Collection Agency Letter Template

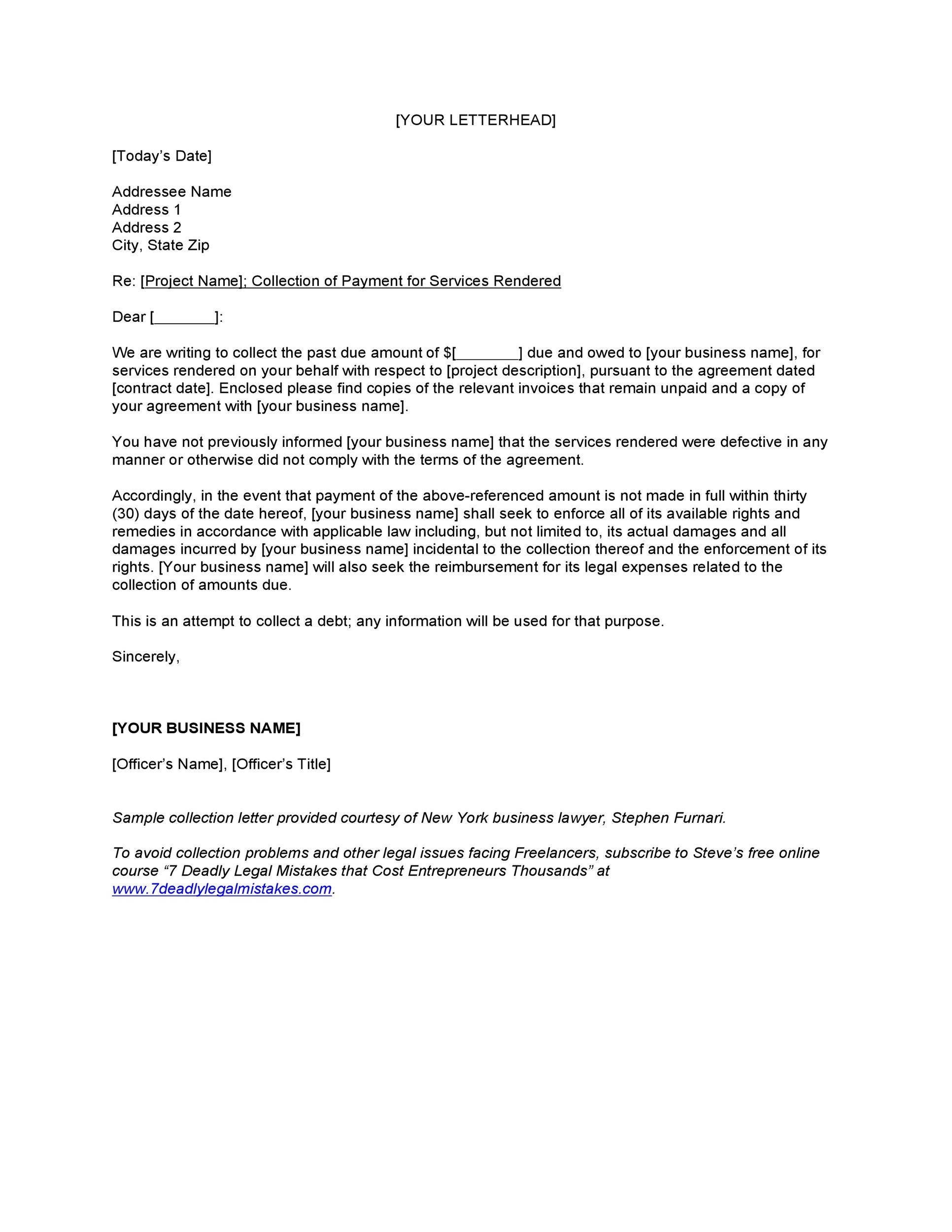

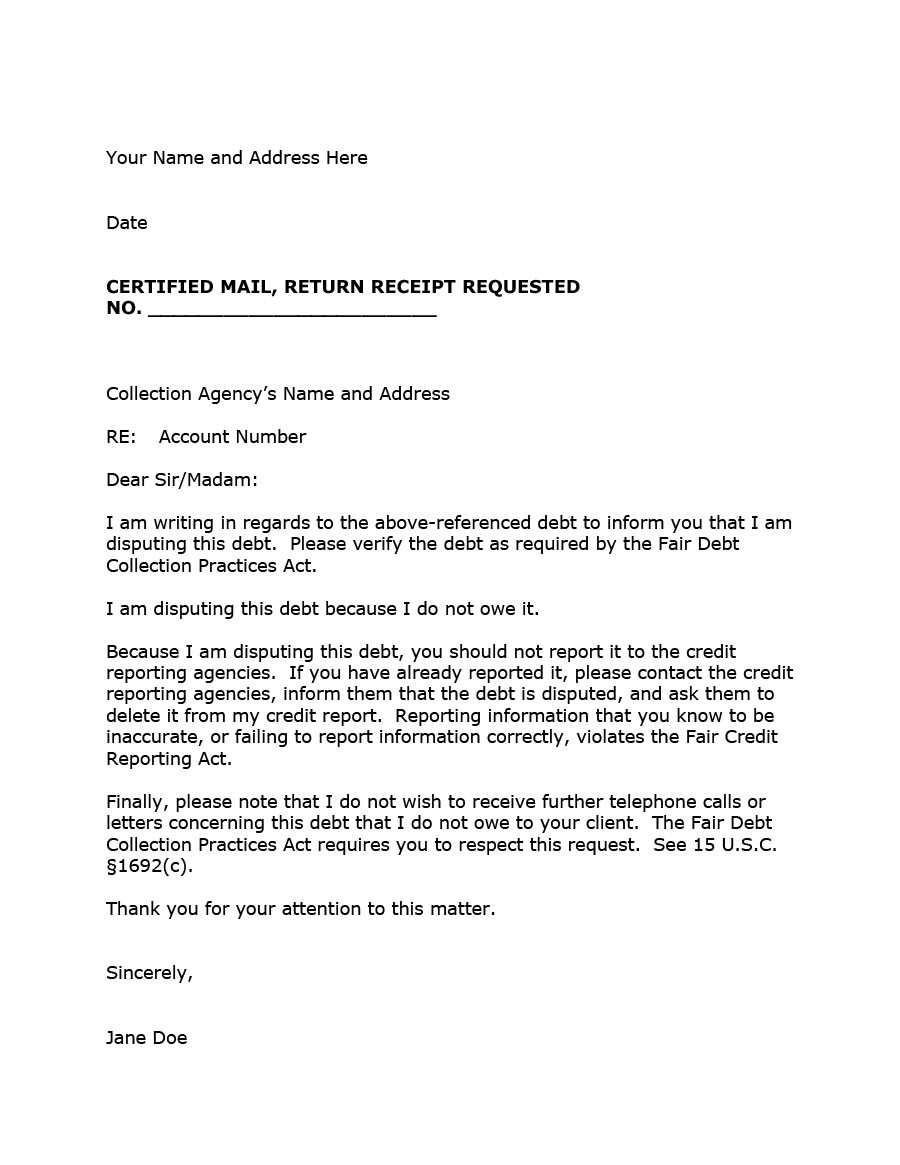

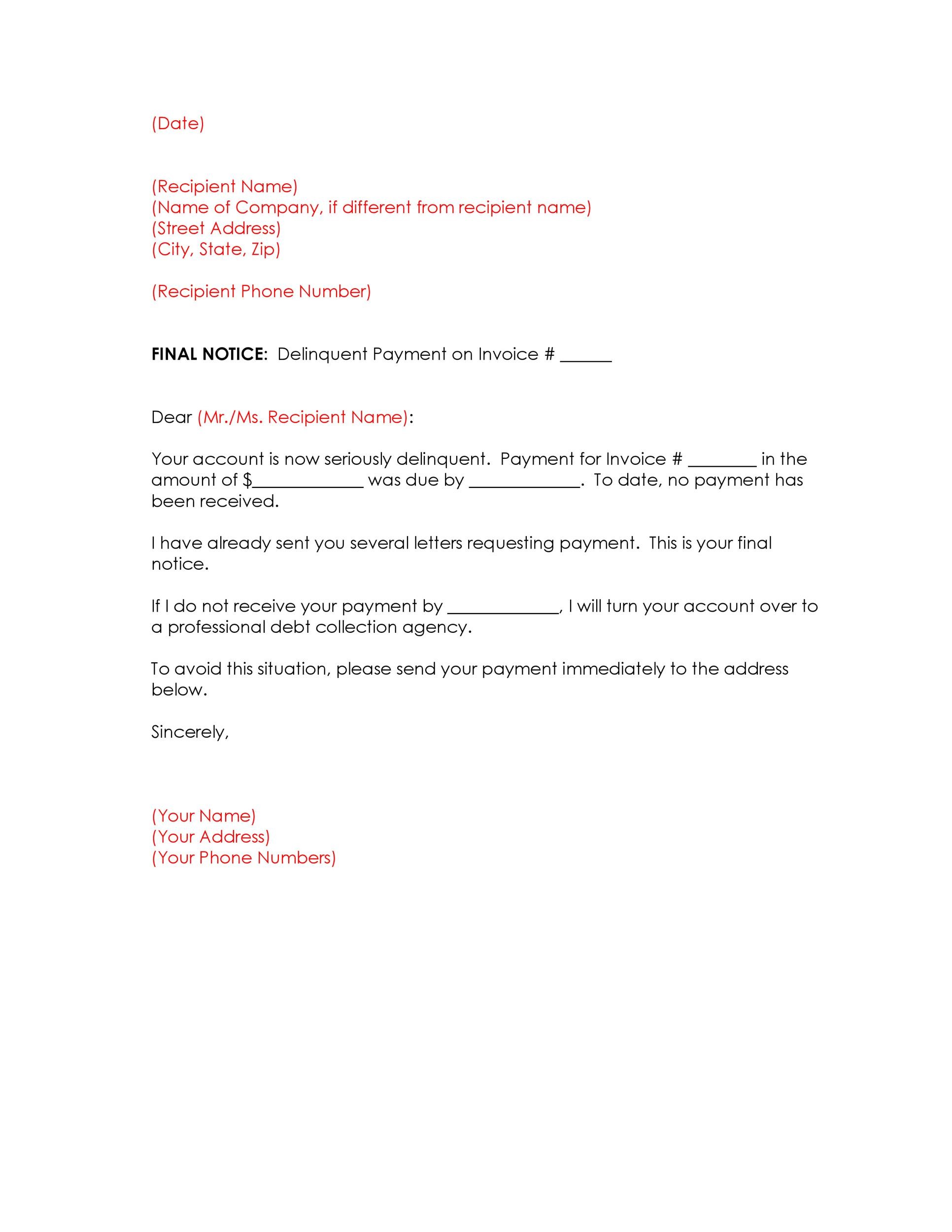

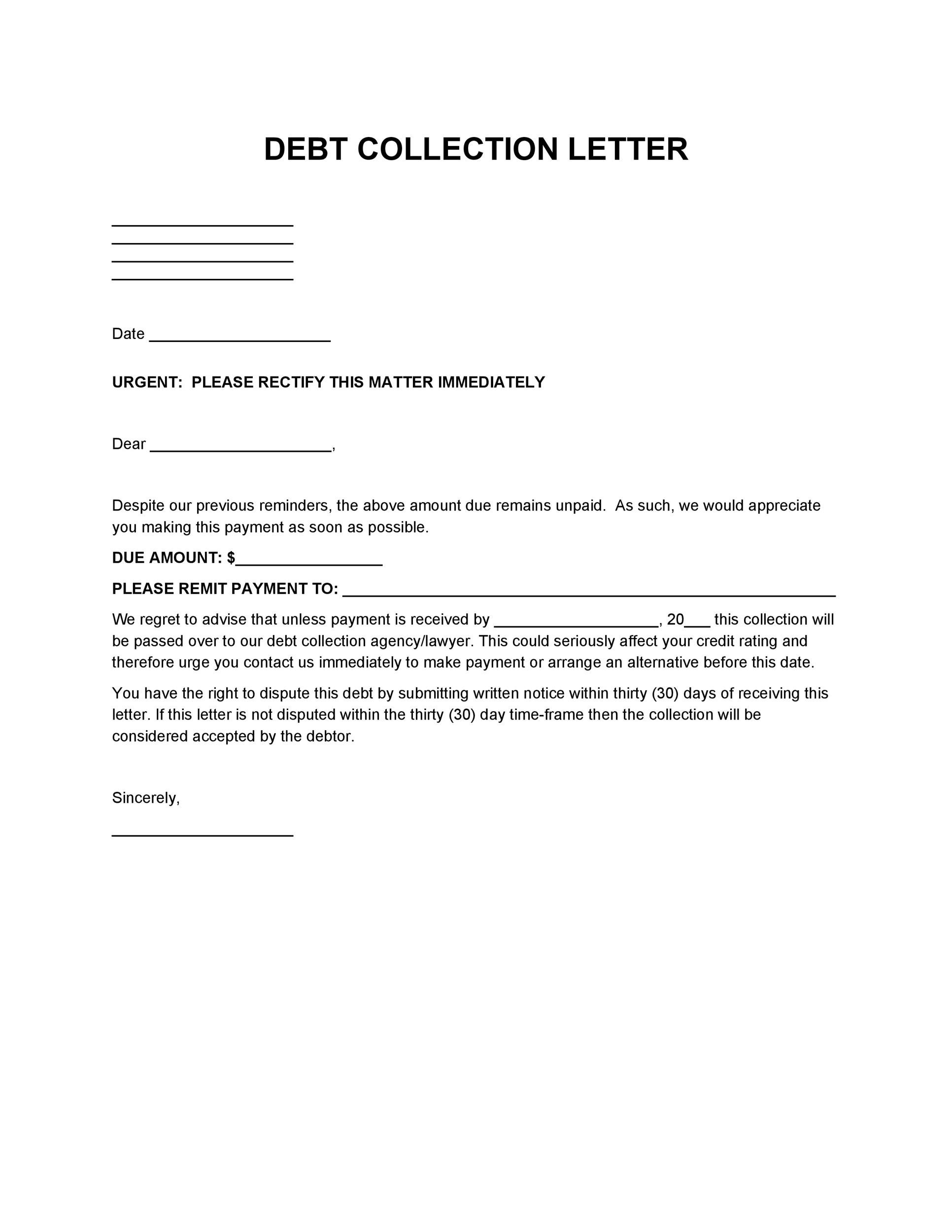

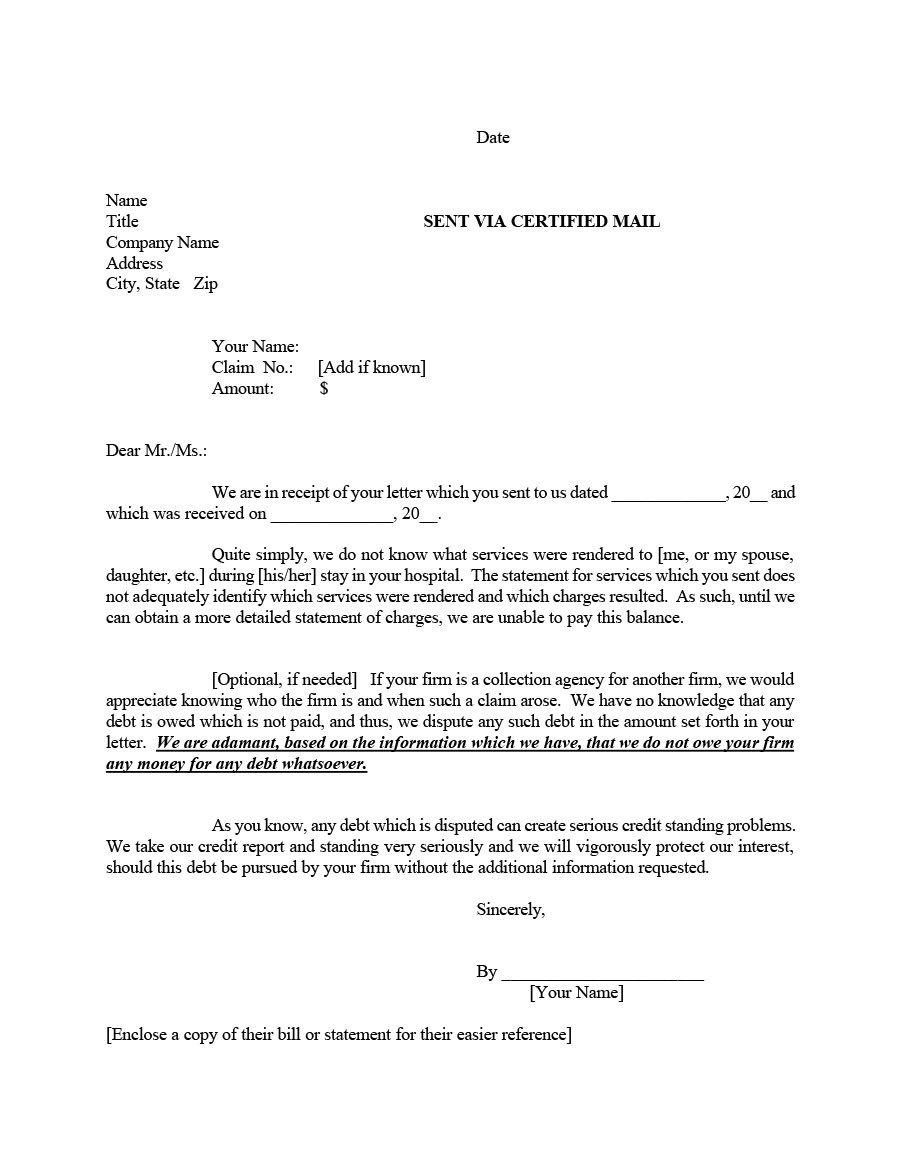

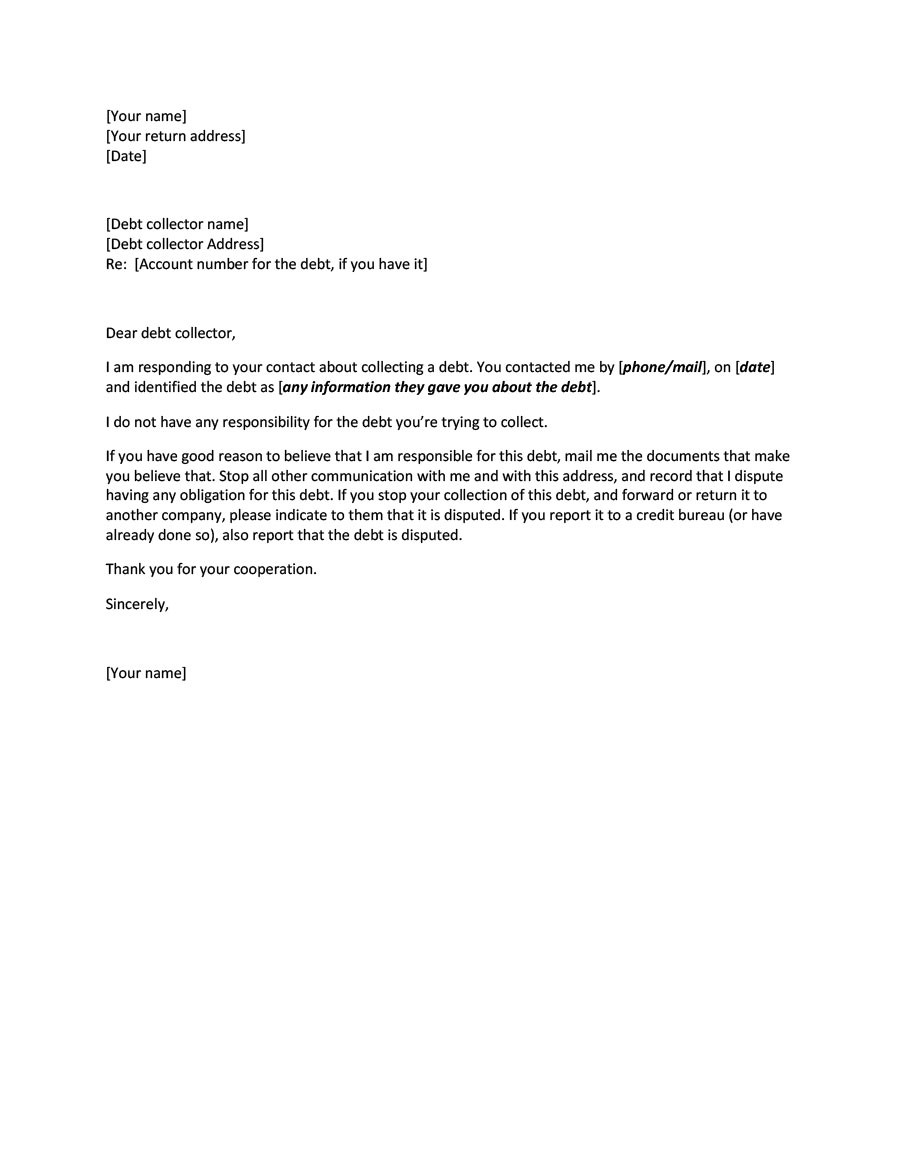

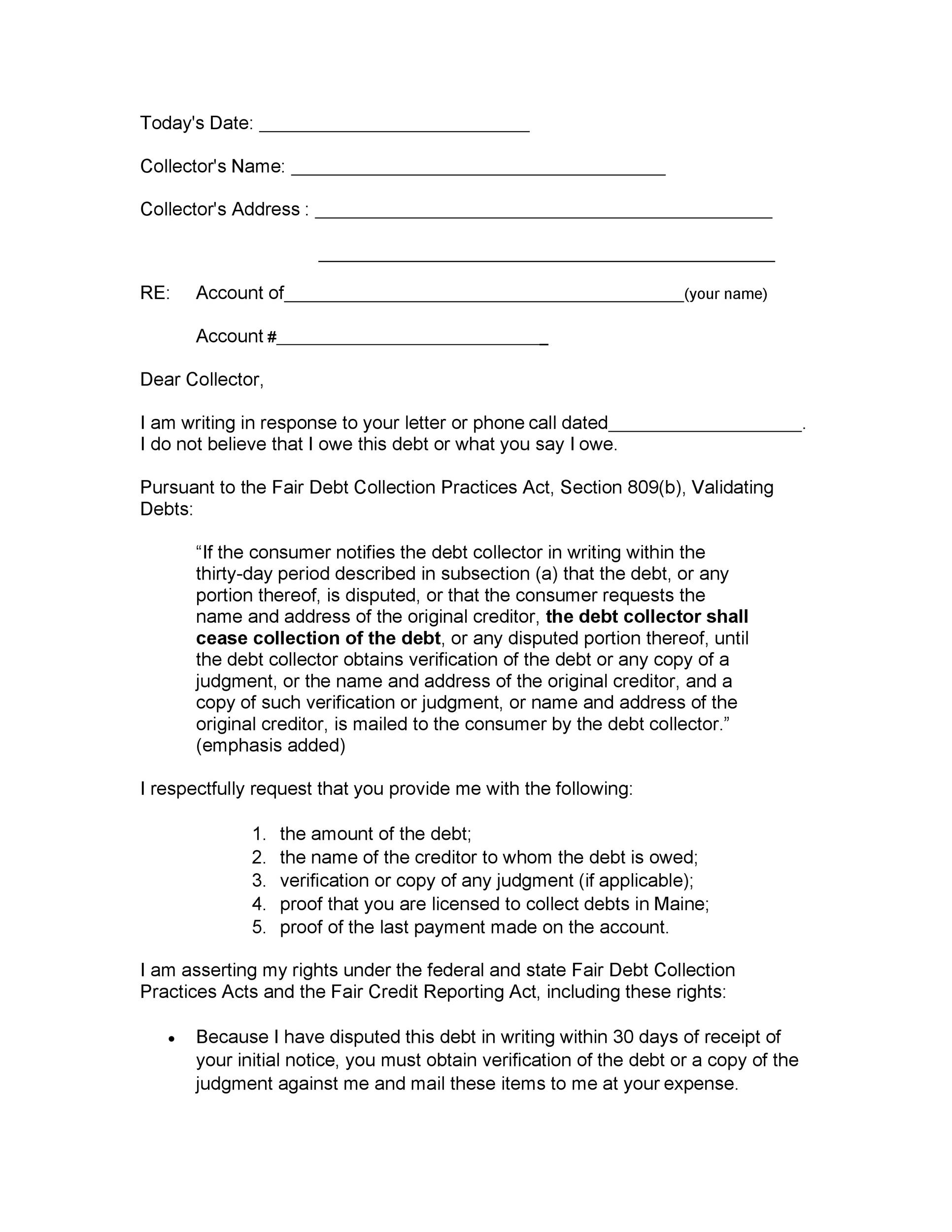

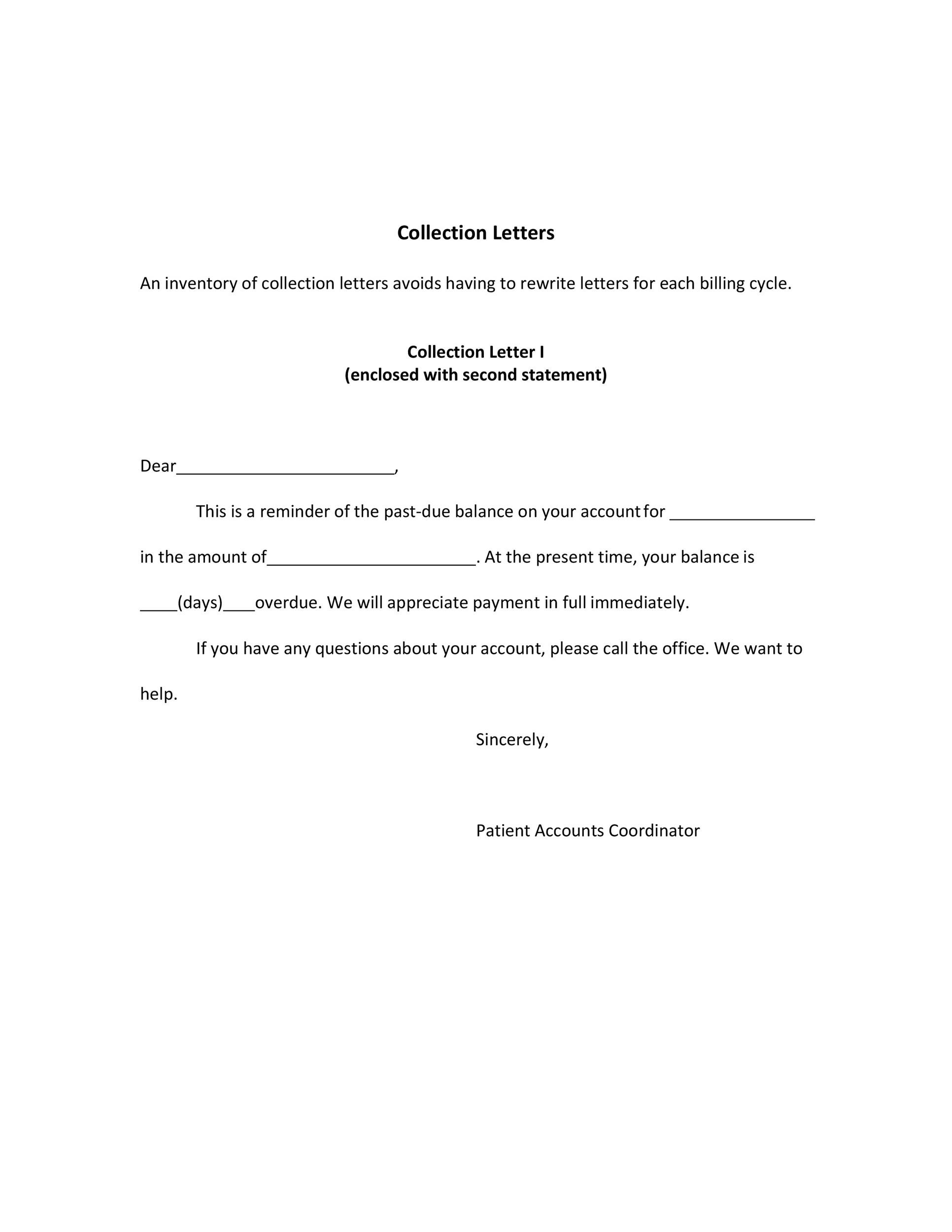

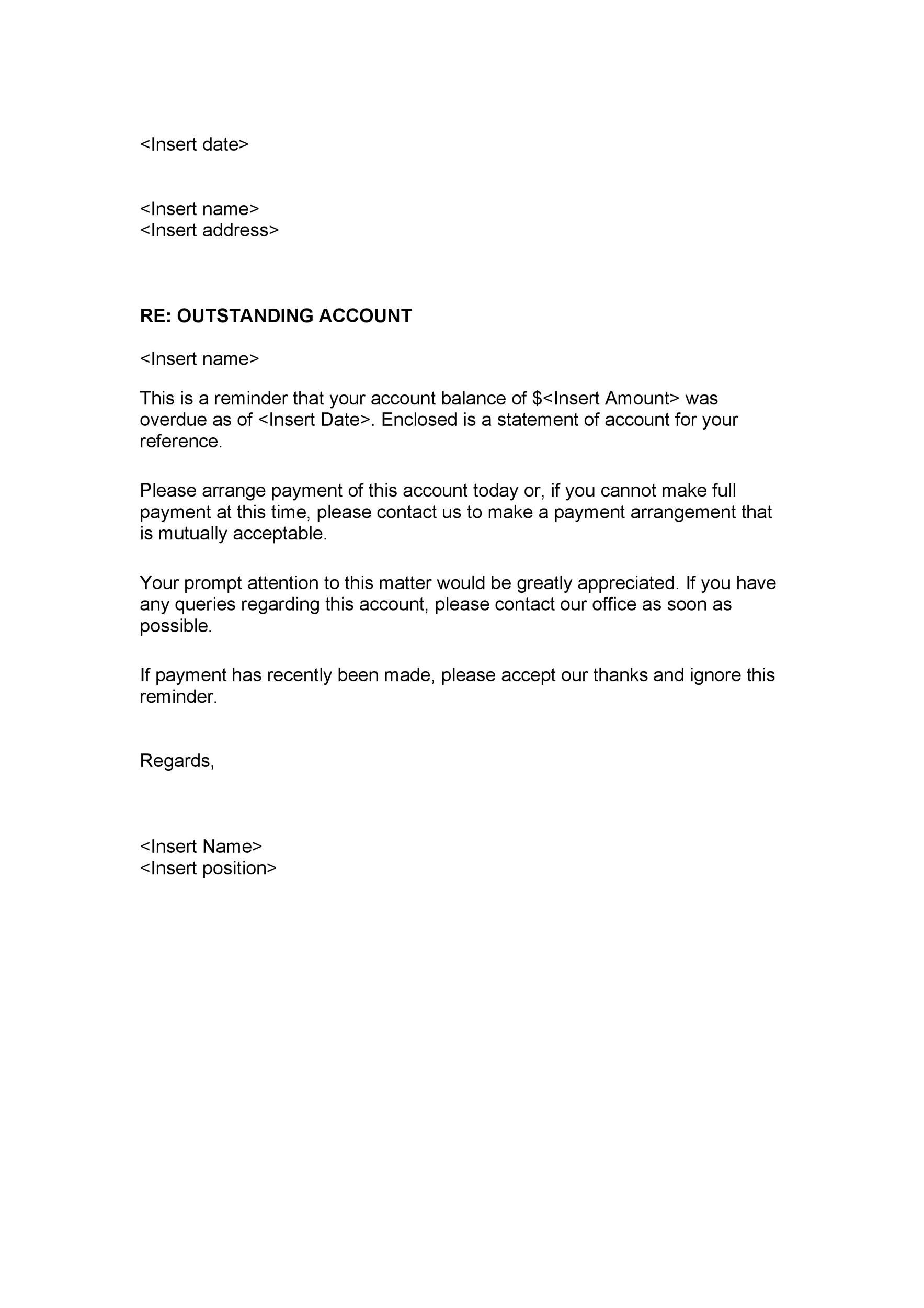

Collection Agency Letter Template - Web write a dispute letter: The collection letter process typically offers more than one warning to the debtor in written form, followed by a final. Include your full name, company name, and mailing address. To inquire about a missed payment, considering there might be a valid reason. The first step is to get the information in writing. Web the debt collection letter template is used to inform a debtor that they owe money to someone. In order to be compliant with fair debt collection practices, the letter must contain the following: When sending a debt collection letter, the sender must receive verifiable. Just cut, paste, and fill in your information and send. To gently remind the debtor of a missed payment. Initial debt collection email or due date notice. Just cut, paste, and fill in your information and send. The consumer should be absolutely sure that the debt. To gently remind the debtor of a missed payment. The collection letter process typically offers more than one warning to the debtor in written form, followed by a final. These collection letter samples can help collect your outstanding balances without having to use a collection agency. Include all necessary details for you, your firm, and the client at the top. According to our current records, your outstanding balance is $100. Clarity is key when addressing such sensitive matters. The debt amount ($) the creditor’s name. Specify and provide proof of the debt in question. Dear, this is a kind reminder that your account is overdue. Web here’s a detailed overview of the different types of debt collection letters: Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Be specific, include your contact details, and request validation of. Collection letters are letters intended to obtain payment from a client, a customer, or other sources of income. You might also use a collection letter to notify a company you are waiting on your refund. If the collection hasn’t been paid, continue paying on time. Web collection letter template #6: From the outset, ensure that your collection letter is straightforward,. It includes details of the missed payment and a payment request. Debt collection letter sample 02. If you have an old credit card balance of $5k with jp morgan and decide to sell it to a debt collector, the collection agency may pay only $250 to $500 for your balance. When sending a debt collection letter, the sender must receive. Include all necessary details for you, your firm, and the client at the top. You might also use a collection letter to notify a company you are waiting on your refund. Download today and get started. To gently remind the debtor of a missed payment. Specify and provide proof of the debt in question. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. To assist you in this endeavor, we have meticulously crafted a series of reminder templates that guide you through various. Dear, this is a kind reminder that your account is overdue. Dear [recipient's name] we regret to inform you that, despite several reminders, your unpaid debt amounting to [full amount] has not been settled. A statement informing the debtor that if they do not dispute the validity of the debt within 30 days, it will be assumed to be valid. As a debt collector or the official representative of a debt collection agency, you would create a collection letter template and send it when asking for. The debt amount ($) the creditor’s name. Web free collection letter templates. To assist you in this endeavor, we have meticulously crafted a series of reminder templates that guide you through various stages, from. You might also use a collection letter to notify a company you are waiting on your refund. Web collection letter sample 1: These collection letter samples can help collect your outstanding balances without having to use a collection agency. Web collection letter sample: Let’s look at the essential best practices necessary for writing a collection letter: The first letter you send is nothing more than a notification. 48 collection letter samples and templates. Let’s look at the essential best practices necessary for writing a collection letter: As a debt collector or the official representative of a debt collection agency, you would create a collection letter template and send it when asking for. Collection letter samples collection letter samples. The collection letter process typically offers more than one warning to the debtor in written form, followed by a final. Mention your contact information, including phone number, email address, and mailing address. As of today [insert date], we have passed your case onto our debt collection agency / legal team. If you’ve not received these email messages and documents, here is a summary of your account. Web consider including the following: You might also use a collection letter to notify a company you are waiting on your refund. Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: A statement informing the debtor that if they do not dispute the validity of the debt within 30 days, it will be assumed to be valid by the debtor. The debt amount ($) the creditor’s name. Web download debt.com’s settlement offer template » debt settlement offer letter for a collector.

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

Collection Letters to Customers Unique 10 Collection Letter Samples

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

Web Collection Letter Sample 1:

Some People Take Out Loans Or Borrow Money And At Times, Forget Their Obligations While There Are Those Who Intentionally Miss Their Payments.

Documentation Showing You Have Verified That I Am Responsible For This Debt, Or A Copy Of Any Judgment;

For Example, You Might Use A Collection Letter To Obtain A Judgment You Won In A Lawsuit.

Related Post: