Collections Dispute Letter Template

Collections Dispute Letter Template - Determine the nature of the debt and debtor information. Web credit inquiry removal letter template. Perhaps your agency is unaware that according to washington. Craft a collection contention letter the the moneylender or collection agency, explaining the inaccuracies and providing exhibits. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. I am requesting an investigation of the following data that. Provide personal and account details. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone.by law, the. Web send a debt dispute letter. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: Research the fair debt collection practices act (fdcpa) document all communications regarding the debt. Collection letter templates are created to provide written notice that there is money owed that will be sent to collections. If this letter is not disputed within the thirty (30) day timeframe then the collection will be considered accepted by the debtor. Federal law requires debt. Web the debt collection letter template is used to inform a debtor that they owe money to someone. Web dispute the charges for the following reason(s): (optional)> collection</strong> agency name> < creditor/collection agency address> subject: If this letter is not disputed within the thirty (30) day timeframe then the collection will be considered accepted by the debtor. The debt as. Web a credit report dispute letter is a one (1) page document sent to the major credit reporting bureaus to request the removal of incorrect information on a credit report. I am disputing this debt because i do not owe it. Add any evidence applicable supporting the dispute. Research any obligatory legal language that must be included in the letter.. The collection letter process typically offers more than one warning to the debtor in written form, followed by a final. Clearly set out reasons for disputing the debt. The date on which the debt fell into arrears and the date of last payment made, including a copy of the last billing statement from the original creditor. These sample letters are. Web debt collection dispute letter. If you don’t find any errors, ask the debt collector to verify it. If this letter is not disputed within the thirty (30) day timeframe then the collection will be considered accepted by the debtor. Web use this letter to dispute a debt and to tell a collector to stop contacting you. Collectors make a. Craft a collection dispute letter to the creditor or collection agency, explaining the inaccuracies and providing evidence. Collection letter templates are created to provide written notice that there is money owed that will be sent to collections. Use this template to ask data furnishers to verify and remove errors on your credit report(s). However, i did not cause any damage. The next step is to send a debt dispute letter, also called a verification letter, to the address you got from the caller. Check your credit report thoroughly. Include a declaration disputing the debt. Name of the debt collector and contact information; Web sample letters to dispute information on a credit report. Under the fair debt collection practices act, i request that you provide me with the following: (optional)> collection</strong> agency name> < creditor/collection agency address> subject: You should do this within 30 days of the time. Web ðï ࡱ á> þÿ f h. Research the fair debt collection practices act (fdcpa) document all communications regarding the debt. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: Under the fair debt collection practices act, i request that you provide me with the following: These sample letters are meant to give you ideas on how to structure your own credit dispute letters. I am requesting. A credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. Detailed documentation or proof of the debt, including the original creditor’s name and the amount you claim i owe. Craft a collection dispute letter to the creditor. Your name your street address city, state zip code. Collection verification letter to credit bureaus, round 1 Use this template to ask data furnishers to verify and remove errors on your credit report(s). Web accordance with the fair debt collection practices act, section 809(b): Research the fair debt collection practices act (fdcpa) document all communications regarding the debt. Web if you decide you want to try to remove a collection from your credit report, here’s a quick recap on the process: Include a declaration disputing the debt. Craft a collection contention letter the the moneylender or collection agency, explaining the inaccuracies and providing exhibits. Web write a dispute letter: Research any obligatory legal language that must be included in the letter. Web 623 credit report dispute letter sample template. (the following is an example, insert your own history here): Web it includes writing dispute letters to the collection agency and if the collection agency is nonresponsive, it requires the threat of filing a lawsuit. Web debt collection dispute letter. Add any evidence applicable supporting the dispute. Prepare an initial draft for the dispute debt collection letter.![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-06.jpg?w=790)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Debt Collection Letter Samples (for Debtors) Guide & Tips

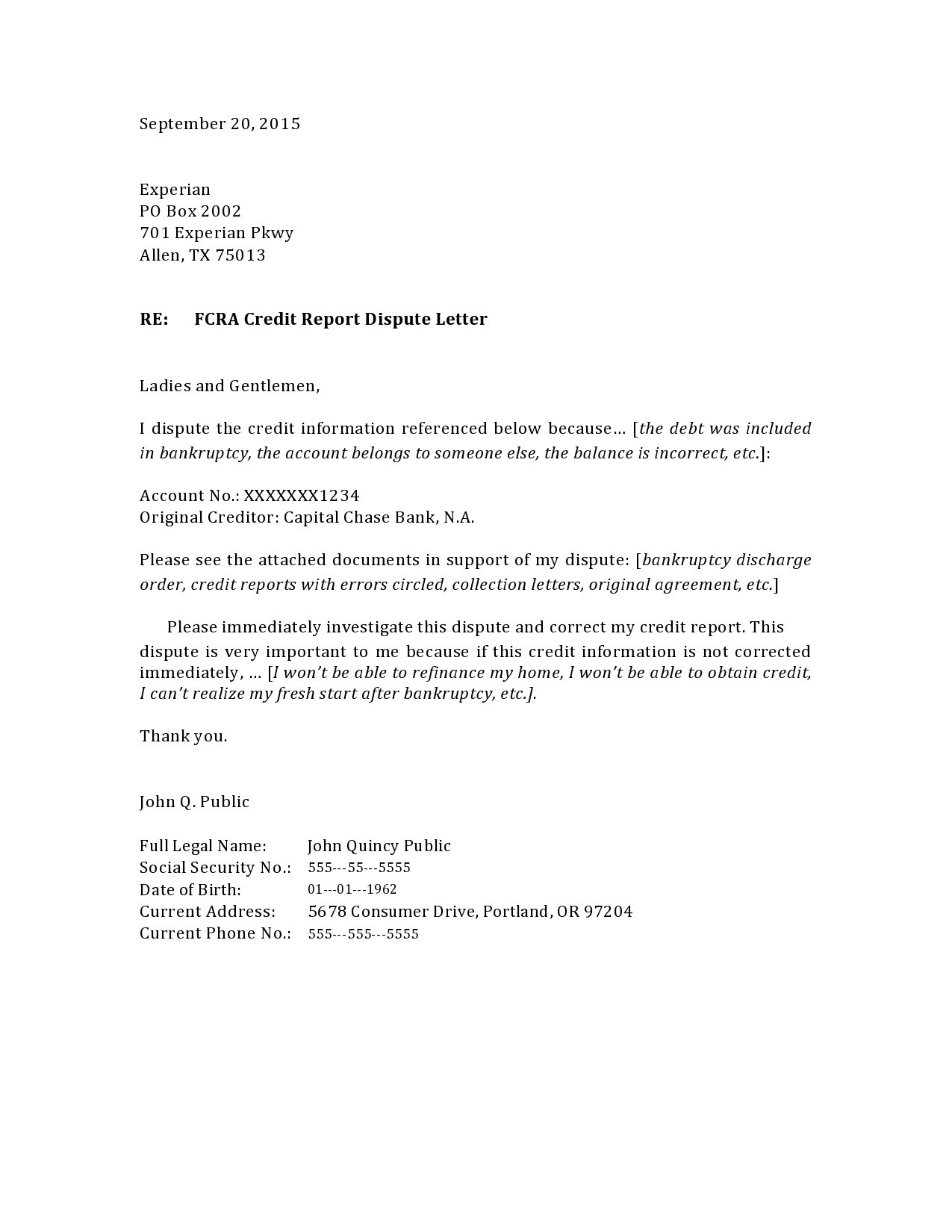

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-01.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

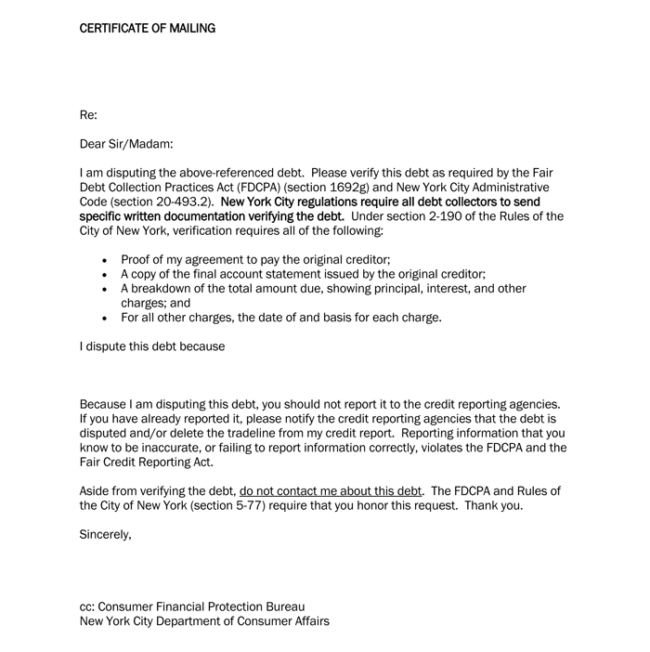

Debt Collection Dispute Letter Template, Debt Collection Dispute Letter

Collection Dispute Letter The form letter below will help you dispute

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

Collection Dispute Letter Template

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

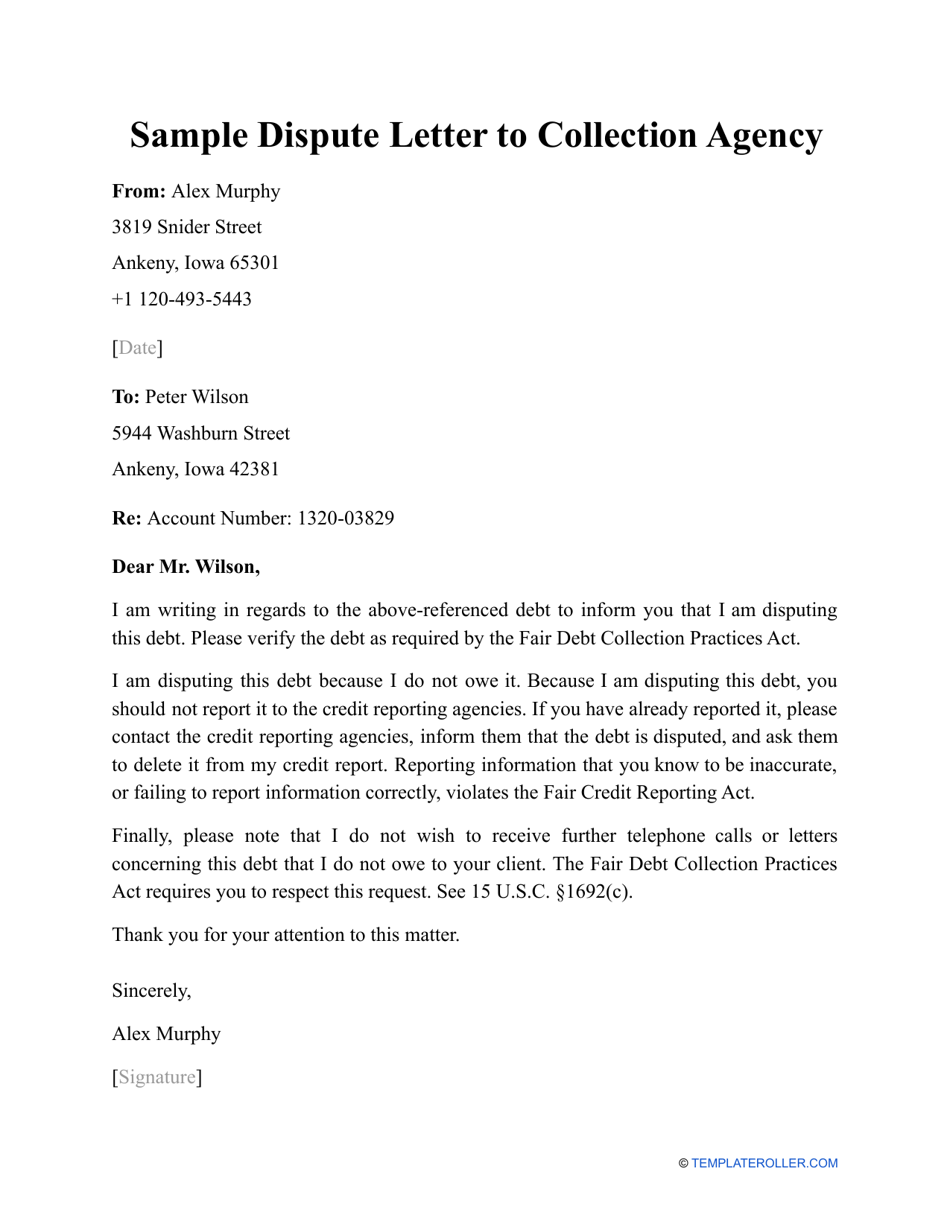

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

![How to Write a Collection Dispute Letter? [With Template]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2022/06/Sample-Letter-for-Debt-Collection-Dispute.png)

How to Write a Collection Dispute Letter? [With Template]

Web Credit Inquiry Removal Letter Template.

This Document Is Intended To Be Used By The Debtor (The Business Or Individual Owing Money) Who Will Send The Letter To The Collection Agency That Originally Contacted Them To Obtain More Information About The Debt.

(Optional)> Collection</Strong> Agency Name> < Creditor/Collection Agency Address> Subject:

Be Specific, Include Your Contact Details, And Request Validation Of The Debt.

Related Post: