Donation Receipt Letter Template

Donation Receipt Letter Template - It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. Don’t stress out, here’s everything you need to know, including official us and canadian donation receipt requirements, and. Web no stress and no hassle! Standards and regulations of the internal revenue service (irs). Microsoft word (.docx) cash donation receipt template. Web how to give a cash donation (3 steps) accept the donation from a recipient. After the receipt has been issued, the donor will be. The templates provide a standardized format for generating receipts, ensuring donors receive proper charitable contributions. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: A donation can be in the form of cash or property. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: According to the irs website : Web under the laws of the united states of america that there were no goods or services provided as. A donation receipt is of. Don’t stress out, here’s everything you need to know,. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. It’s a good idea to start your donation receipt templates with a generic email or letter. Web these email and letter templates will help you create compelling donation receipts without taking your time away from. Web often a goodwill donation receipt is presented as a letter or an email, which is given or sent to the benefactor after the donation has been received. Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the united states of america that there were no goods or services provided. Don’t stress out, here’s everything you need to know, including official us and canadian donation receipt requirements, and. Consider which way you’ll want to create the. Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the united states of america that there were no goods or services provided as part. Consider which way you’ll want to create the. Web our donation receipt templates can help you quickly send a receipt to all of your donors. It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. There are various types of receipts including the following: Web donation receipt letter template in pdf. First, let’s talk about the practical information you need to include in your receipt. Web our donation receipt templates can help you quickly send a receipt to all of your donors. Web so, a donation just came in, and you need to acknowledge the donation by sending a donation receipt letter, or the end of the year has rolled around,. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Check out 45+ free donation receipt templates. Web so, a donation just came in, and you need to acknowledge the donation by sending a donation receipt letter, or the end of the year has rolled around,. Check out our advantage calculator to easily. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Web how to give a cash donation (3 steps) accept the donation from a recipient. Web our donation receipt templates can help you quickly send a receipt to all of your donors.. The templates provide a standardized format for generating receipts, ensuring donors receive proper charitable contributions. Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the united states of america that there were no goods or services provided as part of this donation. 2 the importance of information receipts for benefactors. A donation receipt can be in the form of a letter, card, or email. Microsoft word (.docx) cash donation receipt template. It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. Use our easy template editor. Web a donation receipt acts as a written record that a donor is given, proving that a gift. Consider making the receipt look more like a letter, so it’s more personal than a typical receipt (use our receipt maker to do this easily). 34 first street, gig harbor, wa, 98332. These receipts are also used for tax purposes by the organization. Web our donation receipt templates can help you quickly send a receipt to all of your donors. There are various types of receipts including the following: Web a donation receipt provides documentation to those who give to your organization and serves as a record for tax purposes. Check out our advantage calculator to easily. Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. Scroll down to “enhance your campaign” and click “receipt emails.”. Web finally, the donation receipt can either be an email, a letter, a form, or a postcard sent to the donor. 3 information which should be incorporated in a donation receipt. Standards and regulations of the internal revenue service (irs). Web donation receipt letter template in pdf. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. After the receipt has been issued, the donor will be.

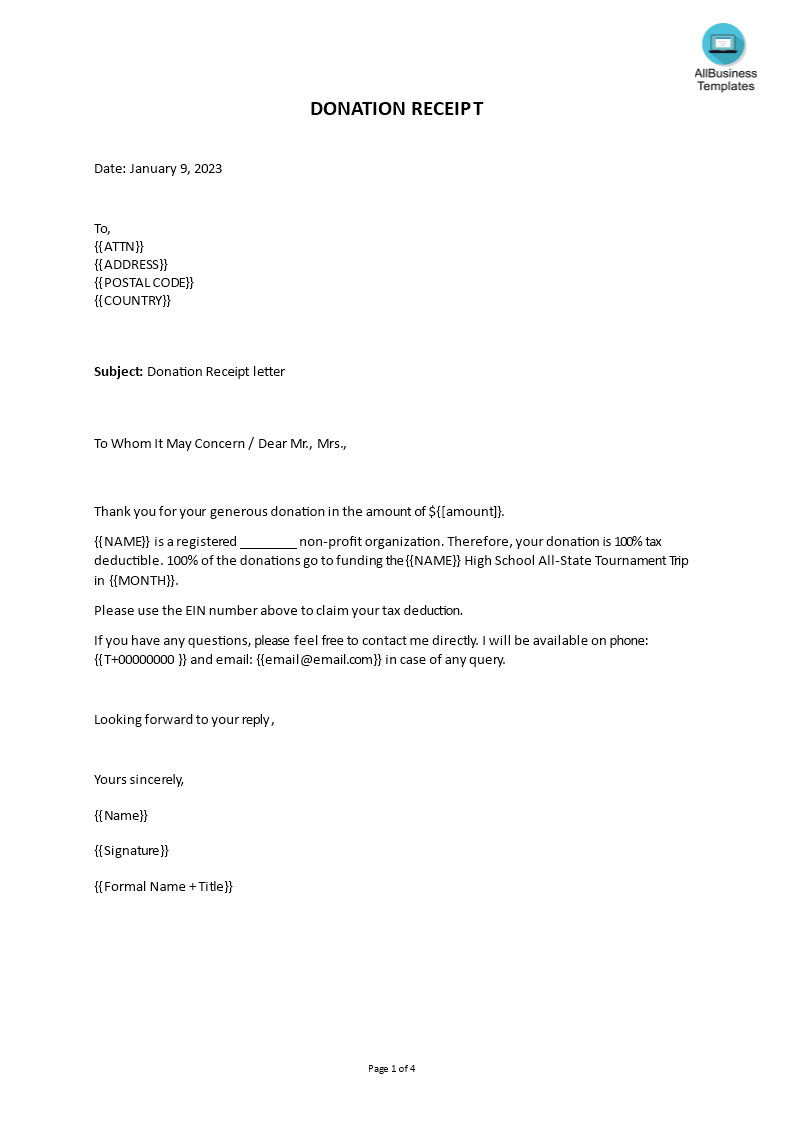

Donation Receipt Template in Microsoft Word

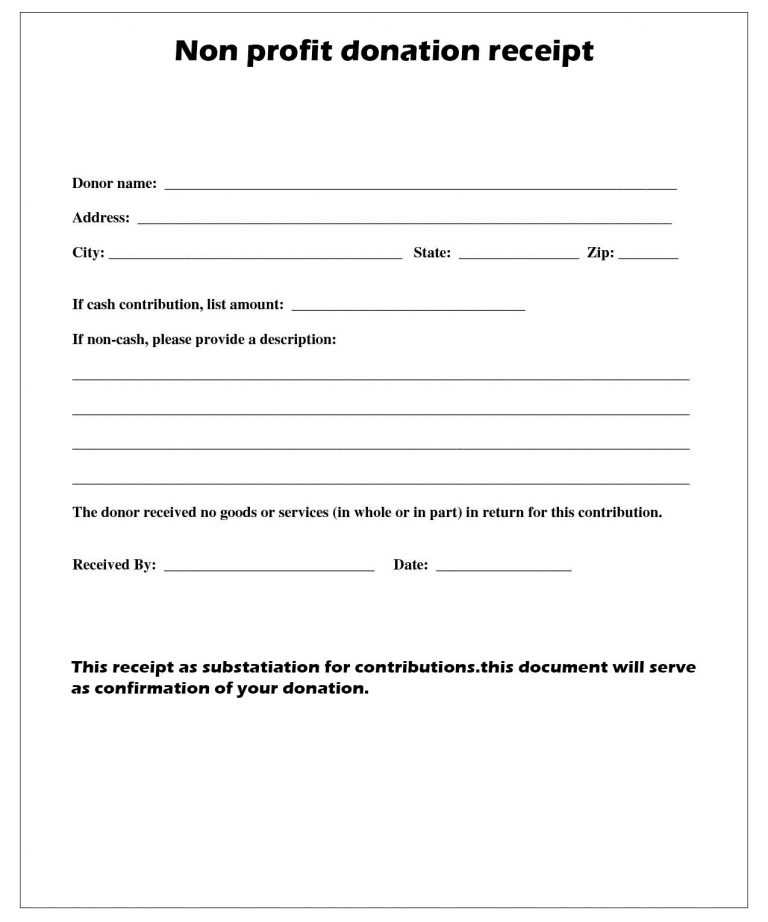

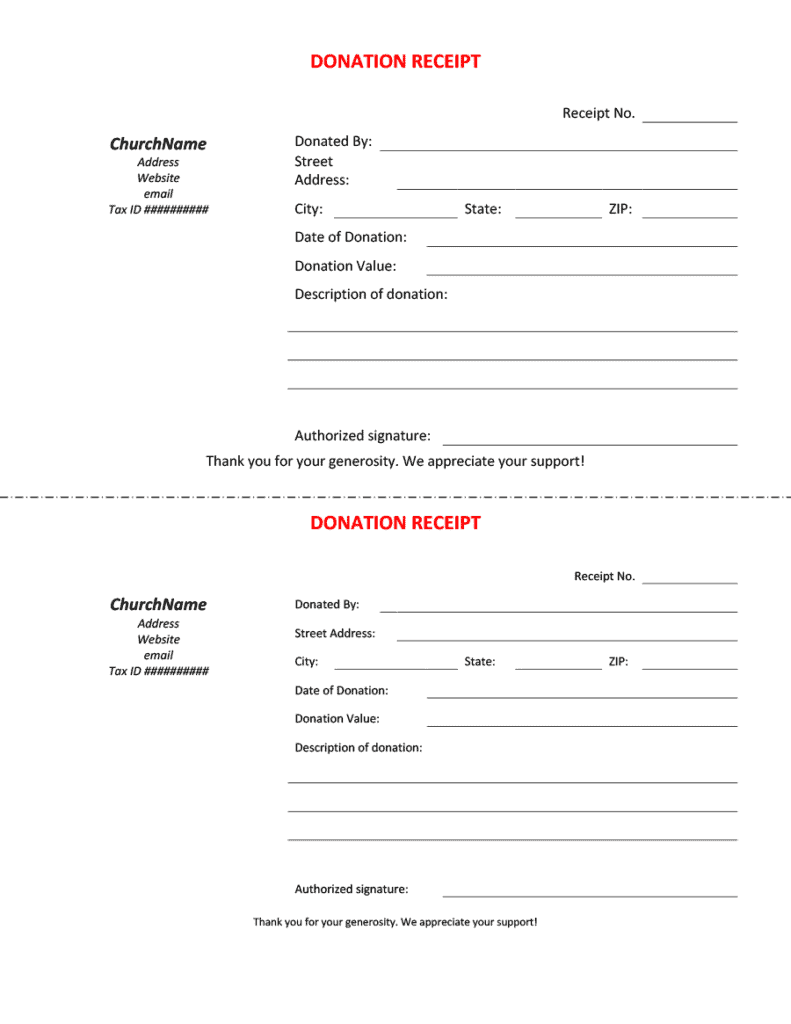

Free Sample Printable Donation Receipt Template Form

FREE 51+ Sample Donation Letter Templates in MS Word Pages Google

Donation Receipt Letter Templates at

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

6+ Free Donation Receipt Templates

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

Donation Receipt Letter Templates at

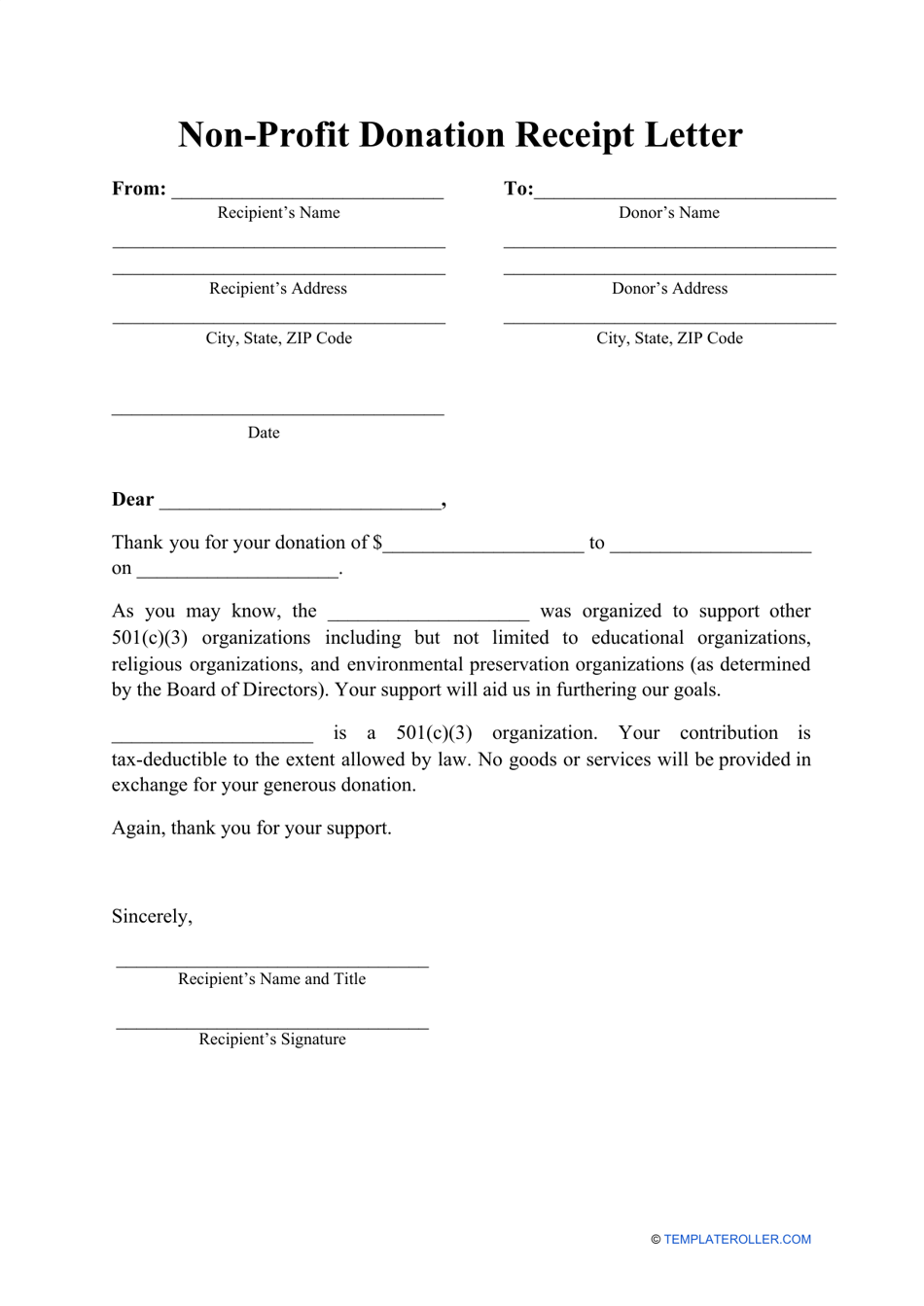

Nonprofit Donation Receipt Letter Template Download Printable PDF

Printable Donation Receipt Letter Template Printable Templates

It’s Important To Remember That Without A Written Acknowledgment, The Donor Cannot Claim The Tax Deduction.

If You Are Responsible For Creating A Document Like This For Your Organization, These Charitable Donation Receipt Templates Make It Easy To Acknowledge Gifts From Your Donors In A Variety Of Situations.

It’s Utilized By An Individual That Has Donated Cash Or Payment, Personal Property, Or A Vehicle And Seeking To Claim The Donation As A Tax Deduction.

The Written Acknowledgment Required To Substantiate A Charitable Contribution Of $250 Or More Must Contain The Following Information:

Related Post: