Irs Letter Response Template

Irs Letter Response Template - Given how complex and challenging it is to file your taxes and how easy it is to make errors, you. The irs mails letters or notices to taxpayers for a variety of reasons including if: The likelihood of getting an. For many notices, the irs will grant an extension of time to. Sign docs electronicallymobile & desktopfinish docs in minutesrocket lawyer guarantee Web updated on april 26, 2024. Web letter to the irs template. Web complete the notice response form and state whether you agree or disagree with the notice. Page last reviewed or updated: Sample letter to the irs template. Examples of these records include but are not limited to: Page last reviewed or updated: Given how complex and challenging it is to file your taxes and how easy it is to make errors, you. Web complete the notice response form and state whether you agree or disagree with the notice. We are sending you letter. Web how to write a letter to the irs to waive penalty. Web provided in response to your request. What you and your family need to know pdf. Tax and information returns filed by the taxpayer, correspondence between the. Which you received the notice> phone: Web discover how quickly and painlessly you can write those important letters using the collection of templates included in the ultimate irs communicator. Web but what about extensions when the irs demands a response to a notice or letter within 30 days? An irs penalty response letter is a document used to file a request with the irs that a. The response form explains what actions to take. Web letter to the irs template. Sign docs electronicallymobile & desktopfinish docs in minutesrocket lawyer guarantee Learn how to write a persuasive letter to the irs to request a waiver of penalties. We are sending you letter. This letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection due process. What you and your family need to know pdf. The response form explains what actions to take. They are due a larger or. Which you received the notice> phone: Keep copies of any correspondence with your. Web how to write a letter to the irs to waive penalty. This letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection due process. An irs penalty response letter is a document used to file a request with the irs that a penalty. Sign docs electronicallymobile & desktopfinish docs in minutesrocket lawyer guarantee The irs mails letters or notices to taxpayers for a variety of reasons including if: Get, create, make and sign. Web updated on april 26, 2024. (your specific notice may not. Web complete the notice response form and state whether you agree or disagree with the notice. Examples of these records include but are not limited to: Web updated on april 26, 2024. Edit your irs response letter template form online. This letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection. Web publication 5187, affordable care act: (your specific notice may not. We are sending you letter. Get, create, make and sign. Sign docs electronicallymobile & desktopfinish docs in minutesrocket lawyer guarantee The likelihood of getting an. The response form explains what actions to take. Get, create, make and sign. This letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection due process. Given how complex and challenging it is to file your taxes and how easy it is to make errors, you. Examples of these records include but are not limited to: For many notices, the irs will grant an extension of time to. Web updated on april 26, 2024. Web learn why the irs sends letters to taxpayers, how to respond when you disagree with the contents, and how to avoid scams when you receive a letter. We are sending you letter. Which you received the notice> phone: Sample letter to the irs template. The irs mails letters or notices to taxpayers for a variety of reasons including if: Web but what about extensions when the irs demands a response to a notice or letter within 30 days? Web provided in response to your request. Web letter to the irs template. Web irs</strong> service center from. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer,. (your specific notice may not. Page last reviewed or updated: Web complete the notice response form and state whether you agree or disagree with the notice.

Irs Response Letter Template Get Free Templates

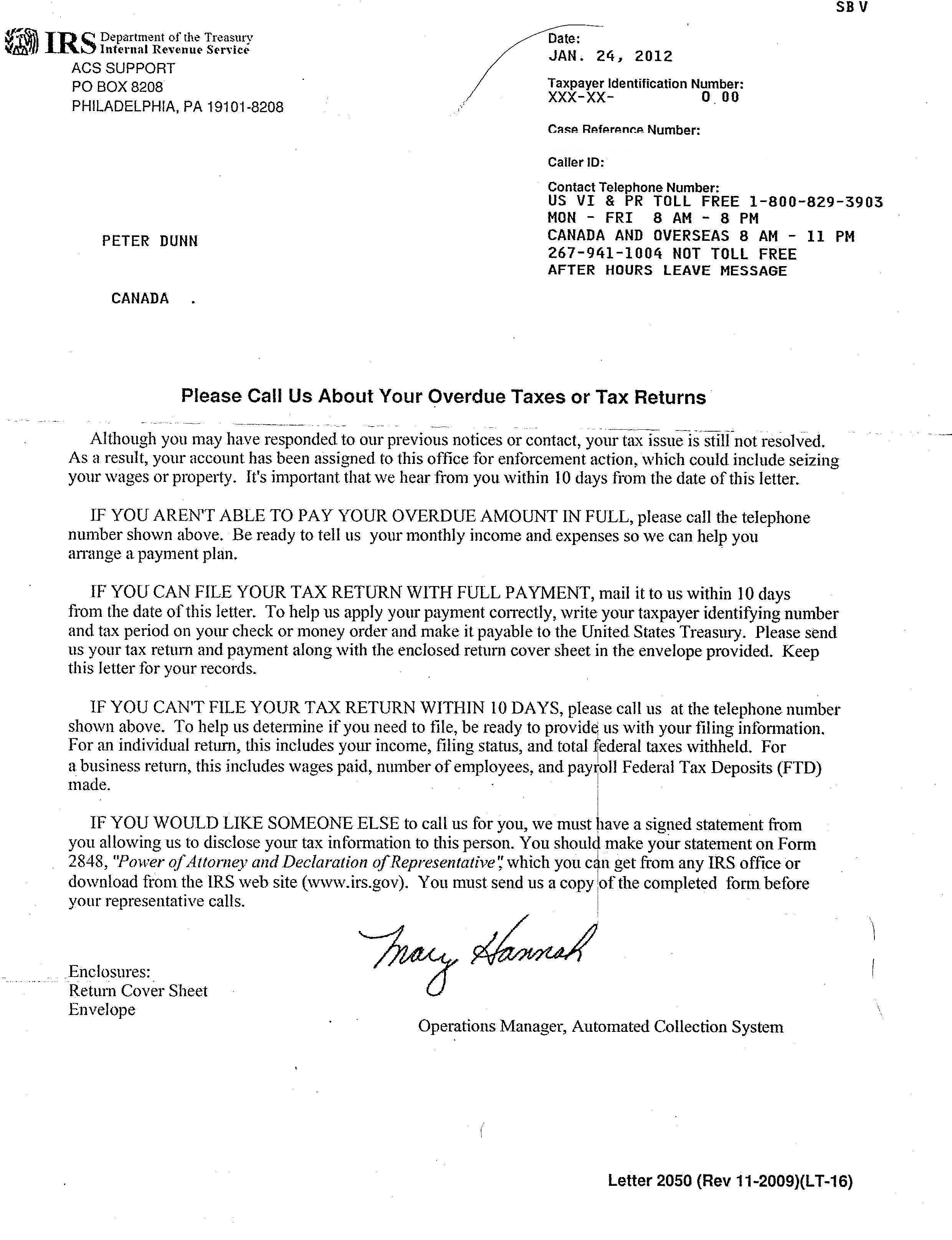

IRS Response Letter Template Federal Government Of The United States

IRS Audit Notice How to Survive One (With Free Response Template!)

Free Response to IRS Notice Make & Download Rocket Lawyer

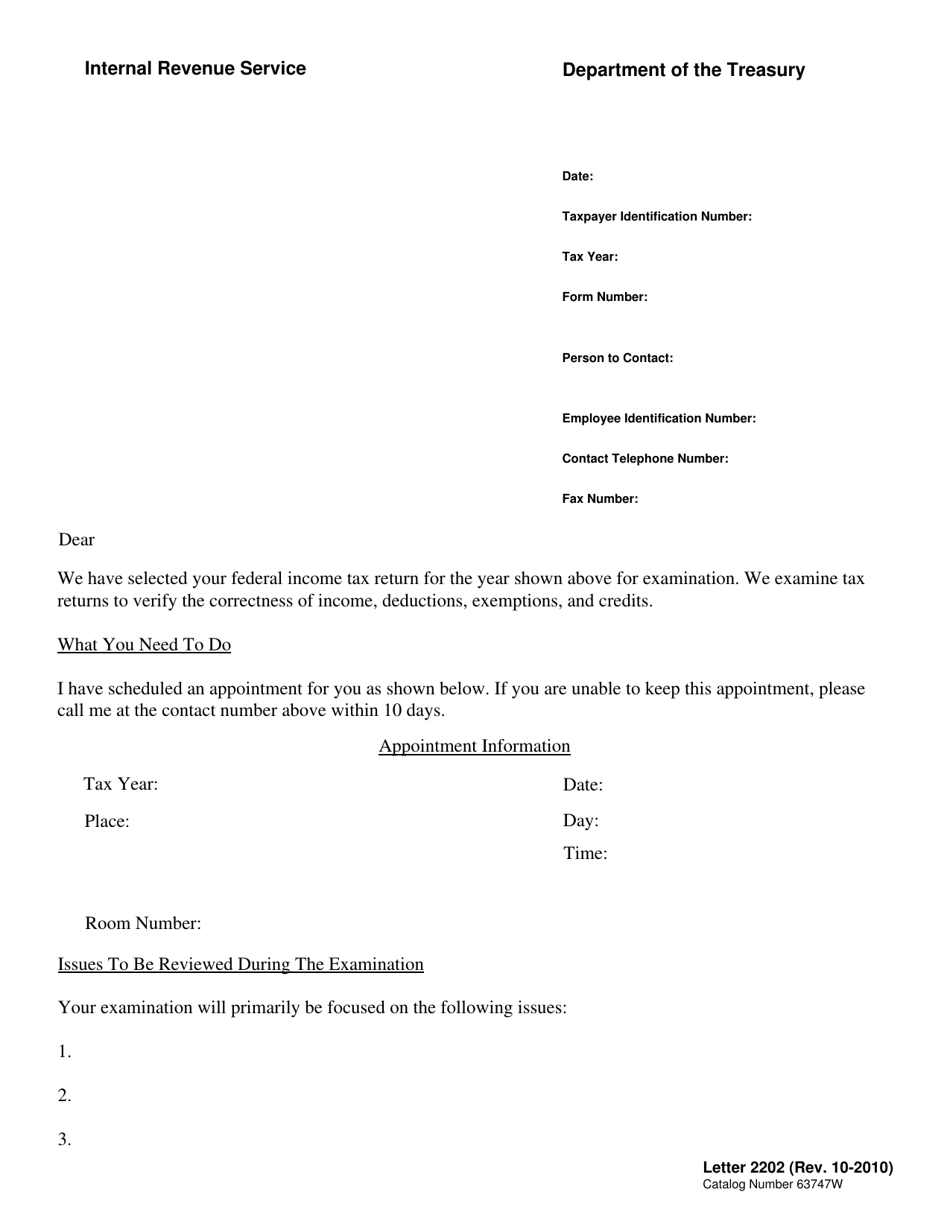

IRS Letter 2202, IRS Audit Letter Fill Out, Sign Online and Download

Irs Letter Response Template

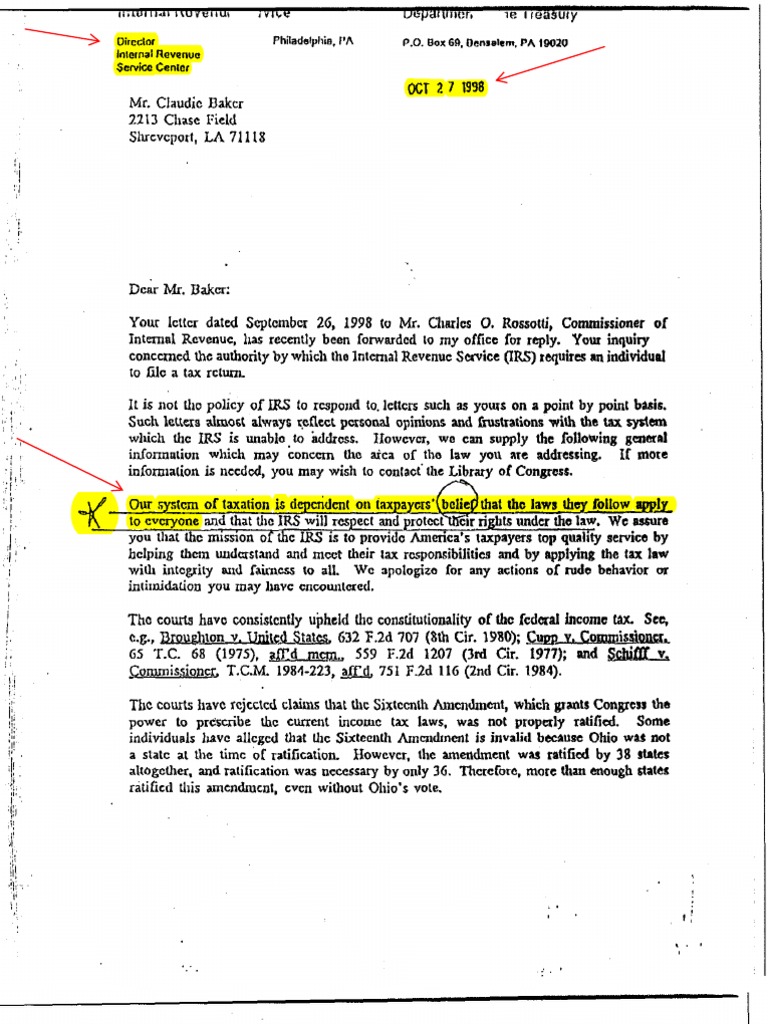

IRS response Letter Internal Revenue Service Ratification

Irs Response Letter Template in 2022 Letter templates, Business

Irs Response Letter Template Best Template Ideas

Letter To Irs Free Printable Documents

Find Out How To Draft A.

Keep Copies Of Any Correspondence With Your.

Given How Complex And Challenging It Is To File Your Taxes And How Easy It Is To Make Errors, You.

Web How To Write A Letter To The Irs To Waive Penalty.

Related Post: