Free 1099 Form Template

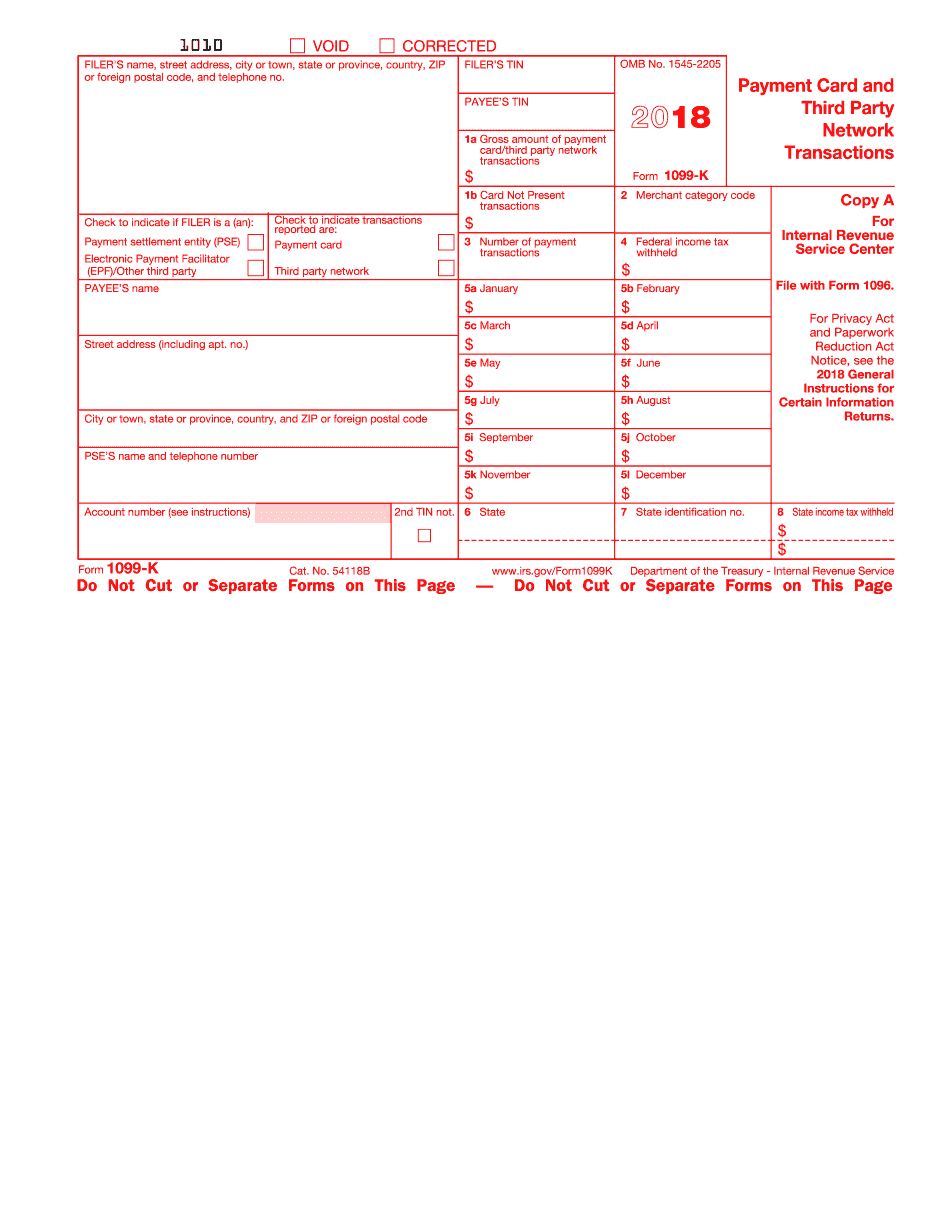

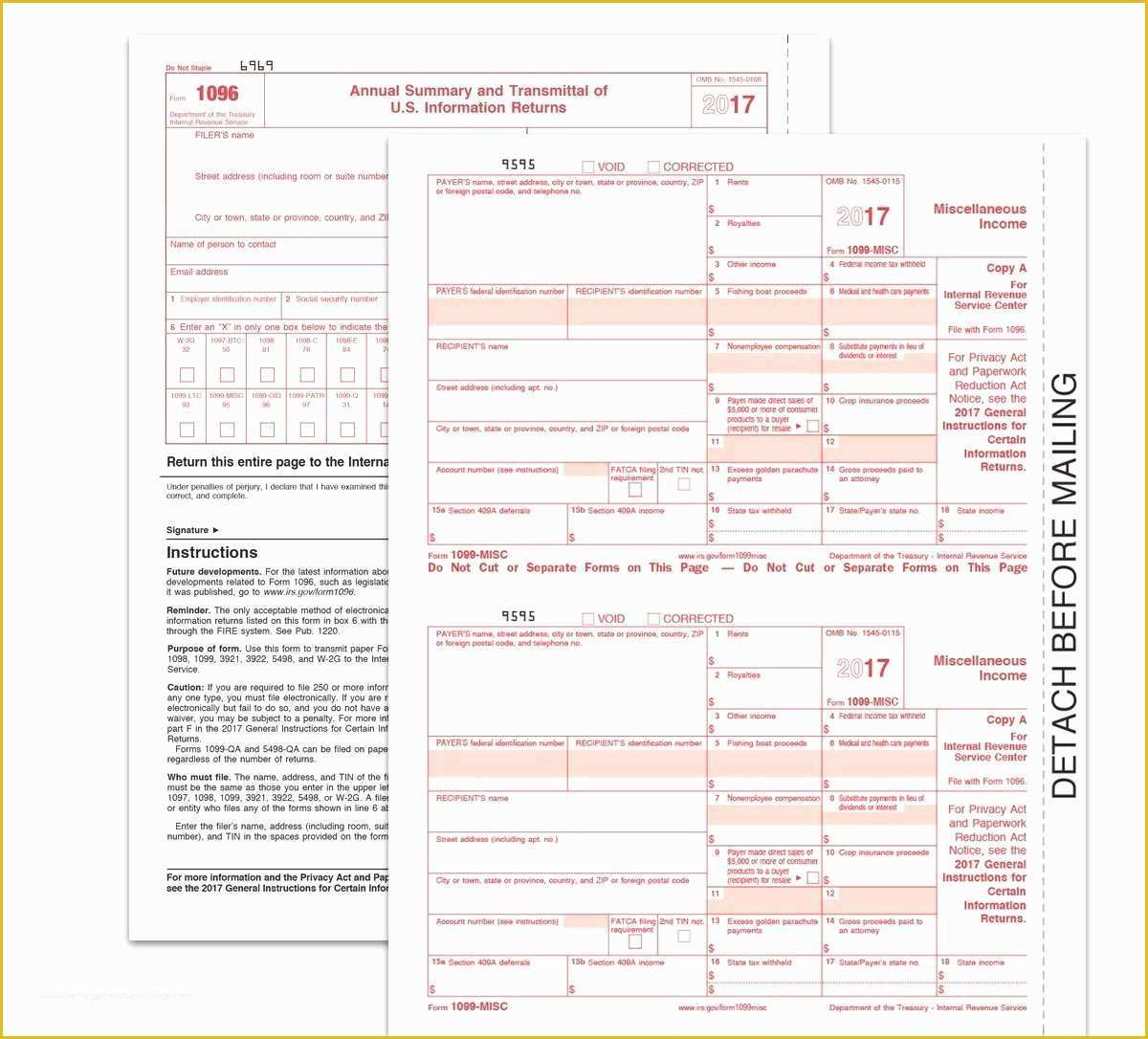

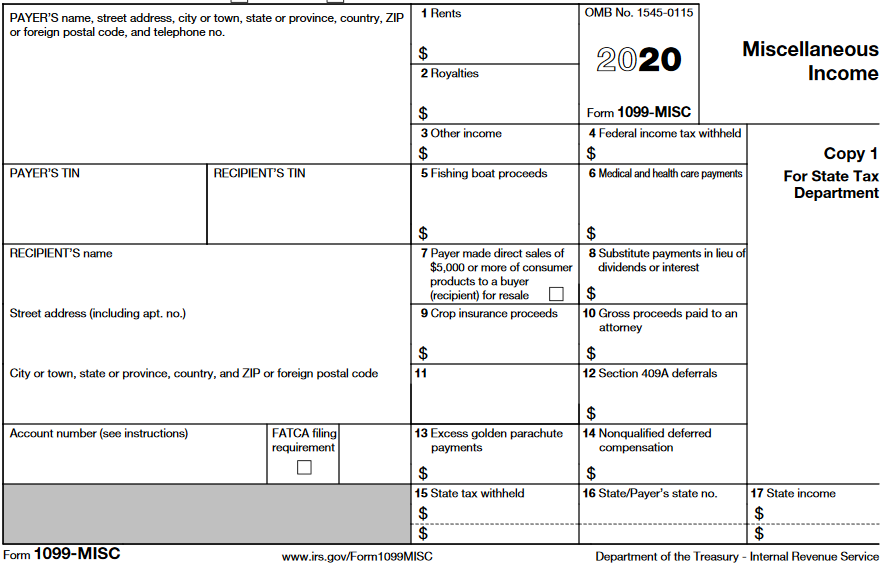

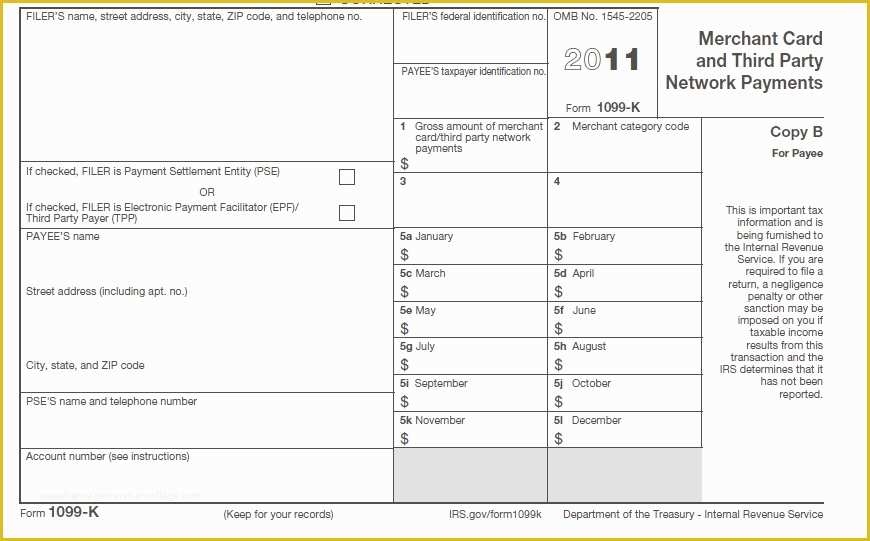

Free 1099 Form Template - *the featured form (2022 version) is the current version for all succeeding years. Web making a fillable 1099 misc pdf for printing. Web irs 1099 form. Web download and print copies. What it is, how it works. How it works, who gets one. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. These can include payments to independent contractors, gambling. Web page last reviewed or updated: Persons with a hearing or speech disability with access to tty/tdd equipment can. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. What it is, how it works. Web making a fillable 1099 misc pdf for printing. Web download. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Web irs 1099 form. Simply hit download, fill in your details, and send it in to the irs. Web updated january 18, 2024. For your protection, this form may show only the last four digits of. Web 10 or more returns: Simply hit download, fill in your details, and send it in to the irs. Web it's just $50. Remember how easy it was to stick a form in them and type in your answers?! A 1099 form is a record that an entity or person (not your employer) gave or paid you money. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Also known as a “1099 agreement” due to the contractor not being an employee of the client. Remember how easy it was to stick a form. Also known as a “1099 agreement” due to the contractor not being an employee of the client. Tips and instructions for use. Web it's just $50. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web this spreadsheet helps you. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment. Web irs 1099 form. To ease. Web this spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax category. Persons with a hearing or speech disability with access to tty/tdd equipment can. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. An independent contractor. Cash paid from a notional principal contract made to an individual,. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web irs 1099 form. 1099 forms can report different types of incomes. Web recipient’s taxpayer identification number (tin). Used for the 2021 tax year only. What it is, how it works. However, the issuer has reported your. Simply hit download, fill in your details, and send it in to the irs. Web 10 or more returns: Persons with a hearing or speech disability with access to tty/tdd equipment can. 1099 forms can report different types of incomes. Also known as a “1099 agreement” due to the contractor not being an employee of the client. What it is, how it works. Remember how easy it was to stick a form in them and type in your answers?! Persons with a hearing or speech disability with access to tty/tdd equipment can. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. *the featured form (2022 version) is the current version for all succeeding years. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web recipient’s taxpayer identification number (tin). Web this spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax category. Tips and instructions for use. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). How it works, who gets one. Used for the 2021 tax year only. Web updated january 18, 2024. These can include payments to independent contractors, gambling. What it is, how it works. Web it's just $50. Try our 1099 expense tracker for free.

Free Fillable 1099 Tax Form Printable Forms Free Online

Free Printable Irs 1099 Misc Form Printable Forms Free Online

Free 1099 Misc Template Word Of 1099 Misc Template for Word Templates

Microsoft Word 1099 Tax Form Printable Template Printable Templates

1099 Employee Form Printable

1099 Form Template. Create A Free 1099 Form Form.

1099 S Fillable Form Printable Forms Free Online

1099 Div Form Fillable and Editable PDF Template

Printable 1099 Misc Tax Form Template Printable Templates

Free 1099 Misc Template Word Of 5 1099 Pay Stub Template Excel

Web It's Just $50.

An Independent Contractor Agreement Is A Legal Document Between A Contractor That Performs A Service For A Client In Exchange For Payment.

Web Irs 1099 Form.

To Ease Statement Furnishing Requirements, Copies B, 1, And 2 Have Been Made Fillable Online In A Pdf Format Available At Irs.gov/Form1099Misc And Irs.gov/Form1099Nec.

Related Post: