Cp2000 Response Letter Template

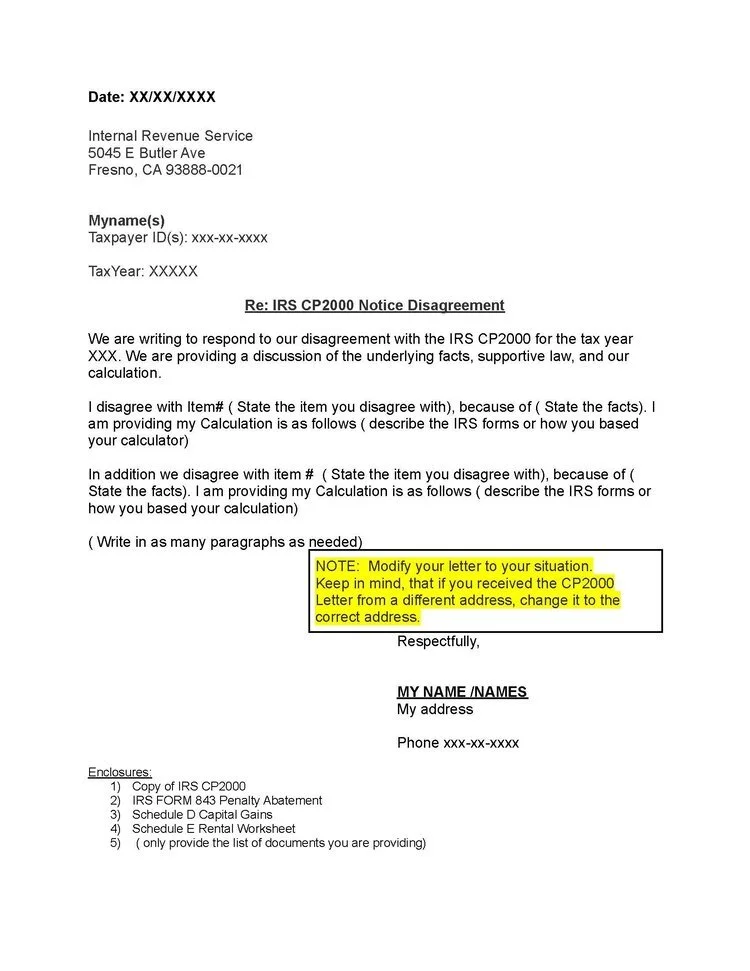

Cp2000 Response Letter Template - Web cp2000 response letter sample for unreported cryptocurrency transactions. Changes to your tax return and the supporting documentation. Web here’s what to do. Send your response to the notice within 30 days of the date on the notice. Web three ways to respond to irs notice cp2000: It’s always best to respond to an irs notice before the deadline in the notice, but you can ask for more time. March 28, 2022 | last updated: The irs generally sends three waves of cp2000. Read the entire notice so you understand the problem. Request for verification of unreported income, payments, and/or credits. Web respond to the notice. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble income information reported to the irs by third parties. A cp2000 letter, “notice of underreported income,” is not a formal audit that would require a full tax examination by the irs. Web the irs cp2000 notice. This specific letter is irs letter cp 2000. Web an irs cp2000 notice is a document sent by the irs notifying you of discrepancies between the income, credits, or deductions reported on your tax return. Web a cp2000 notice is a letter indicating a discrepancy between the information in the tax return the irs has on file for you and. Here is what we put after the heading for a client to whom the irs had. Web here’s what to do. It’s always best to respond to an irs notice before the deadline in the notice, but you can ask for more time. We'll send you a letter proposing changes…. Web the irs cp2000 notice is a notification sent to. Web the first page of the notice provides a summary of proposed changes to your tax, a phone number to call for assistance, and the steps you should take to respond. Web respond to the notice. Carefully read through the cp2000 letter, including the proposed. By mail, by fax (the fax number is. If a taxpayer agrees with the cp2000. Web a cp2000 notice is a letter indicating a discrepancy between the information in the tax return the irs has on file for you and the information provided by an employer. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble income information reported to the irs by third parties. Here. Carefully read through the cp2000 letter, including the proposed. To whom it may concern, i received your notice dated month, xx, year, a copy of which is enclosed as well as. Read the entire notice so you understand the problem. Web the cp2000 notice is sent by the irs when there is a discrepancy between the income, payments, or credits. A cp2000 letter, “notice of underreported income,” is not a formal audit that would require a full tax examination by the irs. Web when our records don't match what you reported on your tax return…. Web the cp2000 notice is sent by the irs when there is a discrepancy between the income, payments, or credits reported on your tax return. Changes to your tax return and the supporting documentation. Here is what we put after the heading for a client to whom the irs had. Cp2000 notices (underreporter inquiries) have a. Web when our records don't match what you reported on your tax return…. A cp2000 letter, “notice of underreported income,” is not a formal audit that would require a. The irs sends cp2000 notices at three times in the year. There are several ways to respond: Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble income information reported to the irs by third parties. If a taxpayer agrees with the cp2000 notice — they can follow the instructions on. The irs sends cp2000 notices at three times in the year. Web the cp2000 notice is sent by the irs when there is a discrepancy between the income, payments, or credits reported on your tax return and the information the irs. To whom it may concern, i received your notice dated month, xx, year, a copy of which is enclosed. Go through the “explanation of changes to your form 1040” section and. Web here’s what to do. There are several ways to respond: Check the claim of the irs against your records to figure out what caused the. Web cp2000 response letter sample for unreported cryptocurrency transactions. Response to cp2000 notice dated month, xx, year. Changes to your tax return and the supporting documentation. March 28, 2022 | last updated: It’s always best to respond to an irs notice before the deadline in the notice, but you can ask for more time. If a taxpayer agrees with the cp2000 notice — they can follow the instructions on the response form or notice, sign,. The irs generally sends three waves of cp2000. A cp2000 letter, “notice of underreported income,” is not a formal audit that would require a full tax examination by the irs. Web here's what to expect and how to handle each one. Web when our records don't match what you reported on your tax return…. Web the irs cp2000 notice is a notification sent to taxpayers when their tax returns do not match the income and tax payments reported by their employers or. Request for verification of unreported income, payments, and/or credits.

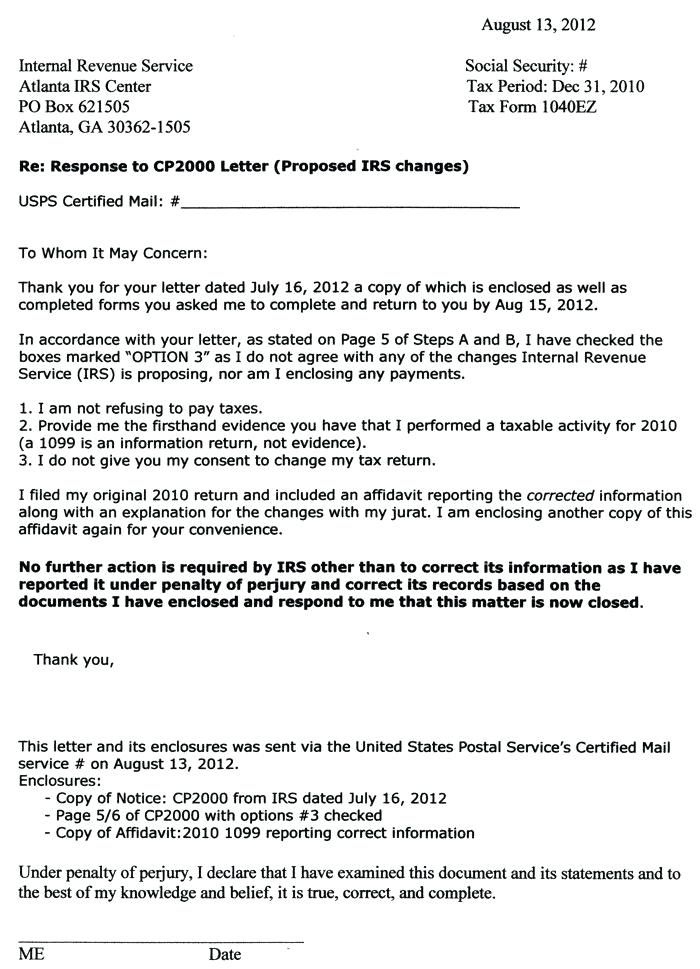

Irs Cp2000 Response Form Pdf Elegant Outstanding Payment with Irs

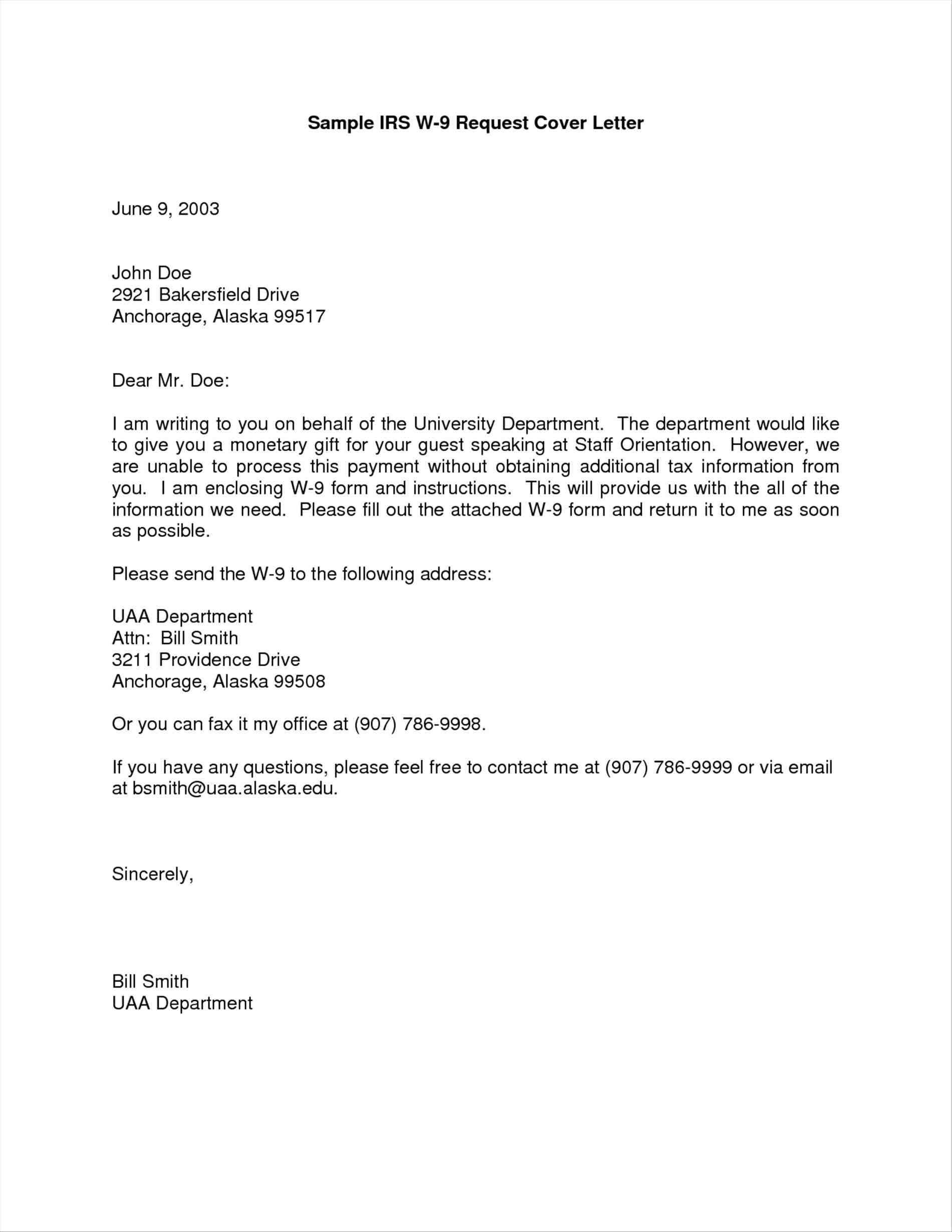

Cp2000 Response Letter Template Samples Letter Template Collection

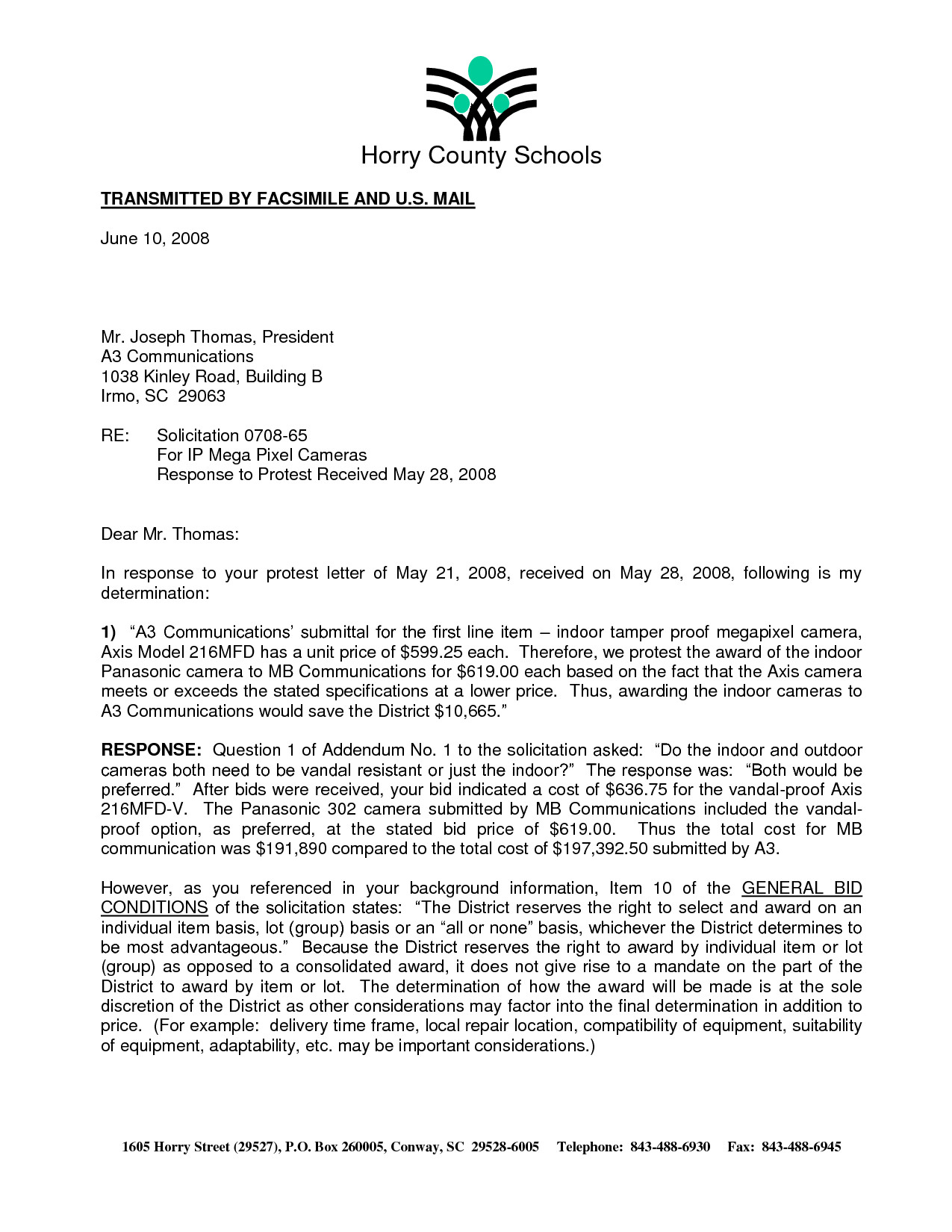

IRS Audit Letter CP2000 Sample 4

Cp2000 response letter sample Fill out & sign online DocHub

Cp2000 Response Letter Template Resume Letter

Cp2000 Response Letter Template Samples Letter Template Collection

Cp2000 Response Letter Template

IRS Audit Letter CP2000 Sample 2

.jpeg)

Cp2000 Response Template

Irs Cp2000 Example Response Letter amulette

Cp2000 Notices (Underreporter Inquiries) Have A.

Web The First Page Of The Notice Provides A Summary Of Proposed Changes To Your Tax, A Phone Number To Call For Assistance, And The Steps You Should Take To Respond.

Make Sure You Actually Earned The Income That The Irs Is Claiming You Did Not Report.

Web The Cp2000 Notice Is Sent By The Irs When There Is A Discrepancy Between The Income, Payments, Or Credits Reported On Your Tax Return And The Information The Irs.

Related Post: