Irs Mileage Log Template

Irs Mileage Log Template - Web this publication explains the tax rules and deductions for travel, gift, and car expenses. If your company has a specific reimbursement form for you to use, then keep a copy of vertex42's mileage. A paper log is a simple, written record of your business miles driven. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web the irs accepts two forms of mileage log formats: Web free mileage log template for excel. Web you can use it as a free irs mileage log template. Web download the printable mileage log template for 2024 with the standard irs mileage rate of 67 cents per mile for business use. Web track your business mileage and calculate your deduction with this free spreadsheet. Web your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending mileage at the conclusion of the year. You have to own or lease the. Web a straightforward way to record your mileage manually for tax purposes is to use an excel spreadsheet template. Web this publication explains the tax rules and deductions for travel, gift, and car expenses. These free excel mileage logs contain everything you need for a. A mileage log for taxes can lead to. Web requirements for the standard mileage rate. The irs has been known to disqualify. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. Learn how to organize, store, and maximize the potential of. It does not provide a mileage log. With the help of this template, you. Web you can use it as a free irs mileage log template. A paper log is a simple, written record of your business miles driven. Web the template will also help you to calculate the amount you are owed. A mileage log for taxes can lead to large savings but what does the. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending mileage at the conclusion of the year. To qualify to use the. Web the irs accepts two forms of mileage log formats: Web for actual expense method: Learn how to use the template, what to include,. You can download the following templates for free: Web this publication explains the tax rules and deductions for travel, gift, and car expenses. Web a straightforward way to record your mileage manually for tax purposes is to use an excel spreadsheet template. You can download the following templates for free: It does not provide a mileage log template or a standard mileage rate for 2023. Web download the printable mileage log template for 2024 with the standard irs mileage rate of 67 cents. Web you can use it as a free irs mileage log template. Learn how to use the template, what to include,. Learn how to organize, store, and maximize the potential of. Learn the pros and cons of different. The irs has been known to disqualify. If your company has a specific reimbursement form for you to use, then keep a copy of vertex42's mileage. Web you can use it as a free irs mileage log template. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Web the easiest way to keep records is to use a mileage log. Web irs compliant mileage log template in excel, openoffice calc & google sheets to record and claim irs tax deductions of mileage expenses. Web the irs accepts two forms of mileage log formats: Web for actual expense method: Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently. Learn how to organize, store, and maximize the potential of. If your company has a specific reimbursement form for you to use, then keep a copy of vertex42's mileage. Paper logs and digital logs. Web free mileage log template for excel. Web this publication explains the tax rules and deductions for travel, gift, and car expenses. The irs has been known to disqualify. If your company has a specific reimbursement form for you to use, then keep a copy of vertex42's mileage. Web a straightforward way to record your mileage manually for tax purposes is to use an excel spreadsheet template. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Learn how to organize, store, and maximize the potential of. Web the irs accepts two forms of mileage log formats: You have to own or lease the. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Web download the printable mileage log template for 2024 with the standard irs mileage rate of 67 cents per mile for business use. With the help of this template, you. Learn the pros and cons of different. It does not provide a mileage log template or a standard mileage rate for 2023. Web for actual expense method: These free excel mileage logs contain everything you need for a. Paper logs and digital logs. Web irs compliant mileage log template in excel, openoffice calc & google sheets to record and claim irs tax deductions of mileage expenses.

25 Printable IRS Mileage Tracking Templates GOFAR

![]()

25 Printable IRS Mileage Tracking Templates GOFAR

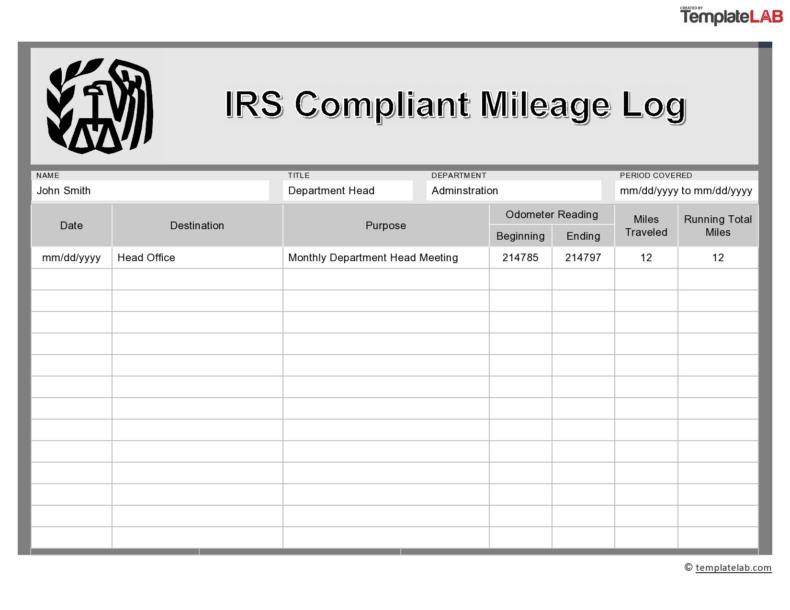

ReadyToUse IRS Compliant Mileage Log Template 2021 MSOfficeGeek

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

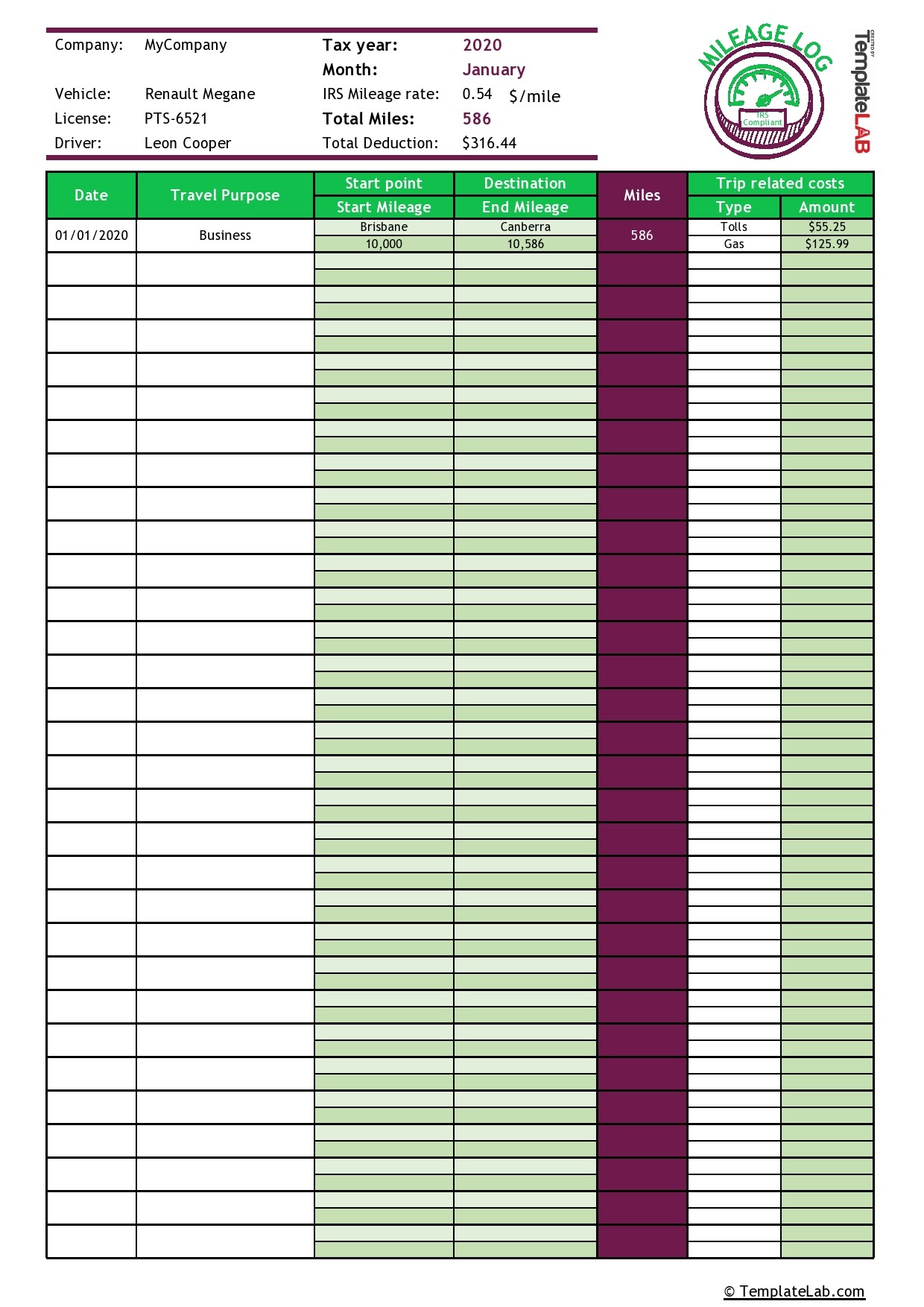

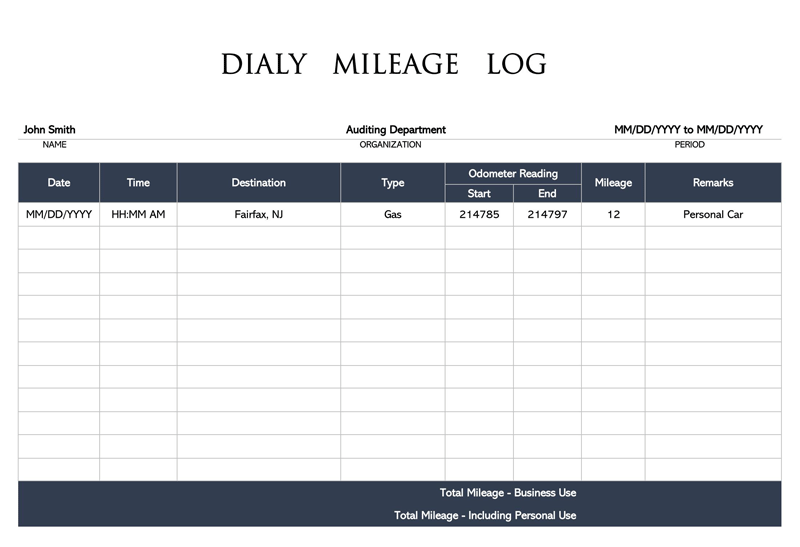

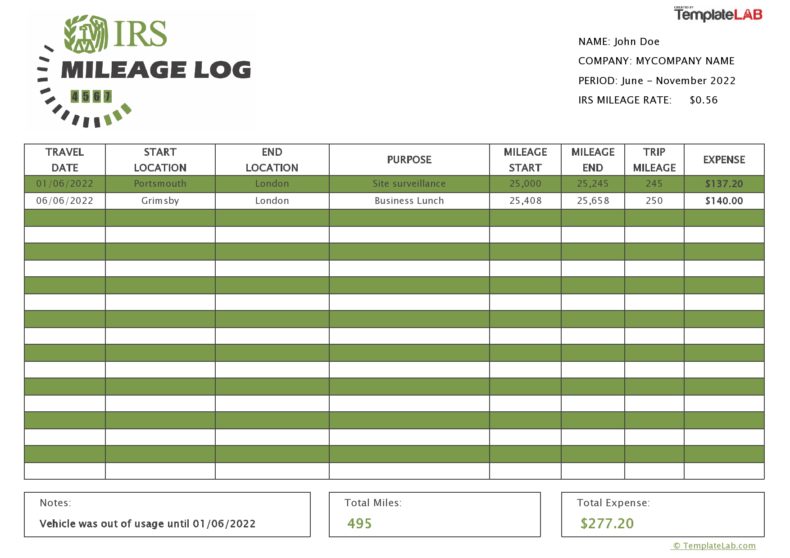

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

21+ Free Mileage Log Templates (for IRS Mileage Tracking)

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

A Mileage Log For Taxes Can Lead To Large Savings But What Does The Irs Require From Your Records?

The Snippet Below Shows All The Above Mentioned Details, Except For The Odometer And The Summary Data, Which We’ll Show On.

Web This Publication Explains The Tax Rules And Deductions For Travel, Gift, And Car Expenses.

Web You Can Use It As A Free Irs Mileage Log Template.

Related Post: