Depreciation Schedule Excel Template

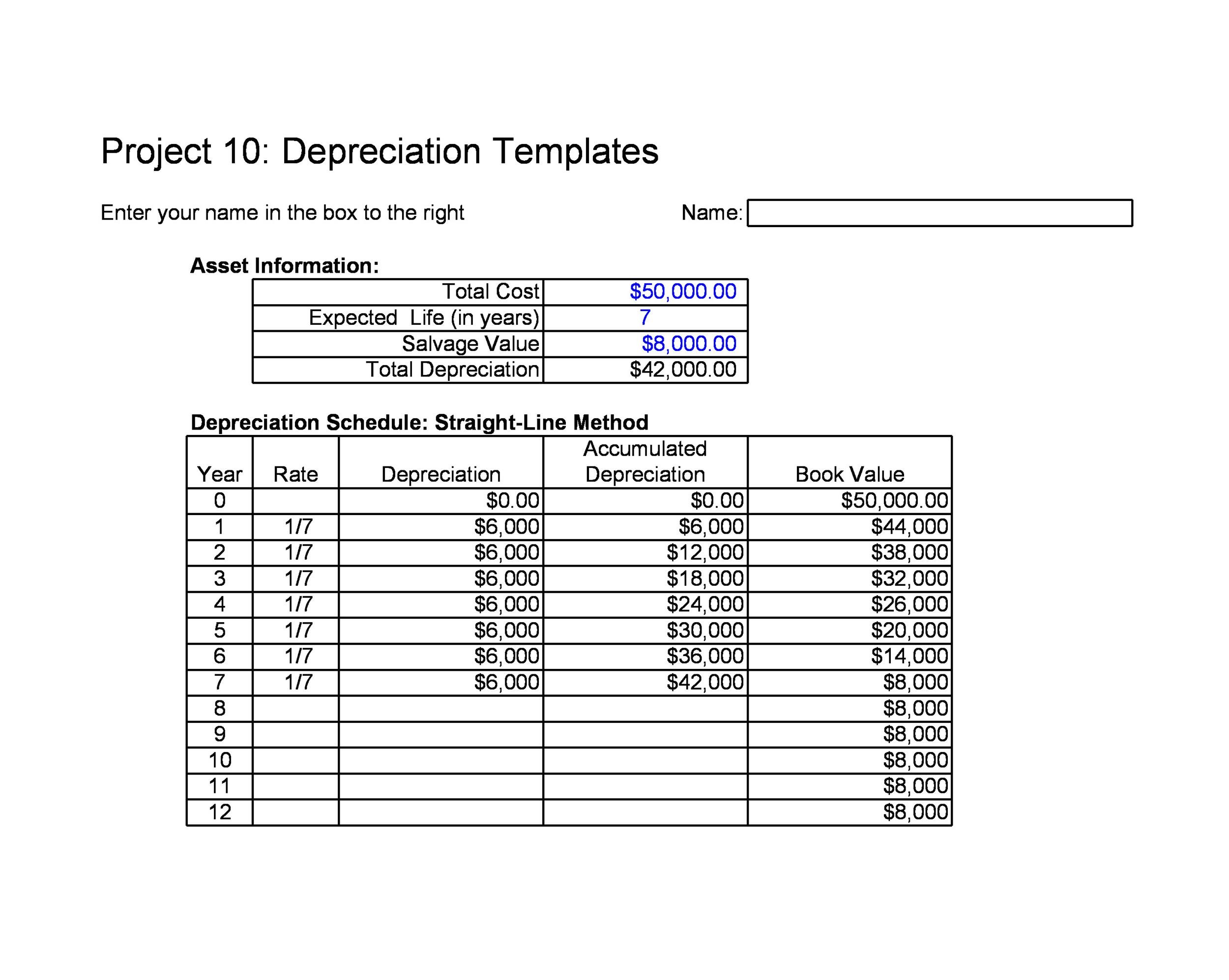

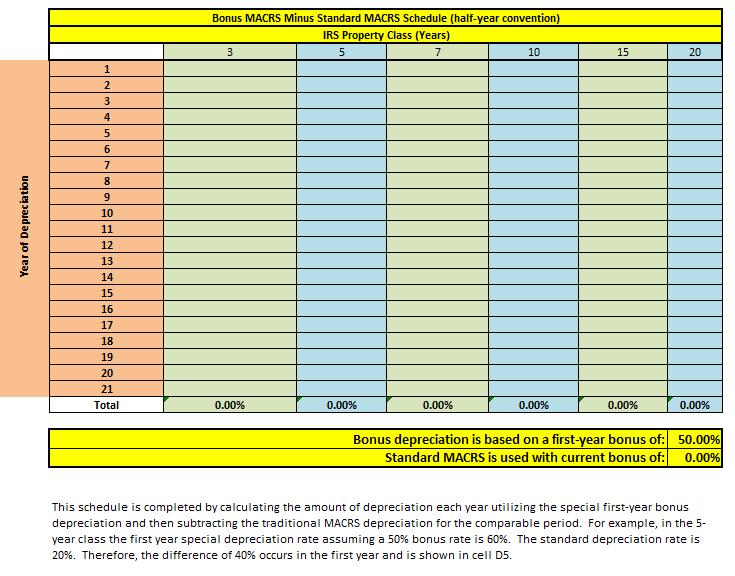

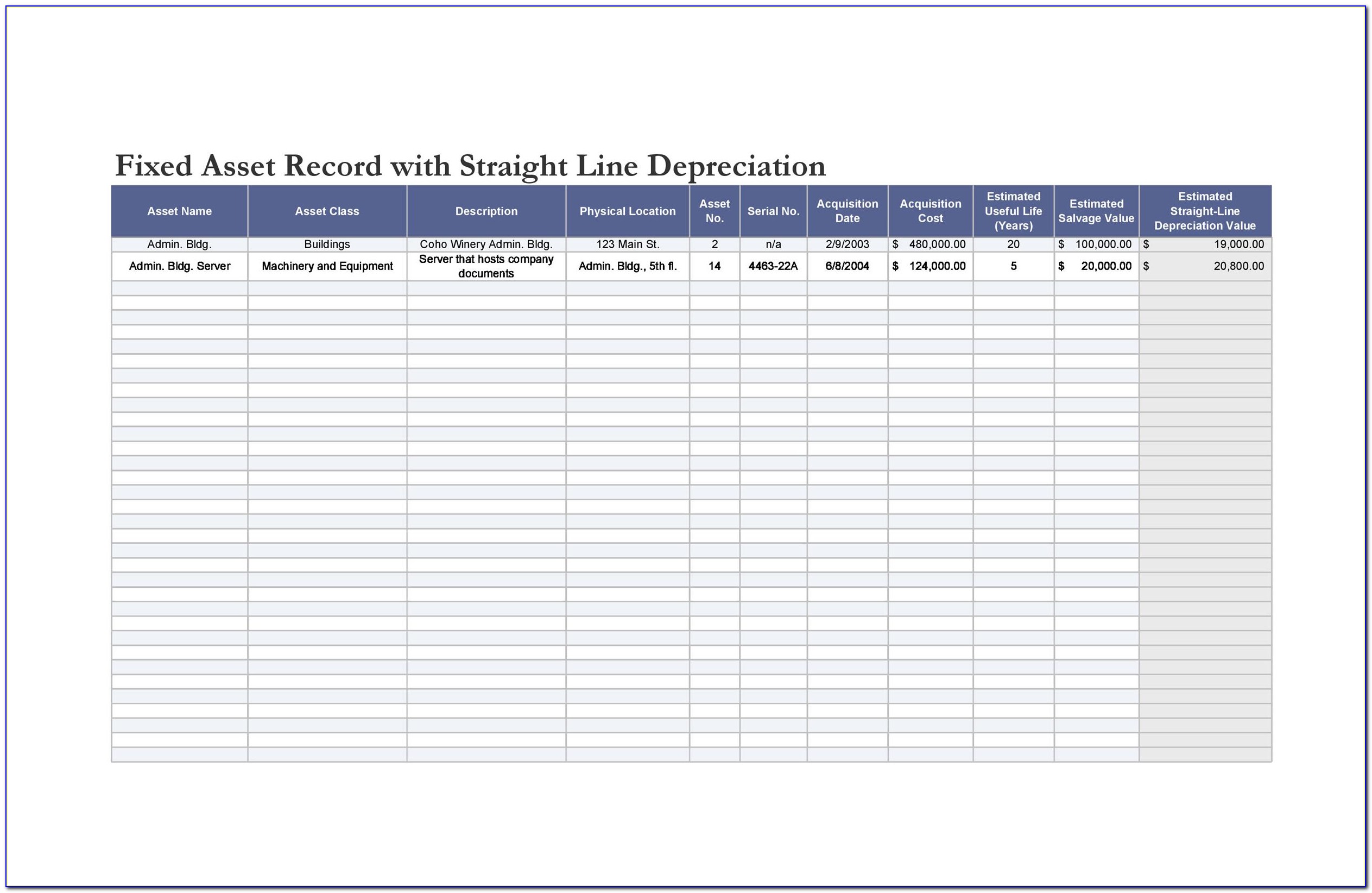

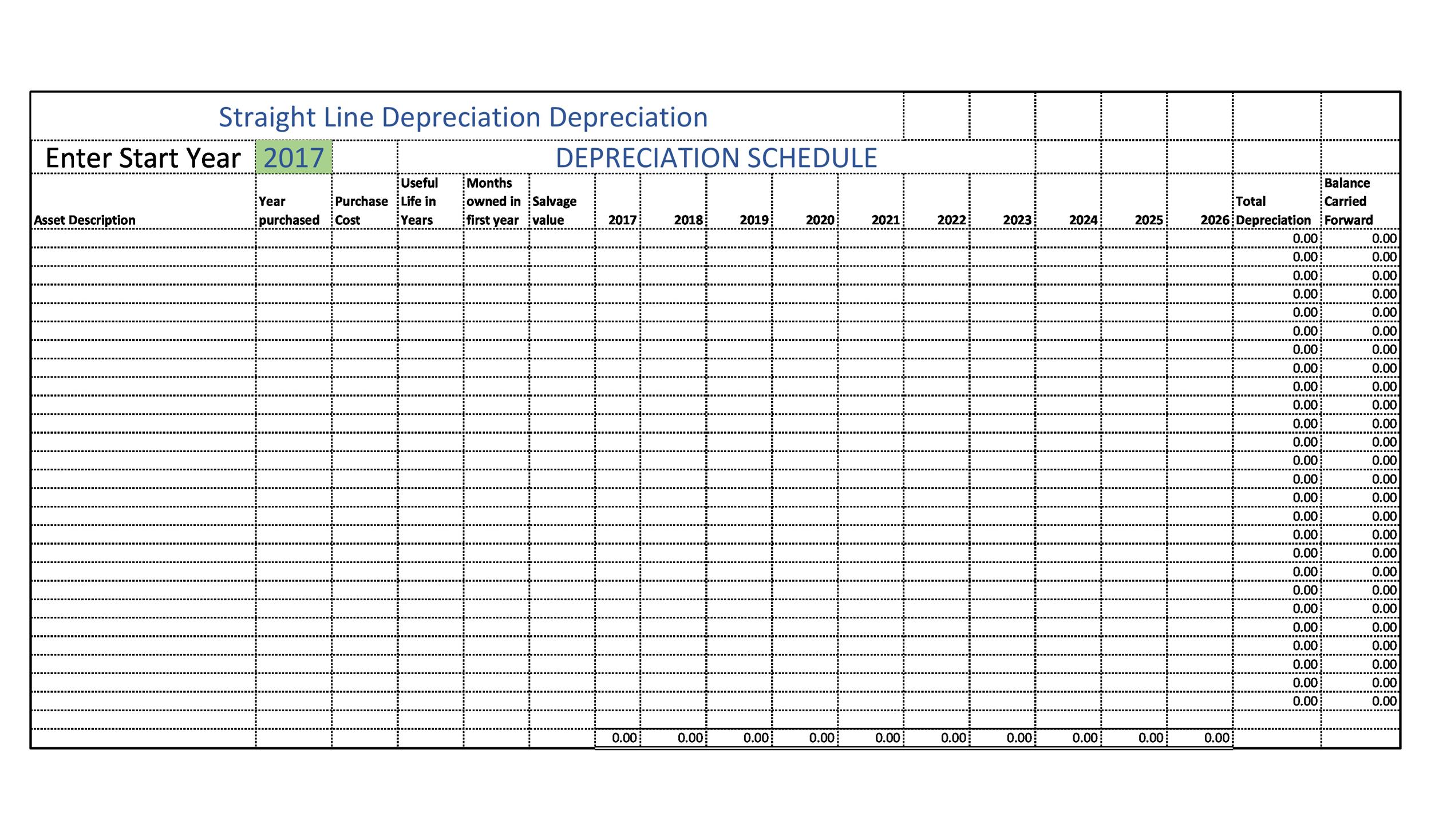

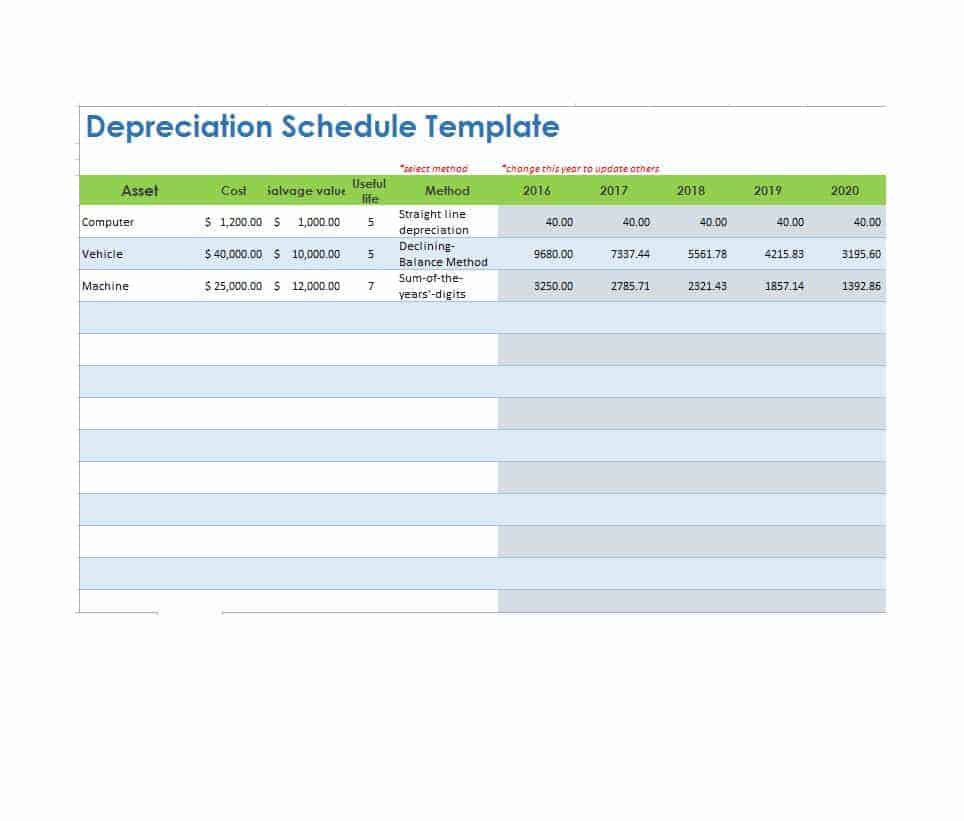

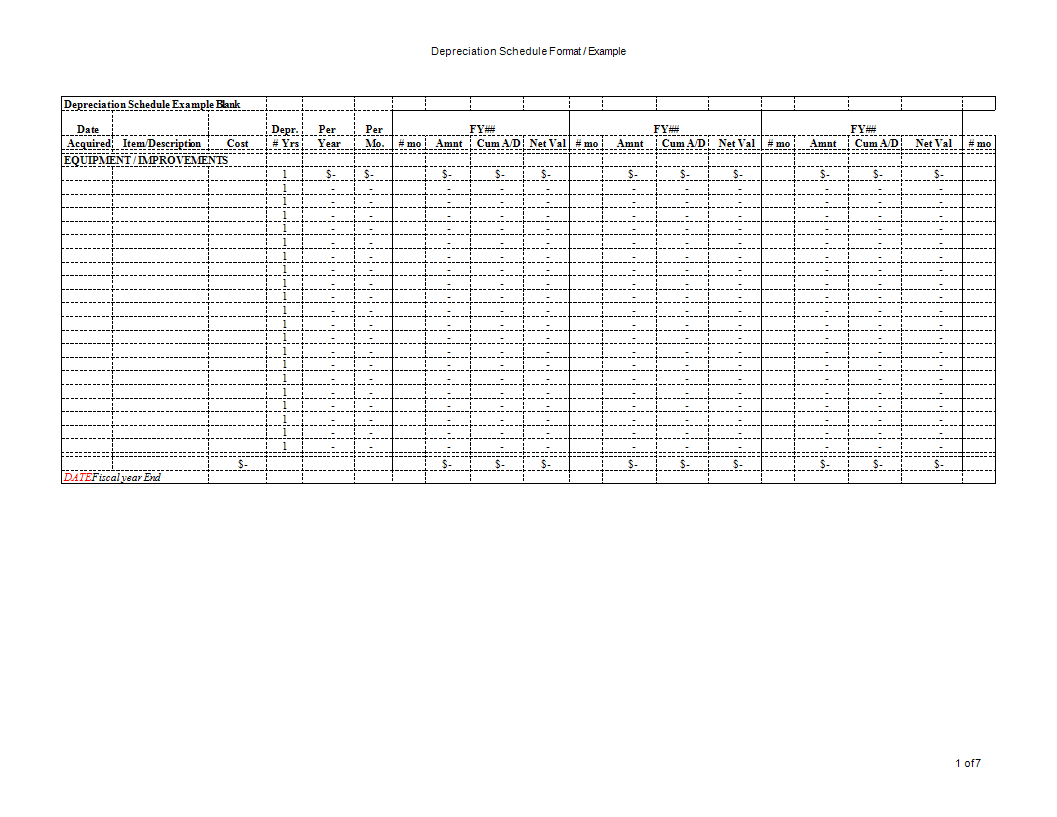

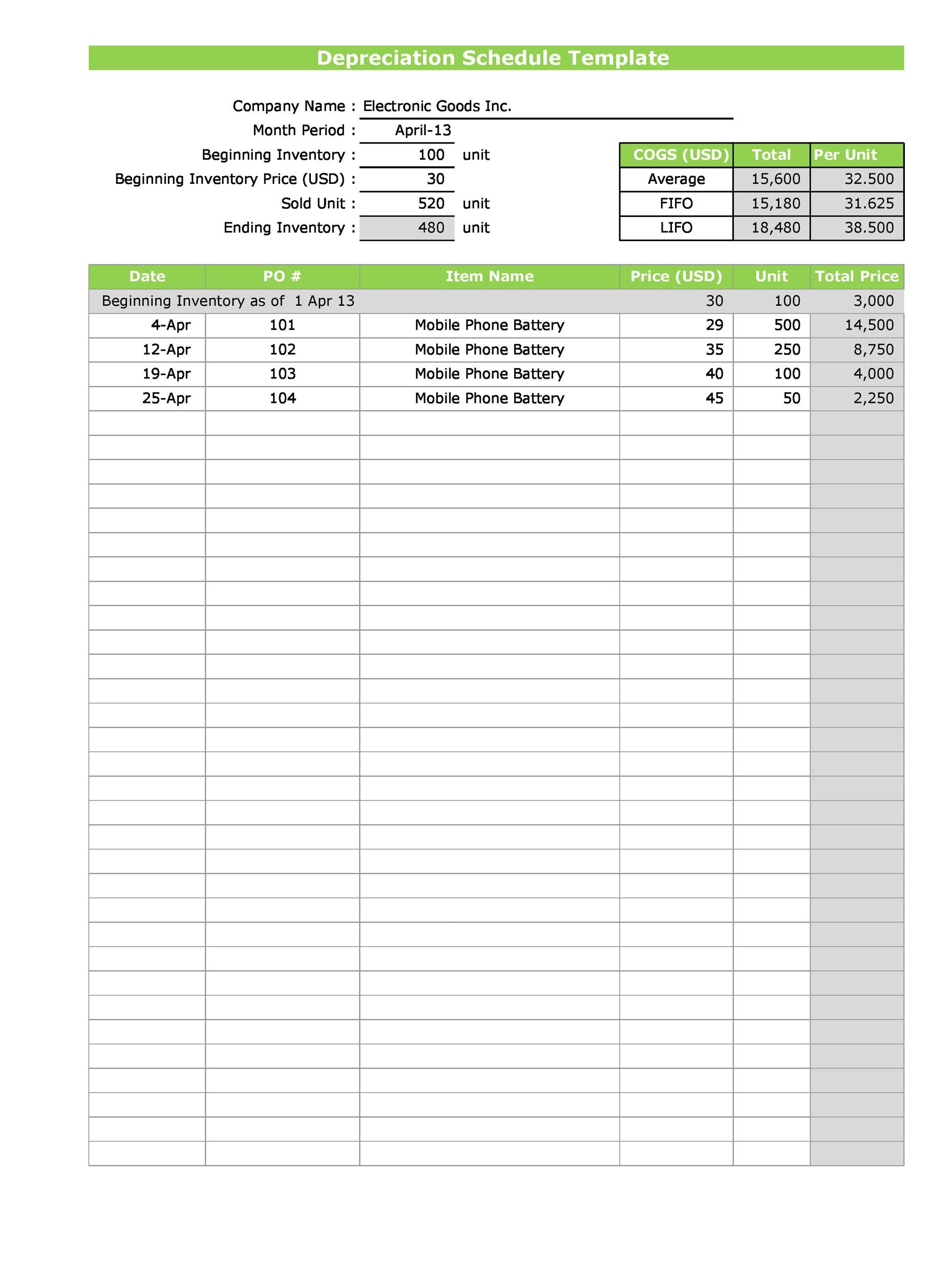

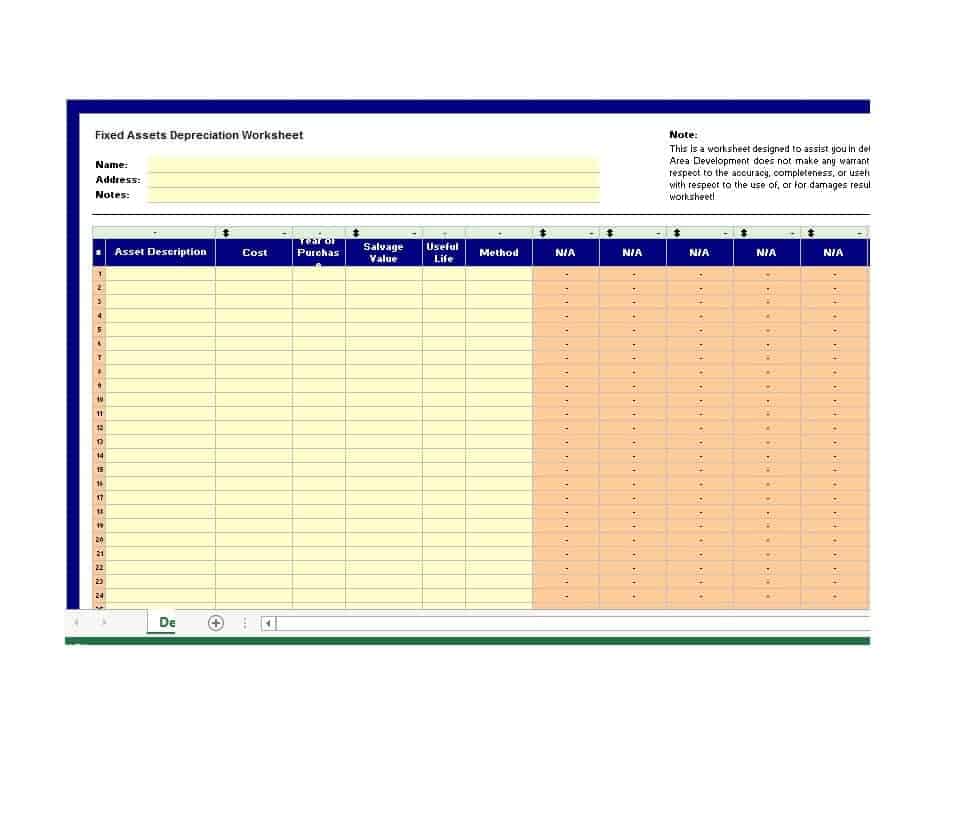

Depreciation Schedule Excel Template - Web the excel depreciation calculator, available for download below, is used to produce a straight line depreciation schedule by entering details relating to the cost and salvage value of the asset and the straight line depreciation rate. The depreciation schedule may also include historic and. Here is a preview of the template: Double declining balance depreciation template. D j = d j c Web under the macrs, the depreciation for a specific year j (d j) can be calculated using the following formula, where c is the depreciation basis (cost) and d j is the depreciation rate. With this depreciation schedule template, businesses are able to create asset specific columns based on whatever criteria that is deemed necessary for tracking and recording the assets. Further, using this dataset, we will create a monthly depreciation schedule in excel. Web excel offers five different depreciation functions. You can use any available excel version. Web depreciation schedule report template; Web download a depreciation schedule template for excel. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). With this depreciation schedule template, businesses are able to create asset specific columns based on whatever criteria that is deemed necessary for. Web download a depreciation schedule template for excel. Web depreciation schedule report template; Capital asset depreciation schedule template download. The depreciation schedule may also include historic and. You can use any available excel version. D j = d j c The depreciation schedule may also include historic and. This double declining balance depreciation template will help you find depreciation expense using one of the most common depreciation methods. Web free download depreciation schedule template in excel format. Web download a fixed asset tracking template with depreciation schedule for excel | google sheets. With this depreciation schedule template, businesses are able to create asset specific columns based on whatever criteria that is deemed necessary for tracking and recording the assets. Web in this article, we’ll teach you how to make a depreciation worksheet in excel, from assembling column headers to entering formulas, and explain the usage and arguments in each depreciation formula. Download. Web under the macrs, the depreciation for a specific year j (d j) can be calculated using the following formula, where c is the depreciation basis (cost) and d j is the depreciation rate. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Double. Here is a preview of the template: Web in this article, we’ll teach you how to make a depreciation worksheet in excel, from assembling column headers to entering formulas, and explain the usage and arguments in each depreciation formula. Web under the macrs, the depreciation for a specific year j (d j) can be calculated using the following formula, where. (years left of useful life) ÷. Non profit depreciation schedule format download in excel. Here, we used microsoft 365. The depreciation schedule may also include historic and. Web the depreciation schedule template is free to download, easy to use and completely customizable. Web download the featured file here: Web the excel depreciation calculator, available for download below, is used to produce a straight line depreciation schedule by entering details relating to the cost and salvage value of the asset and the straight line depreciation rate. Web excel offers five different depreciation functions. Web the depreciation schedule template is free to download, easy. Download your free and customizable rental property depreciation spreadsheet here (google sheet) simply select the link and download it to your computer (or make a copy to edit it online). Non profit depreciation schedule template; Web the schedule will list the different classes of assets, the type of depreciation method they use, and the cumulative depreciation they’ve incurred at various. Here, we used microsoft 365. Capital asset depreciation schedule template download. Non profit depreciation schedule format download in excel. Web excel offers five different depreciation functions. With this depreciation schedule template, businesses are able to create asset specific columns based on whatever criteria that is deemed necessary for tracking and recording the assets. This double declining balance depreciation template will help you find depreciation expense using one of the most common depreciation methods. This depreciation methods template will show you the calculation of depreciation expenses using four types of commonly used depreciation methods. Web excel offers five different depreciation functions. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated, using: Below is a preview of the depreciation methods template: Web the excel depreciation calculator, available for download below, is used to produce a straight line depreciation schedule by entering details relating to the cost and salvage value of the asset and the straight line depreciation rate. With this depreciation schedule template, businesses are able to create asset specific columns based on whatever criteria that is deemed necessary for tracking and recording the assets. Web download a fixed asset tracking template with depreciation schedule for excel | google sheets. The depreciation schedule may also include historic and. Web written by cfi team. Download the free excel template. Fixed asset and depreciation schedule; Capital asset depreciation schedule template download. Here is a preview of the template: Non profit depreciation schedule template; Fixed asset record with depreciation;

9 Free Depreciation Schedule Templates in MS Word and MS Excel

Straight Line Depreciation Schedule Excel Template For Your Needs

20+ Free Depreciation Schedule Templates MS Excel & MS Word

Depreciation Schedule Template Excel Free Printable Templates

Schedule Of Real Estate Owned Excel Sample Excel Templates

13+ Depreciation Schedule Templates Free Word Excel Templates

Fixed Asset Monthly Depreciation Schedule Excel Template

Depreciation schedule Excel format Templates at

Depreciation Excel Template Database

Depreciation Schedule Template Excel Free For Your Needs

D J = D J C

Double Declining Balance Depreciation Template.

We Consider An Asset With An Initial Cost Of $10,000, A Salvage Value (Residual Value) Of $1000 And A Useful Life Of 10 Periods (Years).

Web Free Download Depreciation Schedule Template In Excel Format.

Related Post: