Mileage Log Templates

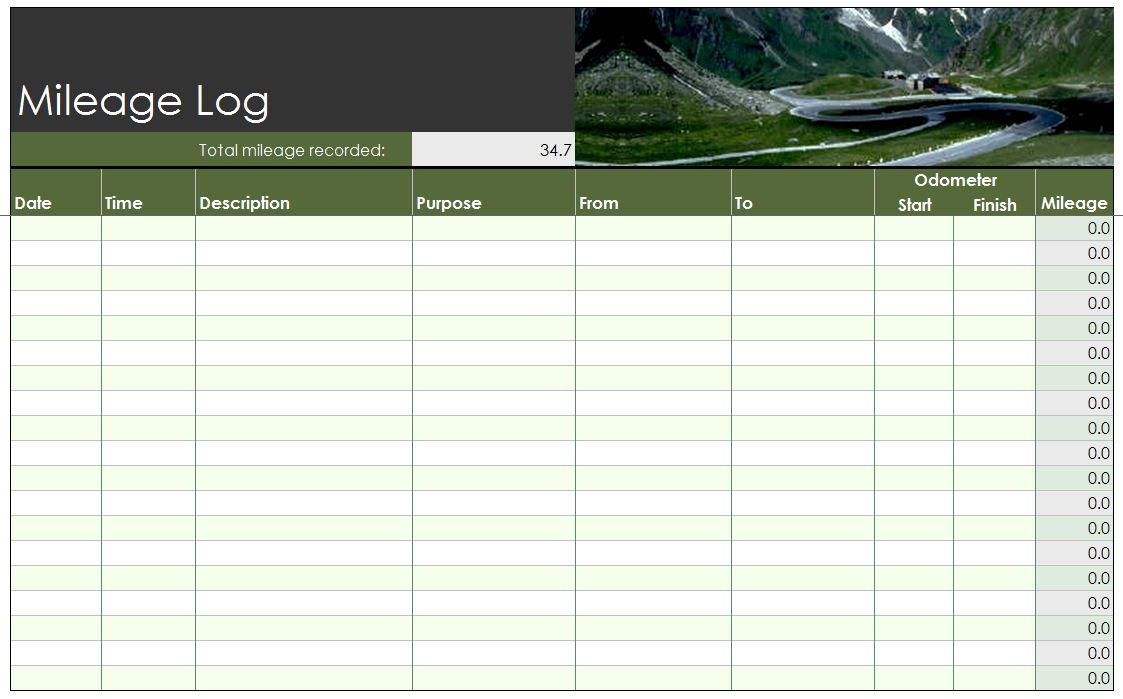

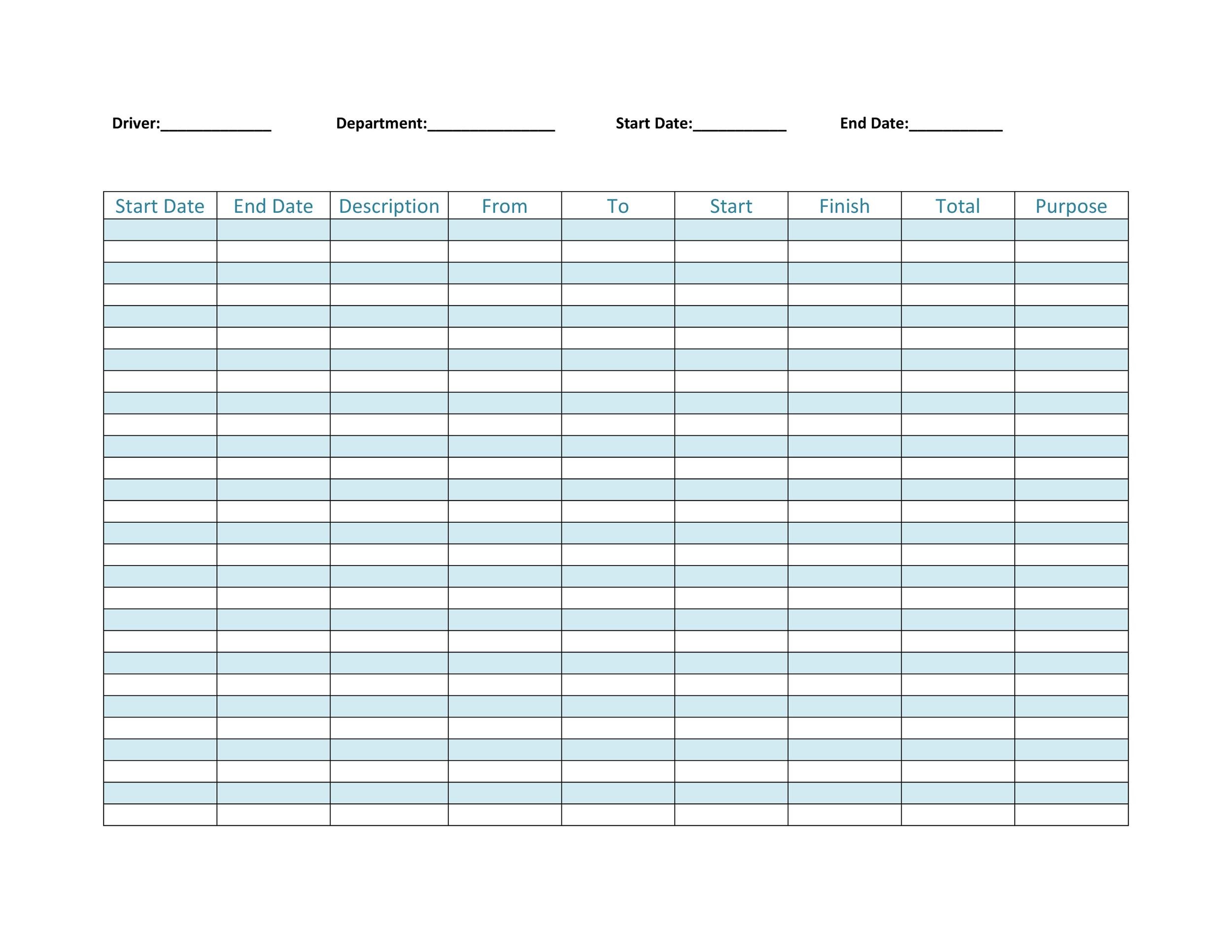

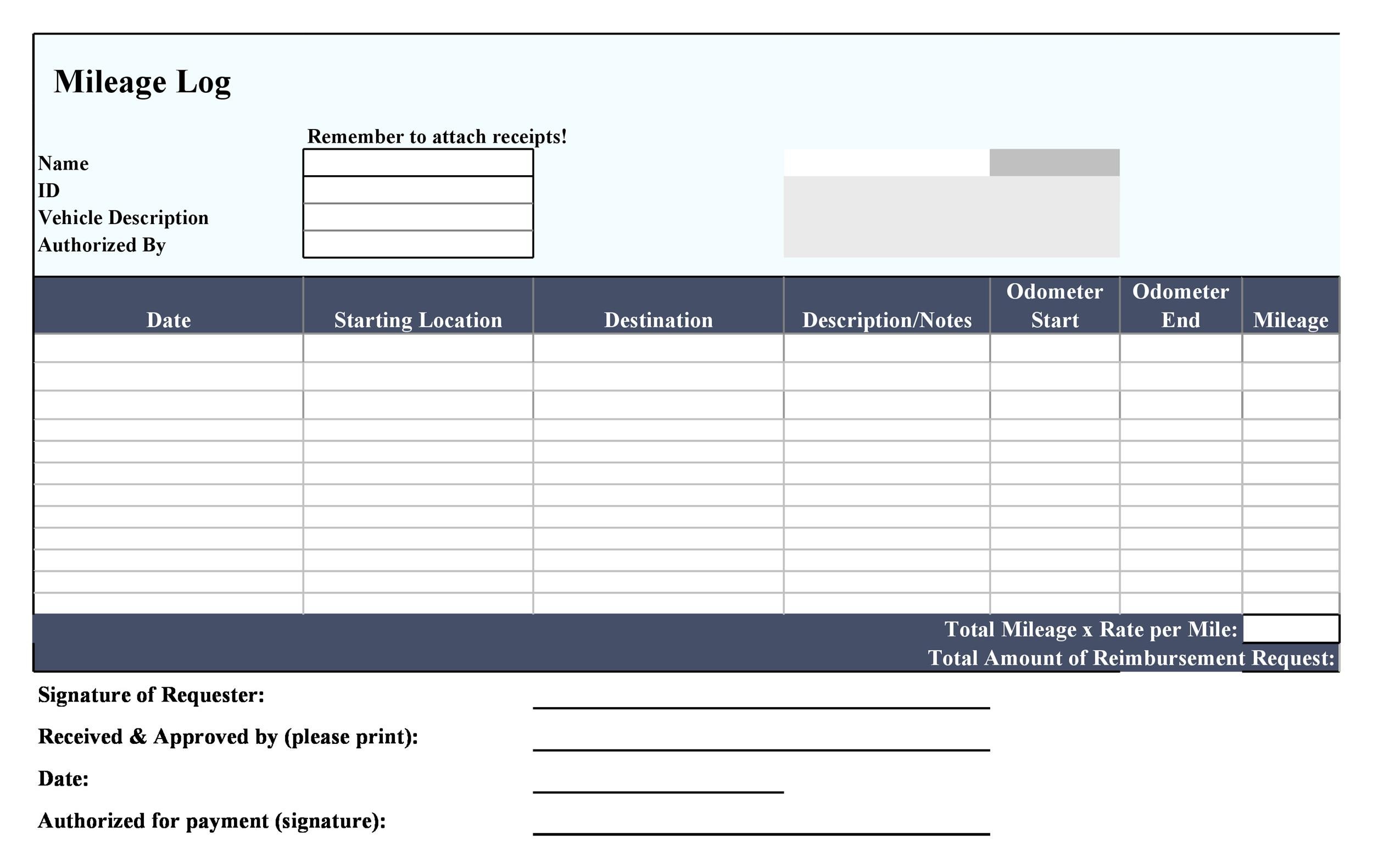

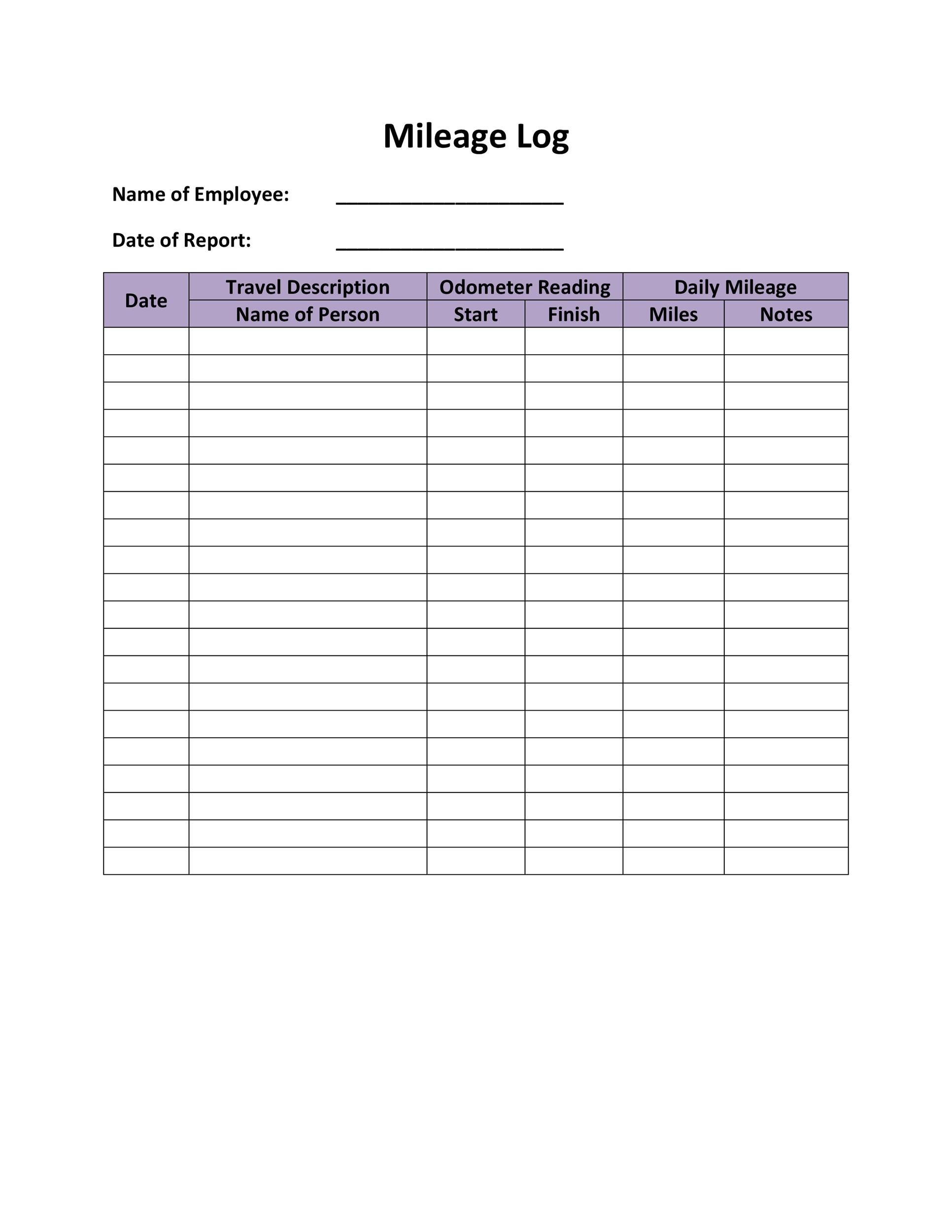

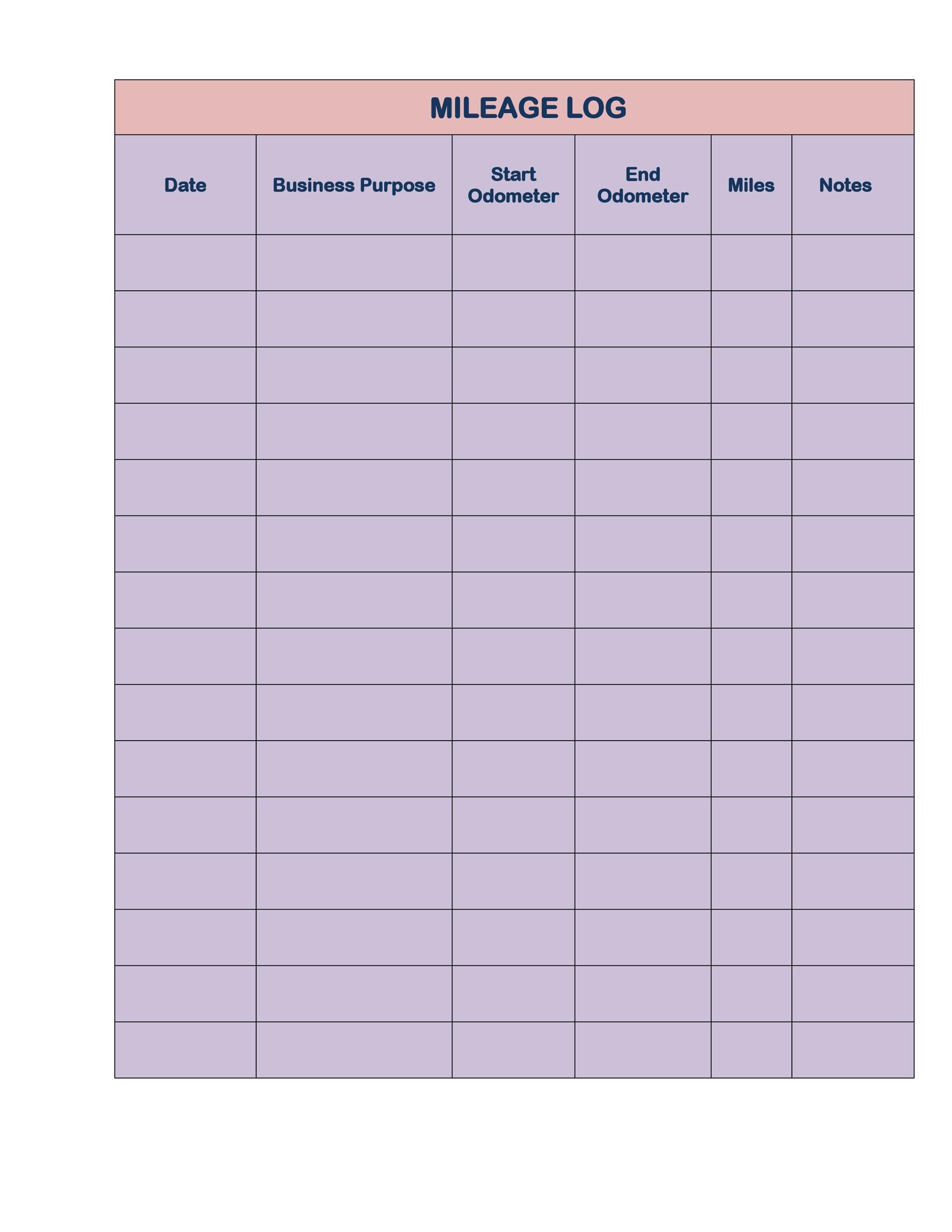

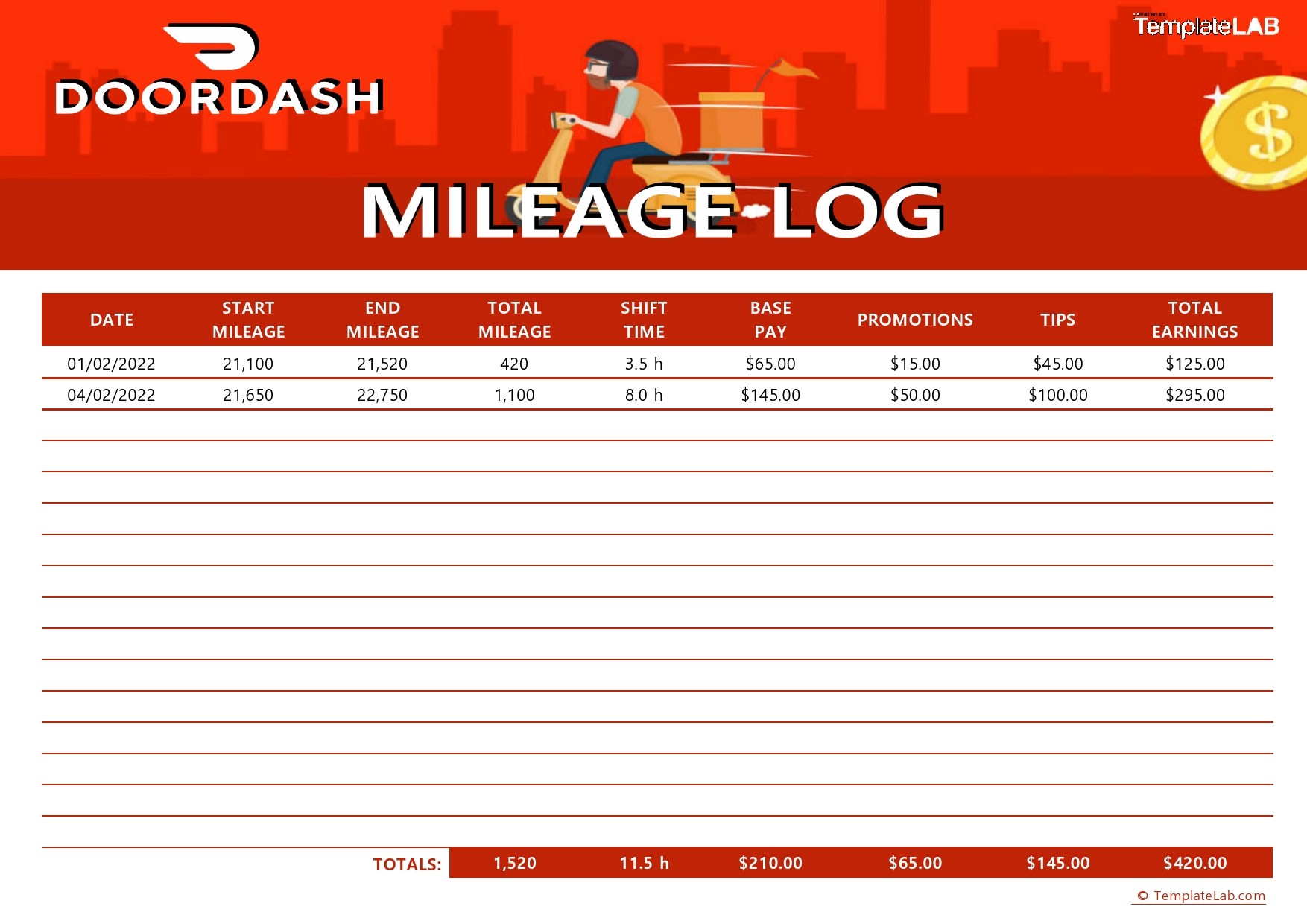

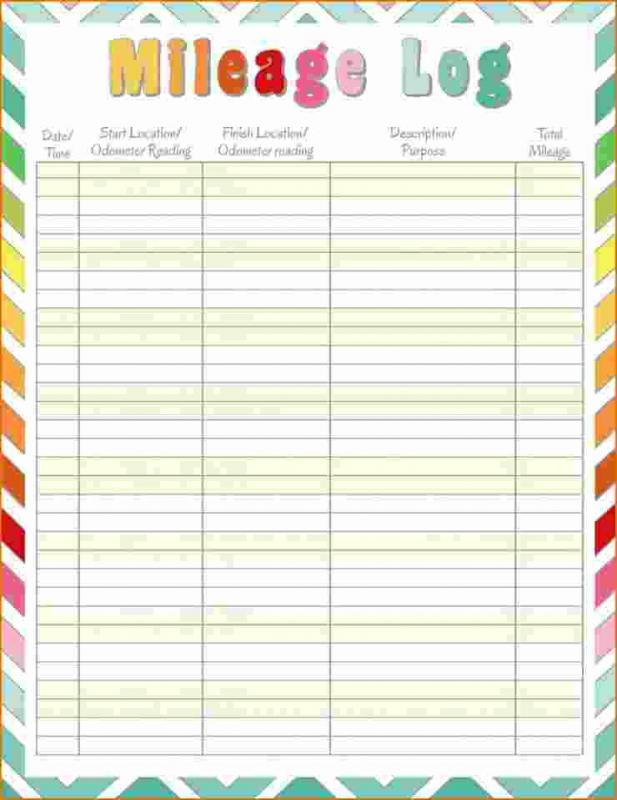

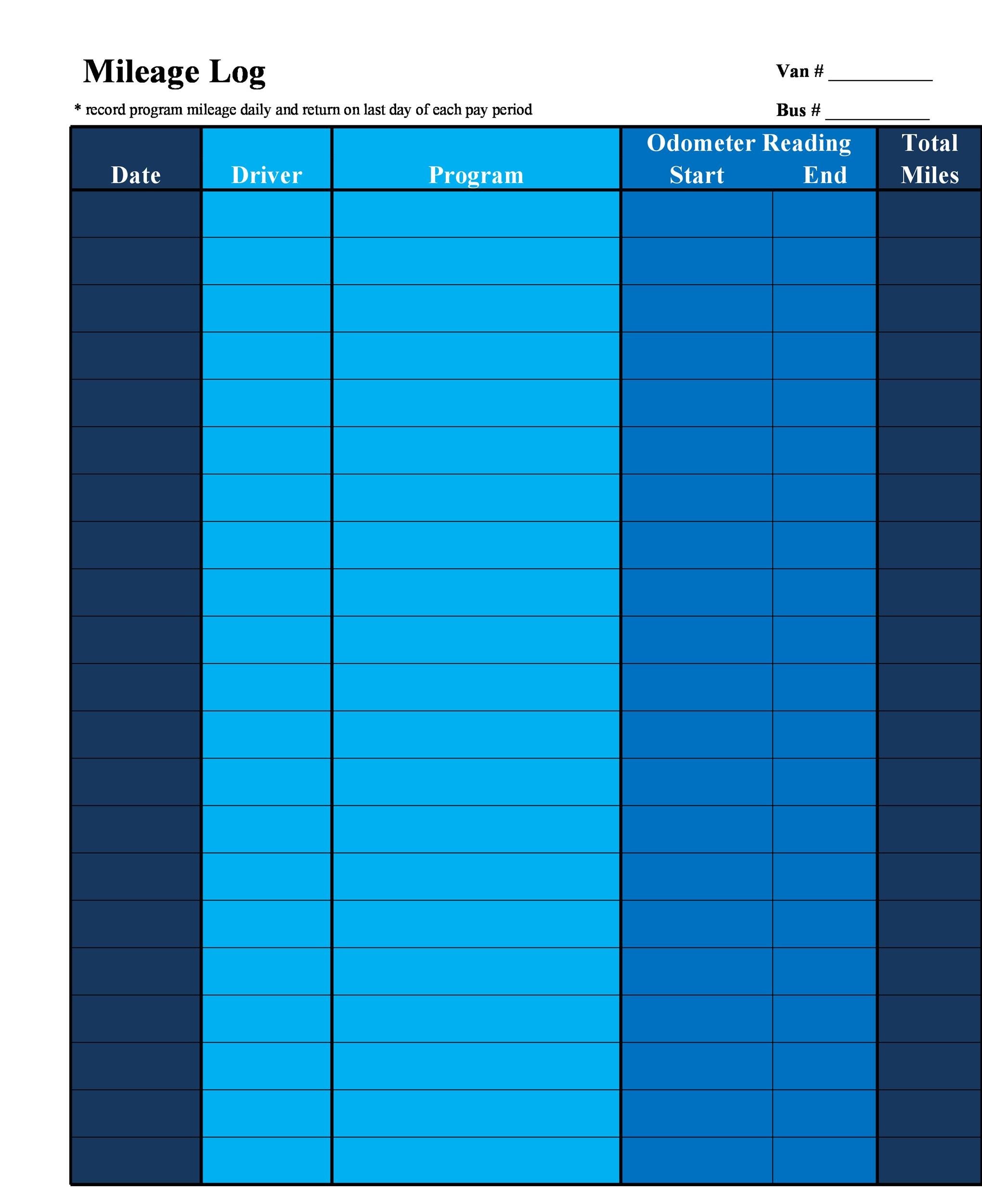

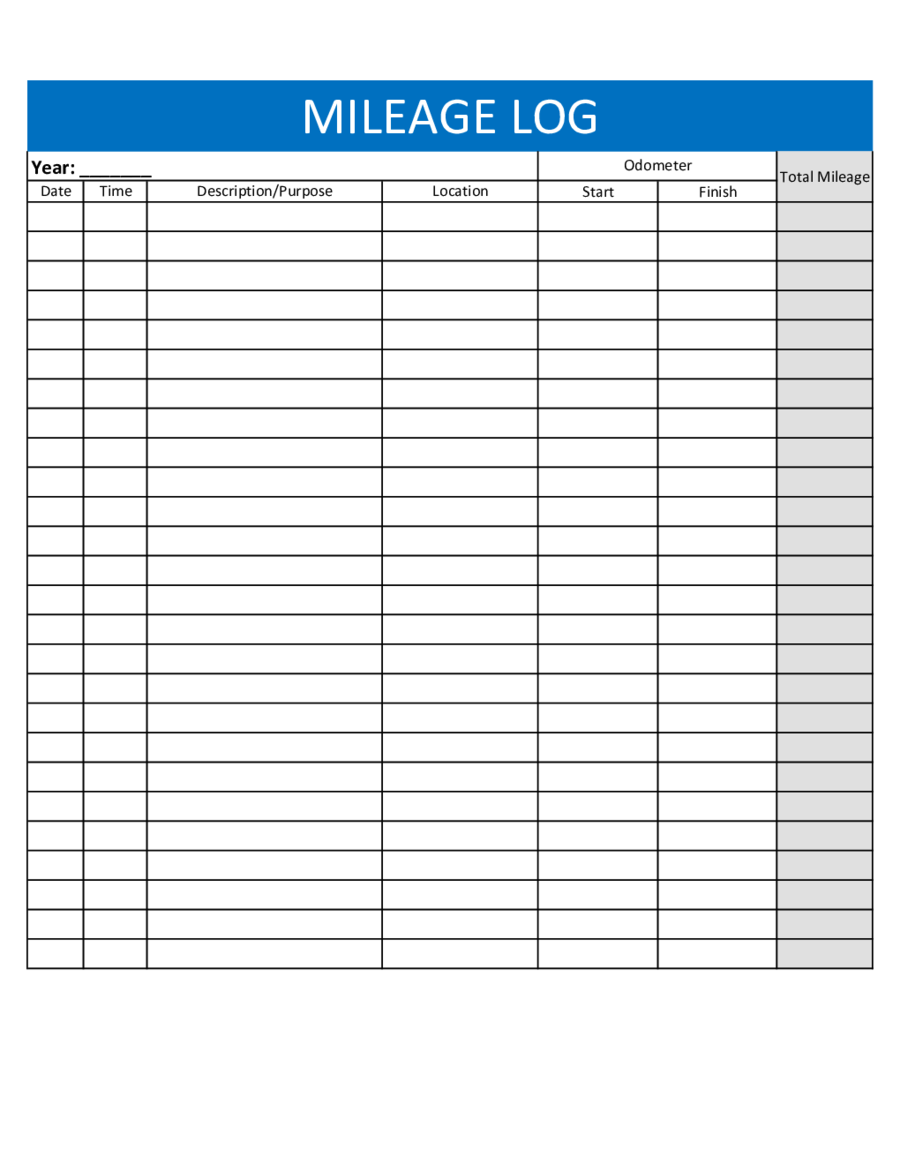

Mileage Log Templates - Standard mileage deduction and actual expense method. These free printable mileage logs are sufficient to meet the irs’s. Get started by downloading, customizing, and. Our mileage log spreadsheet template allows you to replace the outdated paper logs and better track your drivers, asset assignments and vehicle usage. Click to rate this post! Whereas is comes to documenting business miles, this is what the irs considerable appropriate records. Web the main advantage of mileage tracking is that you can record the necessary vehicle information and make detailed mileage reports. Business car log sheet mileage. The date of each trip Irs mileage rates for 2023 are: Anything that is updated once a week is generally considered sufficient. A straightforward way to record your mileage manually for tax purposes is to use an excel spreadsheet template. Web use these mileage log templates to help you track your mileage expenses and related expenses. Our mileage log spreadsheet template allows you to replace the outdated paper logs and better. Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement form or for determining the mileage. It can also ensure irs compliance. The date of each trip Click to rate this post! When tax time rolls around, you can. Workyard provides leading workforce management solutions to construction, service, and property maintenance companies of all sizes. With the top google sheets mileage log templates for 2024, you can skip the hassle of setting up a complex spreadsheet. Print it out, put it in your vehicle’s glove box or keep it in your wallet so that you minimize the chances to. Print it out, put it in your vehicle’s glove box or keep it in your wallet so that you minimize the chances to forget logging every deductible mile on a regular basis. The date of each trip Download pdf [541 kb] download jpg [647 kb] Web donat kekesi and sahil dua. According to the irs, you must include the following. In 2022, the mileage rate was 58.5 cents per mile for january through june, and increased to 62.5 cents per mile after july 1. According to the irs, you must include the following in your mileage log template: Here are the formulas we used in this spreadsheet: There are many places on the internet where printable log templates can be. 31 high quality mileage log templates in excellence, word or pdf. Web following are free mileage log templates that can be edited as per needs: Standard mileage deduction and actual expense method. Web the main advantage of mileage tracking is that you can record the necessary vehicle information and make detailed mileage reports. According to the irs, you must include. Choose from 15 different styles and print for free. Download a free mileage reimbursement and tracking log for microsoft excel®. Available in pdf, word, excel a google formats. It can also ensure irs compliance. Download pdf [541 kb] download jpg [647 kb] Web when using our template spreadsheet for mileage tracking, enter the reimbursement rate to get the proper results for total reimbursement. For 2021, 2022, or 2023. Organize mileage entries from your drivers/operators and quickly surface utilization reports for each of your fleet’s assets. Business car log sheet mileage. When tax time rolls around, you can use this mileage template to. Anything that is updated once a week is generally considered sufficient. You can use the following log as documentation for your mileage deduction. Web this implies that the mileage log template must be filled in at or near the time of departure. Click to rate this post! According to mileiq, the leading automatic mileage tracking app, an average mileiq unlimited. Download a free mileage reimbursement and tracking log for microsoft excel®. These templates already have the key columns, formulas, and features. Sections available in this template: 31 high quality mileage log templates in excellence, word or pdf. Web donat kekesi and sahil dua. Dua shares the résumé that helped him land his first job, a software development role. Printable templates are developed to meet irs regulations and have all the relevant spaces for you to complete to record odometer readings, destination, etc. The date of each trip Choose from 15 different styles and print for free. Tracking your mileage can save you thousands on your taxes (even more if you use an automatic mileage tracker app !). Web the mileage deduction is calculated by multiplying your yearly business miles by the irs’s standard mileage rate. Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Web when using our template spreadsheet for mileage tracking, enter the reimbursement rate to get the proper results for total reimbursement. These templates already have the key columns, formulas, and features. For 2024, it'll be $0.67. According to the irs, you must include the following in your mileage log template: Web business mileage tracking log. There are two methods of calculation that you can choose i.e. Sections available in this template: It can also ensure irs compliance. Feel free to download our excel mileage log template.

Free Timesheet Template With Mileage REPACK

30 Printable Mileage Log Templates (Free) Template Lab

30 Printable Mileage Log Templates (Free) ᐅ Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

30 Printable Mileage Log Templates (Free) Template Lab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Printable Mileage Log Template Business

30 Printable Mileage Log Templates (Free) ᐅ Template Lab

30 Free Mileage Log Templates Excel Log Sheet Format Project

19 Free Printable Mileage Log Templates DocFormats

A Straightforward Way To Record Your Mileage Manually For Tax Purposes Is To Use An Excel Spreadsheet Template.

Web This Implies That The Mileage Log Template Must Be Filled In At Or Near The Time Of Departure.

This Requires A Business To Record A Log Of Qualifying Mileage Driven.

Web Irs Mileage Log Form.

Related Post: