Non Profit Receipt Template

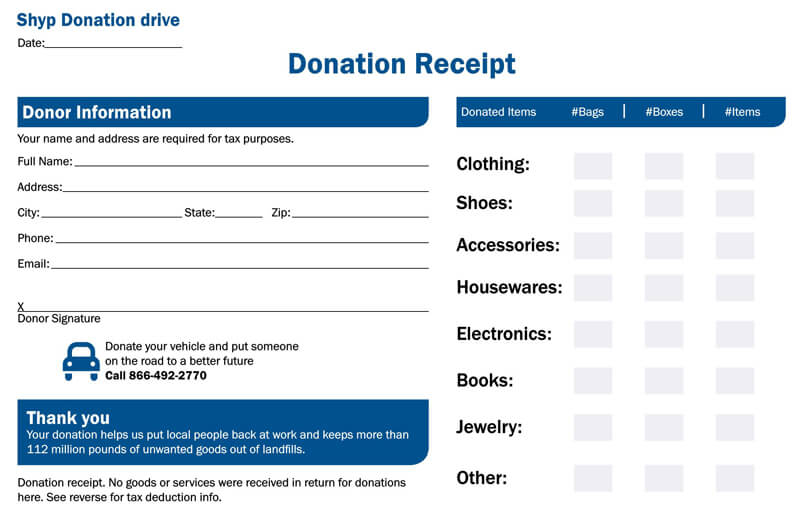

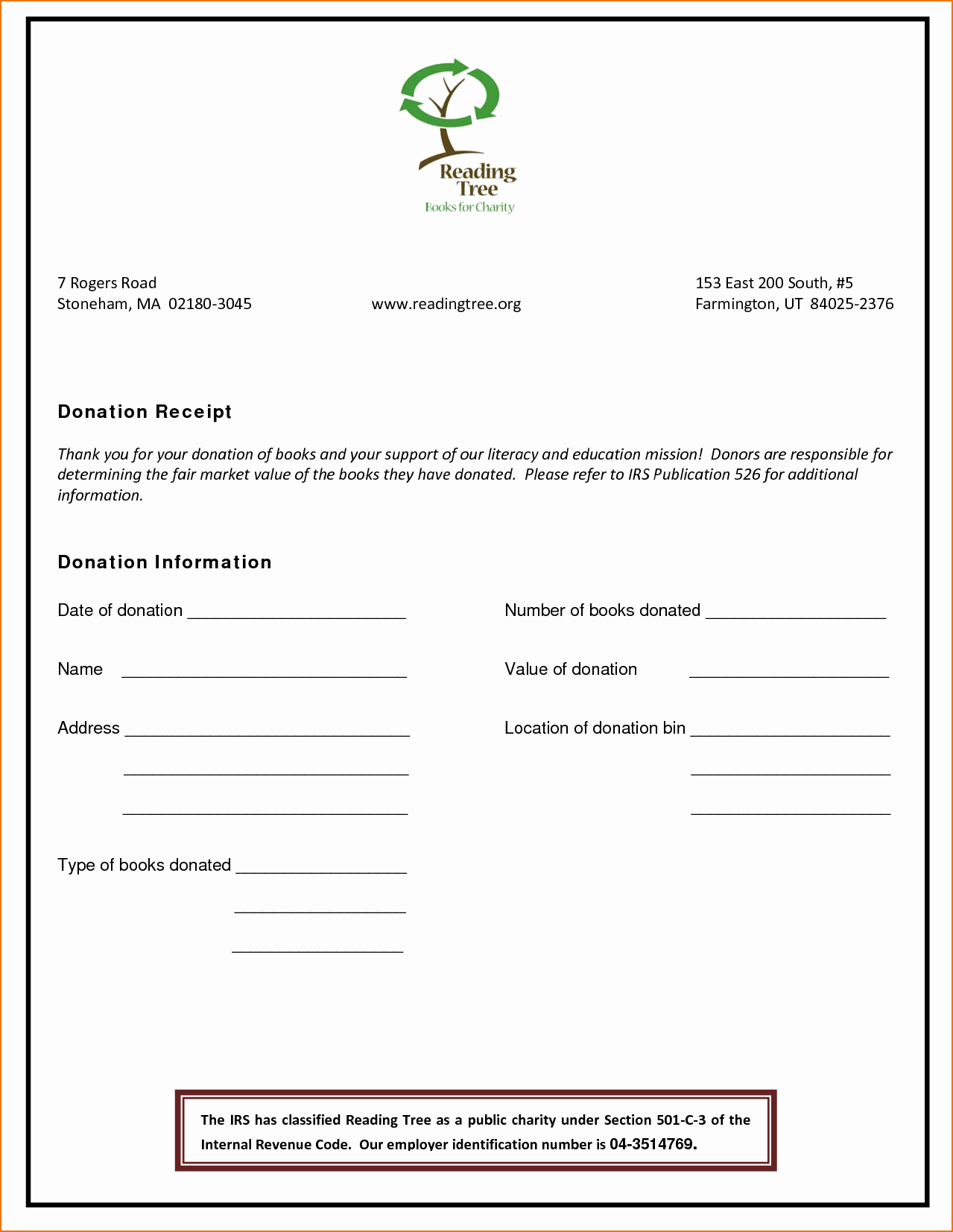

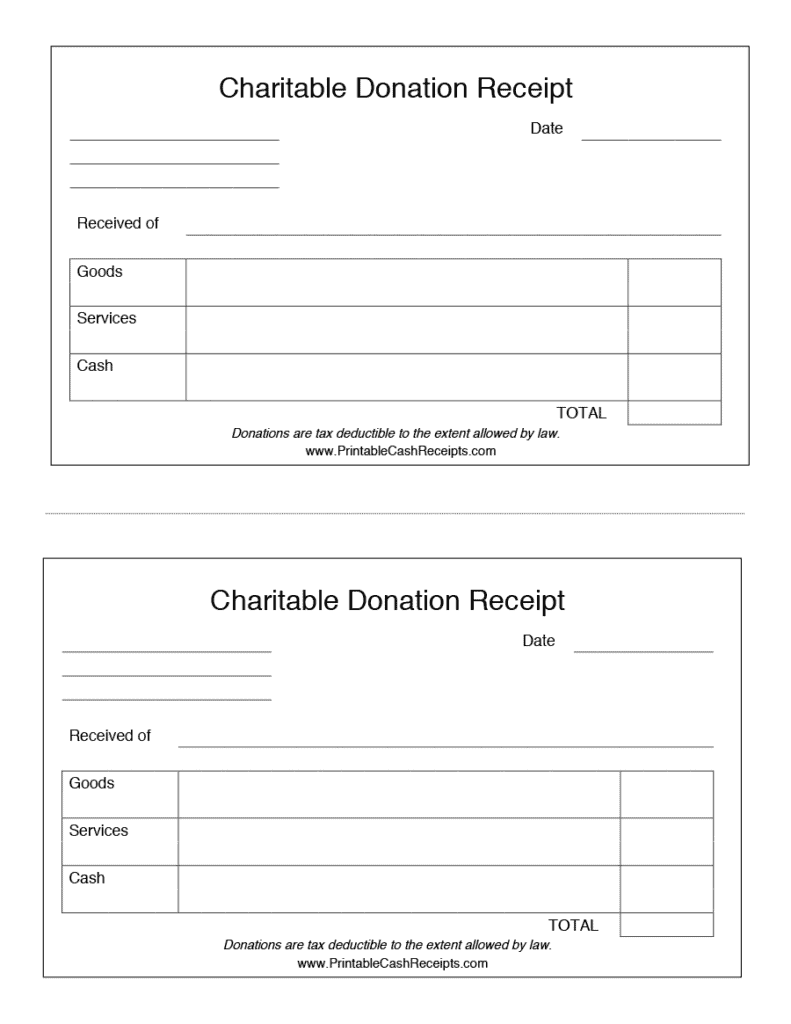

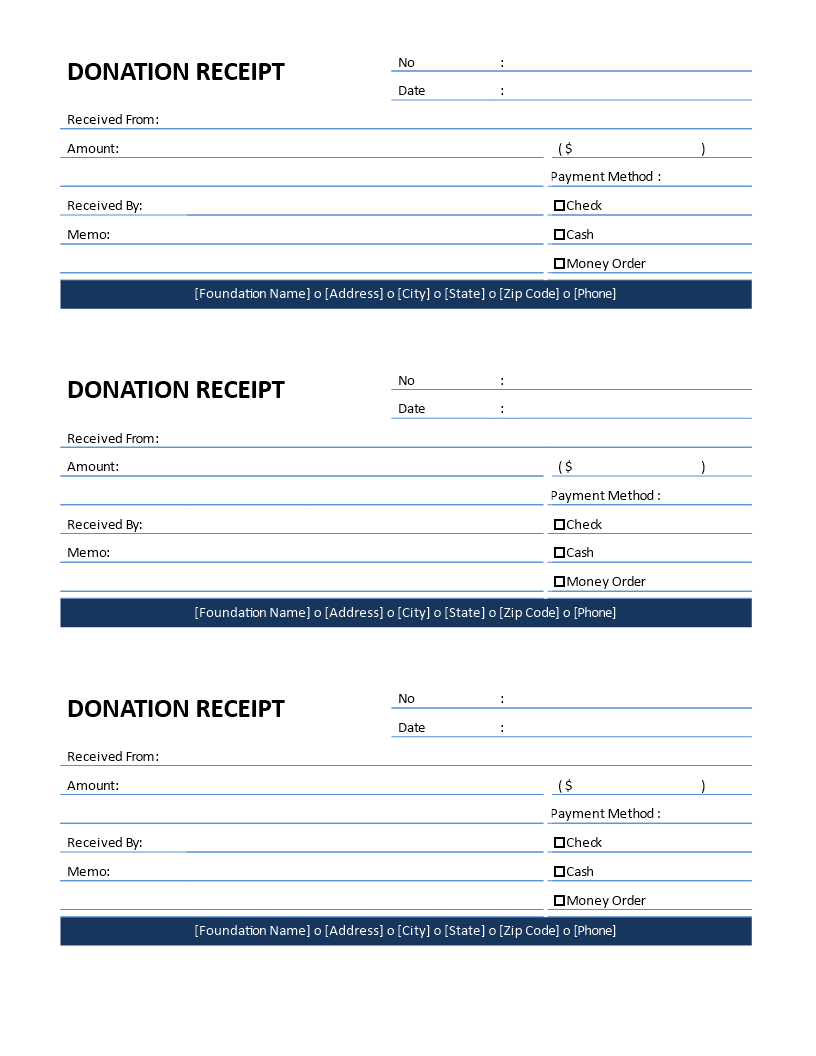

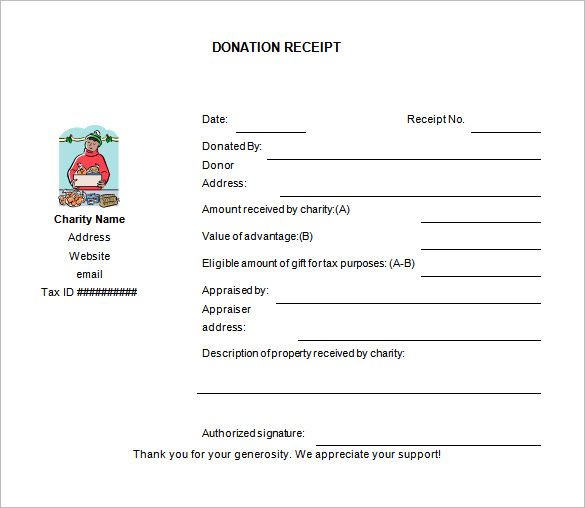

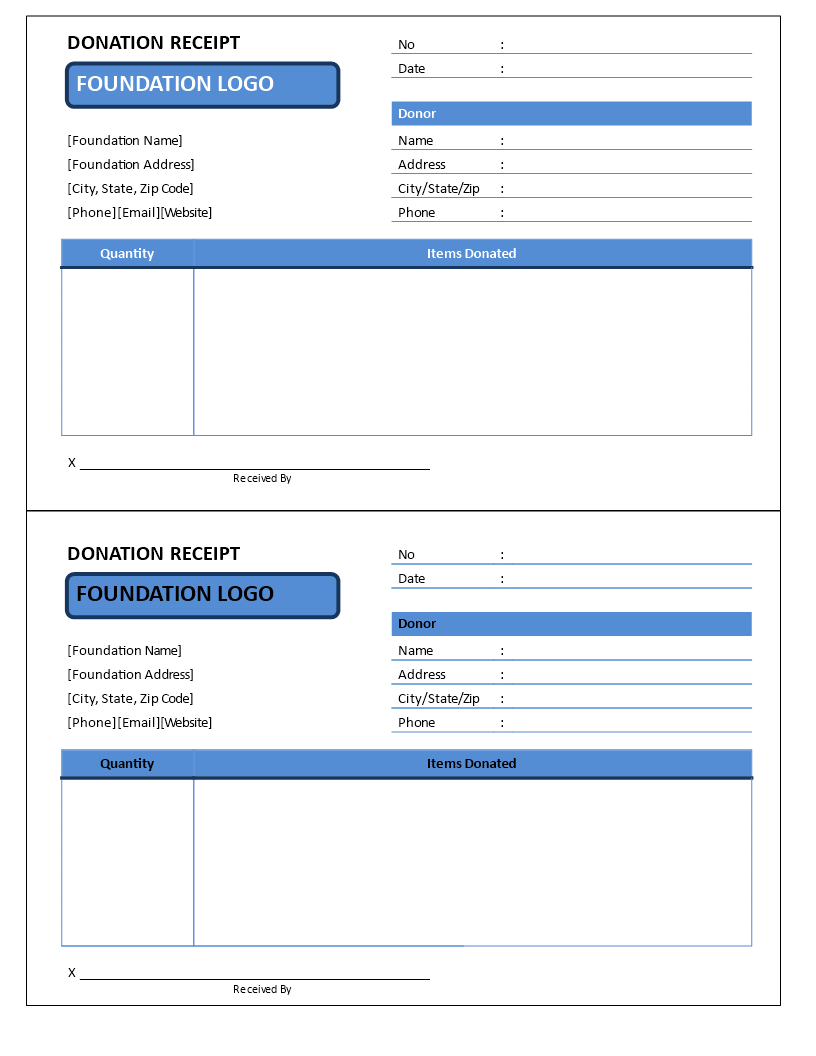

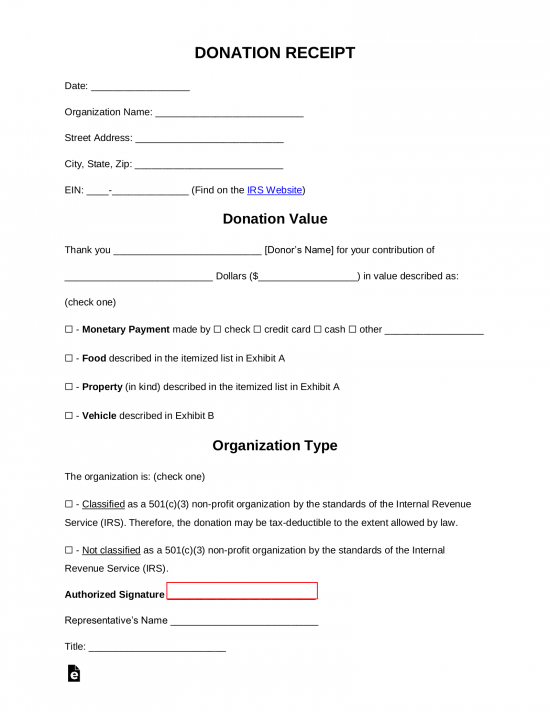

Non Profit Receipt Template - It is also a must part of it.it includes the organization logo, name, federal tax id number, and a statement that verifies that the organization is registered with 501(c)(3). Web a donation receipt acts as a written record that a donor is given, proving that a gift has been made to a legal organization. Web we’ve adapted these kindful email templates to work for any nonprofit. You can use this template to maintain accurate records while maintaining a professional appearance. Skynova has multiple templates and software to help small businesses, including nonprofit 501 (c) (3) organizations. There are various types of receipts including the following: Just make sure you update them with the custom fields that your donor management system uses. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the united states of america that there were no goods or services provided as part of this donation. These email and letter templates will help you create compelling donation receipts without taking your time away from your donors: 2 the importance of information receipts for benefactors and beneficiary. A donation receipt is of. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. Simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Web often a goodwill donation receipt is presented as. Web no stress and no hassle! While there is no legal requirement for you to send a donation receipt for gifts below $250, it is good practice and most nonprofits send acknowledgements for every donation. A great way to achieve this is by downloading a template. 123 monroe way, apple valley, ca 92307. If you’re new to the nonprofit world. We will populate it automatically with all the necessary donation details and organization info. With a template, you can customize the perfect receipt for. 3 information which should be incorporated in a donation receipt. After the receipt has been issued, the donor will be. Web use skynova for donation receipt templates and more. These email and letter templates will help you create compelling donation receipts without taking your time away from your donors: An invoice, under the guidelines of the ease of paying tax act (eopt), serves as the principal documented proof of the sale of goods… Web use skynova for donation receipt templates and more. If you donate but do not obtain. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. There are various types of receipts including the following: We’ve included templates for standard donation receipts, event registrations, and other common nonprofit transactions. Web this template is easily customizable and includes fields for donor information, donation date, and a description of. Standards and regulations of the internal revenue service (irs). Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the united states of america that there were no goods or services provided as part of this donation. The completed receipt is printable, or it can also be sent via email to. Microsoft word (.docx) cash donation receipt template. While there is no legal requirement for you to send a donation receipt for gifts below $250, it is good practice and most nonprofits send acknowledgements for every donation. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. These email and letter templates. Check out our advantage calculator to easily. The charity organization should provide a receipt and fill in their details and a description. 3 information which should be incorporated in a donation receipt. We’ve included templates for standard donation receipts, event registrations, and other common nonprofit transactions. A donation receipt can be in the form of a letter, card, or email. Check out our advantage calculator to easily. Microsoft word (.docx) cash donation receipt template. This type of receipt should also include information about the value of the good received. If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. With a template, you can customize the perfect receipt for. 123 monroe way, apple valley, ca 92307. If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts. This word must be included at the top of this document. 2 the importance of information receipts for benefactors and beneficiary. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. Each template also includes a fundraising tip that will make your receipts even more effective! Simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Web writing a donation receipt from scratch is a big task, but these templates will get you started. With a template, you can customize the perfect receipt for. If you donate but do not obtain and keep a receipt, you cannot claim the donation. Web how to give a cash donation (3 steps) accept the donation from a recipient. Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the united states of america that there were no goods or services provided as part of this donation. This shows that it is a donation receipt. Web nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. We’ve included templates for standard donation receipts, event registrations, and other common nonprofit transactions. Web use skynova for donation receipt templates and more. A donation can be in the form of cash or property. Our receipt template can be used for donations and contains fields you can customize.

Free Nonprofit (Donation) Receipt Templates (Forms)

50 Non Profit Donation Receipt Form

6+ Free Donation Receipt Templates Word Excel Formats

Nonprofit Donation Receipt for Cash Donation Templates at

Get Our Printable Non Profit Donation Receipt Template Receipt

Nonprofit Receipt 5+ Examples, Format, Pdf Examples

Free Non Profit Donation Receipt Templates (Word / Excel) Best

![27+ Free Nonprofit Donation Receipt Templates [Excel+Word] Excel](https://exeltemplates.com/wp-content/uploads/2021/08/receipt-for-donated-goods.jpg)

27+ Free Nonprofit Donation Receipt Templates [Excel+Word] Excel

Non profit donation receipt template Templates at

Free Donation Receipt Templates Samples PDF Word eForms

Web This Template Is Easily Customizable And Includes Fields For Donor Information, Donation Date, And A Description Of The Goods Or Services Provided.

This Type Of Receipt Should Also Include Information About The Value Of The Good Received.

Web Often A Goodwill Donation Receipt Is Presented As A Letter Or An Email, Which Is Given Or Sent To The Benefactor After The Donation Has Been Received.

A Donation Receipt Is Of.

Related Post: