Inkind Donation Receipt Letter Template

Inkind Donation Receipt Letter Template - The letter should describe the item (s) donated, but should not include a dollar value. Use an online donation receipt template for anyone who’s made. Provide information about the party receiving the donation. Web the first step would be to download the template and then: Web check out this solution for more info. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Introduce your organization and its representative. In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. Say “thank you” up front. Show how the donation can help solve an issue. Web check out this solution for more info. For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. Web easily generate an effective in kind donation letter with our free online template. The letter should describe the item (s) donated, but. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Provide information about the party receiving the donation. Year end donation receipt template. Attach a relevant image to make the appeal stand out. Therefore, your contribution is tax deductible to. Web the first step would be to download the template and then: This would include their full name (or name of organization) along with the address and if applicable, the tax number; Attach a relevant image to make the appeal stand out. Web these email and letter templates will help you create compelling donation receipts without taking your time away. As we’ll discuss below, it’s also an opportunity for you to provide the official documentation required by the. Provide information about the party receiving the donation. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. In kind donors do not receive any goods. Therefore, your contribution is tax deductible to. As we’ll discuss below, it’s also an opportunity for you to provide the official documentation required by the. Provide information about the party receiving the donation. Church/religious organization donation receipt template. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250. The name of your donor. A cash donation receipt provides written documentation of a cash gift. Web easily generate an effective in kind donation letter with our free online template. Web the first step would be to download the template and then: It allows you to create and customize the draft of your receipt contents. The name of your donor. For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. In this article, you’ll discover some do’s and don’ts. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. The full legal name of your organization. Therefore, your contribution is tax deductible to. Use an online donation receipt template for anyone who’s made. This would include their full name (or name of organization) along with. Web the first step would be to download the template and then: The name of your donor. In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! Say “thank you” up front. Year end donation receipt. The organization issues a receipt to the donor to maintain financial files and allow the donor to. The full legal name of your organization. The name of your donor. Year end donation receipt template. Web download gift in kind acknowledgement letter (word doc) the letter serves as a thank you and required written acknowledgment, and should include specific language from. Therefore, your contribution is tax deductible to. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Introduce your organization and its representative. It allows you to create and customize the draft of your receipt contents. The full legal name of your organization. This would include their full name (or name of organization) along with the address and if applicable, the tax number; For example, a business may choose to donate computers to a school and declare that donation as a tax deduction. In kind donors do not receive any goods or services for their contribution. Web check out this solution for more info. The name of your donor. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Church/religious organization donation receipt template. Show how the donation can help solve an issue. Let the donor know how the business will benefit by donating. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web updated april 24, 2024.

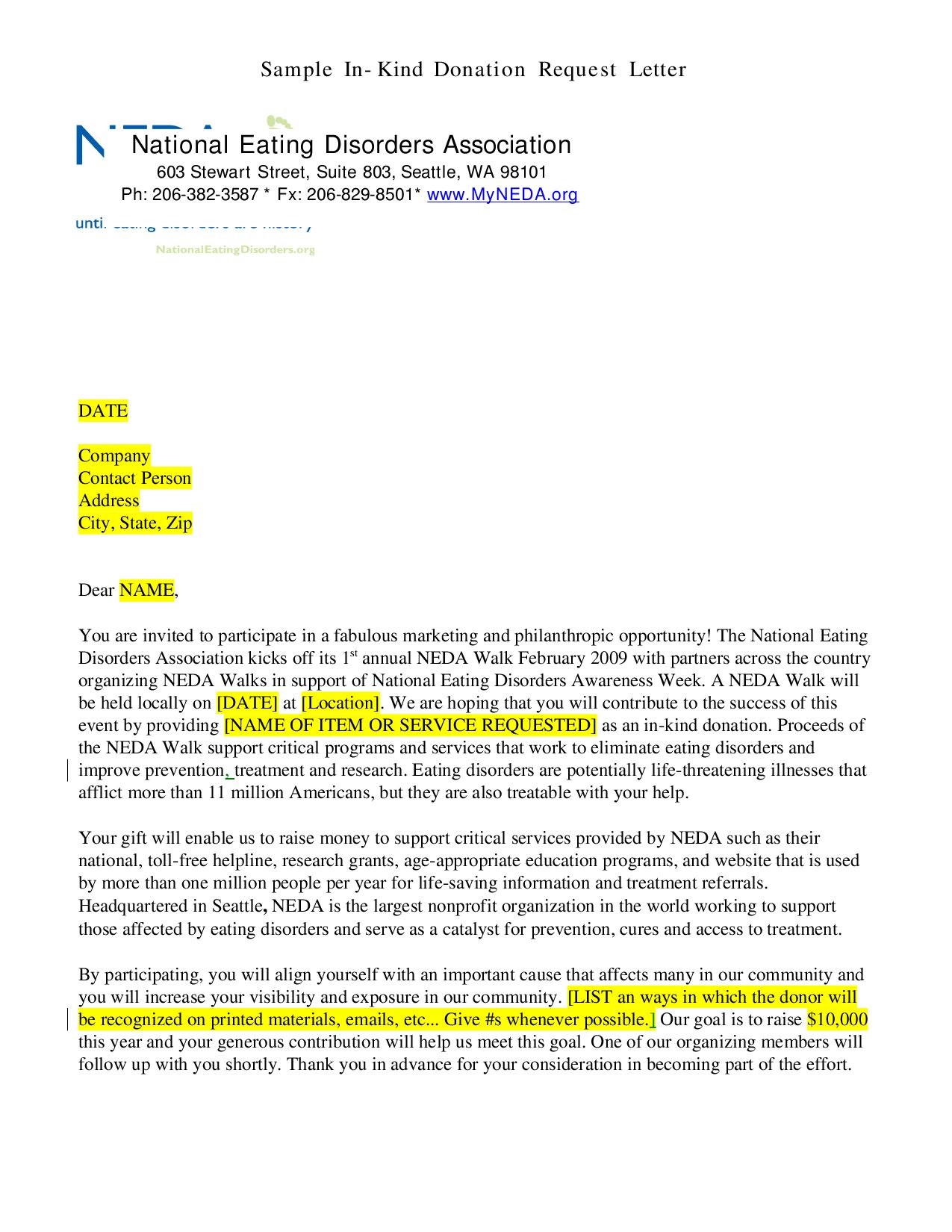

InKind Donation Letter by kathryn smith Issuu

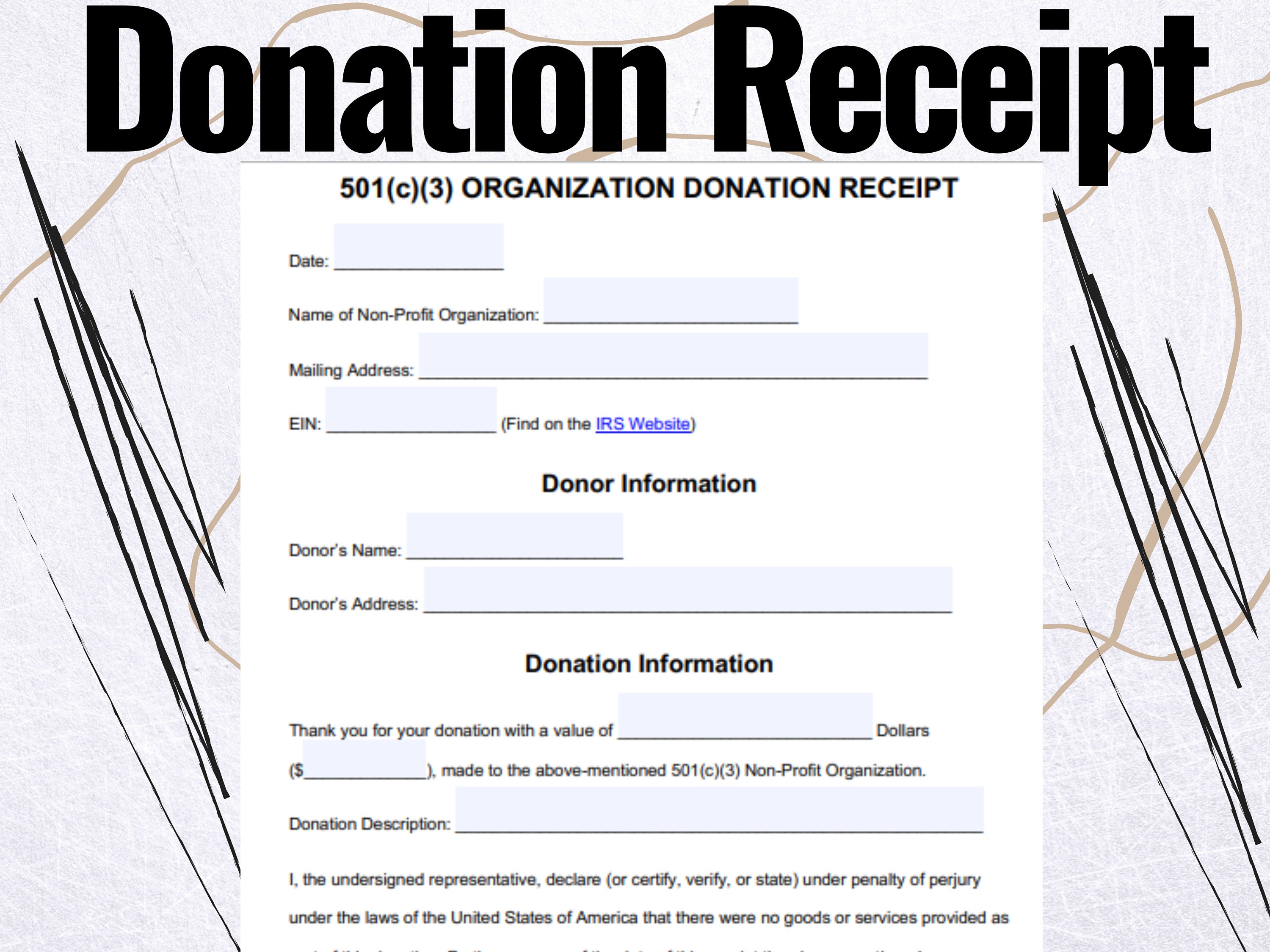

Donation Receipt Donation Receipt Forms , Donation Receipt Template Etsy

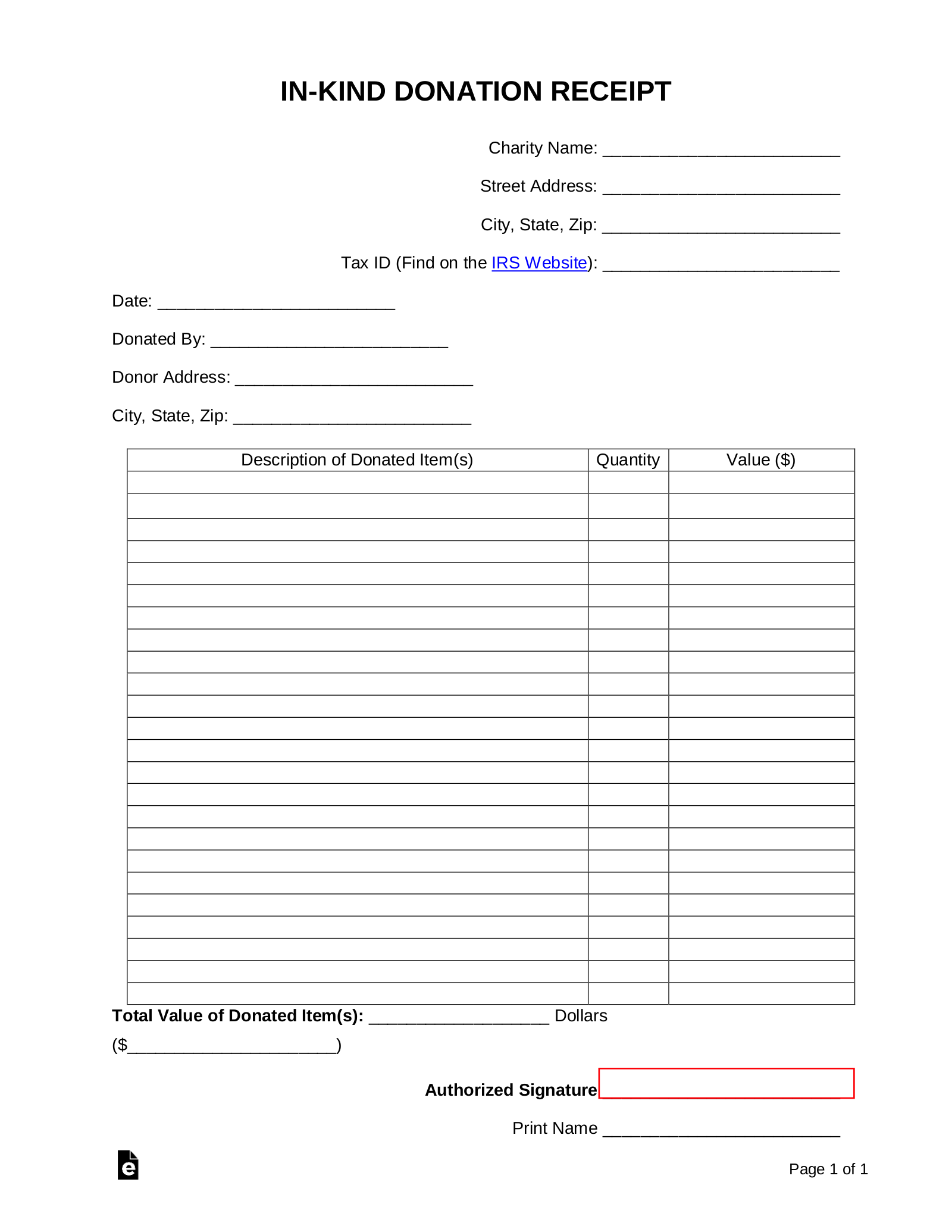

Free InKind (Personal Property) Donation Receipt Template PDF Word

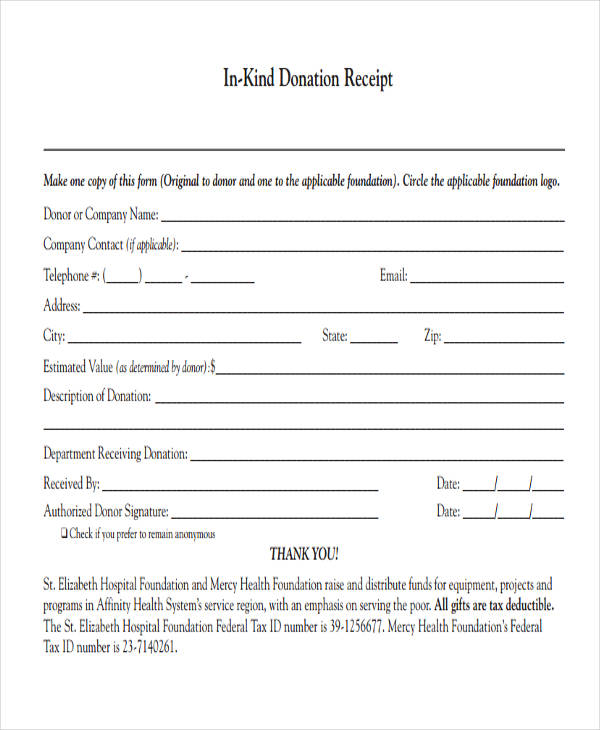

Explore Our Sample of Gift In Kind Donation Receipt Template Receipt

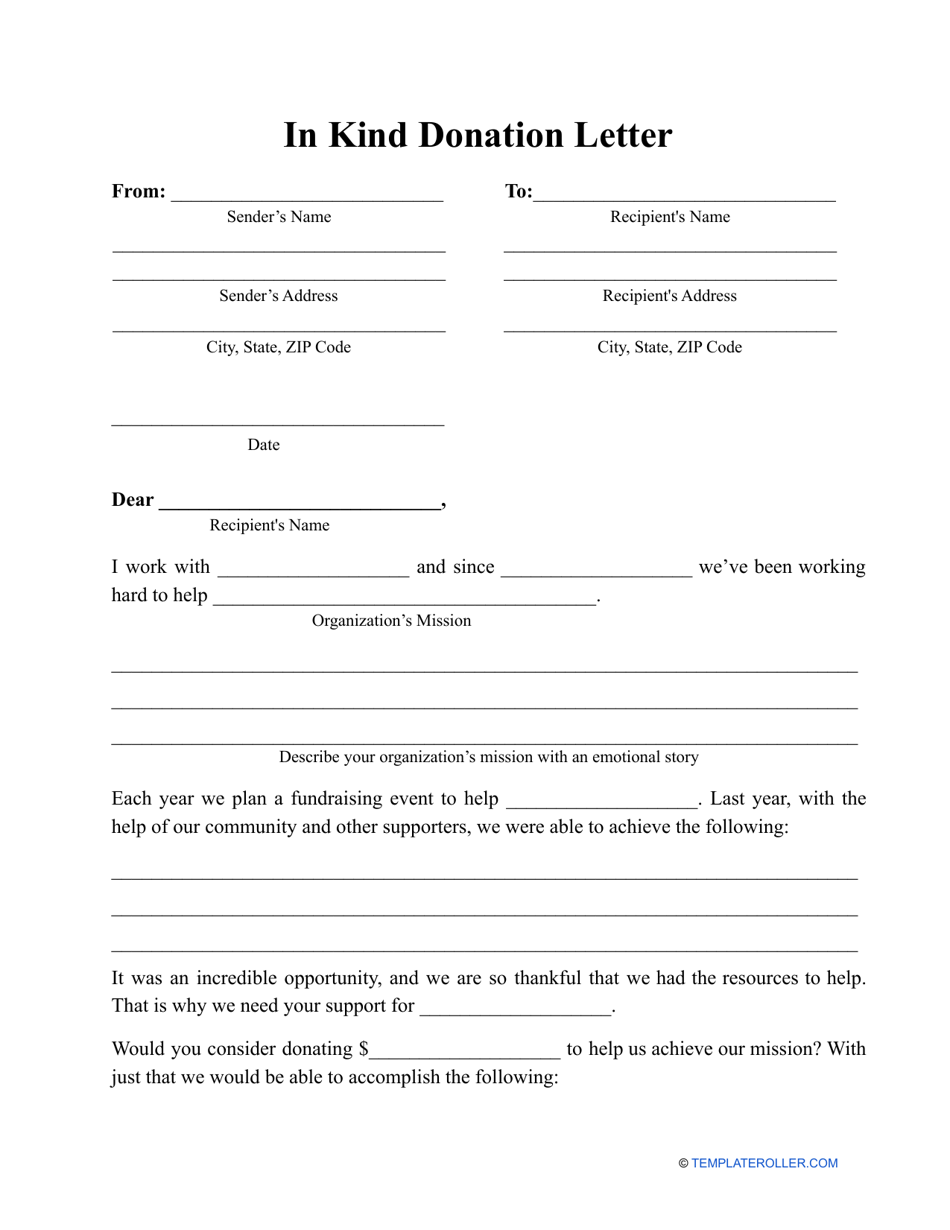

In Kind Donation Letter Template Download Printable PDF Templateroller

![InKind Donation Receipt Template Printable [Pdf & Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/04/In-Kind-Donation-Receipt-Template.jpg?fit=1414%2C2000&ssl=1)

InKind Donation Receipt Template Printable [Pdf & Word]

InKind Donation Receipt Letter Template

In Kind Donation Acknowledgement Letter Template Letter templates

FREE 5+ Donation Receipt Forms in PDF MS Word

In Kind Donation Acknowledgement Sample Letter

Use An Online Donation Receipt Template For Anyone Who’s Made.

Year End Donation Receipt Template.

The Organization Issues A Receipt To The Donor To Maintain Financial Files And Allow The Donor To.

Say “Thank You” Up Front.

Related Post: