Debt Repayment Plan Template

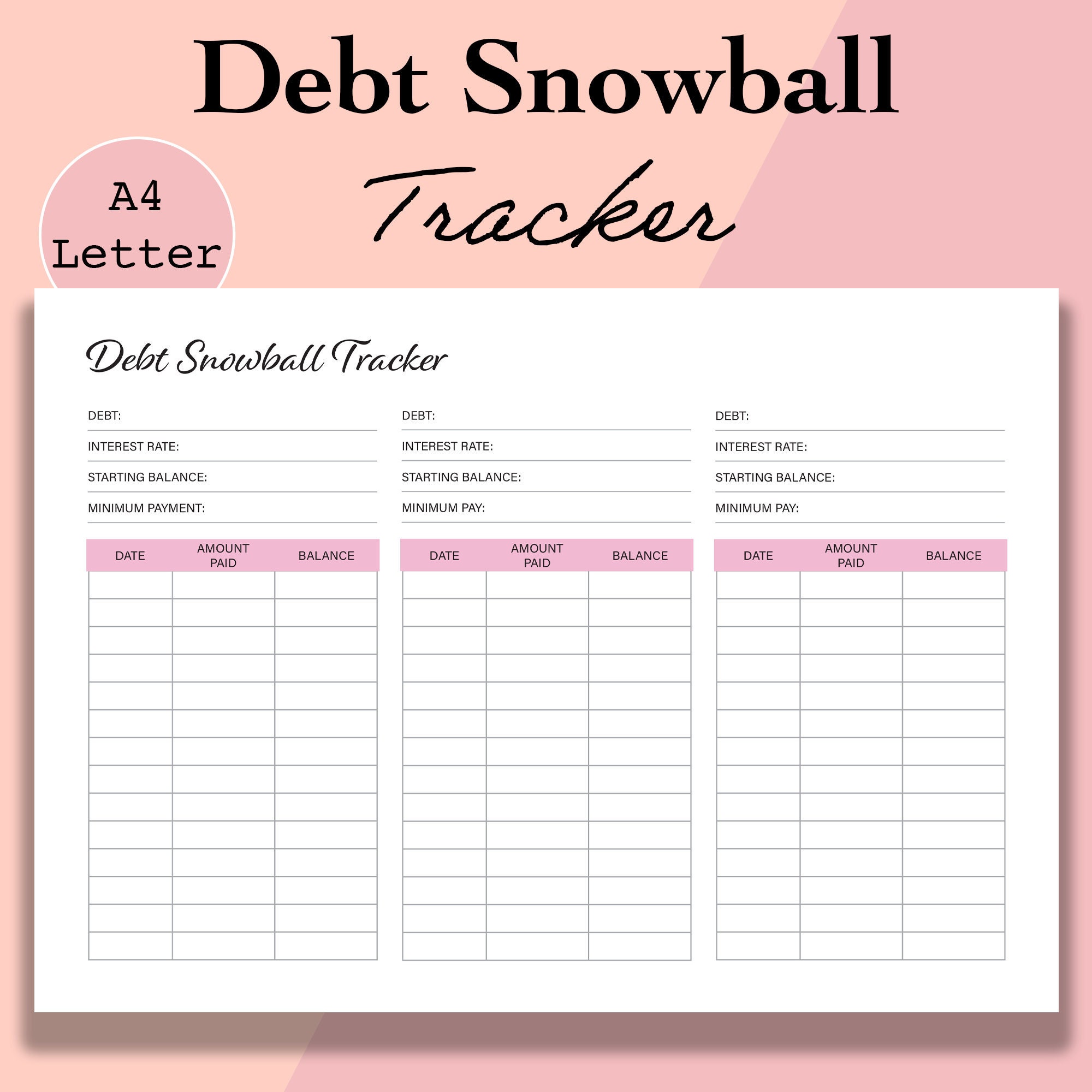

Debt Repayment Plan Template - Paying off your debt means you may have to put off big purchases for a period of time. Web acultivated nest’s debt snowball worksheet. Then simply fill in your new balance each month you make payments and watch your debt dwindle. In the first worksheet, you enter your creditor information and your total monthly payment. By having a structured plan, it is easier to keep up with payments, reduce interest, and ultimately get out of debt. Make a list of debts. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. This debt snowball worksheet created by acultivated nest is another easy to use tracking sheet. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. Stop taking on more debt. Then simply fill in your new balance each month you make payments and watch your debt dwindle. Include all your debts in the “debt name” column. Paying off your debt means you may have to put off big purchases for a period of time. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Web developing a debt payment schedule template can help you manage your debt repayment. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. Paying off your debt means you may have to. This debt snowball worksheet created by acultivated nest is another easy to use tracking sheet. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. Stop taking on more debt. Make a list of debts. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Web repeat this step for the other debts, but don’t include the extra payment yet. Paying off your debt means you may have to put off big purchases for a period of time. Then simply fill in your new balance each month you make payments and watch your debt dwindle. Use our debt snowball calculator to help you eliminate your. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Include all your debts in the “debt name” column. Web sticking with a budget that works will give you the highest chances of success. Stop taking on more debt. In the first worksheet, you enter your creditor information and your. Once you’ve chosen the debt payoff strategy that works best for you, it’s time to list your debts. Here are some steps to create a payment plan template. You list all your debts, the balance on each debt and your debt snowball payments first. Web sticking with a budget that works will give you the highest chances of success. Web. You list all your debts, the balance on each debt and your debt snowball payments first. Web acultivated nest’s debt snowball worksheet. Then simply fill in your new balance each month you make payments and watch your debt dwindle. Here are some steps to create a payment plan template. Include all your debts in the “debt name” column. This debt snowball worksheet created by acultivated nest is another easy to use tracking sheet. Make a list of debts. Web repeat this step for the other debts, but don’t include the extra payment yet. You can do this on the debt dashboard, which is the first page of your new debt payoff planner. Easily create a debt reduction schedule. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. This debt snowball worksheet created by acultivated nest is another easy to use tracking sheet. Web developing a debt payment schedule template can help you manage your debt repayment. You can do this on the debt dashboard, which is the first page of. Then simply fill in your new balance each month you make payments and watch your debt dwindle. Include all your debts in the “debt name” column. Make a list of debts. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. You can do this on the debt dashboard, which. Web repeat this step for the other debts, but don’t include the extra payment yet. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Make a list of debts. You list all your debts, the balance on each debt and your debt snowball payments first. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. This debt snowball worksheet created by acultivated nest is another easy to use tracking sheet. In the first worksheet, you enter your creditor information and your total monthly payment. Stop taking on more debt. Once you’ve chosen the debt payoff strategy that works best for you, it’s time to list your debts. Then simply fill in your new balance each month you make payments and watch your debt dwindle. You can do this on the debt dashboard, which is the first page of your new debt payoff planner. Web sticking with a budget that works will give you the highest chances of success. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Include all your debts in the “debt name” column. Web developing a debt payment schedule template can help you manage your debt repayment. Web acultivated nest’s debt snowball worksheet.

Free Printable Debt Repayment Plan

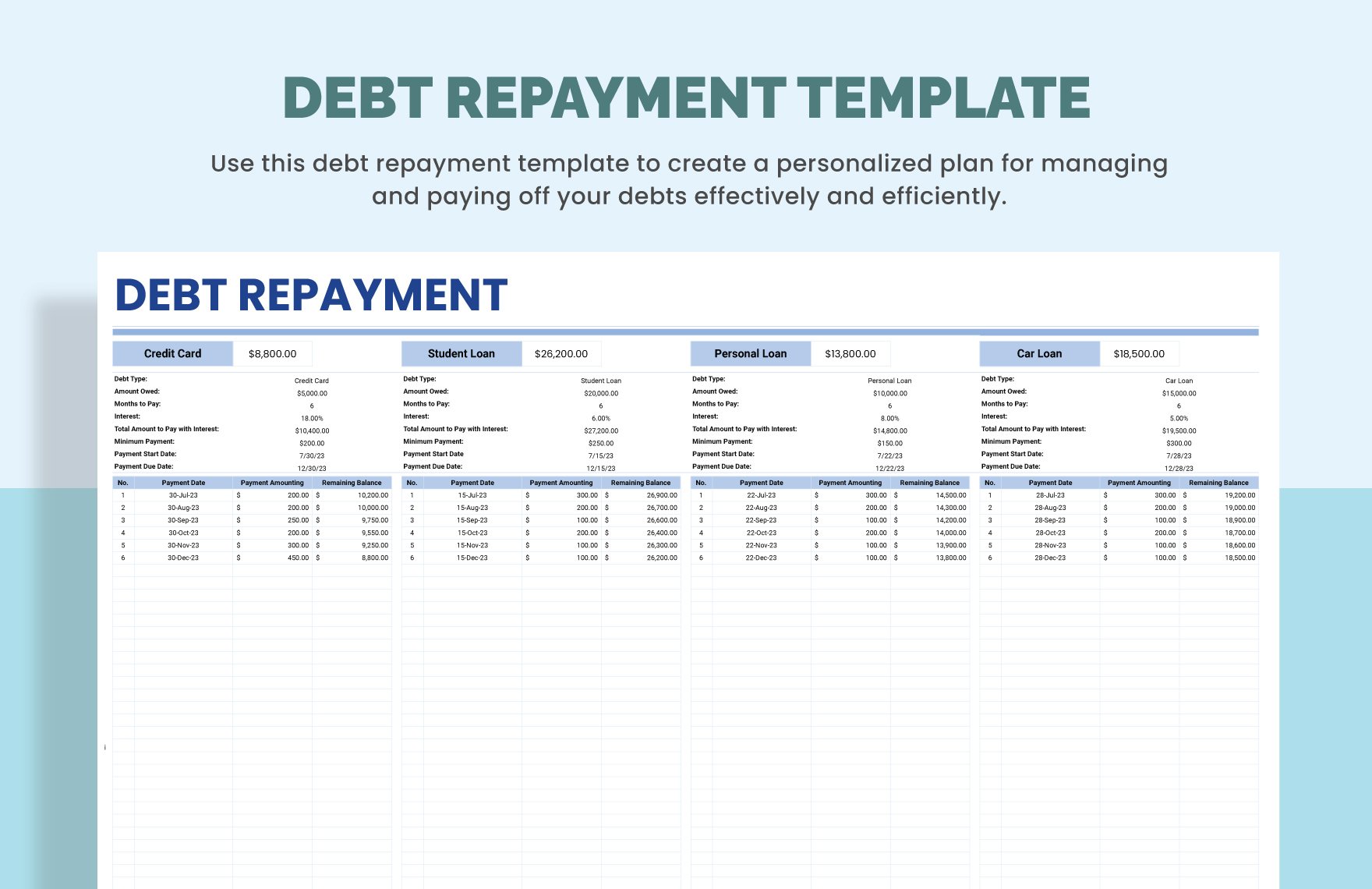

Debt Repayment Template in Excel, Google Sheets Download

Debt Repayment Printables Get organized and focused on improving your

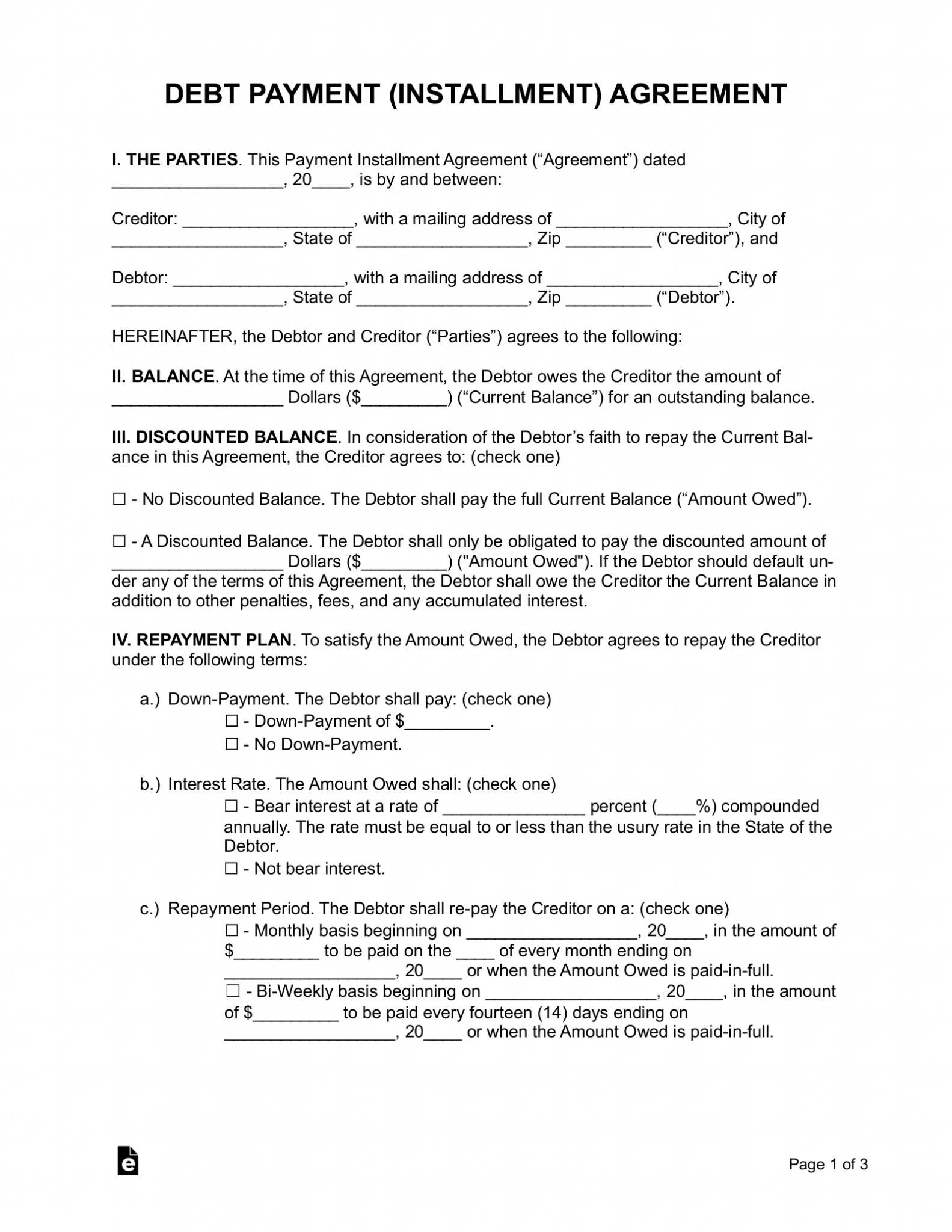

Free Debt Payment Plan Agreement PDF Word eForms

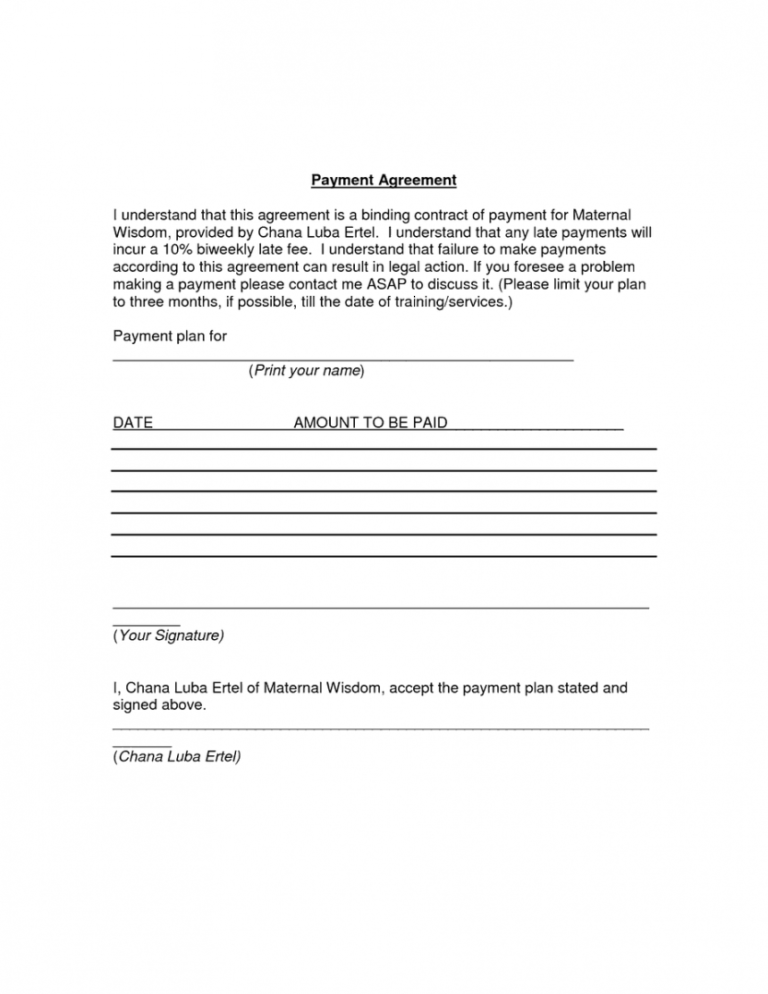

Editable Debt Repayment Contract Template Word Steemfriends

Free Debt Settlement Agreement Template Sample PDF Word eForms

Debt Repayment Printables Simply Stacie

Debt Payoff Planner Free Printables

Debt Repayment Printables Simply Stacie

FREE PRINTABLE! Use this Debt Repayment printable to pay down your debt

Here Are Some Steps To Create A Payment Plan Template.

By Having A Structured Plan, It Is Easier To Keep Up With Payments, Reduce Interest, And Ultimately Get Out Of Debt.

Paying Off Your Debt Means You May Have To Put Off Big Purchases For A Period Of Time.

In This Article, We’ll Share 8 Free Google Sheets Debt Payoff Templates For 2023 To Help You Take Control Of Your Finances.

Related Post: