Free 1099 Misc Template

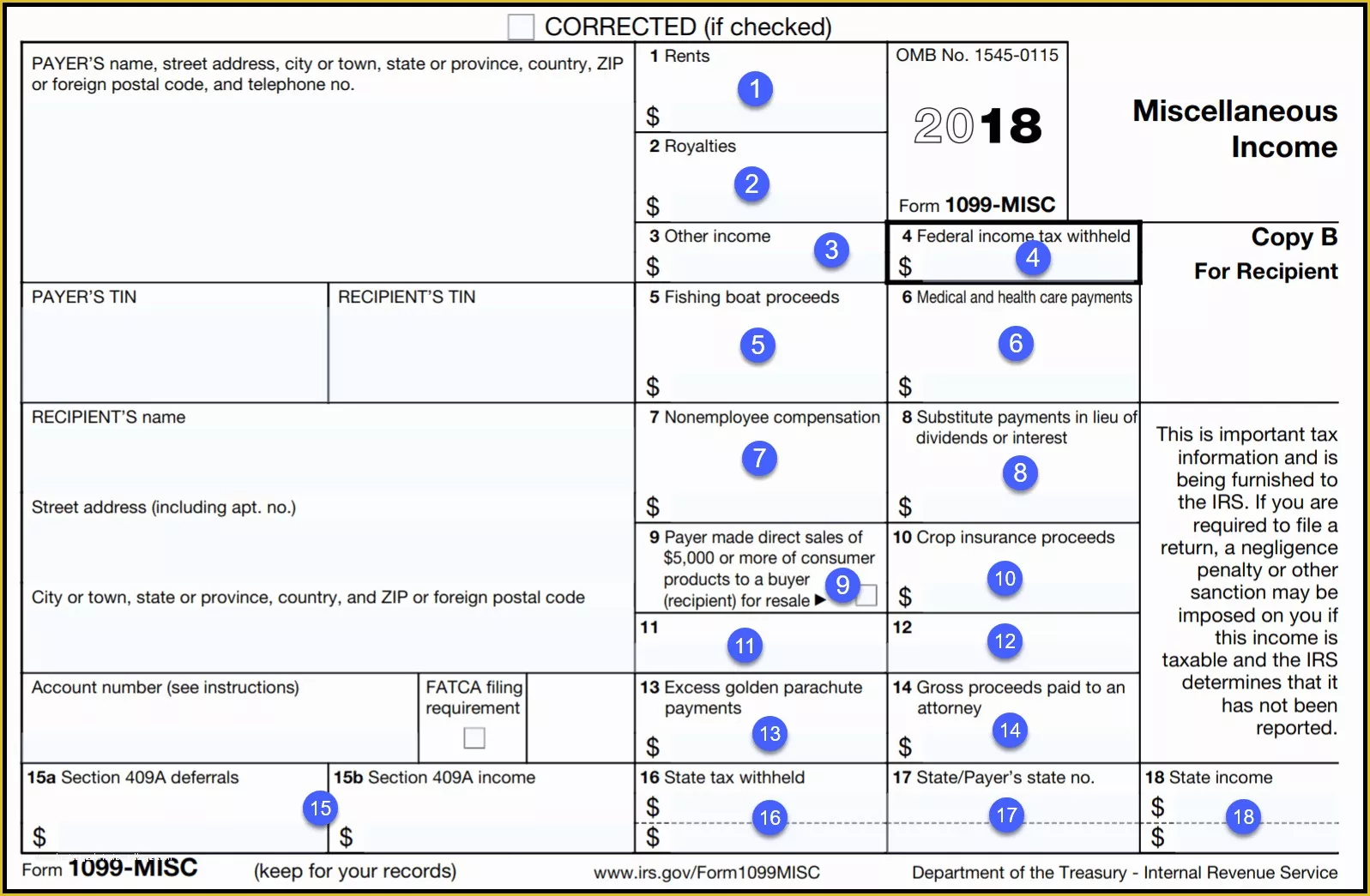

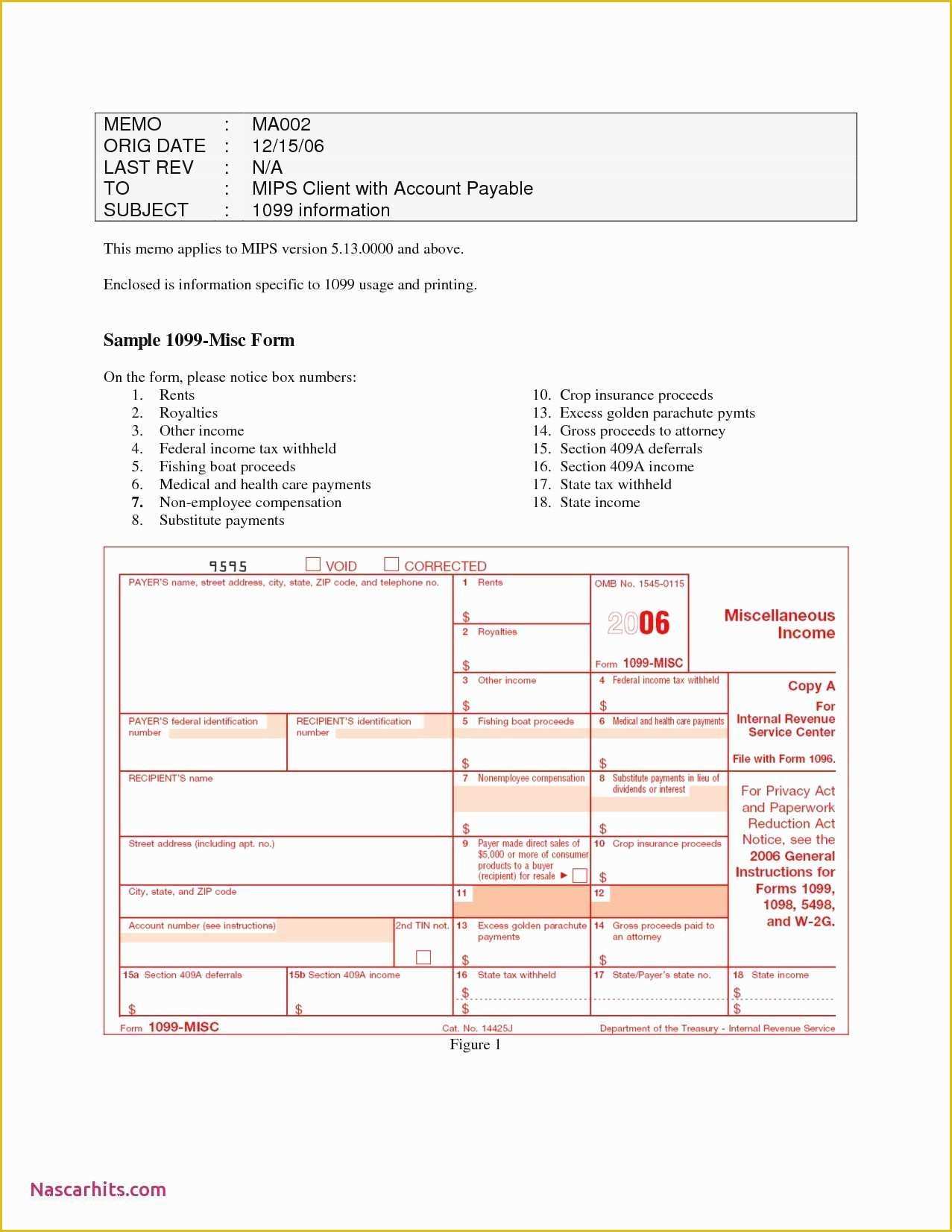

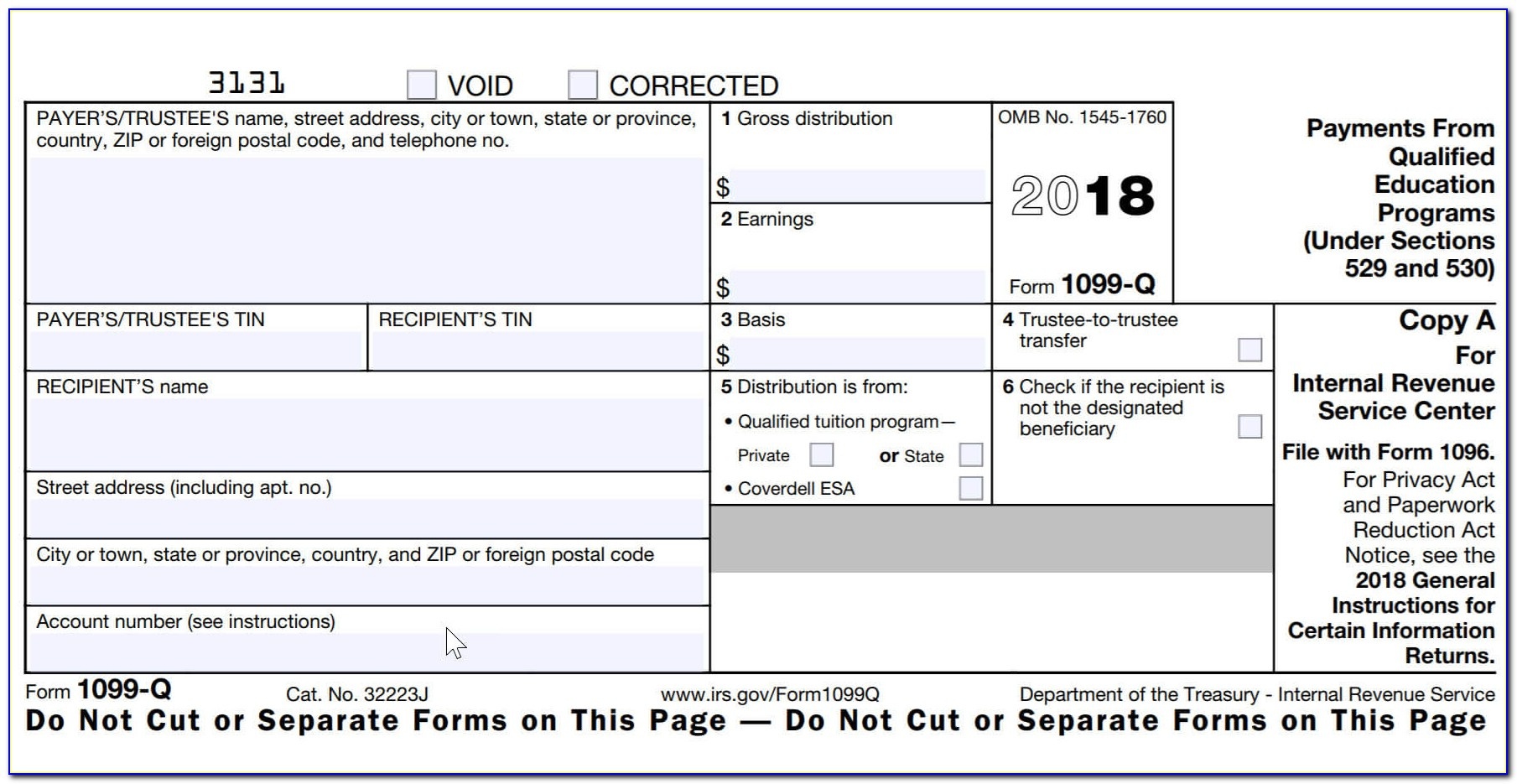

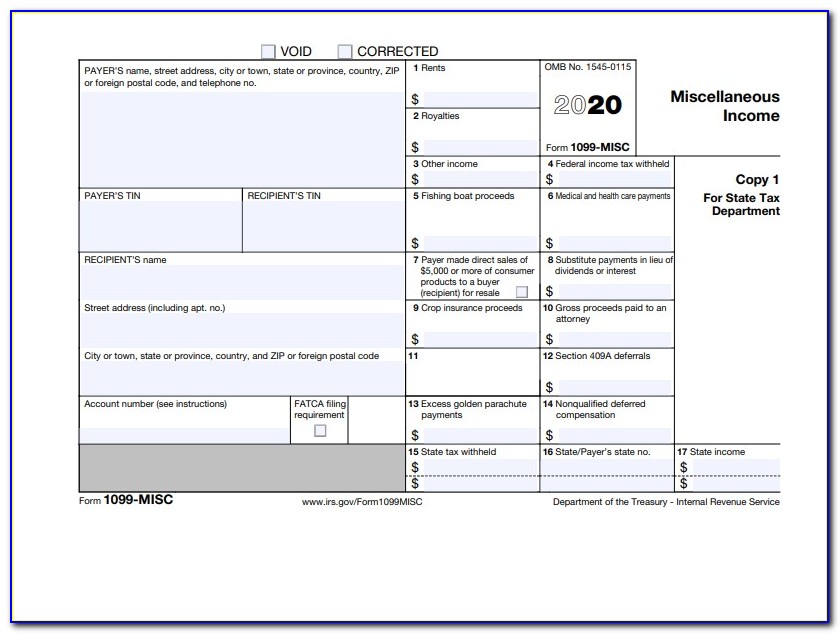

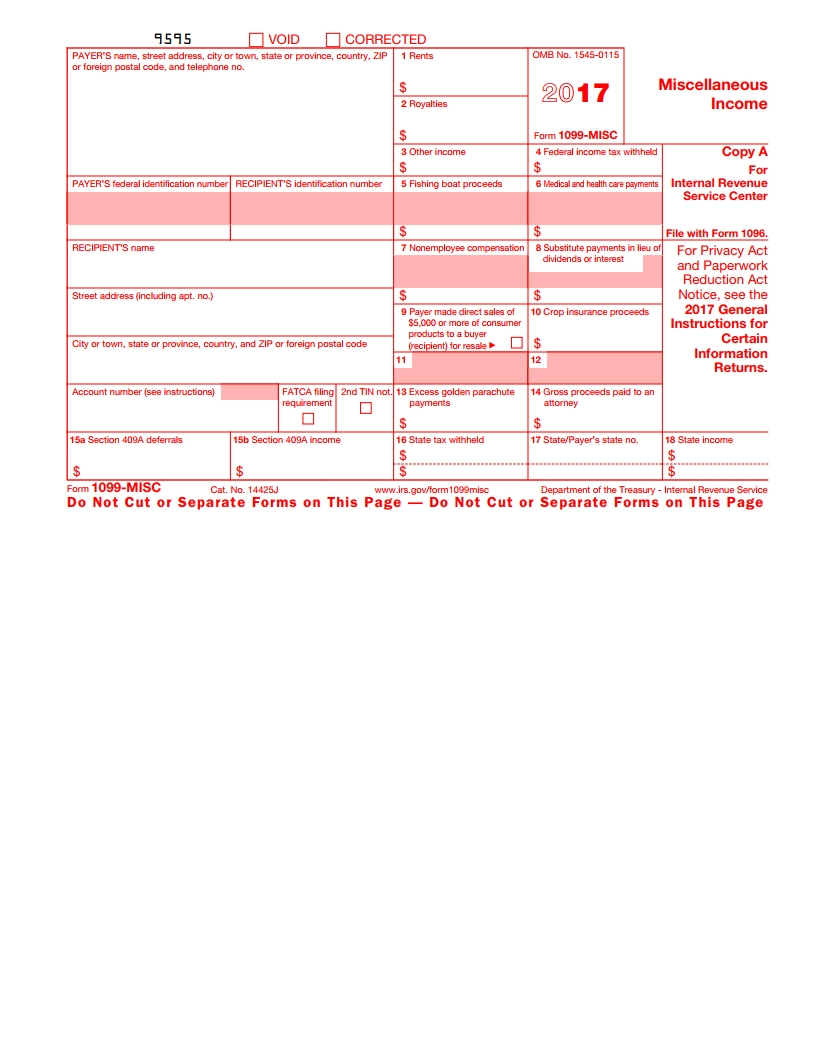

Free 1099 Misc Template - Payments above a specified dollar threshold for rents,. This form is used to report income you received that was not salary. Last updated april 8, 2024. Web updated november 06, 2023. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Before you start, get together the following information for each payee you plan. Web tax forms & irs. Examples of income reported on a 1099. Web download and print copies. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. This form is used to report income you received that was not salary. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Irs 1099 forms. Web download and print copies. This form is used to report income you received that was not salary. Bbb a+ rated businesspaperless workflowover 100k legal formsfast, easy & secure Examples of income reported on a 1099. Web updated november 06, 2023. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Last updated april 8, 2024. Web tax forms & irs. Web download and print copies. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. Payments above a specified dollar threshold for rents,. Before you start, get together the following information for each payee you plan. Web tax forms & irs. Web updated november 06, 2023. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Gather information for all of your payees. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. This form is used to report income you received that was not salary. Web download and print copies. Last updated april 8, 2024. Payments above a specified dollar threshold for rents,. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Before you start, get together the following information for each payee you plan. Web tax forms & irs. Examples of income reported on a 1099. Gather information for all of your payees. Payments above a specified dollar threshold for rents,. This form is used to report income you received that was not salary. Before you start, get together the following information for each payee you plan. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received. Web tax forms & irs. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Web updated november 06, 2023. Gather information for all of your payees. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38. Gather information for all of your payees. Bbb a+ rated businesspaperless workflowover 100k legal formsfast, easy & secure This form is used to report income you received that was not salary. Web download and print copies. Payments above a specified dollar threshold for rents,. Payments above a specified dollar threshold for rents,. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. This form is used to report income you received that was not salary. Web updated november 06, 2023. Web download and print copies. Gather information for all of your payees. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 18, 2024 11:38 am. Web download and print copies. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or. Examples of income reported on a 1099. This form is used to report income you received that was not salary. Bbb a+ rated businesspaperless workflowover 100k legal formsfast, easy & secure Web tax forms & irs. Last updated april 8, 2024. Web updated november 06, 2023.

1099 Misc Excel Template Free

62 Free 1099 Misc Template Word Heritagechristiancollege

1099 Misc Printable Template Free Printable Templates

1099 Misc Form Printable Instructions

What is a 1099Misc Form? Financial Strategy Center

Printable 1099 Misc Tax Form Template Printable Templates

Form 1099MISC for independent consultants (6 step guide)

1099 Misc Template Excel

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Free Printable 1099 Misc Forms Free Printable

Before You Start, Get Together The Following Information For Each Payee You Plan.

Payments Above A Specified Dollar Threshold For Rents,.

Miscellaneous Income (Or Miscellaneous Information, As It’s Now Called) Is An Internal Revenue Service (Irs) Form Used To Report Certain Types Of.

Related Post: