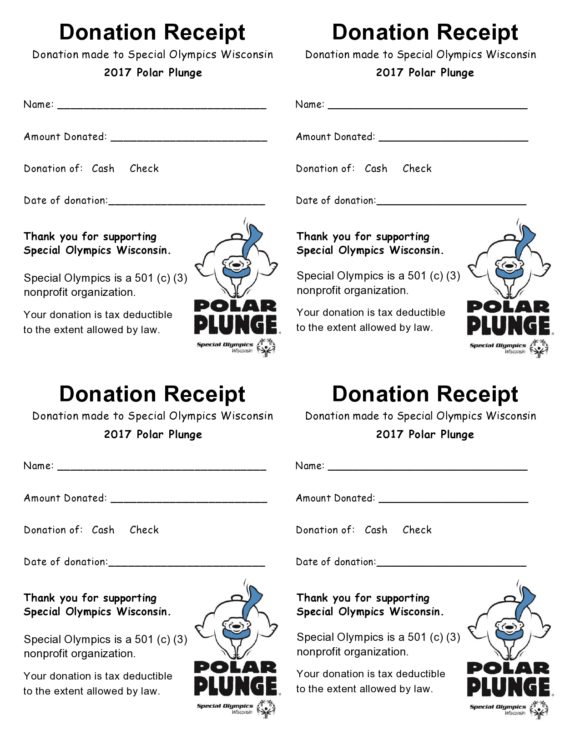

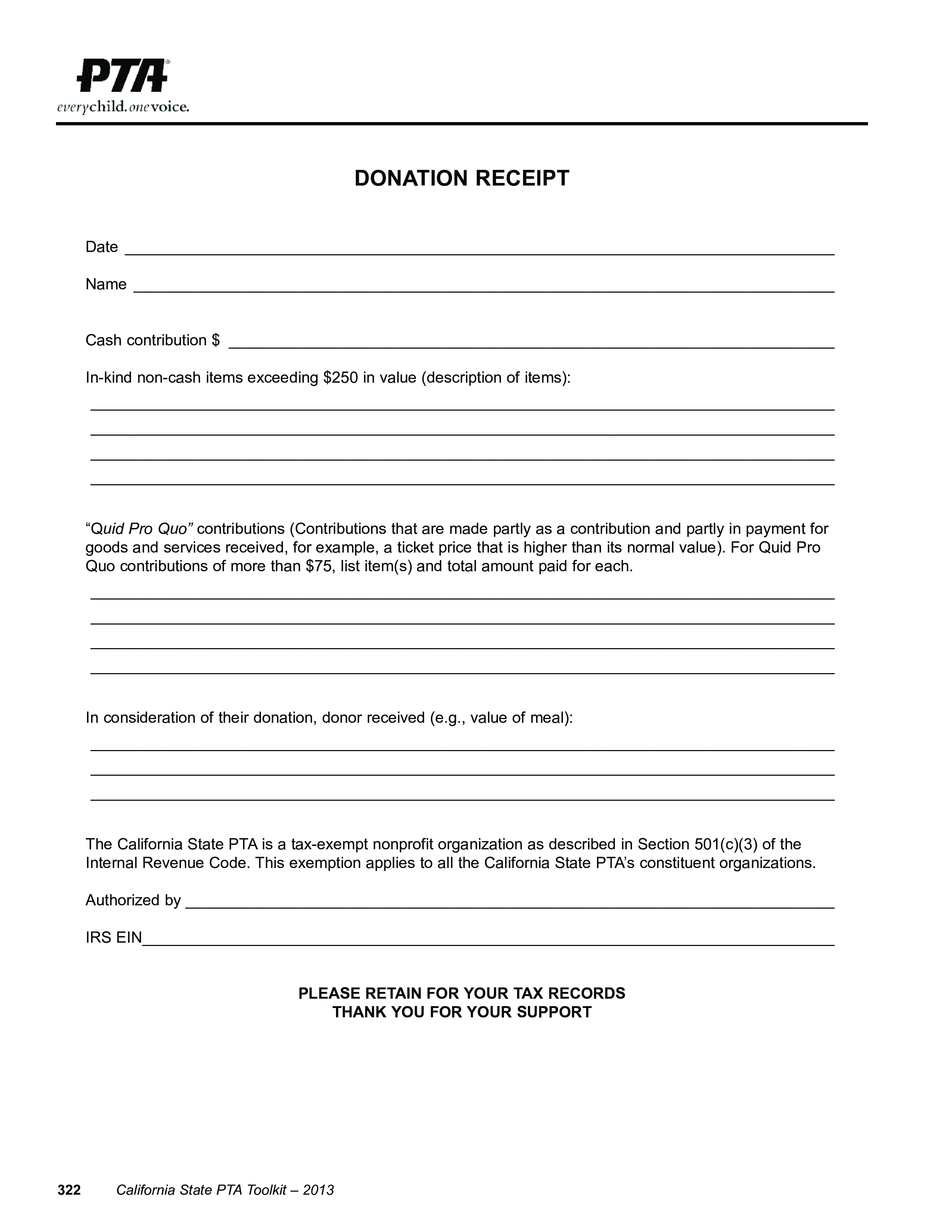

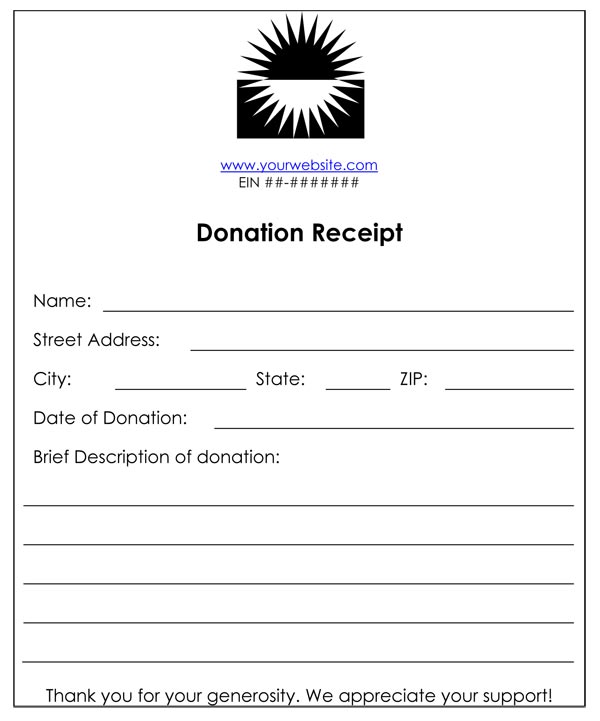

Nonprofit Donation Receipt Template

Nonprofit Donation Receipt Template - Simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Moreover, the average crypto donation size using the solution is around $6,423 and nonprofits that participate in the giving block’s crypto campaigns raise an average of. If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt. Web using this donation receipts template will help streamline your donation acknowledgment process and ensure that all required information is included. If you plan to create your own. Scroll down to “enhance your campaign” and click “receipt emails.”. Use our easy template editor. You should include this information to make your document useful and official. We will populate it automatically with all the necessary donation details and organization info. Moreover, you can only issue a donation receipt under the name of the individual who made the donation. Web nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. It is also a must part of it.it includes the organization logo, name, federal tax id number, and a statement that verifies that the organization is registered with 501(c)(3). It allows you to create and customize the draft of your receipt contents. Web. Just make sure you update them with the custom fields that your donor management system uses. A donation can be in the form of cash or property. Web in the charitable donation process, proper documentation is essential to ensure transparency, accountability, and compliance. Check out our advantage calculator to easily. Web when writing an automatic donation receipt for a 501c3. A specific description of how their gift will make an impact for this particular. This shows that it is a donation receipt. Just having the receipt is not. Web a donation receipt template should comply with particular requirements when it comes to the information it contains. Web a donation receipt provides documentation to those who give to your organization and. Web a donation receipt template should comply with particular requirements when it comes to the information it contains. Web nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. Our receipt template can be used for donations and contains fields you can customize. Web a donation receipt provides documentation to those who give to. There are various types of receipts including the following: These free printable templates in pdf and word format simplify the. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. This is a standard donation receipt informing donors that their money has been received. Web nonprofit donation receipts are both a legal requirement and. It is also a must part of it.it includes the organization logo, name, federal tax id number, and a statement that verifies that the organization is registered with 501(c)(3). Moreover, you can only issue a donation receipt under the name of the individual who made the donation. Just make sure you update them with the custom fields that your donor. The completed receipt is printable, or it can also be sent via email to the donor along. You should include this information to make your document useful and official. If you are responsible for creating a document like this for your organization, these charitable donation receipt templates make it easy to acknowledge gifts from your donors in a variety of. In conclusion, a nonprofit donation receipt template is given by an organization to the donor when he made donation. This word must be included at the top of this document. We’ve included templates for standard donation receipts, event registrations, and other common nonprofit transactions. It allows you to create and customize the draft of your receipt contents. Web types of. Then, you can customize this basic template based on donation type, such as noncash contributions or monetary support. 34 first street, gig harbor, wa, 98332. This is a standard donation receipt informing donors that their money has been received. Web use skynova for donation receipt templates and more. A 501 (c) (3) donation receipt is required to be completed by. Nonprofit donation receipt template is required by an organization that accepts donation. In conclusion, a nonprofit donation receipt template is given by an organization to the donor when he made donation. Web when writing an automatic donation receipt for a 501c3 organization, you should include: Web nonprofit donation receipts are both a legal requirement and an important part of nurturing. This is a standard donation receipt informing donors that their money has been received. The cost of the gift the donor receives must be subtracted to calculate the taxable amount. Donor can also use this receipt to claim a tax deduction for household property and clothing. If you’re new to the nonprofit world and have never created a donation receipt before, don’t stress—in this article, we are going to explain how donation receipts work, outline their basic features, and share 6 nonprofit donation receipt. You should include this information to make your document useful and official. Web nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. Personalization using merge tags, which automatically pull a donor’s name, organization info, and transaction info into the receipt. Skynova has multiple templates and software to help small businesses, including nonprofit 501 (c) (3) organizations. Web use skynova for donation receipt templates and more. Web a donation receipt provides documentation to those who give to your organization and serves as a record for tax purposes. It is also a must part of it.it includes the organization logo, name, federal tax id number, and a statement that verifies that the organization is registered with 501(c)(3). Web donation receipts are necessary when it comes to both the giver and receivers accounting and record keeping. Our receipt template can be used for donations and contains fields you can customize. We’ve included templates for standard donation receipts, event registrations, and other common nonprofit transactions. Moreover, you can only issue a donation receipt under the name of the individual who made the donation. Web in the charitable donation process, proper documentation is essential to ensure transparency, accountability, and compliance.

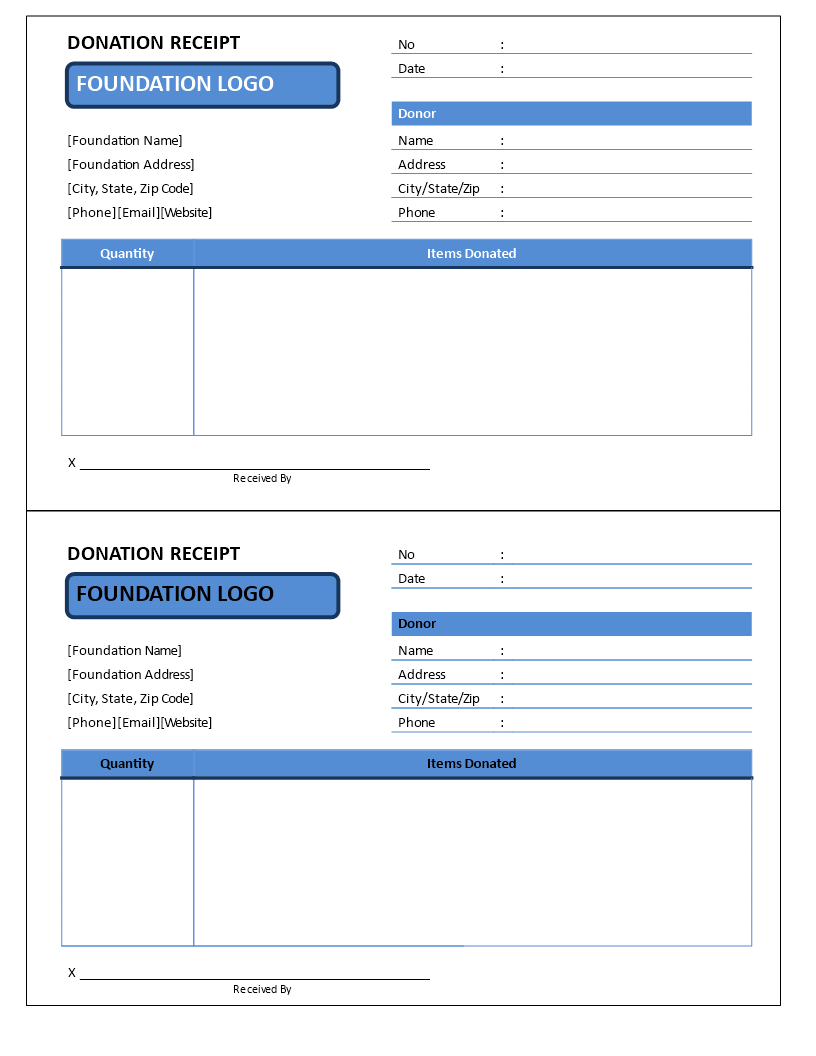

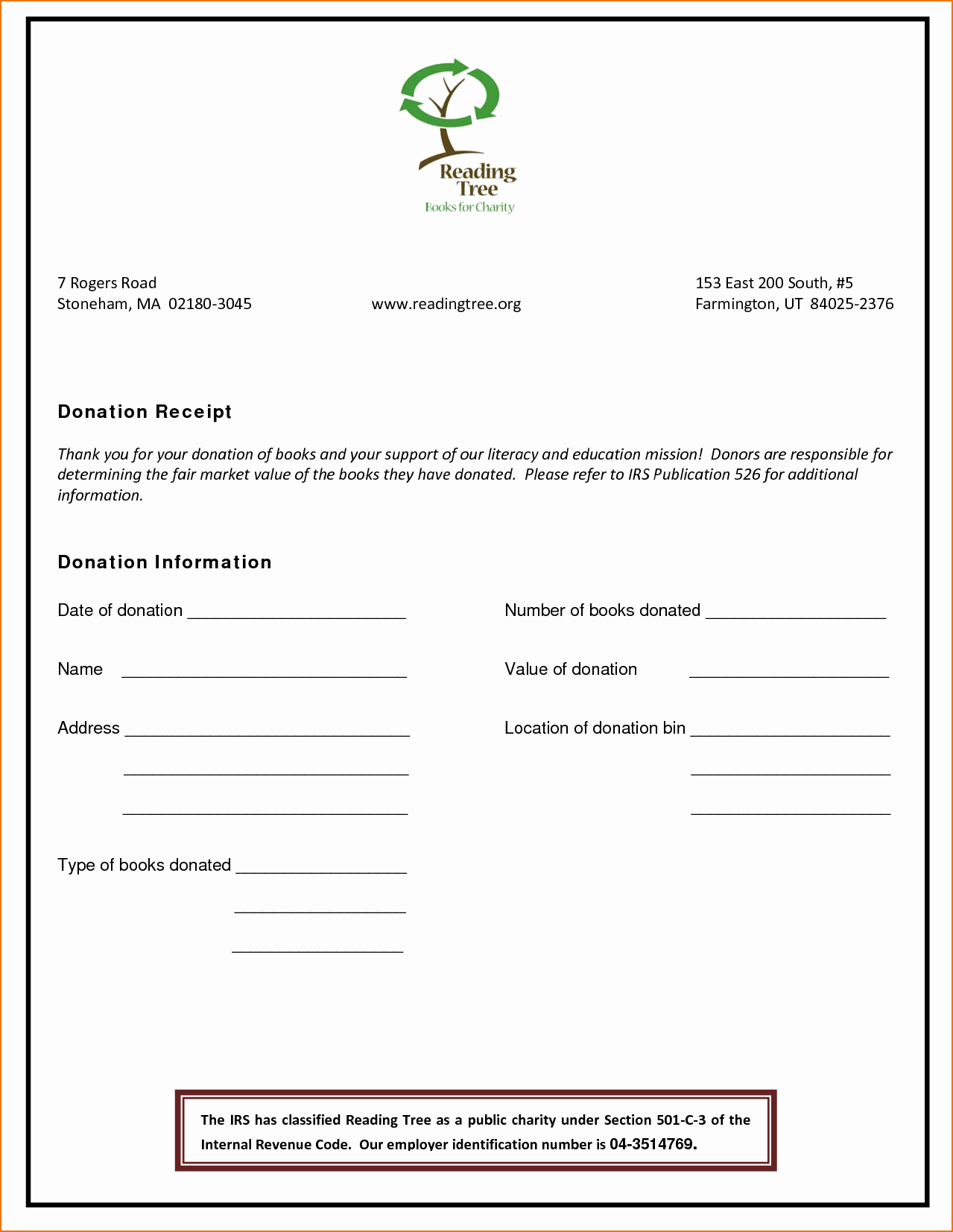

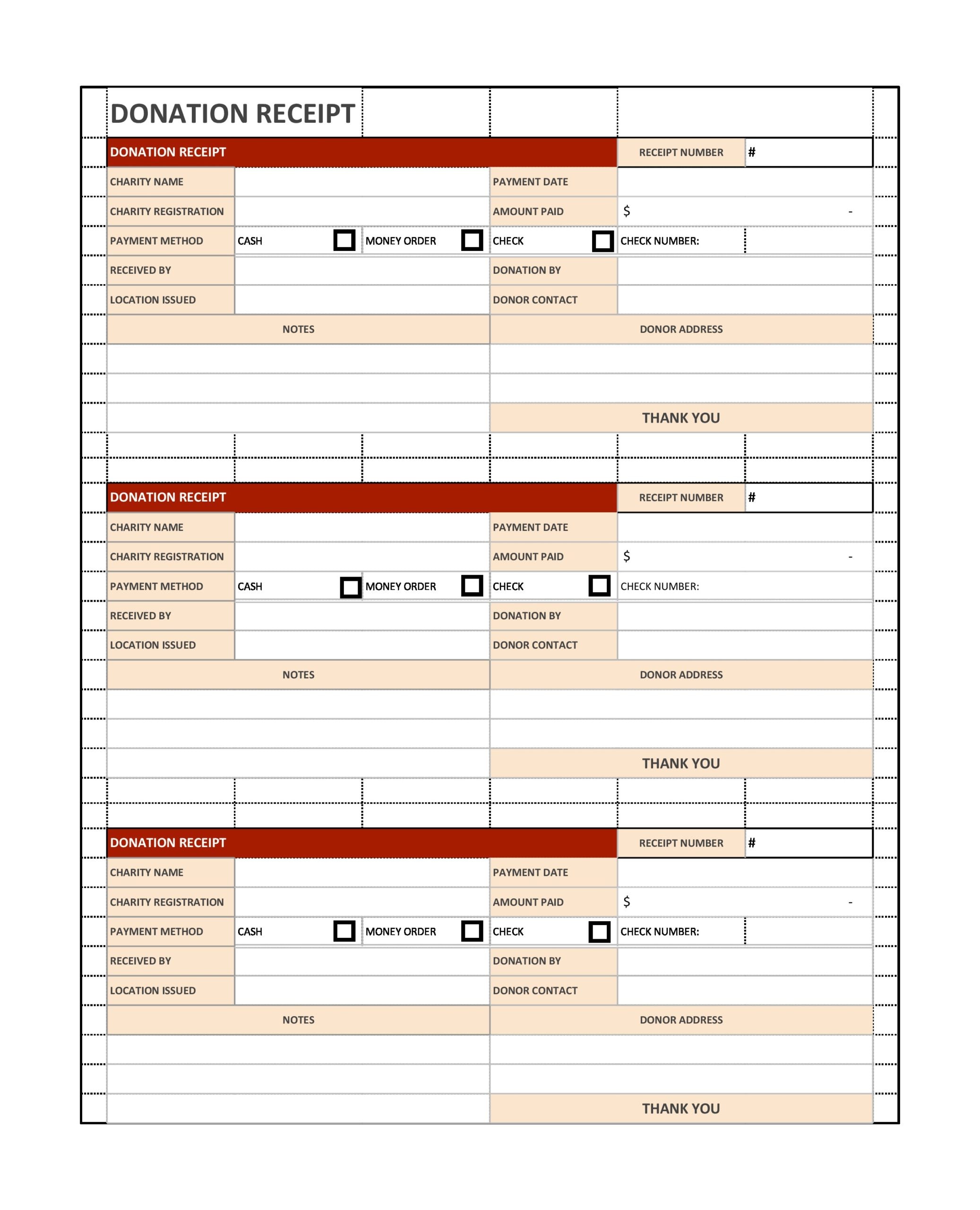

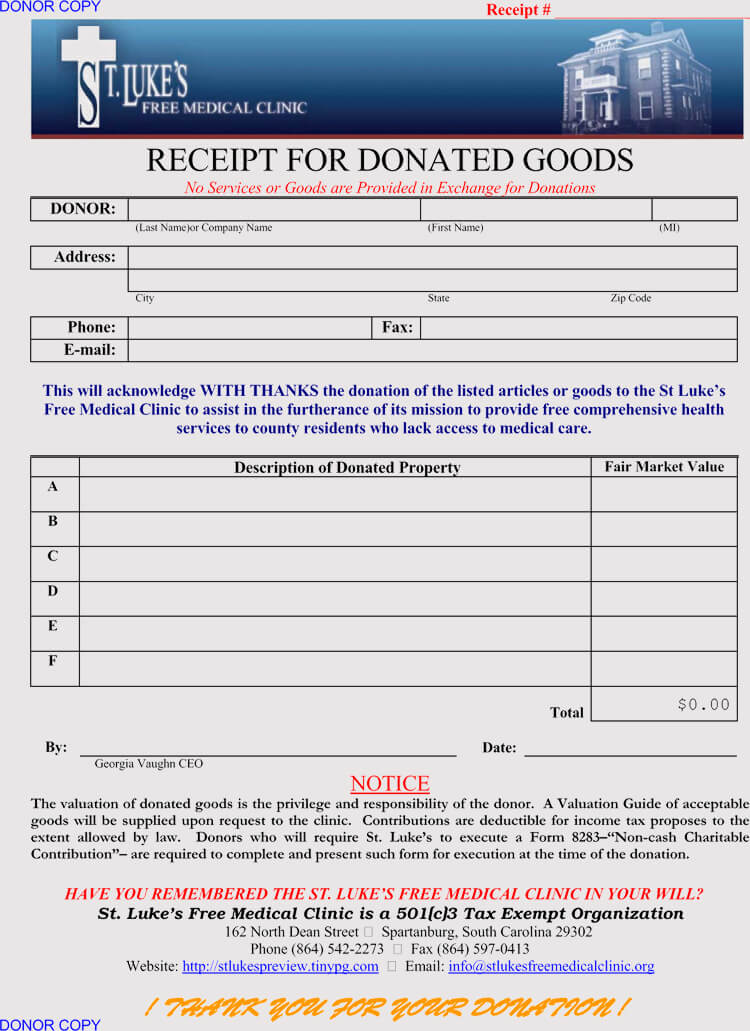

Ultimate Guide to the Donation Receipt 7 MustHaves & 6 Templates

Non profit donation receipt template Templates at

50 Non Profit Donation Receipt Form

30 Non Profit Donation Receipt Templates (PDF, Word) PrintableTemplates

46 Free Donation Receipt Templates (501c3, NonProfit)

30 Non Profit Donation Receipt Templates (PDF, Word) PrintableTemplates

Sample Non Profit Donation Templates at

Non Profit Receipt Template printable receipt template

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-25.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

5 Free Donation Receipt Templates in MS Word Templates

We Will Populate It Automatically With All The Necessary Donation Details And Organization Info.

The Completed Receipt Is Printable, Or It Can Also Be Sent Via Email To The Donor Along.

Simplify Your Process And Ensure Transparency And Gratitude Towards Your Generous Donors With Our Professionally Designed Templates.

Web When Writing An Automatic Donation Receipt For A 501C3 Organization, You Should Include:

Related Post: