Irs Abatement Letter Template

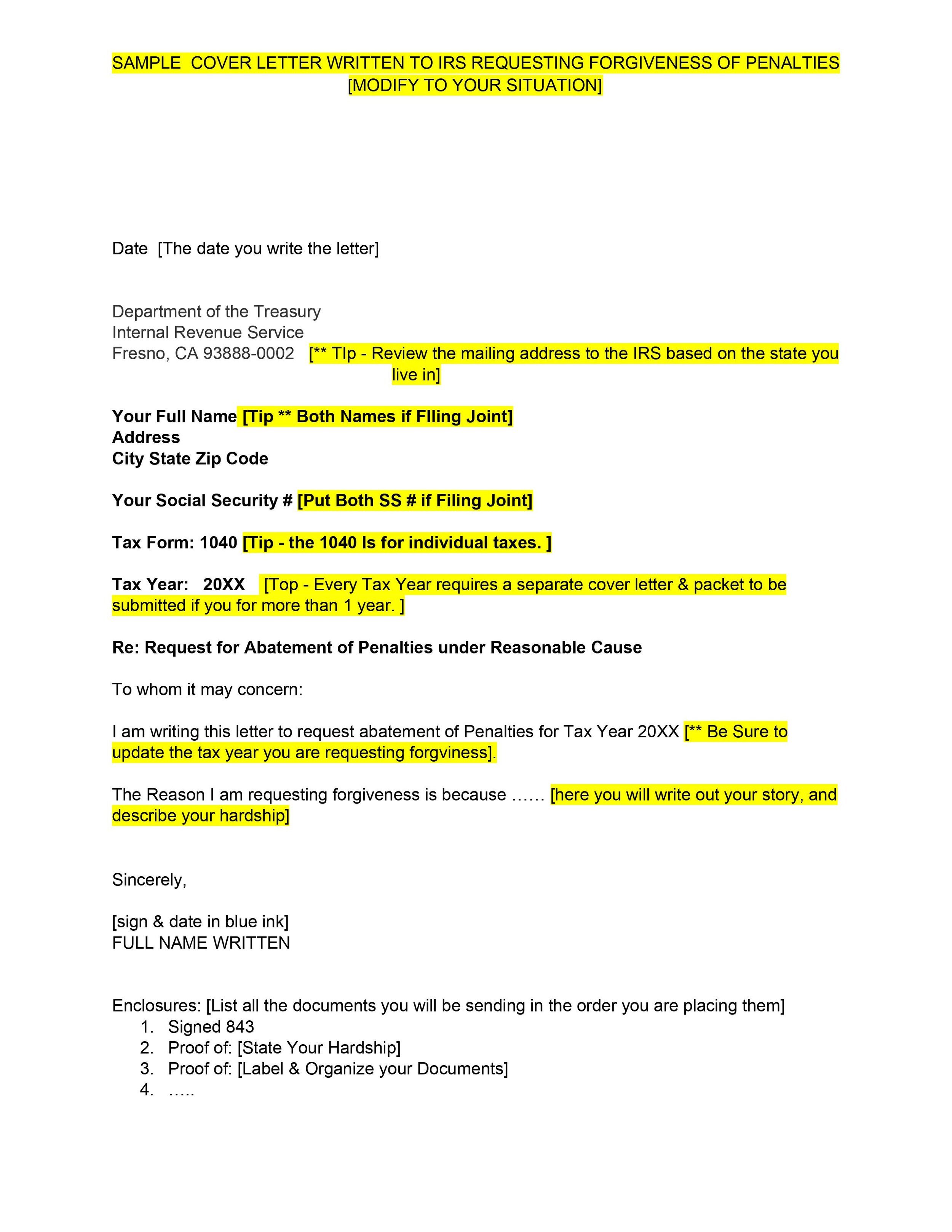

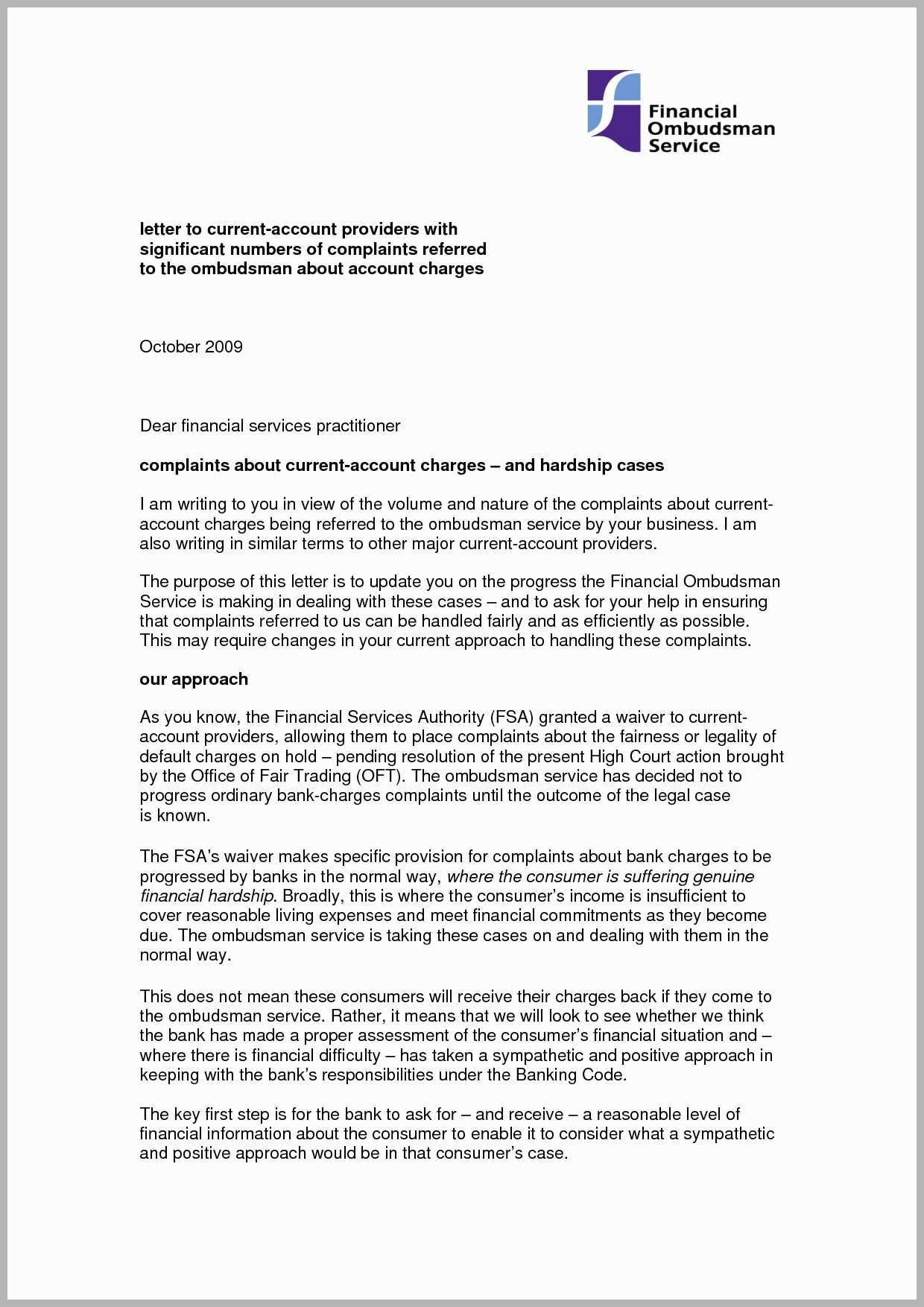

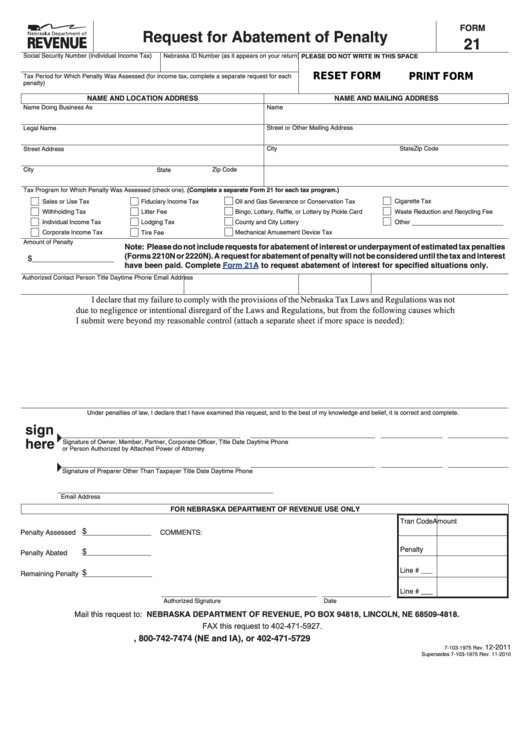

Irs Abatement Letter Template - Web if you don't qualify for either or we can't approve your relief over the phone, you can request relief in writing with form 843, claim for refund and request for. The letter should explain why you deserve abatement. The template is available free to. Affordable tax helpone time fee of $97instant payment quote Web an irs penalty abatement request letter is a formal statement composed by a taxpayer and sent to the internal revenue service (irs) to ask the latter to waive a penalty. Web the irs denied your request to remove the penalty (penalty abatement), you received a letter denying your request, which gives you your appeal rights. Help with irs penalty abatement from community tax. Up to 90% debt reduction.current on tax guidelines20+yrs in tax resolution Unfortunately, most taxpayers assessed an irs penalty do not request relief or are. What is an example of reasonable cause. Web an irs penalty abatement request letter is a formal statement composed by a taxpayer and sent to the internal revenue service (irs) to ask the latter to waive a penalty. The template is available free to. Examination of returns and claims for refund; Unfortunately, most taxpayers assessed an irs penalty do not request relief or are. Web the irs. You may qualify for relief from a penalty. Fortunately, we have a sample petition letter so you get a. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. If you received a notice or. Taxpayers hate paying irs penalties. Up to 90% debt reduction.current on tax guidelines20+yrs in tax resolution Examination of returns and claims for refund; A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your. If you received a notice or. Last updated on june 27th, 2022. What is an example of reasonable cause. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. Fortunately, we have a sample petition letter so you get a. A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Taxpayers hate paying irs penalties. Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to whom it may concern: Web template for success: The importance of tracking your request and being prepared for any follow. 1040, 1065, etc, and the tax period] re: Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to whom it may concern: Web here is a simplified irs letter template that you can use when writing to the irs: Affordable tax helpone time fee of $97instant payment quote Examination of returns and claims for refund; If you received a notice or. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. Determination of tax liability (also: Taxpayers hate paying irs penalties. Web after the irs has assessed a penalty, the taxpayer can request penalty abatement, typically by writing a penalty abatement letter or by calling the irs.. You may qualify for relief from a penalty. A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. Web form 843, claim for refund and. You may qualify for relief from a penalty. You should also include a detailed. Taxpayers hate paying irs penalties. The letter should explain why you deserve abatement. Web template for success: Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to whom it may concern: A signed letter requesting that we reduce or adjust the overcharged interest. Fortunately, we have a sample petition letter so you get a. You should also include a detailed. Examination of returns and claims for refund; Web use this sample irs penalty abatement request letter as a template for your successful appeal letter. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. Web an irs penalty abatement request letter is a formal statement composed by a taxpayer and sent to the internal revenue service (irs) to ask the latter to waive a penalty. The template is available free to. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. Web template for success: A customizable template to kickstart your letter. Determination of tax liability (also: Web after the irs has assessed a penalty, the taxpayer can request penalty abatement, typically by writing a penalty abatement letter or by calling the irs. Affordable tax helpone time fee of $97instant payment quote The importance of tracking your request and being prepared for any follow. Web if you don't qualify for either or we can't approve your relief over the phone, you can request relief in writing with form 843, claim for refund and request for. Web form 843, claim for refund and request for abatement pdf or. Examination of returns and claims for refund; Web writing an irs penalty abatement request letter. Web if we correctly charged the partnership or s corporation a penalty for filing late, but you believe it had reasonable cause for doing so, you can mail a written.

How To Write Letter To Irs About Abatement businessbv

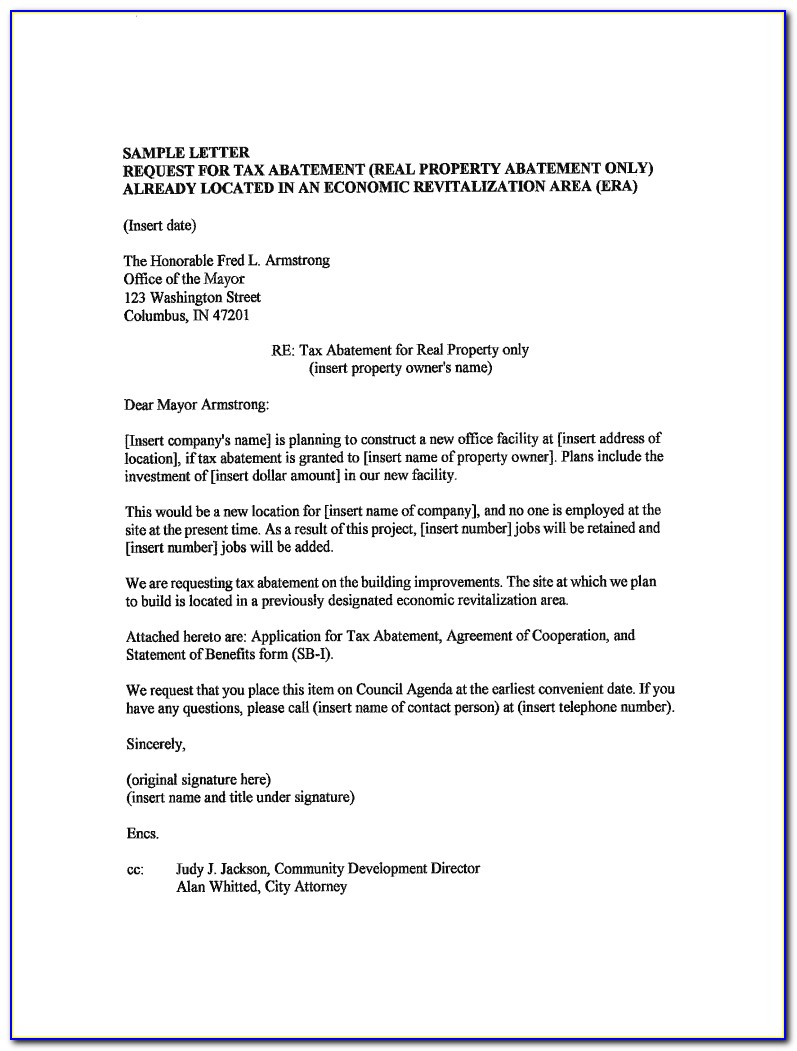

Penalty Abatement Letter Sample

Sample Letter To Irs To Waive Penalty

Sample IRS Penalty Abatement Request Letter PDF Internal Revenue

How to remove IRS tax penalties in 3 easy steps. — Get rid of tax

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties in Bank

Asking For Waiver Of Penalty Unique Irs Penalty Abatement Letter

Fillable Form 21 Request For Abatement Of Penalty printable pdf download

IRS Letter 1277 Penalty Abatement Denied H&R Block

IRS Abatement Letter Template PDF Internal Revenue Service

Fortunately, We Have A Sample Petition Letter So You Get A.

Web Here Is A Simplified Irs Letter Template That You Can Use When Writing To The Irs:

What Is An Example Of Reasonable Cause.

You Should Also Include A Detailed.

Related Post: