Lease Accounting Template

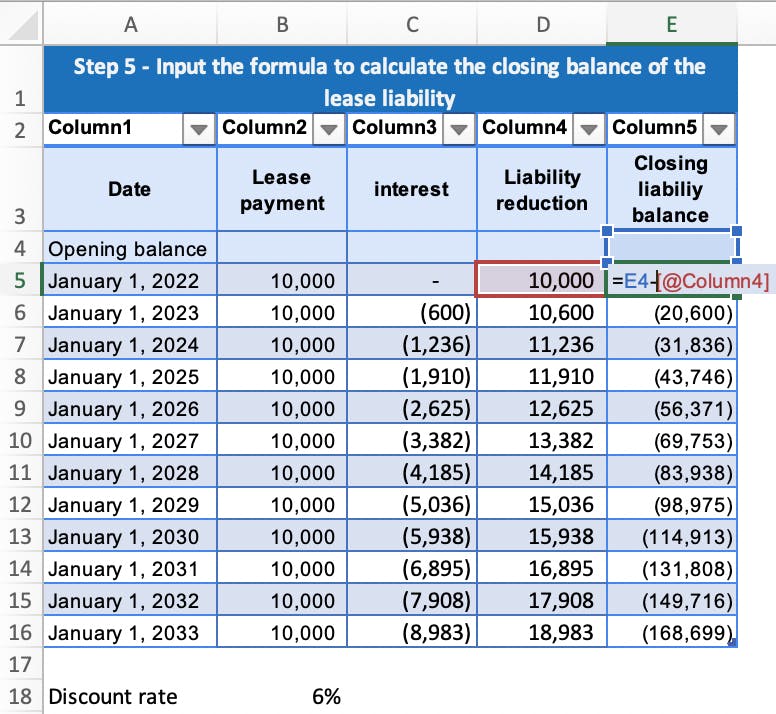

Lease Accounting Template - Web akin to asc 840, the new lease accounting standard asc 842 prescribes the lessee to determine the lease classification. Try leaseguru for free — our lease accounting software for small lease portfolios. Each lease is classified as either a finance lease or an operating lease. “finance lease” is a new term and. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Web • brings most leases ‘on balance sheet’. This data will be taken directly from the lease agreement. Web open excel and create a new blank spreadsheet. Web lease accounting calculates the balances and amortizations by discounting the cash flows using the discount rates on the lease. The tool is designed with usability in mind, catering to businesses of all sizes. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Posted by larson and company. “finance lease” is a new term and. Ifrs 16 led to significant changes in the accounting of lease contracts and is a challenge for many companies. The asc 842 lease accounting standard overhauled how businesses account for leases, enhancing transparency and. The tool is designed with usability in mind, catering to businesses of all sizes. We'll be working out the opening balance of the lease liability for each month. It simplifies lease management and compliance processes. Web leasing is a widely used alternative form of financing for companies. Web an asc 842 lease accounting template streamlines the transition to the new. Obtaining the excel file will also allow you to use it as a template for future lease calculations. Asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. Exemption for initial recognition of leases. This is a contractual agreement between two parties in which one party that owns an asset ( thelessor). A guide to accounting for leases. Web in our lease amortization schedule excel spreadsheet, there are primary inputs that drive the initial recognition of your lease liabilities under the new lease accounting standards: We'll be working out the opening balance of the lease liability for each month. The asc 842 lease accounting standard overhauled how businesses account for leases, enhancing. Web lease accounting calculates the balances and amortizations by discounting the cash flows using the discount rates on the lease. Ifrs 16 led to significant changes in the accounting of lease contracts and is a challenge for many companies. Obtaining the excel file will also allow you to use it as a template for future lease calculations. However, under asc. This data will be taken directly from the lease agreement. Including contract management and closing functionality. Web larson lease accounting template asc 842. The asc 842 lease accounting standard overhauled how businesses account for leases, enhancing transparency and comparability. Set up columns and headers. • ebitda will increase due to reversal of previous ias 17 lease expenses. Web the range of work experiences should help the company attract top accounting graduates that typically would join the big four accounting firms: Including contract management and closing functionality. With the complexity of the new rules, companies often. Accounting for a finance lease by a lessor; Set up columns and headers. Try leaseguru for free — our lease accounting software for small lease portfolios. Click the link to download a template for asc 842. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Web open excel and create a new blank spreadsheet. Explore hot topics, common pitfalls, and more information related to why entities that have adopted asc 842 should continually monitor, evaluate, and update. • will result in recognition of an ifrs 16 lease liability and right of use asset. Web lease accounting calculates the balances and amortizations by discounting the cash flows using the discount rates on the lease. Click. The free excel template from contavio helps you understand the leases standard and. Web here are the steps to calculate this: This applies to all leased asset categories covered under the standard, including leases of equipment and real estate. I suggest performing a nozzle check function to ensure that. “finance lease” is a new term and. We'll be working out the opening balance of the lease liability for each month. In this example, we have 12 payments, that occur on the last day of each month for an amount of $10,000. Web open excel and create a new blank spreadsheet. Including contract management and closing functionality. “finance lease” is a new term and. To make your job easier, we’ve built a few simple examples that show how the lease accounting works under the current and previous standards for capital/finance leases and operating leases. The fasb’s new standard on leases, asc 842, is effective for all entities.this guide discusses lessee and lessor accounting under asc 842.the first four chapters provide an introduction and guidance on determining whether an arrangement is (or contains) a lease and how to classify and account for. The asc 842 lease accounting standard overhauled how businesses account for leases, enhancing transparency and comparability. This issue might be due to a printing problem. Click the link to download a template for asc 842. Sale and leaseback transactions—updated june 2021 It simplifies lease management and compliance processes. Accounting for a finance lease by a lessor; “we have really, really strong tenure,” sanders said. Use our free tools, calculators, & excel templates for lease accounting, lease vs. A) calculate the opening balance of the right of use asset and divide by the total number of days the asset will be used.

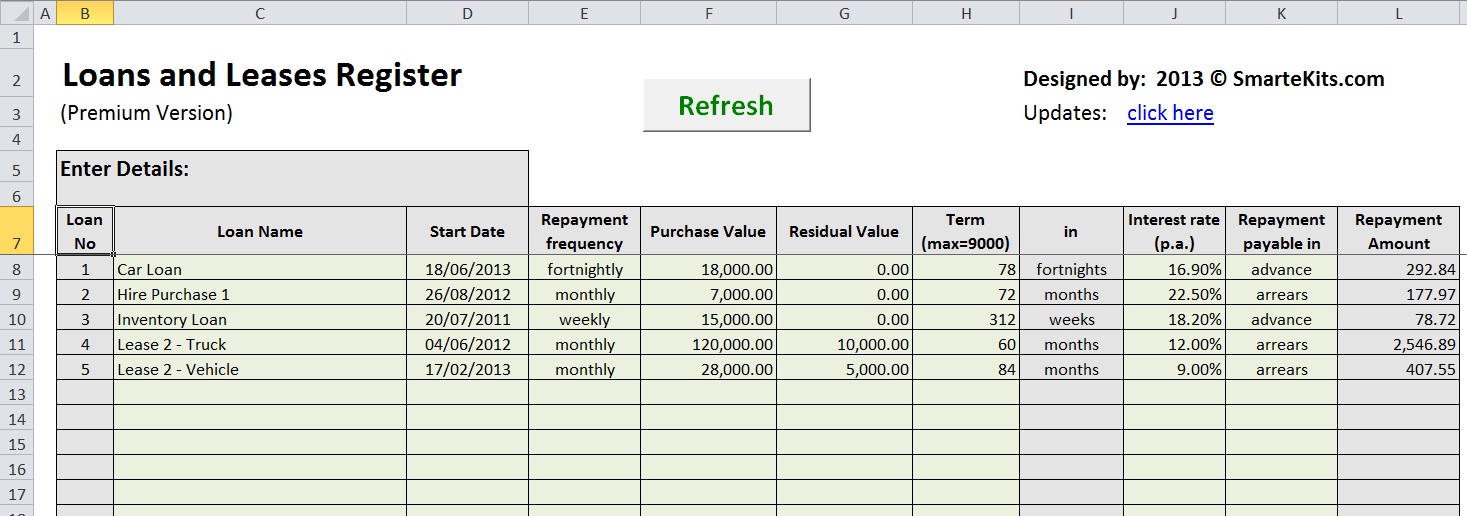

Lease Accounting Template Excel

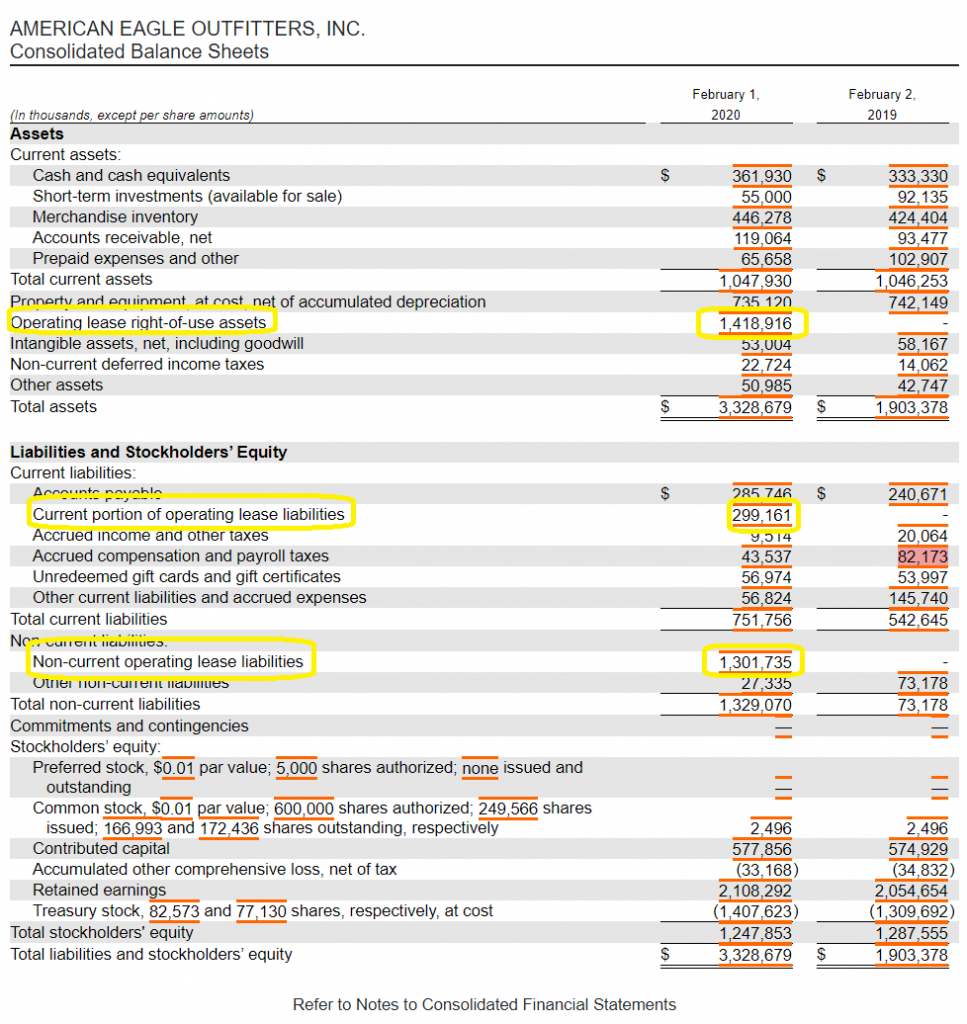

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

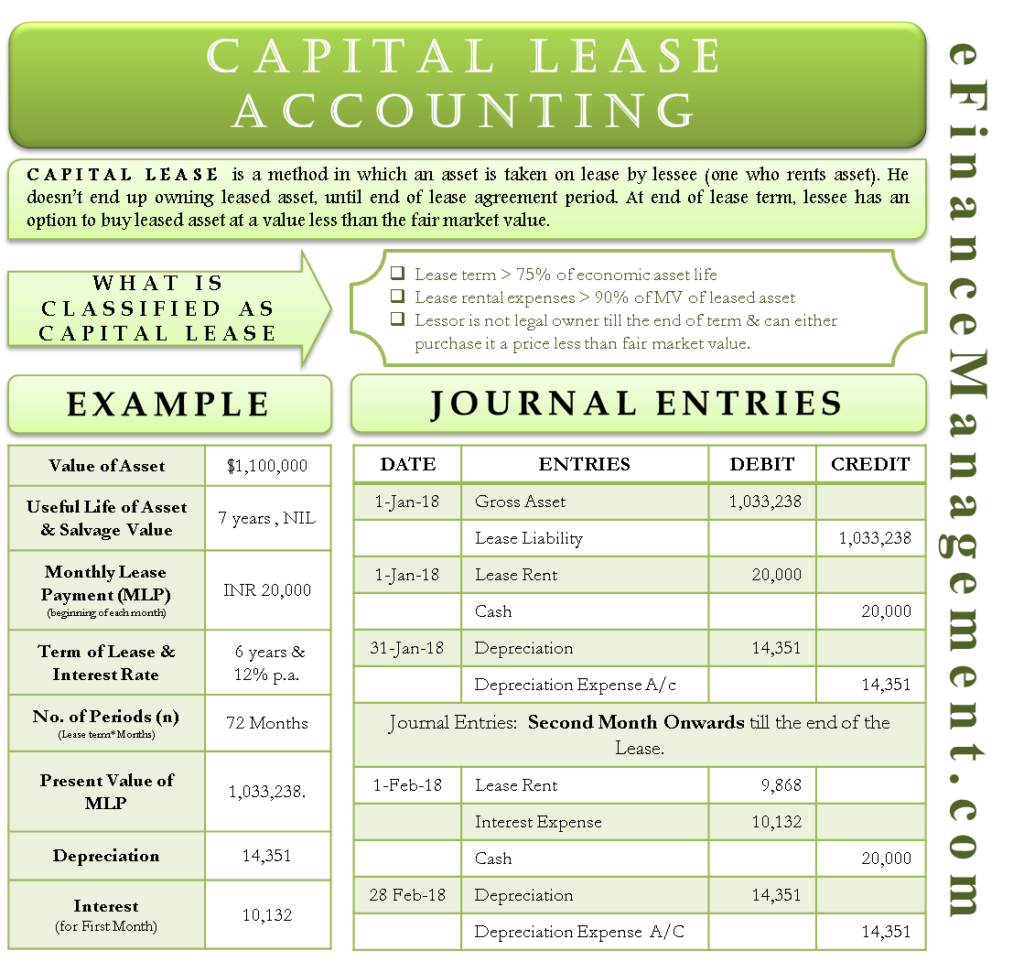

Capital Lease Accounting With Example and Journal Entries

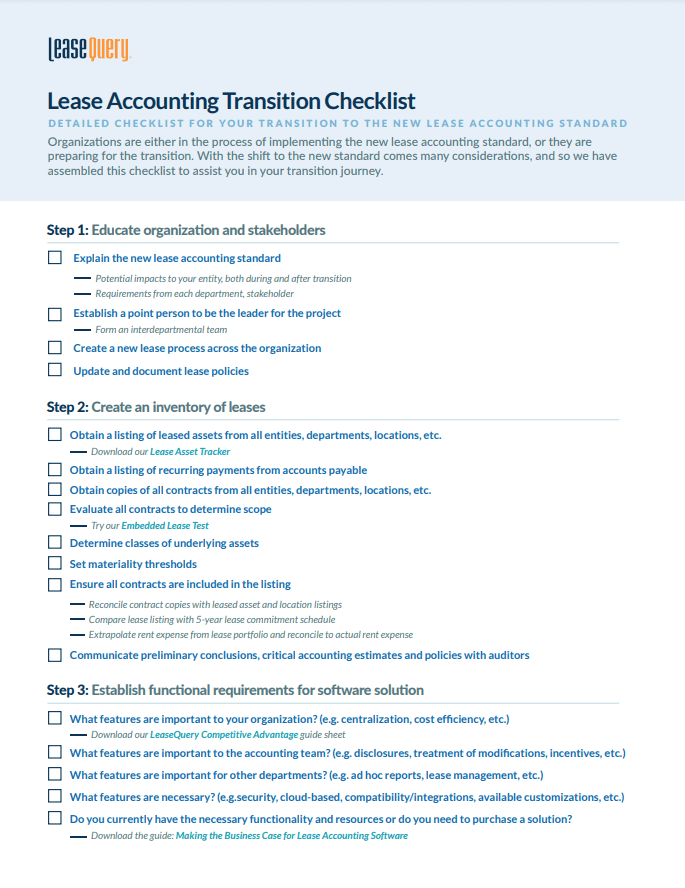

Guide Lease Accounting Transition Checklist LeaseQuery

Breathtaking New Lease Standard Excel Template Automatically Add Dates In

Accounting for Capital Leases Calculator Double Entry Bookkeeping

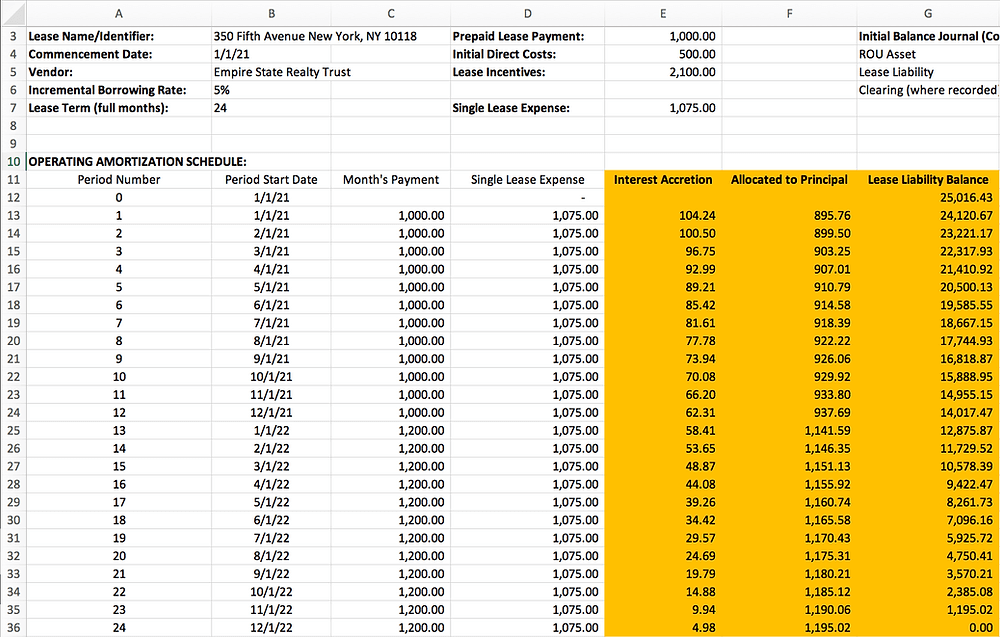

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate a Lease Liability using Excel

Triple Net Lease Spreadsheet for Calculate Effective Rent Excel

Lease Accounting IFRS 16 Excel Template • 365 Financial Analyst

Web • Brings Most Leases ‘On Balance Sheet’.

Several Economic Factors Have Affected The Lease Accounting For Many Commercial Real Estate Entities, Including Owners, Operators, And Developers.

Set Up Columns And Headers.

Posted By Larson And Company.

Related Post: