Mileage Log Excel Template

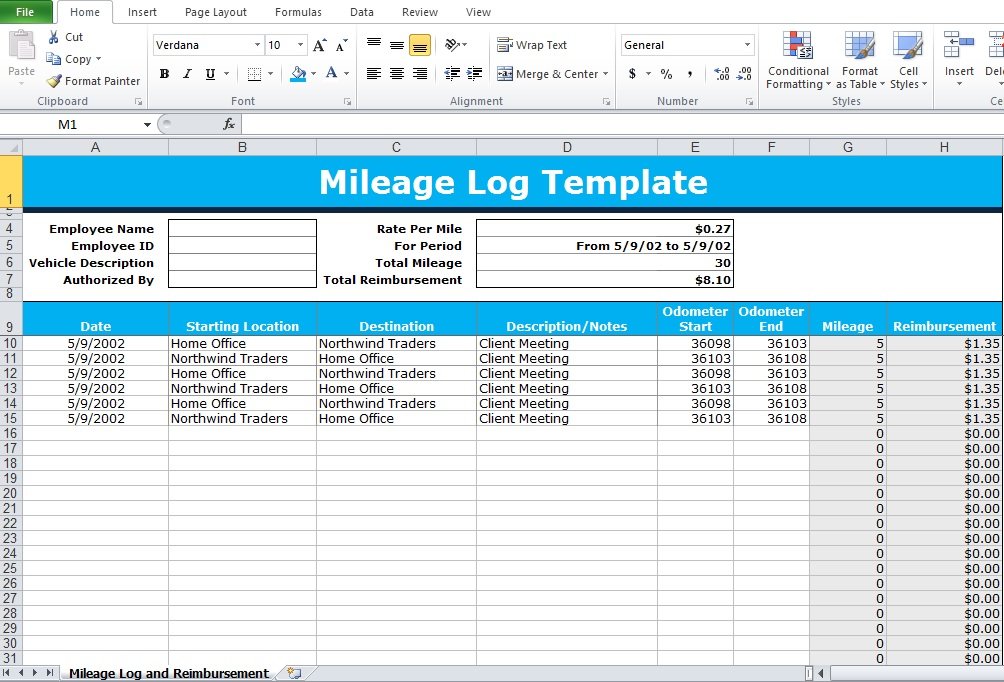

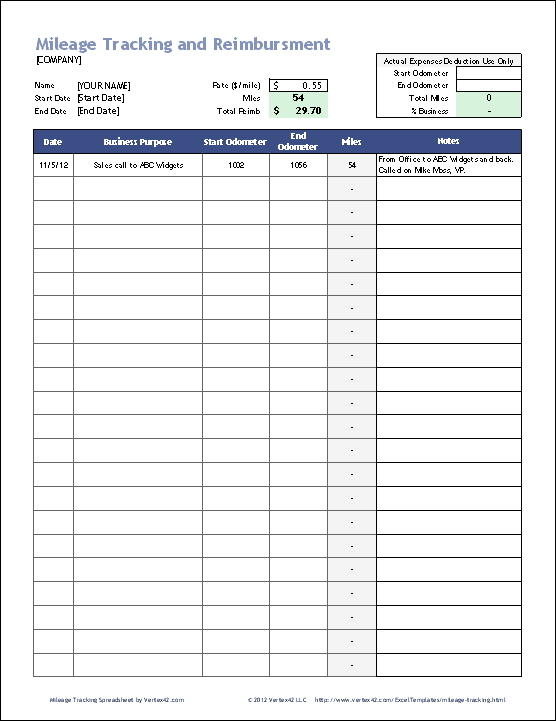

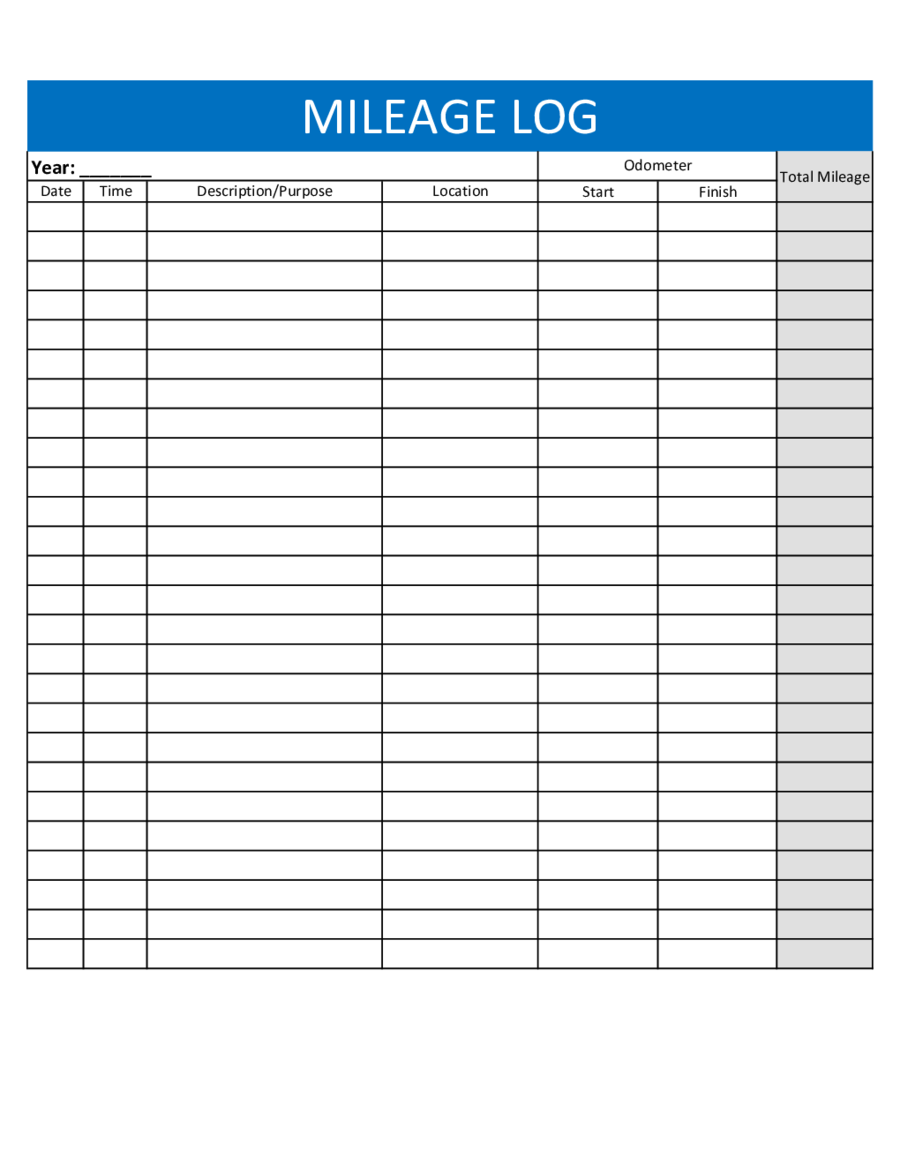

Mileage Log Excel Template - Web business mileage tracking log. Use one of our mileage templates in microsoft excel to track your miles. For 2024, it'll be $0.67. Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. Web this template can be helpful for calculating the actual mileage. Then fold it along the two dotted lines. Excel (.xls) 2007+ and ipad. You will also get an idea about the periodic maintenance required for the vehicle. This template will calculate the value of your business trips based on this figure. You can use the following log as documentation for your mileage deduction. Web free mileage log template for taxes. Web download the mileage log template as a spreadsheet or pdf. With the template, you can log and track your mileage quickly and easily, analyze your trips, and export your trips to other applications. Then fold it along the two dotted lines. Excel (.xls) 2003 + and ipad. Feel free to download our excel mileage log template. Web business mileage tracking log. Total miles driven, missing mileage, vehicle status/operator comments, and more. You can log all of this information in our printable pdf, excel and sheets mileage log templates. The template is highly customizable, secure, and reliable, and provides you. Note that after the first 10,000 miles, the hmrc approved rate changes to 25p per mile. Web following are free mileage log templates that can be edited as per needs: Total miles driven, missing mileage, vehicle status/operator comments, and more. Use the other sheets tab for an empty. Click to copy google spreadsheet. Workyard provides leading workforce management solutions to construction, service, and property maintenance companies of all sizes. Works for both miles per gallon (mpg) or kilometers. In simple words, a mileage log is a fitness guide for your vehicle. Track mileage effortlessly with our free mileage log template & mileage tracker template. Web this template can be helpful for calculating the. You will also get an idea about the periodic maintenance required for the vehicle. Use this template as a daily and monthly mileage log. Then fold it along the two dotted lines. Excel (.xls) 2007+ and ipad. Web this template can be helpful for calculating the actual mileage. It doesn’t matter what type of deduction you’re taking at the end of the year. You must keep a log not only of your business trips but personal as well (if. Click to copy google spreadsheet. Feel free to download our excel mileage log template. Web these free excel mileage logs contain everything you need for a compliant irs mileage. Web a mileage log template is beneficial thing for the fitness of your vehicle. Web business mileage tracking log. Tracking your mileage can save you thousands on your taxes (even more if you use an automatic mileage tracker app !). Download and print this mileage log. Yes, everything you need to make a mileage log the slow and painful way. Web by addressing these common issues proactively, you can overcome potential hurdles in mileage tracking and maintain compliance with irs regulations. For example, a vehicle with $6,000 of expenses and 50 percent of total mileage as business would deduct $3,000 from their taxes. Available in pdf, word, excel a google formats. It doesn’t matter what type of deduction you’re taking. Our mileage log template is built using google sheets, a free online alternative to excel. Feel free to download our excel mileage log template. You can log all of this information in our printable pdf, excel and sheets mileage log templates. Total miles driven, missing mileage, vehicle status/operator comments, and more. The template is highly customizable, secure, and reliable, and. Car rental service agencies can utilize this template to keep a good record of a vehicle’s mileage. Use this template as a daily and monthly mileage log. Track mileage effortlessly with our free mileage log template & mileage tracker template. Our mileage log template is built using google sheets, a free online alternative to excel. Irs mileage rates for 2023. Web these free excel mileage logs contain everything you need for a compliant irs mileage log. Web download the mileage log. Download and print this mileage log. With the template, you can log and track your mileage quickly and easily, analyze your trips, and export your trips to other applications. The template is highly customizable, secure, and reliable, and provides you. You can use the following log as documentation for your mileage deduction. This will make the log a convenient size and just the right thickness to allow you to keep it in your car and write down the date, odometer reading, amount of fuel put in, and the $ cost. Car rental service agencies can utilize this template to keep a good record of a vehicle’s mileage. Feel free to download our excel mileage log template. This template will calculate the value of your business trips based on this figure. You can log all of this information in our printable pdf, excel and sheets mileage log templates. Need to track the miles you and your employees drive? Web a mileage log template is beneficial thing for the fitness of your vehicle. It doesn’t matter what type of deduction you’re taking at the end of the year. Use the other sheets tab for an empty. Note that after the first 10,000 miles, the hmrc approved rate changes to 25p per mile.

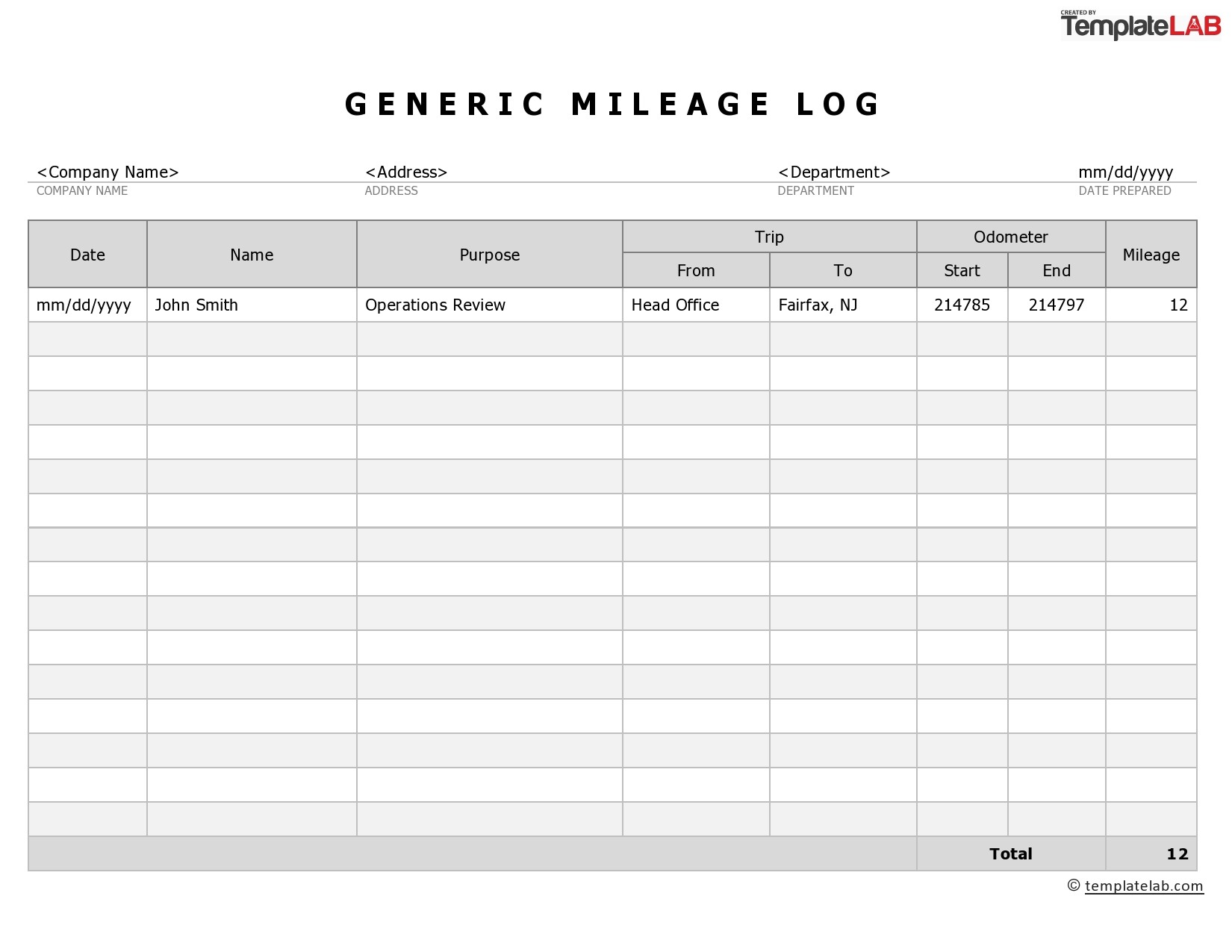

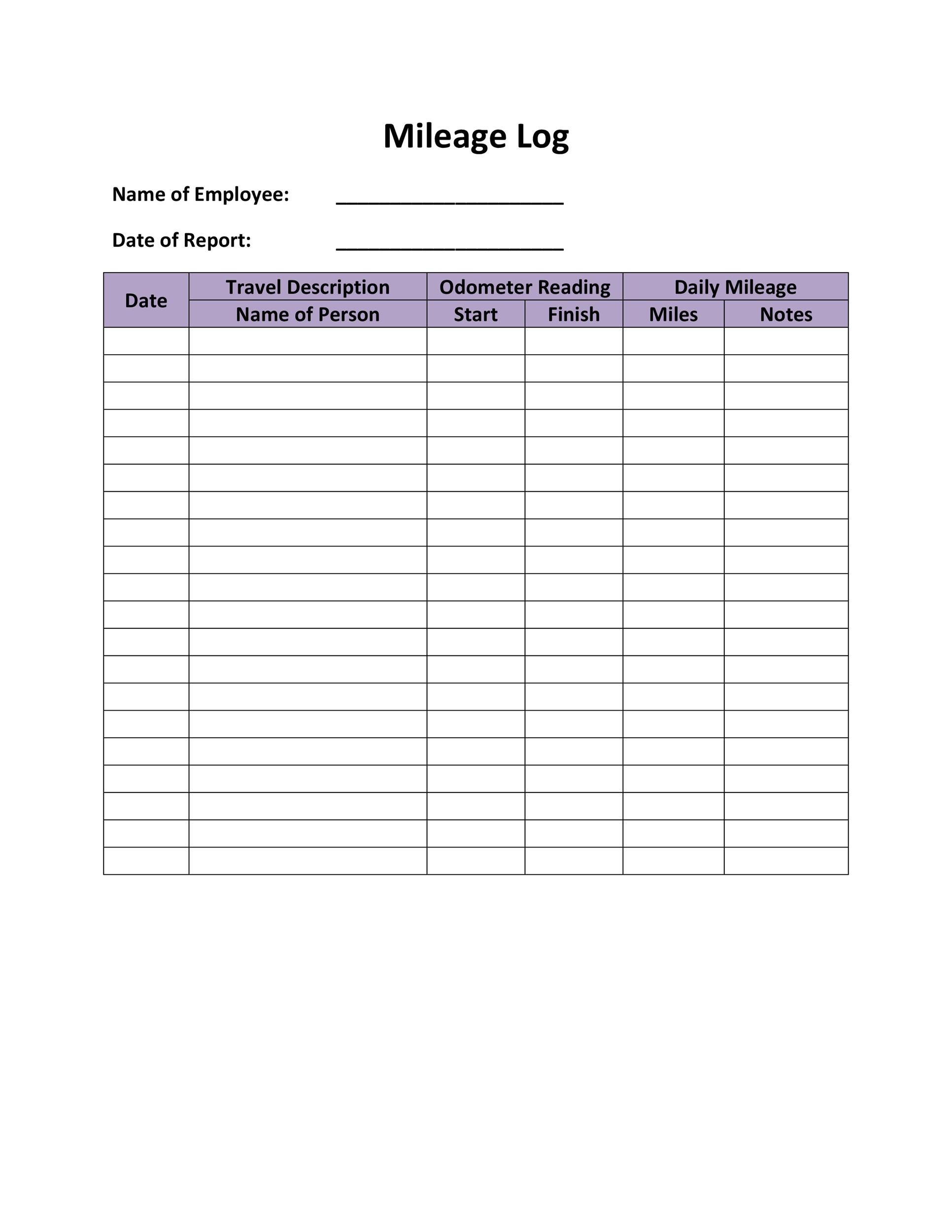

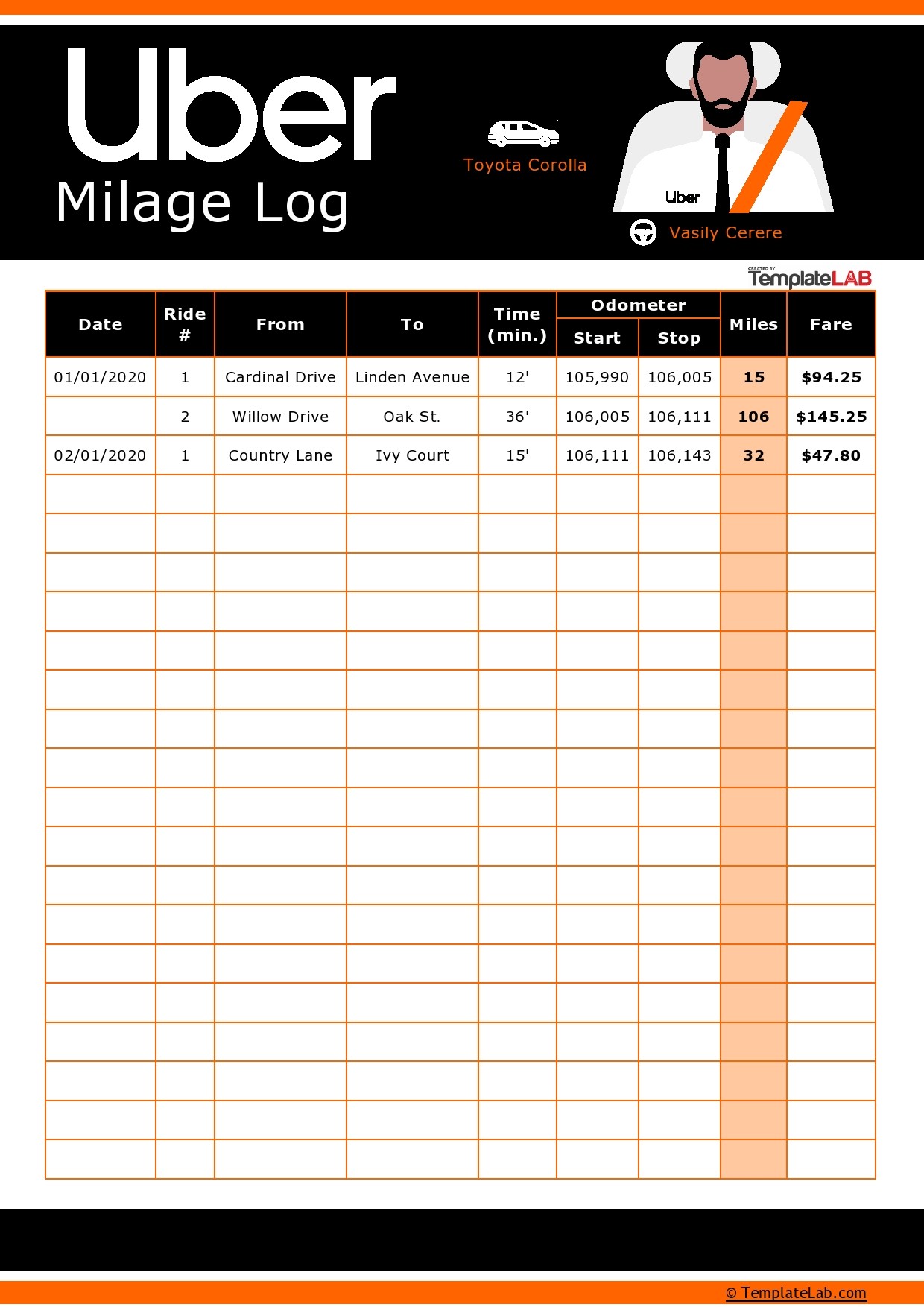

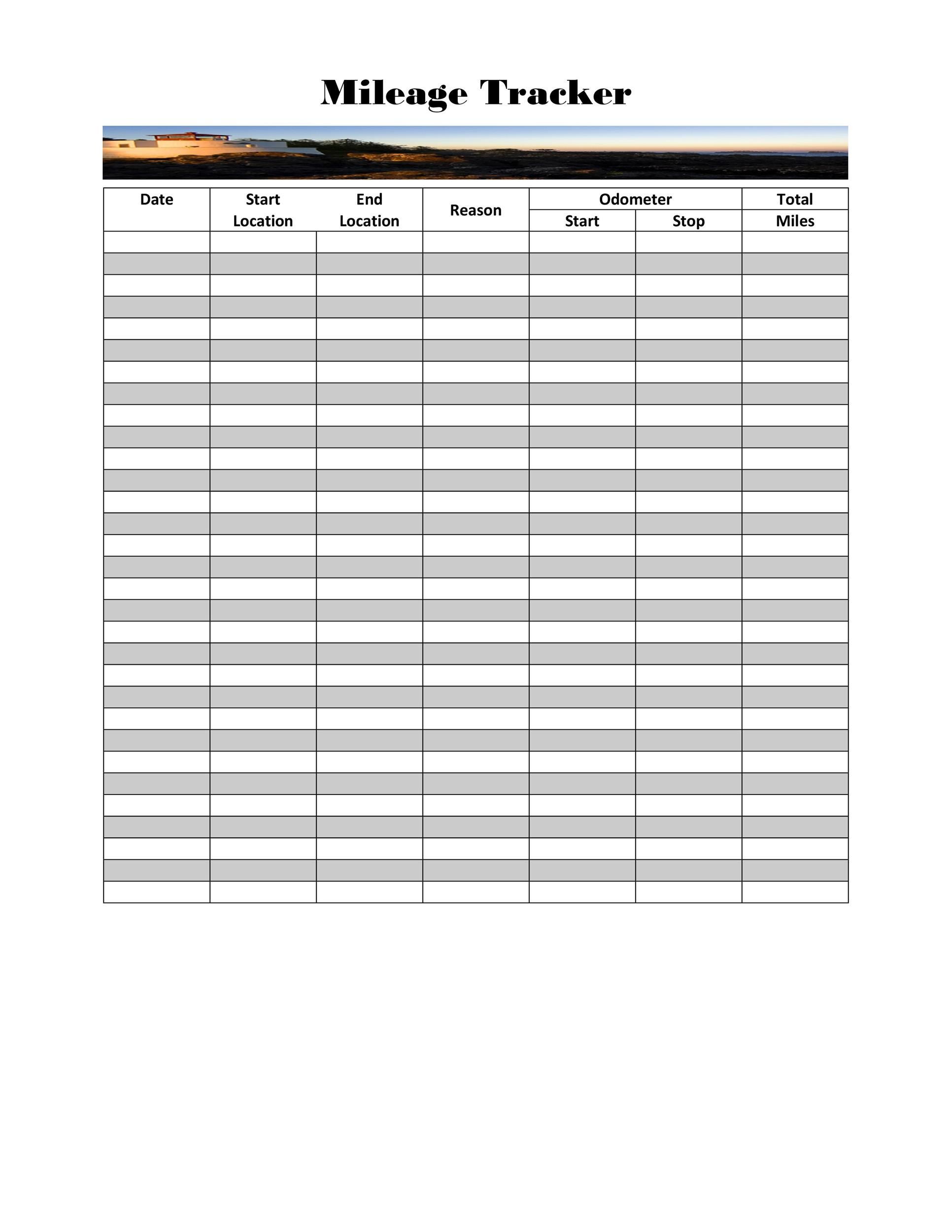

25 Free Mileage Log Templates (Excel Word PDF)

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

8 Excel Mileage Log Template SampleTemplatess SampleTemplatess

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Printable Mileage Log Excel Template Printable Templates

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

30 Printable Mileage Log Templates (Free) Template Lab

Mileage Log Excel Template Excel TMP

10+ Excel Mileage Log Templates Excel Templates

30 Free Mileage Log Templates Excel Log Sheet Format Project

Web By Addressing These Common Issues Proactively, You Can Overcome Potential Hurdles In Mileage Tracking And Maintain Compliance With Irs Regulations.

For 2020, The Irs Lets You Deduct 57.5 Cents Per Business Mile.

This Rate Is Adjusted For Inflation Each Year.

Employee Mileage Log Excel Template.

Related Post: