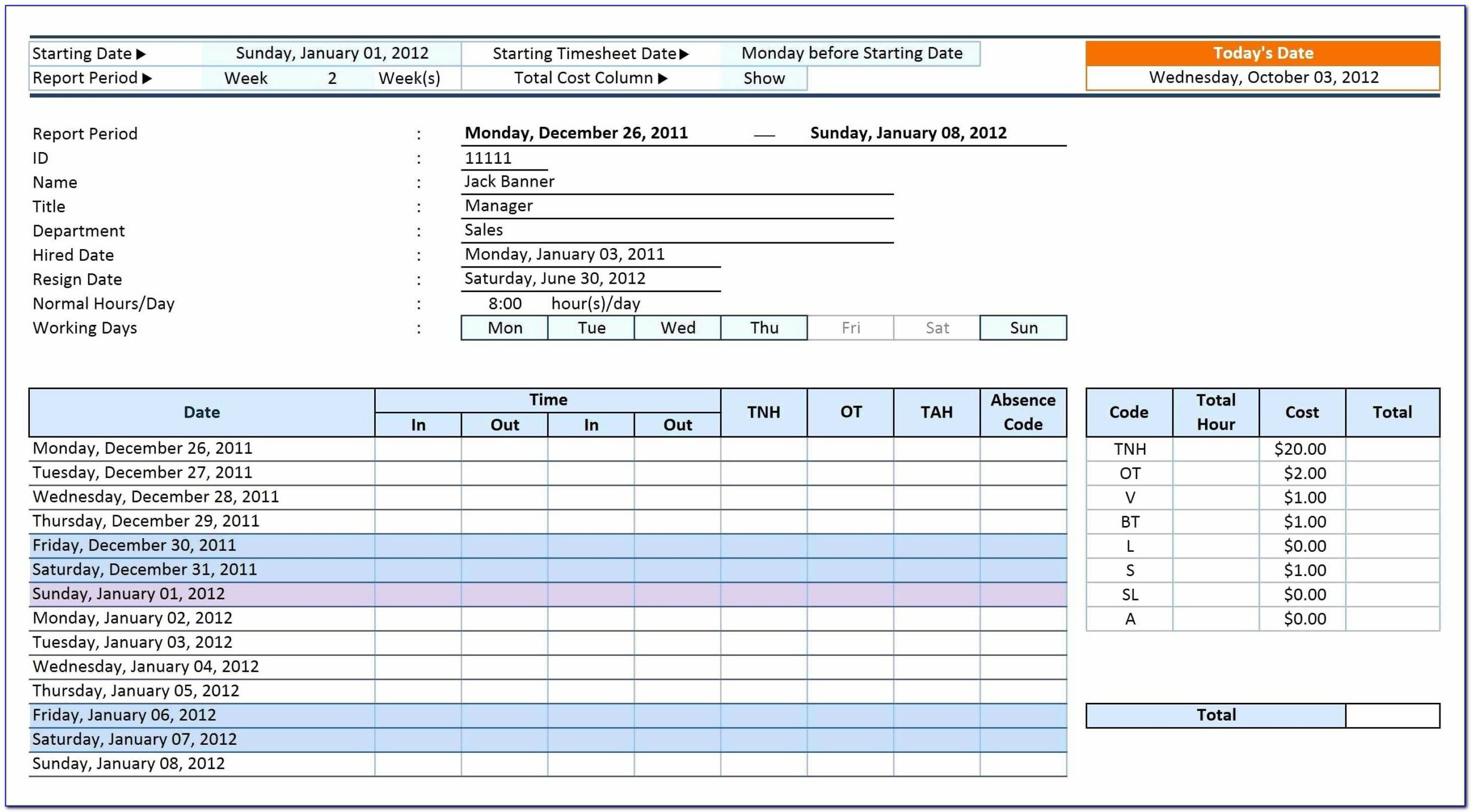

Free Excel Business Valuation Spreadsheet within Business Valuation

Identify A Business' Health And Future Based On Profitability And Other Key Metrics With Our Business Valuation Excel Template.

The Formula We Use Is Based On The Multiple Of Earnings Method Which Is Most Commonly Used In Valuing Small Businesses.

Arrive At A Determination Of Value.

The Forecast Has To Build Up To Unlevered Free Cash Flow (Free Cash Flow To The.

Related Post: