Dave Ramsey Debt Snowball Template

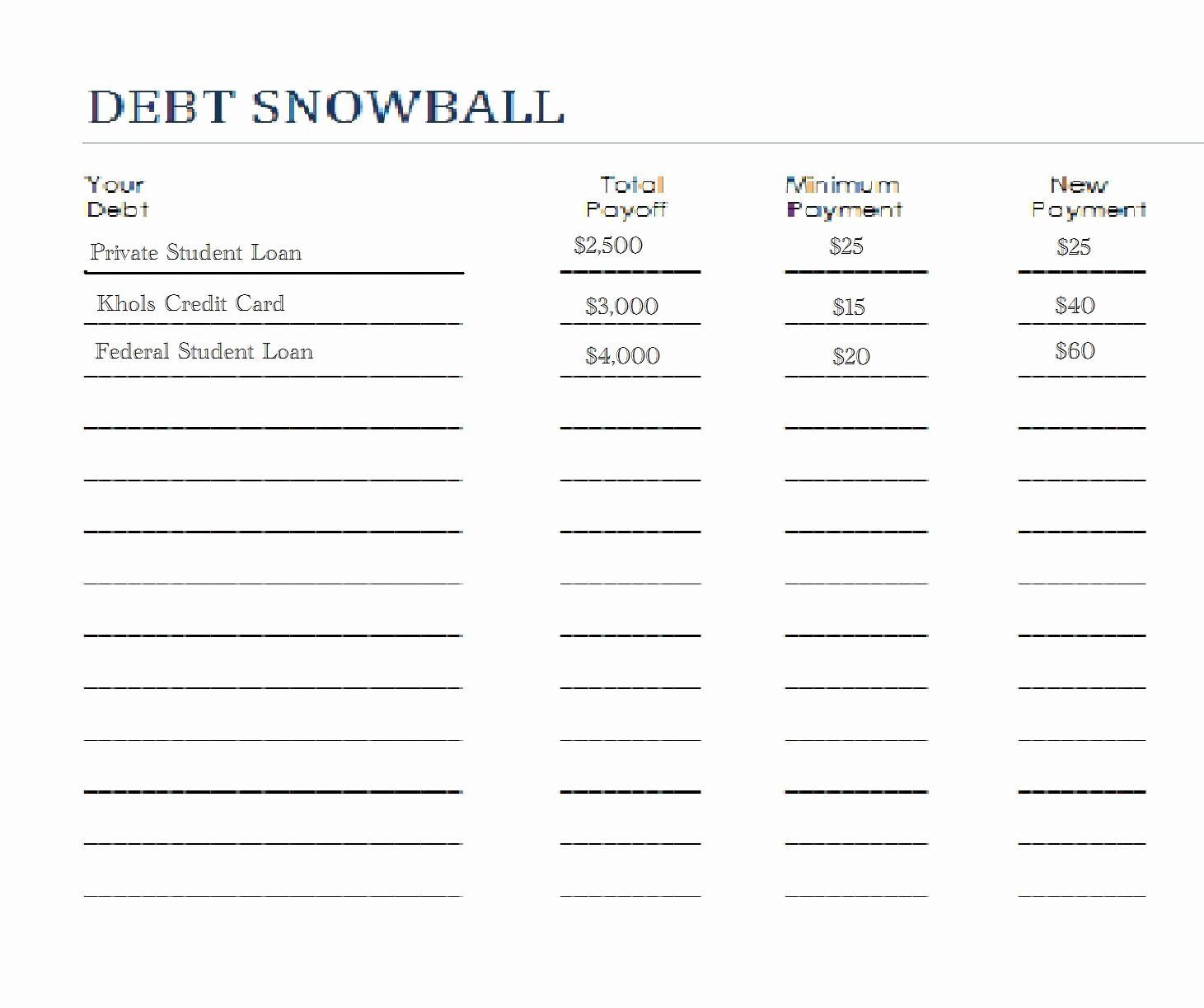

Dave Ramsey Debt Snowball Template - Web if you're following dave ramsey's baby steps or just want to gain a better understanding of the total money makeover, financial peace, and personal finance in general, then this is the community for you! List all of your debts smallest to largest, and use this sheet to mark them off one by one. Admin mod i need an excel spreadsheet for the debt snowball and organizing debt with interest. Make minimum payments on all your debts except the smallest. Web the debt snowball method was originally made popular by personal finance expert dave ramsey. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. 25k views 1 year ago budget. Use our debt reduction calculator to. So you’ve heard about the debt snowball method—you know, where you pay your debts from the smallest to largest balance regardless of interest rate—and now you’re ready to dive right in. How to make (+ free templates) hady elhady feb 15 2023. List your debts from smallest to largest (regardless of interest rate). Pay the minimum payment for all your debts except for the smallest one. How to make (+ free templates) hady elhady feb 15 2023. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Throw as much extra money as. Web the debt snowball was made popular by financial guru dave ramsey, and is his preferred method of paying off consumer debt. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. Web dave ramsey’s debt snowball method has one key exception. Order your debts from lowest balance to highest balance. The ramsey. You begin by listing your debts from smallest to largest in terms of the balance. Web here’s how the debt snowball works: With that one, you throw everything extra at it until it’s paid off. Use our debt reduction calculator to. Pay as much as possible on your smallest debt. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum payments on your other debts). Use the snowball effect to eliminate your credit card debt and other consumer loans | updated 1/11/2023. Repeat until each debt is paid in full. Resources to pay off debt. List your debts from. So, you are not alone when you feel there is a change in the price of fruits, vegetables, meat, and other items on your grocery list. You may have noticed that the smallest debt is paid first, not the highest interest rate. Web 8 min read | jan 12, 2023. The consumer price index rose by 3.1% when comparing january. Pay as much as possible on your smallest debt. The debt snowball method is the best way to get out of debt. The basic idea of the snowball debt spreadsheet is to pay off your smallest debt as quickly as possible. He suggests that paying off debt in this order keeps you motivated to continue your debt payoff journey (and. This is the exact debt snowball form that we used to get out debt in that short period of time. Document your debts and include their balances. How to get out of debt. Web if you're following dave ramsey's baby steps or just want to gain a better understanding of the total money makeover, financial peace, and personal finance in. There are tons of ways to pay off. List your debts from smallest to largest regardless of interest rate. The debt snowball is a method for paying off your consumer debt (not your mortgage). Web here’s how the debt snowball works: Here are the basic steps if the debt snowball method. It helps prioritize debts by focusing on paying off the smallest debt first while making minimum payments on other debts. Repeat until each debt is paid in full. Step 2, in particular, is designed to help you pay off all of your debt. How fast can i get out of debt? Ramsey says that in order to successfully get out. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. There are tons of ways to pay off. Web dave ramsey’s debt snowball method has one key exception. So, you are not alone when you feel there is a change in the price of fruits, vegetables, meat, and other items on your grocery. Web the debt snowball is a methodology to pay off debt developed by david ramsey. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum payments on your other debts). Web dave ramsey’s debt snowball method has one key exception. Repeat until each debt is paid in full. Put any extra dollar amount into your smallest debt until it is paid off. Web 9 months ago updated. Step 2, in particular, is designed to help you pay off all of your debt. There are tons of ways to pay off. You then make minimum payments on all your debts except for the smallest debt. Make minimum payments on all your debts except the smallest. Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web dave ramsey’s and groceries: The debt snowball is baby step 2 of dave ramsey’s 7 baby steps. Here are the basic steps if the debt snowball method. Web debt snowball spreadsheet: The consumer price index rose by 3.1% when comparing january 2024 to january 2023.

Dave Ramsey Debt Snowball Calculator Excel Budget Planner Etsy

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Snowball Sheet

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Calculator Credit

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Calculator Credit

![]()

10 Free Debt Snowball Worksheet Printables to Help You Get Out Of Debt

![]()

Free Debt Snowball Printable Worksheets Simplistically Living

Dave Ramsey Debt Snowball Worksheets —

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy Ireland

Dave Ramsey Debt Snowball Worksheets —

The Basic Idea Of The Snowball Debt Spreadsheet Is To Pay Off Your Smallest Debt As Quickly As Possible.

List Your Debts From Smallest To Largest (Regardless Of Interest Rate).

List Your Debts From Smallest To Largest Regardless Of Interest Rate.

Web 8 Min Read | Jan 12, 2023.

Related Post: