Discounted Cash Flow Model Excel Template

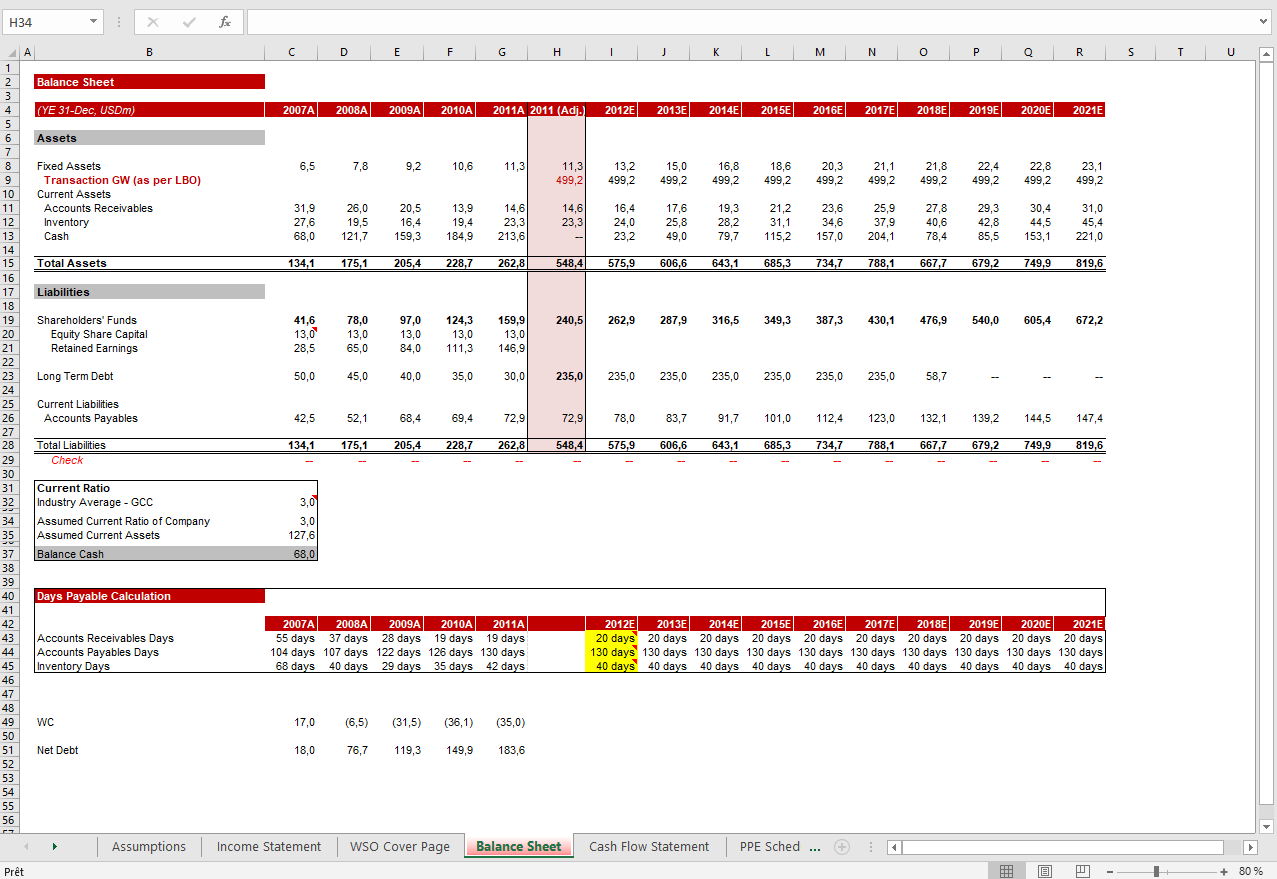

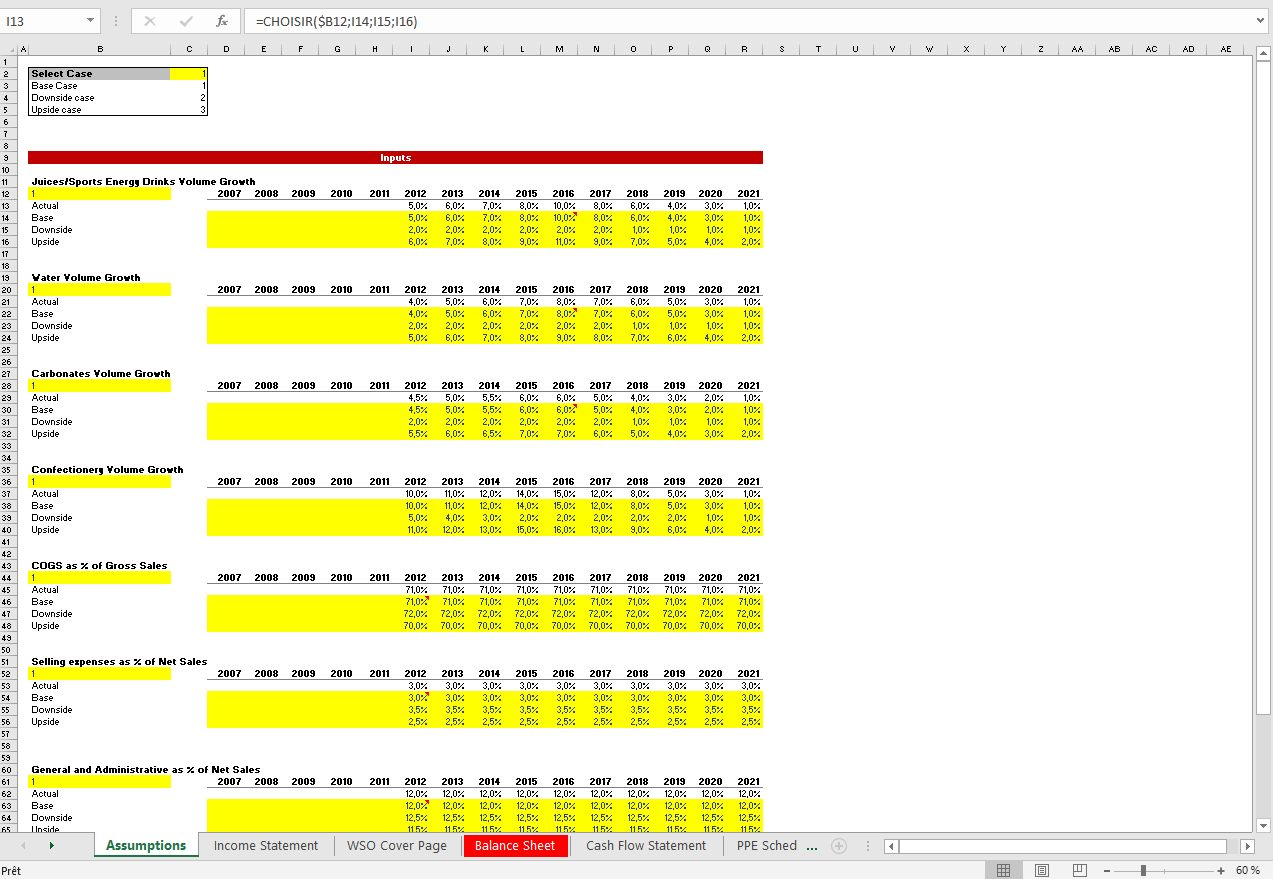

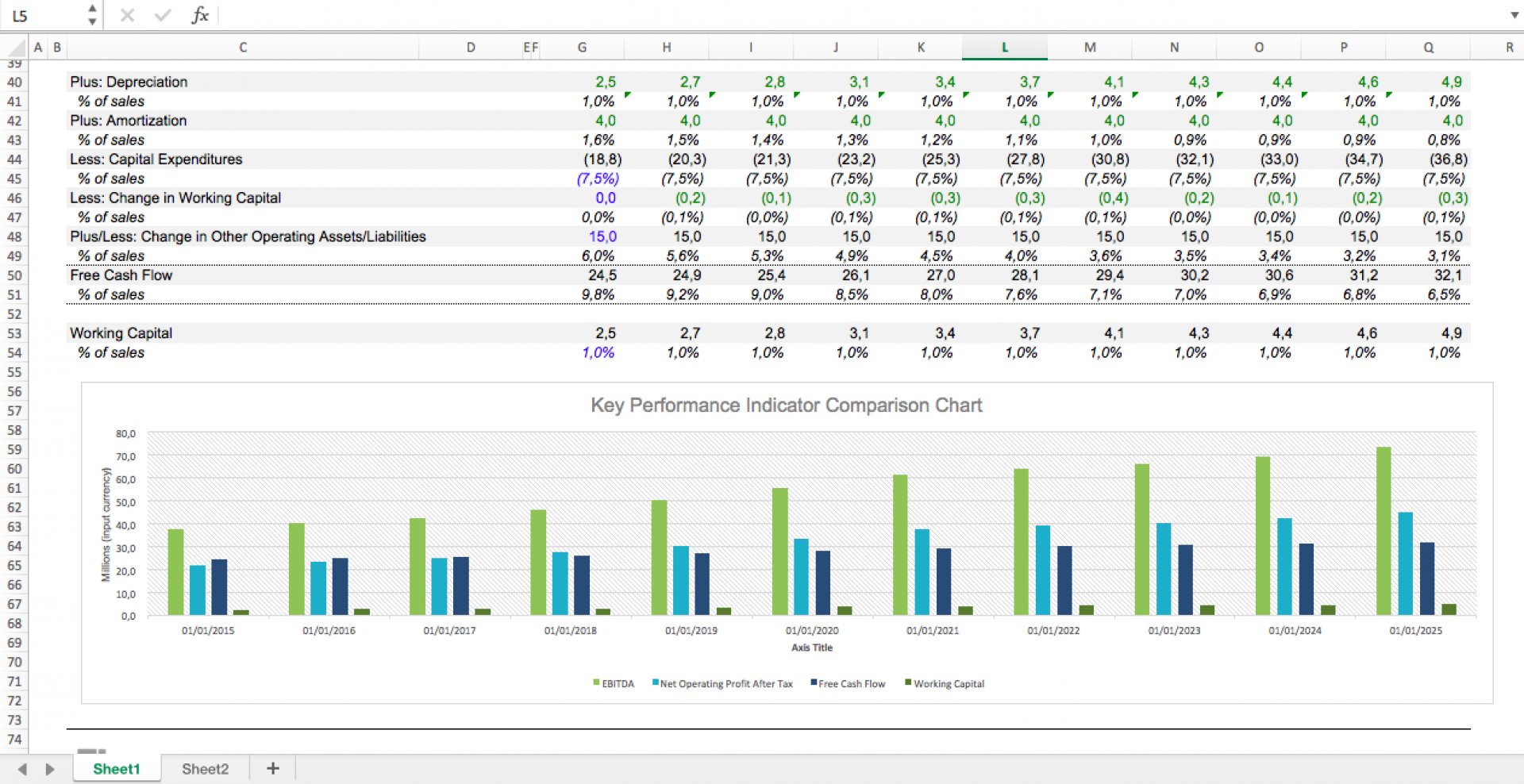

Discounted Cash Flow Model Excel Template - Unlevered free cash flow calculation template. Cf = cash flow in the period. Web discounted cash flow excel template | dcf valuation template. First name * email * submit. Detailed instructions guide you through inputting appropriate figures like operating costs, expected revenues, capital expenditures, and discount rates. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the company reaches maturity or “stabilization” by the end. (if you’ve already downloaded the excel template file from part 1, you’re all good — this lesson uses the same file). Discount the projection period and terminal cash flows to the present using the discount rate. Web discounted cash flow valuation model: R = the interest rate or discount rate. R = the interest rate or discount rate. Rated 4.70 out of 5 based on 10 customer ratings. N = the period number. Web this file allows you to calculate discounted cash flow in excel. Web the formula for discounted cash flow (dcf) in excel is: Web this file allows you to calculate discounted cash flow in excel. Web the sections of this model template are as follows: Excel template | file download form. Discount the projection period and terminal cash flows to the present using the discount rate. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in. R = the interest rate or discount rate. Use the form below to get the excel model template to follow along with this lesson. Web discounted cash flow (dcf) model template. Web download sample discounted cash flow excel template — excel. Discount the projection period and terminal cash flows to the present using the discount rate. Enter your name and email in the form below and download the free template now! Web in excel, you can calculate this using the pv function (see below). Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. Build dcf models with different assumptions. Dcf. Web discounted cash flow (dcf) model template. This video alongside dcf model template in excel will teach you how to build a basic discounted cash flow model. First name * email * submit. Download wso's free discounted cash flow (dcf) model template below! N = the period number. Detailed instructions guide you through inputting appropriate figures like operating costs, expected revenues, capital expenditures, and discount rates. First name * email * submit. Estimate value of future cash flows. Contact information can also be included here. However, if cash flows are different each year, you will have to discount each cash flow separately: This dcf model training guide will teach you the basics, step by. Dcf = cf1 / (1+r)^1 + cf2 / (1+r)^2 +. Web download sample discounted cash flow excel template — excel. Excel template | file download form. Download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. Fcff = ebit × (1−t) + depreciation − capital expenditures −. Web period #1 (explicit forecast period): (if you’ve already downloaded the excel template file from part 1, you’re all good — this lesson uses the same file). A brief description of the model’s purpose. Enter your estimated cash inflows and outflows into the template. Web discounted cash flow excel model template (dcf template) aims to help you calculate the value of a business. Web before we begin, download the dcf template. Web download sample discounted cash flow excel template — excel. Forecast future cash flows and determine the present value of these cash flows by discounting. Web dcf stands for d iscounted c ash. Web before we begin, download the dcf template. Download the free dcf model template. Download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. Cf = cash flow in the period. R = the interest rate or discount rate. The discount rate and cash flow growth rate stop changing because the company is. This dcf model training guide will teach you the basics, step by. Use the form below to. Estimate value of future cash flows. Web before we begin, download the dcf template. Download wso's free discounted cash flow (dcf) model template below! Contact information can also be included here. Fcff = ebit × (1−t) + depreciation − capital expenditures −. Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Enter your name and email in the form and download the free template now! So what does a dcf entail and why do we use it? It looks at the present value of annual cash flows, allowing you to adjust the template for the discount rate. It is often used in discounted cash flow (dcf) analysis to determine the intrinsic value of a company’s equity. So, this model calculates the present. N = the period number. Web discounted cash flow excel model template (dcf template) aims to help you calculate the value of a business.

discounted cash flow excel template —

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Discounted Cash Flow Model Excel Template

How To Use Excel To Calculate Discounted Cash Flow Rate Of Return

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

DCF Discounted Cash Flow Model Excel Template Eloquens

Discounted Cash Flow Model Excel Template

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

Web The Dcf Template Is An Excel Spreadsheet That Allows You To Input Data And Perform Calculations To Determine The Intrinsic Value Of A Stock.

Web Dcf Stands For D Iscounted C Ash F Low, So A Dcf Model Is Simply A Forecast Of A Company’s Unlevered Free Cash Flow Discounted Back To Today’s Value, Which Is Called The Net Present Value (Npv).

This Ufcf Calculation Template Provides You With Insight Into The Tangible And Intangible Assets Generated By Your Business That Are Available For Distribution To All Capital Providers.

Web This File Allows You To Calculate Discounted Cash Flow In Excel.

Related Post: