Irs Name Change Letter Template

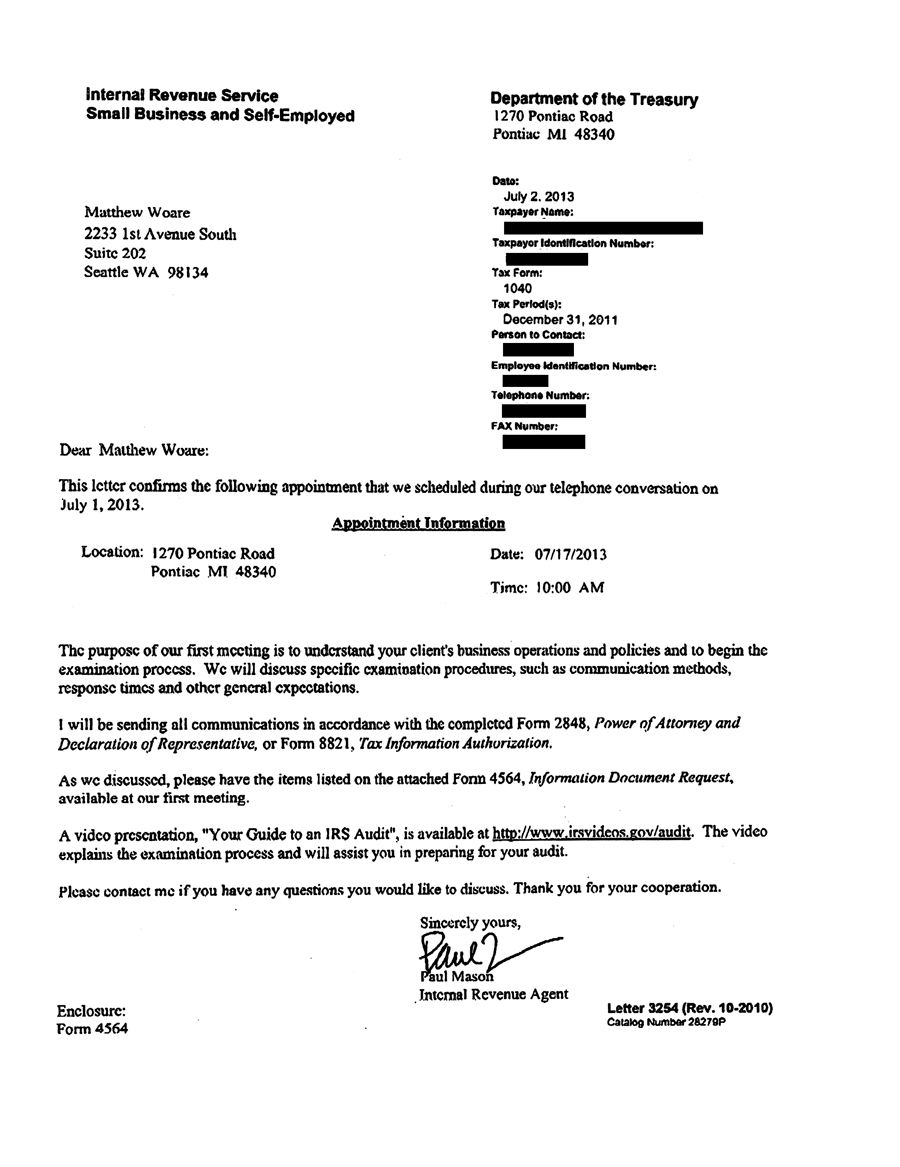

Irs Name Change Letter Template - Sign it in a few clicks. The irs wants people experiencing a name change to remember these important things: Corporations and llcs can check the name change box while filing their annual tax. If you have previously reported a change of name, you may wish to confirm with customer account services. Edit your irs name change letter template online. Web when filing a current year tax return, you can change your business name with the irs by checking the name change box on the entity’s respective form:. When you legally change your name, there are tax consequences. How to write a hardship letter to the irs. To whom it may concern: Type text, add images, blackout confidential details, add comments, highlights and more. Old church name has recently changed their name to new. When you legally change your name, there are tax consequences. Web when filing a current year tax return, you can change your business name with the irs by checking the name change box on the entity’s respective form:. Web sample letter to irs for business name change. Sample letter to. Sign it in a few clicks. As of [effective date], our company, [old business name], has officially changed its. (i) the ein number for the business, (ii) the old business name, and. Corporate entities that have already filed their taxes can send a letter signed by a. A notification of name change letter is a document used to inform both. Corporations and llcs can check the name change box while filing their annual tax. 1 responding to a request for information. Web business owners and other authorized individuals can submit a name change for their business. How to write a hardship letter to the irs. Sample letter to irs for business name change (sole proprietorship): If you are running your business as a sole proprietor, you can use this sample letter to inform the. How to write a hardship letter to the irs. Sample letter to irs for business name change (sole proprietorship): When you legally change your name, there are tax consequences. Corporate entities that have already filed their taxes can send a letter. Sign it in a few clicks. Web for a corporation filing a tax return, mark the “name change” box on form 1120. Web the irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the. If you are running your business as a sole proprietor, you. Letter to the irs template. If you have previously reported a change of name, you may wish to confirm with customer account services. If you are running your business as a sole proprietor, you can use this sample letter to inform the. Church name church street address church city, state and zip tin: Web dear irs, i am writing to. The irs wants people experiencing a name change to remember these important things: Web dear irs, i am writing to inform you of a crucial change in our business details. 2 asking for an abatement. Sign it in a few clicks. Corporate entities that have already filed their taxes can send a letter signed by a. With us legal forms, finding a verified official template for a specific. When you legally change your name, there are tax consequences. If you have previously reported a change of name, you may wish to confirm with customer account services. Corporate entities that have already filed their taxes can send a letter signed by a. Web for a corporation filing. With us legal forms, finding a verified official template for a specific. The ein number for the business, the old business name, as well as. 2 asking for an abatement. When you legally change your name, there are tax consequences. If you have previously reported a change of name, you may wish to confirm with customer account services. Type text, add images, blackout confidential details, add comments, highlights and more. Web changing a business name with the irs can be done in one of two ways. If you haven’t changed your name with the ssa, you'll. To whom it may concern: With us legal forms, finding a verified official template for a specific. The ein number for the business, the old business name, as well as. Corporations and llcs can check the name change box while filing their annual tax. Web sample letter to irs for business name change. If you haven’t changed your name with the ssa, you'll. Old church name has recently changed their name to new. Letter to the irs template. Corporate entities that have already filed their taxes can send a letter signed by a. As of [effective date], our company, [old business name], has officially changed its. The irs wants people experiencing a name change to remember these important things: When you legally change your name, there are tax consequences. If you are running your business as a sole proprietor, you can use this sample letter to inform the. Web business owners and other authorized individuals can submit a name change for their business. Sample letter to irs for business name change (sole proprietorship): With us legal forms, finding a verified official template for a specific. Web the irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the. A notification of name change letter is a document used to inform both.

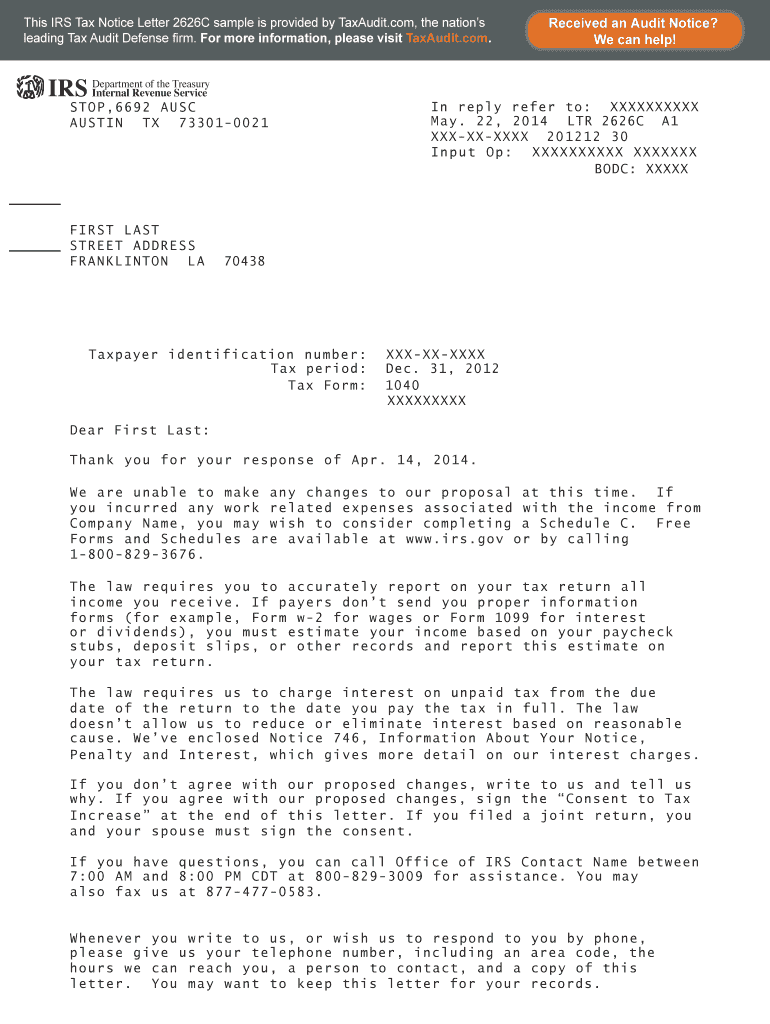

Irs Name Change Letter Sample An irs corporate name change form 8822

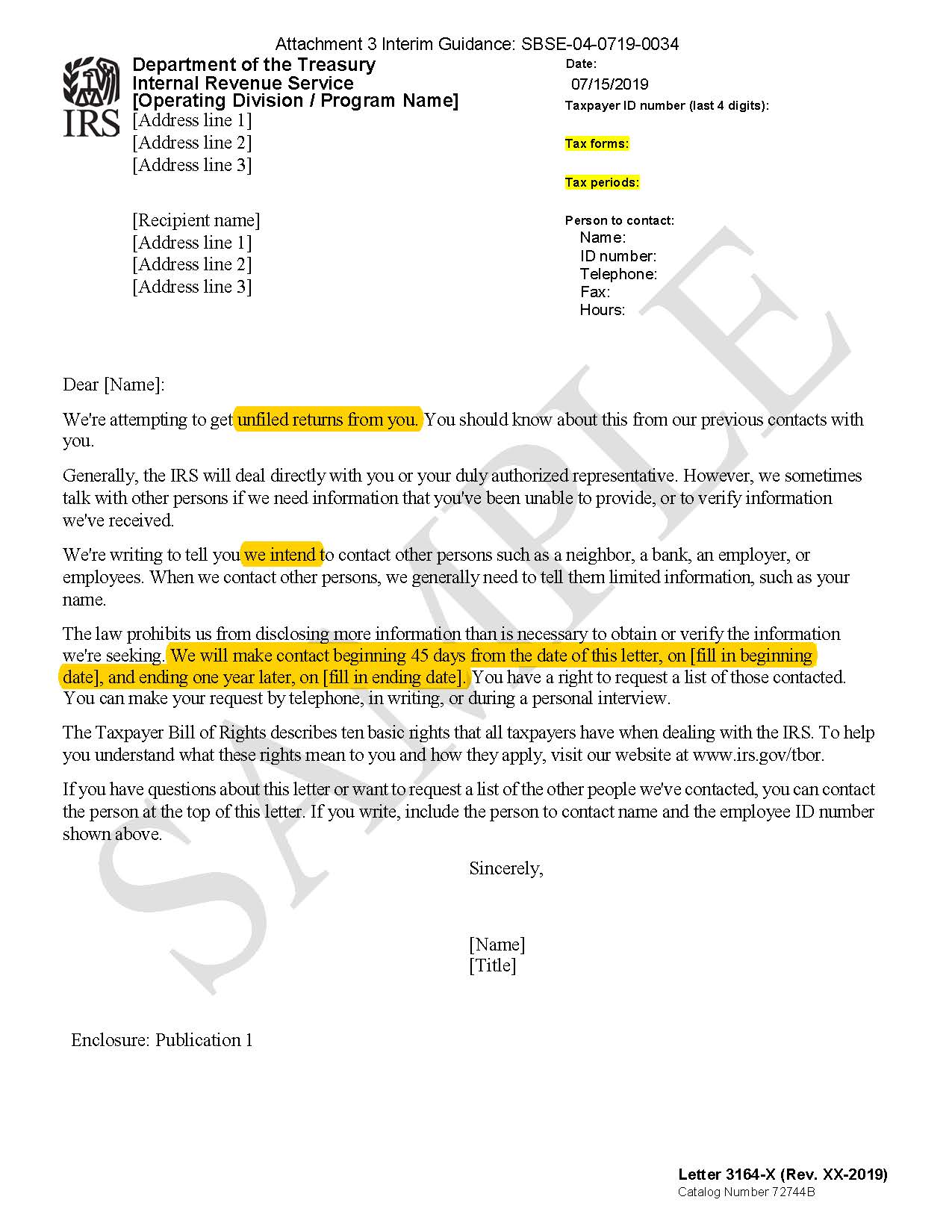

Irs Name Change Letter Sample / Irs Name Change Letter Sample / This

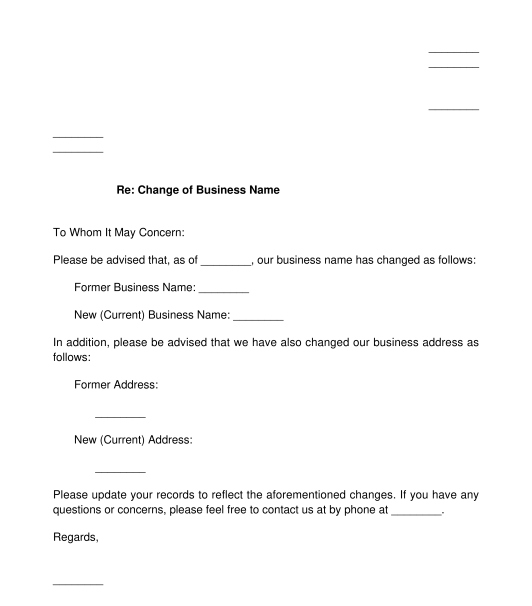

Irs Name Change Letter Sample Example of business name change letter

Irs Name Change Letter Sample Free 8 Sample Business Name Change

IRS Letter 257C We Corrected Your Name or Taxpayer Identification

Irs Name Change Letter Sample Irs Ein Name Change Form Lovely Irs

Irs business name change letter template Fill out & sign online DocHub

How to Change your LLC Name with the IRS? LLC University®

Irs Business Name Change Letter Template

Irs Name Change Letter Sample / Company name change letter examples

How To Write A Hardship Letter To The Irs.

Web When Filing A Current Year Tax Return, You Can Change Your Business Name With The Irs By Checking The Name Change Box On The Entity’s Respective Form:.

The Specific Action Required May Vary Depending On The Type Of Business.

Web Changing A Business Name With The Irs Can Be Done In One Of Two Ways.

Related Post: