Foreign Grantor Trust Template

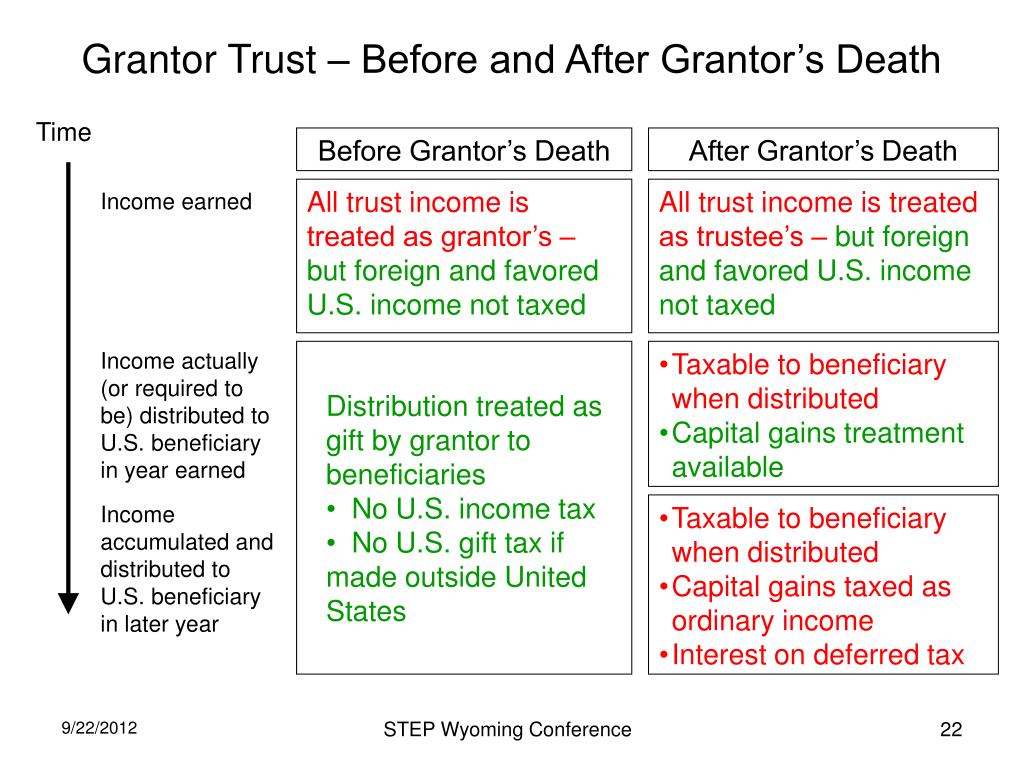

Foreign Grantor Trust Template - It includes instructions, checkboxes, and lines for identifying information, trust details, and obligations. A grantor trust describes a trust for which the grantor retains some ownership over the assets. Web know that moving your assets into a foreign trust will not exempt you from certain taxes. Web learn what a foreign grantor trust is, how it works, and its advantages and disadvantages for u.s. There are a number of options to consider for the design of a trust by a foreign person who intends to benefit u.s. In order to avoid penalties, the us Income tax return for foreign estates and trusts, and relevant schedules, for consideration by the irs. All information must be in english. Web this is the official pdf form for reporting transactions with foreign trusts and receipt of certain foreign gifts. Web aicpa draft form 1041nr, u.s. We’ll provide an overview of revocable foreign grantor trustsand irrevocable u.s. Web aicpa draft form 1041nr, u.s. For instructions and the latest information. Web annual information return of foreign trust with a u.s. Owner (under section 6048(b)) go to. Web a grantor trust is where the foreign settlor is considered the owner of the trust’s income, subject to taxation, which may occur under two specific circumstances. A foreign nongrantor trust is funded with $100 million. The first scenario arises when distributions from the trust during the settlor’s lifetime, whether comprising income or capital, are limited only to the settlor. Federal income tax purposes, a trust is foreign if it fails the “court” test or the “control” test, and is a foreign grantor trust (fgt) if it either (1) the trust is fully revocable by the foreign settlor or (2) the trust is irrevocable, and the only persons to whom income or principal may be. Web know that moving your. In this blog, we’ll talk about the creation of u.s. Web fatca compliance & fbar reporting. The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes under subpart e of subchapter j of the code pursuant to which the trustor shall be the owner of the trust for united states. Owner (under section 6048(b)) go to. Web foreign grantor trust beneficiary statement: In order to avoid penalties, the us Web fatca compliance & fbar reporting. Web learn what a foreign grantor trust is, how it works, and its advantages and disadvantages for u.s. Web learn what a foreign grantor trust is, how it works, and its advantages and disadvantages for u.s. Aicpa letter to irs on rev. Web a grantor trust is where the foreign settlor is considered the owner of the trust’s income, subject to taxation, which may occur under two specific circumstances. A trust is considered a foreign trust unless it. The trustee must also provide the grantor with a foreign grantor trust owner statement, Federal income tax purposes, a trust is foreign if it fails the “court” test or the “control” test, and is a foreign grantor trust (fgt) if it either (1) the trust is fully revocable by the foreign settlor or (2) the trust is irrevocable, and the. A grantor trust is a trust that is treated as owned by its grantor under code §671. In order to avoid penalties, the us The first scenario arises when distributions from the trust during the settlor’s lifetime, whether comprising income or capital, are limited only to the settlor or the settlor’s. Web annual information return of foreign trust with a. Web a grantor trust is where the foreign settlor is considered the owner of the trust’s income, subject to taxation, which may occur under two specific circumstances. Owner (under section 6048(b)) go to. Show all amounts in u.s. Web foreign grantor trust (fgt) for u.s. It includes instructions, checkboxes, and lines for identifying information, trust details, and obligations. Web foreign grantor trust (fgt) for u.s. For instructions and the latest information. It includes instructions, checkboxes, and lines for identifying information, trust details, and obligations. For calendar year 20 , or tax year beginning, 20 , ending.check appropriate boxes. Income tax return for foreign estates and trusts, and relevant schedules, for consideration by the irs. Persons and their tax return preparers should be aware that u.s. Web know that moving your assets into a foreign trust will not exempt you from certain taxes. A grantor trust, whether foreign or domestic, pays no u.s. Income tax return for foreign estates and trusts, and relevant schedules, for consideration by the irs. The trust’s us beneficiaries do not need to receive distributions from this trust for an extended period of time because they have access to other income or assets. A trust is considered a foreign trust unless it meets the court and control tests. We’ll provide an overview of revocable foreign grantor trustsand irrevocable u.s. This primer explains the u.s. For calendar year 20 , or tax year beginning, 20 , ending.check appropriate boxes. Aicpa letter to irs on rev. Web aicpa draft form 1041nr, u.s. Web this is the official pdf form for reporting transactions with foreign trusts and receipt of certain foreign gifts. All information must be in english. Web annual information return of foreign trust with a u.s. Persons who create a foreign trust, or have transactions with a foreign trust, can have both u.s. The trust generates and realizes 10% investment returns every year for 15 years.

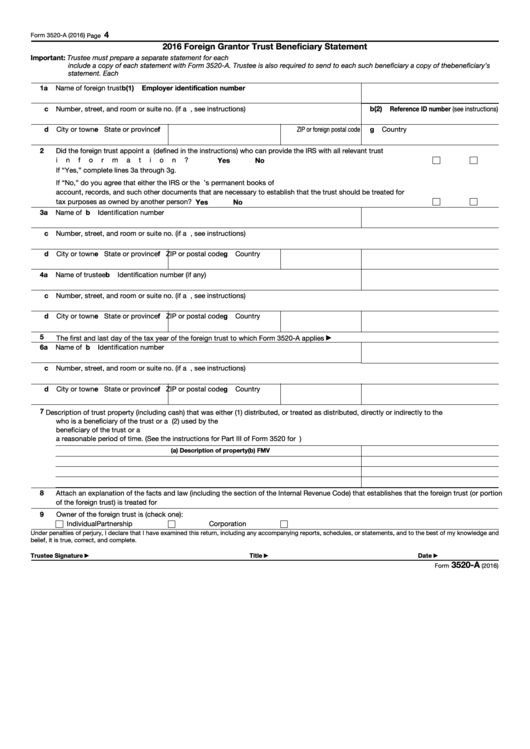

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

Form 3520A Annual Information Return of Foreign Trust with a U.S

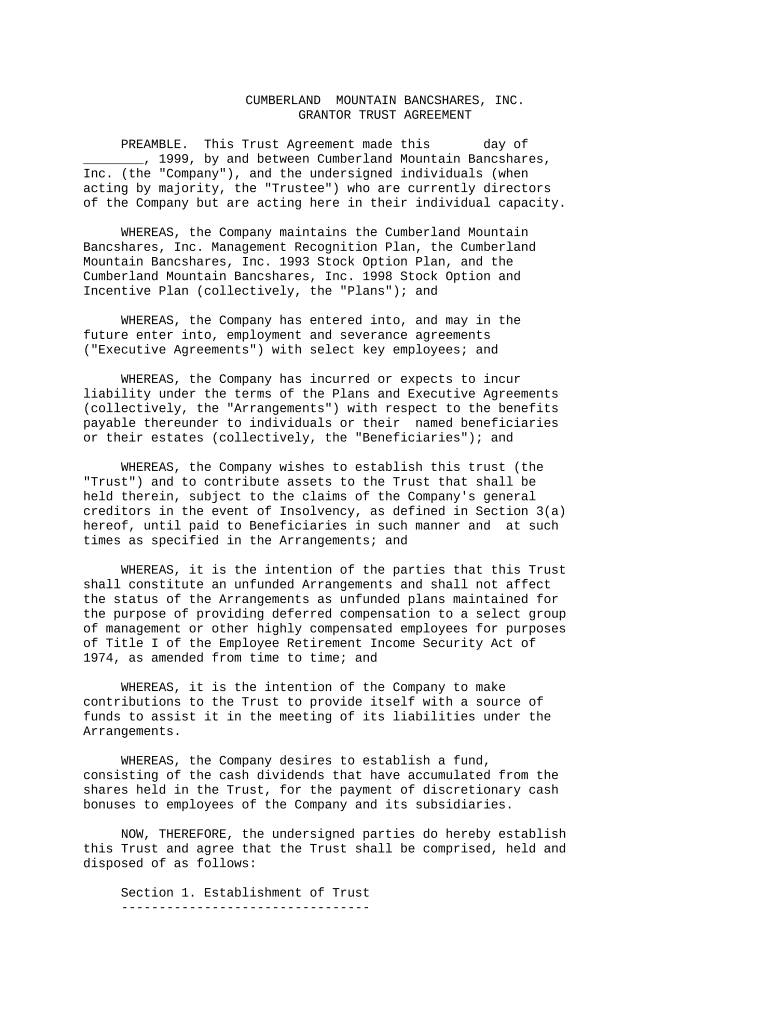

Grantor Trust Agreemetn Form Fill Out and Sign Printable PDF Template

Foreign Grantor Trust Template

Foreign Grantor Trust Template

Form 3520 Examples and Guide to Filing fro Expats

Types of Grantor Trusts What Are They, and When to Use Them

How to set up a foreign trust for ultimate asset protection Nomad

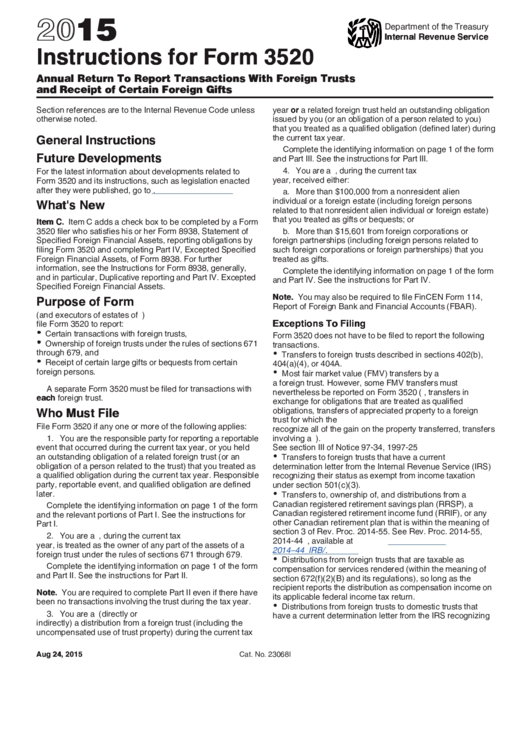

Instructions For Form 3520 Annual Return To Report Transactions With

Form 3520 Annual Return to Report Transactions with Foreign Trusts

A Grantor Trust Describes A Trust For Which The Grantor Retains Some Ownership Over The Assets.

It Includes Instructions, Checkboxes, And Lines For Identifying Information, Trust Details, And Obligations.

Beneficiaries, Depending On The Priorities Of The Settlor.

3 Foreign Trust Without Us Assets.

Related Post: