Discounted Cash Flow Template

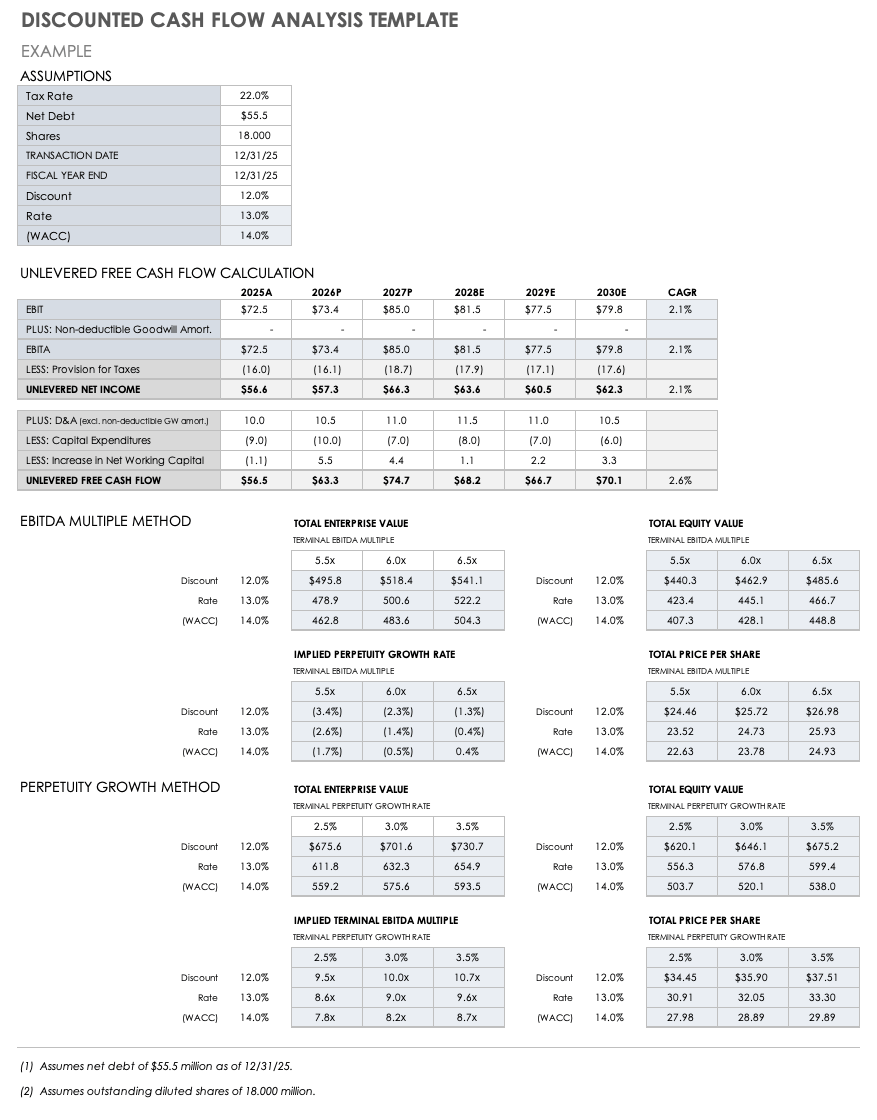

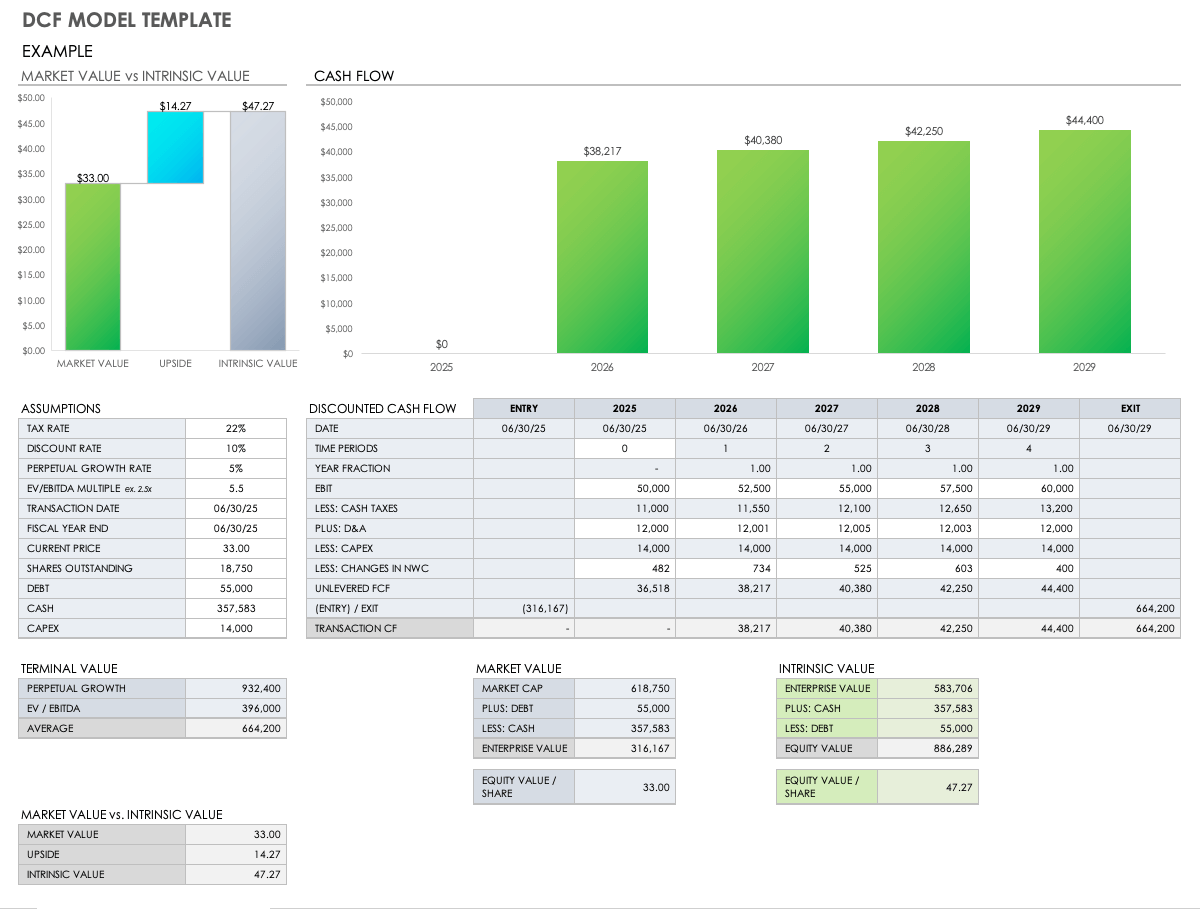

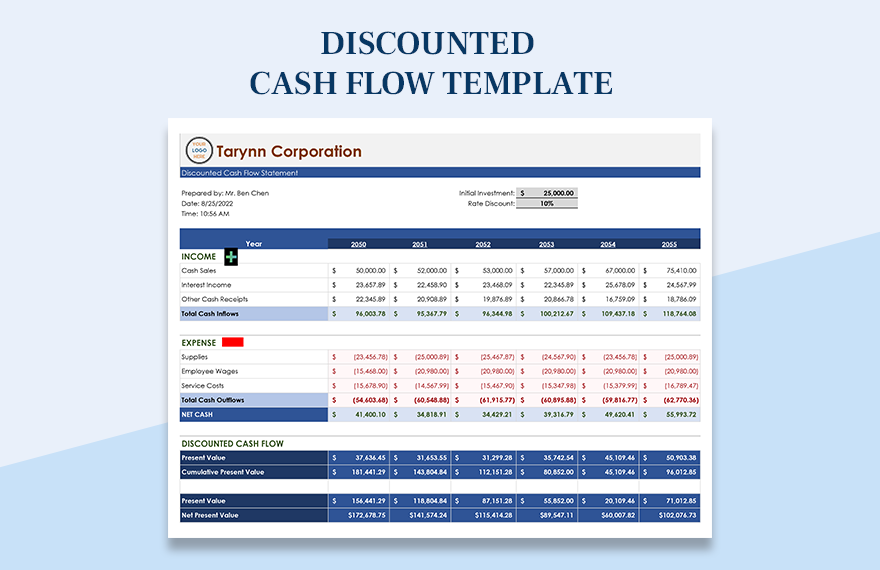

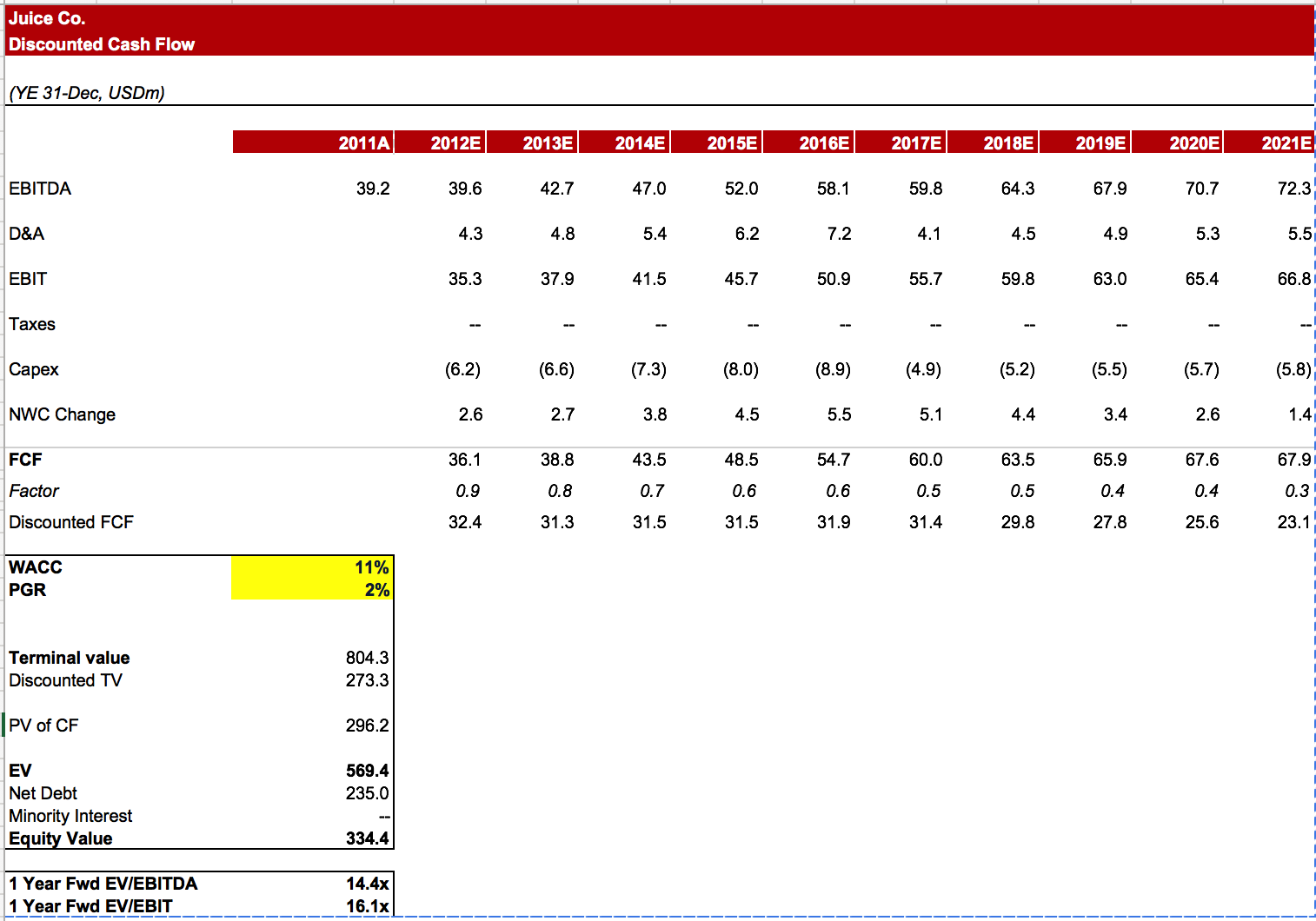

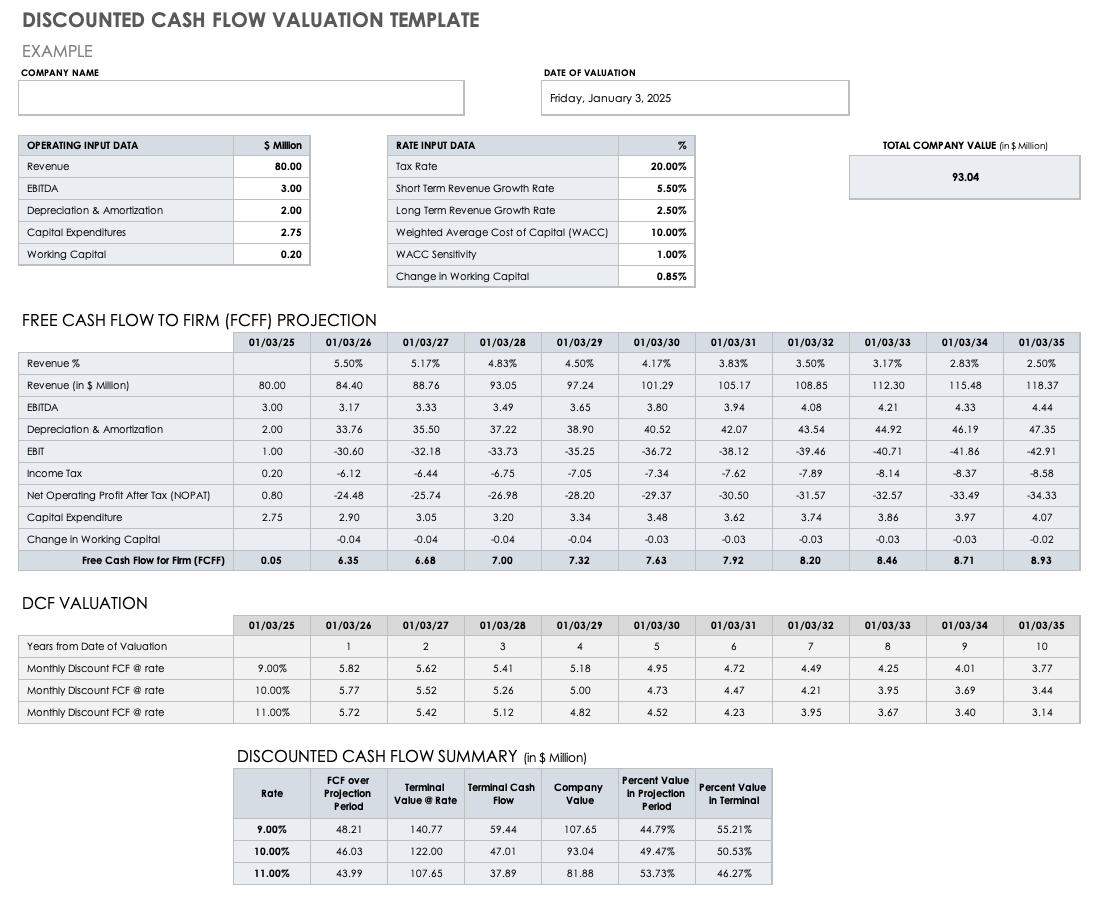

Discounted Cash Flow Template - Dcf stands for d iscounted c ash f low, so a dcf model is simply a. Web use excel formulas like =npv (discount rate, range of cash flows) to calculate the present value of those cash flows. Sum the discounted cash flows to find. Tailored for both beginners and professionals. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. Web download free discounted cash flow (dcf) templates for valuing a company, a project, or an asset based on future cash flows. Web download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of the period. Advantages and disadvantages of discounted cash flow analysis. Web what is a dcf model? Try macabacus for free to accelerate financial modeling in excel. Use our dcf model template for your financial valuations. Dcf analysis can be applied to value a. Dcf stands for d iscounted c ash f low, so a dcf model is simply a. Enhance your financial analysis with our discounted cash flow template: Web discounted cash flow (dcf) is a method of valuing a project, company, or asset using the present value of future cash flows. This technique discounts future cash flows back to. Enhance your financial analysis with our discounted cash flow template: A dcf model is a specific type of financial modeling tool used to value a business. Dcf stands for. This dcf analysis template guides through business valuation by estimating & discounting cash flows, terminal value, & equating to. Web use excel formulas like =npv (discount rate, range of cash flows) to calculate the present value of those cash flows. Download wso's free discounted cash flow (dcf) model template below! A discounted cash flow (dcf) analysis is one of the. Web how to calculate a dcf model in excel. Web what is a dcf model? This technique discounts future cash flows back to. Sum the discounted cash flows to find. Tailored for both beginners and professionals. Web how to calculate a dcf model in excel. Web use excel formulas like =npv (discount rate, range of cash flows) to calculate the present value of those cash flows. A comprehensive workflow for calculating, evaluating, and. Discounted cash flow (dcf) analysis. Sum the discounted cash flows to find. Web download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. This technique discounts future cash flows back to. Web discounted cash flow analysis template. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc). A comprehensive workflow for calculating, evaluating, and. Dcf stands for d iscounted c ash f low, so a dcf model is simply a. Enhance your financial analysis with our discounted cash flow template: Web discounted cash flow (dcf) model template. Tailored for both beginners and professionals. Web how to calculate a dcf model in excel. Sum the discounted cash flows to find. Use our dcf model template for your financial valuations. A comprehensive workflow for calculating, evaluating, and. Try macabacus for free to accelerate financial modeling in excel. Advantages and disadvantages of discounted cash flow analysis. Tailored for both beginners and professionals. Enhance your financial analysis with our discounted cash flow template: Web download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. Web discounted cash flow (dcf) model template. Dcf analysis can be applied to value a. This dcf analysis template guides through business valuation by estimating & discounting cash flows, terminal value, & equating to. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Download wso's free discounted cash flow (dcf) model template below!. Dcf stands for d iscounted c ash f low, so a dcf model is simply a. Advantages and disadvantages of discounted cash flow analysis. A discounted cash flow (dcf) analysis is one of the most important tools an investor can use to determine the intrinsic value of a stock. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. Use our dcf model template for your financial valuations. Sum the discounted cash flows to find. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of the period. Common challenges when performing a dcf. Web discounted cash flow (dcf) model template. Web what is a dcf model? Dcf analysis can be applied to value a. Enhance your financial analysis with our discounted cash flow template: Web use excel formulas like =npv (discount rate, range of cash flows) to calculate the present value of those cash flows. Tailored for both beginners and professionals. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Web discounted cash flow analysis template.

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Free Discounted Cash Flow Templates Smartsheet

Free Discounted Cash Flow Templates Smartsheet

Free Discounted Cash Flow Templates Smartsheet

Cash Flow Analysis Template 11+ Download Free Documents in PDF, Word

Discounted Cash Flow Template Google Docs, Google Sheets, Excel, Word

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

Free Discounted Cash Flow Templates Smartsheet

Forecast Future Cash Flows And Determine The.

Try Macabacus For Free To Accelerate Financial Modeling In Excel.

Web Download Free Discounted Cash Flow (Dcf) Templates For Valuing A Company, A Project, Or An Asset Based On Future Cash Flows.

Web Discounted Cash Flow Valuation Model:

Related Post: