Goodwill Letter Template For Late Payment

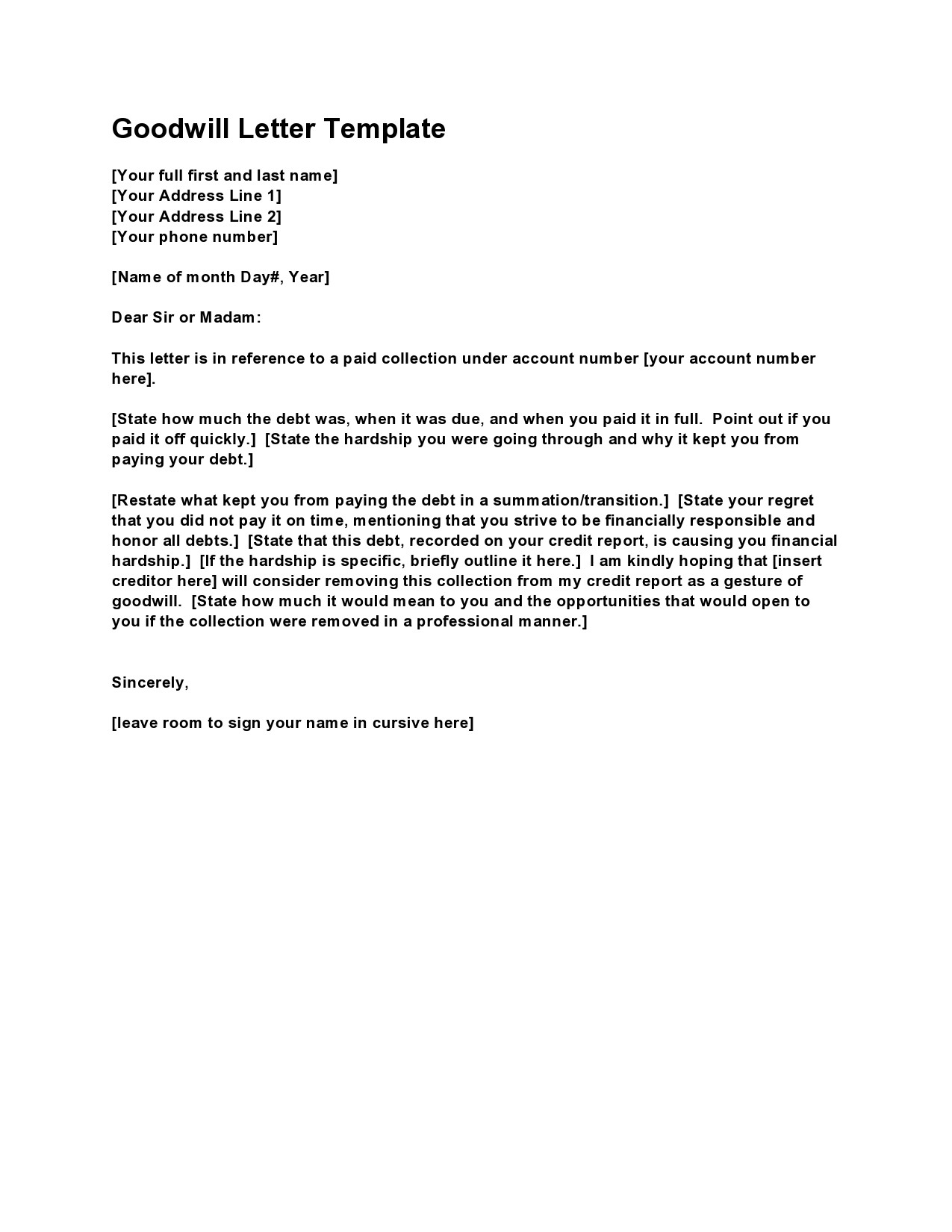

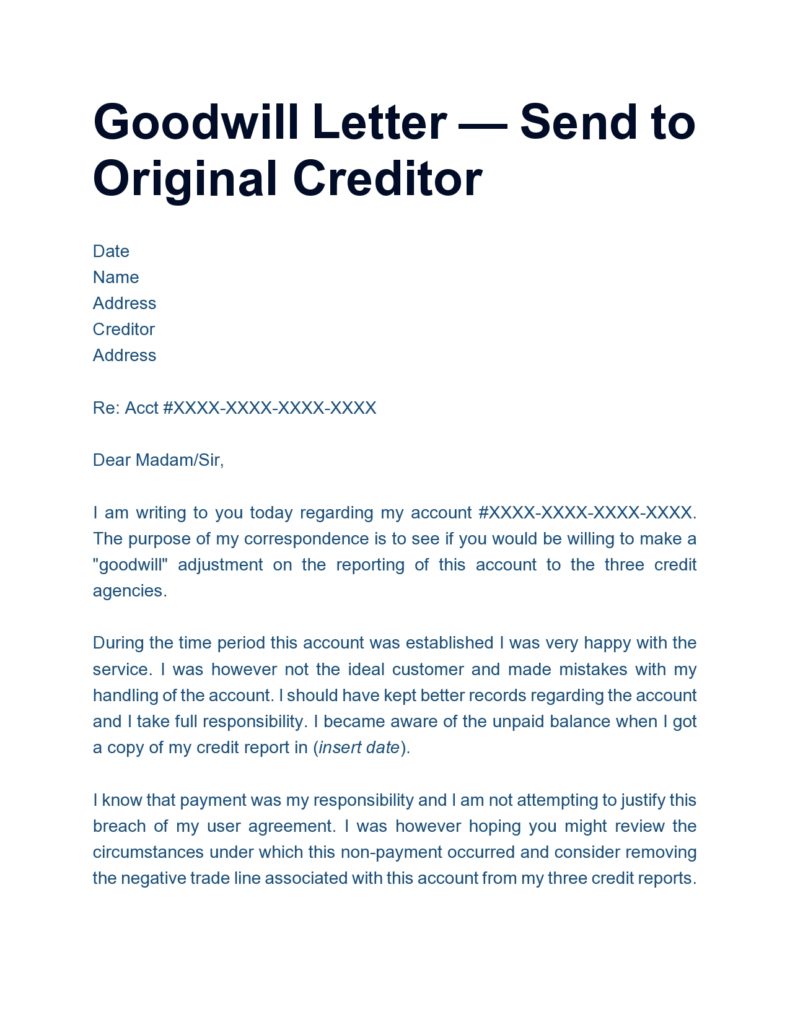

Goodwill Letter Template For Late Payment - Check your credit report thoroughly. Web if you missed a payment but otherwise have a history of using credit responsibly, goodwill letters may help you get the derogatory mark off your credit history. Creditor entity’s name and address; Web a goodwill letter is generally the best option if you have a single late payment that you missed for over 30 days but less than 90 days and when you have since both paid the outstanding bill and resumed regular payments. For example, if you missed a payment because you lost your job, include bank statements, pay stubs or a termination letter to prove financial hardship. Here’s a sample goodwill letter for missed payments on a credit card: Web explain the circumstances that led to the late payment or issue. An explanation for the late payment; Your pledge to not let the account become delinquent again; 100% quality guaranteedtrusted legal formseasy to use on any device A goodwill letter is a request to remove a late payment from your credit report as a gesture of goodwill. If you don’t find any errors, ask the debt collector to verify it. Here’s a sample goodwill letter for missed payments on a credit card: A formal statement requesting the removal of the late payment; Web if you are looking. Check your credit report thoroughly. It serves as a tool used to appeal to the creditor's empathy and understanding, seeking the removal of negative marks that may be impacting an individual's credit history. Your name and address, the date, and the recipients name, department, and address; An explanation for the late payment; For example, if you missed a payment because. Web a goodwill letter is a simple way to restore your credit to good standing by requesting that a lender or servicer erase a late payment on your credit report. If you have a late payment or other negative marks on your credit report that are dragging down your otherwise good credit score, there is a solution. A formal statement. View pricing detailssearch forms by statecustomizable formschat support available Check your credit report thoroughly. It serves as a tool used to appeal to the creditor's empathy and understanding, seeking the removal of negative marks that may be impacting an individual's credit history. Web if you decide you want to try to remove a collection from your credit report, here’s a. Any other supporting information to plead your case ; Use a polite, respectful tone and provide all necessary details. The late payment date ; Web if you've been late on a payment, simply write a goodwill letter explaining why and send it to your creditors. I want you to know that i understand. Web a goodwill letter is generally the best option if you have a single late payment that you missed for over 30 days but less than 90 days and when you have since both paid the outstanding bill and resumed regular payments. Web goodwill deletion request letter template. Web a goodwill letter for late payments is a document that can. If you have a late payment or other negative marks on your credit report that are dragging down your otherwise good credit score, there is a solution. Web a goodwill letter is a simple way to restore your credit to good standing by requesting that a lender or servicer erase a late payment on your credit report. For example, if. Acknowledgement of the late payment and the circumstances that caused it Web write a goodwill letter supported with paperwork that verifies why you missed a payment or posted a late payment. Use a good late payment removal letter template, such as the one we share here, to request the creditor to remove the late payment from your credit report to. In many cases, they will remove the late payment. Your pledge to not let the account become delinquent again; Web explain the circumstances that led to the late payment or issue. An explanation for the late payment; Acknowledgement of the late payment and the circumstances that caused it Web explain the circumstances that led to the late payment or issue. Web a goodwill letter is a simple way to restore your credit to good standing by requesting that a lender or servicer erase a late payment on your credit report. A goodwill letter is a request to remove a late payment from your credit report as a gesture. Web a goodwill letter for late payments is a document that can be used by individuals when they want to remove late payments from their credit history. For example, if you missed a payment because you lost your job, include bank statements, pay stubs or a termination letter to prove financial hardship. Web a goodwill letter is a formal letter to a creditor or lender, such as a bank or credit card company, to request forgiveness for a late payment or other negative item on your credit. Any account or reference numbers; Request that the creditor consider removing or adjusting the. A formal statement requesting the removal of the late payment; In the third paragraph of your letter, request that the creditor remove the late payment from your credit report as a gesture of goodwill. If you have a late payment or other negative marks on your credit report that are dragging down your otherwise good credit score, there is a solution. Express remorse and your intention to pay on time going forward. They can be effectively used. It serves as a tool used to appeal to the creditor's empathy and understanding, seeking the removal of negative marks that may be impacting an individual's credit history. Web a goodwill letter is a simple way to restore your credit to good standing by requesting that a lender or servicer erase a late payment on your credit report. Use a polite, respectful tone and provide all necessary details. Your pledge to not let the account become delinquent again; Web explain the circumstances that led to the late payment or issue. Accurate account information, specific request, explanation of late payment, and any supporting documents.

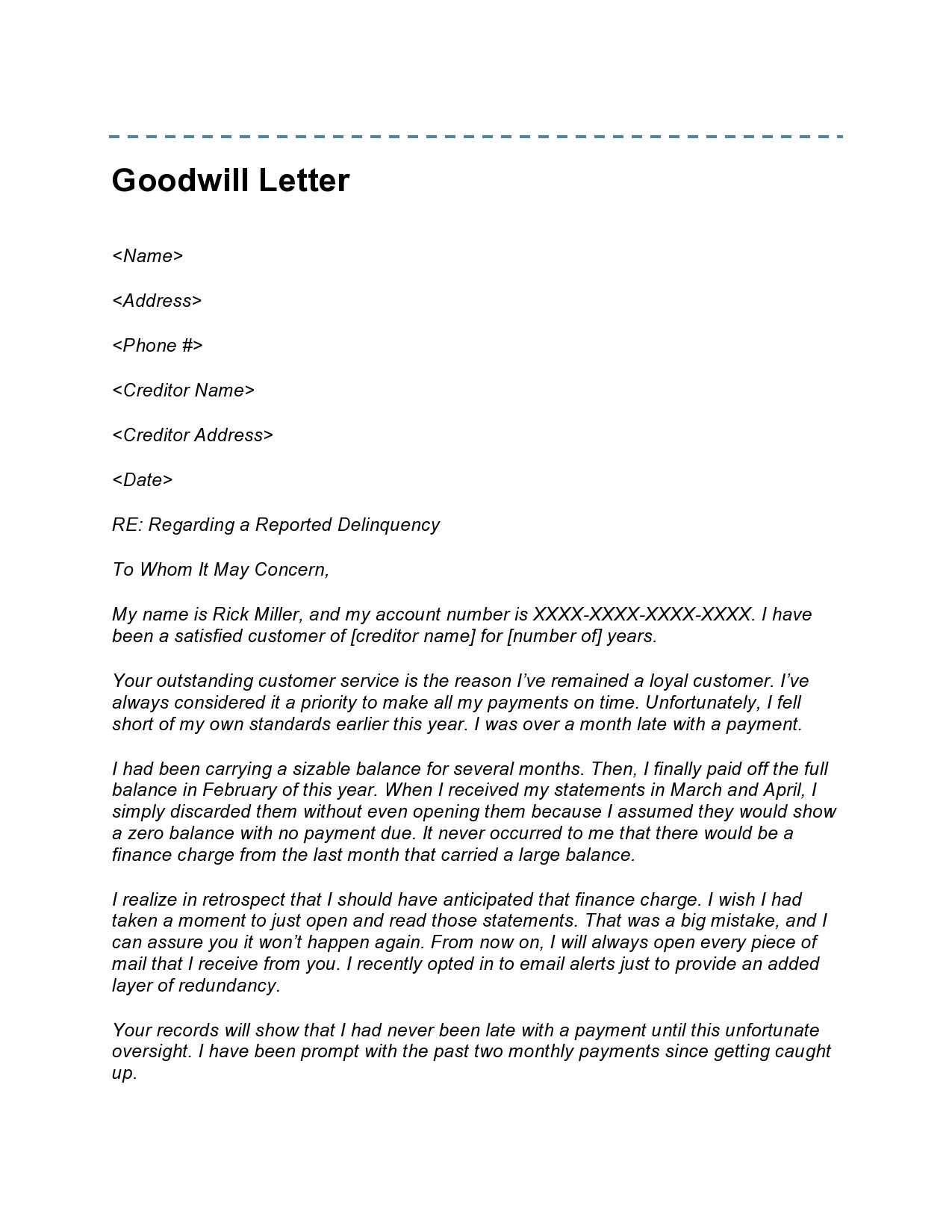

8+ Sample Goodwill Letters Sample Letters Word

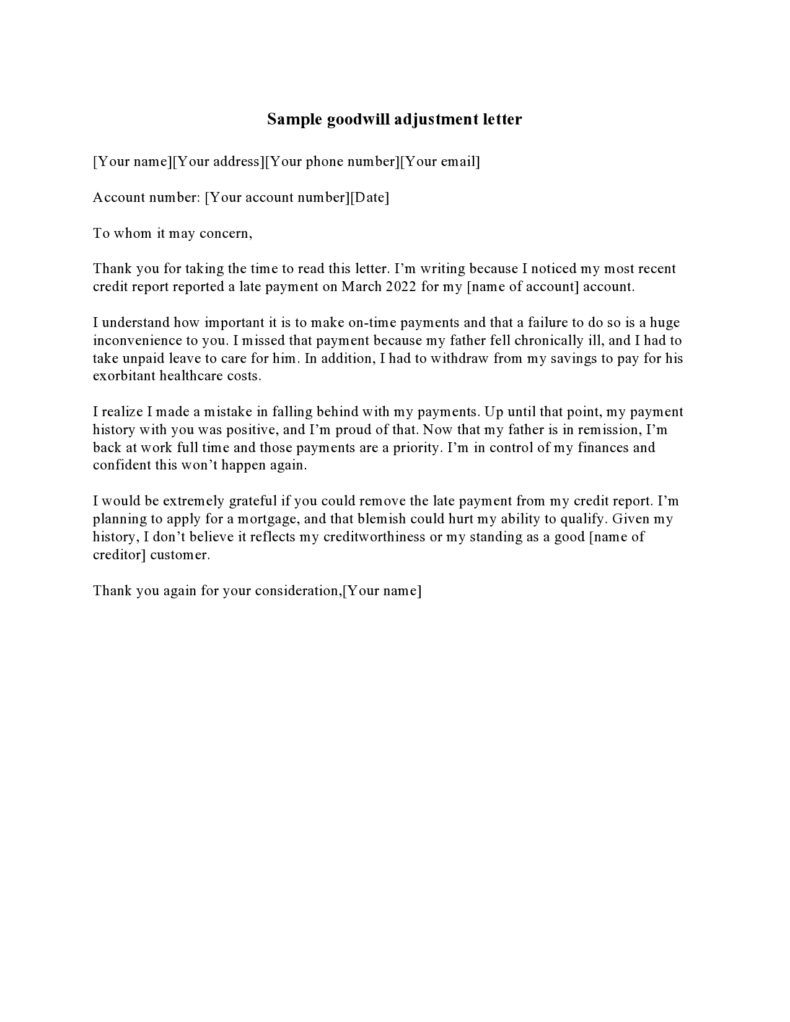

Goodwill Letter Template To Remove Late Payments

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

8+ Sample Goodwill Letters Sample Letters Word

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

Sample Goodwill Letter Template to Remove Late Payments

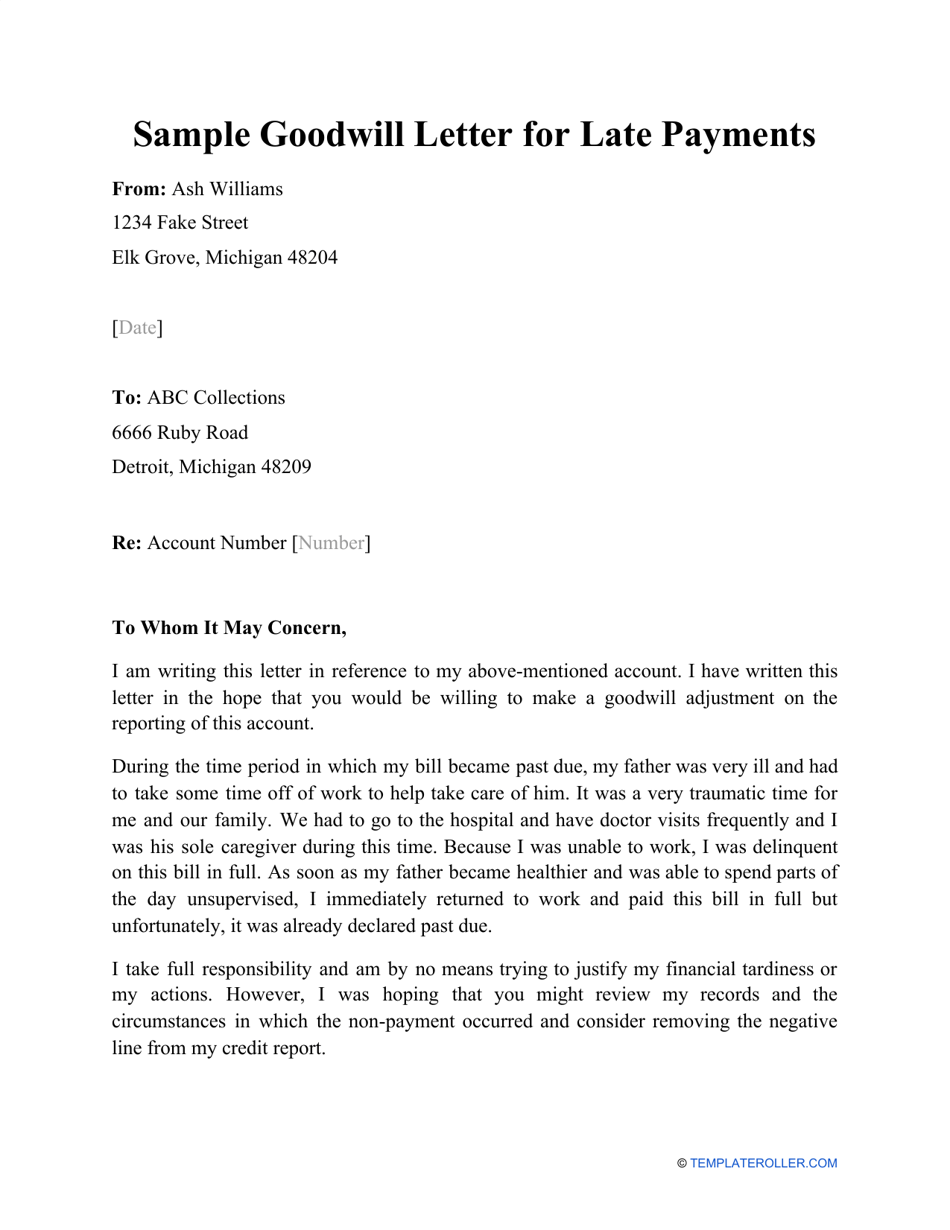

Sample Goodwill Letter for Late Payments Download Printable PDF

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

Web If You Decide You Want To Try To Remove A Collection From Your Credit Report, Here’s A Quick Recap On The Process:

The Late Payment Date ;

Web Your Goodwill Letter Should Contain The Following Elements:

A Goodwill Deletion Letter Should Include The Following:

Related Post: