Esma Securitisation Reporting Templates

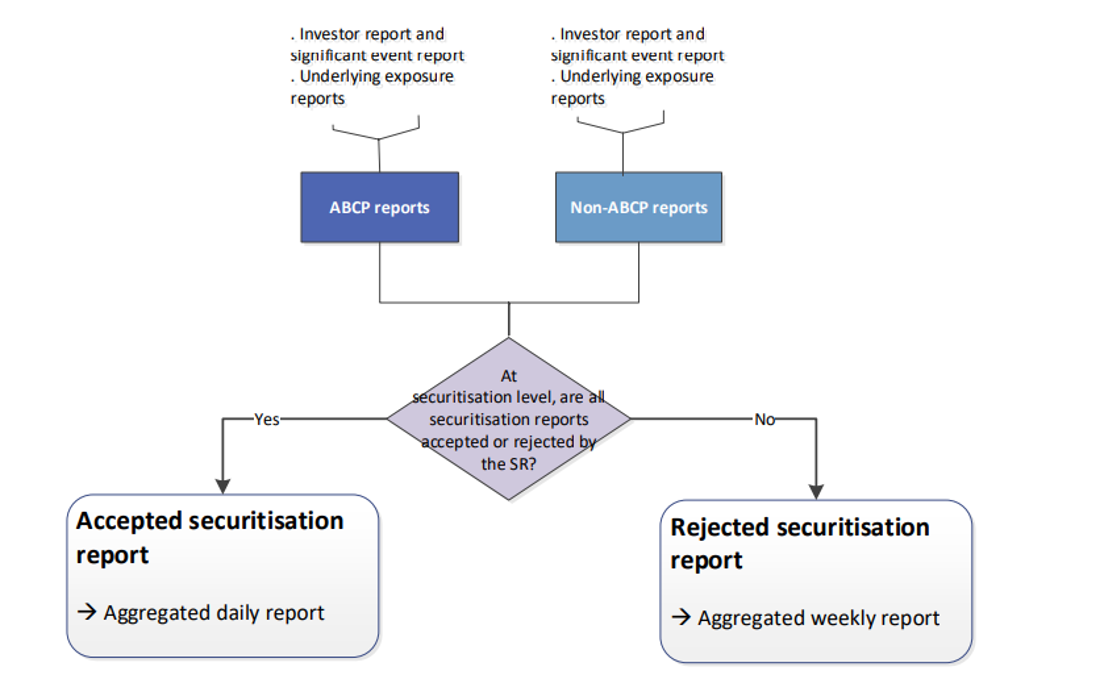

Esma Securitisation Reporting Templates - Web esma5was mandated under article 7 of the securitisation regulation to prepare draft technical standards as regards the detailed information on the underlying exposures and. Web esma has expanded the ability for reporting entities to use the “no data” options in the respective disclosure templates, in particular in the templates for abcp. (6) esma has conducted an open public consultation on the. These are available below using a format that aims to assist stakeholders in their analysis of the technical. The new reports have a prescribed form and. Web esma should draw up a dedicated reporting template for private transactions. Web the adoption of the reporting templates rts follows on from the publication in july 2019 by the european securities and markets authority (“ esma ”) of additional resources to assist market. Article 7 of the securitisation regulation sets out the transparency requirements for all types of securitisations. No introduction of a simple, transparent and standardised (sts) equivalence regime. Web able via a securitisation repository, the reporting format should also take into account. Web comparison, assessment and verification of completeness and consistency (see esma’s final report on securitisation repository technical standards). Web esma published version 1.3.0 of the xml schema and validation rules on disclosure templates as well as version 1.3.0 of the xml schema and technical. Web esma's securitisation reporting templates consultation identifies four possible options. Web the adoption of the reporting. Esma publishes q&as and revised disclosure templates for securitisation. Web esma securitisation reporting q&as disclosure templates. Esma reporting templates to be used as of 1 october 2021, replacing the current ecb templates. Web the adoption of the reporting templates rts follows on from the publication in july 2019 by the european securities and markets authority (“ esma ”) of additional. Web comparison, assessment and verification of completeness and consistency (see esma’s final report on securitisation repository technical standards). Web esma5was mandated under article 7 of the securitisation regulation to prepare draft technical standards as regards the detailed information on the underlying exposures and. Web esma published version 1.3.0 of the xml schema and validation rules on disclosure templates as well. Web esma has published a consultation paper in relation to the securitisation disclosure templates under article 7 of the eu securitisation regulation. Web the reporting templates are available in the xml format on european securities and markets authority’s (“esma “) website, and esma questions & answers. The european securities and markets authority, the eu’s securities markets’ regulator, has today published. The srs, upon reception/ validation of a public securitisation report, should inform the reporting entities on the status of the received report. Web securitisation disclosure templates reporting instructions securitisation disclosure templates reporting instructions. Web the adoption of the reporting templates rts follows on from the publication in july 2019 by the european securities and markets authority (“ esma ”) of. Web esma5was mandated under article 7 of the securitisation regulation to prepare draft technical standards as regards the detailed information on the underlying exposures and. Web securitisation disclosure templates reporting instructions securitisation disclosure templates reporting instructions. Esma reporting templates to be used as of 1 october 2021, replacing the current ecb templates. Web able via a securitisation repository, the reporting. The new reports have a prescribed form and. Esma reporting templates to be used as of 1 october 2021, replacing the current ecb templates. Web the reporting templates are available in the xml format on european securities and markets authority’s (“esma “) website, and esma questions & answers. Web the templates are available on the esma website and are listed. What are the implications of the new disclosure and transparency requirements for clo issuers, sponsors and originators? The new reports have a prescribed form and. Web what are the esma reporting templates? Web the securitisation regulation (secr)2 incorporated lld requirements and also extended to other areas of information, e.g. No introduction of a simple, transparent and standardised (sts) equivalence regime. Web securitisation disclosure templates reporting instructions securitisation disclosure templates reporting instructions. Web esma has expanded the ability for reporting entities to use the “no data” options in the respective disclosure templates, in particular in the templates for abcp. The srs, upon reception/ validation of a public securitisation report, should inform the reporting entities on the status of the received report.. Web able via a securitisation repository, the reporting format should also take into account. Esma publishes q&as and revised disclosure templates for securitisation. Web what are the esma reporting templates? Web the templates are available on the esma website and are listed below: Annexes xii (nabcp) / xiii (abcp) ii/se: Standardised investor reporting.3 the current arrangement, with four sets of templates, captures the principal areas of any. Web on 21 december 2023, the european securities and markets authority ( esma) issued a consultation paper on the securitisation disclosure templates under article 7 of the securitisation regulation. Web esma published version 1.3.0 of the xml schema and validation rules on disclosure templates as well as version 1.3.0 of the xml schema and technical. Annexes xii (nabcp) / xiii (abcp) ii/se: Web esma has expanded the ability for reporting entities to use the “no data” options in the respective disclosure templates, in particular in the templates for abcp. The new reports have a prescribed form and. The srs, upon reception/ validation of a public securitisation report, should inform the reporting entities on the status of the received report. Web the reporting templates are available in the xml format on european securities and markets authority’s (“esma “) website, and esma questions & answers. (6) esma has conducted an open public consultation on the. Web the templates are available on the esma website and are listed below: Esma reporting templates to be used as of 1 october 2021, replacing the current ecb templates. Web esma5was mandated under article 7 of the securitisation regulation to prepare draft technical standards as regards the detailed information on the underlying exposures and. Web the securitisation regulation (secr)2 incorporated lld requirements and also extended to other areas of information, e.g. Web securitisation disclosure templates reporting instructions securitisation disclosure templates reporting instructions. Esma publishes q&as and revised disclosure templates for securitisation. Web the european securities and markets authority (esma) has published a consultation paper on reforming securitisation reporting templates.

Unboxing ESMA ESEF iXBRL Mandate

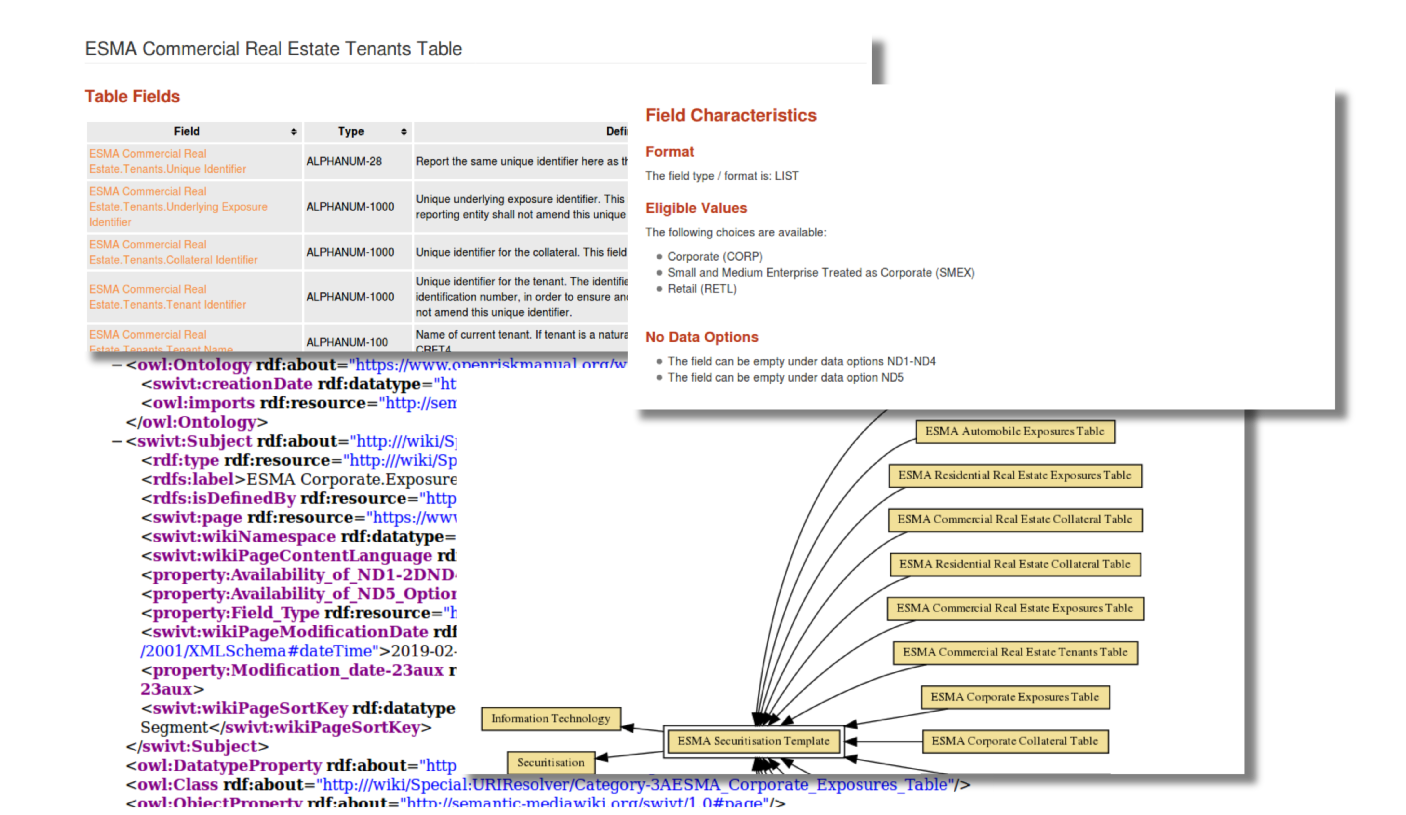

CategoryESMA Securitisation Template Open Risk Manual

Everything you need to know about reporting to a Securitisation

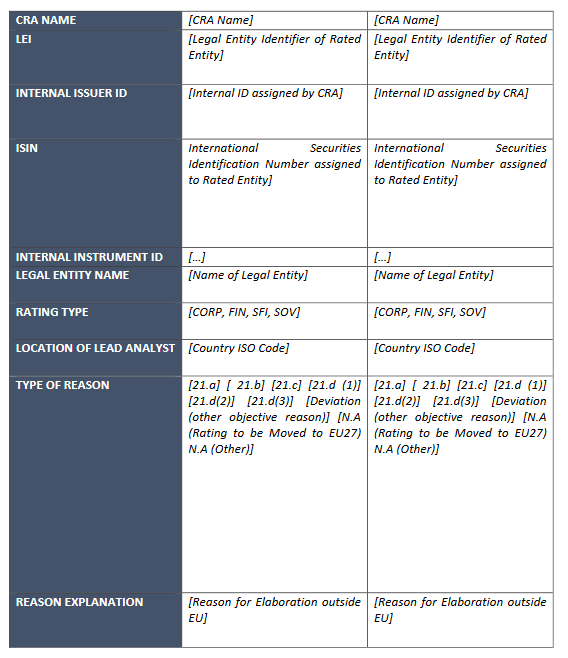

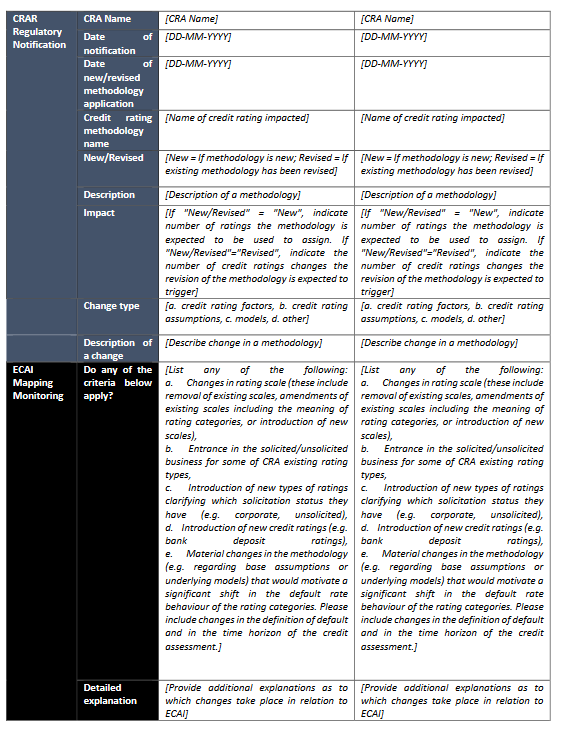

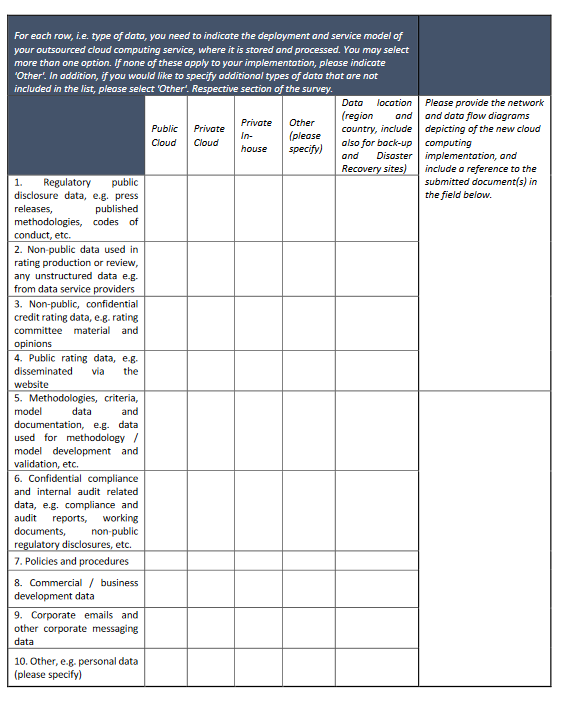

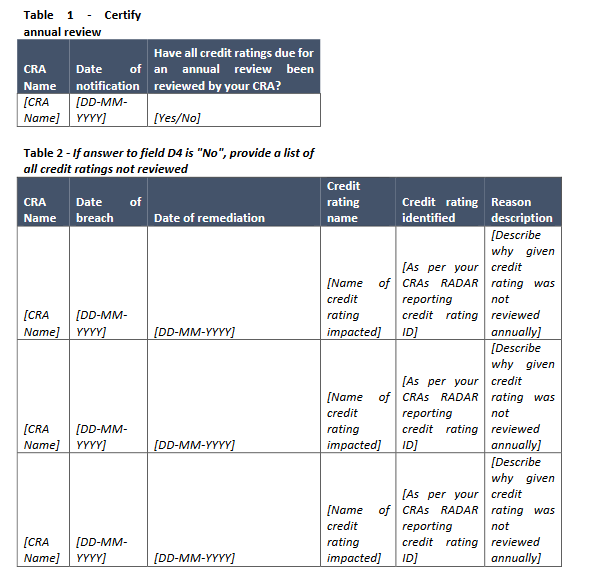

Annex II Reporting Templates Consultation Paper Guidelines on the

ESMA Securitisation Templates are now documented at the Open Risk

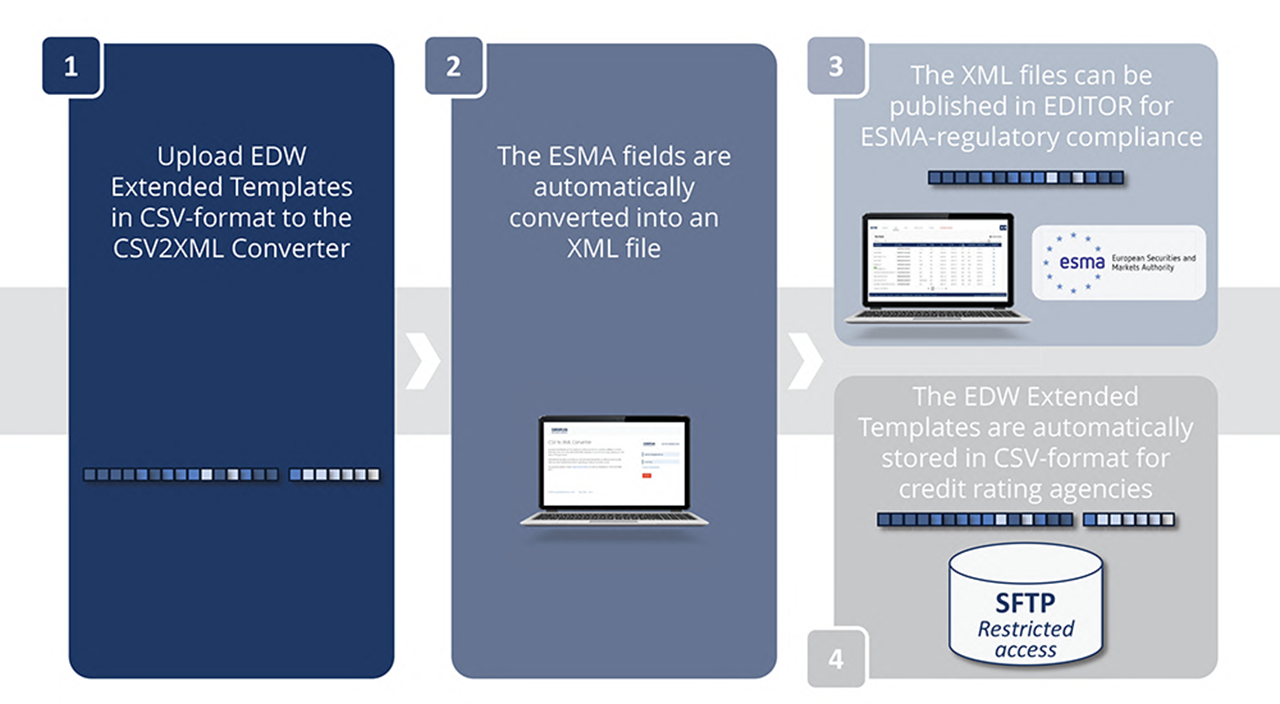

EDW EXTENDED (ESMA + RATING AGENCY) TEMPLATES European DataWarehouse

Annex II Reporting Templates Consultation Paper Guidelines on the

Annex II Reporting Templates Consultation Paper Guidelines on the

Annex II Reporting Templates Consultation Paper Guidelines on the

ESMA updates reporting standards for securitisation reporting RegTech

Web Esma Has Published A Consultation Paper In Relation To The Securitisation Disclosure Templates Under Article 7 Of The Eu Securitisation Regulation.

What Are The Implications Of The New Disclosure And Transparency Requirements For Clo Issuers, Sponsors And Originators?

Web Able Via A Securitisation Repository, The Reporting Format Should Also Take Into Account.

The European Securities And Markets Authority, The Eu’s Securities Markets’ Regulator, Has Today Published 4 New Q&As And Modified 11 Existing Q&As.

Related Post: