Debt Collection Dispute Letter Template

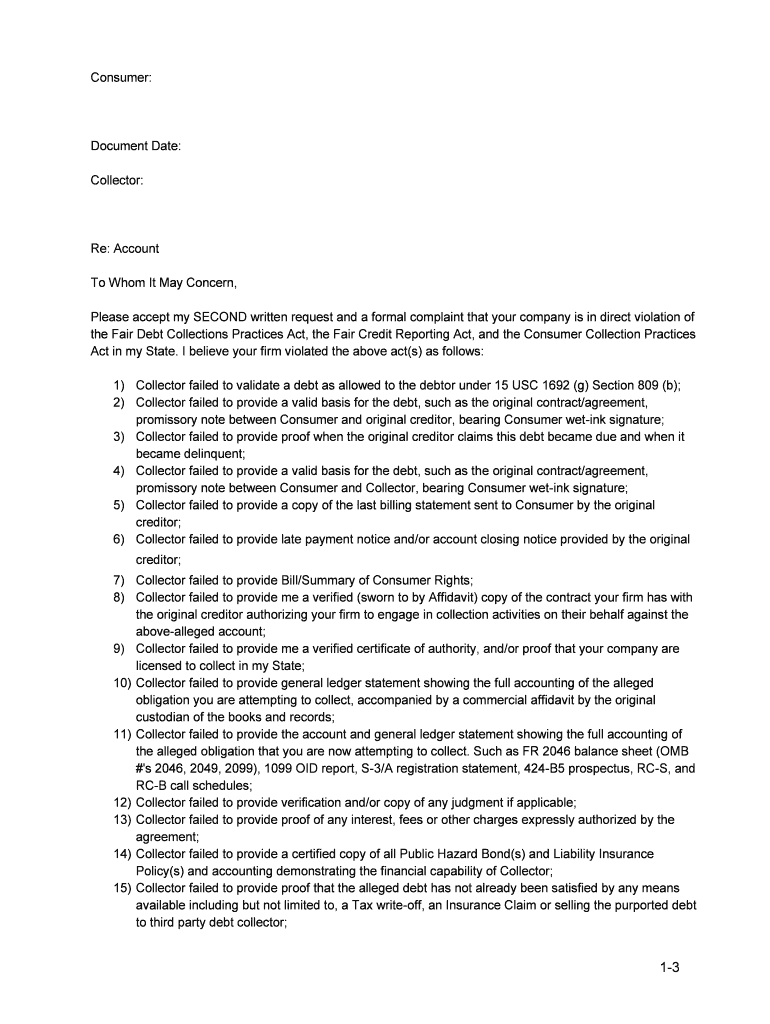

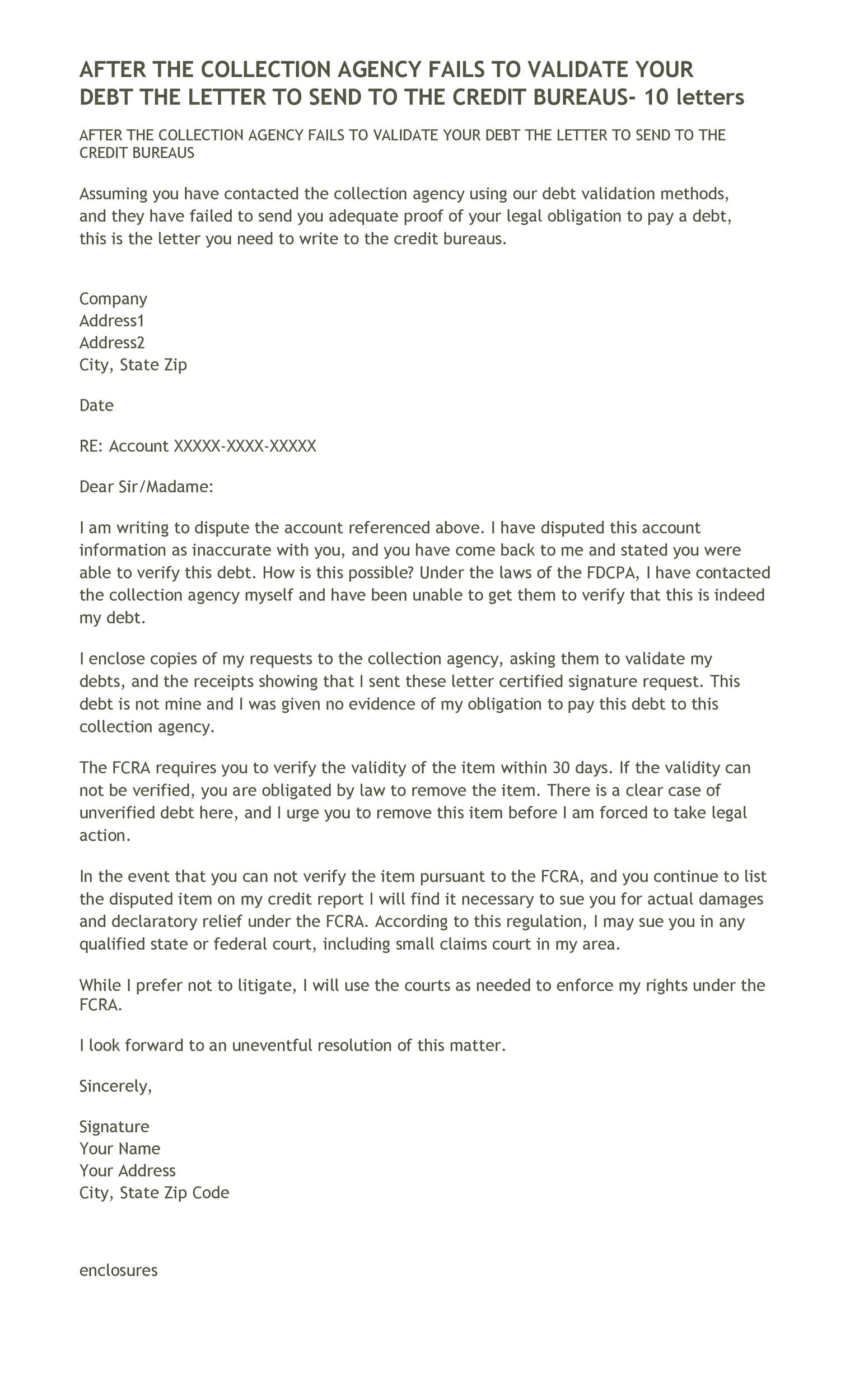

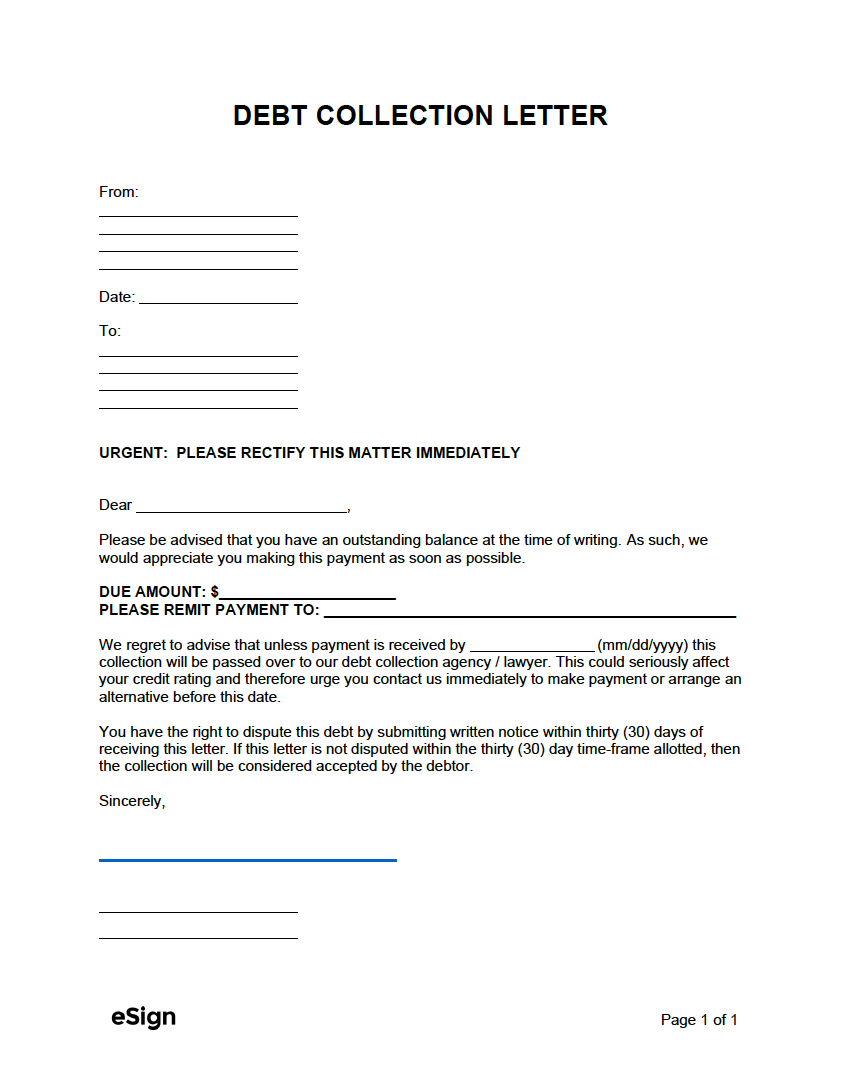

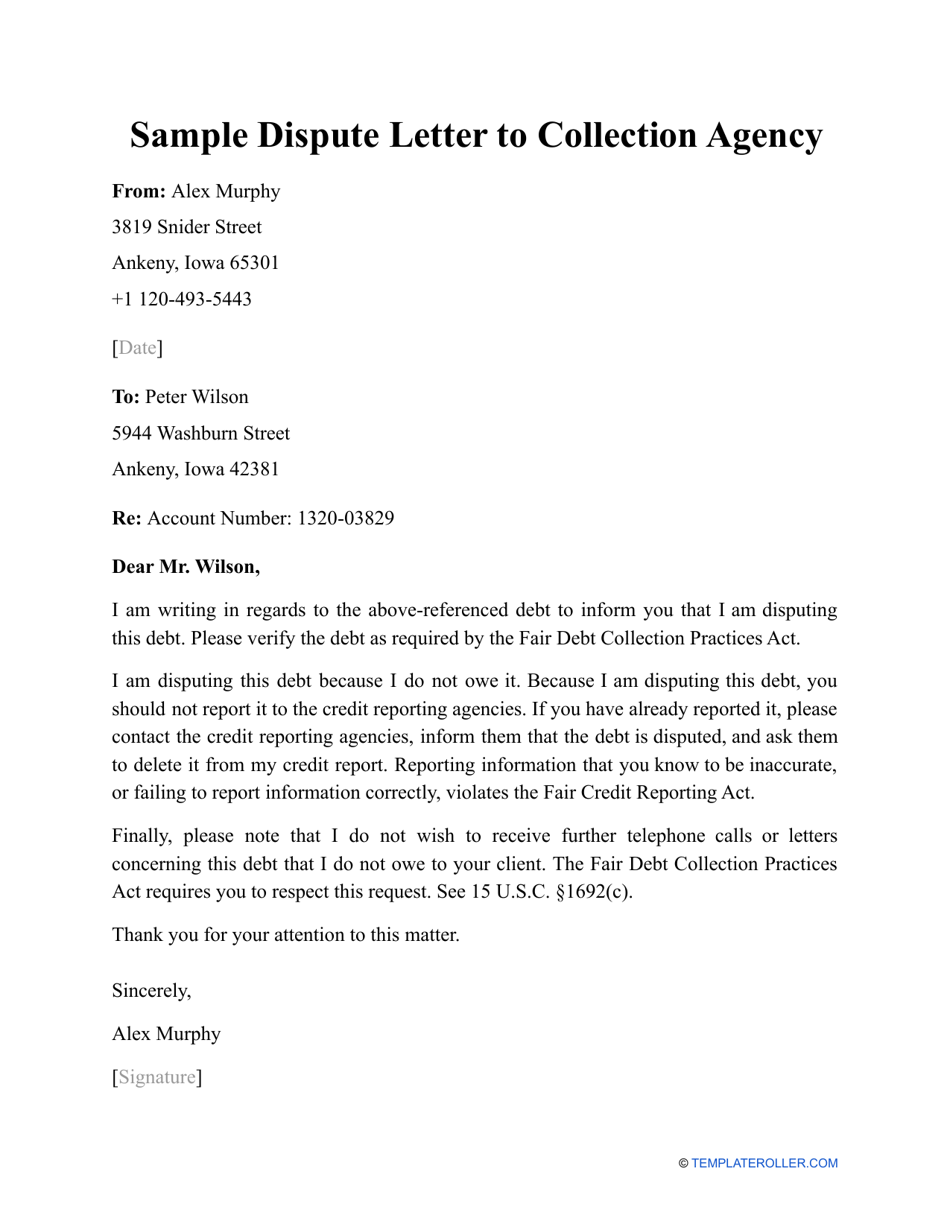

Debt Collection Dispute Letter Template - The date on which the debt fell into arrears and the date of last payment made, including a copy of the last billing statement from the original creditor. Web what to include. According to the consumer financial protection bureau, a credit dispute letter should have four main parts. Provide personal and account details. Add any evidence applicable supporting the dispute. Web sample letters to dispute information on a credit report. The creditor to whom money is owing and for whom the debt collector works; Finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i dispute the debt. Web ðï ࡱ á> þÿ f h. Check your credit report thoroughly. Detailed documentation or proof of the debt, including the original creditor’s name and the amount you claim i owe. Name of the debt collector and contact information; Web use this letter to dispute a debt and to tell a collector to stop contacting you. Check your credit report thoroughly. Ensure the debt collector has validated the debt. The creditor to whom money is owing and for whom the debt collector works; The letter must be sent within 30 days of receiving notice of the attempt to collect. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collection activities until it verifies the. Web debt collection dispute letter. If the collection hasn’t been paid, continue paying on time. Determine the nature of the debt and debtor information. Finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i dispute the debt. This document. If the collection hasn’t been paid, continue paying on time. Finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware of my dispute with this debt. Sample letter to collection agency disputing debt the following page is a sample of a. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original. Your name and account number. Remember, you must send the letter within 60 calendar days of the date that the first statement on which the disputed charge appears was sent to you. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the. You should do this within 30 days of the time. Web use this letter to dispute a debt and to tell a collector to stop contacting you. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as. If the collection hasn’t been paid, continue paying on time. Prepare an initial draft for the dispute debt collection letter. Signature here your printed name How to write a credit report dispute letter. Web the letter is a written notice to the card company about the problem. Download our sample letter and instructions to submit a dispute. A debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Don’t just accept the conversation quickly deteriorating into verbal harassment. Web that if you dispute the debt in writing within 30 days the debt collector will provide verification of the debt; The creditor to whom money is owing and for whom the debt collector works; This document is intended to be used by the debtor (the business or individual owing money) who will send the letter to the collection agency. If you don’t find any errors, ask the debt collector to verify it. Finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware of my dispute with this debt. Make sure your letter includes. A debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. Check your credit report thoroughly. Web to whom it may concern, please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Research the fair debt collection practices act (fdcpa) document all communications regarding the debt. Web here are the four basic steps to dispute a debt you don’t owe: As such, collection agencies are required to provide the following information: Web updated september 22, 2023. Provide personal and account details. I also request verification, validation, and the name and address of the original creditor pursuant to 15. Web updated september 22, 2023. The letter must be sent within 30 days of receiving notice of the attempt to collect. Web use this letter to dispute a debt and to tell a collector to stop contacting you. Oval, suite 101, plattsburgh, new york 12903.

Sample Letters To Debt Collectors

Debt Dispute Letter Debt With Dispute Letter To Creditor Template

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-01.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Printable Debt Recovery Letter Template Sample Collection letter

Debt Collector Dispute Letter Fill and Sign Printable Template Online

Debt Validation Letter Template

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-04.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Sample Letters To Debt Collectors

Debt validation letter Sample letter to dispute your debt Doc

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

Web In This Letter, You Ask The Data Furnisher To Prove That The Debt Belongs To You.

Finally, If You Do Not Own This Debt, I Demand That You Immediately Send A Copy Of This Dispute Letter To The Original Creditor So They Are Also Aware That I Dispute The Debt.

If The Collection Hasn’t Been Paid, Continue Paying On Time.

Web Send A Debt Dispute Letter.

Related Post: