Free W9 Template

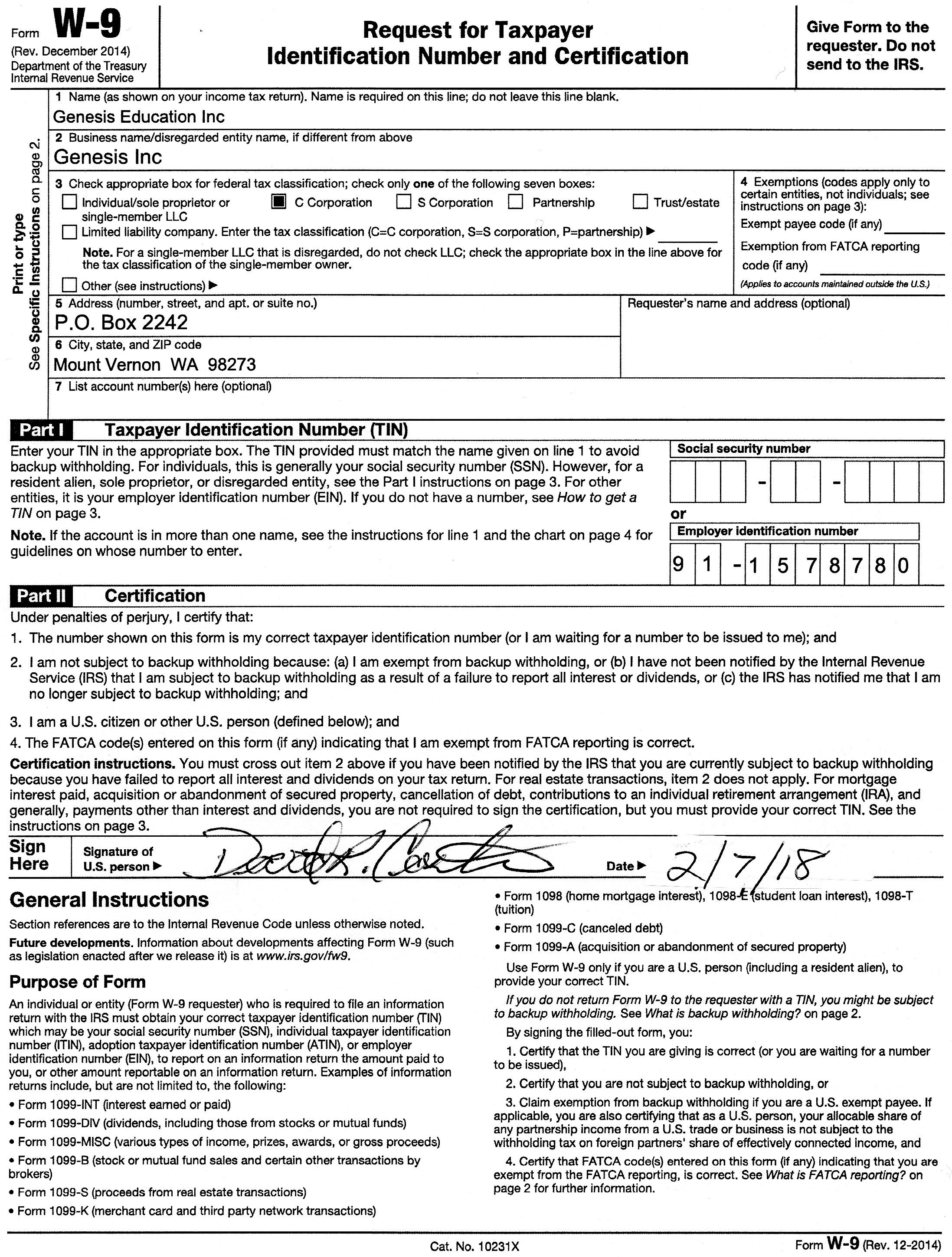

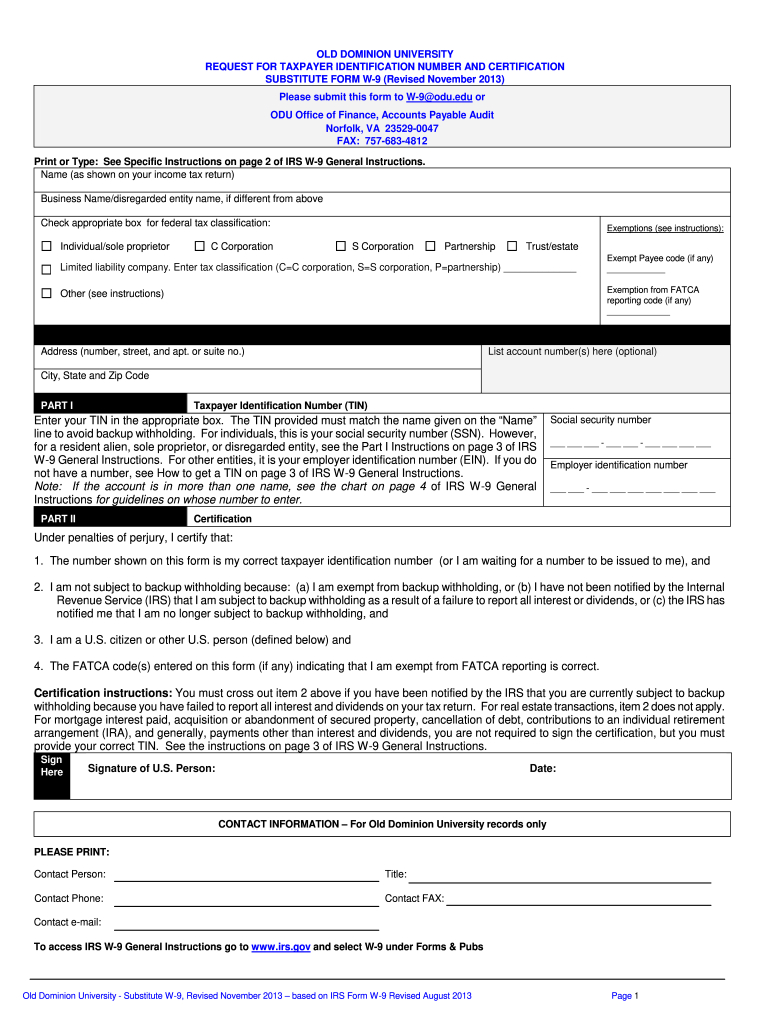

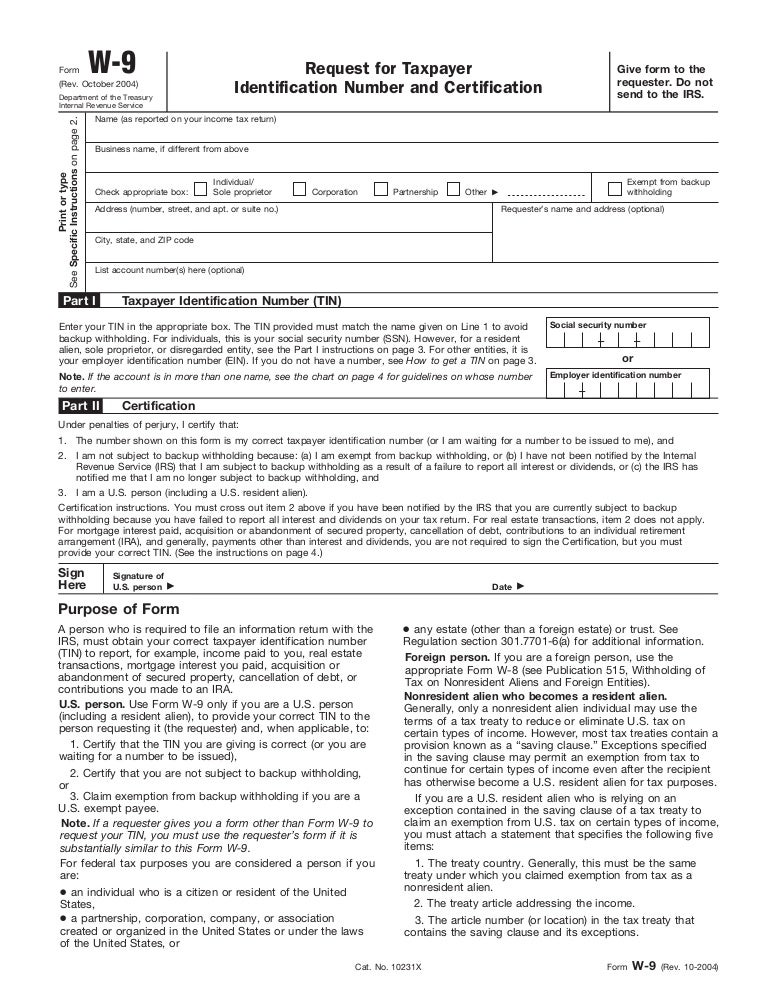

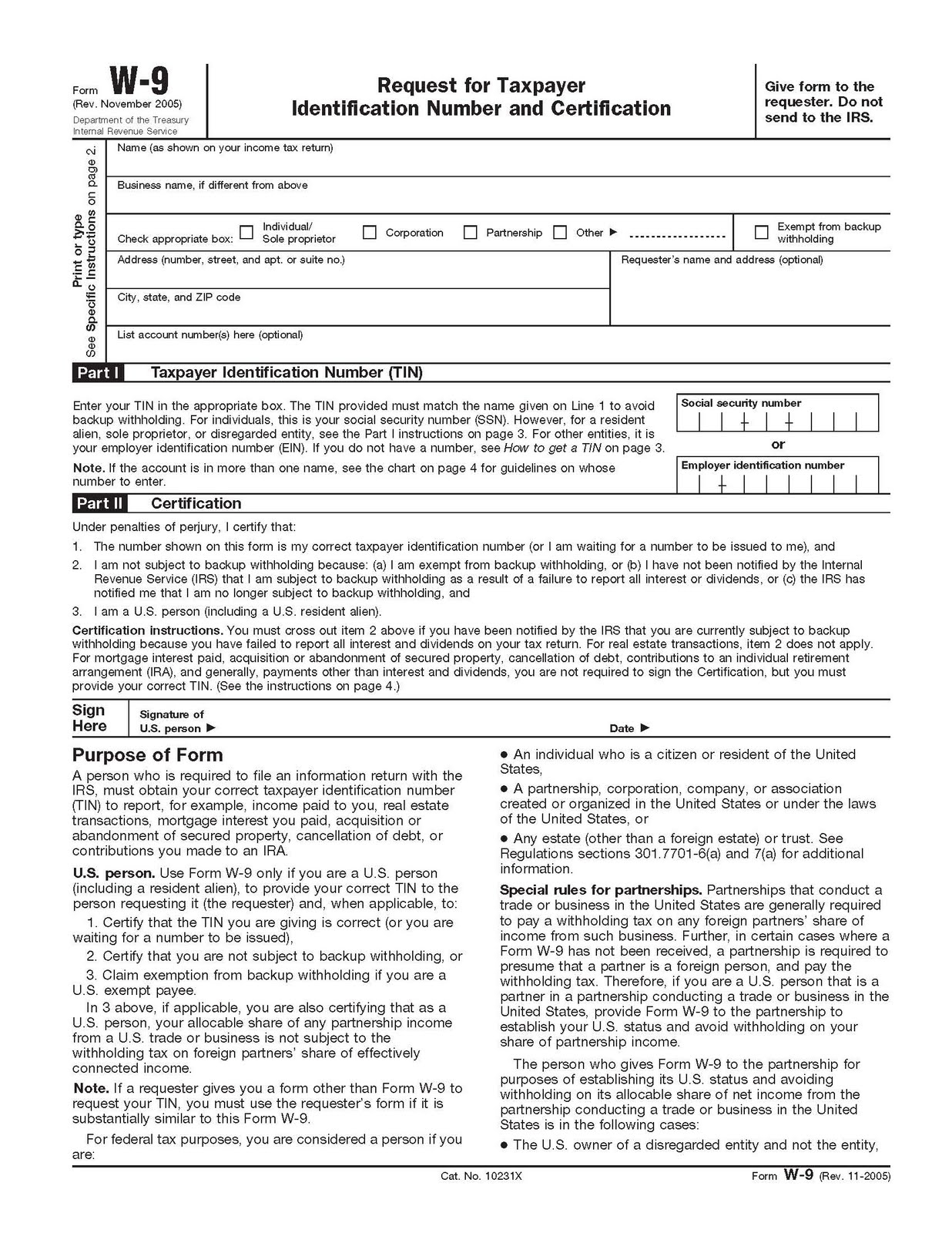

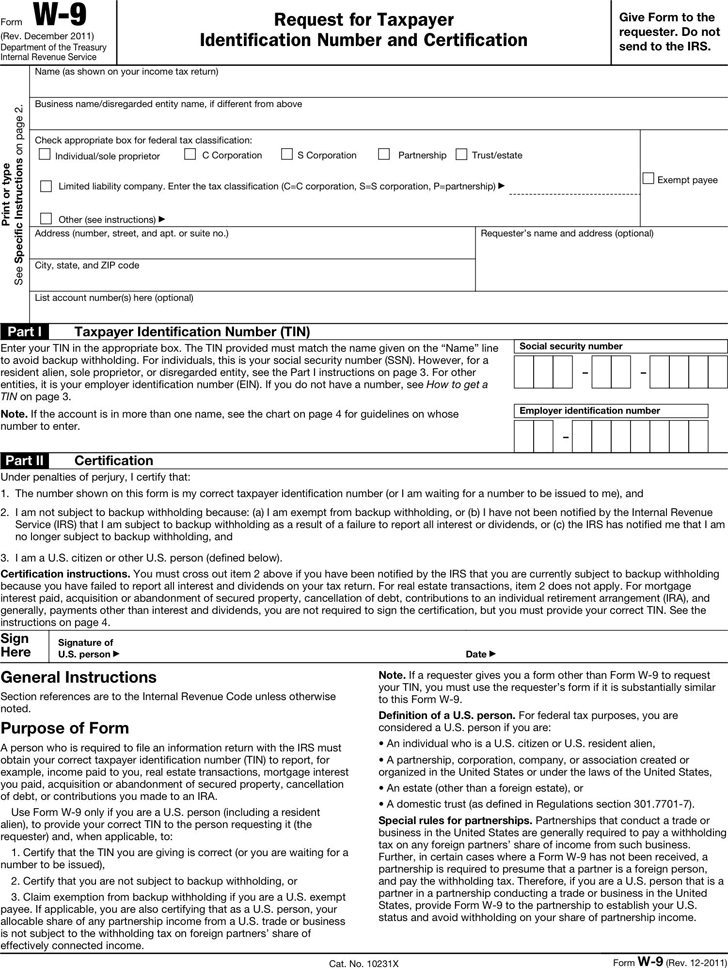

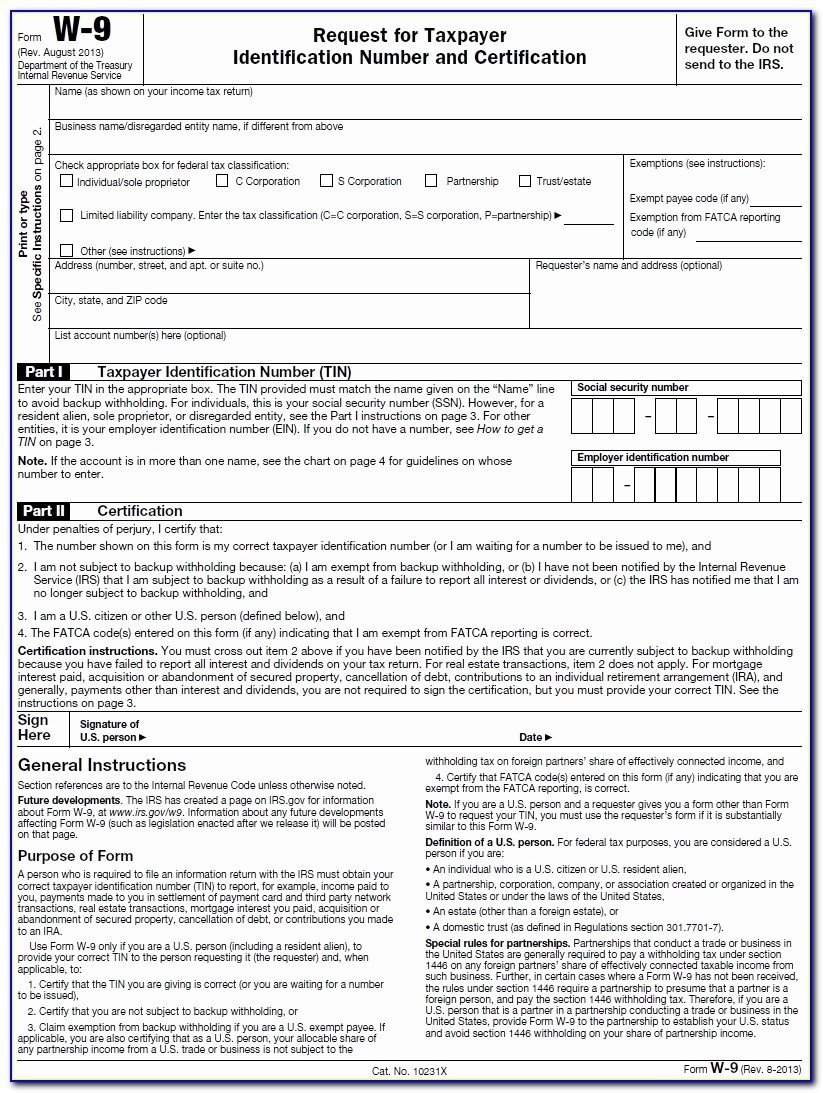

Free W9 Template - Written by sara hostelley | reviewed by brooke davis. This form can be used to request the correct name and taxpayer identification number, or tin, of the payee. Anyone who owns a company knows that taxes are an inevitable part of business. The template uses special formula logic for social security and employee identification numbers to ensure the signer enters the correct information. Contributions you made to an ira. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. For individuals, the tin is. See what is backup withholding, later. Afterward, you can print or save the completed form on your computer or mobile to send to your client. Web enter your ssn, ein or individual taxpayer identification as appropriate. For individuals, the tin is. Person (including a resident alien), to provide your correct tin. You must enter one of the following on this line; Web updated january 16, 2024. Claim exemption from backup withholding if you are a u.s. Web enter your ssn, ein or individual taxpayer identification as appropriate. The w9 tax form also called the request for taxpayer identification number and certification form, is a document in the us income tax system used by a third party who must file an information return with the irs. See what is backup withholding, later. This form can be used. Owner of a disregarded entity and not the entity, the u.s. Do not leave this line blank. Afterward, you can print or save the completed form on your computer or mobile to send to your client. Contributions you made to an ira. Claim exemption from backup withholding if you are a u.s. You must enter one of the following on this line; Web download this free w9 form in pdf and fill it out confidently with the guidelines below. See what is backup withholding, later. It is commonly required when making a payment and withholding taxes are not being deducted. Other common irs tax forms. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases: Web updated january 16, 2024. Acquisition or abandonment of secured property. See what is backup withholding, later. This form is for income earned in tax year 2023, with tax returns due in. Owner of a disregarded entity and not the entity, the u.s. Anyone who owns a company knows that taxes are an inevitable part of business. Web download this free w9 form in pdf and fill it out confidently with the guidelines below. Other common irs tax forms. Afterward, you can print or save the completed form on your computer or. This template is available in one format. See what is backup withholding, later. Person (including a resident alien), to provide your correct tin. You must enter one of the following on this line; Written by sara hostelley | reviewed by brooke davis. Do not leave this line blank. Acquisition or abandonment of secured property. An irs form w9 is a critical document used predominantly in the united states financial and tax systems. This template is available in one format. The name should match the name on your tax return. This template is available in one format. Web a w9 form — also known as a request for taxpayer identification number and certification form — is used by employers and other entities to collect taxpayer identification numbers (tin) from their temporary employees or contractors. Acquisition or abandonment of secured property. See what is backup withholding, later. The w9 tax form. Claim exemption from backup withholding if you are a u.s. Person (including a resident alien), to provide your correct tin. The name should match the name on your tax return. Request for taxpayer identification number and certification keywords: An irs form w9 is a critical document used predominantly in the united states financial and tax systems. Owner of a disregarded entity and not the entity, the u.s. Web a w9 form — also known as a request for taxpayer identification number and certification form — is used by employers and other entities to collect taxpayer identification numbers (tin) from their temporary employees or contractors. This template is available in one format. Request for taxpayer identification number and certification keywords: Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases: Other common irs tax forms. The template uses special formula logic for social security and employee identification numbers to ensure the signer enters the correct information. It is commonly required when making a payment and withholding taxes are not being deducted. Claim exemption from backup withholding if you are a u.s. Web download a free w9 form. The w9 tax form also called the request for taxpayer identification number and certification form, is a document in the us income tax system used by a third party who must file an information return with the irs. Web enter your ssn, ein or individual taxpayer identification as appropriate. Afterward, you can print or save the completed form on your computer or mobile to send to your client. Contributions you made to an ira. Web updated january 16, 2024. Anyone who owns a company knows that taxes are an inevitable part of business.

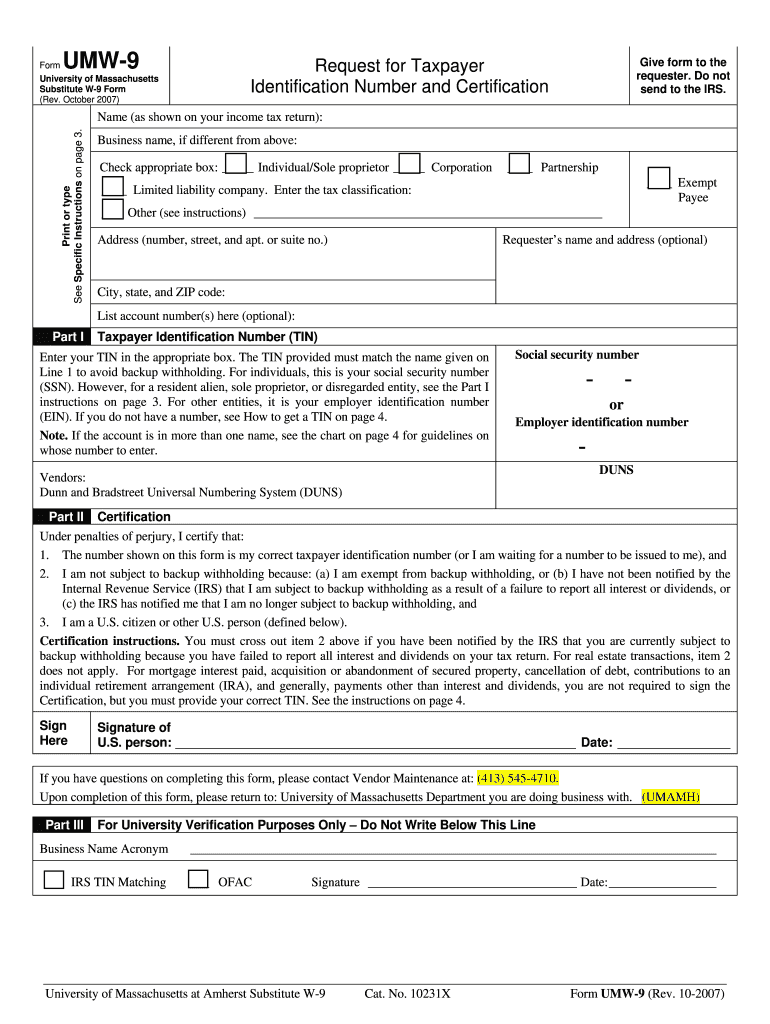

W9 Form Fill Out and Sign Printable PDF Template signNow

2020 W9 Printable Form Example Calendar Printable

Free Fillable W9 form W9 Invoice Template attending W11 Invoice

Free Blank W9 Form Pdf 2021 Calendar Template Printable

W9 Form Free Download Fillable & Printable PDF 2022 CocoDoc

Editable W9 Form

Blank Printable W9 Form

Form W9 Request for Taxpayer Identification Number and Certification

Form W9 Template Free Download Speedy Template

Print Irs W9 Blank Form 2020 Calendar Template Printable

This Form Is For Income Earned In Tax Year 2023, With Tax Returns Due In April 2024.

For Individuals, The Tin Is.

You Must Enter One Of The Following On This Line;

Written By Sara Hostelley | Reviewed By Brooke Davis.

Related Post: