Debt Tracker Template

Debt Tracker Template - Web the debttracker includes seven worksheets, including a paydown worksheet with a graph for tracking the results of paying off a debt over time. Web create your free budget. The first step is to list all your debt in ascending order by the balance due, as the snowball method focuses on the smallest debt first. Check out a collection of the most popular debt payoff trackers that will help you pay off your debts more quickly and efficiently. With the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: Current balances on all credit cards and loans ; Web how do you figure out which one to focus on paying off first? When working on paying off debt, you can use all the help you can get. Then, take what you were paying on that debt and add it to the payment of your next smallest debt. Get 15 items for the price of 3. Web planner by amit debnath. Simple debt worksheets to make tracking your debt repayment progress a breeze. Get 15 items for the price of 3. The benefits of using a debt repayment tracker. Black and white minimalist debt repayment tracker planner. Web gathering info about your debt — including the different accounts, their balances and interest rates — can help you figure out how to manage it and keep you on track. In order not to get bogged down in an avalanche of debt, you should manage your money wisely and make the necessary payments on time to the appropriate accounts.. Minimalist savings tracker planner worksheet. Projected debt payoff date (based on your inputs) All pages are 100% free. I usually don’t count the mortgage, but you certainly can. Although it may seem like a little thing, you can get a very real motivational boost from tracking your debt payoff goal using worksheets and charts. $2,000 ($65 minimum payment) 3rd debt: $1,000 ($50 minimum payment) 2nd debt: Knock out the smallest debt first. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Budget planner templates bundle (90 in 1) save. Web gathering info about your debt — including the different accounts, their balances and interest rates — can help you figure out how to manage it and keep you on track. Web free printable debt payoff planner template. Planner by rizelle anne galvez. Web planner by amit debnath. Web how do you figure out which one to focus on paying. Then, take what you were paying on that debt and add it to the payment of your next smallest debt. Web get your financial life on track with the debt payoff template on google sheets designed by spreadsheet class. Keep track of how much you owe and record the amount of money you're paying back with these handy sheets that. $2,000 ($65 minimum payment) 3rd debt: Simple debt worksheets to make tracking your debt repayment progress a breeze. You also need to list the interest rate and minimum payments for each. I usually don’t count the mortgage, but you certainly can. Keep track of how much you owe and record the amount of money you're paying back with these handy. What is the debt snowball? Check out a collection of the most popular debt payoff trackers that will help you pay off your debts more quickly and efficiently. Interest rates for each liability based on your input; All pages are 100% free. The template helps you calculate your loan details with utmost accuracy. Pink and cream playful y2k budget tracker planner. Don't forget to track and pay debts on time, turn this handy tracker into a complete debt reduction calculator. Then, take what you were paying on that debt and add it to the payment of your next smallest debt. With the debt snowball method, you simply start with the smallest debt first,. Usually, the interest on the mortgage is much less than other consumer debt or student loan debt. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Web keep track of debts for your company or financial institution with this free debt tracker template from jotform. Current balances on. This isn’t just another spreadsheet. Estimated monthly interest totals ; Download this template in pdf format and start using it printed or digital right now. Knock out the smallest debt first. Black and white minimalist debt repayment tracker planner. Web pretty debt printables to keep you focused on reducing debt. $3,000 ($70 minimum payment) 4th debt: Web planner by amit debnath. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Planner by rizelle anne galvez. It boasts plenty of tools to calculate monthly and yearly expenses instantly. Budget planner templates bundle (90 in 1) save. Then, take what you were paying on that debt and add it to the payment of your next smallest debt. Planner by rizelle anne galvez. Progress toward your debt payoff goals; Check out a collection of the most popular debt payoff trackers that will help you pay off your debts more quickly and efficiently.![]()

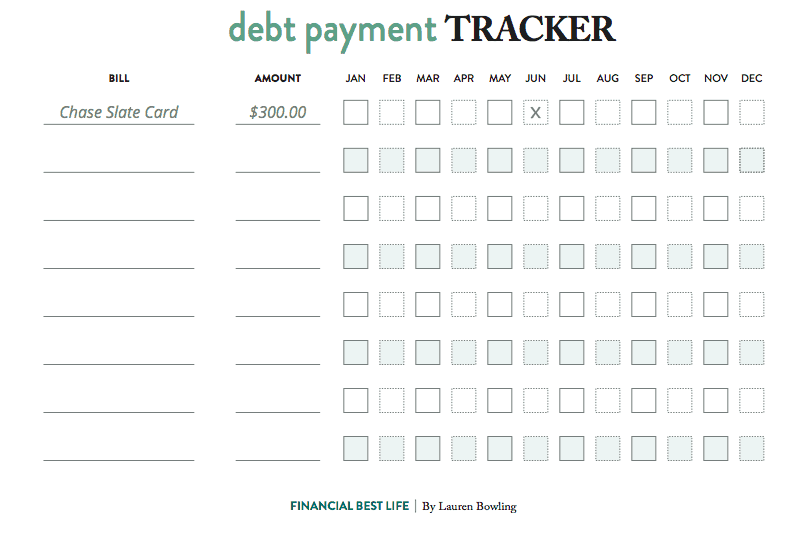

Free Printable Debt Tracker Use This To Payoff Your Debts Quicker

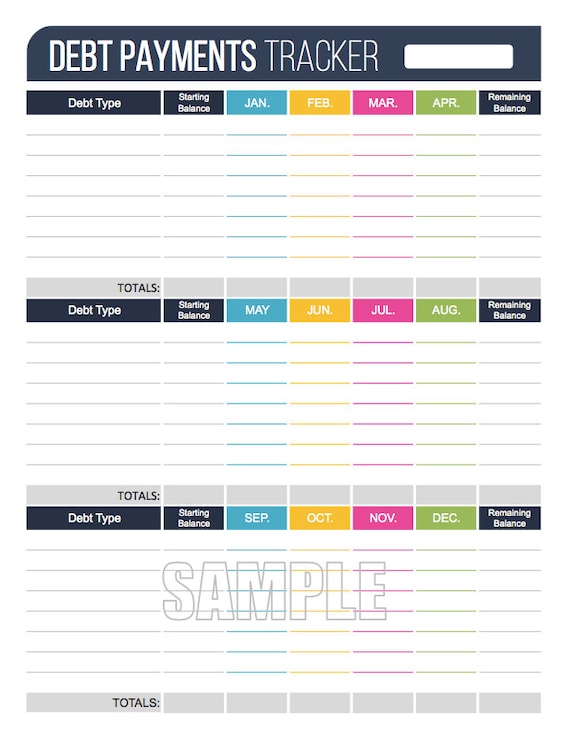

Debt Tracker Printable, Debt Payoff Log, Debt Tracker Sheets Etsy

![]()

Download Debt Tracker Template PDF World of Printables

(Free Template!) How to Use a Debt Tracker to Visualize Debt Payoff

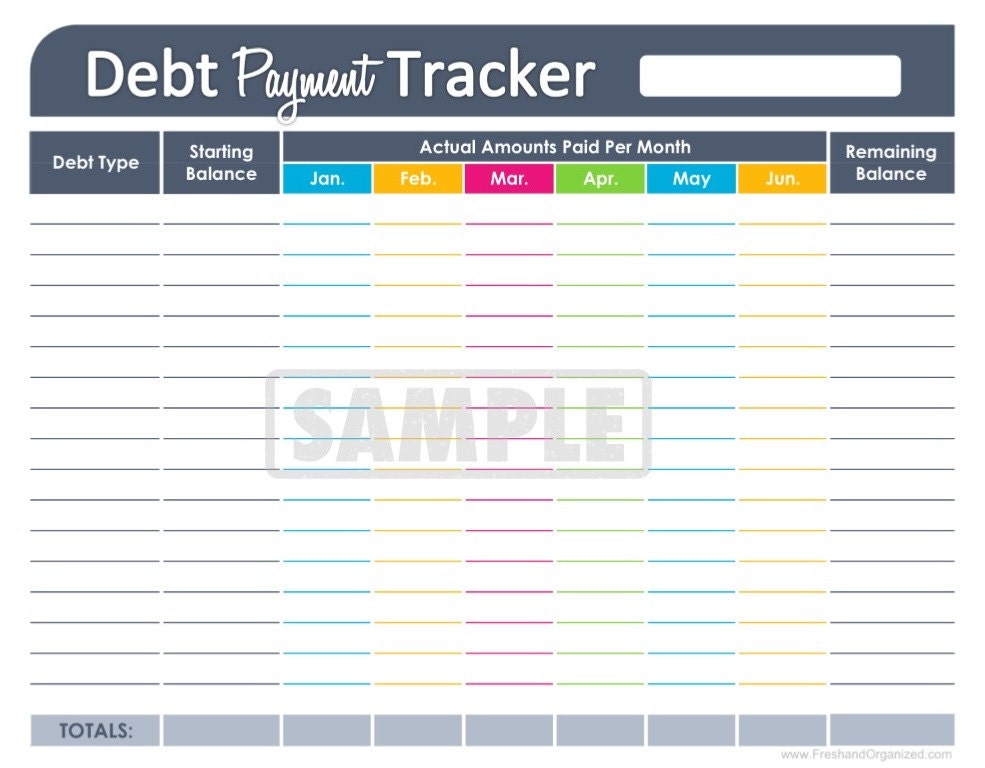

Debt Payment Tracker EDITABLE Personal Finance Organizing

Debt Payment Tracker EDITABLE Personal by

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

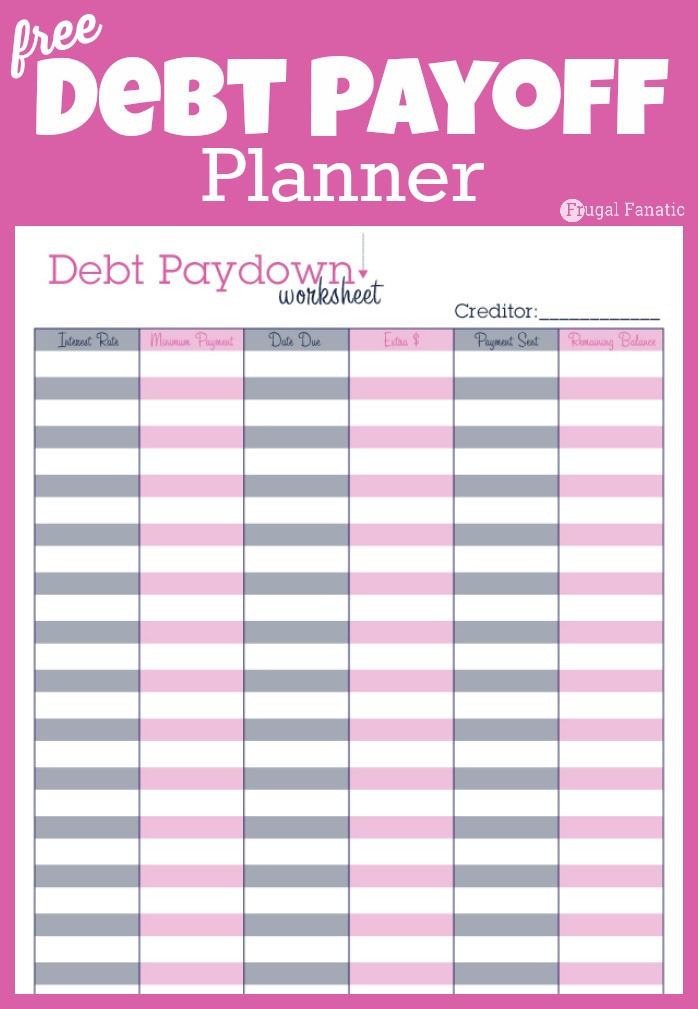

Debt Payoff Planner Free Printable

![]()

Free Debt Tracker Printable Template World of Printables

Debt Tracker Printable Colorful Debt Tracker Finance Etsy

Practical Debt Trackers That'll Keep Your Eyes On The Prize Of Paying Off Debt.

Web The Debt Payoff Planner Makes Tracking Debt Simple.

You Also Need To List The Interest Rate And Minimum Payments For Each.

When Working On Paying Off Debt, You Can Use All The Help You Can Get.

Related Post: