Discounted Cash Flow Excel Template

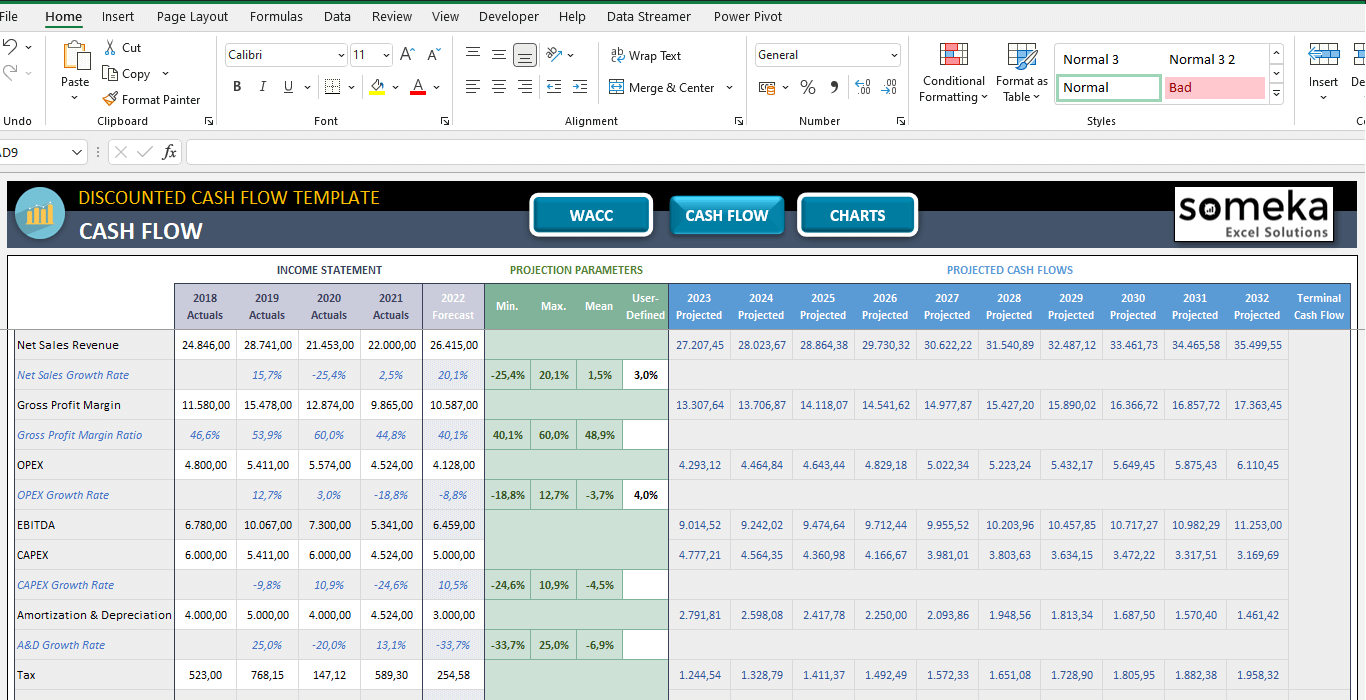

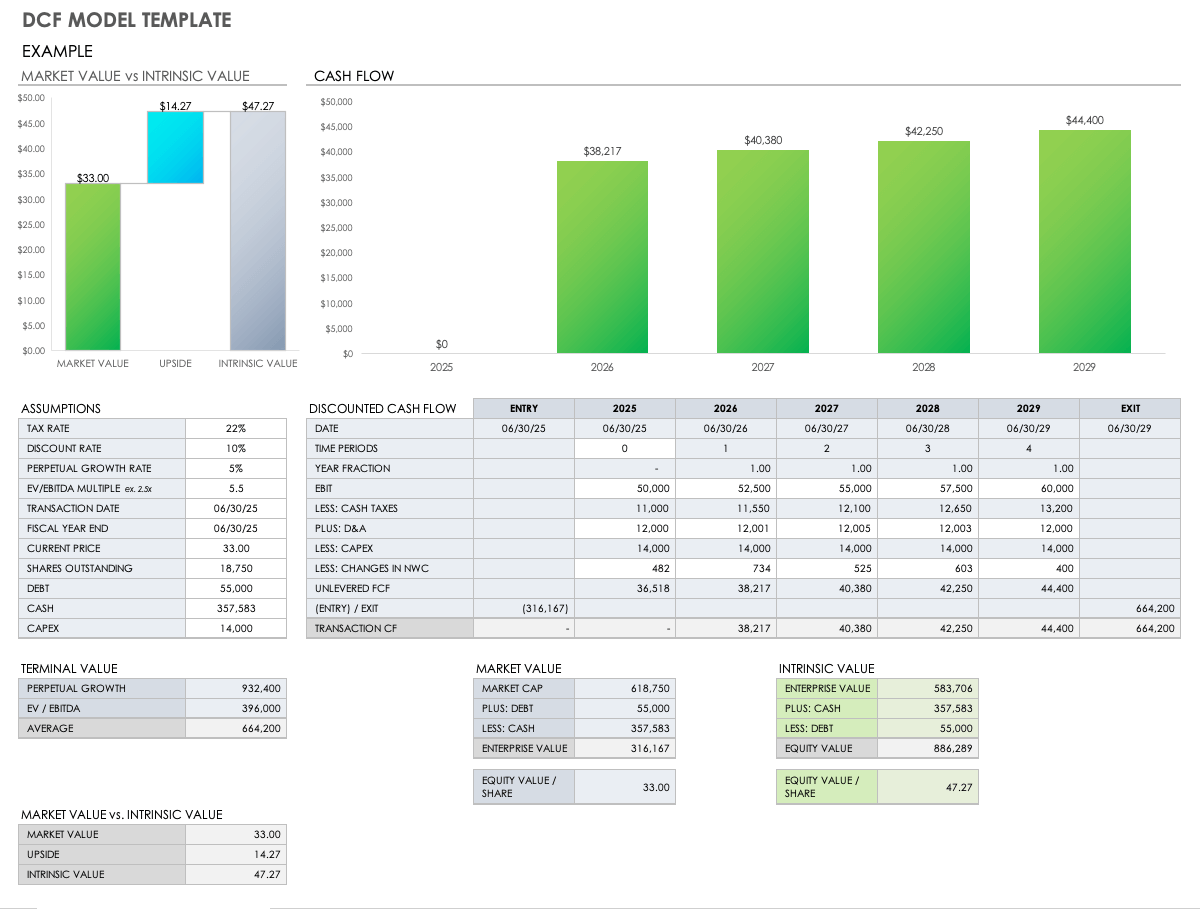

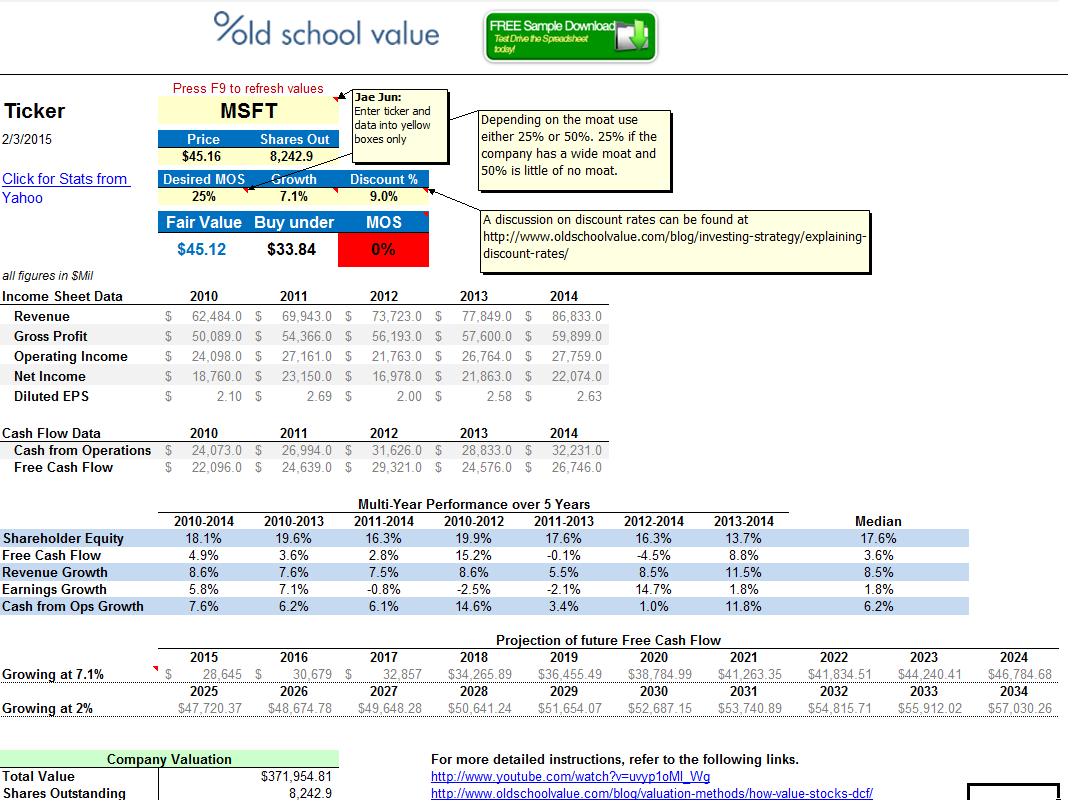

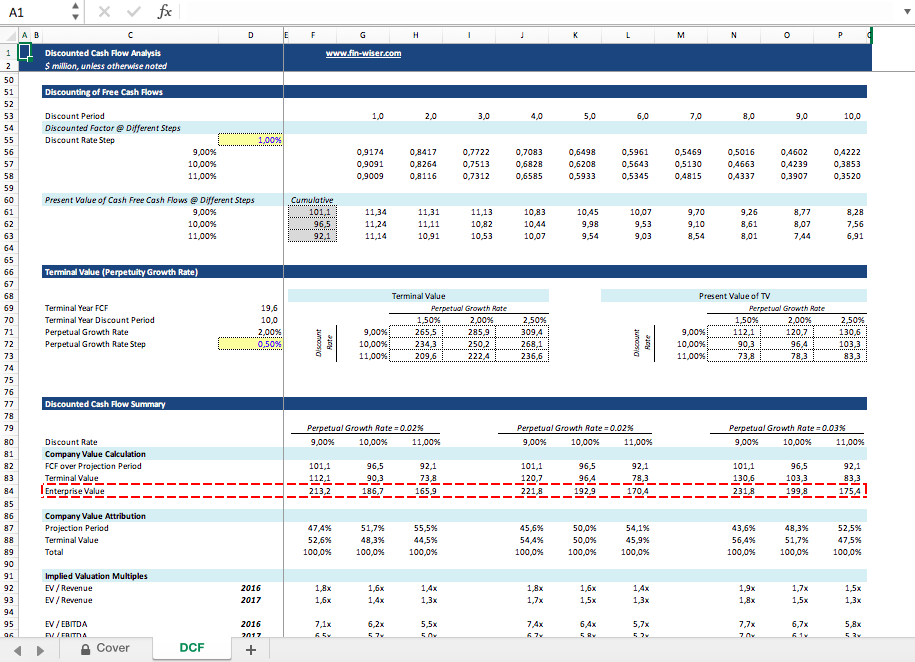

Discounted Cash Flow Excel Template - Free animation videos.master the fundamentals.learn finance easily.find out today. Ethan summers april 22, 2024 comments. 1.3 present value of multiple cash flows • 5 minutes. Input your own numbers in place of the example numbers in the blue font color cells. You now have your own cash flow. Add or cut line items as needed (select the row with your mouse, right click and choose insert, or delete) ensure that the formulas in the black font color cells include all your new line items. Sum the discounted cash flows to find the investment’s npv. Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. This is a nifty dcf for newbies. The big idea behind a dcf model. Our simple dcf template is your key to unlocking the intrinsic value of businesses without the complexity. The template also includes other tabs for. 1.4 npv of multiple cash flows • 4 minutes. This is a nifty dcf for newbies. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, * dcf calculation, * liquidity. You’ve probably built more discounted cash flow models than you care to remember. You now have your own cash flow. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. =sum(d6:d25) here, the sum function adds the present value over the 20 years of cash flow. The dcf model enables users to. Web formula for discounted cash flow in excel: (wso users get 15% off!) from axial. The formula for discounted cash flow (dcf) in excel is: And here are the relevant files and links: 10 readings • total 100 minutes. Understand the capabilities and limitations of the various cash flow analysis techniques for evaluating capital investments. The dcf model enables users to. You will learn more complex, real world models in our financial modeling packages. This template allows you to build your own discounted cash flow model with different assumptions. It achieves this by assessing the company’s expected future earnings. Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web download wso's free discounted cash flow (dcf) model template below! The. 1.4 npv of multiple cash flows • 4 minutes. Input the following formula for that purpose: Free animation videos.master the fundamentals.learn finance easily.find out today. Web download wso's free discounted cash flow (dcf) model template below! This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa and sensitizes the analysis over a range of assumed terminal multiples and perpetuity growth rates without the use of slow excel. Our simple dcf template is your key to unlocking the intrinsic value of businesses without the complexity. To achieve this, consider a few factors:. (yum) dcf excel template main parts of the financial model: Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. =sum(d6:d25) here, the sum function adds the present value over the 20 years of cash flow. Link to course evaluation form • 10 minutes.. Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. The big idea behind a dcf model. Determine an appropriate discount rate based on the risk of the investment. 1.4 npv of multiple cash flows • 4. =sum(d6:d25) here, the sum function adds the present value over the 20 years of cash flow. To calculate dcf, you discount future cash flows back to their present value. It achieves this by assessing the company’s expected future earnings and then knowing its present value. 10 readings • total 100 minutes. * dashboard, * income statement, * cash flow, *. The only thing left here is to calculate the total of all these. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa and sensitizes the analysis over a range of assumed terminal multiples and perpetuity growth rates without the use of slow excel. The template also includes other tabs for. The big idea behind a dcf model. This is a nifty dcf for newbies. Determine your discount rate based on investment risk. (yum) dcf excel template main parts of the financial model: Web discounted cash flow template. Download the free dcf model template. Our simple dcf template is your key to unlocking the intrinsic value of businesses without the complexity. And here are the relevant files and links: Dcf = cf1 / (1+r)^1 + cf2 / (1+r)^2 +. Web a discounted cash flow (dcf) analysis is one of the most important tools an investor can use to determine the intrinsic value of a stock. Derive and apply the various interest formulas to solve the cash flow problems in the most computationally efficient way. Apply cash flow analysis using computer tools (excel spreadsheet). I created a discount rate named range so that it’s easy to reference the percentage and to change it.

Discounted Cash Flow Excel Template DCF Valuation Template

discounted cash flow excel template —

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Discounted Cash Flow Spreadsheet

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

DCF Discounted Cash Flow Model Excel Template Eloquens

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Web 1.1 Future Value • 9 Minutes.

List All Projected Cash Flows In A Column.

Discover The Intrinsic Value Of Any Company Using Our Free Discounted Cash Flow (Dcf) Template.

You Then Add Up All Of Those Discounted Cash Flows, And The Sum Is Really The Intrinsic Value Of The Company.

Related Post: