Credit Card Debt Excel Template

Credit Card Debt Excel Template - This calculator is the first one in the series of debt reduction calculators provided by spreadsheet123. Follow the steps below to set one up on your own. Here are the steps to create a perfect one. Web this page is a collection of various excel templates to manage debt and loans. Compile a list of all your credit card debts, their balances, interest rates, and minimum payments. $3,000 ($70 minimum payment) 4th debt: Create a table to insert all the necessary inputs. Web now to see it in action, assume the following is your debt snowball strategy. The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt payoff in addition to your savings goals. Entering the starting balance and interest rate. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. You owe $2,000 on each credit card. Card b has a fixed rate of 14 percent, and card c. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly. Enter the values in cells. You owe $2,000 on each credit card. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: Shred them if you need to. Using the function pmt(rate,nper,pv) =pmt(17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off. Compile a list of all your credit card. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly. It also creates a payment schedule and graphs your payment and balance over time. In the first worksheet, you enter your creditor information and your total monthly payment. Web this printable worksheet can be used to. Shred them if you need to. $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. Your credit history influences your eligibility for loans and balance transfer cards. This credit card debt reduction calculator. Web the author of the spreadsheet and the squawkfox blog, kerry taylor, paid off $17,000 in student loans over six months using. Web call your credit card company(ies) and ask them to lower your interest rates. $1,000 ($50 minimum payment) 2nd debt: You owe $2,000 on each credit card. $3,000 ($70 minimum payment) 4th debt: Here's how to input the necessary data: Here's how to input the necessary data: Entering the starting balance and interest rate. In the first worksheet, you enter your creditor information and your total monthly payment. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: Your credit history influences your eligibility for loans and balance transfer. Compile a list of all your credit card debts, their balances, interest rates, and minimum payments. Enter the values in cells e5 to e8 which are required for calculations. The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt payoff in addition to your savings goals. Nothing else will be. Web call your credit card company(ies) and ask them to lower your interest rates. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. This calculator is the first one in the series of debt reduction calculators provided by spreadsheet123. Firstly, there will be three debts for us and the information. If you paid credit card a at a rate of $100 per month, it would take you 23 months to retire. To name a few, our selection includes various loan payment calculators, credit card and debt reduction calculators, payment schedules, and loan amortization charts. Next, select “ credit card payoff calculator ” from the search result. Web the author of. To create a credit card payoff spreadsheet for your debt snowball method, you can use excel. Creating a credit card payoff spreadsheet in excel requires inputting various pieces of data to accurately calculate and track your progress. $1,000 ($50 minimum payment) 2nd debt: Your first credit card is $1000 at 12% interest. Web call your credit card company(ies) and ask. The minimum payment represents the amount of cash flow you will free up by completely paying off the debt. The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt payoff in addition to your savings goals. Enter the start debt, then print the worksheet. Free downloadable debt reduction template. $2,000 ($65 minimum payment) 3rd debt: Your first credit card is $1000 at 12% interest. Travel credit cards are a great way to earn points and miles and accrue other. Here's how to input the necessary data: Entering the starting balance and interest rate. Record the creditor and the minimum payment at the top of the worksheet. Open a blank debt snowball calculator as shown below. Type “ credit card ” and press enter. To create a credit card payoff spreadsheet for your debt snowball method, you can use excel. Firstly, there will be three debts for us and the information related to our debts is as follows: Card b has a fixed rate of 14 percent, and card c. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts.

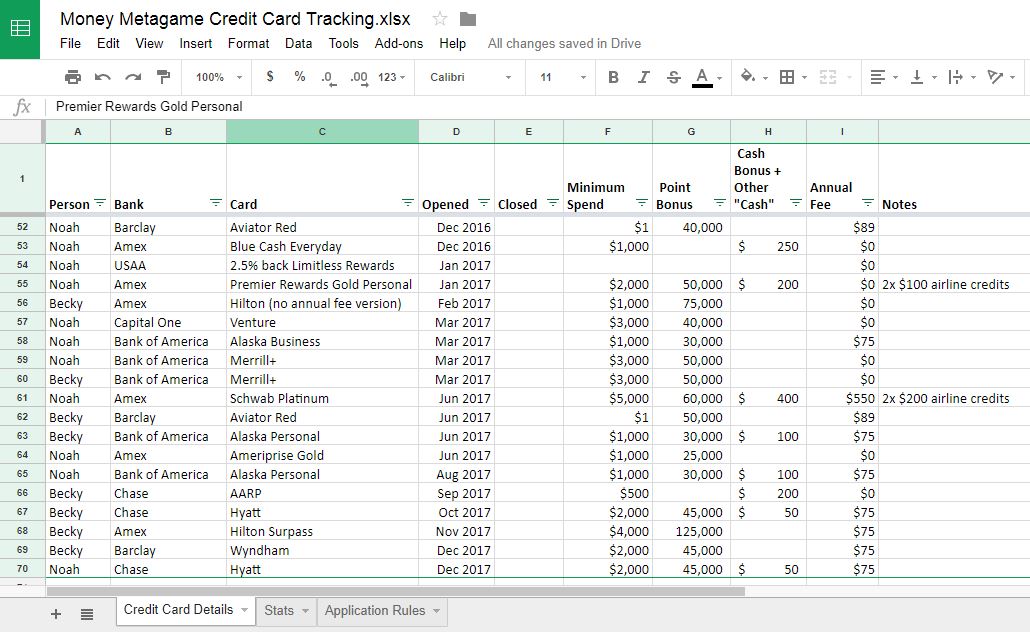

Excel Credit Card Payment Tracker Template

Credit Card Debt Excel Template

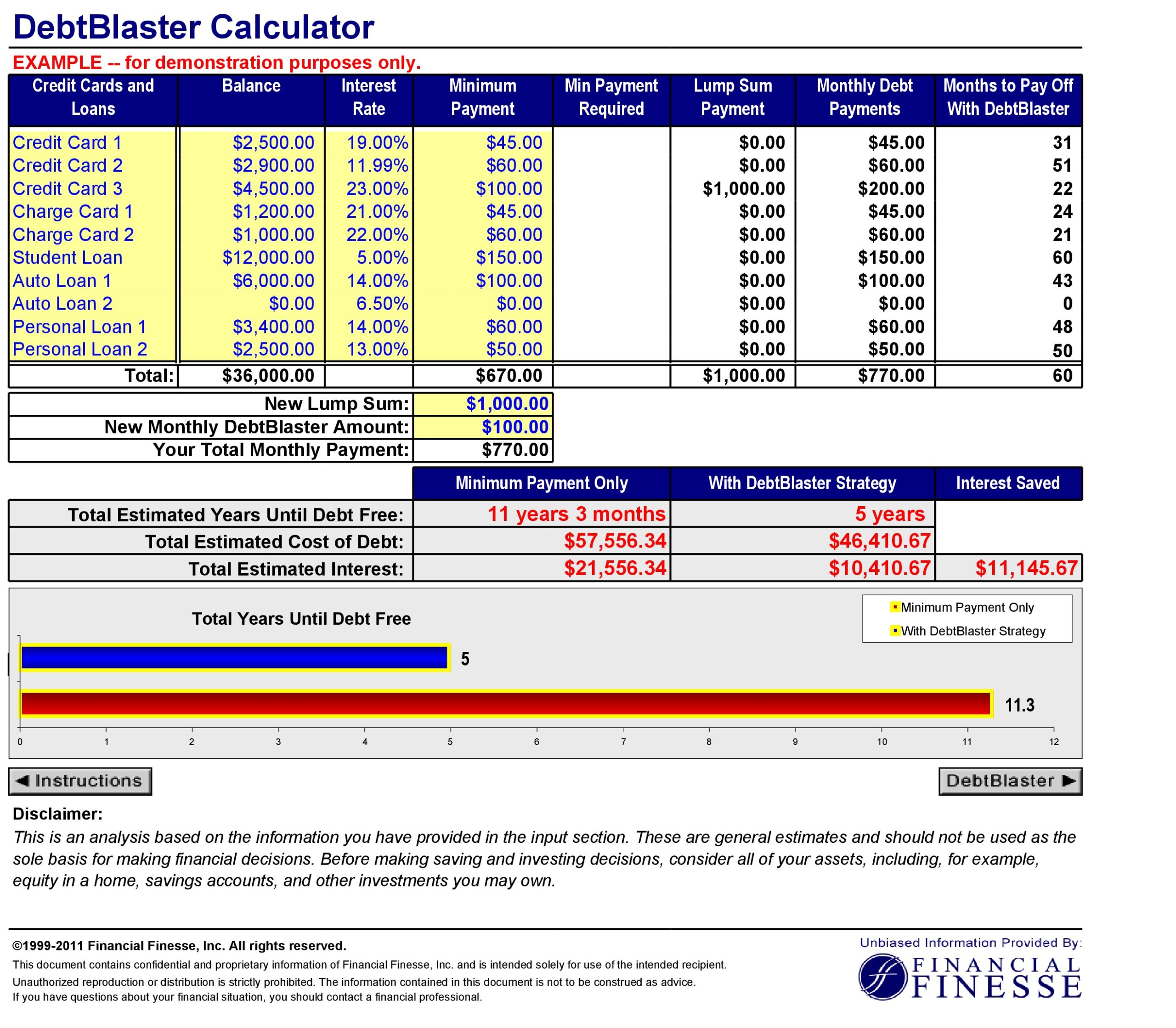

Single Debt Analysis Template

Credit Card Statement Template Excel

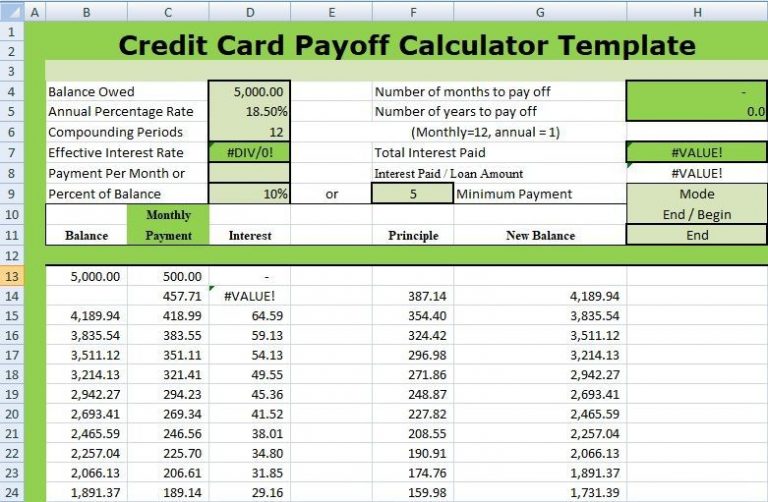

Excel Credit Card Payoff Calculator and Timeline Easy Etsy

Credit Card Payment Spreadsheet Template

EXCEL of Credit Card Payoff Calculator.xlsx WPS Free Templates

credit card payoff ExcelTemplate

![]()

50 Free Credit Card Tracking Spreadsheet

![]()

Credit Card Debt Payoff Tracker Template in Excel, Google Sheets

For The First Method, We Will Input Information About The Debt.

Follow The Steps Below To Set One Up On Your Own.

Get A Handle On Your Finances And Start Making A Dent In Your Debt With This Debt Reduction Template From Vertex42.

Web Figure Out The Monthly Payments To Pay Off A Credit Card Debt.

Related Post: