Excel Mileage Log Template

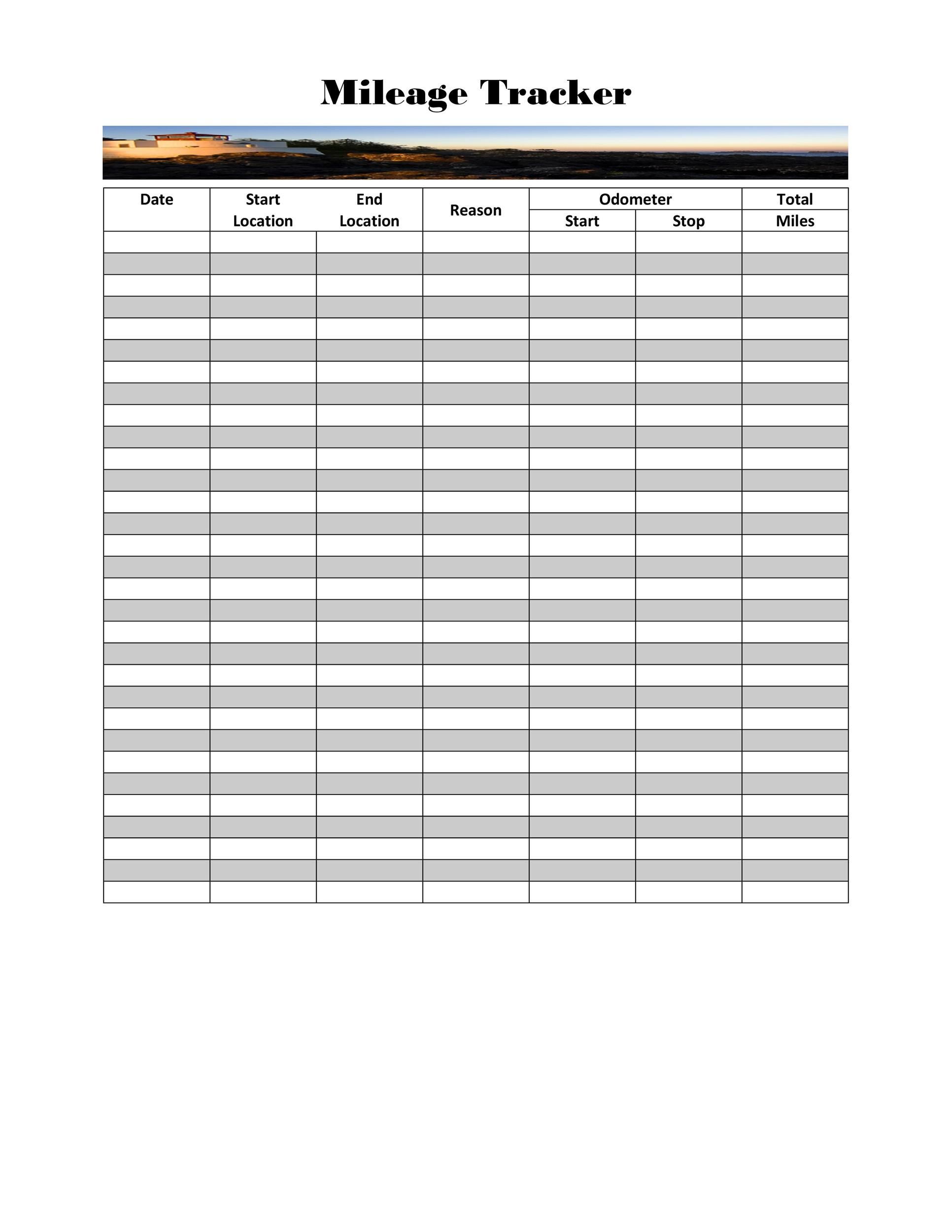

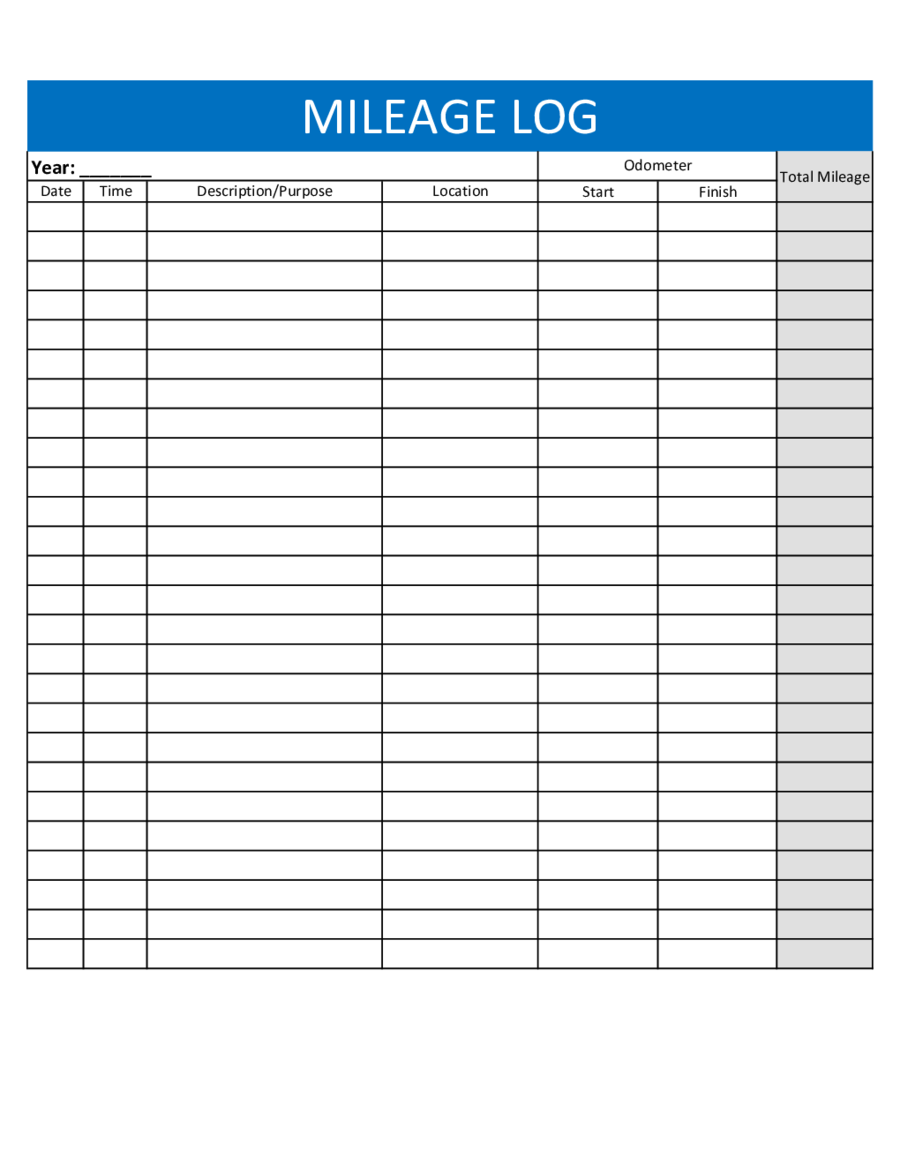

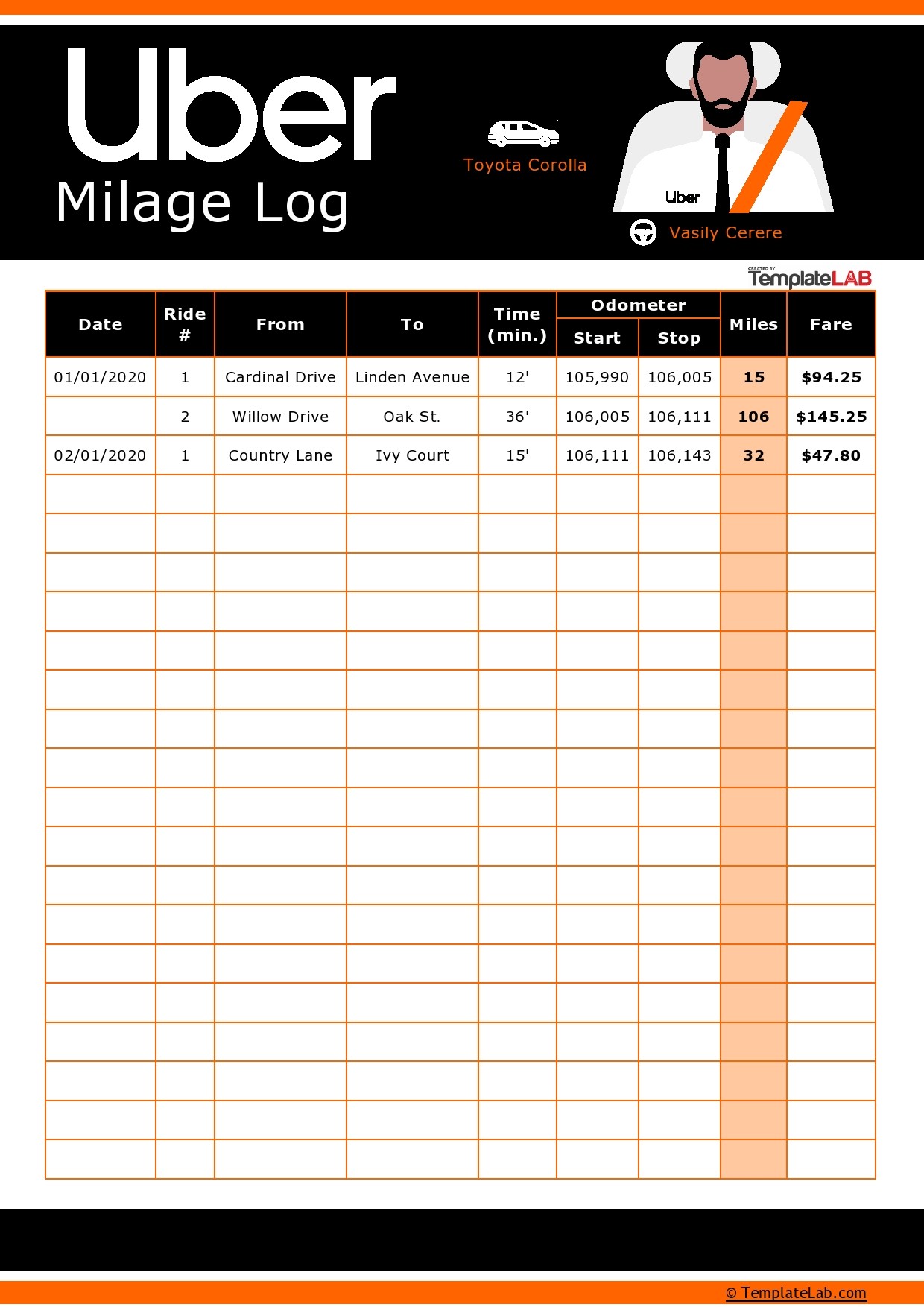

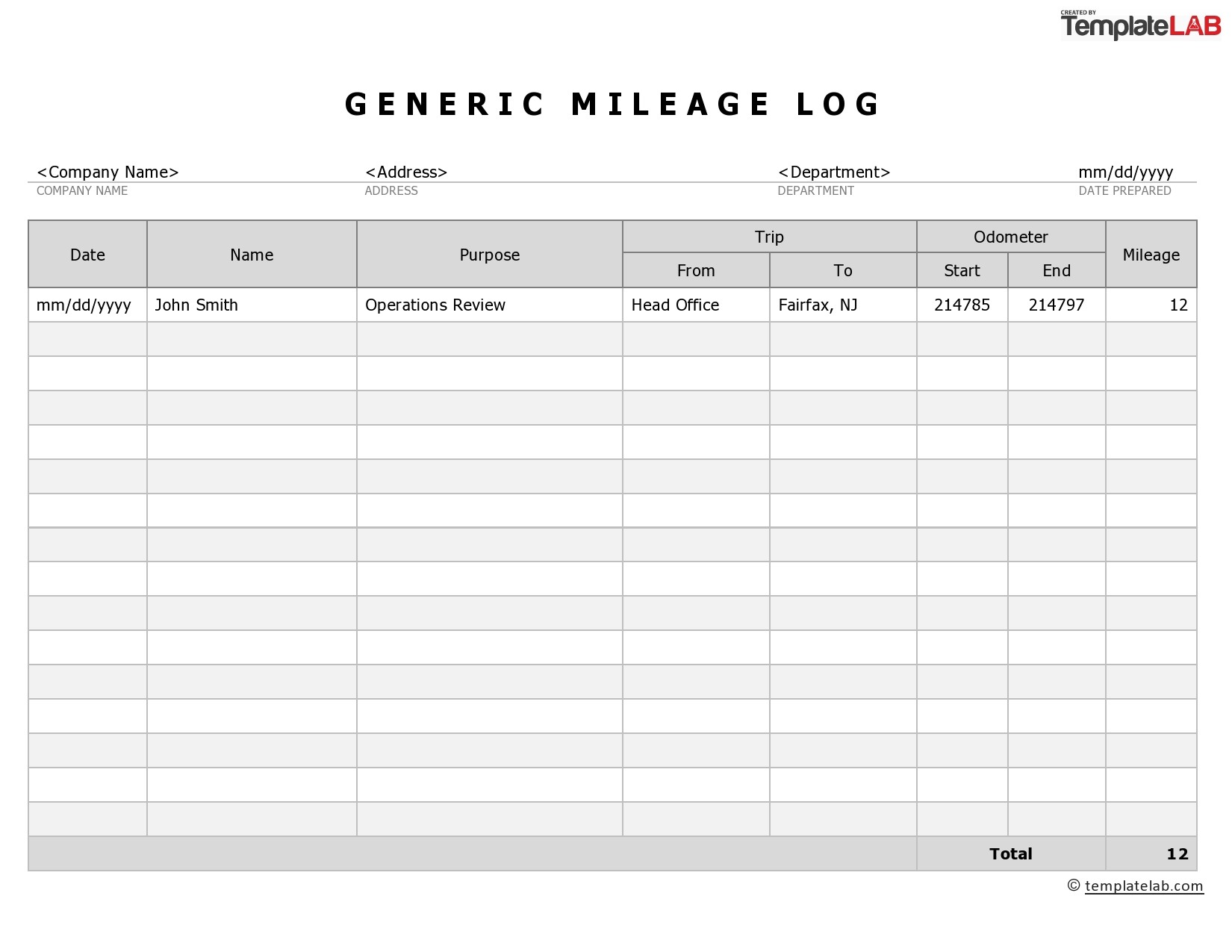

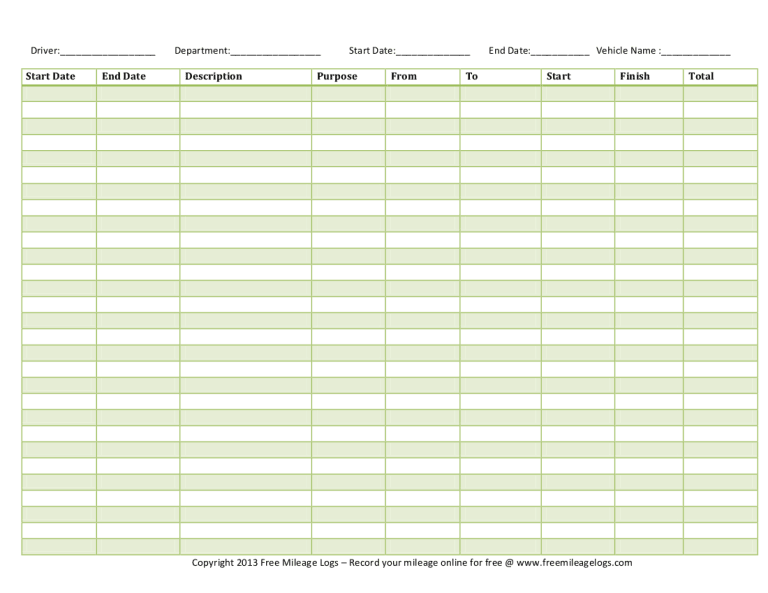

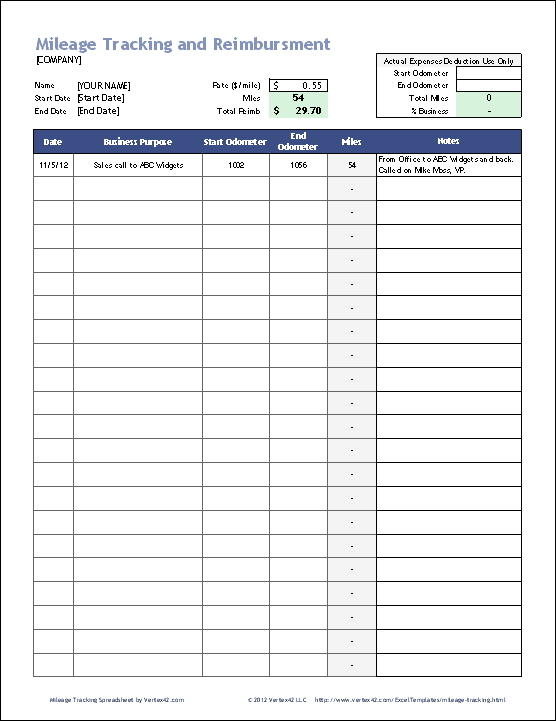

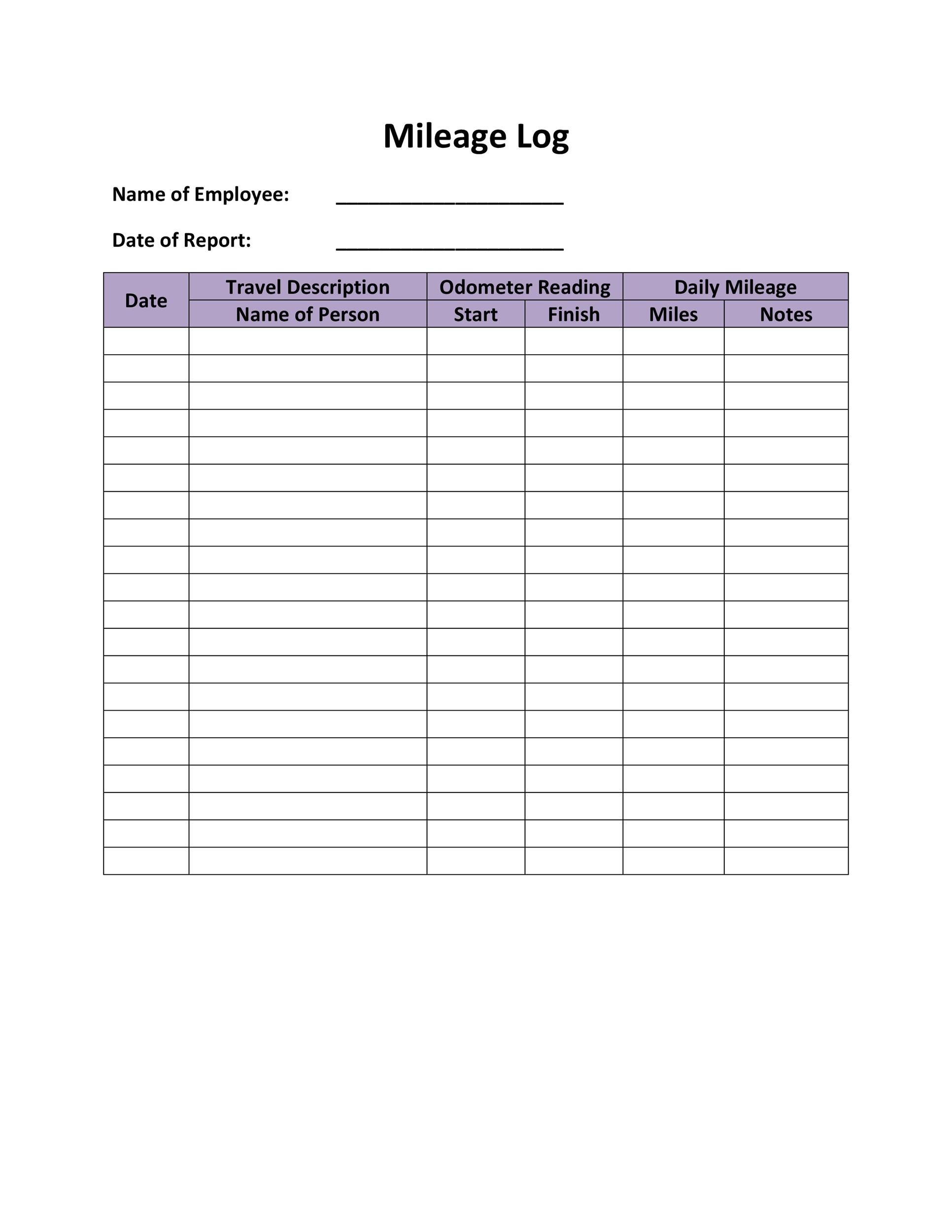

Excel Mileage Log Template - Click to copy google spreadsheet. Use the other sheets tab for an empty. The excel and sheets versions include a mileage log example for you to see how the mileage log template should be filled out. Note that after the first 10,000 miles, the hmrc approved rate changes to 25p per mile. Mileiq provides automatic mileage logging. Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement form or for determining the mileage. Date, destination, business purpose, odometer start, odometer stop, miles this trip, expense type, expense amount. Web it includes columns to list the date and purpose of a trip, odometer start and finish readings, and relevant notes about trip details, which can provide important documentation during an audit. Web these free excel mileage logs contain everything you need for a compliant irs mileage log. Track mileage effortlessly with our free mileage log template & mileage tracker template. Enter your name, month, and mileage brought forward from a previous month or sheet. Web it includes columns to list the date and purpose of a trip, odometer start and finish readings, and relevant notes about trip details, which can provide important documentation during an audit. A professional design vehicle mileage log for commercial mileage calculation. Web the mileage deduction. Works for both miles per gallon (mpg) or kilometers. Available in pdf, word, excel a google formats. Use this template as a daily and monthly mileage log. The workbook contains a running log worksheet, walking log worksheet, as well as a race log, each on a different worksheet. For example, a vehicle with $6,000 of expenses and 50 percent of. Date, destination, business purpose, odometer start, odometer stop, miles this trip, expense type, expense amount. Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement form or for determining the mileage. Web one can use the mileage tracker for. Web use one of our mileage templates in microsoft excel to track your miles. Explore subscription benefits, browse training courses, learn how to secure your device, and more. Date, destination, business purpose, odometer start, odometer stop, miles this trip, expense type, expense amount. Web by addressing these common issues proactively, you can overcome potential hurdles in mileage tracking and maintain. Car rental service agencies can utilize this template to keep a good record of a vehicle’s mileage. This running log spreadsheet helps you track your daily running or walking progress, including distance, time, heart rate, and route information. Download and print this mileage log. Mileiq provides automatic mileage logging. This will make the log a convenient size and just the. Use this template as a daily and monthly mileage log. Both versions require the same information: Web it includes columns to list the date and purpose of a trip, odometer start and finish readings, and relevant notes about trip details, which can provide important documentation during an audit. Uses of excel mileage log template. Excel (.xls) 2003 + and ipad. Use the other sheets tab for an empty. Web to use this mileage log template for excel, you should record all your drives and then transfer to the sheet when you’re in front of the computer. You can use it as a mileage log as well as the reimbursement form. In the main section, enter the travel date, the reason. Web one can use the mileage tracker for the accurate measurement of the mileage so that you have exact mileage records. Enter your name, month, and mileage brought forward from a previous month or sheet. Car rental service agencies can utilize this template to keep a good record of a vehicle’s mileage. Web these free excel mileage logs contain everything. Web to use this mileage log template for excel, you should record all your drives and then transfer to the sheet when you’re in front of the computer. For 2024, it'll be $0.67. You can log all of this information in our printable pdf, excel and sheets mileage log templates. Use this template as a daily and monthly mileage log.. Feel free to download our excel mileage log template. Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement form or. Get started by downloading, customizing, and. Total miles driven, missing mileage, vehicle status/operator comments, and more. Download a free mileage reimbursement and tracking log for microsoft excel®. Date, destination, business purpose, odometer start, odometer stop, miles this trip, expense type, expense amount. Tracking your mileage can save you thousands on your taxes (even more if you use an automatic mileage tracker app !). Web how to use fleetio’s free mileage log template. Excel (.xls) 2003 + and ipad. Download the pdf mileage claim form and print it out, or download the excel version. Irs mileage rates for 2023 are: Web the percentage of mileage on the vehicle for business is then deducted from the costs on your taxes. Web the minimum information requirements regardless of your situation are each business trip's miles, the year's total mileage, the time (a date will suffice), place (your destination), and purpose of each trip. In the main section, enter the travel date, the reason for the journey and either start. You can log all of this information in our printable pdf, excel and sheets mileage log templates. Track mileage effortlessly with our free mileage log template & mileage tracker template. Web these free excel mileage logs contain everything you need for a compliant irs mileage log. It doesn’t matter what type of deduction you’re taking at the end of the year.

30 Printable Mileage Log Templates (Free) Template Lab

30 Free Mileage Log Templates Excel Log Sheet Format Project

![]()

25 Free Mileage Log Templates (Excel Word PDF)

25 Free Mileage Log Templates (Excel Word PDF)

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Downloadable Mileage Log MS Excel Templates

10+ Excel Mileage Log Templates Excel Templates

10+ Excel Mileage Log Templates Excel Templates

25 Free Mileage Log Templates (Excel Word PDF)

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

The Excel And Sheets Versions Include A Mileage Log Example For You To See How The Mileage Log Template Should Be Filled Out.

Whether You're An Employee Or A Business Owner, It's Important To Keep Good Business Mileage Records So That You Have The Information You Need For Either Completing Your Company's Mileage Reimbursement Form Or For Determining The Mileage.

Web To Use This Mileage Log Template For Excel, You Should Record All Your Drives And Then Transfer To The Sheet When You’re In Front Of The Computer.

Enter Your Name, Month, And Mileage Brought Forward From A Previous Month Or Sheet.

Related Post: