Depreciation Schedule Template Excel

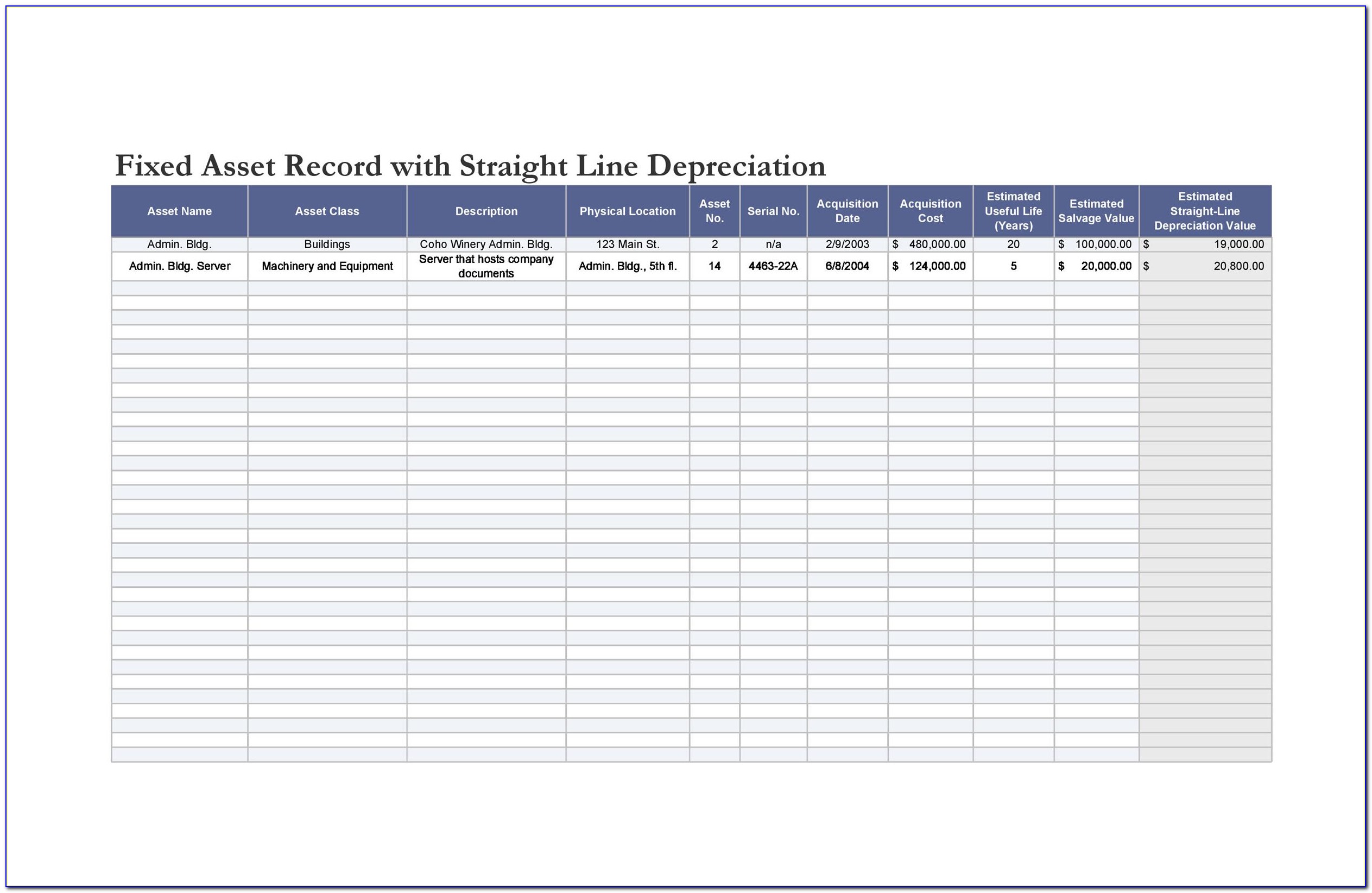

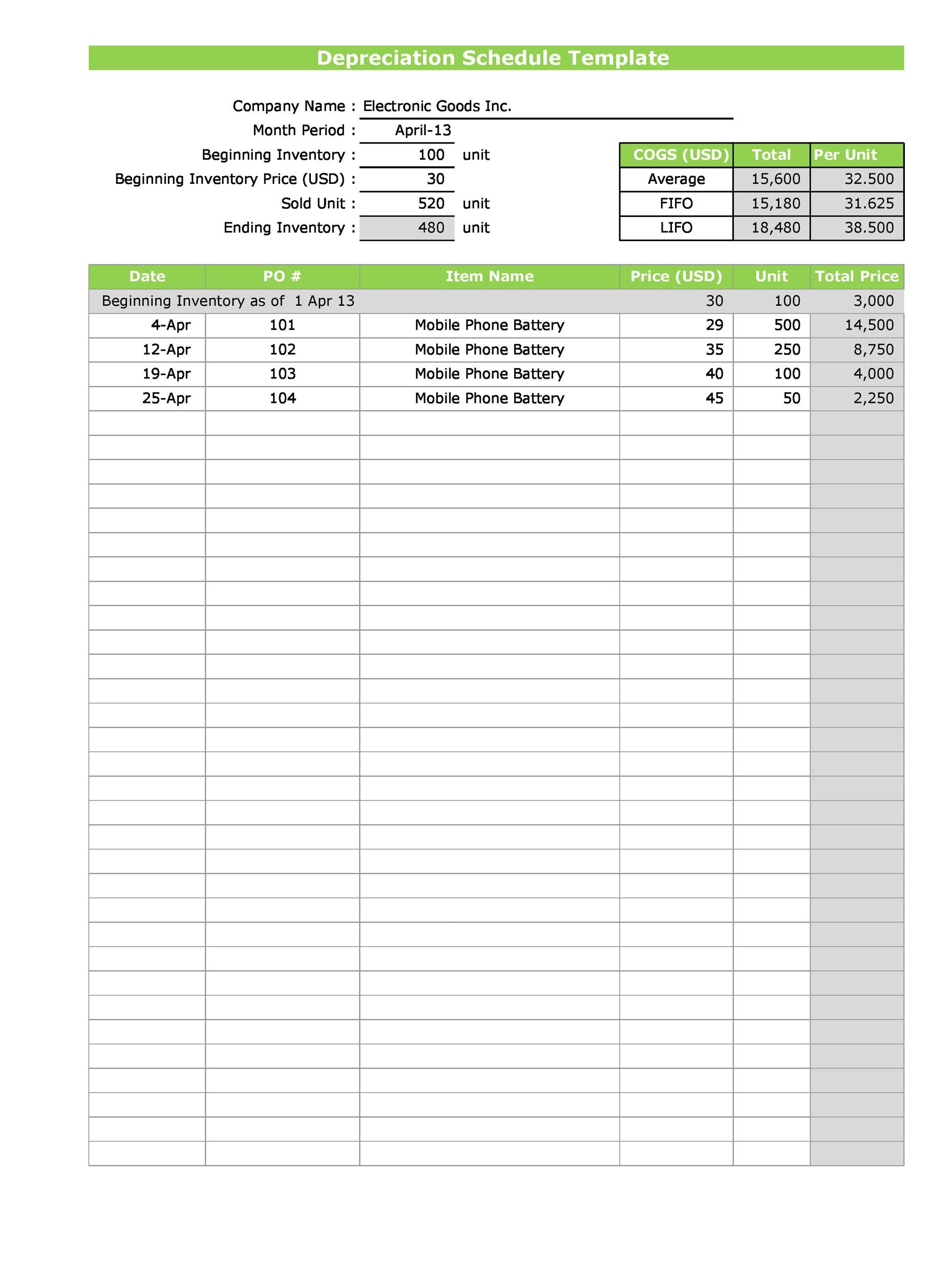

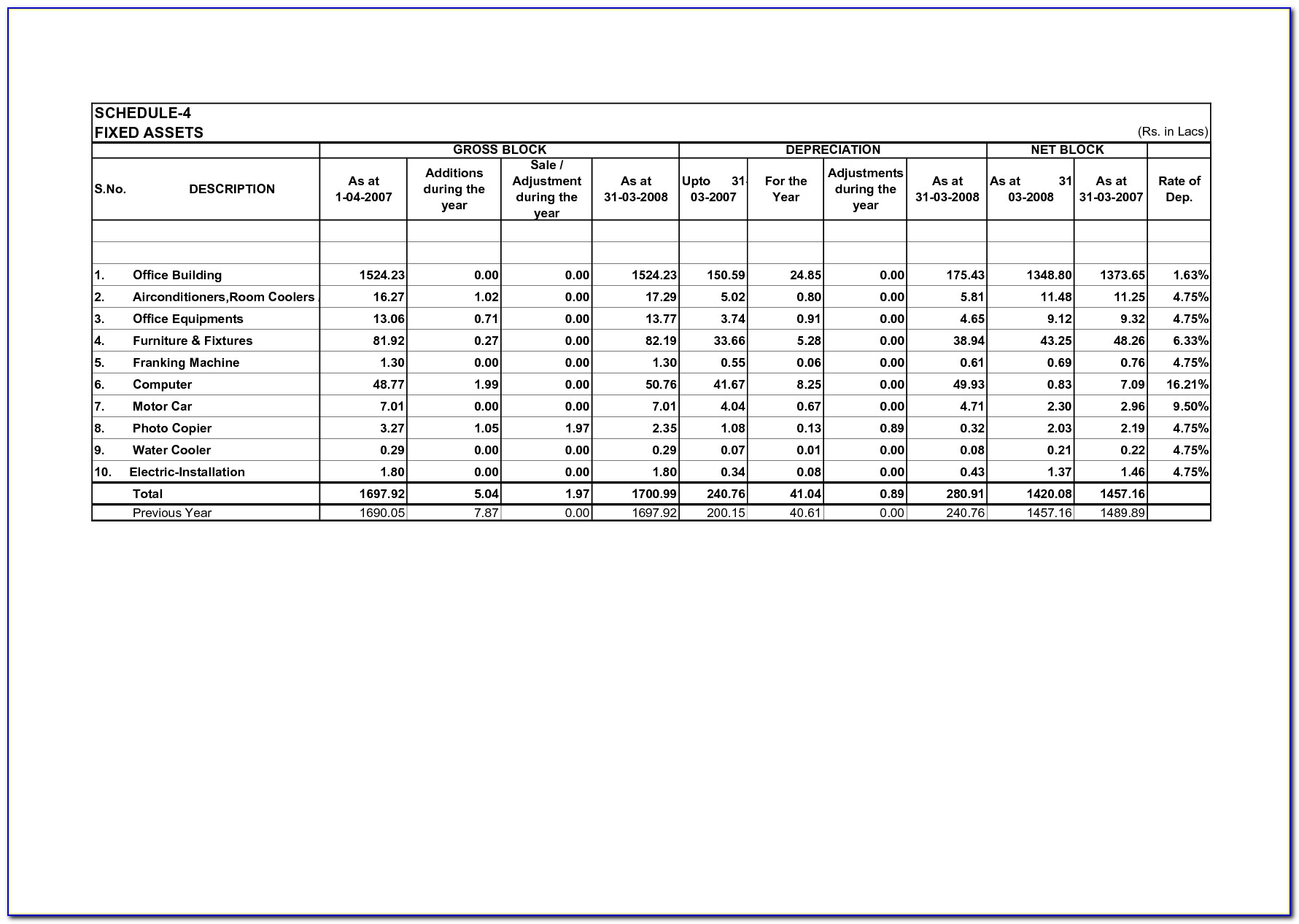

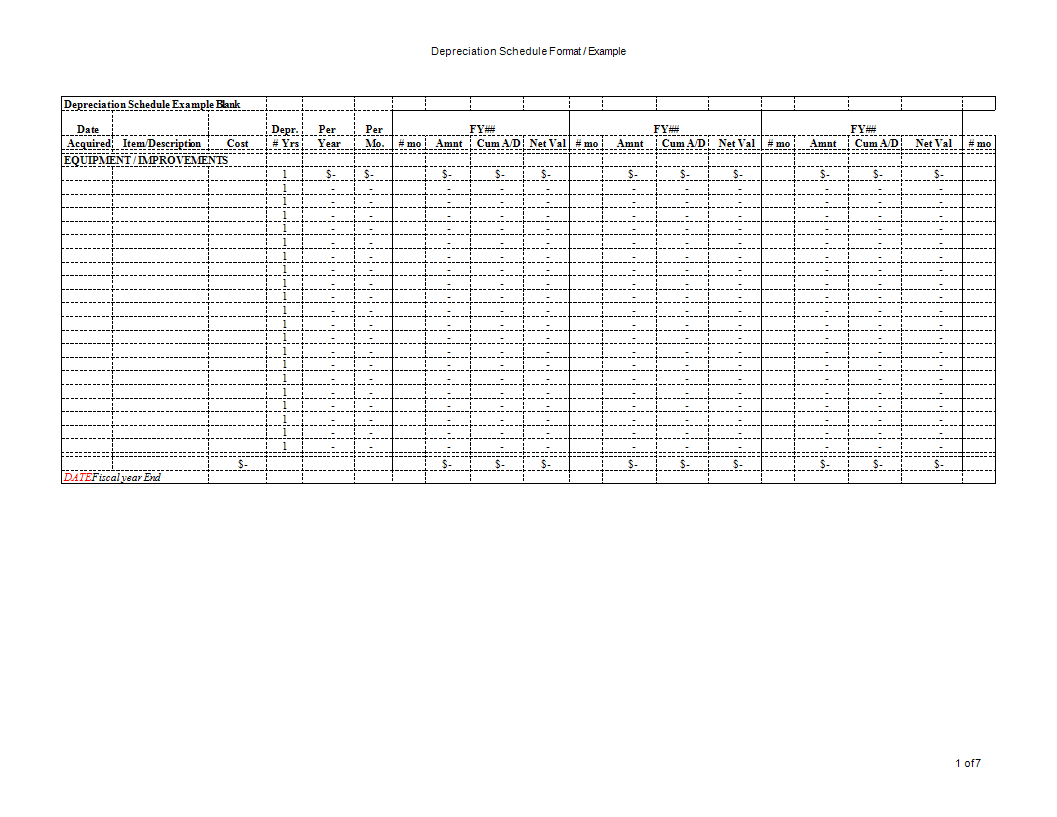

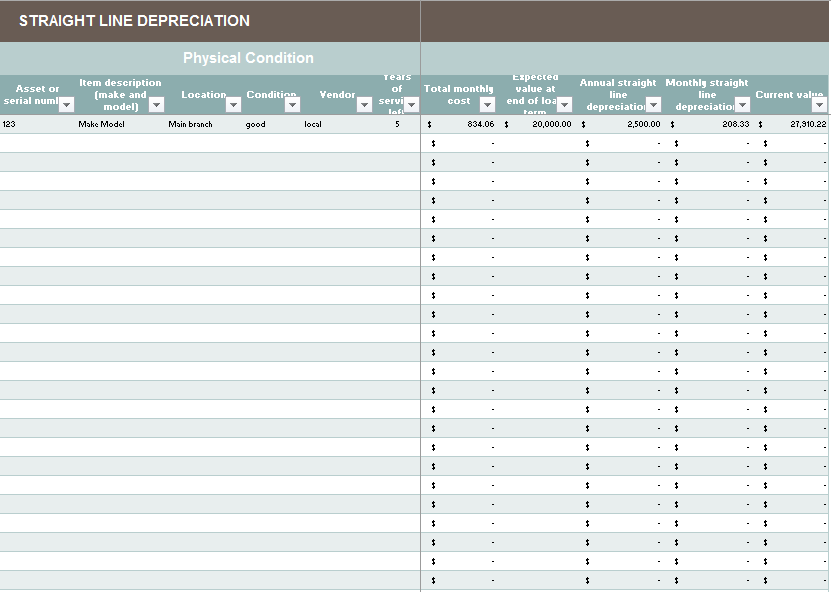

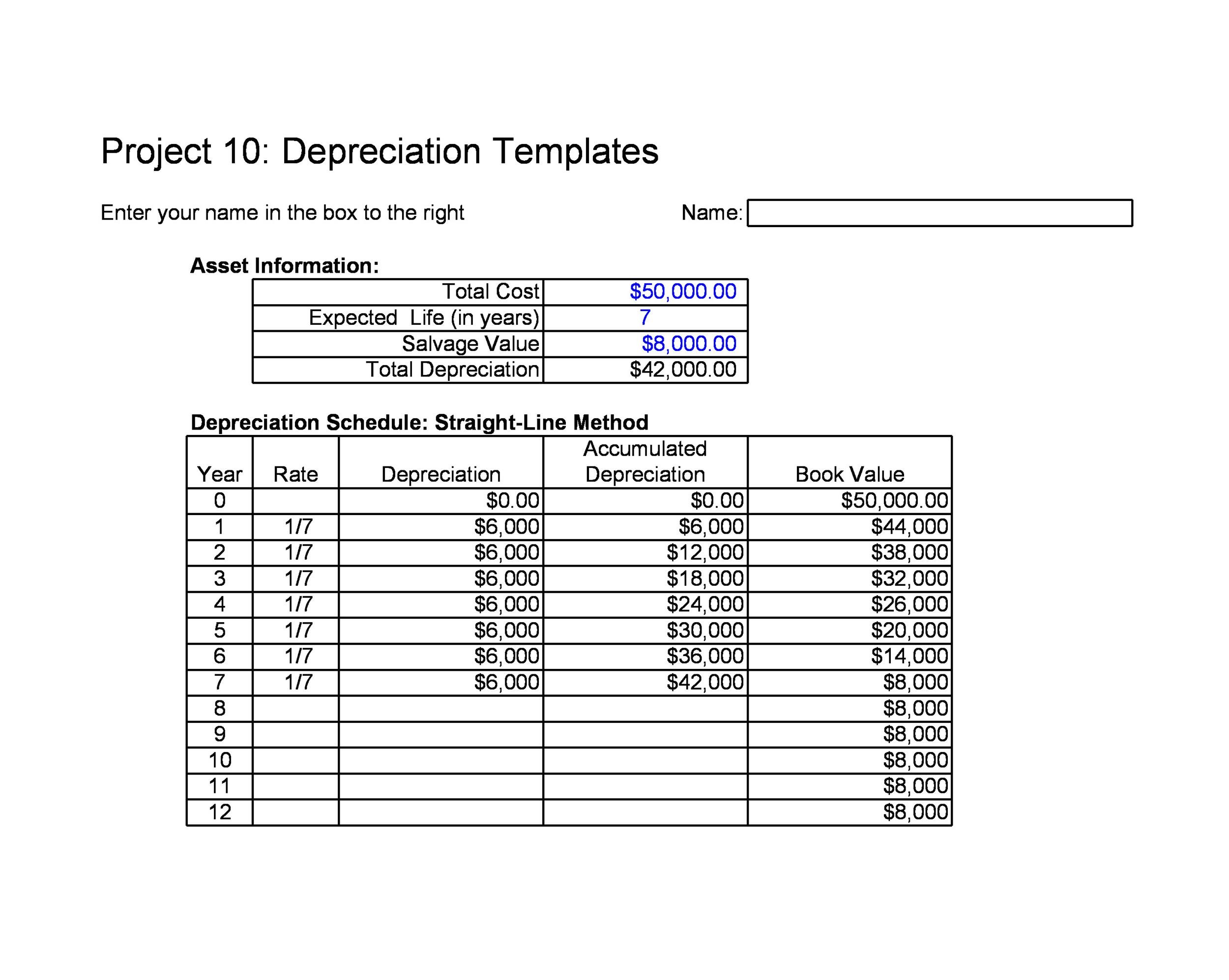

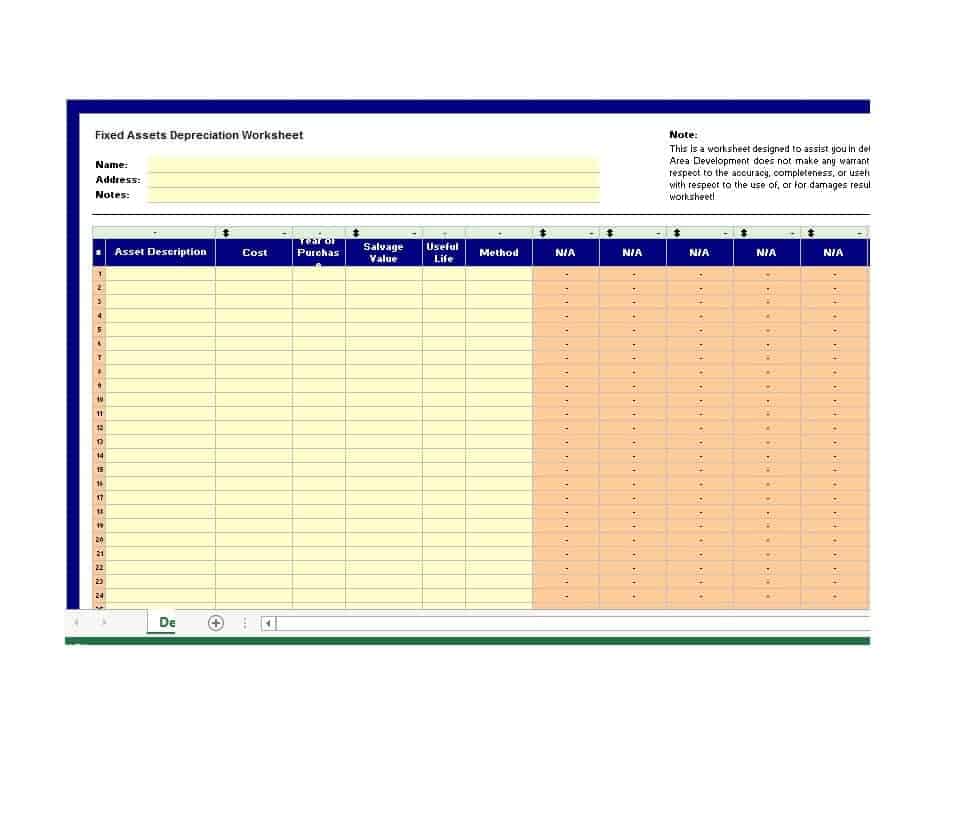

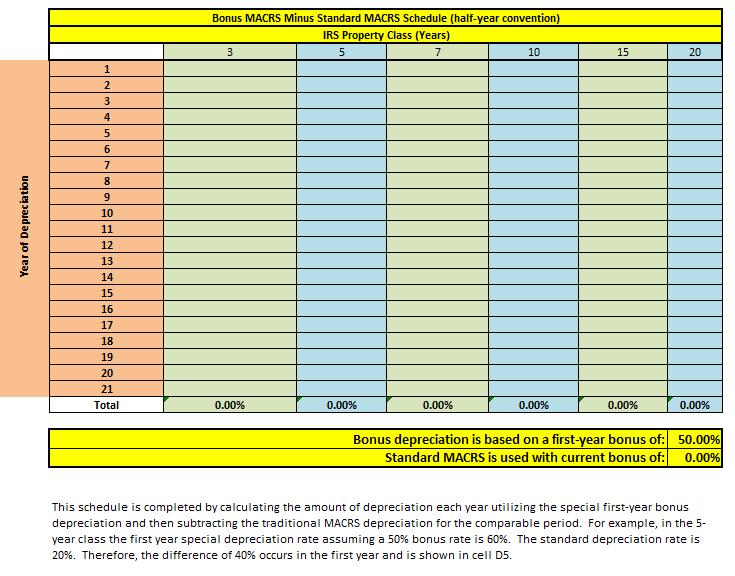

Depreciation Schedule Template Excel - The depreciation formula is pretty basic, but finding the correct depreciation rate (d j) is the difficult part because it. Create a new excel spreadsheet file and assemble the following information in row 1 of the spreadsheet. In the next year row for the first year, in the column of “depreciation expanse”, write the total amount that you want to depreciate. You can depreciate the property from the second year at 3.636% (100%/27.5 years): The practice of spreading out the cost of a tangible item over the course of its useful life is called depreciation. The above example only considers the value of the property only as the basis of our depreciation calculation. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Web in the value of asset column, type the full value of the asset. Web excel | google sheets. Web the straight line depreciation schedule template is available for download in excel format by following the link below. Web at the bottom of the depreciation schedule, prepare a breakdown of the net change in pp&e. Web however, there is an easier method for creating a depreciation schedule in microsoft excel using templates. Repeat the above steps until the salvage value is reached. Web depreciation schedules edit this template edit this template depreciation schedules are important tools for businesses. Web contents of depreciation calculator excel template. Web excel depreciation schedule instructions. In the remaining two rows type “0”. Web however, there is an easier method for creating a depreciation schedule in microsoft excel using templates. In the search bar, located at the top of the dialog box, click on schedules and search for “depreciation.” notice that there are several. In the search bar, located at the top of the dialog box, click on schedules and search for “depreciation.” notice that there are several templates to choose from. 100% / 5 years = 20%). Web under the macrs, the depreciation for a specific year j (d j) can be calculated using the following formula, where c is the depreciation basis. Straight line method depreciation schedule v 1.01 download link the straight line depreciation schedule calculator is one of many financial calculators used in bookkeeping and accounting, discover another at the links. In the end, the template displays the depreciation schedule for the diminishing balance method. The syntax is =syd (cost, salvage, life, per) with per defined as the period to. Web in the value of asset column, type the full value of the asset. Web the depreciation schedule template is an effective and easy way to help business owners keep a working long term depreciation schedule for their assets. Web excel depreciation schedule instructions. Web you can also see schedule template. Web depreciation is used to match the cost of. Web excel | google sheets. Web in the value of asset column, type the full value of the asset. Given that it is used for tangible assets, examples of the assets that a company will use depreciation for include land, buildings, vehicles and equipment and machinery. Open microsoft excel and click the new button. The above example only considers the. The first four arguments are mandatory, while the. Assemble the column headers in row 1 of the spreadsheet. The above example only considers the value of the property only as the basis of our depreciation calculation. The unit used for the period must be the same as the unit used for the life; The final total should be the ending. This begins with the beginning balance of pp&e, net of accumulated depreciation. Given that it is used for tangible assets, examples of the assets that a company will use depreciation for include land, buildings, vehicles and equipment and machinery. Web in the value of asset column, type the full value of the asset. Our free excel depreciation template is simple. Deduce the annual depreciation expense from the beginning period value to calculate the ending period value. Web 28+ free simple depreciation schedule templates (ms excel, pdf) businesses and organizations use a depreciation schedule template, a spreadsheet or document, to monitor and control the asset’s depreciation over time. Next, we can also create depreciation by using the db function in excel.. Web you can also see schedule template. It uses the rate of depreciation on the closing asset value of the. Straight line method depreciation schedule v 1.01 download link the straight line depreciation schedule calculator is one of many financial calculators used in bookkeeping and accounting, discover another at the links. Create a new excel spreadsheet file and assemble the. Web download the featured file here: D j = d j c. You can depreciate the property from the second year at 3.636% (100%/27.5 years): Use the template to list all of your assets (including serial numbers, condition, descriptions, vendor, payment or loan details, and vendor), so you accurately account for each of your fixed assets. First calculate the amount using your preferred method. $1,200,000 x 40% = $480,000). In the green box, enter the current year in format yyyy, 2024 is entered, but if it is a later or earlier year, change it. As for amortization, the purpose is also to match the cost. Open microsoft excel and click the new button. Given that it is used for tangible assets, examples of the assets that a company will use depreciation for include land, buildings, vehicles and equipment and machinery. Deduce the annual depreciation expense from the beginning period value to calculate the ending period value. The first four arguments are mandatory, while the. Web depreciation schedules edit this template edit this template depreciation schedules are important tools for businesses and individuals to track the value of assets over time. Web calculate the annual depreciation rate (i.e. In the remaining two rows type “0”. Multiply the beginning period book value by the twice the regular annual rate (i.e.

Depreciation Schedule Template Excel Free Printable Templates

Monthly Depreciation Schedule Excel Template Printable Templates

9 Free Depreciation Schedule Templates in MS Word and MS Excel

Depreciation Schedule Template Excel Free Printable Templates

Depreciation schedule Excel format Templates at

20+ Free Depreciation Schedule Templates MS Excel & MS Word

Create Depreciation Schedule in Excel (8 Suitable Methods) ExcelDemy

Straight Line Depreciation Schedule Excel Template For Your Needs

Depreciation Schedule Template Excel Free For Your Needs

20+ Free Depreciation Schedule Templates MS Excel & MS Word

100% / 5 Years = 20%).

The Unit Used For The Period Must Be The Same As The Unit Used For The Life;

As A Rental Property Owner, You Already Know The Process.

Web The Depreciation Schedule Template Is An Effective And Easy Way To Help Business Owners Keep A Working Long Term Depreciation Schedule For Their Assets.

Related Post: