Convertible Debt Template

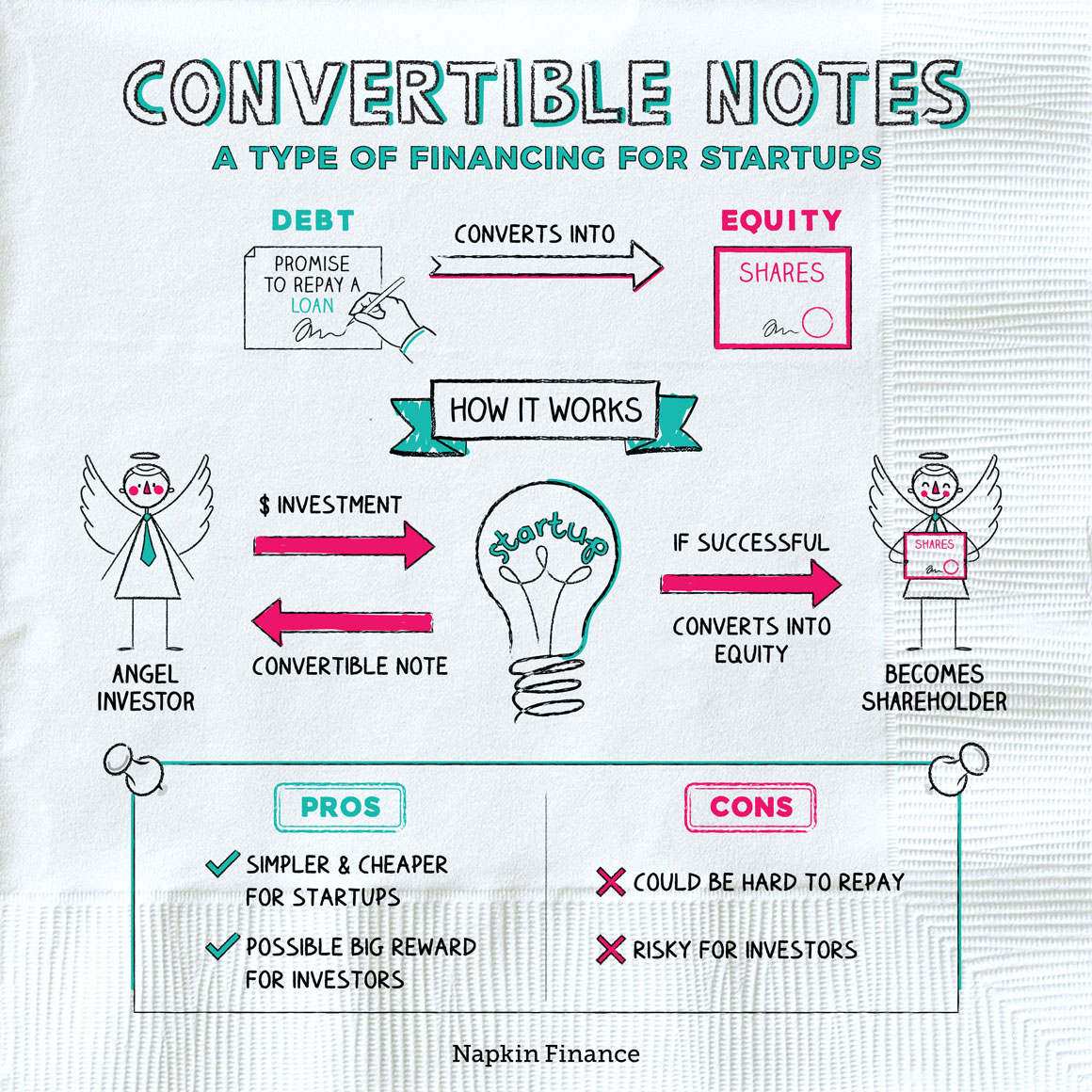

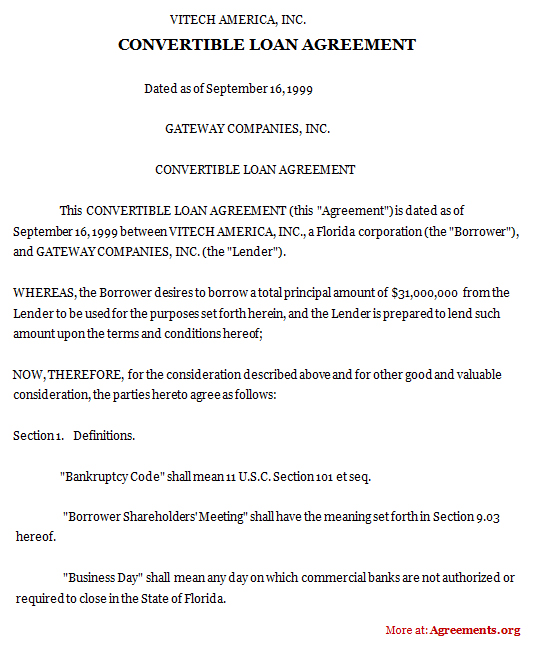

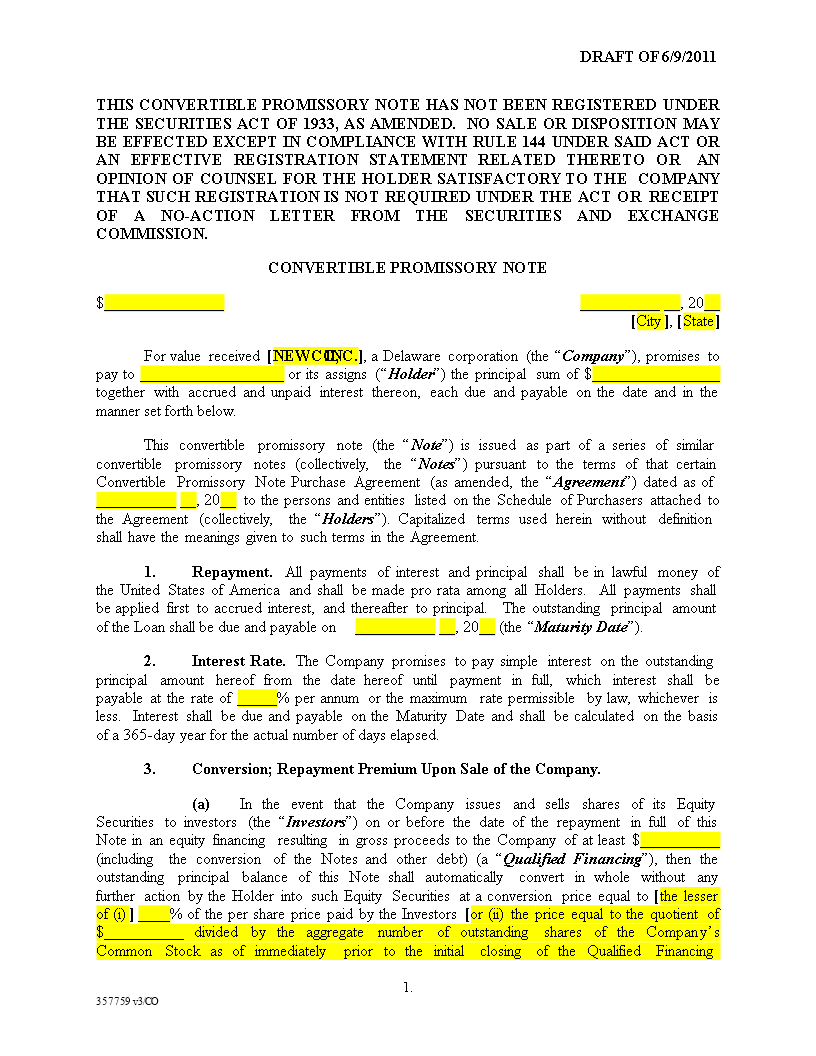

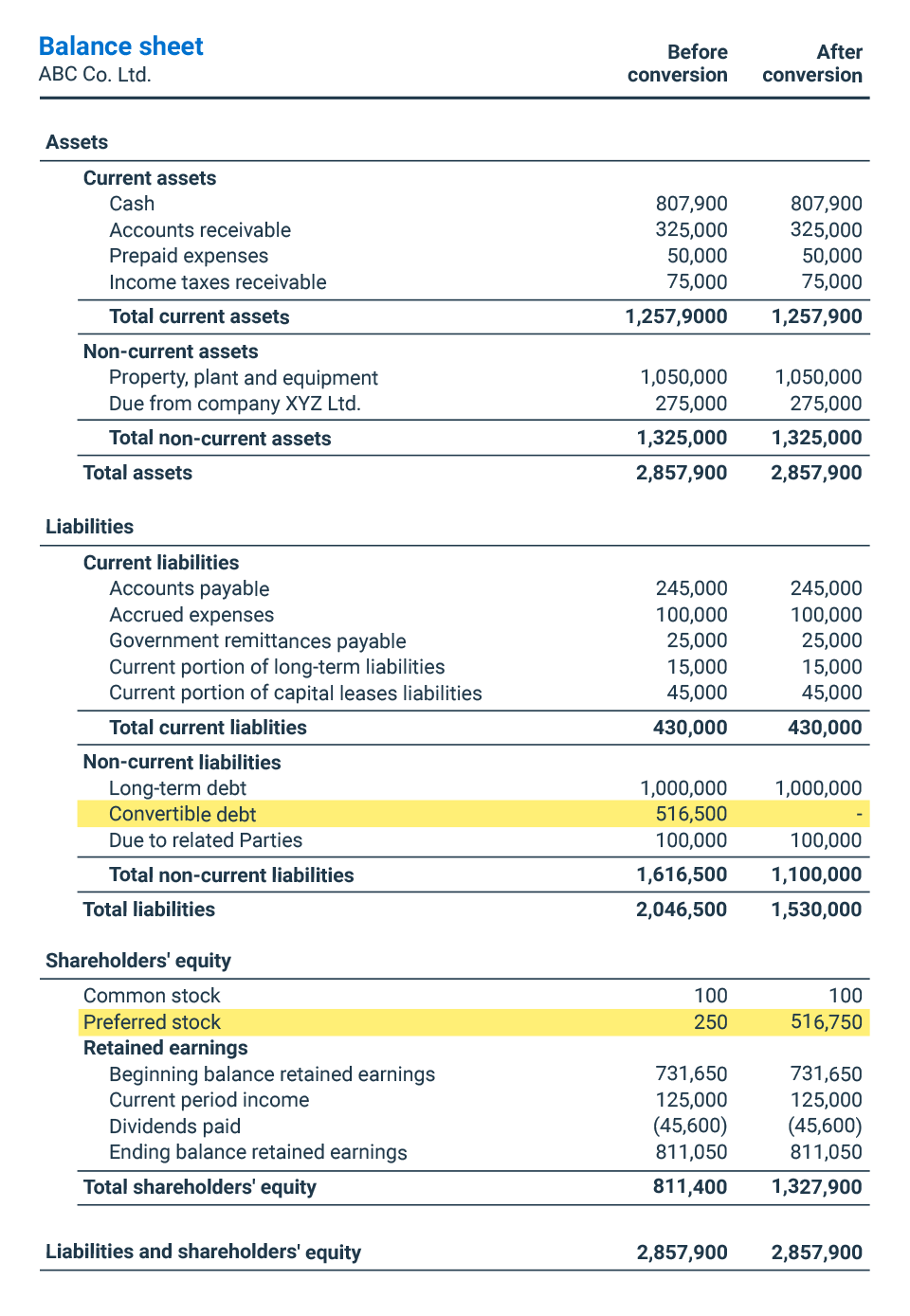

Convertible Debt Template - Web a typical convertible note structure is something like this: Convertible debt is a loan or debt obligation that is paid with equity or stocks in a. Bbb a+ rated businessover 100k legal forms3m+ satisfied customers What is a convertible bond? Most companies have investors who offer money that serves as the capital for the business to operate. Web template documents for convertibles. Everything you need to know. Web convertible note template | eqvista. Web convertible note agreement template. Web new convertible debt accounting guidance (updated august 2020) observations from the front lines. Web convertible note template | eqvista. It starts off as a loan (debt), but the lender and the. What is a convertible bond? Web a typical convertible note structure is something like this: Web template documents for convertibles. Web new convertible debt accounting guidance (updated august 2020) observations from the front lines. 3 the typical range of discounts that we see is 10. Conversion conditions (triggering event, maturity date, etc.) 3. Web convertible note agreement template. Everything you need to know. This is an excel template illustrating how to calculate earnings per share (eps) and diluted earnings per share (deps) for a company with a complex capital. Web a convertible note agreement is a record or a deal for an investor to subscribe to convertible notes (a debt instrument that converts into equity under predetermined. Loan sum and interest rate 2.. Web a typical convertible note structure is something like this: Convertible debt is a loan or debt obligation that is paid with equity or stocks in a. What is a convertible bond? Web convertible note agreement template. Everything you need to know. They represent a loan from an investor to the company. This is an excel template illustrating how to calculate earnings per share (eps) and diluted earnings per share (deps) for a company with a complex capital. Web 1 the typical type of interest for a convertible note is simple. Loan sum and interest rate 2. 3 the typical range of. This is an excel template illustrating how to calculate earnings per share (eps) and diluted earnings per share (deps) for a company with a complex capital. Web a typical convertible note structure is something like this: Web convertible notes, also known as convertible promissory notes or convertible debt, are a type of debt instrument commonly used by startups to secure. Conversion conditions (triggering event, maturity date, etc.) 3. Loan sum and interest rate 2. Web convertible note template | eqvista. It starts off as a loan (debt), but the lender and the. Web a convertible note agreement is a record or a deal for an investor to subscribe to convertible notes (a debt instrument that converts into equity under predetermined. They represent a loan from an investor to the company. It starts off as a loan (debt), but the lender and the. Web new convertible debt accounting guidance (updated august 2020) observations from the front lines. Web a typical convertible note structure is something like this: Bbb a+ rated businessover 100k legal forms3m+ satisfied customers Fill & sign this document online. Web convertible note agreement template. Web template documents for convertibles. Everything you need to know. Web convertible note template | eqvista. What is a convertible bond? Web convertible notes, also known as convertible promissory notes or convertible debt, are a type of debt instrument commonly used by startups to secure financing during their early. Our forms of series seed debt documents are. 3 the typical range of discounts that we see is 10. Web a typical convertible note structure is something. Convertible debt is a loan or debt obligation that is paid with equity or stocks in a. They represent a loan from an investor to the company. Bbb a+ rated businessover 100k legal forms3m+ satisfied customers Web template documents for convertibles. It starts off as a loan (debt), but the lender and the. Web 1 the typical type of interest for a convertible note is simple. Web table of contents. Web convertible promissory notes are financial instruments commonly used in the early stages of a business. Fill & sign this document online. Web a convertible note agreement is a record or a deal for an investor to subscribe to convertible notes (a debt instrument that converts into equity under predetermined. Most companies have investors who offer money that serves as the capital for the business to operate. Our forms of series seed debt documents are. Web updated october 06, 2020. Web new convertible debt accounting guidance (updated august 2020) observations from the front lines. Web a typical convertible note structure is something like this: Web convertible notes, also known as convertible promissory notes or convertible debt, are a type of debt instrument commonly used by startups to secure financing during their early.

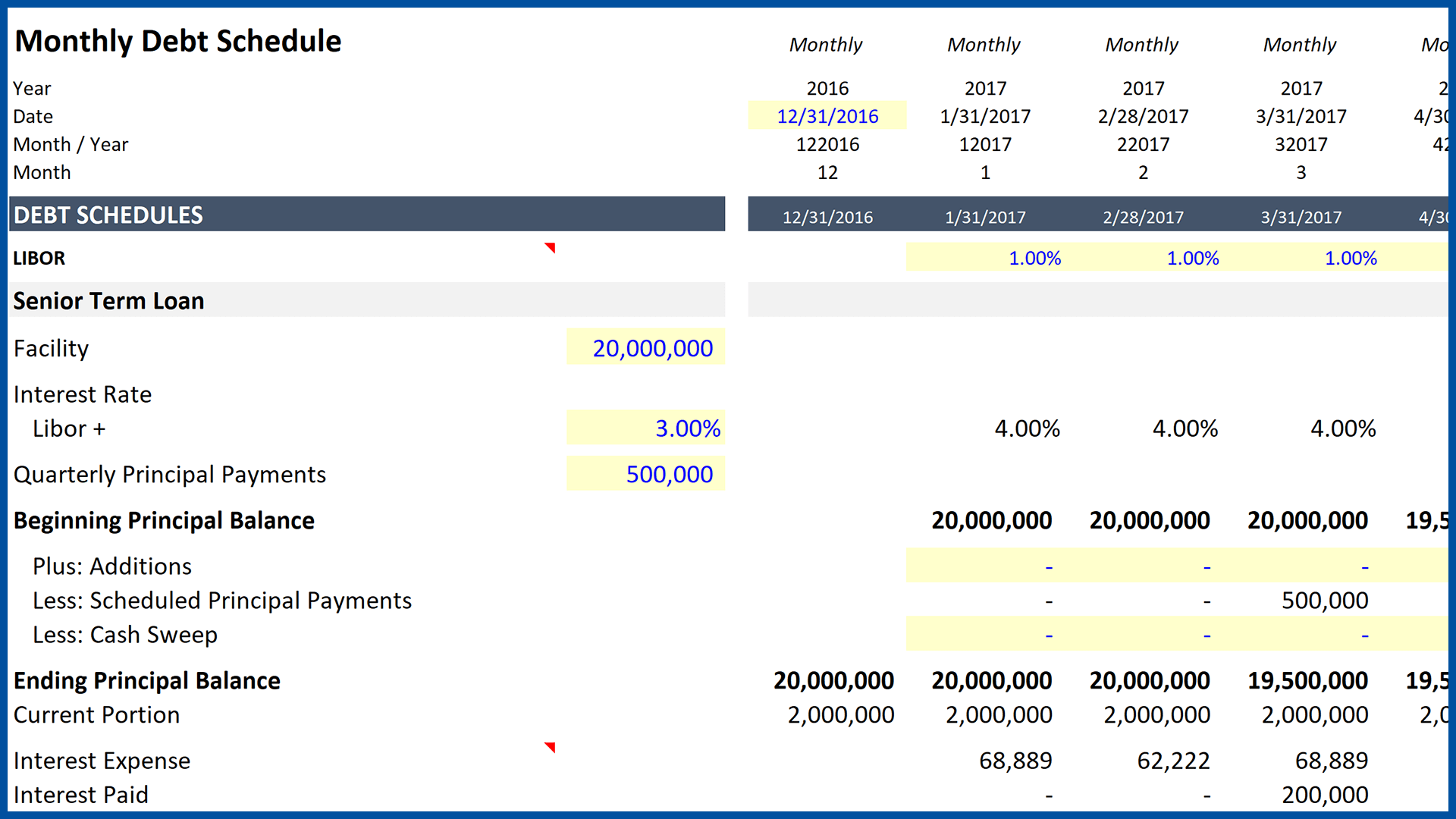

Monthly Debt Schedules Example A Simple Model

Convertible Debt Template

Convertible Note Template Word

Convertible Debt Template

Convertible Note Term Sheet Template

Convertible Note Term Sheet Form Fill Out and Sign Printable PDF

Convertible Promissory Note Templates at

What is convertible debt? BDC.ca

7+ Convertible Note Agreement Templates Sample Templates

What is Convertible Note? Definition + Lending Examples

Web Convertible Note Template | Eqvista.

Conversion Conditions (Triggering Event, Maturity Date, Etc.) 3.

Loan Sum And Interest Rate 2.

Web Convertible Note Agreement Template.

Related Post: