Debt Payoff Plan Template

Debt Payoff Plan Template - The set includes a debt overview sheet, a debt payoff tracking sheet, and a debt thermometer to give you a visual of your progress as you. Use a variety of payoff prioritization methods to build your debt payoff plan including: Make a plan to get out of debt and estimate how much you can save. Otherwise, your credit will suffer. Web 10 free debt snowball worksheet printables money minded mom’s debt payoff worksheets. To start, no matter which strategy you choose, you’ll want to make the minimum payments on all your debts. Use snowball, avalanche, or whatever payoff strategy works best for you. Web combining the debt payoff planner with the budgeting tools in the tiller foundation template will give you a master plan for transforming your financial life. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. Here’s how the debt snowball works: In the first worksheet, you enter your creditor information and your total monthly payment. $1,000 ($50 minimum payment) 2nd debt: The debt payoff calculator template offers the three most popular methods: Web for a student with the average debt of $26,494 that means an indexation credit of about $1,200 for the last two years if legislation reforming hecs is passed. Use snowball, avalanche, or whatever payoff strategy works best for you. Web you can borrow up to half or $50,000 — whichever is less — from your 401(k) to pay off debt. When it comes to figuring out the best tactic, two popular debt repayment methods are the: With any debt payoff plan, you should commit to funneling extra money. Web use the debt payoff calculator for google sheets to plan the best debt payment strategy for the fastest payoff based on your current financial situation. Make a plan to get out of debt and estimate how much you can save. The second credit card is $9,000 at 9% interest. Web on september 27, 2023. Use snowball, avalanche, or whatever. Make a plan to get out of debt and estimate how much you can save. Biden’s new plan would eliminate up to $20,000 in interest for all borrowers who have experienced interest accrual or. Use a variety of payoff prioritization methods to build your debt payoff plan including: The new program, designed as a second attempt to enact mass. Web. In the first worksheet, you enter your creditor information and your total monthly payment. Include all your debts in the “debt name” column. Use a variety of payoff prioritization methods to build your debt payoff plan including: Web 10 free debt snowball worksheet printables money minded mom’s debt payoff worksheets. List your debts from smallest to largest regardless of interest. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. Web repeat this step for the other debts, but don’t include the extra payment yet. The set includes a debt overview sheet,. Otherwise, your credit will suffer. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. $1,000 ($50 minimum payment) 2nd debt: Use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. The. The new program, designed as a second attempt to enact mass. Web under the new plan, households earning more than $312,000 annually and with more than 20 years in repayment will have their debt relieved on average by $25,541.39. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly:. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take control of your finances. $1,000 ($50 minimum payment) 2nd debt: The new program, designed as a second attempt to enact mass. $3,000 ($70 minimum payment) 4th debt: With any debt payoff plan, you should commit to funneling extra money toward your debt. There are a couple of ways you can do this. All you have to do is enter: Web now to see it in action, assume the following is your debt snowball strategy. How to use this template step 1: Web repeat this step for the other debts, but don’t include the extra payment yet. The first step in creating a plan to pay off debt is to calculate what debt you have, what you owe, and how much you owe. Web the author of the spreadsheet and the squawkfox blog, kerry taylor, paid off $17,000 in student loans over six months using this downloadable debt reduction spreadsheet. Download free credit card payoff and debt reduction calculators for excel. Commit to living within your means and avoid taking on new debt while you work towards paying off existing debts. The new program, designed as a second attempt to enact mass. $3,000 ($70 minimum payment) 4th debt: Biden’s new plan would eliminate up to $20,000 in interest for all borrowers who have experienced interest accrual or. Pay as much as possible on your smallest debt. Record the creditor and the minimum payment at the top of the worksheet. Web repeat this step for the other debts, but don’t include the extra payment yet. This printable worksheet can be used to track individual debts you are trying to pay off. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. The two most common methods to pay off debt are “debt snowball” and “debt stacking,” which we like to call “debt wrecking ball.”. Web use the debt payoff calculator for google sheets to plan the best debt payment strategy for the fastest payoff based on your current financial situation. Include all your debts in the “debt name” column. The minimum payment represents the amount of cash flow you will free up by completely paying off the debt.

Debt Tracker Printable, Debt Payoff Log, Debt Tracker Sheets Etsy

Free Printable Debt Repayment Plan

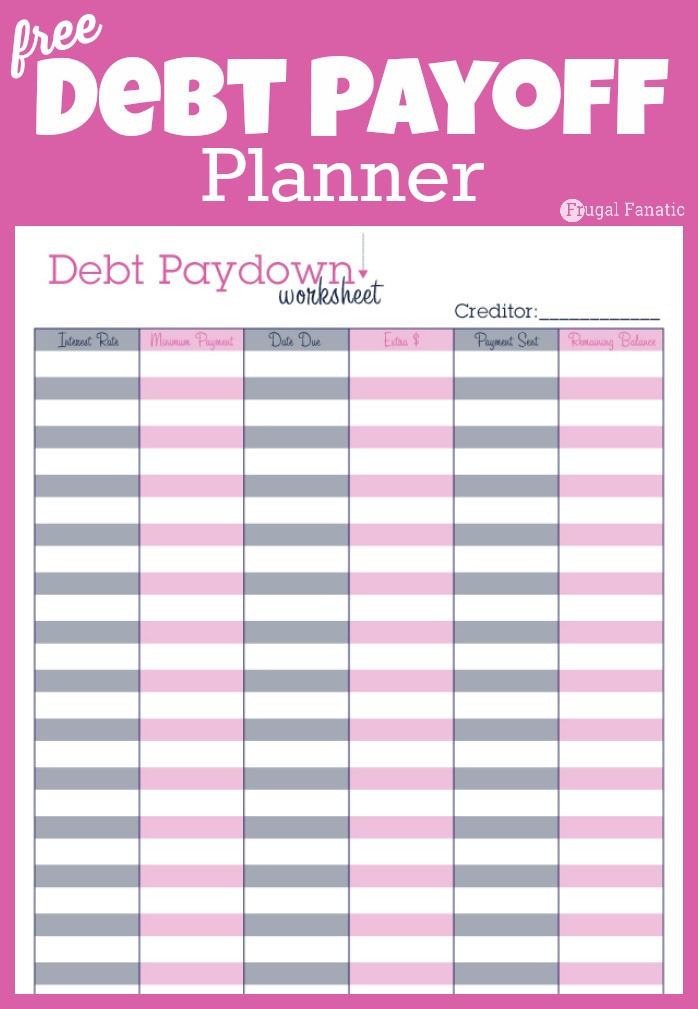

Debt Payoff Planner Free Printable

FREE 11+ Sample Debt Payoff Calculator Templates in PDF

Debt Repayment Printables Simply Stacie

![]()

Debt Payoff Tracker Free Printable Digital Template

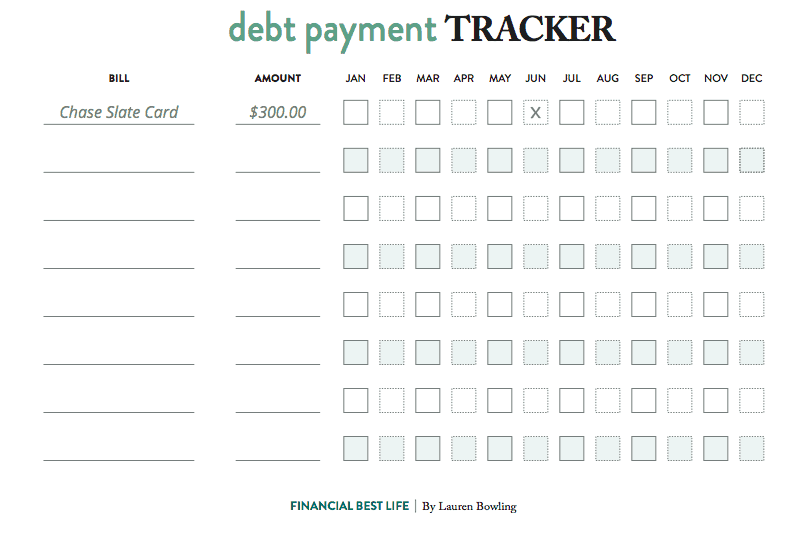

(Free Template!) How to Use a Debt Tracker to Visualize Debt Payoff

![]()

Free Printable Debt Payoff Worksheet —

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

Web Create A Plan Of Attack.

Use Snowball, Avalanche, Or Whatever Payoff Strategy Works Best For You.

$4,000 ($75 Minimum Payment) For Example, Let's Say You Have $1,000 To Pay Towards.

$1,000 ($50 Minimum Payment) 2Nd Debt:

Related Post: