Cogs Template

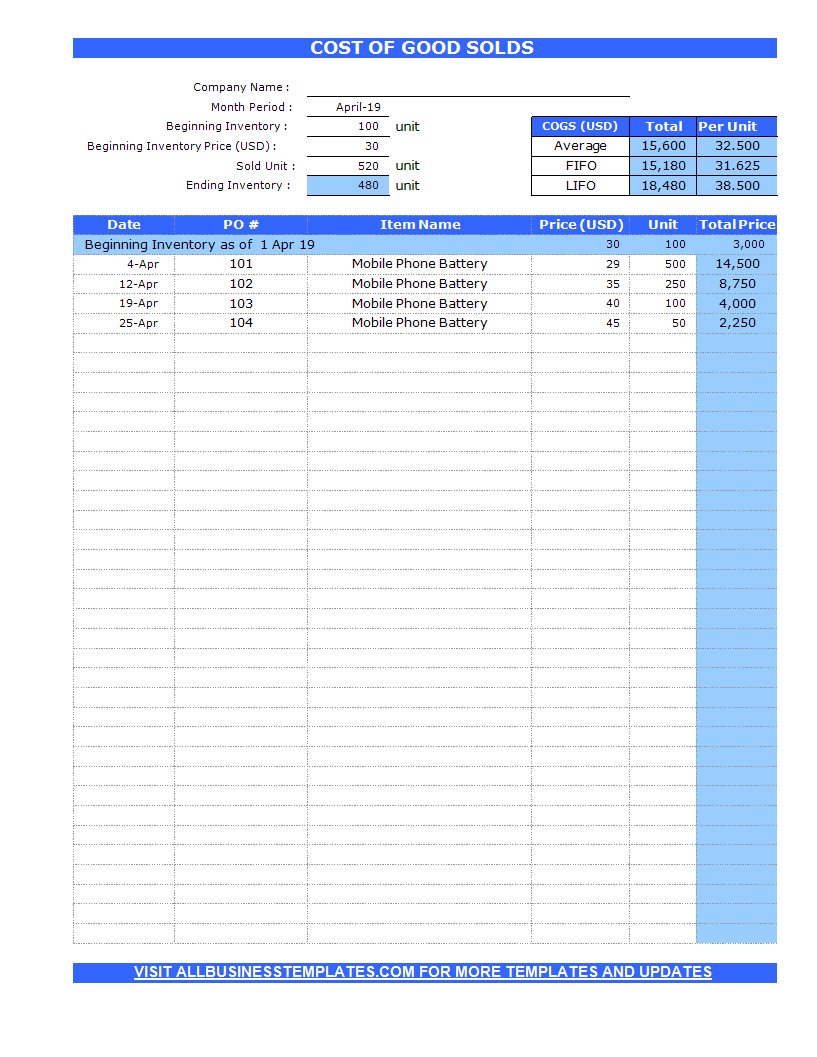

Cogs Template - How much does it cost to produce or buy the products and services that you sell in your small business? This cost of goods sold template demonstrates three methods of cogs accounting: Cogs is the direct expense or cost of the production for the goods sold by a business. Learn how this metric is used on income statements to determine gross profit. Web the cost of goods sold (cogs) formula is essential for creating an accurate income statement. This template will help you reconcile, update, and correct inventory and cogs numbers on your books in an easy and manageable may. Fifo, lifo, and weighted average. This cost of goods manufactured (cogs) template lays out a schedule of cogm using the amount of direct materials, direct labor, manufacturing overhead, and work in process inventory. Fact checked by rebecca mcclay. This template offers a comprehensive solution for businesses seeking to enhance their financial planning strategies. Cogs is the direct expense or cost of the production for the goods sold by a business. You can follow right along with the same template used in this video! Has the following details for recording the inventory for the calendar year ending on december 31st, 2018. Web table of contents. Cost of goods sold calculation example (cogs) 2. Web cost of goods sold (cogs) template. Has the following details for recording the inventory for the calendar year ending on december 31st, 2018. Put simply, it’s how much it costs you to produce a menu item. Fact checked by rebecca mcclay. The cost of goods sold is considered an expense in accounting. They are reported on the p&l statement as and expense and directly affect the gross profit of the business. This template will help you reconcile, update, and correct inventory and cogs numbers on your books in an easy and manageable may. This template offers a comprehensive solution for businesses seeking to enhance their financial planning strategies. Corporate management revenue &. Web the cost of goods sold (cogs) budget is essentially part of your operating budget. This cost of goods sold template demonstrates three methods of cogs accounting: Forecast cost of goods sold (cogs) expand +. This template will help you reconcile, update, and correct inventory and cogs numbers on your books in an easy and manageable may. Calculate cost of. You can follow right along with the same template used in this video! Put simply, it’s how much it costs you to produce a menu item. Cogs includes all of the direct costs involved in manufacturing products. Fact checked by rebecca mcclay. Web cost of goods sold, or cogs, is the direct cost of producing the items a business sells. Learn how this metric is used on income statements to determine gross profit. What is cost of goods sold? The cogs formula can calculate your business’s gross profit, which is the difference between revenue and cogs. This template will help you reconcile, update, and correct inventory and cogs numbers on your books in an easy and manageable may. How much. Learn how this metric is used on income statements to determine gross profit. Enter your name and email in the form below and download the free template now! This template can be an effective tool for general managers, higher management of production units for defining the product prize, and keep the monitor the cost. They are reported on the p&l. Based on accounting rules and inventory valuation method, cogs can be calculated using one of three cost flows : Cogs is important because it’s tied directly to your profit margins, revenue and inventory management. We’ve created an excel file for a downloadable inventory and cogs template. Sales revenue minus cost of goods sold is a business’s gross profit. Cogs is. Web the cost of goods sold (cogs) formula is essential for creating an accurate income statement. Sales revenue minus cost of goods sold is a business’s gross profit. Has the following details for recording the inventory for the calendar year ending on december 31st, 2018. Web table of contents. Below is a screenshot of the cogs template: You can follow right along with the same template used in this video! The cost of goods sold (cogs) is how much it costs a business to produce its goods. This cost of goods manufactured (cogs) template lays out a schedule of cogm using the amount of direct materials, direct labor, manufacturing overhead, and work in process inventory. Historical cogs. Web cogs template you can download below is based on that merchandising companies model. Excel cost of goods sold. Has the following details for recording the inventory for the calendar year ending on december 31st, 2018. Fifo, lifo, and weighted average. Web the cost of goods sold (cogs) formula is essential for creating an accurate income statement. Enter your name and email in the form below and download the free template now! This template will help you reconcile, update, and correct inventory and cogs numbers on your books in an easy and manageable may. Learn how this metric is used on income statements to determine gross profit. You can get this cost of goods sold template and worksheet to calculate important factors that can maximize profits and lead to better business practices. Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cost of goods sold (cogs) may be one of the most important accounting terms for business leaders to know. These expenses include the costs of raw material and labor but do not include indirect costs such as that of employing a salesperson. Cogs is important because it’s tied directly to your profit margins, revenue and inventory management. Forecast cost of goods sold (cogs) expand +. This cost of goods sold template demonstrates three methods of cogs accounting: Corporate management revenue & cogs forecasting template.

Cog Cogwheel Outline Clip Art at vector clip art online

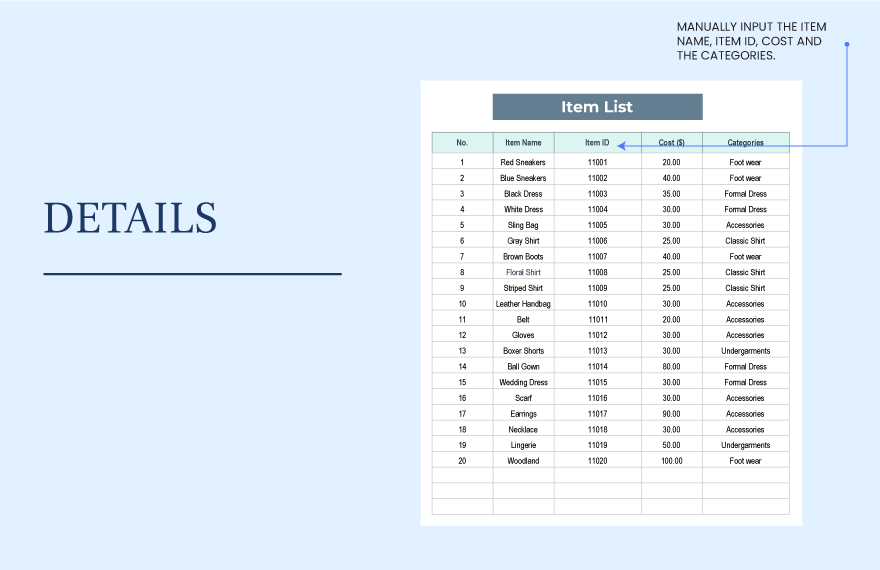

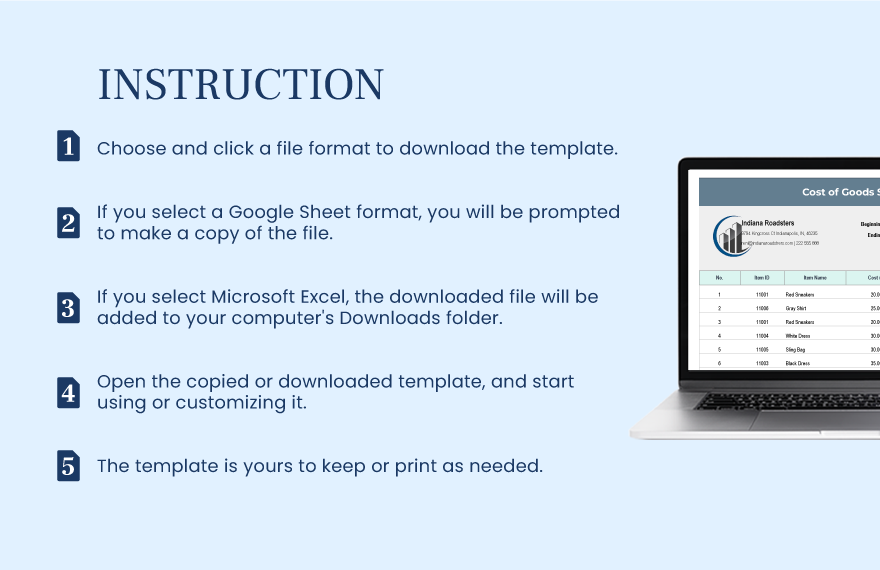

Cost of Goods Sold (COGS) Template Download in Excel

![Cost of Goods Sold Calculator [Updated] Excel Templates](http://exceltemplate.net/wp-content/uploads/2009/07/CoGS-Calculator-Inventory-Item-Summary.jpg)

Cost of Goods Sold Calculator [Updated] Excel Templates

Cost of Goods Sold (COGS) Template Download in Excel

![Cost of Goods Sold Calculator [Updated] Excel Templates](http://exceltemplate.net/wp-content/uploads/2009/07/CoGS-Calculator-Spreadsheet.jpg)

Cost of Goods Sold Calculator [Updated] Excel Templates

Cost of Goods Sold (COGS) Template in MS Excel Download

Cogs Template

CoGS Calculator Excel Templates Excel Spreadsheets Excel

Cost of Goods Sold (COGS) Template in MS Excel Download

CoGS Calculator Templates at

Calculate Cost Of Goods Sold In Minutes

Web Cost Of Goods Sold Template.

Put Simply, It’s How Much It Costs You To Produce A Menu Item.

Cost Of Goods Sold (Cogs), Otherwise Known As The “Cost Of Sales”, Refers To The Direct Costs Incurred By A Company While Selling Its Goods Or Services.

Related Post: