Merger Model Template

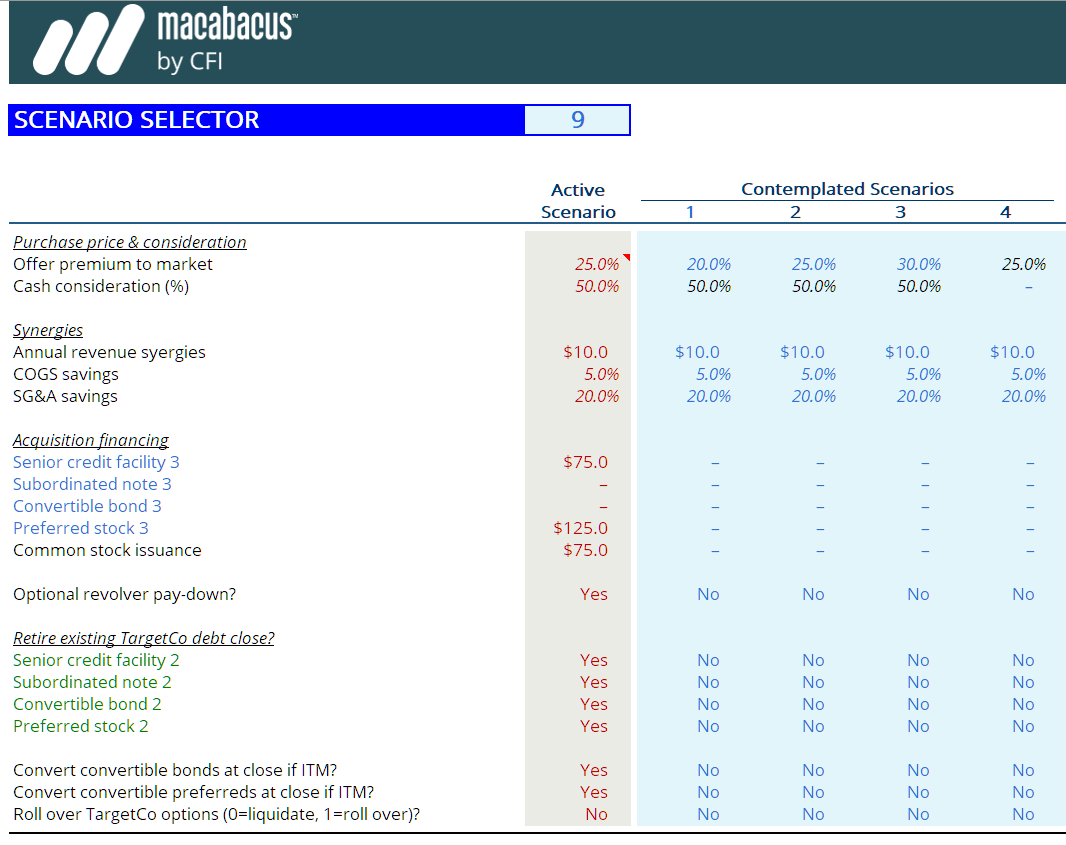

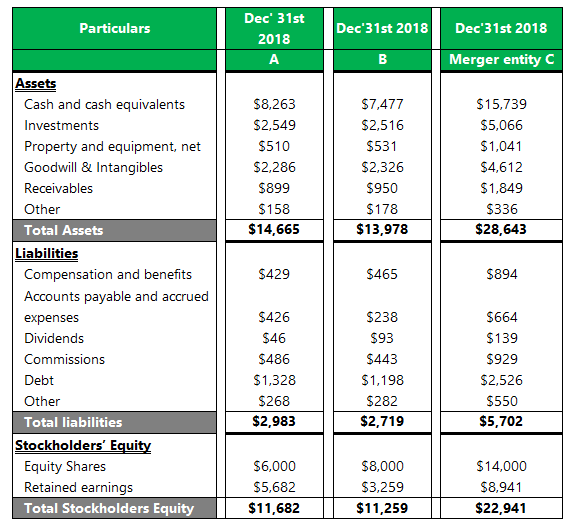

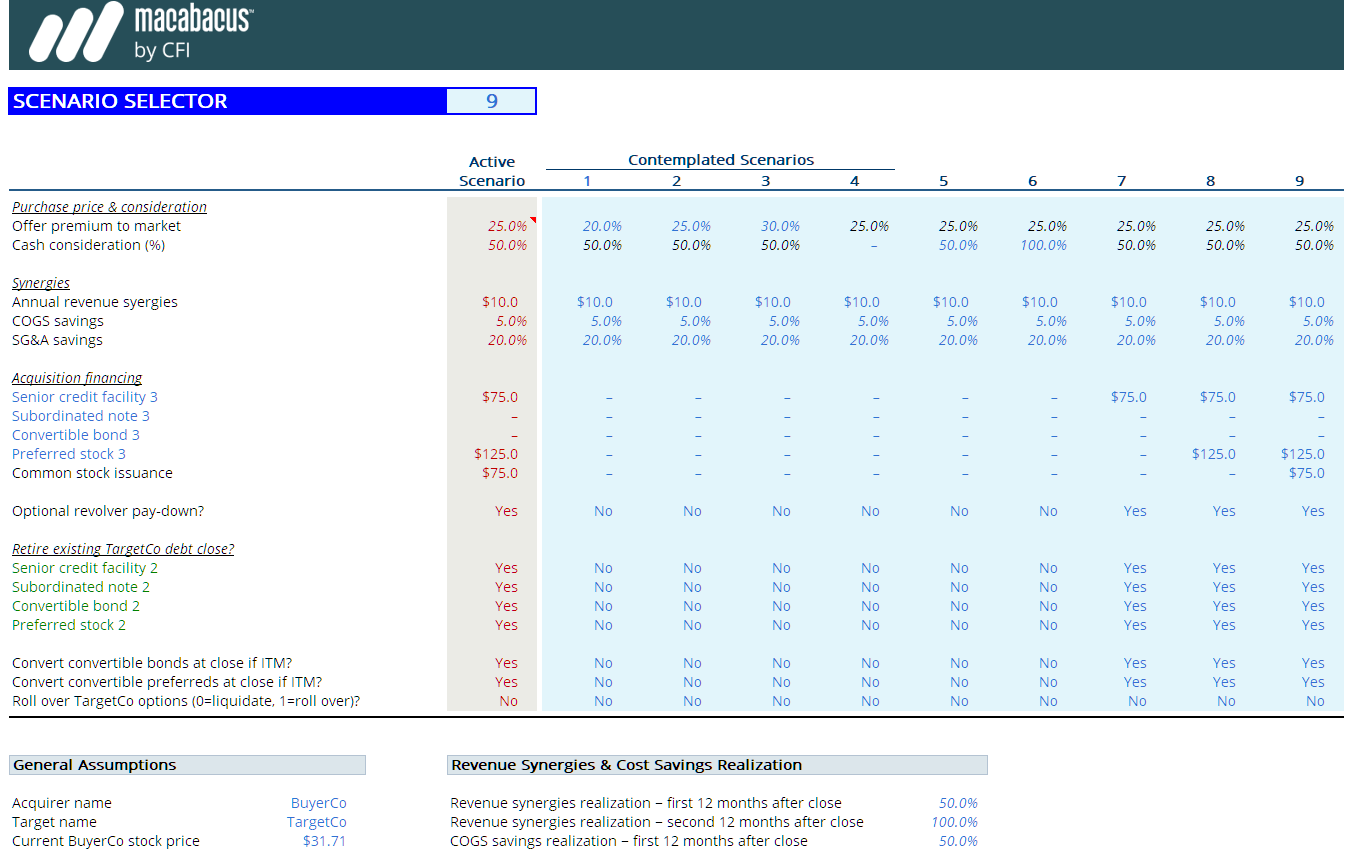

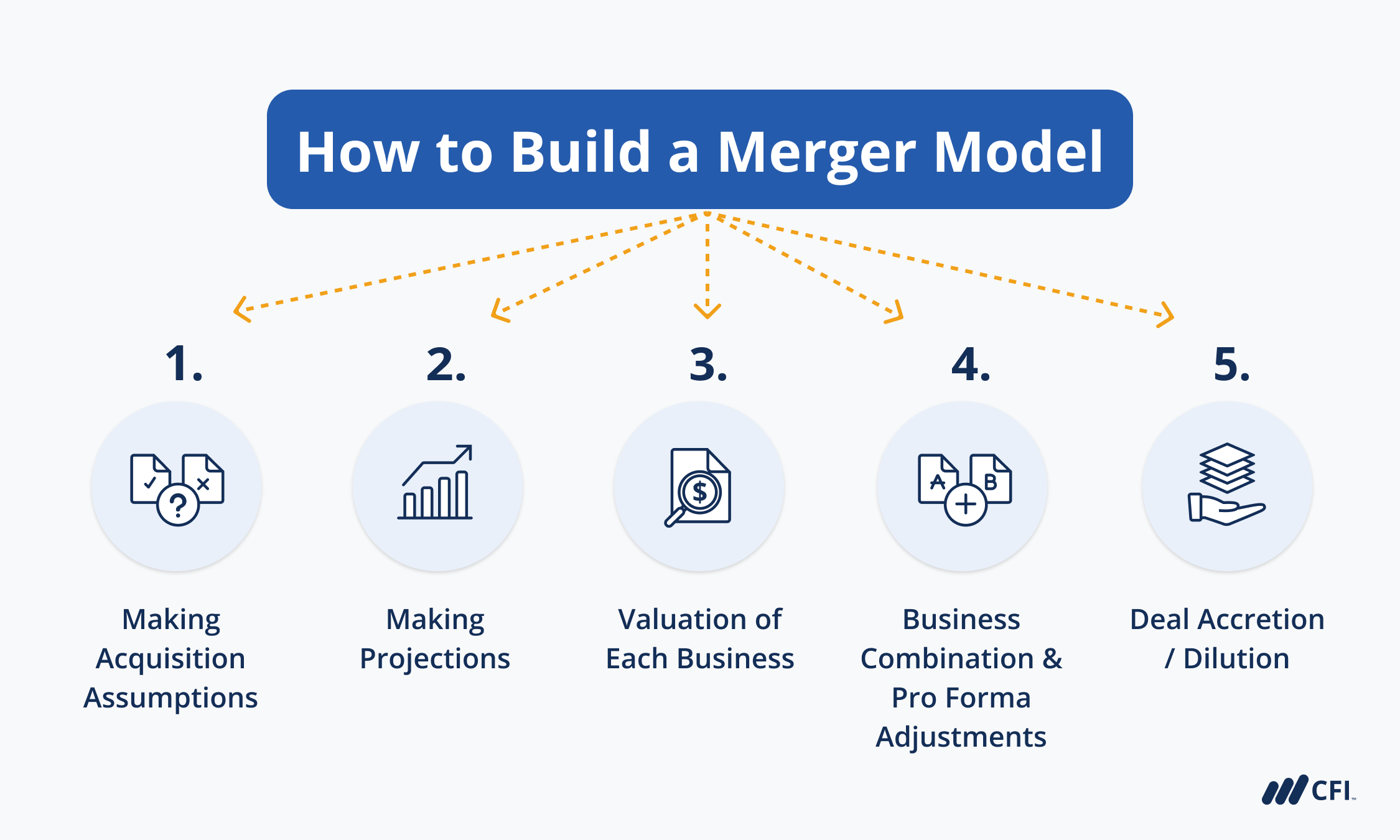

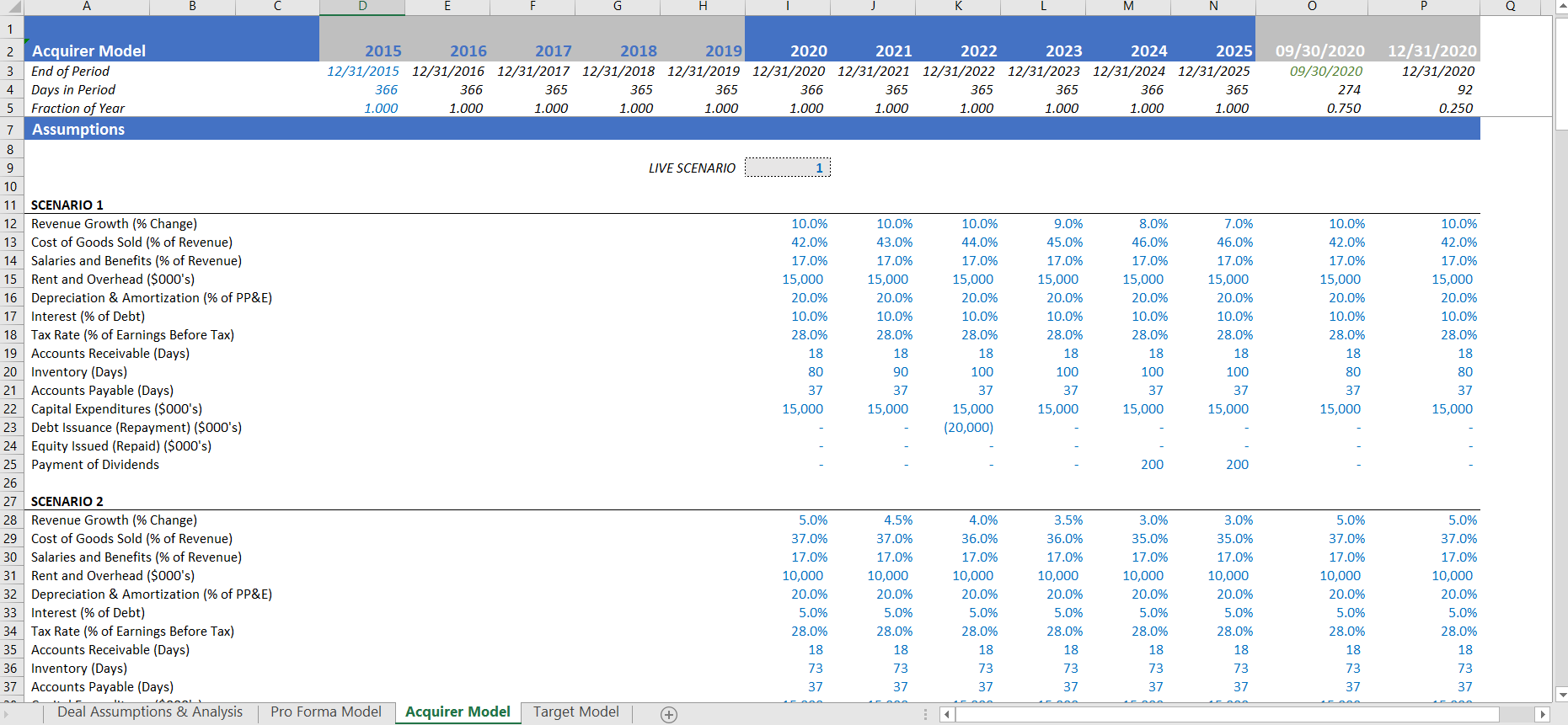

Merger Model Template - 300 + 600 = 900. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potential merger or acquire another company. Market data can be obtained from a number of sources, including factset, capitaliq, google finance, reuters, and bloomberg. $15,000 / $50 = 300. Web disney and warner bros. A lot of that decision depends on the valuation of both the acquiring company and the target. The excel spreadsheet calculates the cash flow, p&l and balance sheet resulting from a merger or acquisition. Web thanks for contributing an answer to stack overflow! Note that our synergies can be toggled on and off from our assumptions tab in our model. Web create financial models 10x faster with macabacus. The big idea behind a dcf model. It also estimates the resulting synergies and the impact of the transaction on the valuation. Searching for a song you heard between stories? Web the key steps involved in building a merger model are: Note that our synergies can be toggled on and off from our assumptions tab in our model. And here are the relevant files and links: Web download merger and acquisition model template. Included in the template, you will find: We've retired music buttons on these pages. (both standard model and beyond the standard model physics). Discovery are teaming up to offer a new streaming bundle, bringing max, disney+ and hulu together for the first time in a bid that resembles the cable subscription model. The merger model can allow analysts to look at different scenarios for a potential deal, such as varying the purchase price, or looking at the best funding option for the deal. Check out our large inventory of state of the art financial. The merger model can allow analysts to look at different scenarios for a potential deal, such as varying the purchase price, or looking at the best funding option for the deal (equity or debt) Web download the simple business model canvas template for google slides when to use this. On the first tab is the deal assumptions section, where the details. Each topic contains a spreadsheet with which you can interact within your browser to inspect cell equations and read comments or download and open in excel.this is a very detailed m&a model, loaded with bells and whistles and built using “best practices” for. We combine the new issues. Purchase checkout excluding 8.1% tax. Web there are five steps required for any m&a model. Web create financial models 10x faster with macabacus. Discovery are teaming up to offer a new streaming bundle, bringing max, disney+ and hulu together for the first time in a bid that resembles the cable subscription model. Web the key steps involved in building a. Discovery are teaming up to offer a new streaming bundle, bringing max, disney+ and hulu together for the first time in a bid that resembles the cable subscription model. The big idea behind a dcf model. Web disney and warner bros. Note that our synergies can be toggled on and off from our assumptions tab in our model. Web thanks. Searching for a song you heard between stories? These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as. 300 + 600 = 900. Deciding whether it’s going to be a cash deal, an equity deal or some combination of the two is the first step in creating an m&a model. $15,000 / $50. Discovery are teaming up to offer a new streaming bundle, bringing max, disney+ and hulu together for the first time in a bid that resembles the cable subscription model. 300 + 600 = 900. Web mergers & acquisitions (m&a) modeling is part of the commercial banking & credit analyst (cbca)® certification, which includes 59 courses. Web the mergers & acquisition. Web in this section, we demonstrate how to model a merger of two public companies in excel. This model runs through different scenarios and synergies to forecast future value after the transaction. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Market data can be obtained from a. These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as. For example, the buyer has revenue of $100, and the seller has revenue of $50. It also estimates the resulting synergies and the impact of the transaction on the valuation. Web there are five steps required for any m&a model. Market data can be obtained from a number of sources, including factset, capitaliq, google finance, reuters, and bloomberg. Web download the simple business model canvas template for google slides when to use this template: We begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer (“buyerco”). Web merger model template: In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. The merger model can allow analysts to look at different scenarios for a potential deal, such as varying the purchase price, or looking at the best funding option for the deal (equity or debt) The excel spreadsheet calculates the cash flow, p&l and balance sheet resulting from a merger or acquisition. The buyer can sell more products to the seller’s customers, or vice versa. The macabacus merger model implements advanced m&a, accounting, and tax concepts, and is intended for use in modeling live transactions (with some modification, of course). Web thanks for contributing an answer to stack overflow! Web this is done by taking the acquisition cost and dividing it by the share price of company a. Web mergers & acquisitions (m&a) modeling is part of the commercial banking & credit analyst (cbca)® certification, which includes 59 courses.

Merger Model Templates Download Excel Template for M&A Macabacus

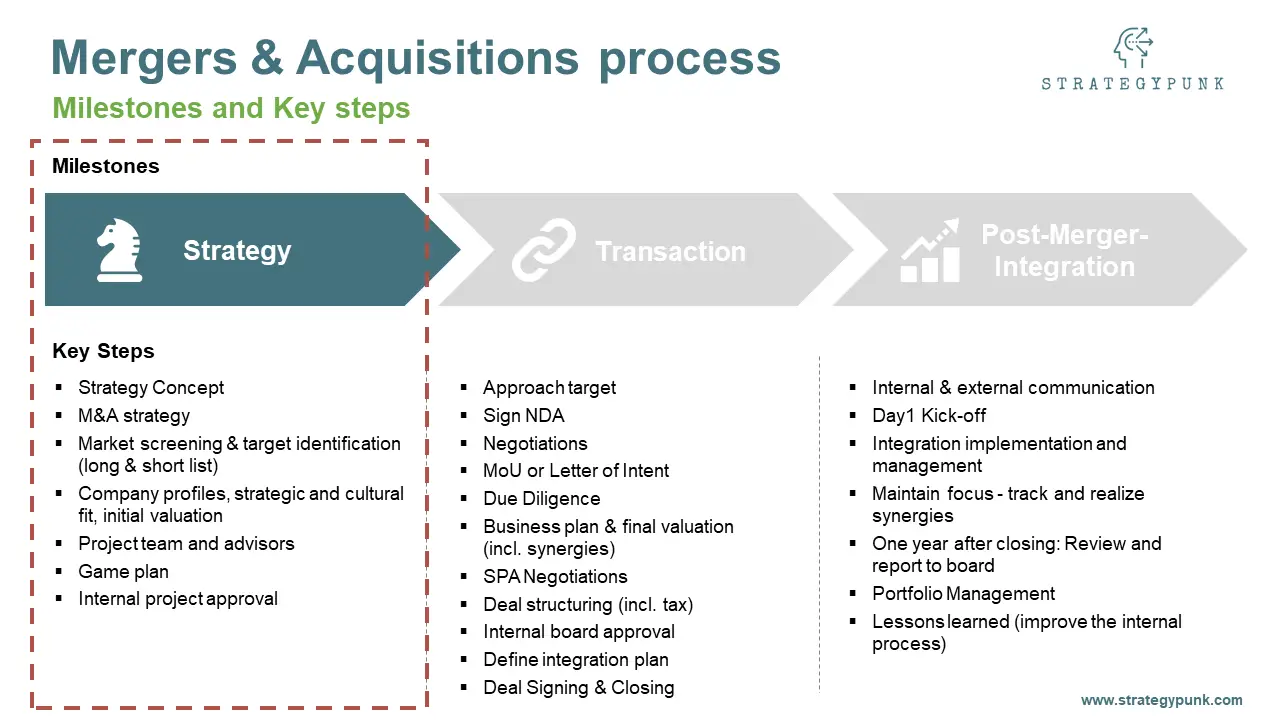

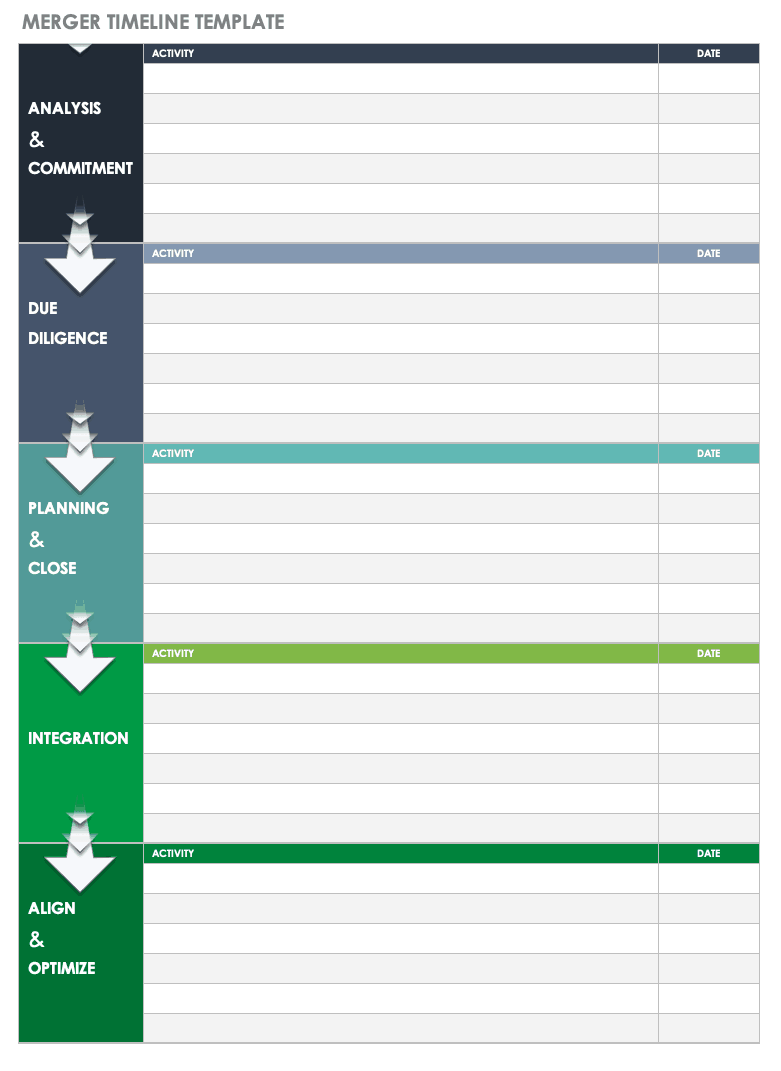

Mergers & Acquisitions Process Guide and free template

Merger Examples Top 3 Examples of Merger with excel template

Merger Model Templates Download Excel Template for M&A Macabacus

Merger and Acquisition Model Excel Tutorial & Template

Merger Model M&A Training Tutorial + Excel Template

Merger Model Template

Merger and Acquisition Model Excel Tutorial & Template

How To Build A Merger Model

Merger and Acquisition Excel Model Template Icrest Models

Deciding Whether It’s Going To Be A Cash Deal, An Equity Deal Or Some Combination Of The Two Is The First Step In Creating An M&A Model.

M&A Model Inputs, Followed By A Range Of M&A Model Assumptions, Model Analysis And Model Outputs.

Click The Button Below To Download My Capital Investment Plan Template.

Each Topic Contains A Spreadsheet With Which You Can Interact Within Your Browser To Inspect Cell Equations And Read Comments Or Download And Open In Excel.this Is A Very Detailed M&A Model, Loaded With Bells And Whistles And Built Using “Best Practices” For.

Related Post: