Debt Collection Agency Letter Template

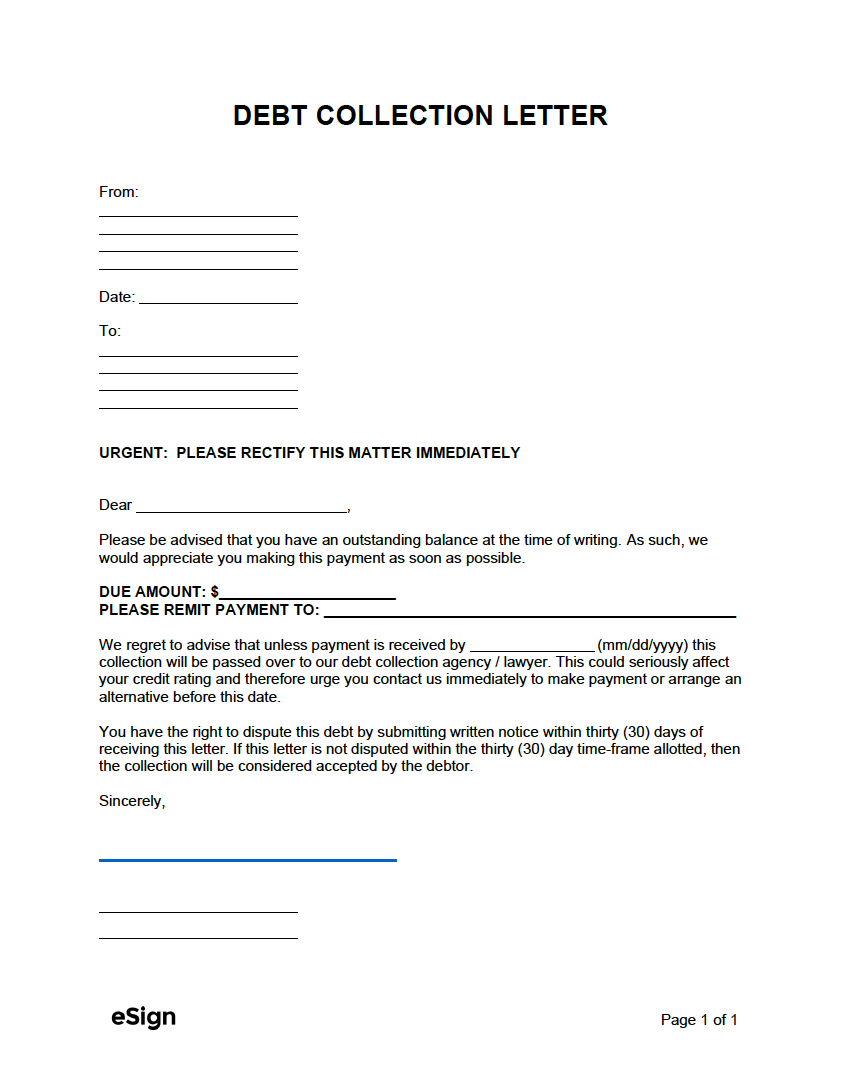

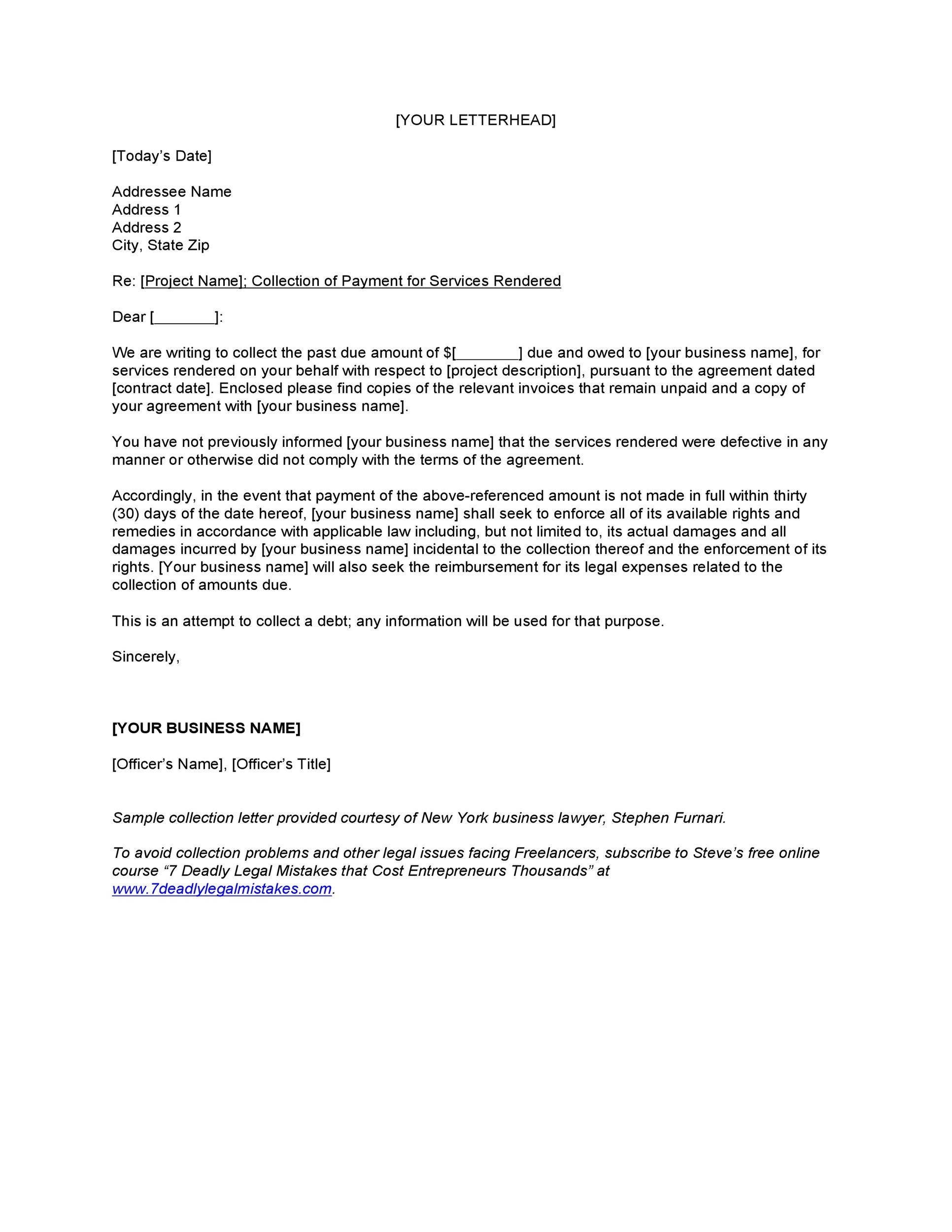

Debt Collection Agency Letter Template - Web here’s a detailed overview of the different types of debt collection letters: It includes details of the missed payment and a payment request. The letter should include the following information: Dear, this is a kind reminder that your account is overdue. When sending a debt collection letter, the sender must receive verifiable. Some people take out loans or borrow money and at times, forget their obligations while there are those who intentionally miss their payments. To gently remind the debtor of a missed payment. Dear john creditor doe, [if this is the first or second debt collection letter. It should also include a detachable form that you can fill out and return to the debt collector to dispute the debt or request information. Include your full name, company name, and mailing address. Include your full name, company name, and mailing address. Under the fair debt collection practices act, i request that you provide me with the following: Use this template if your debt was sold by the original creditor to a collection agency or debt buyer. In a debt collection letter, the subhead contains the details of both your law firm and. When sending a debt collection letter, the sender must receive verifiable. This template will help you stop collection. According to the fair credit reporting act (fcra), credit reporting agencies and creditors must investigate and respond to disputes within 30, and sometimes up to 45, days of receiving your credit report dispute. More than one reminder can be sent to a. Use debt.com’s free letter templates! Dear john creditor doe, [if this is the first or second debt collection letter. Specify and provide proof of the debt in question. Government agency that makes sure banks, lenders, and other financial companies treat you fairly. This template will help you stop collection. The amount of the alleged debt; Web what to include. In a debt collection letter, the subhead contains the details of both your law firm and your client. Web collection letter sample 1: Web let's look at a debt settlement example. If you have an old credit card balance of $5k with jp morgan and decide to sell it to a debt collector, the collection agency may pay only $250 to $500 for your balance. Web want to make a settlement offer or send a cease & desist to your collection agency. The letter should include the following information: The amount. The offer includes a request to pay for delete. Use this template if your debt was sold by the original creditor to a collection agency or debt buyer. You should do this within 30 days of the time. Your office address, zip code, and contact number. Reference invoice numbers, contract agreements, etc. The client’s full name and address. If you have an old credit card balance of $5k with jp morgan and decide to sell it to a debt collector, the collection agency may pay only $250 to $500 for your balance. The amount of the debt ($); It should also include a detachable form that you can fill out and return. Some people take out loans or borrow money and at times, forget their obligations while there are those who intentionally miss their payments. We're the consumer financial protection bureau (cfpb), a u.s. Mortgage loans make up the majority of debt, followed by student loans, then auto loans, and finally credit card debt. The offer includes a request to pay for. Debt collector’s mailing address and contact information. When sending a debt collection letter, the sender must receive verifiable. The amount of the alleged debt; The letter may include information on the consequences of failing to. The amount of the debt ($); The letter can serve as a general reminder or can be used to inform the recipient that legal action will be taken against them soon. When sending a debt collection letter, the sender must receive verifiable. Web debt settlement offer letter for a collector. To gently remind the debtor of a missed payment. Specify and provide proof of the debt. You should do this within 30 days of the time. Corresponding with creditors, debt collectors, and the credit bureaus can be stressful. This template will help you stop collection. This information should be offered in each of the letters that you submit, including the final collection letter that is sent out before the debt is transferred to an agency. The amount of the debt ($); Under federal law, you have a right to get information about any debt you supposedly owe. Download our sample letter templates call now: Include your full name, company name, and mailing address. If you have an old credit card balance of $5k with jp morgan and decide to sell it to a debt collector, the collection agency may pay only $250 to $500 for your balance. Your office address, zip code, and contact number. A new due date or immediately upon receipt of the letter. Use this template if your debt was sold by the original creditor to a collection agency or debt buyer. Reference invoice numbers, contract agreements, etc. Under the fair debt collection practices act, i request that you provide me with the following: Web a debt collection letter is a written communication sent by a debt collection agency or creditor to an individual or business that owes money. Web the debt collection letter must comply with fair debt collection practices in your state and federally.

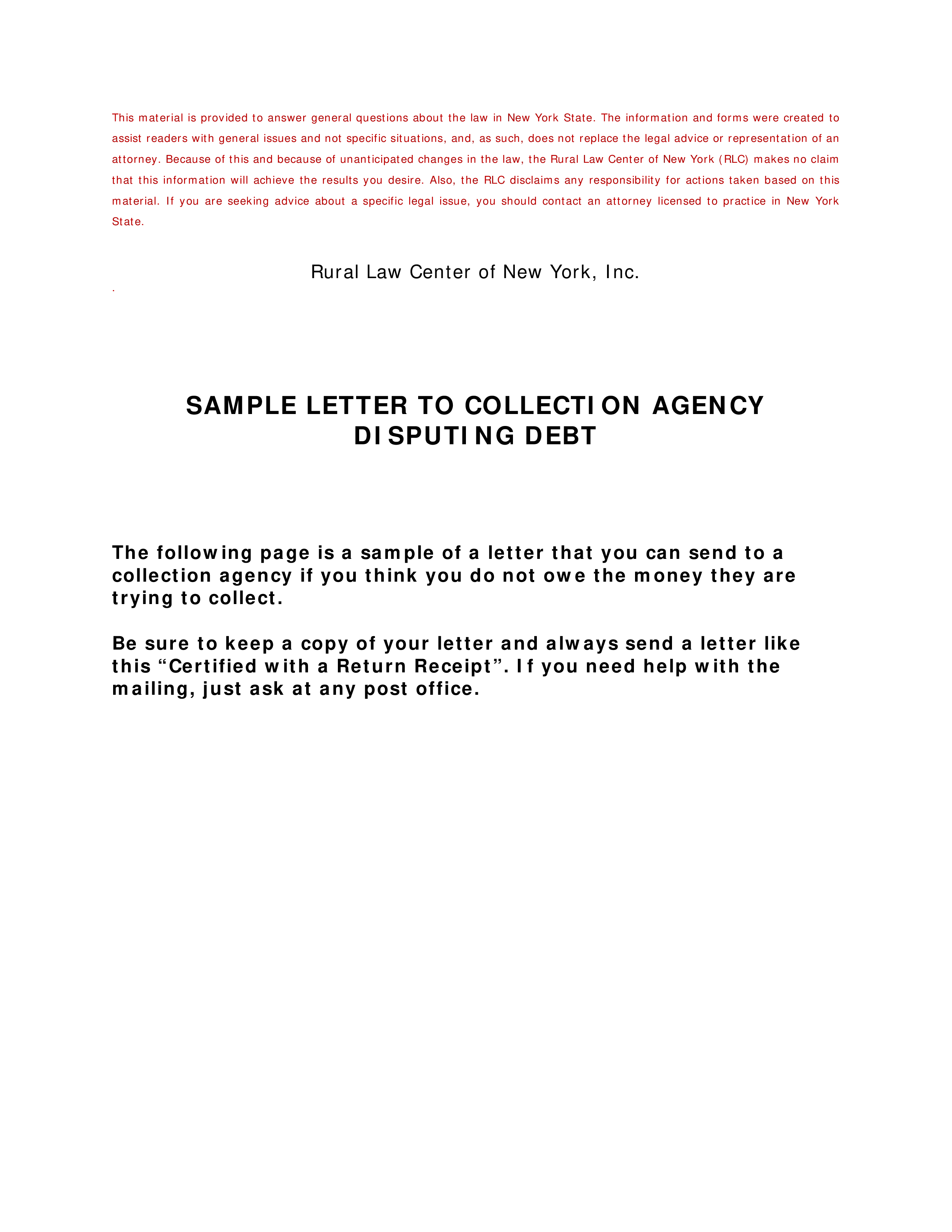

Debt Agency Letter Templates at

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

Free Debt Collection Letter Template PDF Word

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

44 Effective Collection Letter Templates & Samples ᐅ TemplateLab

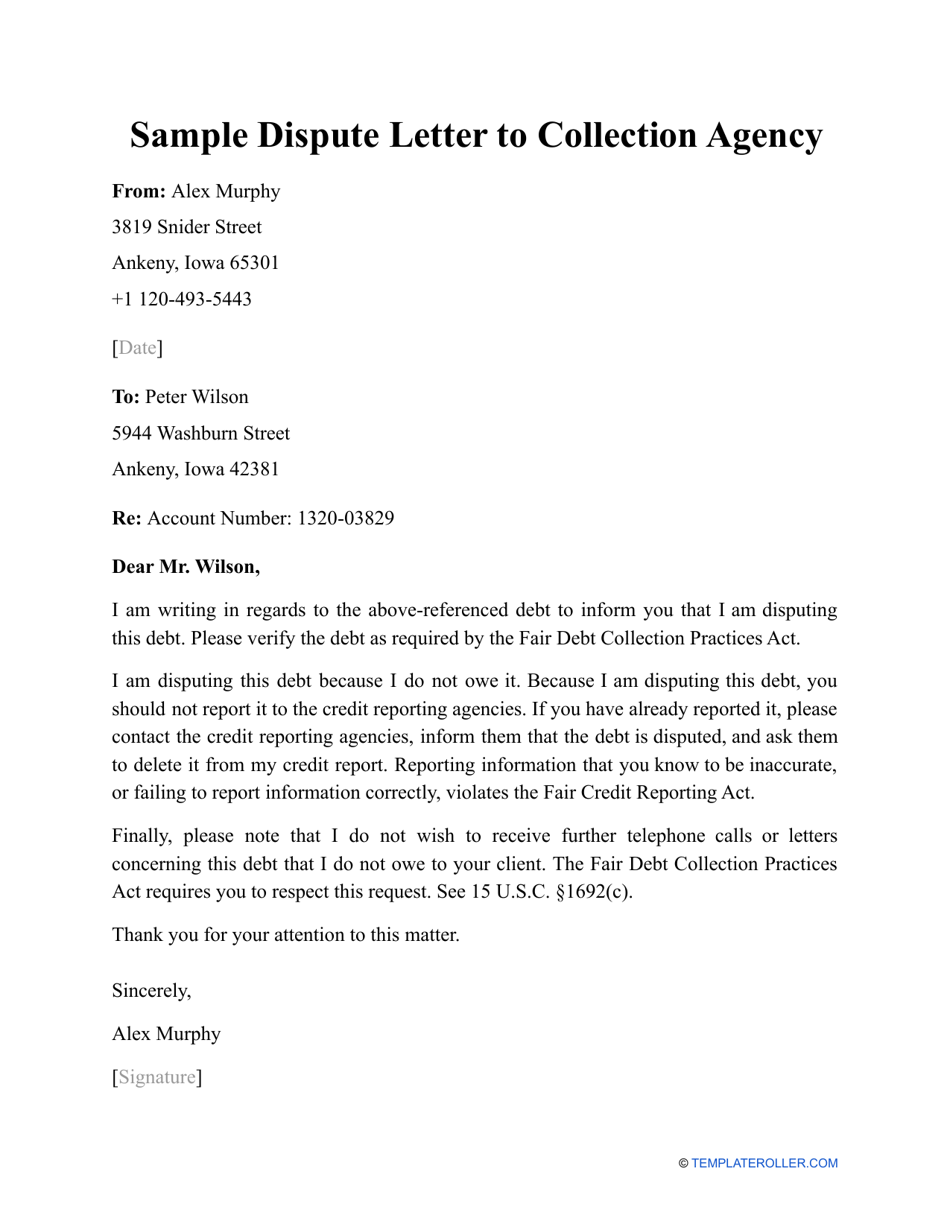

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

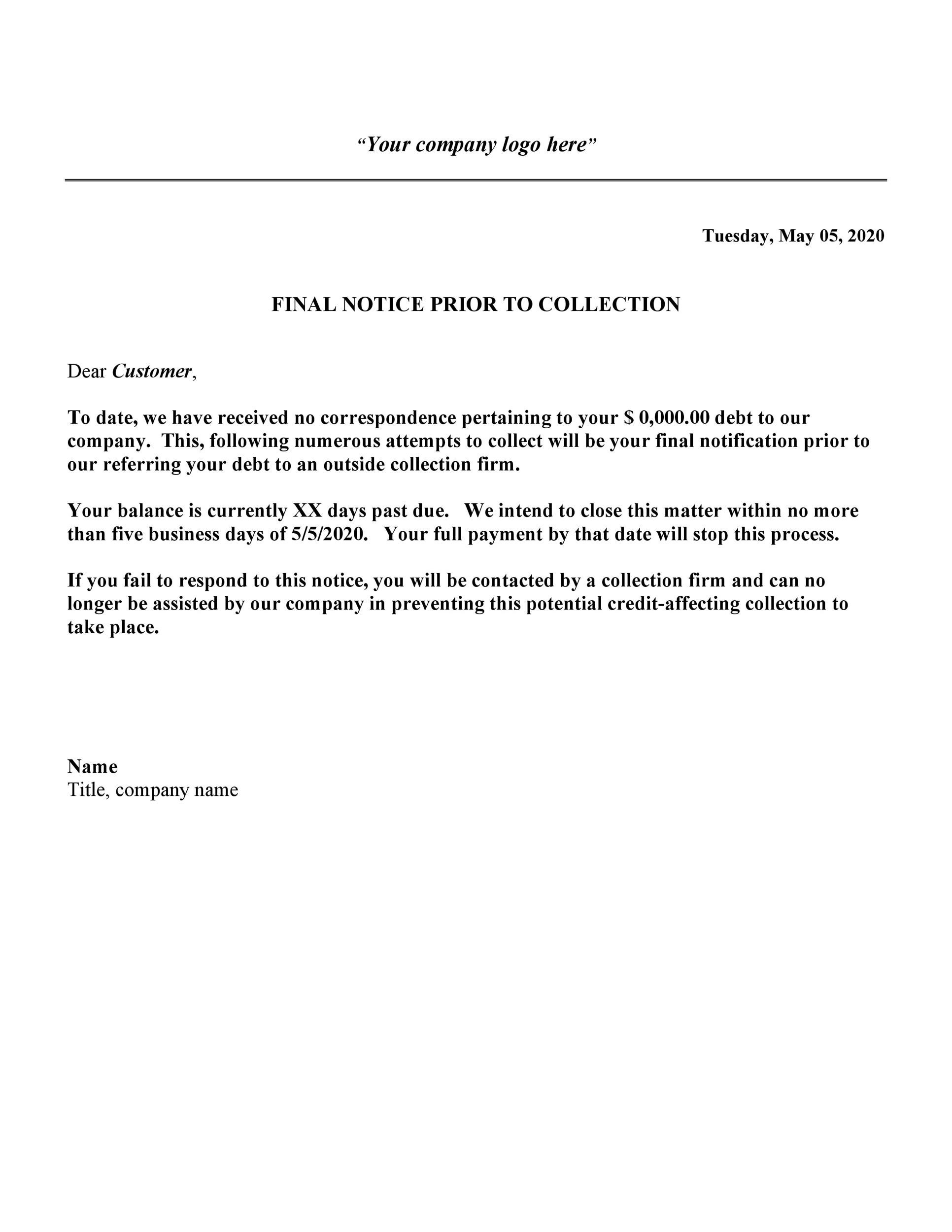

Sample Debt Collection Letter Templates (for Debtors)

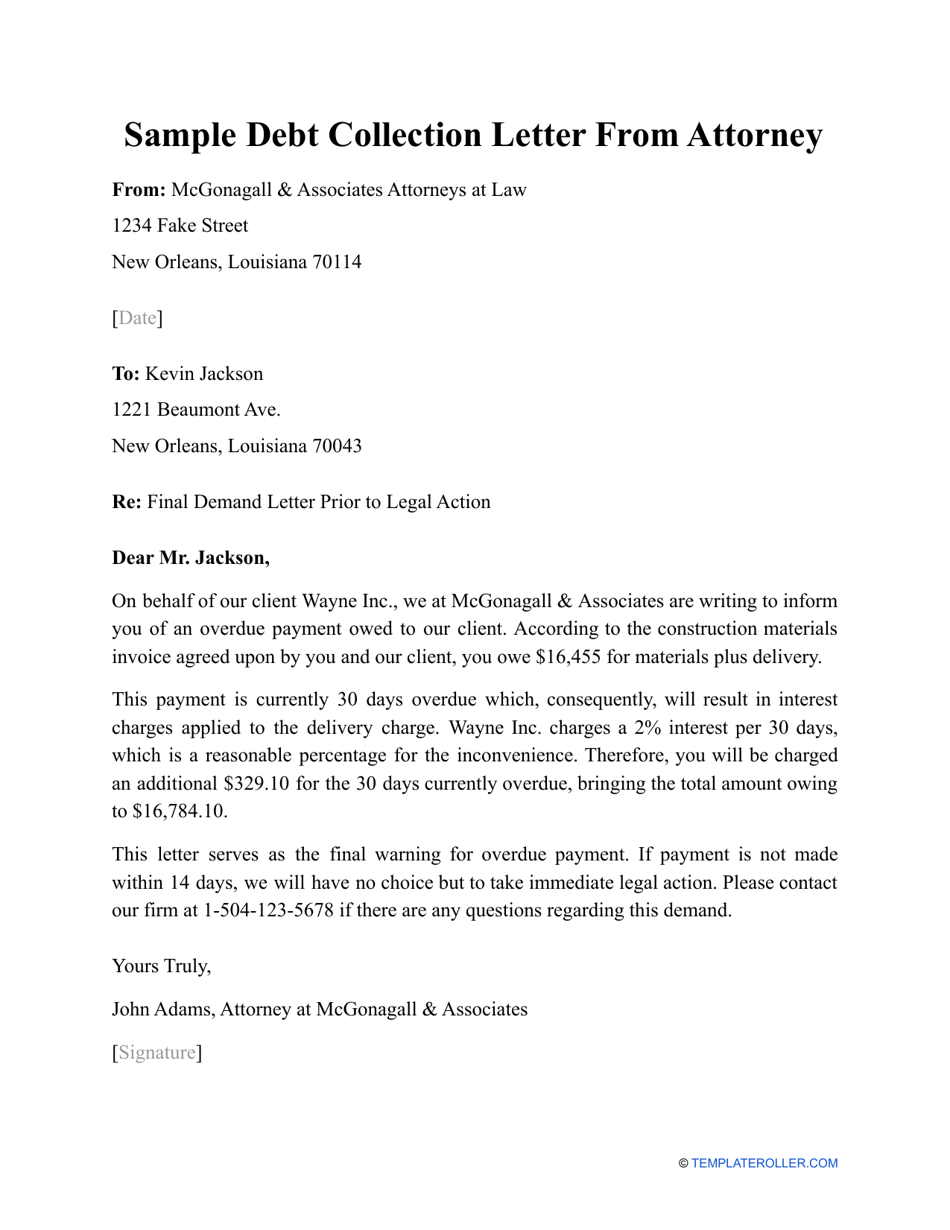

Sample Debt Collection Letter From Attorney Fill Out, Sign Online and

Free Debt Collection Letter Templates

Free Debt Collections Letter Template Sample PDF Word eForms

According To The Fair Credit Reporting Act (Fcra), Credit Reporting Agencies And Creditors Must Investigate And Respond To Disputes Within 30, And Sometimes Up To 45, Days Of Receiving Your Credit Report Dispute.

As A Debt Collector Or The Official Representative Of A Debt Collection Agency, You Would Create A Collection Letter Template And Send It When Asking For.

Web A 609 Dispute Letter, Also Known As A Credit Dispute Letter, Is A Written Request To Credit Bureaus To Remove Incorrect, Negative Information From Your Credit Report.

In A Debt Collection Letter, The Subhead Contains The Details Of Both Your Law Firm And Your Client.

Related Post: