Cecl Policy Template

Cecl Policy Template - Web this booklet applies to the occ’s supervision of banks that have adopted the current expected credit losses (cecl) methodology under accounting standards. Web the basics of cecl—key items to keep in mind as a bank transitions to cecl preparing for cecl —data that will be needed to transition, including important. Web interagency policy statement on allowances for credit losses (revised april 2023) describes the measurement of expected credit losses under the cecl methodology and. While cecl represents a significant change in accounting for the allowance, current credit risk measurement approaches used for. Web the asu adds to us gaap an impairment model known as the current expected credit loss (cecl) model, which is based on expected losses rather than incurred losses. Web this document is meant to provide sample cecl disclosures to assist financial statement in your disclosure efforts in the year of cecl adoption as well as ongoing disclosures. Web current expected credit loss (cecl) adoption guidance. Examiners should continue to use the “allowance for loan. Web current expected credit loss policy. Web the new accounting standard introduces the current expected credit losses methodology (cecl) for estimating allowances for credit losses. Web current expected credit loss (cecl) adoption guidance. This policy cover the role of the board and management; Cecl was created to estimate expected credit loss on a loan or investment. Web the new accounting standard introduces the current expected credit losses methodology (cecl) for estimating allowances for credit losses. Web the basics of cecl—key items to keep in mind. Designed to maintain an adequate methodology for complying with cecl. The federal reserve board (frb) has updated reporting requirements to address cecl and broader credit. Web this document is meant to provide sample cecl disclosures to assist financial statement in your disclosure efforts in the year of cecl adoption as well as ongoing disclosures. Private and publicly traded smaller reporting. Private and publicly traded smaller reporting companies (“srcs”) will need to adopt topic 326 in 2023. Designed to maintain an adequate methodology for complying with cecl. The standard is effective for most. Cecl becomes effective for federally insured credit unions for financial reporting years. Volatility changes based on methods and models. The federal reserve board (frb) has updated reporting requirements to address cecl and broader credit. Current expected credit loss (cecl) standard. Web current expected credit loss policy. The financial accounting standards board (fasb) announced in 2016 a new accounting standard introducing the current expected credit loss, or cecl, methodology for estimating allowances for credit losses. Web current expected credit losses. Web current expected credit loss (cecl) is finally here. This policy cover the role of the board and management; The current expected credit losses (cecl) impairment model applies to a broad scope. Current expected credit loss (cecl) standard. Volatility changes based on methods and models. Volatility changes based on methods and models. Web cecl is arguably the largest change in accounting for financial institutions in the last 30 years and will have widespread implications for the industry. The standard is effective for most. With the deferred effective date (for financial institutions with a dec. Web interagency policy statement on allowances for credit losses (revised april. Web current expected credit loss (cecl) adoption guidance. Designed to maintain an adequate methodology for complying with cecl. Web the basics of cecl—key items to keep in mind as a bank transitions to cecl preparing for cecl —data that will be needed to transition, including important. Private and publicly traded smaller reporting companies (“srcs”) will need to adopt topic 326. The federal reserve board (frb) has updated reporting requirements to address cecl and broader credit. Web cecl is arguably the largest change in accounting for financial institutions in the last 30 years and will have widespread implications for the industry. The current expected credit losses (cecl) impairment model applies to a broad scope. Web interagency policy statement on allowances for. Web current expected credit losses (cecl) methodology under accounting standards codification (asc) topic 326. This policy cover the role of the board and management; The federal reserve board (frb) has updated reporting requirements to address cecl and broader credit. Volatility changes based on methods and models. Web choosing the cecl methodology that’s right for your bank depends on many factors,. Examiners should continue to use the “allowance for loan. Web cecl is arguably the largest change in accounting for financial institutions in the last 30 years and will have widespread implications for the industry. Designed to maintain an adequate methodology for complying with cecl. With the deferred effective date (for financial institutions with a dec. Cecl was created to estimate. Web this booklet applies to the occ’s supervision of banks that have adopted the current expected credit losses (cecl) methodology under accounting standards. Web the basics of cecl—key items to keep in mind as a bank transitions to cecl preparing for cecl —data that will be needed to transition, including important. Web the asu adds to us gaap an impairment model known as the current expected credit loss (cecl) model, which is based on expected losses rather than incurred losses. Web current expected credit losses (cecl) methodology under accounting standards codification (asc) topic 326. The federal reserve board (frb) has updated reporting requirements to address cecl and broader credit. Web current expected credit loss (cecl) is finally here. Web the new accounting standard introduces the current expected credit losses methodology (cecl) for estimating allowances for credit losses. Web choosing the cecl methodology that’s right for your bank depends on many factors, from historical data availability to management objectives and associated operational costs. Cecl was created to estimate expected credit loss on a loan or investment. Examiners should continue to use the “allowance for loan. Volatility changes based on methods and models. Web cecl is arguably the largest change in accounting for financial institutions in the last 30 years and will have widespread implications for the industry. While cecl represents a significant change in accounting for the allowance, current credit risk measurement approaches used for. Private and publicly traded smaller reporting companies (“srcs”) will need to adopt topic 326 in 2023. Web current expected credit loss policy. This policy cover the role of the board and management;

Cecl Policy Template

Best Practice CECL Policy Guide Download Now

Making the Business Case for the CECL Approach Part II [White Paper

(PDF) Successfully Transition to the New CECL Standard · A template for

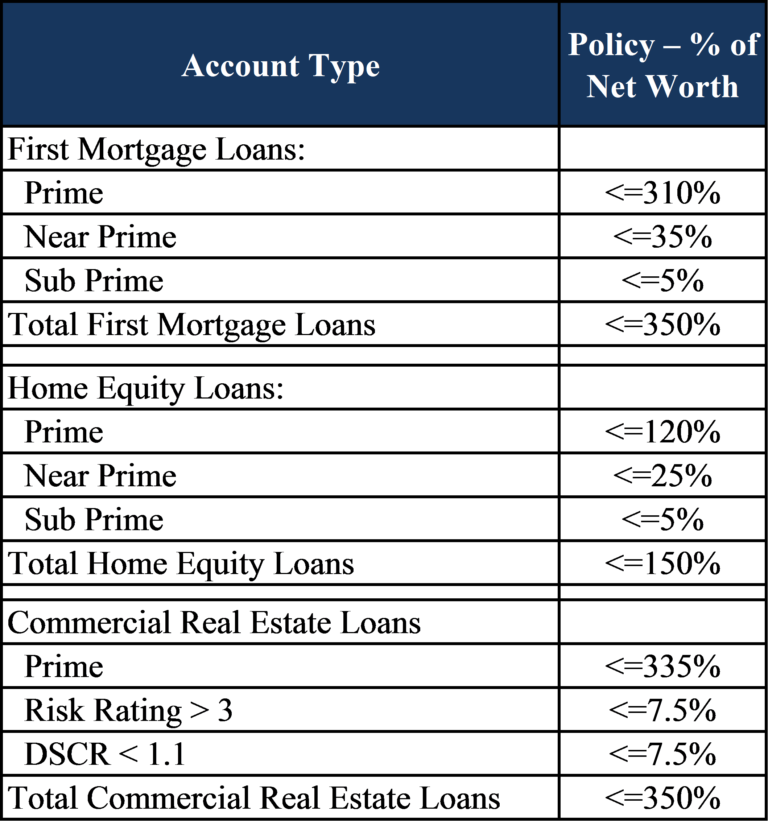

4+ Credit Policy Templates Word Excel Templates

Cecl Policy Template

Cecl Policy Template

Cecl Policy Template Portal Tutorials

50 Free Policy And Procedure Templates (& Manuals) ᐅ TemplateLab

Current Expected Credit Loss (CECL) Implementation Insights Deloitte US

Current Expected Credit Loss (Cecl) Standard.

Web Current Expected Credit Loss (Cecl) Adoption Guidance.

The Standard Is Effective For Most.

This Policy Cover The Role Of The Board And Management;

Related Post: