Donation Tax Receipt Template

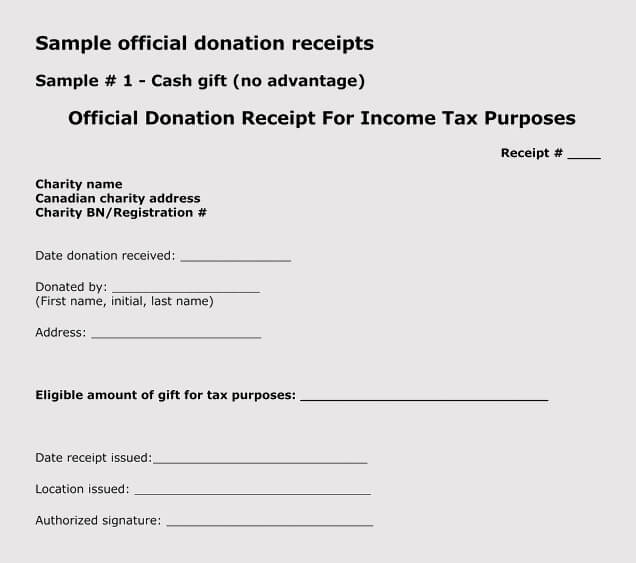

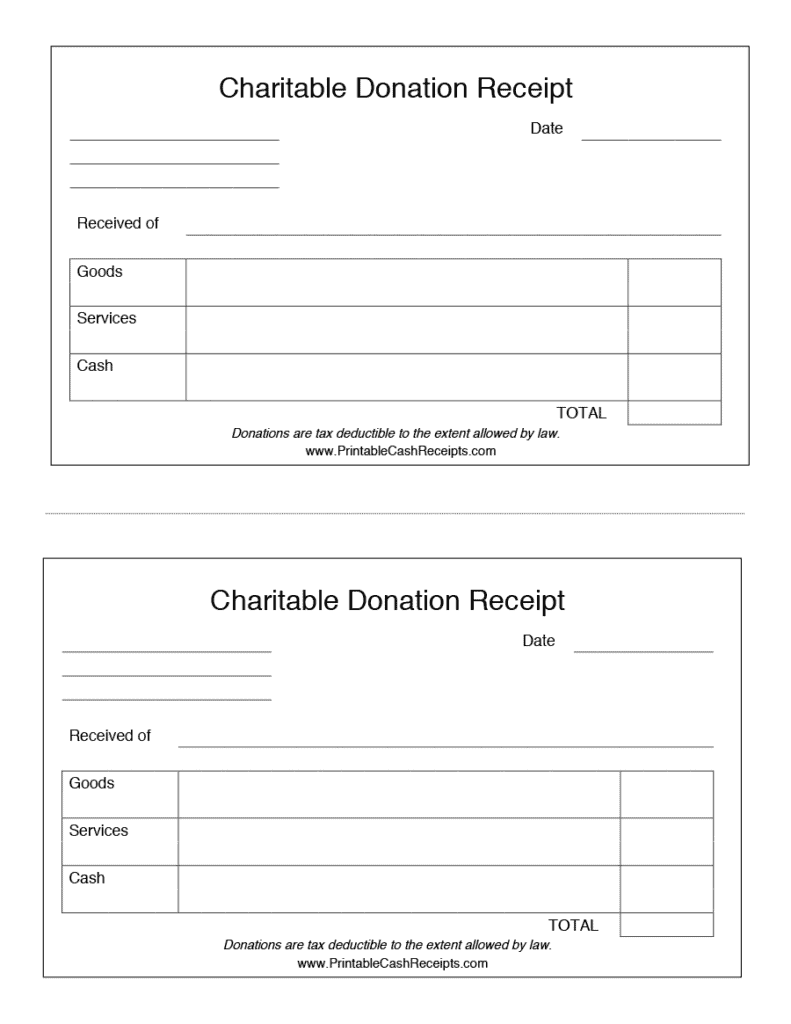

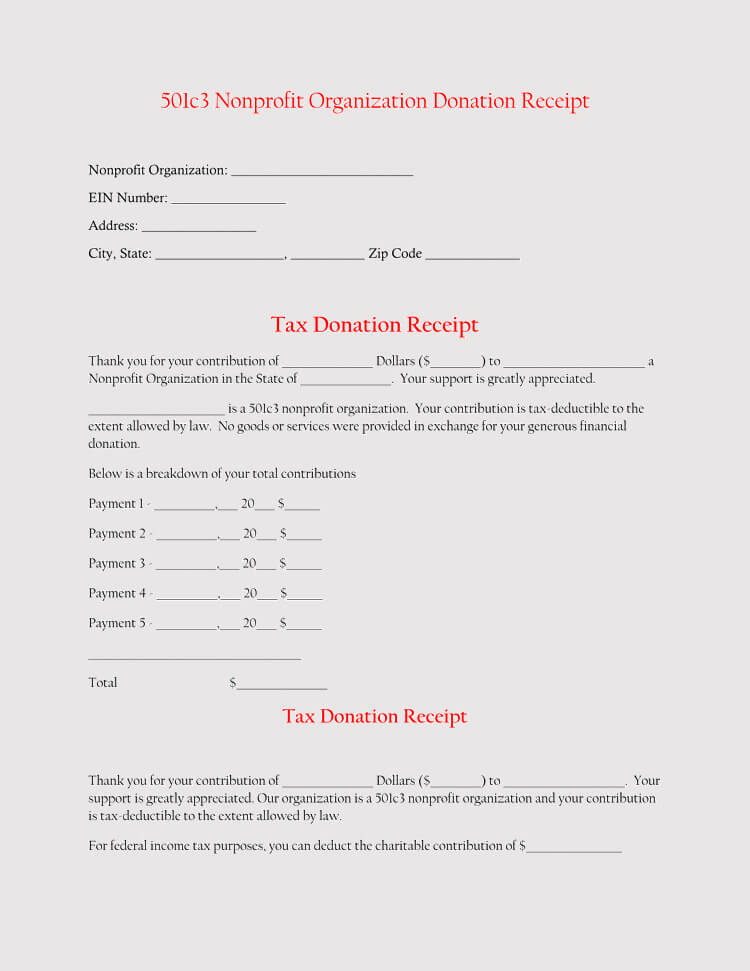

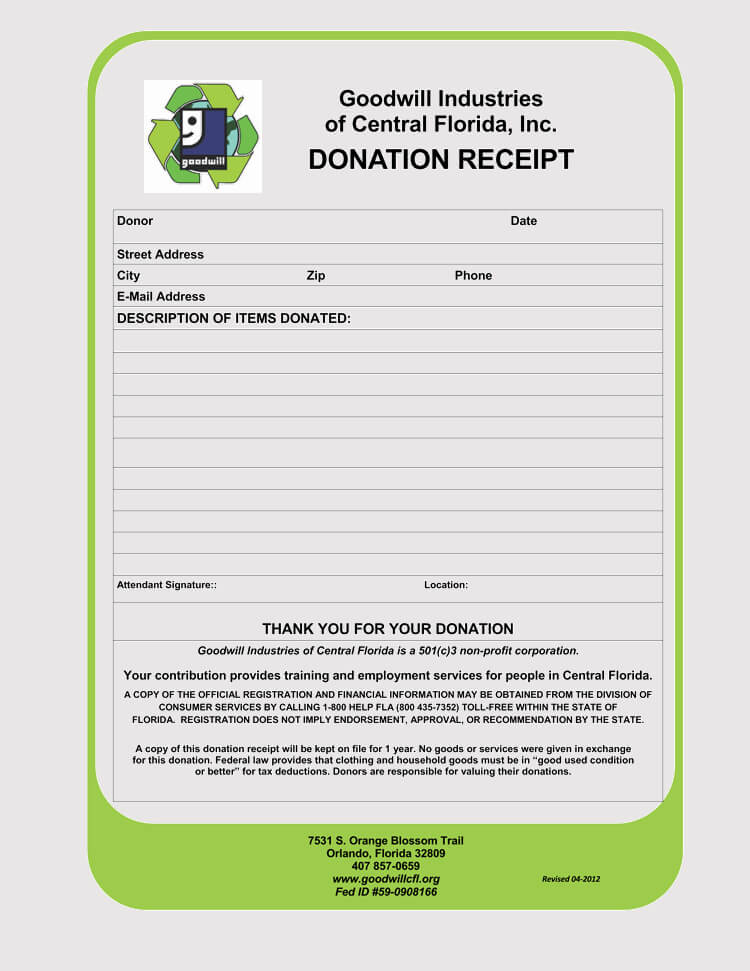

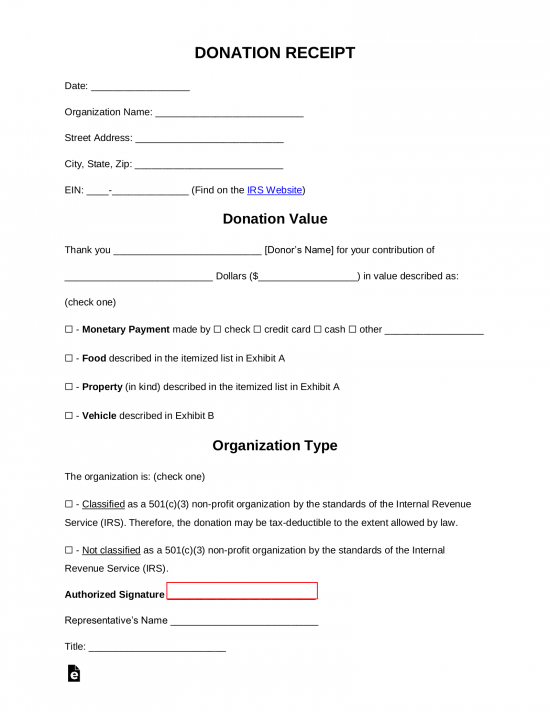

Donation Tax Receipt Template - Web customize receipt template with your organization’s information; The irs requires donation receipts in certain situations: Web a donation tax receipt is essential for your organization and donors, and they ensure you’re maintaining good relationships with your donors. Web a 501c3 donation receipt template is issued only by registered charitable organizations and allows users to claim tax benefits based on their donations. Please refer to irs publication 561 for information determining the value. Microsoft word (.docx) cash donation receipt template. A donor gives a charity a house valued at $100,000. Deliver the written acknowledgment of the contribution. The holiday giving season, the most significant part of. Web in the charitable donation process, proper documentation is essential to ensure transparency, accountability, and compliance. Web a donation tax receipt is essential for your organization and donors, and they ensure you’re maintaining good relationships with your donors. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Simplify your process and ensure transparency and gratitude towards your generous donors. Please refer to irs publication 561 for information determining the value. Goodwill provides a donation value guide to help determine fair market value. Simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. As described above, this means. Web donors can choose the 501(c)(3) donation receipt template that fits best their needs. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. The irs requires donation receipts in certain situations: Receipt templates simple donation receipt. Web a donation tax receipt is essential for your organization and donors, and they ensure you’re maintaining good relationships with your donors. A donation receipt is used by. Web from the donor side of things, receipts are important when it comes to tax time. Web how to give a cash donation (3 steps) accept the donation from a recipient. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Charities are only required to submit 501c3 donation receipts for amounts. Web updated december 18, 2023. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization.primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. So, the eligible amount of. Please refer to irs publication 561 for information determining the value. Web donors can choose the 501(c)(3) donation receipt template that fits best their needs. Web how to give a cash donation (3 steps) accept the donation from a recipient. Microsoft word (.docx) cash donation receipt template. First, craft the outline of your donation receipt with all the legal requirements. So, the eligible amount of the gift is $80,000. According to the irs website : The amount of the advantage ($20,000) must be subtracted from the amount of the gift (the $100,000 value of the house). Goodwill provides a donation value guide to help determine fair market value. First, let’s talk about the practical information you need to include in. This can be achieved by automating the process of issuing donation tax receipts (more on this below). Web donation receipt template. This value is determined by you, the donor. Web donors can choose the 501(c)(3) donation receipt template that fits best their needs. Receipt templates simple donation receipt. The charity gives the donor $20,000 in return. According to the irs website : Whatever the form, every receipt must include six items. The irs requires donation receipts in certain situations: So, the eligible amount of the gift is $80,000. Web customize receipt template with your organization’s information; Microsoft word (.docx) cash donation receipt template. You can search for an ein on the irs website. These free printable templates in pdf and word format simplify the. A donor gives a charity a house valued at $100,000. So, the eligible amount of the gift is $80,000. Single donations greater than $250. Receipt templates simple donation receipt. Web and, with a letter builder, you can also create a free, printable donation receipt template to use again and again. Inform the recipient about recordkeeping. The holiday giving season, the most significant part of. An invoice, under the guidelines of the ease of paying tax act (eopt), serves as the principal documented proof of the sale of goods… The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: First, craft the outline of your donation receipt with all the legal requirements included. First, let’s talk about the practical information you need to include in your receipt. Whatever the form, every receipt must include six items. This template is easily customizable and includes fields for donor information, donation date, and a description of the goods or services provided. You can search for an ein on the irs website. The irs requires donation receipts in certain situations: Web donation receipt template. Web updated december 18, 2023.

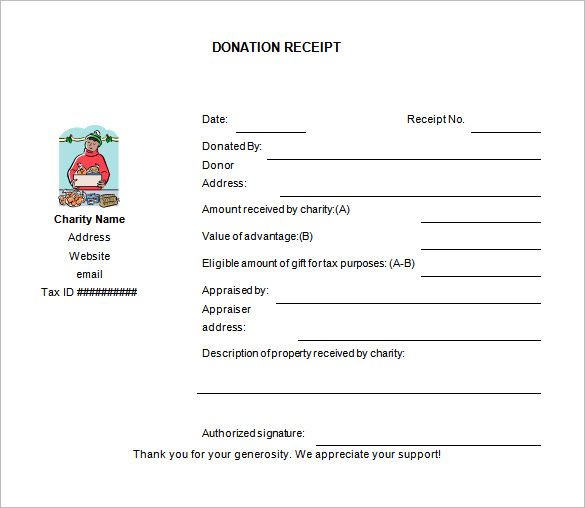

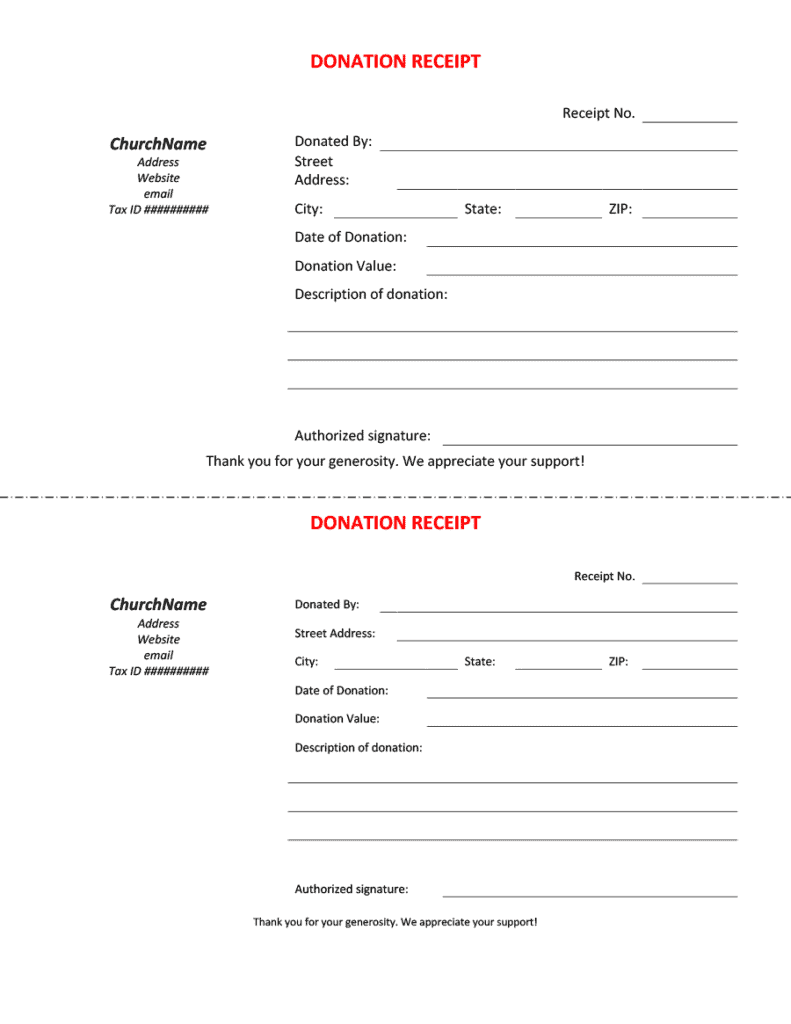

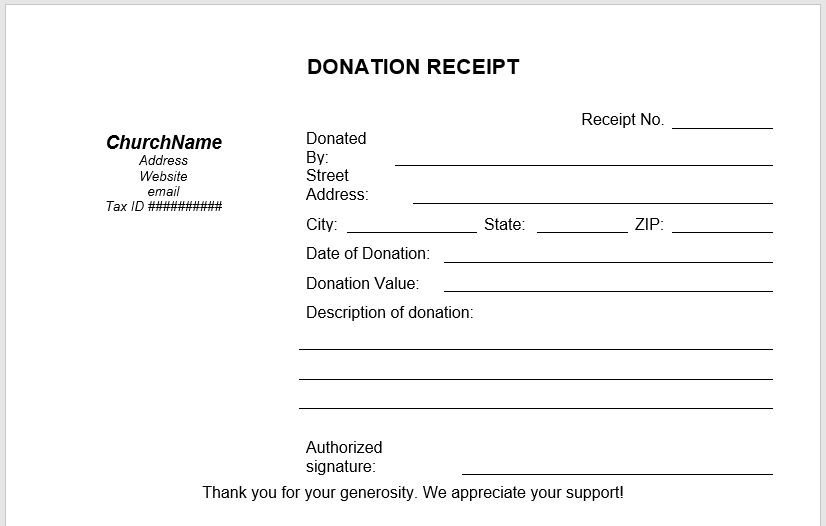

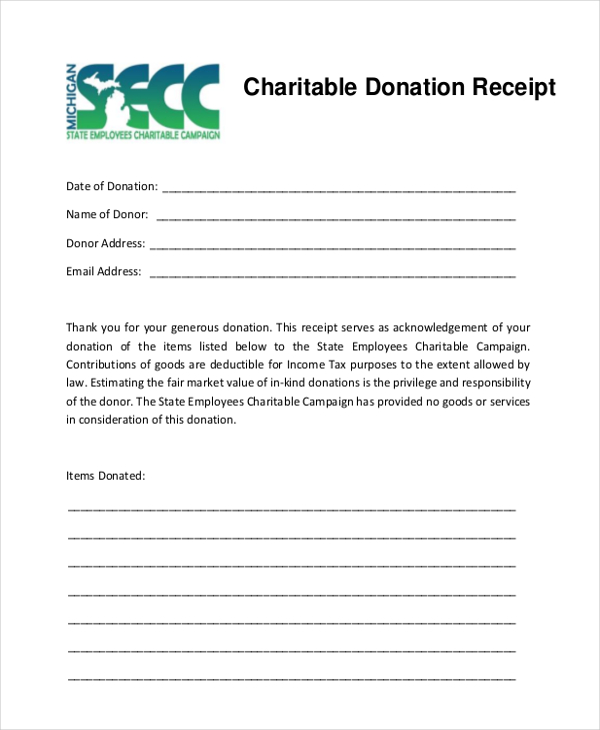

46 Free Donation Receipt Templates (501c3, NonProfit)

6+ Free Donation Receipt Templates Word Excel Formats

45+ Free Donation Receipt Templates (NonProfit) Word, PDF Receipt

46 Free Donation Receipt Templates (501c3, NonProfit)

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

Nonprofit Receipt 5+ Examples, Format, Pdf Examples

6+ Free Donation Receipt Templates

5 Free Donation Receipt Templates in MS Word Templates

Free Donation Receipt Templates Samples PDF Word eForms

FREE 8+ Sample Donation Receipt Forms in PDF Excel

Also Known As Its Ein, The Tax Id Number Is Provided By The Irs That Legally Identifies The Organization.

Please Refer To Irs Publication 561 For Information Determining The Value.

Goodwill Employees Cannot Help Determine Fair Market Value.

A Donor Gives A Charity A House Valued At $100,000.

Related Post: