Npv Template

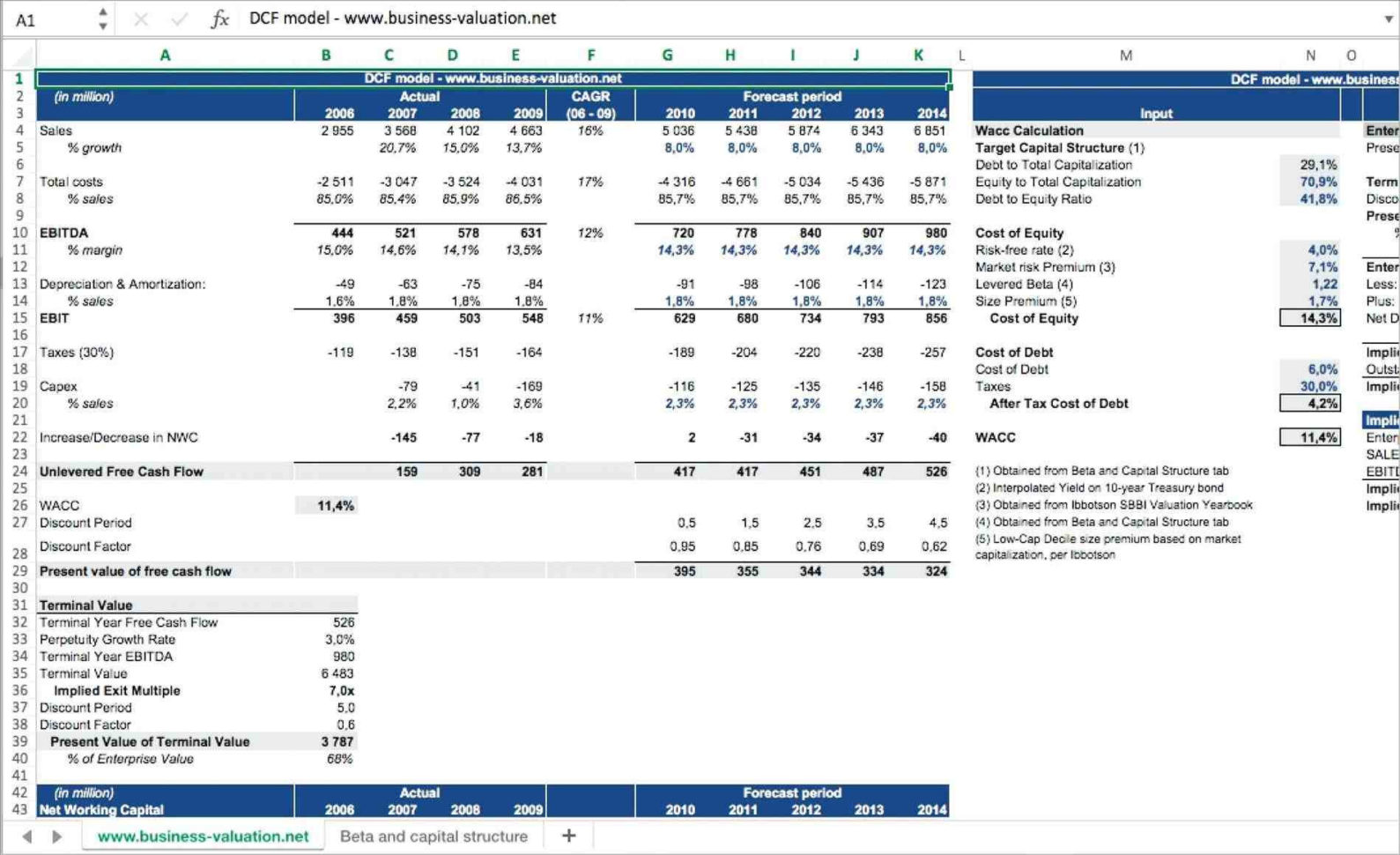

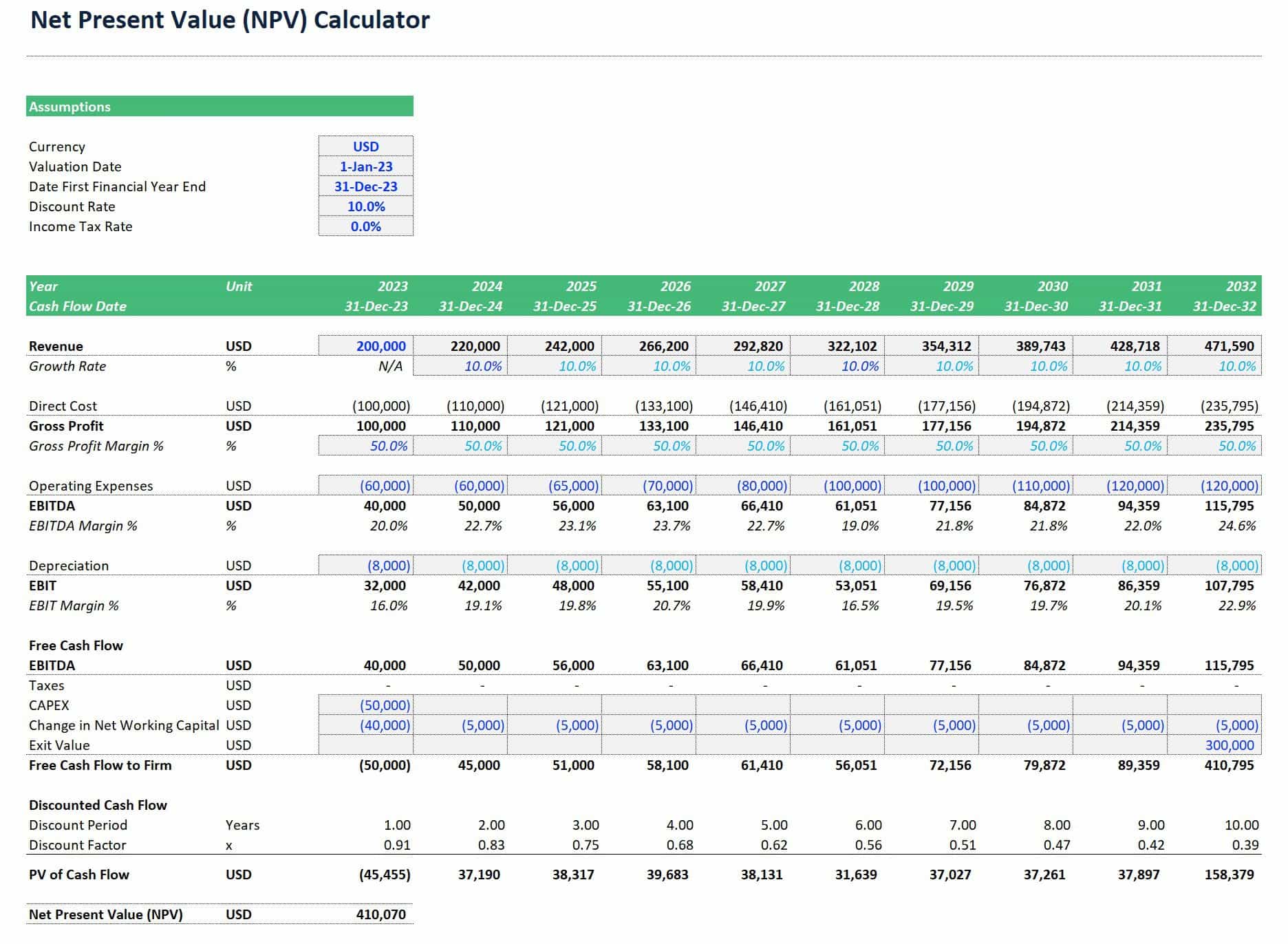

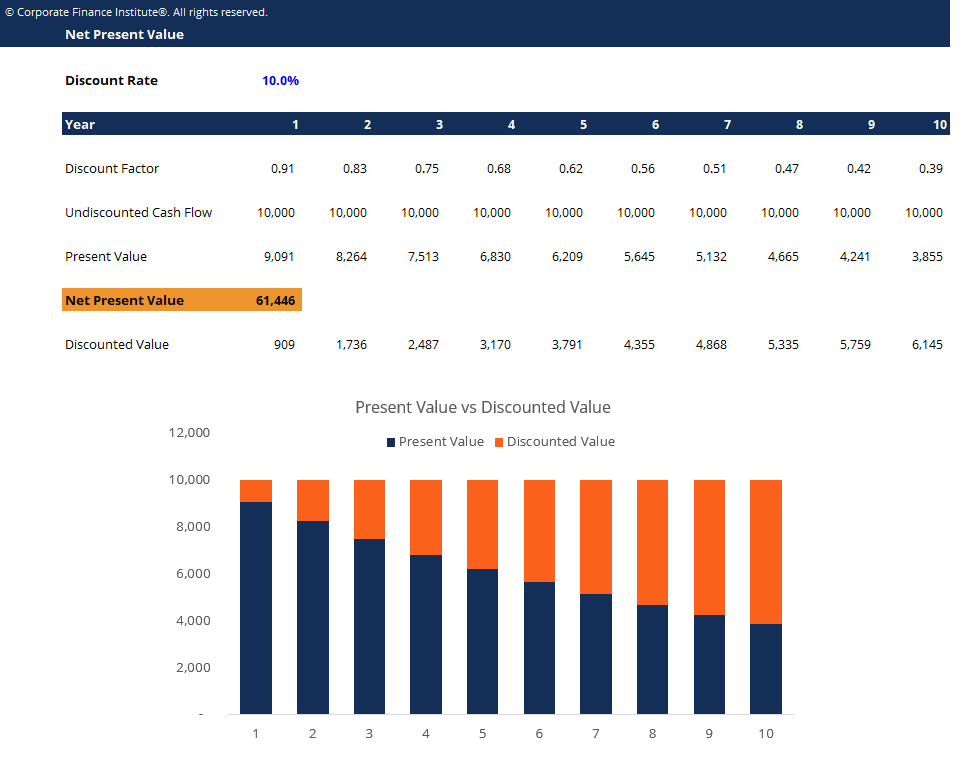

Npv Template - Web establish a series of cash flows (must be in consecutive cells). Npv analysis is a form of intrinsic valuation and is used extensively across finance and accounting for determining the value of a business, investment security, capital project, new venture. Net present worth calculator, npv formula and how to determine npv/npw. The npv calculation tells you whether you should invest or forgo a project. If the result is positive, the project is worth investing in. For example, project x requires an initial investment of $100 (cell b5). Web npv (short for net present value), as the name suggests is the net value of all your future cashflows (which could be positive or negative) for example, suppose there’s an investment opportunity where you need to pay $10,000 now, and you will. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web net present value means the net value of an investment today. Web to calculate the net present value (npv): Web calculation of net present value using an npv calculator. For example, project x requires an initial investment of $100 (cell b5). Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. The row titled ‘project npv’ displays your net present value for the. Rated 4.62 out of 5 based on 13 customer ratings. To calculate npv, we estimate the cashflows (outflows and inflows) to be generated from a. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web establish a series of cash flows (must be in consecutive. Web establish a series of cash flows (must be in consecutive cells). Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows. If the result is positive, the project is worth investing in. 4.62 ( 13 reviews ) professional excel spreadsheet to calculate npv & irr. Where n is the number of cash flows, and i is the interest or discount rate. Web net present value (npv) is the value of all future cash flows (positive and negative) over the entire life. Net present value represents the discounted future cash inflows minus discounted future cash outflows, or simply the discounted future net cash flows. If the result is positive, the project is worth investing in. Web calculation of net present value using an npv calculator. Web npv calculates that present value for each of the series of cash flows and adds them. The formula to calculate npv is as follows: Get started today and make informed decisions about your investments! Web net present value means the net value of an investment today. Cfi’s free excel crash course. Web calculation of net present value using an npv calculator. You can click on individual cells within npv excel file to see the formulas used to calculate the excel net present value. Web what is npv? Type “=npv (“ and select the discount rate “,” then select the cash flow cells and “)”. If the result is positive, the project is worth investing in. Net present worth calculator, npv formula. Where n is the number of cash flows, and i is the interest or discount rate. Net present worth calculator, npv formula and how to determine npv/npw. Web establish a series of cash flows (must be in consecutive cells). The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and. It is a financial measure to tell if an investment is going to be profitable or if it is worth investing in. It is a valuable tool that calculates the net present value of a future stream of future free cash flow. Web net present value (npv) excel template helps you calculate the present value of a series of cash. For example, project x requires an initial investment of $100 (cell b5). Our npv calculator is an excel template that you can download for free. Web this npv excel template has three example investment projects already done for you. It is a valuable tool that calculates the net present value of a future stream of future free cash flow. Npv. Web what is npv? Web establish a series of cash flows (must be in consecutive cells). The formula to calculate npv is as follows: The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Web net present value (npv) excel template helps you calculate the present value of a series of cash flows. The row titled ‘project npv’ displays your net present value for the specified investment. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web npv (short for net present value), as the name suggests is the net value of all your future cashflows (which could be positive or negative) for example, suppose there’s an investment opportunity where you need to pay $10,000 now, and you will. Web calculation of net present value using an npv calculator. Web net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Our npv calculator is an excel template that you can download for free. Npv analysis is a form of intrinsic valuation and is used extensively across finance and accounting for determining the value of a business, investment security, capital project, new venture. The npv calculation tells you whether you should invest or forgo a project. The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows. Web this npv excel template has three example investment projects already done for you. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present.

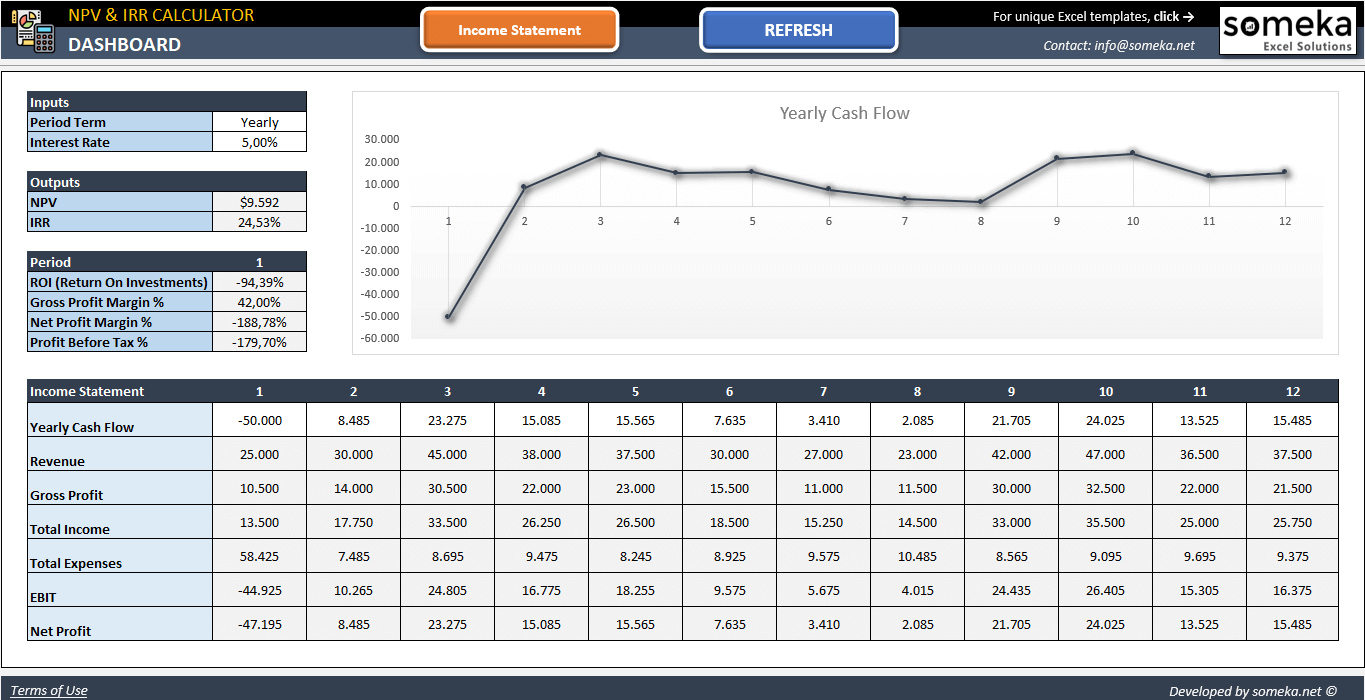

NPV Calculator Template Free NPV & IRR Calculator Excel Template

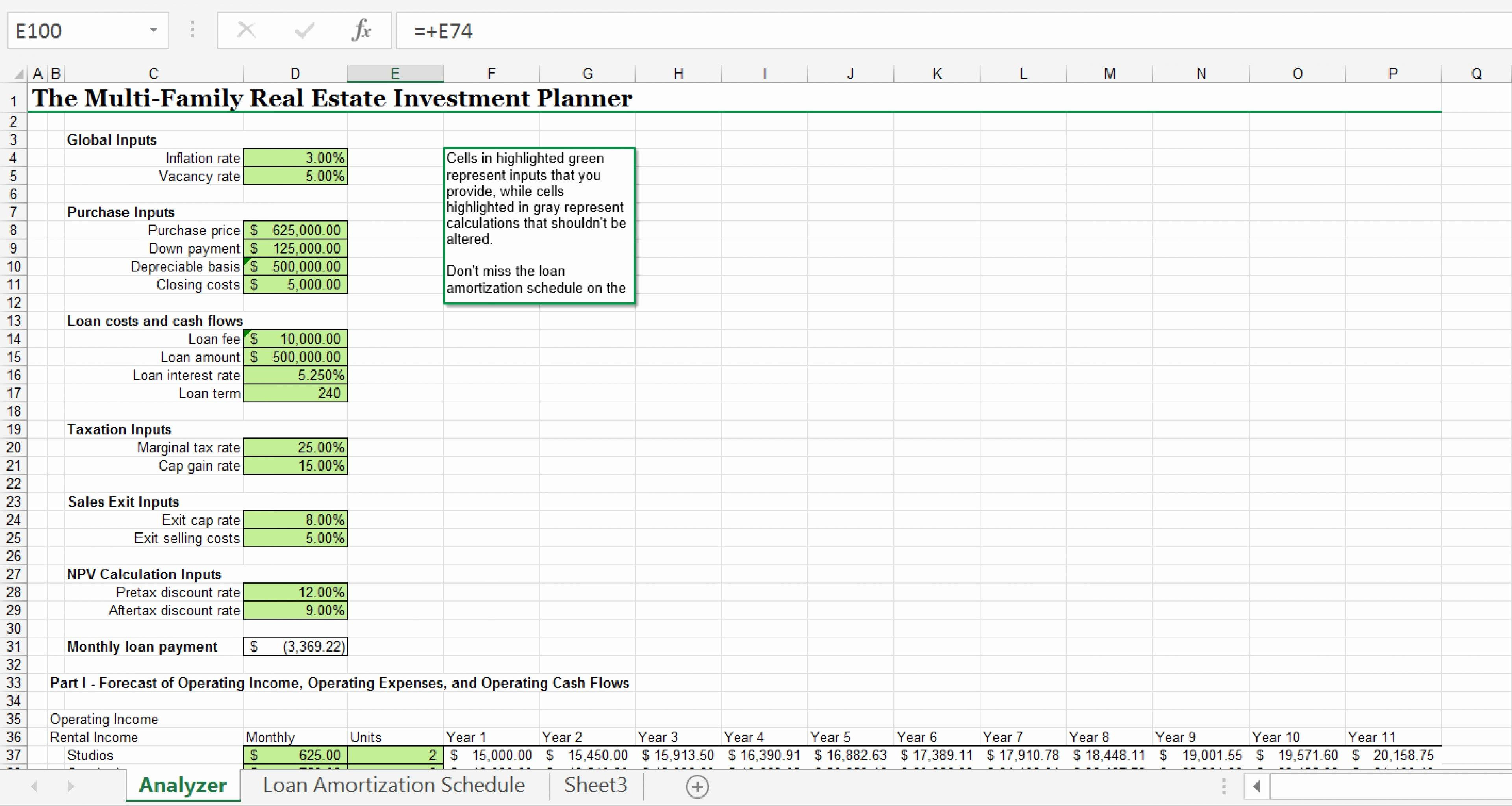

Npv Excel Spreadsheet Template —

Professional Net Present Value Calculator Excel Template Excel TMP

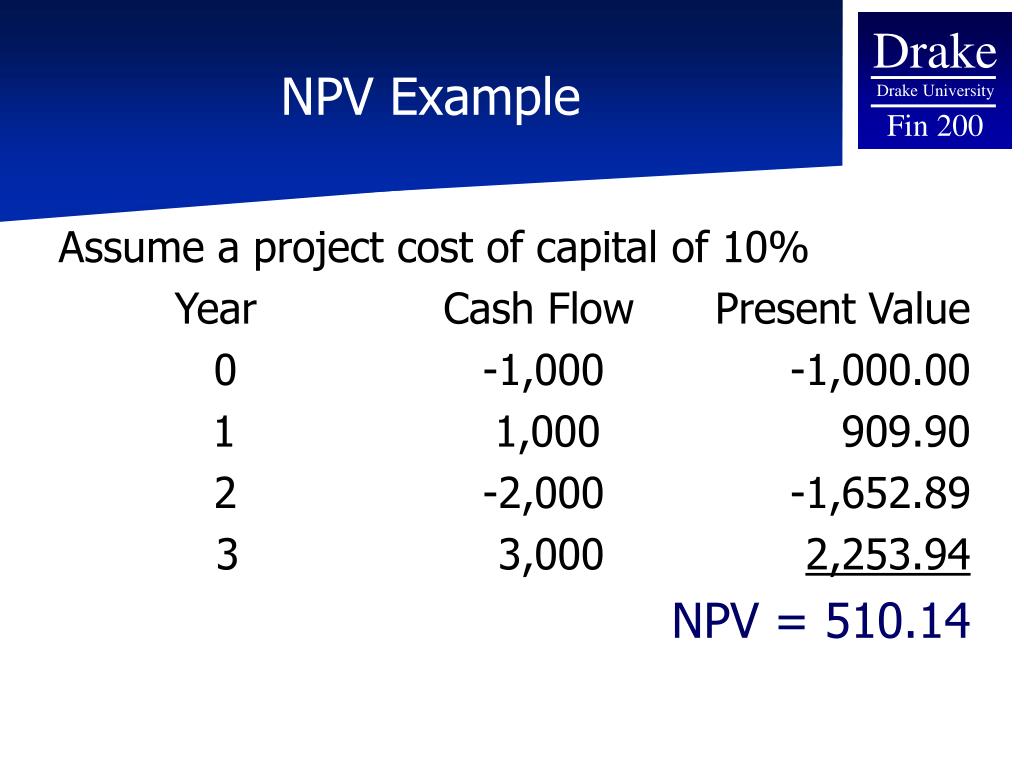

How To Calculate Npv Of A Project Example Haiper

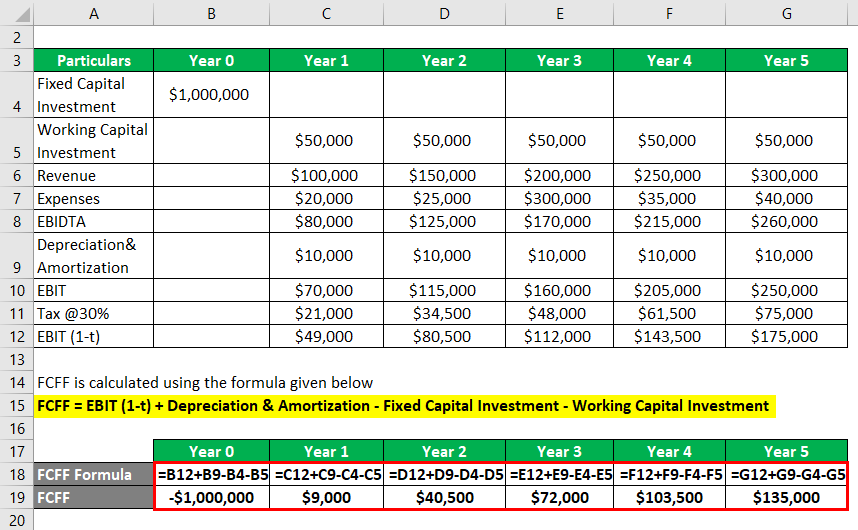

Net Present Value Formula Examples With Excel Template Images

Npv Excel Spreadsheet Template —

Net Present Value (NPV) Calculator in Excel eFinancialModels

Net Present Value (NPV) Meaning, Formula, Calculate, Example, Analysis

Net Present Value Template Overview, Formula

Net Present Value Formula Examples With Excel Template

Web Net Present Value Means The Net Value Of An Investment Today.

4.62 ( 13 Reviews ) Professional Excel Spreadsheet To Calculate Npv & Irr.

Congratulations, You Have Now Calculated Net Present Value In Excel!

If The Result Is Positive, The Project Is Worth Investing In.

Related Post: